Mining

Riot stocks poised for a comeback ahead of Oct. 30 earnings release

Published

2 months agoon

By

admin

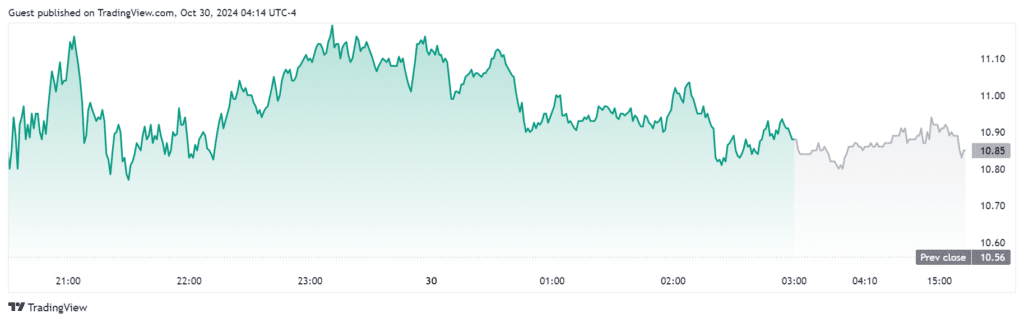

Bitcoin mining company Riot stocks are predicted to make a comeback after experiencing a 28.96% decline in year-to-date. Its shares are on an upward trend in anticipation of the company’s Q3 2024 earnings report on Oct. 30.

According to data from Trading View, Riot’s stocks are on the rise at nearly 3% in the past day. The Bitcoin (BTC) mining company is expected to release its third quarter 2024 earnings on Oct. 30 after markets close at 4:00 PM EST.

Riot Platform’s shares have been experiencing a year-to-date decline of 28.96%. Although, its stock price has seen a rise of 13.91% in the past year. In fact, the company is anticipating a loss of $0.16 per share with revenues of $95.35 million. At the time of writing, the Riot stock is trading hands at $10.87.

Although things are not looking good, there are signs that suggest a turnaround for Riot may be possible. Riot’s shares are on a bullish run, going above their five, 20,and 50-day exponential moving average. If it can maintain its bullish pressure, Riot Platforms could experience a comeback.

Moreover, Riot’s moving average convergence or divergence is indicated to be positive, at 0.73. While the stocks’ Relative Strength Index is at 73.07, which means that the stock is currently in overbought territory.

Based on data on Trading View, the stock has been going up due to a similar rise also found in other crypto mining stocks.

Reminder: Riot’s Q3 2024 earnings conference call is tomorrow, Wednesday, October 30, 2024, at 4:30 PM EST!

🖥 For the audio-only webcast, register here: https://t.co/YOrtZ57wgo.

📞 To dial in from the U.S. or internationally, register here: https://t.co/yNuMCbHmKX.

— Riot Platforms, Inc. (@RiotPlatforms) October 29, 2024

On Oct. 29, Riot Platforms posted a reminder on its X account that the company will be holding a conference call to go over its third quarter Q3 2024 earnings report on Oct. 30 4:30 PM EST. Its previous Q2 2024 earnings report showed a total revenue of $70 million, decreasing by 8.7% compared to its Q2 2023 revenue, which was $76.7 million.

The company stated the decrease was driven by a $9.7 million decrease in engineering revenues. Though, this was offset by a $6 million increase in Bitcoin mining revenue.

According to its press release, Riot is a Bitcoin mining and digital infrastructure company focused on a vertically integrated strategy. Founded in 2000, Riot has Bitcoin mining operations located in central Texas and Kentucky, as well as electrical switchgear engineering and fabrication operations in Denver, Colorado.

Source link

You may like

Investors turn to Lightchain AI 3000x potential after PEPE drop

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Bitcoin

Bitcoin’s Price Drives Up Mining Equipment Costs by 30%

Published

5 days agoon

December 19, 2024By

admin

Bitcoin’s recent price surge has driven up mining equipment costs, with Shenzhen’s Huaqiangbei district—a global hub for crypto hardware—seeing a notable 30% price hike.

According to a report by Wen Wei Po, the price of the Antminer S21 335T, a mining device, has now reached $5,600, or around RMB 40,700, climbing up by 30% compared to last year’s price of $3836.19, which comes to 28,000 RMB. There is even much higher demand for the Antminer S21 XP, a raw mining device with water-cooling facilities, which has continued to cause stockouts on Bitmain’s official website.

Huaqiangbei merchants report a surge in bulk orders, with buyers from Russia, the U.S., and Canada purchasing hundreds or thousands of units. This demand is driven by Bitcoin’s (BTC) growing price, which has caused mining businesses to become more lucrative even with the inflated costs of equipment.

Hong Kong has become an important export hub

The 2021 ban on cryptocurrency mining in China resulted in mining machine transactions being redirected through Hong Kong due to Hong Kong’s free-trade environment and ease of logistics. Merchants in Shenzhen said most of the new mining equipment is exported through Hong Kong, capitalizing on its status as a way station for international trade. Cross-border logistics services can deliver mining machines to Hong Kong on the same day, and the machines are then sent to domestic and foreign air and sea transports.

In the $100K to $108K range, BTC mining difficulty reached an all-time high. The mining difficulty adjustment at block height 874,944, around 1:33 UTC on Dec. 16, increased 4.43% and achieved an all-time high of 108.52 trillion, according to TheMinerMag.

According to data from Hashrate Index, the network’s average hashrate in the last 14 days hit 771 EH/s while the seven-day moving average stood above 800 EH/s. This record hashing difficulty and fall in hash price reflects the macro impact of BTC’s price increase on mining economics. It confirms the claimed hardware shortages and price surges and also provides insight into global competition among miners. Although mining-related activities are explicitly banned in any form by mainland China, the legal framework in Hong Kong permits the sale and export of mining hardware, giving merchants an outlet to satisfy this global demand.

Source link

Bitcoin Magazine Pro

What is the Bitcoin Puell Multiple Indicator and How Does It Work?

Published

5 days agoon

December 18, 2024By

admin

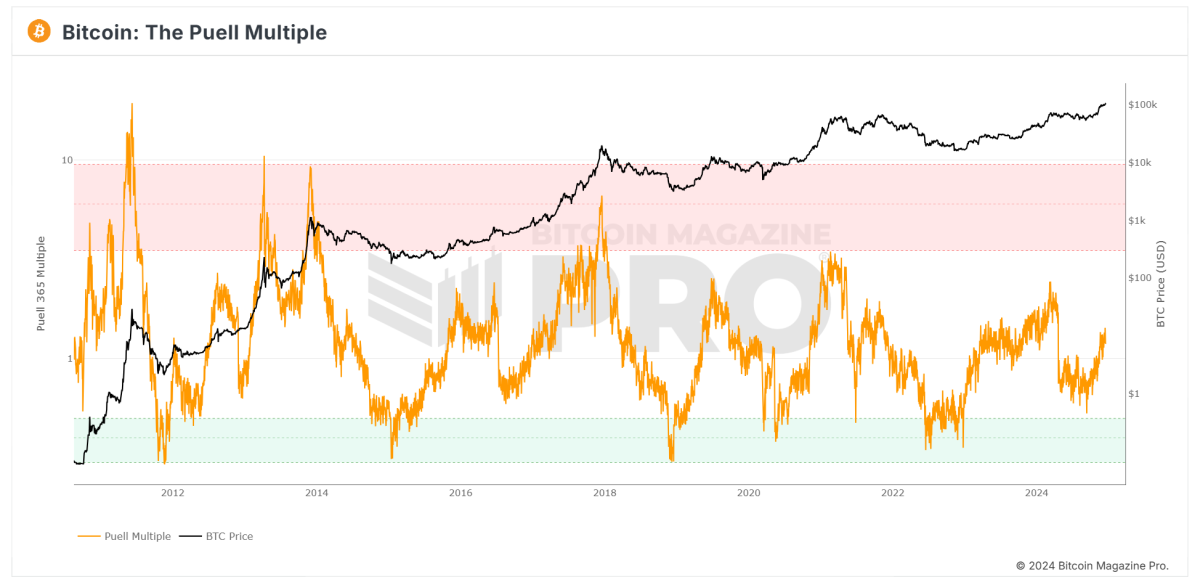

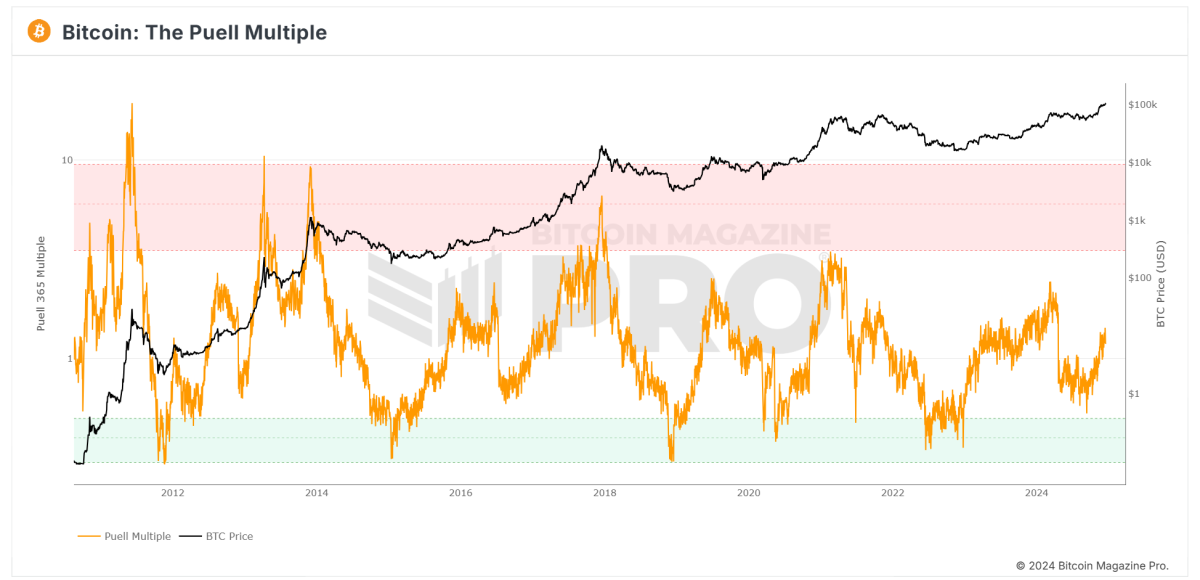

In the world of Bitcoin investing, understanding market cycles is key to identifying buying opportunities and spotting potential price peaks. One indicator that has stood the test of time in this regard is the Puell Multiple. Originally created by David Puell, this metric examines Bitcoin’s valuation through the lens of miner revenue, offering insights into whether Bitcoin might be undervalued or overvalued compared to its historical norms.

This article will explain what the Puell Multiple is, how to interpret it, and what the current reading on the chart suggests for investors. For a real-time look at this tool, check out the Puell Multiple chart on Bitcoin Magazine Pro.

What is the Puell Multiple?

The Puell Multiple is an indicator that compares Bitcoin miners’ daily revenue to its long-term average. Miners, as the “supply side” of Bitcoin’s economy, must sell portions of their BTC rewards to cover operational costs like energy and hardware. This makes miner revenue a critical factor influencing Bitcoin’s price dynamics.

How is the Puell Multiple Calculated?

The formula is simple:

Puell Multiple = Daily Issuance Value of BTC (in USD) ÷ 365-Day Moving Average of Daily Issuance Value

By comparing current miner revenues to their yearly average, the Puell Multiple identifies periods where miner profits are unusually high or low, signaling potential market tops or bottoms.

How to Read the Puell Multiple Chart

The Puell Multiple chart uses color zones to make interpretation straightforward:

- Red Zone (Overvaluation)

- When the Puell Multiple enters the red zone (above 3.4), it suggests miner revenues are significantly higher than usual.

- Historically, this has coincided with Bitcoin price peaks, indicating potential overvaluation.

- Green Zone (Undervaluation)

- When the Puell Multiple drops into the green zone (below 0.5), it signals that miner revenues are unusually low.

- These periods have historically aligned with Bitcoin market bottoms, offering prime buying opportunities.

- Neutral Zone

- When the Puell Multiple hovers between these levels, Bitcoin’s price is typically in a steady range relative to historical norms.

Current Insights: What is the Puell Multiple Telling Us?

Looking at the current Puell Multiple chart from Bitcoin Magazine Pro:

- The Puell Multiple (orange line) is trending upward but remains well below the red overvaluation zone.

- This suggests that Bitcoin is not yet in an overheated phase, where prices historically peak.

- At the same time, the metric is far above the green undervaluation zone, signaling we are no longer in a market bottom phase.

What Does This Mean for Investors?

The current Puell Multiple reading points to Bitcoin being in a mid-market cycle:

- Bullish Momentum: With the metric rising steadily, the market appears to be moving into a bullish phase, though it remains far from “overheated.”

- No Immediate Peak: The lack of a red zone reading suggests there may still be room for upside growth before a major correction.

Investors should monitor this chart closely in the coming months, particularly as Bitcoin approaches its next halving event in 2028, which could further influence miner revenues.

Why the Puell Multiple Matters for Bitcoin Investors

The Puell Multiple offers a unique perspective on Bitcoin’s market cycles by focusing on the supply side (miner revenue), rather than just demand. For long-term investors, this tool can be valuable for:

- Identifying Buying Opportunities: The green zone highlights periods of undervaluation.

- Spotting Market Peaks: The red zone has historically aligned with major price tops.

- Navigating Market Cycles: Combining the Puell Multiple with other indicators can help investors time their entries and exits more strategically.

Stay Ahead of the Market with Bitcoin Magazine Pro

For professional investors and Bitcoin enthusiasts looking to deepen their analysis, tools like the Puell Multiple chart on Bitcoin Magazine Pro provide essential insights into Bitcoin’s valuation trends.

By understanding the Puell Multiple and its historical significance, you can make informed decisions and better navigate Bitcoin’s unique market cycles.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Source link

Joules

The Joule Paradox: Energy sets the value of bitcoin and bitcoin sets the value of energy

Published

2 weeks agoon

December 6, 2024By

admin

Early in our thinking about the interaction between bitcoin and energy it became obvious to me that the value of bitcoin was fundamentally underpinned by the amount of energy that went into producing the bitcoin. As with any free market system, the value of a widget (in this case bitcoin) is determined by the cost of producing the widget plus the various levels of profit margin needed to get from manufacturing to the consumer. If someone has an innovative ability to supply something that no one else can and there is a large demand for this product then they have the ability to extract more profit based upon the scarcity of the supply relative to the demand. If the innovation is not sufficiently proprietary then others will recognise this arbitrage opportunity and seek to satisfy some or all of the demand. Over some period of time, we expect the ecosystem of producers to compete with each other for demand until a point is reached where the price of the product reflects the minimally acceptable level of profit margin for all participants in the production, supply, and sales chain. Additional innovations in production technique, material sourcing, or labour costs may give a temporary advantage to one producer over others and they can enjoy a period of greater profitability – that is until the other producers implement similar advantages and the overall price for the product gets driven lower.

This is what Adam Smith called the invisible hand or more modern economic thinkers call the economic equilibrium principle. If actors in a truly free market system (something we seldom actually achieve) act in their own interests by chasing profits, these actions will ultimately lead to a societal benefit through the satisfaction of demand at the point of optimum economic value. While we may never reach a truly optimal point of economic exchange of value, we certainly see the benefit of decreasing prices and increasing quality (especially in technical terms) in industries ranging from transportation to computing. My father bought an IBM PS/2 Model 25 with a 16 colour display and 10MB of storage space in the late 1980’s for around $7,000. Today, forty years later, a $70 Asian smartphone exceeds every capability of that IBM by many orders of magnitude for 1% of the cost. This is one aspect of the deflationary effect of technology that Jeff Booth discusses in his book The Price of Tomorrow.

While a computing device can increase in capabilities by 100,000% while decreasing in cost by 99% in the space of 40 years, why can’t we say the same thing of the automobile?

I drive a 1977 Range Rover that cost around $14,000 when it was new. Nearly 50 years later, the current model of Range Rover costs about 10 times that amount but delivers only marginally increased capabilities. Why did automobiles not experience the same technological deflationary effect as computers? In large part because the cost of the raw materials to produce a car including steel, aluminium, copper have all increased in that same time frame. In addition, the cost of running a factory to produce cars and the cost of transporting a 2 tonne vehicle from manufacturing to the point of sale have all gone up significantly in that period of time.

While you can’t get a comparable Asian SUV brand new for $14,000 today, you can get a very capable SUV for about twice that amount with significantly greater comfort and technical features versus my spartan 70’s off roader. In 1977 the most basic VW Beetle cost around $3,000. Similar low-end cars today from Asian manufactures with similarly sparse specifications tend to be around the $6,000 price point. What is hard to see with these numbers is the inflationary effect of the devaluation of currency – in this case the US dollar. A dollar in 1977 effectively had the spending power of $5.19 today or, said another way, a 2024 dollar has the same spending power of $0.19 in 1977. That is an 80% reduction in spending power. This means that a $6,000 basic car in 2024 would be priced at $1,140 in 1977 dollars. By the way, the $7,000 dollar IBM would have cost over $35,000 in 2024 dollars making the $70 smartphone an absolute steal!

What is it about a computer that allowed its technical deflationary effect to so far outpace inflation while the automobile could not achieve the same result? In short, the reason is twofold: energy and the scarcity of resources. It takes about 278kWh of energy and 120g of raw materials to produce one smartphone. A car takes around 17,000kWh of energy and 5,000,000g of raw materials to be produced (according to MDPI). Both products will end up with a similar profit margin for the manufacturer of roughly 10%. While technology can solve a lot of challenges of efficiency or miniaturisation, it cannot fundamentally reduce the quantity of physical and energy commodities that need to go into the production of something the size of a car.

In the same way, bitcoin has a fundamental cost of production that is driven by the amount of energy required to produce one bitcoin. While we are continually making progress with respect to the efficiency of the machines we use to convert energy into bitcoin (we have seen an increase in efficiency of around 83% from 2019-2024), the growth of the network hashrate has still driven up the amount of energy needed to produce 1 bitcoin to around 800,000kWh. That sets the intrinsic value of a Bitcoin produced in late 2024 at around $66,000 including a profit margin of roughly 10% for the average producer.

Does that mean that the current price of bitcoin is determined solely by the cost of producing a bitcoin?

Of course not; but it does play a critical role in setting the value of a bitcoin. The cost of production and the current market price have reached a point of equilibrium where the producer is able to make enough margin to continue to produce in their own self interests while the market is able to benefit from a fairly priced product. The amazing thing about the bitcoin network is that it is one of the only true free-markets in existence. Absent the ability for an actor to monopolise or governments to exert control over the market, the invisible hand will continue to push these two forces towards this state of equilibrium. This means that we can understand the true value of a bitcoin by understanding the cost of the energy required to produce a bitcoin. In this way, energy effectively values bitcoin.

Since I have already brought you into my worldview of thinking about most things from the perspective of a Land Rover, let me continue with that approach as we consider the other side of this Joule Paradox. As I said, I drive a 1977 Range Rover (what is now referred to as a Range Rover Classic Suffix D). I bought the truck here in Kenya about 5 years ago for right around $5,000. It was completely intact, unmolested, and 100% rust free. It was the equivalent of what is often referred to as a barn find – a perfect specimen for a functional restoration. In the Kenyan market I paid a bit above the going rate for a similar car due to its condition. If I were to attempt to purchase a similar vehicle in the UK market (assuming you can find a rust-free example still) it would have cost me significantly more. Fully restored in original condition in Kenya the truck might be worth $15,000 on the best day, a perfectly restored example in the UK would likely cost 10 times that amount. Why is there such a disparity in the value of two essentially identical things? In short, it is because of the isolation of economies.

The economic pool that I have to work within here in Kenya does not value this vehicle the same way that the economic pool in the UK does. If I could just send the truck across my Starlink connection to the UK, I could make a lot of money from this arbitrage opportunity. However, vehicle shipping doesn’t work like that. For me to move this truck from my Kenyan economic pool to the UK economic pool would require a tremendous amount of time (dealing with government paperwork on both ends), transportation expense, and a multitude of unforeseen expensive issues in making sure that the quality of my Kenyan-performed work would meet the far more rigorous requirements to operate a vehicle in the UK. Would it make financial sense? Possibly. Is it economically worth the effort for me? Definitely not. Plus, I really love the truck so I emotionally over value it.

Energy suffers from this same isolation of economies. If a natural gas producer in West Texas is trying to sell electricity into their regional pool at the same time that the wind is blowing and the sun is shining across the state, the value for their unit of energy can actually go negative. This means that they would have to pay someone to take their energy. At the very same point in time, someone charging their electric car in California may be paying a peak-demand surcharge for electricity that doubles their cost of energy. The Californian Tesla owner would very much love to have cheaper energy from Texas and the Texas producer would love to charge even a few cents for their power to anyone that would buy it. Unfortunately, these two energy pools operate in isolation. You can’t move a joule of energy from the Texas pool to the California pool without a lot of government paperwork and transportation costs. The arbitrage opportunity can’t be realised.

The same is true for a small hydro energy producer in Northwestern Zambia, they are isolated in a very small economic pool. They can produce more energy than they can sell to the local community but there is no one else other than the community to buy their electricity. Even if they offered it for $0.01, no one would take it. Meanwhile, 100km away, another village is being charged nearly $1.00 per kWh to get electricity from a solar mini-grid. Those villagers would love to have some cheap electricity. Unfortunately, you can’t move a joule of energy across 100km of bumpy, dusty African roads. The arbitrage opportunity is lost due to economic isolation.

Although I doubt that Satoshi thought about it this way, the bitcoin mining network is effectively an adapter to connect any isolated energy pool into a global marketplace. By simply plugging in a mining machine and connecting it to the internet, you can now sell your electricity to an always willing buyer. These two simple pieces of technology allow for energy pools to be linked in a way that hasn’t really existed before. Bitcoin is a non-government-controlled, internet-enabled, real-time energy market that is open 24/7, 365 days a year.

At any point in time, the invisible hand of the market will determine what is the going hashprice. This is the amount of bitcoin paid to a miner for submitting 1TH/s of compute power for 1 day. This value represents how much a miner can earn from running their machines and – thanks to mining pools – this amount is payable in very small units of work. If you run a 100TH/s machine for 1 hour then you will earn 1/24th of the hashprice paid directly to your bitcoin wallet. This is true anytime of the day and from anywhere on earth. Using this hashprice and knowing the efficiency of your mining machine, you can know with absolute certainty how much the bitcoin network is willing to pay you for any kWh of electricity that you want to sell.

As an example, as of 7:34am East Africa Time on October 5th, 2024, the bitcoin network will pay you $0.078 per kWh if you are using a 24J/T Whatsminer M50s and $0.103 per kWh if you are using a 18J/T Antminer S21. Those numbers will fluctuate with the change in bitcoin price, but then it is up to you to decide if you can get a better offer from your local economic pool. Willing buyer, willing seller as they say.

By acting as the real-time marketplace for internet-enabled energy, the bitcoin network allows us to complete the Joule Paradox: energy sets the value of bitcoin and bitcoin sets the value of energy.

Notice that I said value and not price. An old friend of mine used to frequently say that price is what you pay and value is what you get. The same is true here. The value of a bitcoin is based upon the energy inputs and production costs but the market determines the price. Similarly, bitcoin determines what the minimum value for a unit of electricity is but the seller determines whether they will accept that price or sell to someone else for more.

In thinking about the relationship between bitcoin and energy within this paradox, we start to see why the proof-of-work model that Satoshi chose to implement and the system of automated market regulation through the difficulty adjustment is so genius. If either of these features was missing from bitcoin then we would not have the highly valuable asset that we have today. It all comes back to this simple realisation, energy is the fundamental, base commodity upon which everything of value is produced and bitcoin is the most pure embodiment of energy in a monetary form. If we took the energy out of bitcoin then bitcoin would be no better than any other fiat system of money. Remember that when someone tries to tell you that ethereum is the more environmentally friendly cryptocurrency. Energy is the true source of value and no other monetary system is built on energy.

This is a guest post by Philip Walton. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Investors turn to Lightchain AI 3000x potential after PEPE drop

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential