Hamster

Red alert for Hamster Kombat as Avacoin, Notcoin, Pixelverse tokens dive post-airdrop

Published

5 months agoon

By

admin

The performance of popular Telegram tap-to-earn tokens like Avacoin, Pixelverse, and Notcoin is sending a warning to Hamster Kombat.

Hamster Kombat hits 300 million users

Due to its huge popularity, the Hamster Kombat token launch is one of the most anticipated events in the crypto industry, although the timeline for an airdrop is uncertain.

Data shows that the platform has accumulated over 300 million users globally and 50 million daily active users. Its YouTube channel has added over 35 million subscribers, while its other social media platforms have millions of users.

Hamster Kombat has surpassed other popular players in the blockchain industry, like Pi Network, which had over 50 million users at its peak. Many HMSTR holders look forward to the token listing, which will let them liquidate or HODL their tokens.

Notcoin, Avacoin, and Pixelverse have dropped

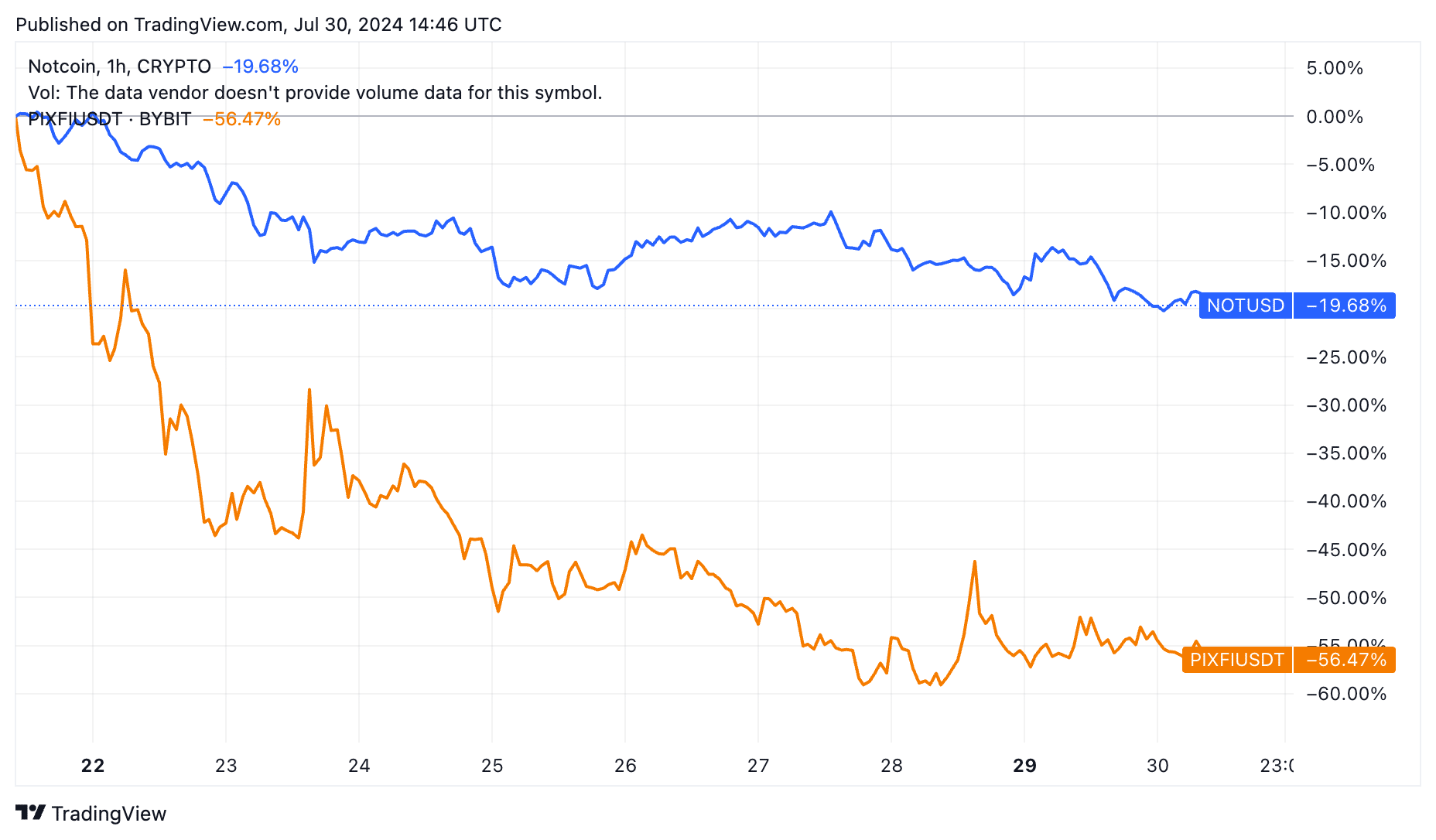

Current data shows that other popular tap-to-earn tokens are not doing well after listing.

Notcoin (NOT), which was listed in May, has dropped by 55.8% to $0.012. Its market cap has decreased from over $2.5 billion to $1.32 billion, even after recent measures to grow its ecosystem.

Similarly, the Pixelverse (PIXFI) token has dropped to $0.030, down by 70% from its highest point this month, sending its market cap tumbling to $160 million.

Avacoin (AVCN), the latest tap-to-earn token to list, has also not performed well. According to Bitget, the token opened at $0.002 on Tuesday and traded at $0.00091 during the day.

Avacoin, Notcoin, and Pixelverse are similar projects to Hamster Kombat in letting users earn tokens by doing simple tasks. In addition to regular tapping, users can gain more tokens by completing tasks like watching YouTube videos and following social media accounts.

Therefore, the price action of these coins is a warning shot to Hamster Kombat, suggesting that their price could also drop after their airdrops. According to its new white paper, Hamster Kombat users will receive 60% of the airdrop tokens, with the rest going to market liquidity, partnerships, and grants.

The developers hope to learn from other play-to-earn platforms like Decentraland (MANA), Sandbox (SAND), and Axie Infinity (AXS). These games have had little activity in the past few years, and their tokens have dropped.

Hamster Kombat aims to solve this challenge by launching regular seasons where users can earn tokens. However, the risk remains that current HMSTR holders might dump tokens after the airdrop, pushing the price lower.

Source link

You may like

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Ethereum

Hamster Kombat enjoys triple-digit boost from six days ago

Published

1 month agoon

November 9, 2024By

admin

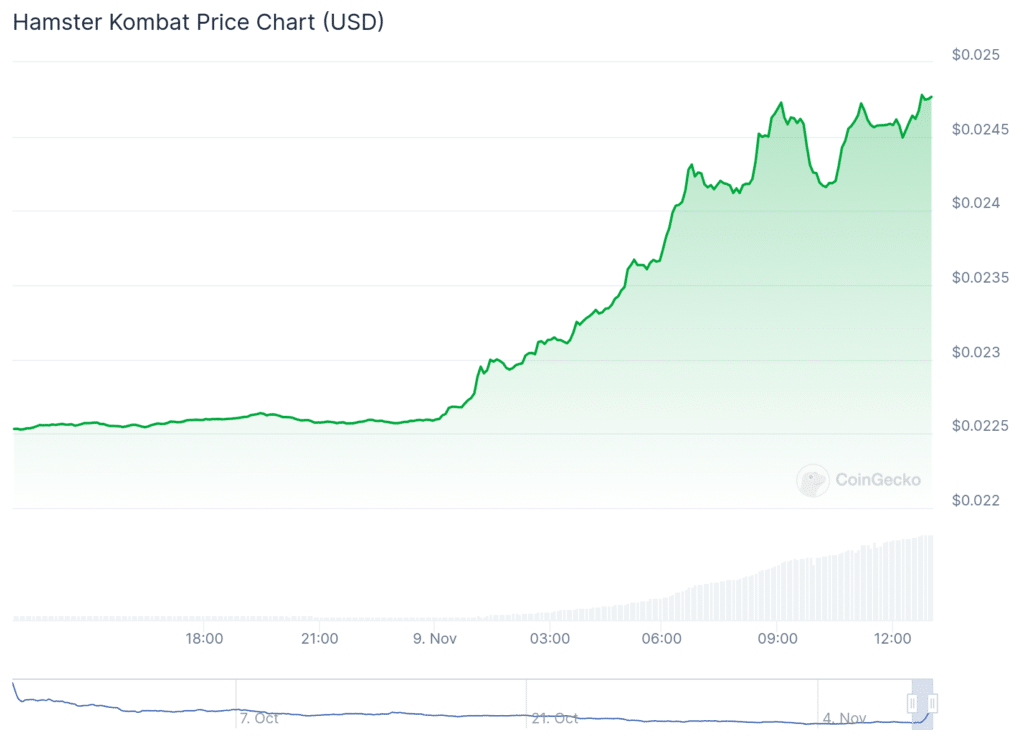

Hamster Kombat is up over 110% from its all-time low price of $0.002263 six days ago.

At last check Saturday, Hamster Kombat (HMSTR) was among the top-three trending coins on CoinGecko, up by almost 88%.

Its fully diluted valuation currently hovers at around $475.6 million. See below.

What is Hamster Kombat?

The creators of Hamster Kombat remain anonymous — a common choice in the crypto sector.

Based on a game launched via Telegram, Hamster Kombat meshes gaming with blockchain technology, allowing players to earn in-game HMSTR tokens.

Players can tap on digital hamsters to gain rewards. They can then be upgraded and use the coins to access special game features.

Hamster Kombat also uses non-fungible tokens, or NFTs, and is set to integrate TON blockchain wallets for storing and converting earned tokens.

The recent activity around the meme coin comes as crypto.news reported that Hamster Kombat’s recent chart pattern indicated that a comeback was imminent, despite the coin wallowing in a deep bear market.

Bongo Cat enjoys a brand-new beat

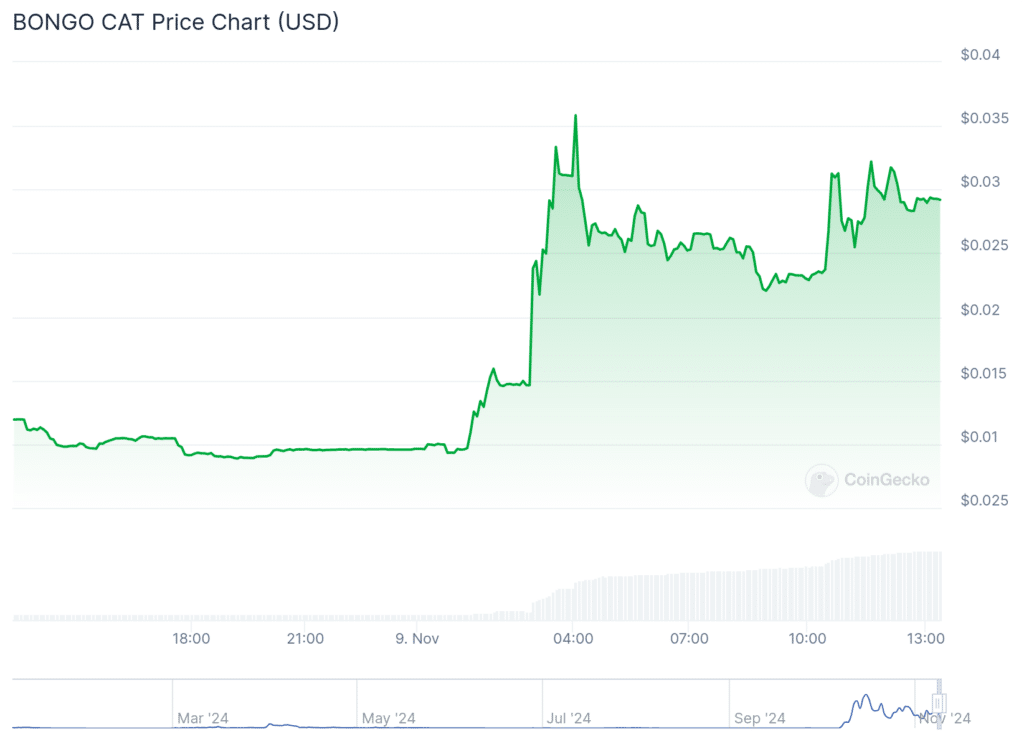

Bongo Cat (BONGO) is a meme coin inspired by an internet meme and video featuring a cat playing the bongos.

It has gained attention in the cryptocurrency community, combining meme culture with blockchain technology. As of now:

Bongo Cat is priced at approximately $0.02922 and is currently up 150% at last check on Saturday — the largest-gaining digital asset on CoinGecko.

This blend of meme and finance illustrates the ongoing trend of meme coins capturing both speculative interest and community-driven support in the crypto market.

LMEOW purrs in Thailand

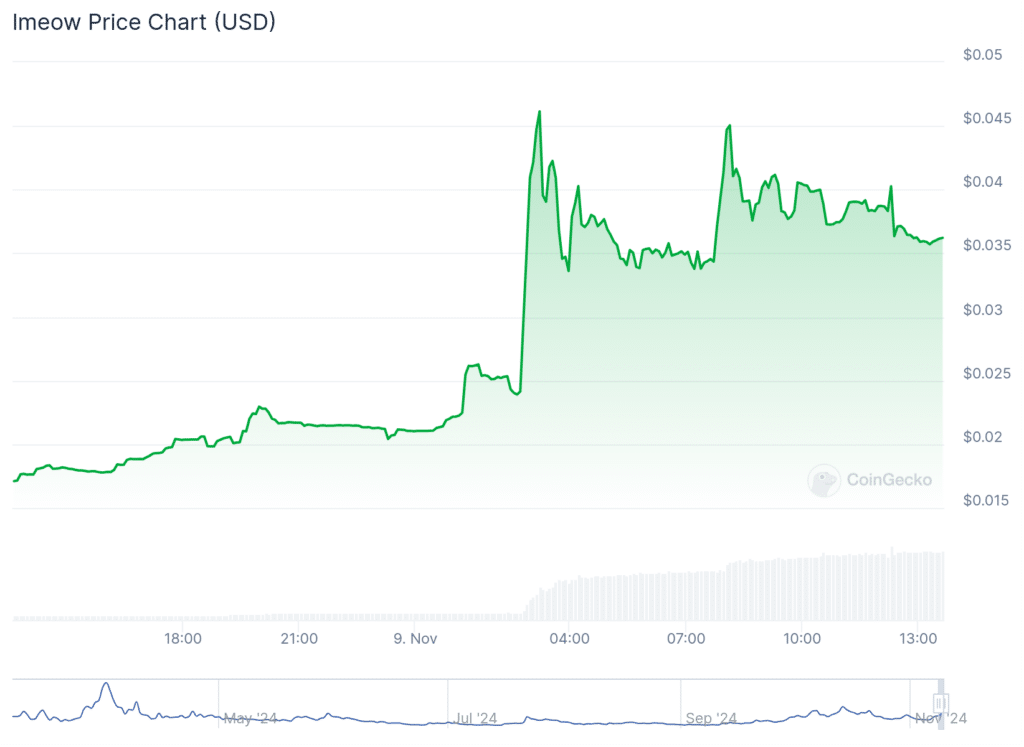

Lmeow (LMEOW) jumped triple-digits on Saturday, coinciding with hype and promotion at Thailand Blockchain Week 2024.

The event, which aims to elevate Thailand into a new era of financial technology, is currently taking place Saturday and Sunday.

Lmeow has a fully diluted valuation of $34.8 million.

The cat-themed tokens can be traded on decentralized exchanges and centralized crypto exchanges, including Uniswap V2 (Ethereum), where the most active trading pair

LMEOW currently has a trading volume of more than $6 million in the last 24 hours.

Source link

blockchain games

Hamster Kombat Ended in a Mass Exodus of 260 Million Players

Published

2 months agoon

November 6, 2024By

admin

Did Hamster Kombat’s viral rise lead to its own downfall? How did 260 million players vanish in months, leaving the game a shadow of its former self?

From boom to dust

Hamster Kombat (HMSTR), a once-celebrated tap-to-earn game on Telegram, seemed destined for blockchain gaming fame, amassing a jaw-dropping 300 million users within months of its launch in March 2024.

But in a surprising twist, this viral sensation has seen an 86% nosedive in active users, dropping to just 41 million by November 2024 and facing one of the most dramatic declines in crypto gaming history.

.@hamster_kombat loses nearly 260 million players in just three months

Hamster Kombat, the tap-to-earn Telegram game that boasted a massive 300-million-strong user base back in August, has reportedly shed 259 million players.

The game’s active monthly player count currently… pic.twitter.com/vVfwhbI4E6

— ICO Drops (@ICODrops) November 4, 2024

The game’s token, HMSTR, has also plummeted in value by over 76%, sliding from its September high of $0.01004 to just $0.0024 as of Nov. 5, casting doubts over the project’s stability.

Behind this exodus lie a series of interconnected setbacks: delayed airdrops, poor user experience, government criticisms, and controversial player bans.

Could the game’s ambitious goals have been the very seeds of its undoing? Let’s delve into the numbers, the strategies, and the backlash to find out what led to Hamster Kombat’s colossal fall from grace.

The rise and promise of Hamster Kombat

Hamster Kombat launched with an ambitious promise: to make blockchain gaming accessible to everyone. A big part of the game’s appeal lies in its simplicity. No need for gaming consoles, advanced computers, or complex controls — players simply tapped, and in return, they earned.

Even Telegram’s CEO, Pavel Durov, hailed it as “the fastest-growing digital service in the world,” citing its potential to redefine how people interacted with blockchain technology.

People from all over the world were suddenly part of this booming virtual ecosystem, where tapping became the new mining, and the tokens they collected had real value attached.

But the game itself couldn’t keep players engaged. The initial excitement over the tap-to-earn model quickly faded as players found the gameplay repetitive and shallow.

With no fresh challenges, Hamster Kombat began to lose its appeal, leaving users with little reason to return, especially as the HMSTR token kept losing value.

The AI-generated graphics, which initially seemed quirky, were also criticized for feeling cheap and uninspired, adding to the perception that Hamster Kombat was more of a cash grab than a well-crafted gaming experience.

The simplicity that first drew users in became a source of frustration, and the game’s high hopes for sustainability faced challenges that even a massive user base couldn’t fix.

The airdrop disappointment and the backlash of bans

One of Hamster Kombat’s most eagerly awaited events was its token airdrop in late September, intended as a reward for player loyalty and engagement.

With nearly 129 million players eligible to claim HMSTR tokens, expectations ran high. But what was meant to be a celebratory event ended up driving players away in droves.

The airdrop left many users frustrated, not just because of delays but due to the surprisingly low value of their rewards.

Some players who had spent hours grinding the game found their earnings amounted to just $1 to $10 — a fraction of what they’d hoped for, leading some to label the airdrop as “dust.”

To make matters worse, the rollout of the airdrop was marred by delays and technical glitches. Originally promised as a straightforward distribution, the airdrop faced several postponements, testing players’ patience.

By the time it finally happened, the discontent among the user base was palpable. Many players took to social media to vent their frustrations, some claiming they felt deceived by what they saw as broken promises.

This backlash severely damaged the game’s reputation, transforming the airdrop from an incentive to a point of contention.

The controversy didn’t end there. Hamster Kombat introduced a new anti-cheat system alongside the airdrop, aiming to curb fraudulent activities.

While intended to protect genuine players, this system ended up banning around 2.3 million accounts and confiscating approximately 6.8 billion HMSTR tokens. Many players felt blindsided by these sudden restrictions, as even legitimate users were caught in the dragnet.

Some felt that the sweeping bans were too harsh, and the confiscations only added to the resentment, leaving a large chunk of the player base feeling alienated and mistreated.

The fallout was swift. The airdrop disappointment, combined with the massive bans, fueled a wave of user departures. By early November, Hamster Kombat’s once-formidable user base had dwindled to just 41 million monthly active players, a fraction of its 300 million peak.

Government scrutiny and the ripple effect of public doubt

Hamster Kombat’s rapid rise wasn’t just on players’ radar — it also attracted the attention of governments, and not always in a positive way.

In some regions, officials expressed concern over the game’s influence, viewing it as more than just a harmless pastime. As its user base swelled, so did the scrutiny, with some authorities labeling the game as a “disruptive force” in their societies.

In Iran, the backlash was particularly strong. The game caught the attention of the country’s military officials, who were concerned that Hamster Kombat was drawing attention away from political matters.

One Iranian military deputy chief went so far as to call it a “soft tool” being used by the West to distract citizens from national priorities and weaken the country’s religious governance, positioning it as a digital disruptor with intentions beyond simple entertainment.

The situation was similar in Russia, where the chairman of the State Duma Committee took an even harsher stance, branding Hamster Kombat as a “scam”, and called for an outright ban.

The developers of Hamster Kombat have also had to address their connection with Gotbit, a crypto market maker now under investigation for fraud in the U.S.

As the authorities filed charges against Gotbit for market manipulation, Hamster Kombat publicly distanced itself from the company.

Dear CEOs,

We are committed to ensuring transparency within the Hamster Ecosystem.

In light of recent news regarding Gotbit, we want to clarify that Hamster Kombat has never worked with Gotbit as a market maker.

— Hamster Kombat (@hamster_kombat) October 12, 2024

Despite these efforts, users have continued to question the stability of the HMSTR token, which has already experienced a stark drop in value.

What’s next for HMSTR?

The sharp downturn in Hamster Kombat’s player base and token price has left many in the crypto community asking: is this just a stumble, or has the game reached a point of no return?

One of the most pressing concerns is a breakdown in trust, with disappointed users feeling that Hamster Kombat has “betrayed the trust of its community.”

❌ Enough is Enough Hamster Kombat ❌

Hamster Kombat has betrayed the trust of its community through deceptive practices, prioritizing influencers over genuine users. It’s time to hold them accountable and demand justice.

😥😥🙏🙏💯🤝 pic.twitter.com/nBaGHRPYQz— Caleb (@Canny5b23n) November 2, 2024

The backlash stems from a perception that the game prioritized influencer partnerships and flashy marketing over a genuinely user-focused experience.

Many early adopters, who initially hoped for long-term rewards, are now disillusioned by broken promises, delayed airdrops, and the steady devaluation of the token.

One disappointed player noted they left after the first season, saying they had “so much hope” for the game but ultimately felt let down by the experience.

I personally left the game after the disappointed me in the first season, i had so much hope but they made it short 🥺

— Millie (@origanalybohay) November 5, 2024

Another major worry has been the ongoing decline in the value of the HMSTR token. As one observer put it, the token’s price chart is “in freefall,” with many users predicting that exchange delistings are “probably around the corner.”

This prediction isn’t baseless; projects unable to sustain interest or stabilize token value often find themselves sidelined by major exchanges due to low trading volume and high volatility.

For Hamster Kombat, rebuilding user trust and stabilizing the HMSTR token will demand not only operational adjustments but also clear communication. This includes rethinking gameplay mechanics, enhancing reward quality, and building genuine engagement with the community.

The broader takeaway here is that crypto games must go beyond promises to deliver real value if they want to survive the increasingly skeptical eyes of their audiences.

Source link

cryptocurrency

Top cryptocurrencies to watch this week

Published

3 months agoon

October 6, 2024By

admin

The global crypto market cap ended last week with a 7% drop, losing $160 billion as it closed at $2.15 trillion.

While Bitcoin (BTC) influenced the broader market, several altcoins charted their own paths, benefiting from unique developments within their ecosystems.

Here are some of these cryptocurrencies to keep an eye on this week, following their diverse price movements last week:

HMSTR collapses 18%

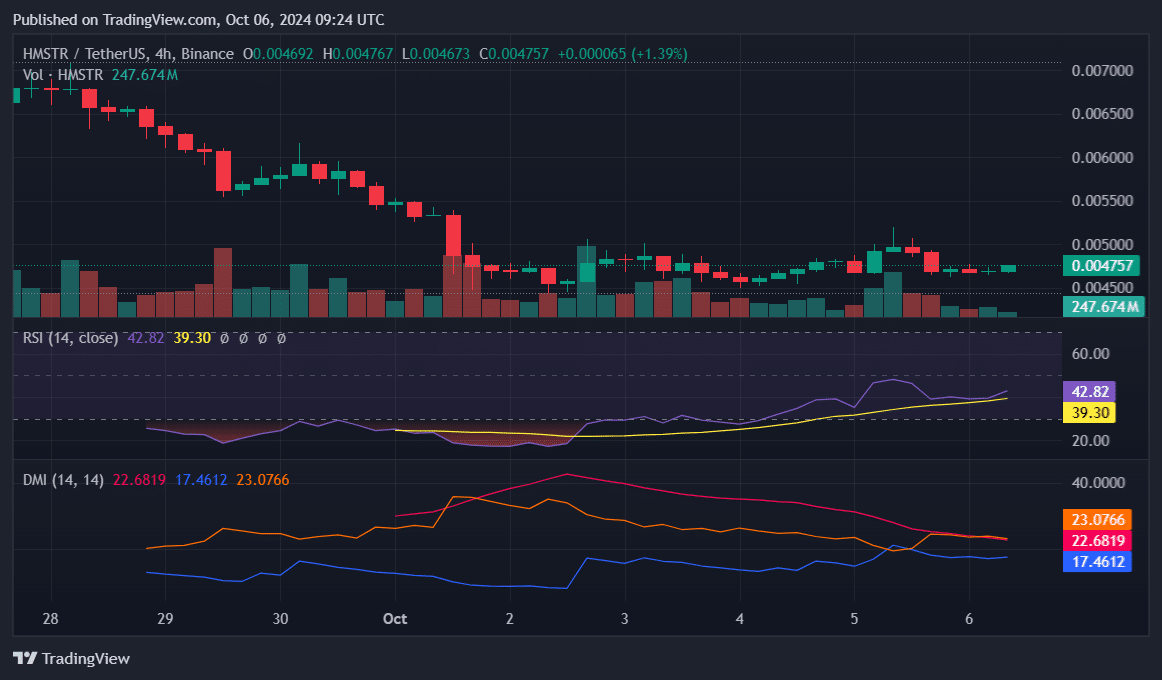

Hamster Kombat (HMSTR) saw a bearish week, dropping 18% to $0.004714. Its worst day came on Oct. 1 when it fell 13.94% amid a broader market decline on the back of geopolitical tensions.

Last week’s bearishness built on a downtrend HMSTR has faced since its airdrop on Sept. 26. However, the four-hour chart shows some signs of recovery, with the RSI sloping upward, now at 42.82.

For the DMI, the +DI is steady at 17.46, signaling slight buyer momentum. However, the -DI at 23.07 slopes downward, indicating weakening selling pressure. The ADX is at 22.68 and trending downward, as the current trend loses strength.

These figures suggest a possible recovery if buying momentum continues, with bulls possibly targeting $0.0051. However, the downtrend may persist if buyers do not pick up pace this week.

SUI demonstrates resilience

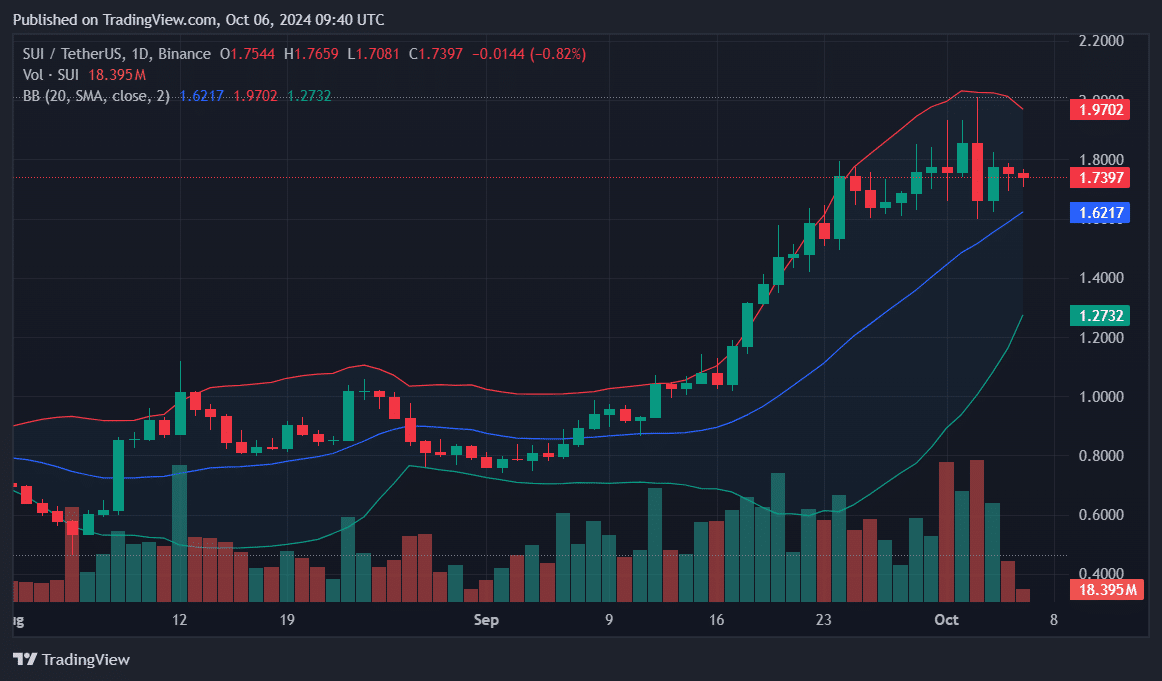

Sui (SUI) showed resilience despite broader market volatility, dropping only 0.3%. On Oct. 1, amid market turmoil, SUI dipped just 0.97%.

However, it saw a sharper 10.38% decline on Oct. 3, its largest intraday crash in three months.

SUI appears to be forming a bull pennant following its uptrend in September. Currently, the Bollinger Bands indicate the upper band at $1.97, which acts as resistance, and the 20-day MA at $1.62 provides immediate support.

With SUI trading below the upper band, the price could stabilize above the $1.62 support.

Investors should monitor for a bounce between $1.62 and $1.97, with a breakout above the resistance likely signaling bullish momentum for the week.

FTT bucks the trend

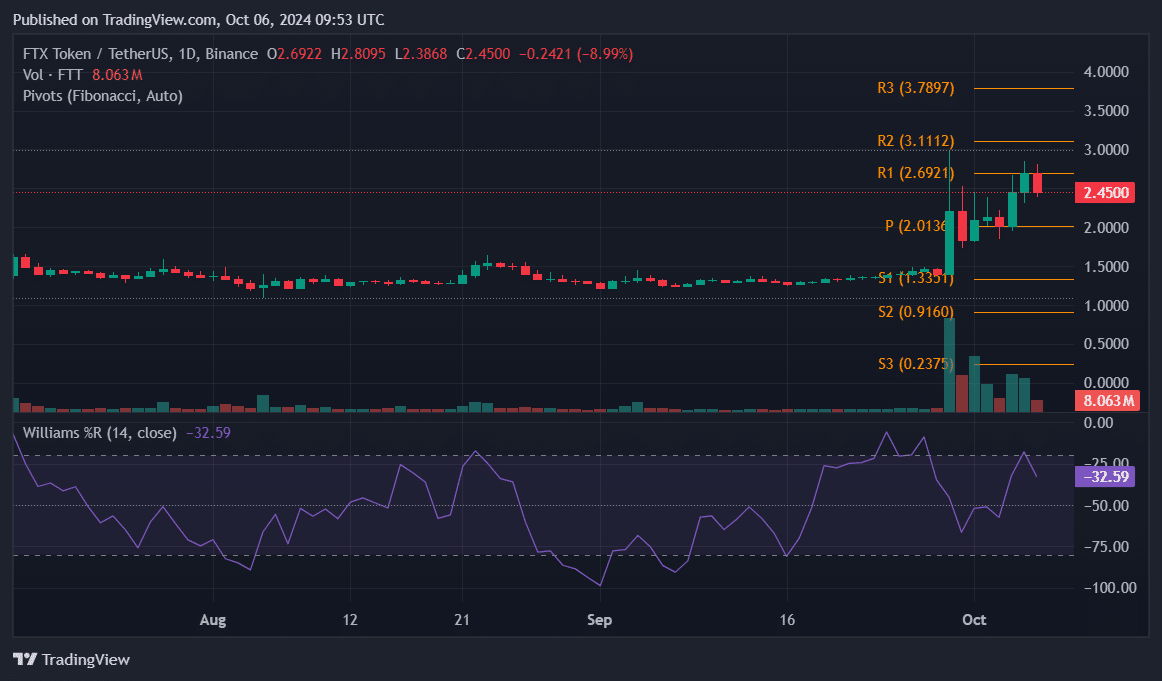

FTX Token (FTT) defied market trends last week, gaining 22% while most assets declined.

On Oct. 1, FTT rose by 13.89%, followed by a 21.53% surge on Oct. 4 and another 9.86% the next day.

Amid this uptrend, the Williams Percent Range stands at -32.59, signaling that FTT is near overbought territory but still has room for further gains.

As it witnesses a 9% retracement this new week, bulls need to defend the Pivot support at $2.01 to prevent a slip into bearish territories. Below this, the next support rests at $1.33, marking lows last seen in two weeks.

Should FTT recover from the latest correction, market participants should watch for a break above the resistance level at $2.68, which continues the bullish momentum.

Source link

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential