Bored Ape Yacht Club

Pudgy Penguins floor price rises as key metrics improve

Published

4 months agoon

By

admin

Pudgy Penguins, the viral Ethereum Non-Fungible Token collection, has defied the gloom in the industry in August.

Data by CryptoSlam and Dune Analytics shows that its key metrics performed well even as the sector came under intense pressure.

Total sales jumped by 29% in August to over $8.6 million as the number of transactions jumped by 73% to 348.

Additionally, the number of buyers and sellers rose by 73% and 39% to 176 and 205, respectively. The average number of days held also rose slightly by 5% to 85.5.

While Pudgy Penguins sales rose in August, they remain sharply lower than their all-time high of $99.2 million in August 2021. They were also lower than the March high of $26.5 million

Pudgy Penguins Get Pricey

The prices of Pudgy Penguin NFTs are also rising.

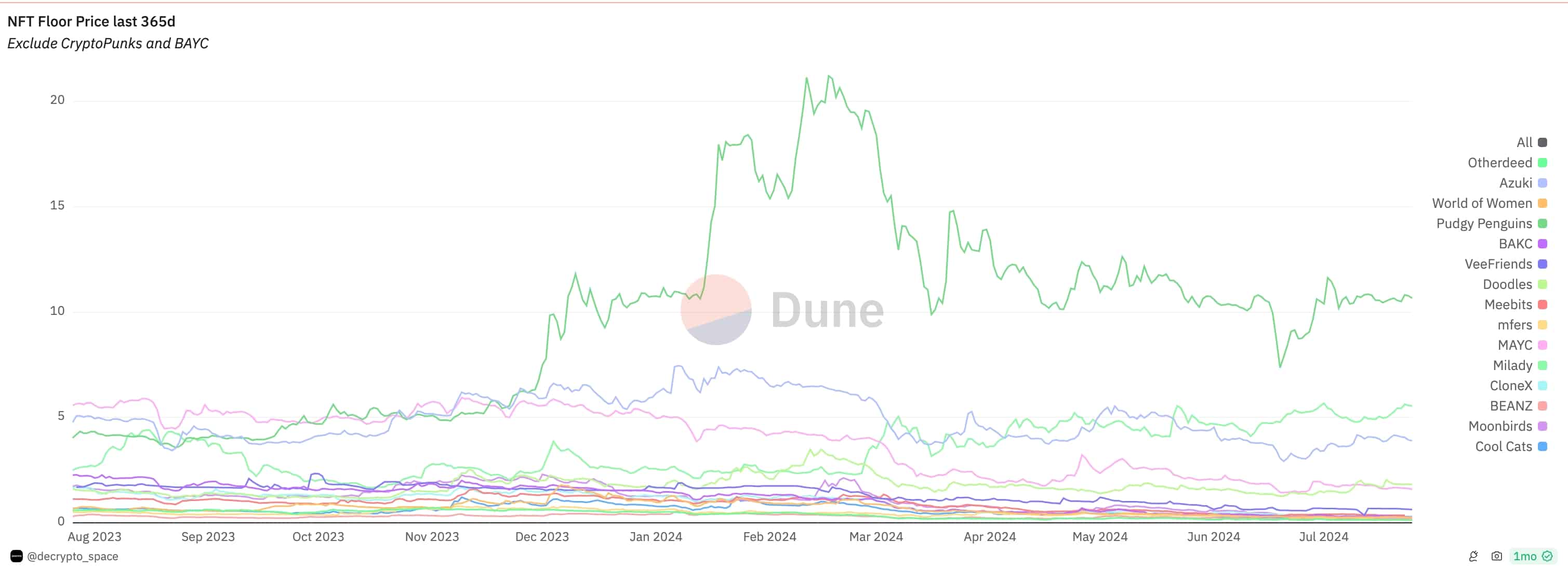

According to Dune, the floor price rose by 30% in August to 10.66 ETH and 166% from the same period in 2023. Floor price refers to the lowest price that an NFT is being sold in marketplaces.

Pudgy Penguins is one of the three blue-chip NFT collections that has seen its floor price rise in the past 12 months. Milady’s floor price has jumped by 121% while Doodles has risen by 12%.

The floor price of other popular blue-chip NFT collections like CryptoPunks, Bored Ape Yacht Club, Azuki, and Mutant Ape Yacht Club has dropped by over 50% in the last 12 months as their demand has waned.

According to NFT Evening, 96% of all NFTs have “died,” with four out of 10 holders being in loss. Additionally, the average lifespan of an NFT has dropped to 1.14 years, much lower than other crypto assets.

Pudgy Penguins, founded by entrepreneur Luca Schnetzler (aka Luca Netz), has done well even as the total sales, transactions, and NFT users have continued to fall.

Total NFT sales in August dropped by 41% to $376 million, down from an all-time high of over $6 billion.

Pudgy Penguin’s sales rose a month after the developers secured $11 million funding from a group of investors to build a layer-2 network. The funding came from Founders Fund, Peter Thiel’s venture company.

The developers have also launched branded toys that are being sold in popular retailers like Walmart and Target.

Source link

You may like

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

Bored Ape Yacht Club

Pudgy Penguins NFT price surpass Bored Ape Yacht

Published

2 weeks agoon

December 9, 2024By

admin

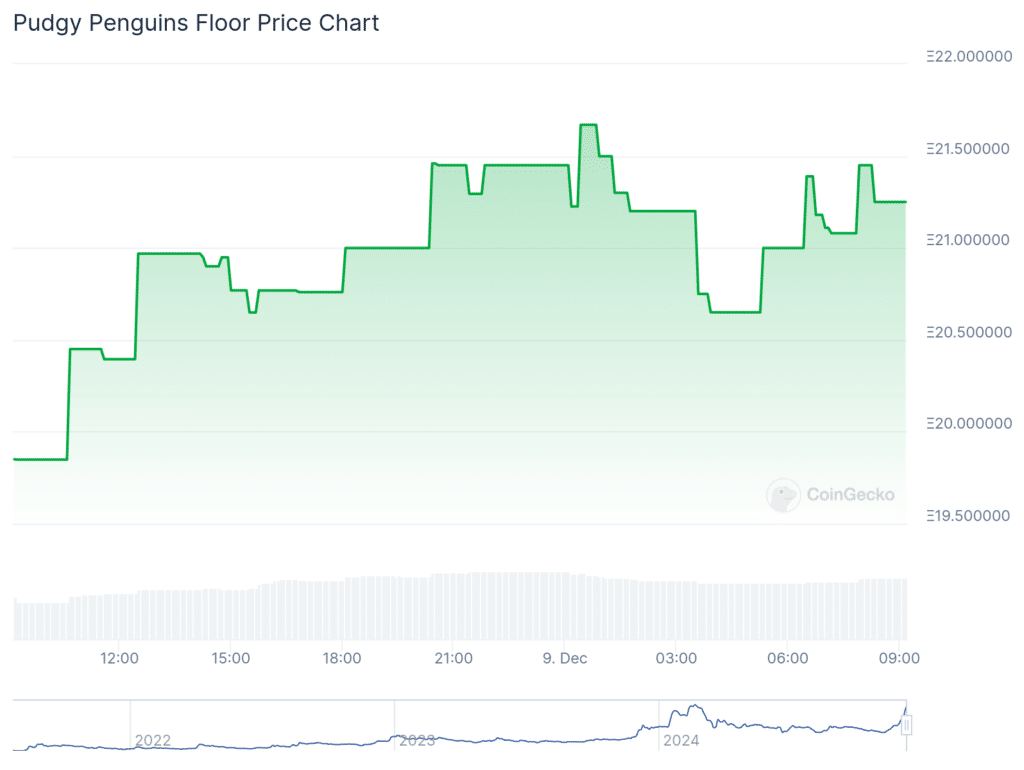

Pudgy Penguins surpassed the phenomenal Bored Ape Yacht on Ethereum price for the first time. This surged amid the NFT’s native token, which would be released in the short term.

Pudgy Penguins price on Ethereum (ETH) surged to 21.49 ETH or equal to $83.930, surpassing the Bored Ape Yacht price of 19.85 ETH or equal to $83.930.

According to CoinGecko data on Dec. 09, these NFTs increased by 7.1% from 19.85 ETH in the past day of trading. Trading volume also surged almost half of the latest trading day to 2,653 ETH.

The increase of this penguin-inspired non-fungible token (NFT) amid the native token $PENGU that was announced a few days ago. This token will be released this year on the Solana (SOL) blockchain.

The Igloo Inc. would prepare 88 billion in token supply, with 25.9% of the supply allocated to the community. Another 24% will be allocated to another community, while the company will account for 11.48%.

“$PENGU will have a total supply of 88,888,888,888 and will launch on Solana,”

they mentioned on X’s post on Dec. 06

Viral Pudgy Penguins NFT

According to the post, these viral Pudgy Penguins were gaining momentum this year with millions of followers and billions of viewers across the globe. These NFTs also reached a market cap of 188,569 ETH after the price surged, which is only a few caps away from Bored Ape Yacht NFT with 196,101 ETH.

The NFTs, with 8,888 unique penguin cartoons, price on Ethereum will also target a new all-time high of 22.9 ETH that was created 10 months ago on Feb. 17.

Penguin’s firm also secured $11 million to build a new project on Layer 2 to support ventures named Cubed Labs and targeting mass cryptocurrency adoptions. This project will take a user-first approach to building abstracts and deploying the testnet ahead of the next wave of consumer crypto products.

Source link

ApeCoin

Turtle-themed Speedy, Bored Ape’s ApeCoin spike over 100%

Published

2 months agoon

October 20, 2024By

admin

Meme coins Speedy and ApeCoin have both seen their prices pump by over 100% in the last 24 hours.

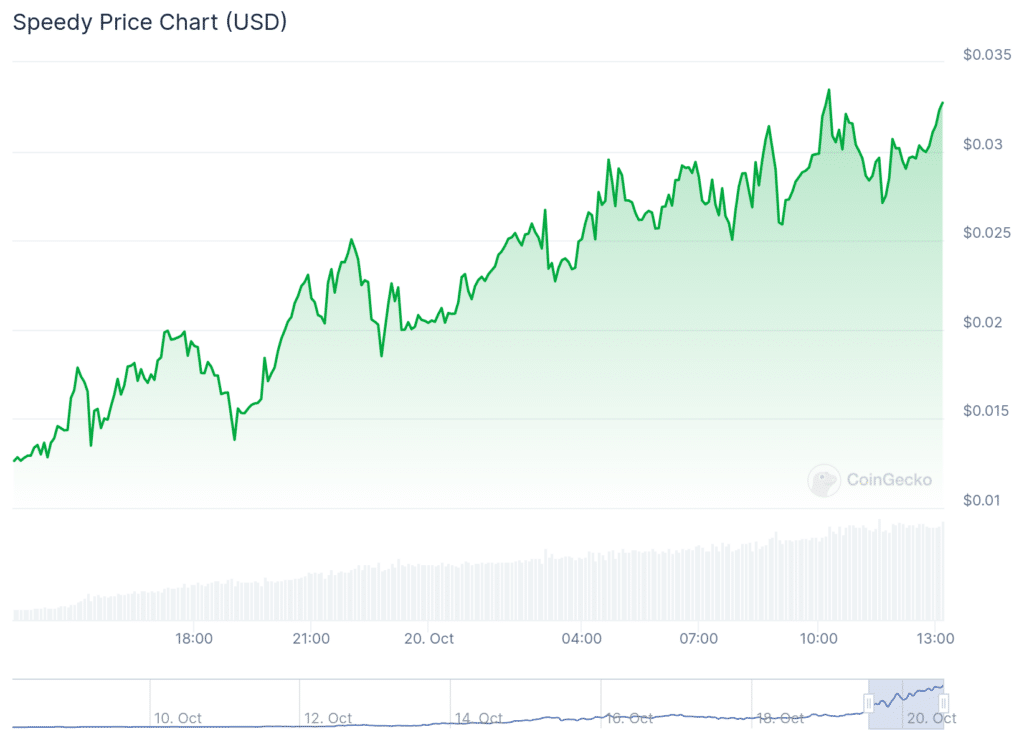

According to current market data, Speedy (SPEEDY) — a meme coin launched on the Fantom blockchain by The GOAT Foundation — was among the top gainers on CoinGecko as of Sunday afternoon.

The team behind Speedy, which includes experts in blockchain technology like Gonzales Spidorius serving as the CIO, saw the token spike over 150%. The coin’s all-time high hovers at around $0.03346; its all-time low was on Oct. 20, at $0.0007253.

See the chart below.

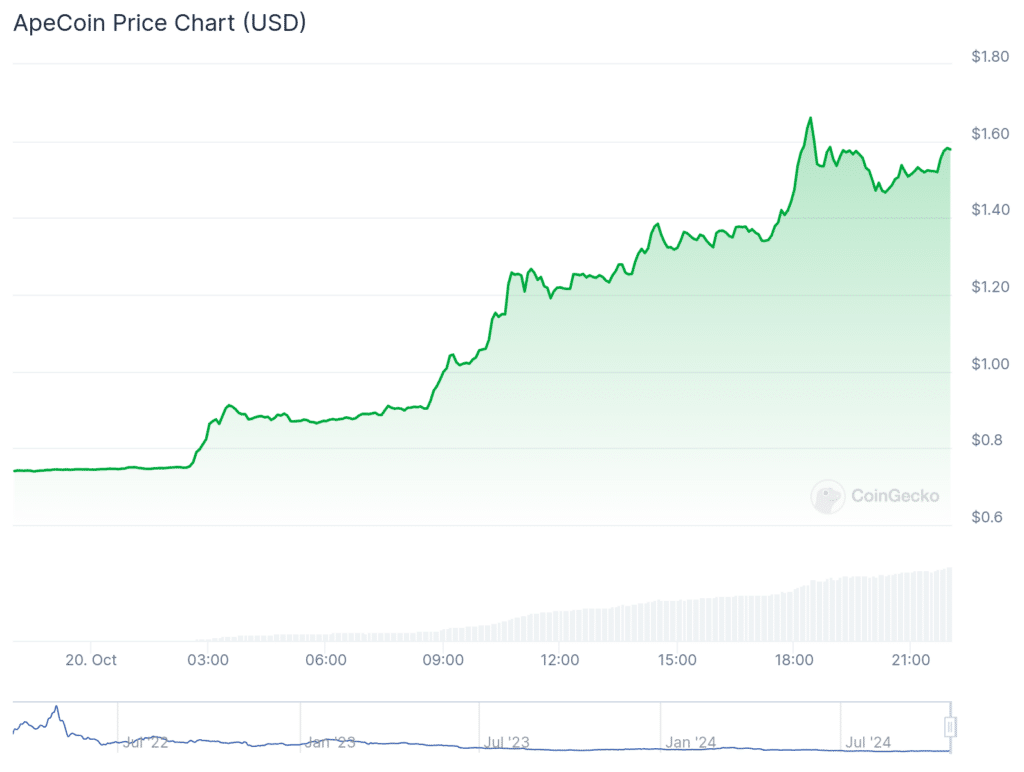

ApeCoin (APE), meanwhile, enjoyed a 105.0% increase.

Per their data, APE was trading in a 24-hour range of $0.7393 to $1.66. A closer look at the price in the last seven days shows that the coin has surged from a low of $0.6981 to $1.57.

What triggered the surge?

While the sudden surge in Speedy could not be confirmed, Ben Crypto — a crypto observer with over 30,000 subscribers on YouTube took a closer look.

Yes, turtles move slow, but this coin is fast. It ain’t slowing down anytime soon… for full two weeks, this coin was below $1 million market cap. Then, in the next few days, it quickly rose to about $10 million, pulled back slightly then in the last two days, it has gone parabolic.”

See below.

If you invested $1,000 during this period, it would be $30,000 right now, Ben Crypto explained. If you invested $3,000, it would be just around $100,000.

Always look for coins with $1 million market caps that have been trading for at least a week, he advises. Why? There’s minimal downside risk of a rug pull and the risk-reward ratio is high, he argues.

As for ApeCoin, the primary reason for the bullish momentum appears to be the launch of ApeChain, a new Layer-3 blockchain.

The ApeCoin X account made an official announcement regarding this development. “Bridges are live. Bring your tokens to ApeChain now to start earning native yield on APE, ETH, and various stablecoins,” ApeCoin stated.

The newly launched ApeChain offers several key features that have contributed to the positive market sentiment.

Now that the bridge has been launched, token holders can now move their tokens to ApeChain, Ethereum (ETH) and the Arbitrum (ARB) chain.

Their team announced that holding ApeCoin on ApeChain puts their APE in automatic yield mode, letting users earn yields on APE, ETH, and other stablecoins.

The ApeCoin team also announced on X that memes on ApeChain are up by over 12,000%.

The APE coin has been on a downward trend in the second half of 2024. The coin had touched an all time low of $0.482 in August 2024. However, the coin has surged by over 215% since that low.

The recent ApeChain launch has also pushed the price up above $1.5. However, it should be seen whether APE can sustain the $1.50 level.

ApeCoin is the native cryptocurrency of the Bored Ape Yacht Club non-fungible token collection. It was launched in March 2022 by Yuga Labs and is governed by the ApeCoin DAO, which allows holders of the coin to vote on the direction of the ecosystem.

Source link

Bored Ape Yacht Club

Arbitrum, ApeCoin in focus ahead of big token unlocks

Published

3 months agoon

September 15, 2024By

admin

Arbitrum and ApeCoin prices will be in the spotlight this week as their networks unlock millions of tokens.

ApeCoin (APE) token was trading at $0.756, up by 57% from its lowest point in August, while Arbitrum (ARB) was stuck at $0.5345, where it has been at in the past few weeks.

Arbitrum will unlock 93 million tokens

The two coins will be in focus as their dilution continues. Arbitrum will unlock 93.2 million new tokens on Monday, Sep. 16. This unlock will bring the number of coins in circulation to over 3.52 billion.

Arbitrum will still have more unlocks to go since it has a total supply of 10 billion tokens, with the last unlock expected to happen in April 2027.

This unlock will happen at a time when Arbitrum’s ecosystem is going through a challenging period. Data by Nansen shows that the number of active addresses has dropped to 455,000, down from the year-to-date high of 1.50 million.

The number of daily deployments in the blockchain has dropped to 8,600 from the year-to-date high of 32,750. Also, transaction count dropped by over 24% in the last 24 hours to 1.07 billion.

Arbitrum has been passed by Base Blockchain in the decentralized exchange industry. The volume of transactions in its DEX networks dropped by 20% in the last seven days to $2.7 billion while Base handled $2.91 billion.

ApeCoin token unlock ahead

ApeCoin, the cryptocurrency started by Yuga Labs, will unlock 15.38 million tokens on Sep. 17. This event will bring the number of coins in circulation to 620 million.

ApeCoin has a maximum supply of 1 billion coins and 15.3 million are released each month. The final unlock will happen in March 2026.

There’s also the upcoming ApeChain launch. ApeChain will be a layer-2 network and enable developers to build applications across the gaming, decentralized finance, non-fungible tokens, and decentralized public infrastructure industries.

Token unlocks are often seen as bearish events in the crypto industry because they dilute existing holders. They also reduce the staking yield received by investors since most of these tokens flow to staking pools.

ApeCoin and Arbitrum will also react to the upcoming Federal Reserve interest rate decision on Wednesday.

Economists expect the bank to deliver its first interest rate cut since 2020 since U.S. inflation has eased while the unemployment rate remains above 4%. In most cases, cryptocurrencies and other risk assets do well when the Fed has embraced a dovish tone.

Source link

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential