Bored Ape Yacht Club

Pudgy Penguins NFT price surpass Bored Ape Yacht

Published

4 months agoon

By

admin

Pudgy Penguins surpassed the phenomenal Bored Ape Yacht on Ethereum price for the first time. This surged amid the NFT’s native token, which would be released in the short term.

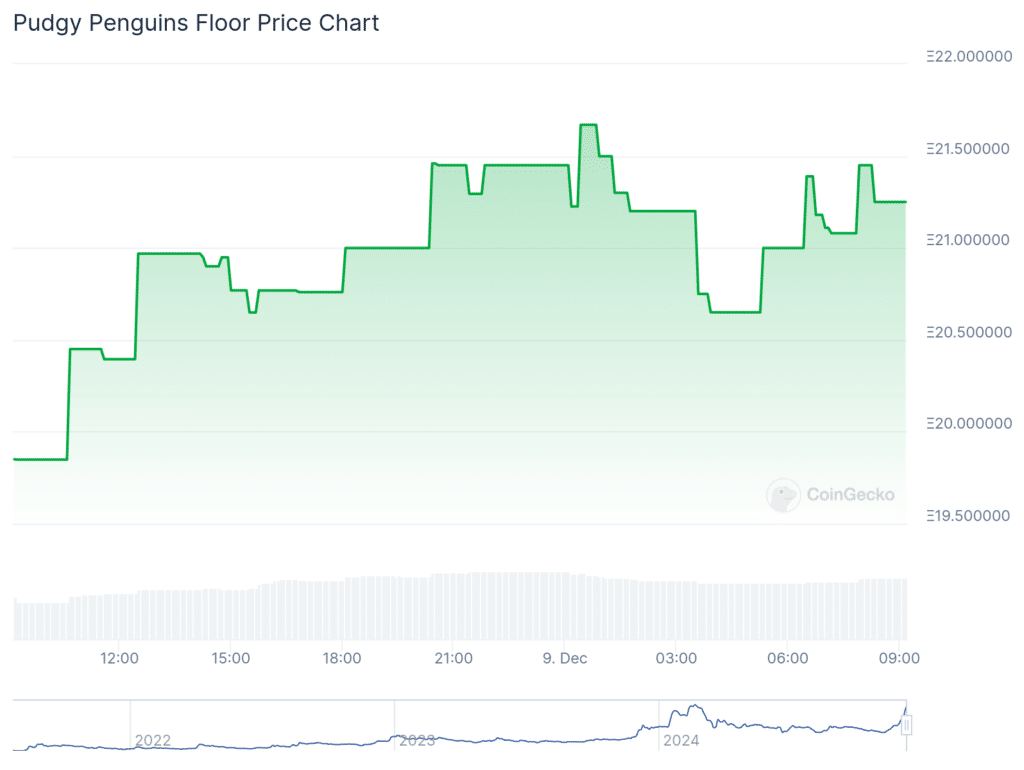

Pudgy Penguins price on Ethereum (ETH) surged to 21.49 ETH or equal to $83.930, surpassing the Bored Ape Yacht price of 19.85 ETH or equal to $83.930.

According to CoinGecko data on Dec. 09, these NFTs increased by 7.1% from 19.85 ETH in the past day of trading. Trading volume also surged almost half of the latest trading day to 2,653 ETH.

The increase of this penguin-inspired non-fungible token (NFT) amid the native token $PENGU that was announced a few days ago. This token will be released this year on the Solana (SOL) blockchain.

The Igloo Inc. would prepare 88 billion in token supply, with 25.9% of the supply allocated to the community. Another 24% will be allocated to another community, while the company will account for 11.48%.

“$PENGU will have a total supply of 88,888,888,888 and will launch on Solana,”

they mentioned on X’s post on Dec. 06

Viral Pudgy Penguins NFT

According to the post, these viral Pudgy Penguins were gaining momentum this year with millions of followers and billions of viewers across the globe. These NFTs also reached a market cap of 188,569 ETH after the price surged, which is only a few caps away from Bored Ape Yacht NFT with 196,101 ETH.

The NFTs, with 8,888 unique penguin cartoons, price on Ethereum will also target a new all-time high of 22.9 ETH that was created 10 months ago on Feb. 17.

Penguin’s firm also secured $11 million to build a new project on Layer 2 to support ventures named Cubed Labs and targeting mass cryptocurrency adoptions. This project will take a user-first approach to building abstracts and deploying the testnet ahead of the next wave of consumer crypto products.

Source link

You may like

Dogecoin Follows This Blueprint, Says Crypto Analyst

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

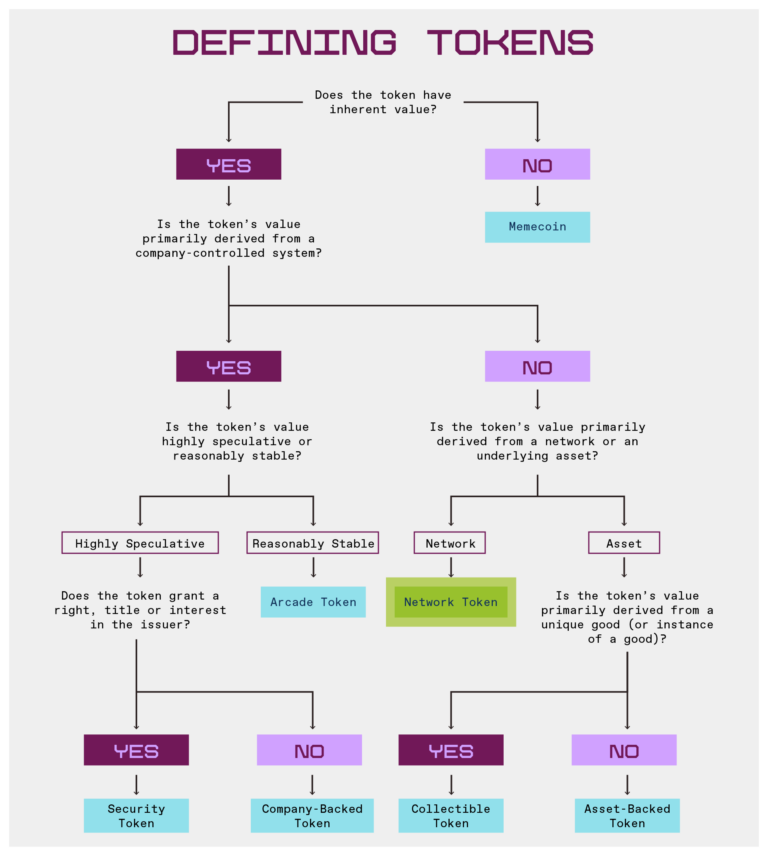

From network tokens to meme coins, a16z crypto has laid out a framework to help businesses navigate the evolving crypto landscape.

What is a cryptocurrency? According to Wikipedia’s definition, it is a digital currency designed to work through a computer network that is “not reliant on any central authority, such as a government or bank, to uphold or maintain it.”

And while at the very beginning in 2009 there was one and only cryptocurrency out there, called Bitcoin (BTC), things have changed significantly since then. Now, there over 12 million different tokens, per data from crypto price aggregator platforms. But how to differ them? There are memecoins, utility tokens, security tokens, and many more. No wonder crypto has become so complex.

“So, whether you’re building a blockchain-based project, investing in tokens, or simply using them as a consumer, it’s essential to know what to look for. It’s important not to confuse, for instance, memecoins with network tokens.”

a16z crypto

To help sort the crypto things out, Miles Jennings, Scott Duke Kominers, and Eddy Lazzarin from a16z crypto created a framework for understanding the seven categories of tokens they see entrepreneurs building with most often. Below is a breakdown of these categories.

Network tokens

Network tokens are used to keep a blockchain or smart contract protocol running. Basically, their value comes from how the network works. They usually have a clear purpose, like helping with network operations, forming consensus, upgrading the protocol, or rewarding certain actions within the network.

As a16z crypto explains, these networks, where the tokens live, usually have features like “programmatic buybacks, dividends, and other changes to the total token supply via token creation or burning to introduce inflationary and deflationary pressures in service of the network.”

Network tokens depend on trust. And in this aspect a16z crypto says these tokens “are similar to both commodities and securities.”

“Recognizing this, both the SEC’s 2019 Framework and FIT21 provided for network tokens to be excluded from U.S. securities laws when those trust dependencies are mitigated through decentralization of the underlying network.”

a16z crypto

These tokens are used to launch new networks, distribute ownership or control, and keep the network secure. The brightest examples are Bitcoin, Ethereum (ETH), Solana (SOL), Uniswap (UNI), and Dogecoin (DOGE).

Security tokens

While network tokens might seem like securities, security tokens are actually digital versions of traditional securities, like company shares or corporate bonds. They can also have special features, like giving profits interest in an LLC or rights to future settlement payments from lawsuits.

While securities give holders specific rights, titles, or interests, and the issuer often controls the asset’s risk, these tokens will still be under U.S. securities laws, as a16z crypto points out. Even though these tokens aren’t as common as network tokens or memecoins, they’ve still been used to raise money for business ventures.

For example, Etherfuse Stablebonds and Aspen Coin gave people fractional ownership in the St. Regis Aspen Resort.

Company-backed tokens

Company-backed tokens are tied to an off-chain application, product, or service run by a company or centralized organization.

Like network tokens, company-backed tokens may use blockchain and smart contracts (e.g., to facilitate payments). However, they primarily serve off-chain operations rather than network ownership. As a result, a company has more control over the issuance, utility, and value of the token.

Although these tokens don’t provide a defined right or title like traditional securities, they still have trust dependencies akin to securities.

“Their value is inherently dependent upon a system that is controlled by a person, company or management team.”

a16z crypto

For this exact reason, company-backed tokens could be subject to U.S. securities laws when they attract investment, the analysts warn. Historically, company-backed tokens have been used to circumvent securities laws in the U.S., acting as proxies for equity or profits interests in companies.

For instance, examples include (FTT), which was a profit interest in the notorious FTX exchange. Binance Coin (BNB) is another example of a company-backed token that transitioned into a network token after the launch of BNB Chain.

Arcade tokens

Arcade tokens are primarily used within a system and are not meant for investment, a16z crypto explains. These tokens often serve as currencies within virtual economies, like digital gold in a game, loyalty points for a membership program, or credits for digital products.

What makes arcade tokens unique is that they are designed to discourage speculation. They may have an uncapped supply — meaning an unlimited number can be minted — and/or limited transferability.

As a16z crypto points out, these tokens may even “expire or lose value if unused, or they may only have monetary value and utility within the system in which they are issued.” As a rule, arcade tokens don’t promise financial returns, which makes them relatively safe from U.S. securities laws.

Examples include FLY, the loyalty token for the Blackbird restaurant network, and Pocketful of Quarters, an in-game asset that received relief from the U.S. Securities and Exchange Commission in 2019.

Collectible tokens

One of the most well-known types of tokens are collectible ones. They can represent things like a work of art, a music piece, or even a concert ticket stub. But for the public, they’re more commonly known by a different name — NFTs, or non-fungible tokens. And while NFTs might seem like another speculative bubble, these tokens may actually have utility within specific contexts.

“A collectible token may function as a license or ticket to an event; could be used in a video game (like that sword); or could provide ownership rights with respect to intellectual property.”

a16z crypto

Because collectable tokens generally relate to finished goods and don’t rely on third-party efforts, they are usually excluded from U.S. securities laws, a16z crypto notes. The well-known NFTs are probably Bored Ape Yacht Club and CryptoPunks.

Asset-backed tokens

Asset-backed tokens get their value from a claim on underlying assets. For example, commodities, fiat currency, or even digital assets such as cryptocurrencies.

These tokens may be fully or partially collateralized, and they serve various purposes, such as acting as stores of value or hedging instruments. However, unlike collectable tokens, which derive value from the ownership of unique goods, asset-backed tokens function more like financial instruments. Per a16z crypto, the “regulatory treatment of asset-backed tokens, however, depends on their structure and use.”

Examples include fiat-backed stablecoins like Circle’s USD Coin (USDC), liquidity provider tokens like Compound’s C-tokens, or derivative tokens like OPYN’s Squeeth.

Memecoins

And then, we’ve got memecoins – probably the most well-known ones. These are like the peak of internet chaos. They don’t really do anything useful and are mostly all about memes or whatever community hype is going on. Their fundamentals? Forget it. It’s all about speculation and whatever the market feels like, which means they’re super easy to manipulate or get rug-pulled.

Because of how wild they are, memecoins are “generally excluded from U.S. securities laws,” as a16z crypto says, noting though that they’re still “subject to anti-fraud and market manipulation laws.” What makes them stand out? They’ve got zero purpose or real use, and their prices can swing like crazy, which makes them pretty much a no-go for investment. Some famous ones include Pepe (PEPE), Shiba Inu (SHIB), and the new Official Trump (TRUMP) memecoin linked to U.S. President Donald Trump.

Source link

Dogecoin Follows This Blueprint, Says Crypto Analyst

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x