Bitcoin Policy

Report From The DNC: Democrats Warm Up To Bitcoin And Crypto, But Offer No Policy Specifics

Published

4 months agoon

By

admin

Bitcoin was not a big topic at the Democratic National Convention (DNC) this week. None of the speakers at the event uttered a word about the electronic cash system or other crypto assets from the event’s main stage at Chicago’s United Center. And you’d have been hard pressed to have overheard a conversation on Bitcoin or crypto anywhere in the halls of the arena either.

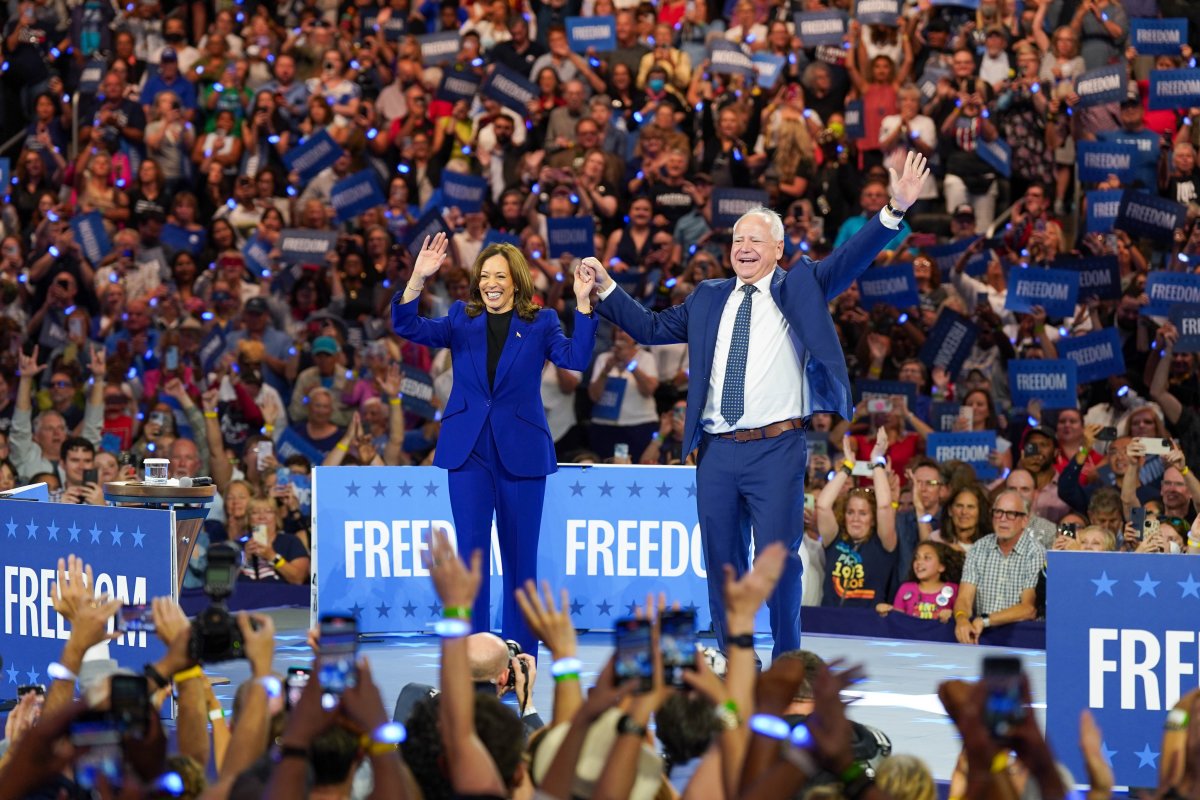

However, despite the fact that Democrats chose not to include Bitcoin or crypto in their official platform, some high-ranking Democrats did say this week that a Harris administration would be more pro-Bitcoin and pro-crypto than the Biden administration has been — though without offering specifics. Also, at satellite events for the conference, some Democrats spoke passionately about why their party should embrace Bitcoin and crypto.

Congressman Wiley Nickel (D-NC), a Bitcoin and crypto proponent, spoke to the idea that a Harris administration will take a different approach to the crypto industry than the Biden administration has.

“Vice President Harris has been working for and as part of the Biden-Harris administration, but now she’s coming into this campaign with her own positions on issues,” Rep. Nickel told Bitcoin Magazine explained in an interview at the convention.

“A lot has happened in the last few week’s, so she’s [only now] starting to come out with policy positions. It’s not going to be an immediate process of her coming out with things she would do differently from President Biden, but she will have different positions on issues, and she will make those known,” he added.

On Wednesday, Bloomberg reported that Vice President Harris will introduce policies to support the crypto industry if elected. This was according to her senior campaign advisor for policy, who spoke at a Bloomberg News roundtable at the convention.

The article touched on how Harris plans to engage with the cryptocurrency industry — though, again it didn’t offer any particulars on how she plans to do so. It also quoted Harris saying that she plans to “cut needless bureaucracy and unnecessary regulatory red tape” while encouraging “innovative technologies” by offering “transparent rules of the road,” though none of Harris’ quotes in the piece included any direct references to Bitcoin or crypto.

Rep. Nickel didn’t offer any specifics on what Harris’ policy might look like either, as he said he didn’t want to speak on behalf of Harris, but did note the success of the Crypto4Harris town hall, an event held on Wednesday, August 15, that featured Democratic lawmakers including Sen. Chuck Schumer (D-NY), Sen. Kirstin Gillibrand (D-NY) and Sen. Debbie Stabenow (D-MI) as well as billionaire crypto enthusiast Mark Cuban, sharing that there’s “a real sense of momentum amongst Democrats on the issue.”

Rep. Nickel also asked Bitcoin and crypto enthusiasts to heed a certain warning.

“The anti-crypto names you hear are just totally invented by folks who are trying to damage her campaign,” said Rep. Nickel about rumors of Harris bringing the likes of Brian Reese and Bharat Ramamurti, economic advisors from the Biden administration who were behind Operation Chokepoint 2.0, back into the fold.

“I don’t [give] any credence to the weird names that you hear being thrown around for big jobs. I heard Gary Gensler for Treasury Secretary. I can tell you that there’s 0% chance that he would be able to be confirmed by the Senate,” he added.

“That one is not happening.”

Pro-Bitcoin/Pro-Crypto Democrats Speak At Satellite Events

At an event held at a University of Chicago facility, Cleve Mesidor, Executive Director of the Blockchain Foundation and former Obama appointee who worked as the Director of Public Affairs at Commerce’s Economic Development Administration (EDA), spoke on a panel entitled “Democrats’ Path Forward On Digital Assets & Crypto.”

TODAY: I’m Speaking in Chicago During DNC Convention!

I’m excited to be part of this panel hosted by @ProgressChamber & @BusinessForward, which also features:@RepWileyNickel | @clydevanel | @JBSDC @paradigm| @KyleBligen

= Democrats' Path Forward On Digital Assets & Crypto = pic.twitter.com/WIYggp1V9o

— Cleve Mesidor (@cmesi) August 21, 2024

Mesidor shared her perspective on the importance of crypto, which differed notably from the perspectives of notoriously anti-crypto Democrats like Sen. Elizabeth Warren (D-MA) and Rep. Brad Sherman (D-CA).

“Senator Liz Warren and Congressman Brad Sherman are stuck in time,” said Mesidor on the panel.

“They are so determined to fight big money, so laser focused on hitting the big guys, that their blind spot is the fact that communities of color are the largest adopters of cryptocurrency. Black and Latino communities lead national adoption of this $2 trillion market,” she added.

“Let’s be clear, consumer protection is important — we need guardrails. But if you don’t couple it with financial inclusion, you’re just saying to all of the communities who capitalized on bitcoin over the last 15 years — who made it something, who built products and services on blockchain — that you’re going to continue [supporting] policies to make sure they can’t continue to participate.”

Mesidor, a Latina herself, was emotional as she spoke, as she feels that Democrats are missing one of the major narratives around Bitcoin and crypto. At the same time, she acknowledged why they might be apprehensive to look favorably upon the crypto industry.

“Democrats have PTSD,” she told me in an interview after the panel.

“[They have] PTSD because decades ago the predatory lenders, as we call them today, came to them and said we were going to democratize finance. The internet was supposed to democratize us, right? It was supposed to be decentralized. And today, big tech is not diverse,” she added.

New York Assemblyman Clyde Vanel (D), a legislator who’s part of the New York State Black, Puerto Rican, Hispanic, and Asian Legislative Caucus, was also on the panel.

Vanel recalled first being introduced to crypto in the mid-2010s and being impressed by how it catalyzed an increase in the financial savviness of inner city youth.

“I went to different high schools and there were high school kids [who owned crypto] using the same muscles that seasoned investors do, watching markets,” recounted Vanel.

“We had a convenience store in my neighborhood [that had a] Bitcoin ATM. I went to the convenience store and saw a line of young people buying different denominations of Bitcoin — amazing,” he added.

Vanel wasn’t just happy to be seeing his constituents acquiring bitcoin because of the financial benefits they may have reaped from investing in it, but because blockchain technology also gives those from his community an alternative to the traditional financial system, which some — including his own father — don’t trust.

“My dad never used a bank, never trusted a bank,” said Vanel. “He used check cashing places.”

Vanel also touched on the remittance payment use case for Bitcoin and crypto.

“When he sent money to another country, he spent a lot of money doing so,” said Vanel, still speaking about his father “What does it mean to make sure that we make it easier for people like him to transfer value?”

Because Vanel understands well the benefits of Bitcoin and crypto, he’s glad to see Democrats starting to come around to it.

“I’m very excited that this event is happening on the heels of this campaign to show the importance of financial inclusion [via] digital technology,” said Vanel. “10 years ago, this wouldn’t have happened at the National Convention.”

Not far from the event at which Mesidor and Vanel spoke, an event entitled CryptoDNC took place, featuring appearances by Reps. Bill Foster (D-IL) and the aforementioned Wiley Nickel.

🎉 New speaker announcement!

We're pleased to have @RepBillFoster as a featured speaker during our event next Wednesday in Chicago during the 2024 @DemConvention

Make sure to RSVP now to secure your spot!

Register: https://t.co/mJzVzchfx2

Or sign up below 👇👇 pic.twitter.com/V9lnPlgmox

— CryptoDNC (@crypto_dnc) August 16, 2024

During a fireside chat at the event, Rep. Nickel shared that not embracing crypto technology would be like not embracing the internet two and a half decades ago.

Are The Democrats Serious?

Have the Democrats really changed their tune regarding Bitcoin and crypto or are they just pandering to single-issue voters who would otherwise vote Trump because of his pro-crypto stance?

This is the question that seems to have remained on the minds of most Bitcoin and crypto enthusiasts. Part of the reason many seem hesitant to trust the Democrats’ proposed 180 on crypto may be because of the Biden administration’s support of SEC Chair Gary Gensler’s regulation by enforcement approach to the crypto industry over the last three and a half years.

Rep. Wiley Nickel seems to be making an earnest attempt to get the Democrats to “reset” their approach to crypto, but is Harris really listening? And can the likes of Assemblyman Vanel and Ms. Meridor raise their pro-crypto voices loudly enough to get the attention of a potential Harris administration?

We will have to wait and see.

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

Bitcoin Policy

Vancouver’s Mayor Shares His Pro-Bitcoin Vision

Published

4 days agoon

December 19, 2024By

admin

Vancouver’s Mayor, Ken Sim, is a genuine Bitcoin enthusiast who’s doing his part to get Vancouver’s city council as well as its citizens to see what he sees when it comes to Bitcoin.

And his efforts are starting to bear fruit.

On December 11, 2024, the Vancouver City Council greenlit a motion Mayor Sim prepared to start making Vancouver a more Bitcoin-friendly city.

The motion directs city staff to explore the ideas of Vancouver establishing a strategic bitcoin reserve as well as accepting taxes and city fees in bitcoin.

In my conversation with Mayor Sim, we discussed the passing of this motion as well as some of his deeper philosophical thoughts about Bitcoin.

We also touched on what Bitcoin adoption in Vancouver would look like in a perfect world, his own journey down the proverbial Bitcoin rabbit hole and why Bitcoin can bring financial hope to the citizens of Vancouver at a point in time when many are struggling to make ends meet.

The Vancouver City Council recently passed your motion to make Vancouver a more Bitcoin-friendly city.

On a personal level, though, if you could wave a magic wand and enable whatever level of Bitcoin adoption you see fit in Vancouver, what would that look like?

I’ve got to give you a caveat here. These are my own personal views. We have a pretty incredible team at the City of Vancouver, and they’ve been tasked to explore. So, it’s not as if I can really influence the team and tell them “You have to do this and that.”

In a perfect world, the first thing we would do is add to a strategic reserve. The second thing would be allowing people to transact with bitcoin without triggering capital gains tax events and to accept payments in the form of bitcoin. Tax regulation across not just Canada, but in the U.S. and a lot of other jurisdictions, still hasn’t caught up, so every time you transact with bitcoin, there’s a capital gains tax fee, which is very cumbersome.

The third thing is that we start the conversation and we bust the myths around narratives like Bitcoin is bad for the environment. That’s all hogwash, right? Bitcoin is actually going to help us save the environment.

Plus, it provides us with an immutable record and it actually adds to a level of transparency we’ve never seen in the history of humankind. Having that incorporated into our systems would be great.

You spoke about this process of educating people about Bitcoin on Natalie Brunell’s show. You said you “shower them with love and then you hit them with facts.” Can you give an example of what this looks like?

There’s a lot of resistance with Bitcoin, especially as it pertains to its perceived effects on the environment. People hear this narrative that it’s bad for the environment, and it’s like, “Well, wait a second…”

I’m an environmentalist, and I know that if you force organizations across the planet to do stuff that they aren’t incentivized to do, nothing’s going to happen. Whereas if you incentivize them — if you build in a reward system — it’s amazing.

So, what do we know? Well, we flare natural gas as a by-product of oil production, and if we actually capture that and repurpose it for Bitcoin mining, it is actually good for the environment. Same with capturing methane that seeps from the ground.

Also, with alternative or green energy sources, be it wind power or solar power, where the economics often don’t pan out to build these projects, you provide someone with a guaranteed customer in the form of Bitcoin miners, and the economics work and these things get built. So, it’s net positive for the environment.

There’s also this false narrative that nefarious things happen with Bitcoin. That’s garbage, right? Cash is untraceable. With Bitcoin, we’re talking about an immutable record where you can see every single transaction since the beginning of time and you can catch people at the on and off ramps.

Some of the narratives are actually the complete opposite of reality, and so we have to counter these narratives.

Based on my experience, it’s easy to teach someone something, while it’s a lot harder for people to unlearn, and we are in the process of helping people unlearn what they’ve learned.

You have referred to Bitcoin as the greatest invention in human history. Could you expand on that?

Our money is broken. People can’t use it to store their energy into the future. We’re on this rinse and repeat cycle. In Ray Dalio’s book The Changing World Order, he talks about the rise and fall of the Dutch empire, the rise and fall of the British empire, the rise and, as he puts it, fall of the U.S. empire. If you agree with Dalio’s perspective, the point is that the money’s broken.

We do not have a reserve currency that’s ever lasted. We keep repeating history. But Bitcoin changes all that. As we all know, you can’t mess with it, and you can’t manipulate it. It’s a game-changer and when we finally get onto the bitcoin standard — I think it’s a matter of when, not if — it’s going to change how humans interact with each other and how nation states evolve.

You just cited one of Ray Dalio’s books, and I’ve heard you discuss how you’ve also read books like The Bitcoin Standard and Layered Money. You’re also a friend of Jeff Booth’s. With all the reading you’ve done and the conversations you’ve had with Jeff, did you end up having a lightbulb moment with Bitcoin or was it more of a gradual learning process?

Well, I had the opposite of the lightbulb moment when my son Mitchell came up to me and said “Dad, I want to buy bitcoin.” And I was like, “You touch that shit, and I’m going to punch you in the throat.” Obviously, I wasn’t going to do that.

Then, I started seeing more of it and had conversations with Jeff. So, I started to look into it, read a bunch about it and went to a couple of conferences. My journey was very similar to a lot of other people’s. I was completely against it and then I warmed up to it and eventually became an evangelist.

I can’t point to any one point where it was like, “Wow, there you go” and I went 180 degrees the other way. I do remember though, I made my first $500 purchase of bitcoin on November the 14th, 2020. The reason it took me so long was I had to learn how to use the app on which I bought the bitcoin. It was all clunky — just a pain in the butt.

But I remember that day, because when I finally bought it I thought, “Did I miss out?” I think I bought it at like 16 or 17 grand and it had run from like seven or eight grand the month before. I was like, “Did I miss it?” I remember Jeff saying, “No, you’re still super early; we’re all still super early.”

You’ve talked about how unaffordable housing in Vancouver is. Does bitcoin fix this?

Yes. Let me give you an example. We have a small studio rental up in Whistler (a town north of Vancouver). When we bought it, it would have cost 17.2 bitcoin. That’s about four years ago. In terms of dollars, the property is up 36%, but in terms of bitcoin, it’s down something like 85%. As of today, it costs like 3.3 bitcoin to buy it.

By the way, I’m not giving investment advice. I’m just talking about a theoretical, if this plays out how it could. If at some point in the not so distant future, you’ll be able to buy a house in Vancouver for a bitcoin, what that means is you can literally buy a house for about US$106,000 or about CA$150,000 if you bought a bitcoin today.

I’m not telling people to take out a loan to buy bitcoin — very far from it. Go seek financial advice. But if you believe bitcoin’s price will continue to appreciate, you can literally buy a house for CA$150,000 in the near future by buying a bitcoin right now.

You’ve brought Bitcoin, a taboo subject, into the fold as Mayor of Vancouver, and you’ve said that doing so might lead to your not getting re-elected. Have you ever considered that the opposite might be true, that maybe by embracing Bitcoin the people of Vancouver will want to re-elect you?

I’m not too concerned about that. I have no desire to be a premier or prime minister. I’m not a politician, even though I’m sitting in this role, which I really honor, value and take very seriously. But the goal was never to be popular. The goal was never to get re-elected. The goal was to do what I believed is right for the future of the City of Vancouver.

And so I couldn’t sit back any longer and ignore this because I truly believe that this sets the city up for the next hundred years. Am I right? We don’t know, but we have a pretty good feeling, and I truly believe in it.

I think voters, residents — it doesn’t matter what side of the political spectrum you sit on — are sick of politicians who do stuff just to get re-elected. They want people to do what they believe is right, and I believe this is right. If we don’t get re-elected because of it, I can personally hold my head up high and say, “You know what? We stuck to our values and we did what’s right.” If it works out, great. I actually think it’s going to work out, though.

It seems like a progressive city like Vancouver — the first city in Canada to have a Bitcoin ATM — should be in favor of Bitcoin. However, the previous mayor tried to ban Bitcoin ATMs in the city. Was there a reaction from the Vancouver community when the mayor did this?

I didn’t follow it too closely at the time, so I don’t know. I can’t comment on it. What I can comment on is we do have a lot of politicians who will make policy up based on virtue signaling as opposed to data. We’re a data driven administration, and we care about the future prosperity of our city.

I think the distinction here is we choose to have the most impact — we’re more concerned about the steak than the sizzle. If someone can make an argument on why this is a bad idea based on data, we’ll listen to it. We might have it wrong, but I can tell you no one has been able to attack our Bitcoin stance with data.

Bitcoin can be kind of difficult to use technically. So, let’s say, in a perfect world, maybe Bitcoin becomes legal tender in Vancouver at some point, or if there’s just greater adoption of it, do you worry about the technical difficulties associated with using Bitcoin? Would the Vancouver city government ever get involved in educating its Vancouver residents about Bitcoin?

It’s not one of the core services we provide as a city, so I don’t see us going down the educational rabbit hole. We’ll leave it up to other experts.

If the industry makes Bitcoin simpler to use, so many more groups and individuals will just hop on the bandwagon. And you know it’s coming because there are a lot of people working on this right now.

I’m not an expert, but when I, when I hear about some of the things that are happening on Layer 2s and the Lightning Network, I see a future where this is seamless. When people go into a Walgreens and they buy a candy bar, they won’t think about how they’re paying with Bitcoin. All the plumbing underneath will happen without them knowing, and it’s going to revolutionize the planet.

You’ve done a handful of interviews on this topic thus far. Is there anything that we in the media haven’t asked you yet that you’d like to discuss or point out?

Yes, I’d like to make a general call out and not just for the city of Vancouver. It’s for every single city and province and state and jurisdiction and canton, and country on the planet.

We have to get the education out there, which is still a hard challenge. Some people in the media have made the comment that what we’re doing right now is more virtue signaling, because we have the hope of making this happen. This is incorrect, though.

We need Bitcoin supporters to start pumping the true narrative of why bitcoin is a sound financial asset. It’s the best performing asset in the last 16 years on the planet. And we’re not traders, so if you’re not looking to day trade, all of the volatility doesn’t matter.

We need to start getting that narrative out, but not from me, from the community. We need to let our elected officials know this because they’re not going to do anything until people hit them with data and tell our politicians that they want this.

We’re doing this because we believe in it. We want to get ahead of it. We want to set up the city for the next 100 years, and that’s why we’re willing to take political risk to do this. But we need help. So, if your audience can help us push that narrative with our provincial government and in their jurisdictions, as well, that would be great.

If people come onboard and see how bitcoin can reduce some of the financial stress in their lives, do you think Vancouver transforms into a pro-Bitcoin city relatively quickly?

Yes.

I go back to my sister-in-law, who if she watches the video she’s gonna punch me in the face. About 13 years ago, she was afraid of getting an iPhone. She didn’t understand the technology. It was a mental block.

Then, she jumped on the bandwagon like everyone else, because all her buddies had iPhones. It’s ridiculous now to think that people were afraid of iPhones, right?

Will Bitcoin give us hope? Absolutely.

I go back to the City of Vancouver and why this is so important. The City of Vancouver exists in the same conditions as everyone else does. While people can’t afford a home or they’re struggling with groceries, we have a budget.

We have to hire police officers, firefighters, engineers, and we’re living in an environment where our currency is getting debased and we can’t increase taxes at a rate that keeps up with that. We don’t want to cut services, and so Bitcoin gives us hope where we can fix our financial state, our balance sheet.

And that will actually help us run this city for the next hundred years. I think when people understand Bitcoin and they start to adopt it, they will have hope, as well, because they will realize their purchasing power is going up, which is a great thing.

Source link

Bitcoin Policy

Want Greater Bitcoin Adoption? Engage With Your Government.

Published

1 month agoon

November 21, 2024By

admin

It’s been a good week for Bitcoin and its status in the eyes of federal deposit insurance corporations. (Well, there’s a weird sentence I never thought I’d write.)

On Tuesday, the anti-crypto U.S. Federal Deposit Insurance Corporation (FDIC) Chairman, Martin Gruenberg, announced he’d be stepping down in January.

And yesterday, Heritage Falodun, CEO of DigiOats, Nigeria’s leading Bitcoin education and consultancy platform, educated members of the Nigeria Deposit Insurance Corporation (NDIC) about the benefits of bitcoin and other digital assets.

Falodun, an indefatigable Bitcoin proponent, spearheaded a seminar for the NDIC entitled “Cryptocurrency in the Evolving Financial Industry”.

This week, @DigiOats alongside with #MassCyberTech completed a groundbreaking seminar for @NDICNigeria 🇳🇬on “Cryptocurrency in the Evolving Financial Industry”. We explored #Bitcoin adoption, regulation, and sustainable finance marking a key moment for Nigeria’s financial future pic.twitter.com/hpWQOqZt8L

— DigiOats⚡️ (@DigiOats) November 21, 2024

In it, he highlighted the following points:

- Bitcoin can serve as a reserve asset for nation states, including Nigeria

- Using bitcoin (and other digital assets), banks can reduce settlement time

- Bitcoin can reduce capital controls, as its censorship resistant

Falodun and his team also provided an overview on the evolution of money and financial systems and also touched on the ways in which bitcoin and crypto are already integrated into traditional financial structures in efforts to convince the NDIC of Bitcoin and crypto’s importance.

“Nigeria must adopt balanced regulations that protect citizens and foster innovation,” Falodun told Bitcoin Magazine. “By embracing Bitcoin’s uniqueness and engaging the Bitcoin community, Nigeria can lead the global financial revolution.”

Falodun knows that without properly educating government officials, Bitcoin runs the risk of being misunderstood and, therefore, regulated improperly.

“I would like regulators to understand that Bitcoin’s decentralized nature is not a flaw to be regulated out of existence, but a feature that offers unprecedented opportunities for inclusion, economic freedom and optimization of financial rails,” he added.

I respect Falodun’s efforts.

Before you go calling me a statist or some other silly reductive term, I’d like to remind you that even well-known cypherpunks like Adam Back have said that part of the struggle around greater Bitcoin adoption (and encryption in general) will include engaging with governments (and courts).

Proponents of Bitcoin should acknowledge our current political reality and make the case for Bitcoin to those in power if they want to see it flourish — or if they want to at least stop governments from crafting poor policy around Bitcoin and/or attacking the industry.

Take a cue from Falodun and do your part to educate local government officials, members of state-level administrative agencies or even Federal-level bureaucrats about Bitcoin.

It’s one of the most important things you can do to keep your country from falling behind.

Source link

Bitcoin Policy

Don’t Lose Sight Of The Bitcoin Mission

Published

1 month agoon

November 9, 2024By

admin

Now that Trump has been elected, Bitcoin enthusiasts and companies alike are more optimistic about the future of Bitcoin in the United States. We can clearly see this reflected in the price of bitcoin, which continues to reach new all-time highs in the wake of the election.

While it’s exciting for to watch US Bitcoiners breathe something of a collective sigh of relief as bitcoin’s price pumps (which is important), it’s also essential to recognize that we that if we don’t stay vigilant and lose our ability to transact privately and as anonymously as possible with bitcoin, as some are rightfully suggesting could easily happen, then we will have failed in our mission.

Former presidential advisor Pippa Malmgren on the legalization of Bitcoin:

"If you make crypto and Bitcoin legal […] you can't hold them anonymously, you have to declare them."

"You're not going to be able to escape the reach of the US Government. […] And because we're in… pic.twitter.com/aVeZBKodQ4

— L0la L33tz (@L0laL33tz) November 8, 2024

While it seems that the Trump administration will be kinder to the Bitcoin and broader crypto industry than the Biden administration was, we still have little idea of what the regulatory details will look like under the incoming administration. Plus, the judge in the Tornado Cash case recently posited that the Bank Secrecy Act (BSA) doesn’t require control of funds (private keys) for money transmission, which means that we may soon see legal precedent that sets the stage for much greater AML/KYC requirements for Bitcoin users.

Main points of the @TornadoCash ruling (so far):

(1) BSA doesn't require control for money transmission

(2) 2019 guidance doesn't have broad control requirement for money transmission, and "total independent control" is merely one part of a four-factor test specific to the… https://t.co/1rnB2SCVpA— Zack Shapiro (@zackbshapiro) September 26, 2024

If we don’t support efforts to legally defend our right to transact peer-to-peer without having to provide identifying information, then we’ll have lost one of Bitcoin’s core value propositions.

So, by all means, celebrate the fact that the incoming administration supports things like Bitcoin mining in the US and the right to hold your private keys, but stay vigilant in regards to what both the administration and the courts say about the need to provide identifying information to use bitcoin — and get ready to push back.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential