24/7 Cryptocurrency News

RBI, SEBI Join To Develop India Crypto Policy, Paper Due In Q3

Published

5 months agoon

By

admin

India Crypto Policy: The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have joined an inter-ministerial group tasked with formulating a comprehensive crypto policy. This collaboration marks a potential turning point in their stance on cryptocurrencies, with a discussion paper outlining the government’s position expected to be released in the third quarter of 2024.

India Crypto Policy Development & Regulatory Collaboration

India’s financial regulators, RBI and SEBI, are joining forces with other government bodies to develop the India crypto policy. Economic Affairs Secretary Ajay Seth revealed in an interview that a discussion paper outlining their stance on cryptocurrencies is expected to be released before September 2024.

The paper aims to gather input from stakeholders on potential regulations for India crypto policy. Seth explained that the current regulatory approach focuses solely on anti-money laundering (AML) and counter-terror financing (CTF) measures, which were extended to crypto assets and intermediaries in March 2023.

An inter-ministerial group, including the RBI and SEBI, is working on a broader policy framework. This development follows their G20 presidency in 2023, during which member countries endorsed guidelines set by the International Monetary Fund (IMF) and the Financial Stability Board (FSB).

The discussion paper will address key questions about policy stance and regulatory scope. It comes amid conflicting views within Indian authorities, with SEBI reportedly open to allowing private virtual asset trading, while the RBI maintains concerns about macroeconomic risks.

This initiative marks a significant step in their approach to cryptocurrencies, following the Supreme Court’s 2020 decision to strike down the RBI’s 2018 ban on crypto-related financial services. The government’s stance has evolved since 2021 when a bill proposing a ban on private cryptocurrencies was drafted but never introduced.

The upcoming discussion paper is expected to align with the G20-endorsed IMF-FSB framework, which advises against blanket bans on crypto activities. This development signals their move towards a more nuanced and potentially inclusive approach to cryptocurrency regulation.

Also Read: Steve Forbes Says Kamala Harris Policies Will Ruin The Middle Class

Divergent Regulatory Views and Market Impact

SEBI has shown openness to allowing private virtual asset trading, recommending multiple regulators oversee crypto trading nationwide in May. This stance contrasts with the RBI’s historically tighter grip on cryptocurrencies and its ongoing concerns about macroeconomic risks.

However, SEBI’s recommendation has gained significant traction among crypto market participants, potentially signaling a more inclusive approach to cryptocurrency regulation. This development has created a state of anticipation in the market, as it represents a potential shift from the RBI’s longstanding restrictive stance on cryptocurrencies.

The upcoming discussion paper and the resulting policy framework are expected to navigate these differing viewpoints and establish a balanced approach to cryptocurrency regulation in the country.

Also Read: Bitcoin ETF Inflows Surge As Ether ETF Loses $133M In Hype Shift

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

24/7 Cryptocurrency News

BTC Risks Falling To $20K If This Happens

Published

46 minutes agoon

December 23, 2024By

admin

Bitcoin News: A recent report from The Kobeissi Letter hints at a potential BTC crash to $20,000 in the coming few weeks. The report cited Bitcoin’s relation with the global monetary supply, saying that if the crypto continues to move in tandem, it could witness a massive dip ahead. Besides, it also comes amid highly volatile trading noted in the broader crypto market, with the flagship crypto falling below the $100K mark recently.

Bitcoin News: Why BTC Can Crash To $20K?

In the latest Bitcoin news, the crypto could face a significant correction, potentially dropping to $20,000 in the coming weeks, The Kobeissi Letter said. The report highlights Bitcoin’s historical tendency to mirror global money supply trends, suggesting a steep decline might be on the horizon. The analysis revealed a close relationship between Bitcoin prices and global monetary supply, with BTC often reacting with a 10-week lag.

As global money supply peaked at $108.5 trillion in October, Bitcoin hit an all-time high of $108,000 recently. However, a subsequent $4.1 trillion drop in money supply to $104.4 trillion, its lowest since August, raises concerns about Bitcoin’s near-term trajectory.

Meanwhile, The Kobeissi Letter raised concerns over the potential crash ahead. They noted, “If the relationship still holds, this suggests that Bitcoin prices could fall as much as $20,000 over the next few weeks.” Notably, this prediction comes amid heightened market volatility, with BTC recently slipping below the psychological $100K mark. Such movements have amplified fears of a broader selloff in the crypto market, which has already faced pressure from global economic uncertainties.

What’s Next For BTC Amid Bearish Sentiment?

The latest positive Bitcoin news and strong rally this year showcased its resilience but this potential correction could pause its bullish momentum. Traders and investors are now closely monitoring macroeconomic factors, including shifts in monetary supply, which could significantly impact BTC’s performance. However, the question remains whether Bitcoin will defy this predicted trend or align with historical patterns.

If the BTC crash occurs, it would mark a critical juncture for the cryptocurrency market, testing Bitcoin’s role as a safe haven in uncertain times. For context, Robert Kiyosaki has recently hinted towards a looming economic depression, while urging investors to buy Bitcoin amid the economic turmoil.

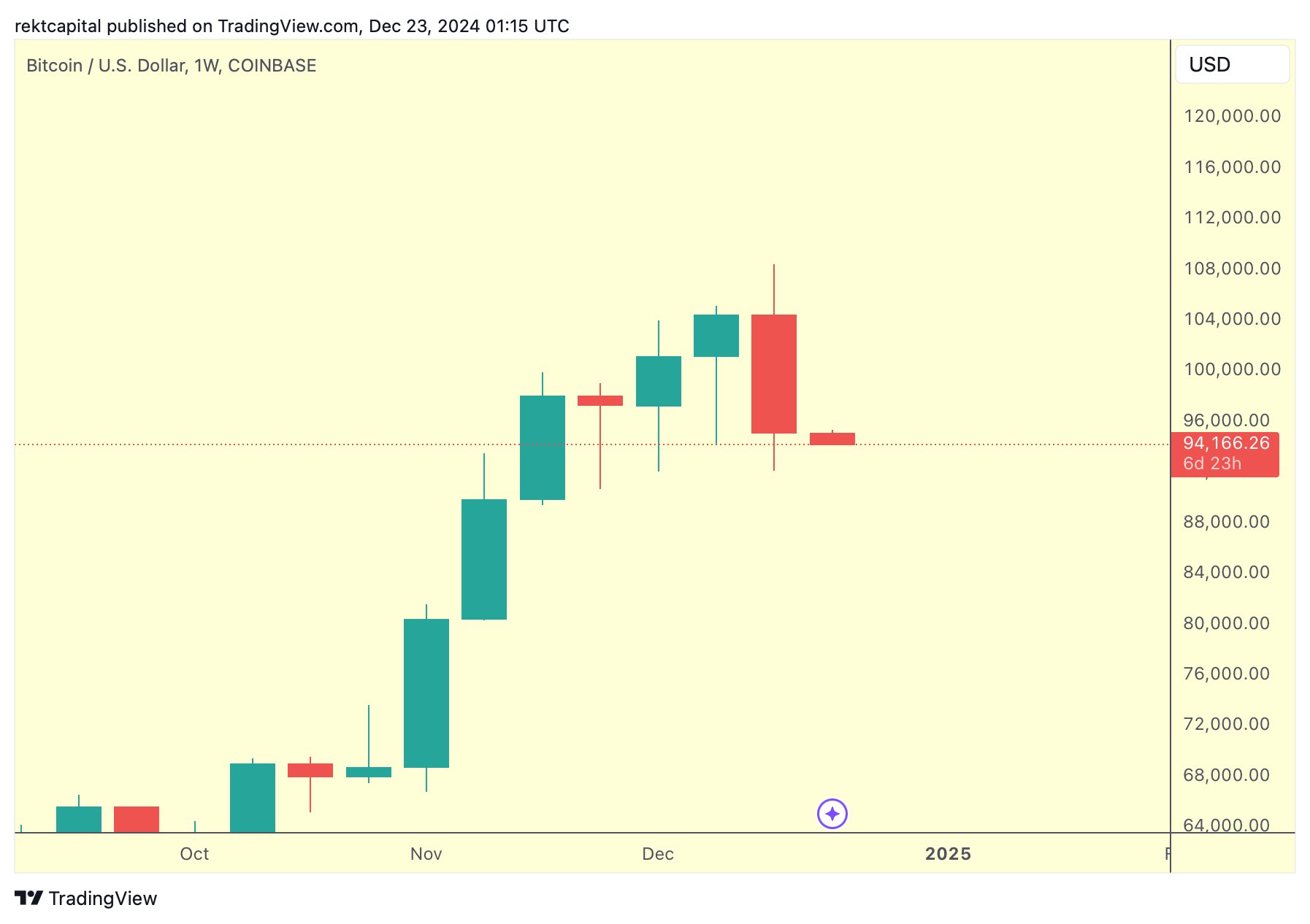

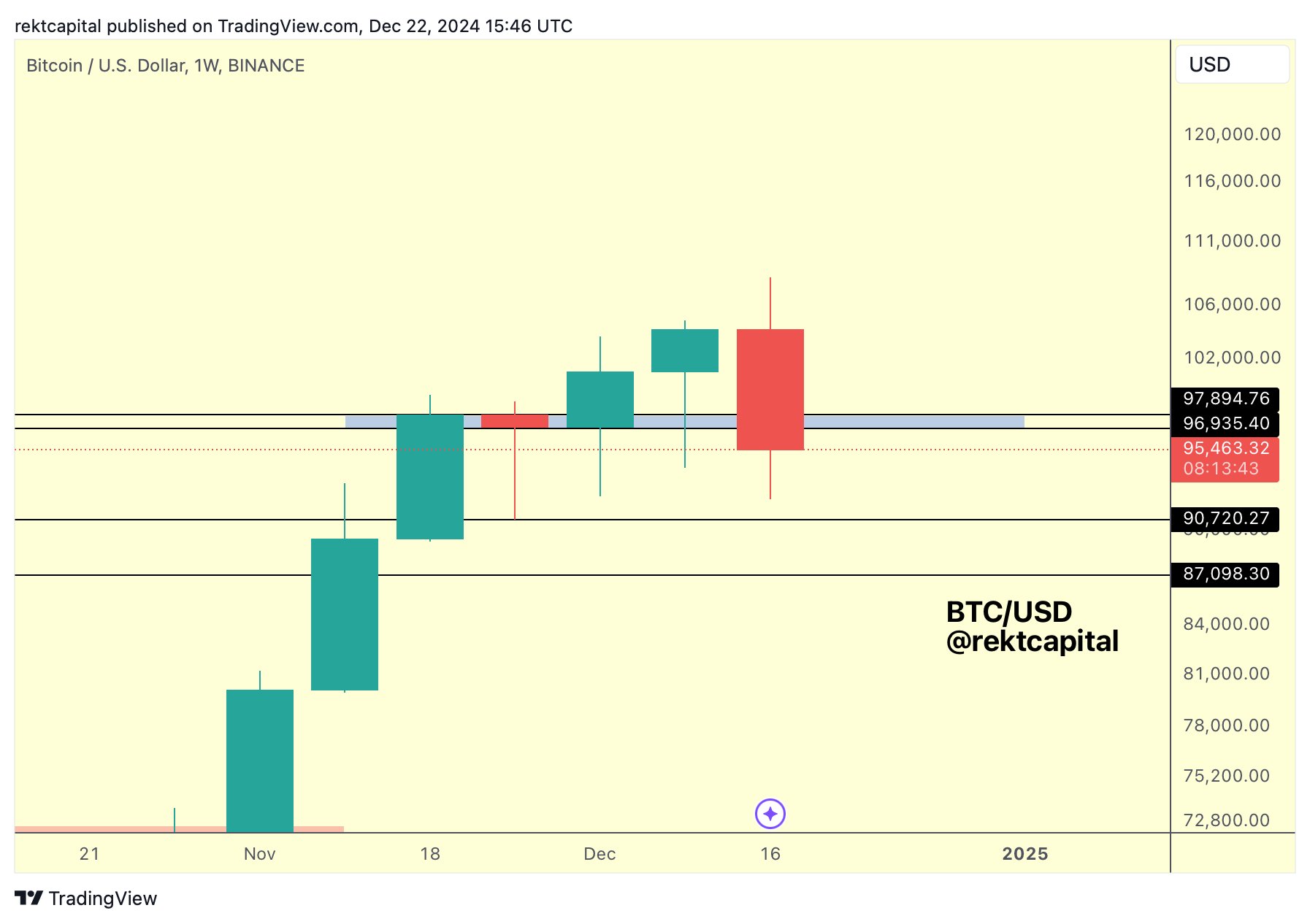

However, popular crypto market expert Rekt Capital also said that the crypto “has confirmed a Bearish Engulfing Candlestick formation”, highlighting the bearish momentum in the market.

In a separate post, the analyst said that BTC has lost its weekly support and its 5-week technical uptrend is over. Considering that, the expert warned about a potential multi-week correction for the crypto ahead.

However, despite that, the institutional interest remained strong for the crypto. For context, Matador has recently revealed its plan to buy $4.5 million in BTC this month. On the other hand, MicroStrategy also continued its buying trend, indicating strong market interest.

Meanwhile, BTC price today was down more than 1% to $94,430, while its one-day trading volume jumped nearly 34% to $54.39 billion. Notably, the crypto has touched a high of $97,217 over the last 24 hours. In addition, a recent Bitcoin price analysis highlights three potential reasons that could help in ending the bearish momentum ahead.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

Published

7 hours agoon

December 23, 2024By

admin

Rich Dad Poor Dad author Robert Kiyosaki has issued a stark warning while hinting towards an economic depression ahead. In a recent X post, the renowned author said that the global market crash has already started, as he predicted earlier, which indicates that the financial market might enter a “depression” phase. Notably, this comes as the crypto market records immense volatility, sparking concerns over what’s next for Bitcoin (BTC).

Robert Kiyosaki Hints At Economic Depression Ahead

Robert Kiyosaki, in a recent X post, has revealed a stark warning of a looming economic depression. The Rich Dad Poor Dad author warned that a global market crash has already begun, citing Europe, China, and the U.S. as regions facing significant downturns.

In his post, Kiyosaki urged caution, advising individuals to safeguard their finances and maintain their jobs. “Global crash has started. Europe, China, USA going down. Depression ahead?” he asked while emphasizing the enduring value of assets like gold, silver, and Bitcoin. He added, “For many people, crashes are the best times to get rich.”

This warning aligns with Kiyosaki’s earlier prediction of what he called the “biggest crash in history.” Earlier this month, he encouraged his followers to prepare for financial turmoil, stating, “Please be proactive and get rich… before the BOOMER’s go BUST.”

However, this recent comment from Robert Kiyosaki indicates his sustained confidence in BTC. As the crypto market faces heightened volatility, Bitcoin could emerge as a hedge against traditional market instability, he noted. Besides, it also indicates that the flagship crypto, alongside gold and silver, might continue to gain traction amid this economic turmoil.

What’s Next For BTC?

Bitcoin price today has continued its volatile trading, losing nearly 1.5% over the last 24 hours to $95,323. The crypto touched a high and low of $97,260 and $93,690 in the last 24 hours, showcasing the highly volatile scenario in the market.

In addition, the US Spot Bitcoin ETF also recorded significant outflow, with BlackRock Bitcoin ETF witnessing its largest outflux since its launch. This has weighed on the investors’ sentiment, sparking concerns over a waning institutional interest.

However, despite that, many experts remained confident on the asset’s future trajectory. For context, in a recent X post, Peter Brandt shared a new BTC price target, indicating his confidence in the digital asset.

On the other hand, institutions like Metaplanet have also continued to boost their BTC holdings. These moves indicates that the institutions, as well as many investors, are bullish towards the long-term potential of the crypto. Besides, as Robert Kiyosaki said, the recent dip also provides a buying opportunity to investors, which might further boost Bitcoin to its new ATH ahead.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Published

10 hours agoon

December 23, 2024By

admin

Tron founder Justin Sun has been heavily offloading his ETH holdings with Ethereum price crashing 17% following the rejection at $4,000. Over the past 7 days, Sun has offloaded another 50% of his holdings worth $143 million. Market analysts predict that ETH price could further take a dip below $3,000 once again before resuming upside momentum.

Tron’s Justin Sun on ETH Selling Spree

Justin Sun is on a massive Ethereum selling spree since the coin resumed its upward journey after Donald Trump’s election win. This continued even until last week, when Tron founder offloaded $143 million worth of ETH causing Ethereum price to tank over 15% amid the crypto market crash.

Blockchain analytics firm Spot On Chain reported that Justin Sun redeemed 39,999 ETH (valued at $143 million) from liquid staking platforms Lido Finance and EtherFi. He subsequently deposited the entire amount into HTX.

Since November 10, as Ethereum price has trended upward, Sun has deposited a total of 108,919 ETH (worth $400 million) to HTX at an average price of $3,674. Notably, many of these deposits occurred near local price peaks.

Spot On Chain also revealed that Justin Sun currently has 42,904 ETH (valued at $139 million) in the process of unstaking from Lido Finance. The Tron founder might potentially send this funds to HTX later.

Ethereum Price Drop Below $3,000 Coming?

With Ethereum price losing its crucial support of $3,500, the market sentiment for the world’s largest altcoin has turned bearish. Last week, crypto market analysts turned bearish on Ethereum expecting the ETH price to drop $2,800 on selloff by whales.

Popular market analyst IncomeSharks stated that it was a “low-volume weekend,” for Ethereum following a volatile week for stocks. The analysts added that it won’t be the right time to sell.

The On-Balance Volume (OBV) indicator, a tool used to gauge buying and selling pressure, remains steady, oscillating within a channel. Recent Ethereum buyers are still in profit, providing some support for the market. However, the below chart shows that there’s still scope for Ethereum to take a dip to $3,000.

Prominent crypto analyst “I am Crypto Wolf” also highlighted a bullish outlook with a potential inverse head-and-shoulders (iHS) pattern. According to the analyst, Ethereum price chart is currently forming the “right shoulder” of the iHS continuation pattern.

This setup could provide the momentum needed to surpass the $4,000 resistance and aim for a $10,000 target by May. A breakout is anticipated by the end of January, though a retest of the $3,000 level remains a possibility before the rally takes off, he noted.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: