consenSys

SEC claims unsupported in law

Published

2 months agoon

By

admin

Ethereum infrastructure developer Consensys has filed its response to the U.S. Securities and Exchange Commission’s claims of federal securities law violations, adding to its lawsuits against the agency.

The SEC previously accused Consensys’ crypto wallet, MetaMask, of operating as an unregistered broker and securities issuer.

Consensys fully refuted the SEC’s allegations, criticizing the agency and its chair, Gary Gensler, for what it described as an unconstitutional attack on the decentralized finance ecosystem. Its court-submitted reply reaffirmed its stance and dissatisfaction with the SEC’s lawsuit.

This action is just the latest step in the SEC’s recent campaign to seize control over the future of blockchains and cryptocurrency, one of the fastest-growing and most innovative technologies in the world… The SEC’s attempt to impose its regulatory authority on this technology and insert itself into this crypto architecture is unsupported in the law — its claims must fail.

Consensys response to SEC suit

Before becoming the subject of an SEC probe, Lubin’s firm had sued the SEC over its Ethereum (ETH) investigation. Agency prosecutors closed the inquiry and promptly filed a complaint against MetaMask’s creator. The SEC alleges that MetaMask facilitated illegal securities trading and that its staking service violated financial regulations.

Consensys countersued the regulator to determine whether the law grants the SEC regulatory oversight. Bill Hughes, a lawyer for Consensys, revealed that U.S. Judge O’Connor granted an expedited calendar for the case.

Meanwhile, CEO Joseph Lubin announced staff layoffs attributed to regulatory battles and macroeconomic factors, with Consensys reducing its workforce by 20%.

Several firms under pressure from SEC litigation may see the approaching U.S. general elections as a potential advantage. Digital asset companies have donated over $190 million to crypto-focused super PACs like Fairshake, outspending all other industries.

Republican candidate Donald Trump has stated he would dismiss Gensler in January 2025 if elected. SEC legal actions may temporarily stall in the event of a commissioner stalemate. Conversely, Gensler could continue in office until 2026 if Democrat Kamala Harris wins.

Source link

You may like

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

consenSys

Two Crypto Firms Announce New Layoffs: What’s Happening?

Published

2 months agoon

October 31, 2024By

admin

Two crypto companies, dYdX and ConsenSys, have announced a new round of layoffs. What’s happening, and why are American regulators being blamed for this?

Antonio Juliano, the CEO of the decentralized derivatives exchange dYdX, announced a 35% layoff. He thanked the former employees for their work and explained the layoffs as the need to “revitalize” the exchange since, in its current form, it is “different from the company dYdX must be.”

“I have seen this over and again, and it will continue. What we are building is much larger than just a company, and this you will always be a part of.”

Notably, the layoffs at dYdX came shortly after ConsenSys cut its staff by 20%. ConsenSys CEO Joseph Lubin cited unfavorable macroeconomic conditions, uncertainty over crypto regulation in the U.S., and the cost of a legal battle with the Securities and Exchange Commission (SEC).

1/5

The broader macroeconomic conditions over the past year and ongoing regulatory uncertainty have created broad challenges for our industry, especially for US-based companies.

— Joseph Lubin (@ethereumJoseph) October 29, 2024

At the same time, Lubin called the company’s financial position stable.

According to him, ConsenSys will focus on its core revenue drivers, which aligns with its previously adopted strategy. The company’s flagship products, MetaMask and Linea, the second-layer Ethereum network, will serve as the basis for further development.

In addition, ConsenSys CEO said that the laid-off employees will receive support after leaving the company, namely, severance pay depending on the length of service, assistance with future employment, and expanded health benefits.

Lubin also told Fortune that the layoffs will affect about 162 of the 828 employees working from all divisions at Consensys. Now, ConsenSys has now become the leader in layoffs in 2024, according to layoffs.fyi.

Why the SEC is again the culprit of all the worst?

In the layoff statement, Lubin cited the SEC as one of the reasons why he will cut staff. In June, the regulator sued the developer of the MetaMask wallet, noting that the company violated the law through the MetaMask Staking service.

The lawsuit comes shortly after ConsenSys filed a lawsuit against the SEC and five of its unnamed employees over its “oversight of ETH,” asking the court to formally approve language that would not classify the asset as a security.

As a result, the SEC’s Division of Enforcement closed its investigation into Ethereum 2.0. The agency took this step after the organization sent a letter asking for clarification on the asset class when approving the spot Ethereum ETF. However, the lawsuit over the SEC’s allegations is ongoing, leaving ConsenSys facing legal costs.

The layoffs come at a time when the market is bucking trends

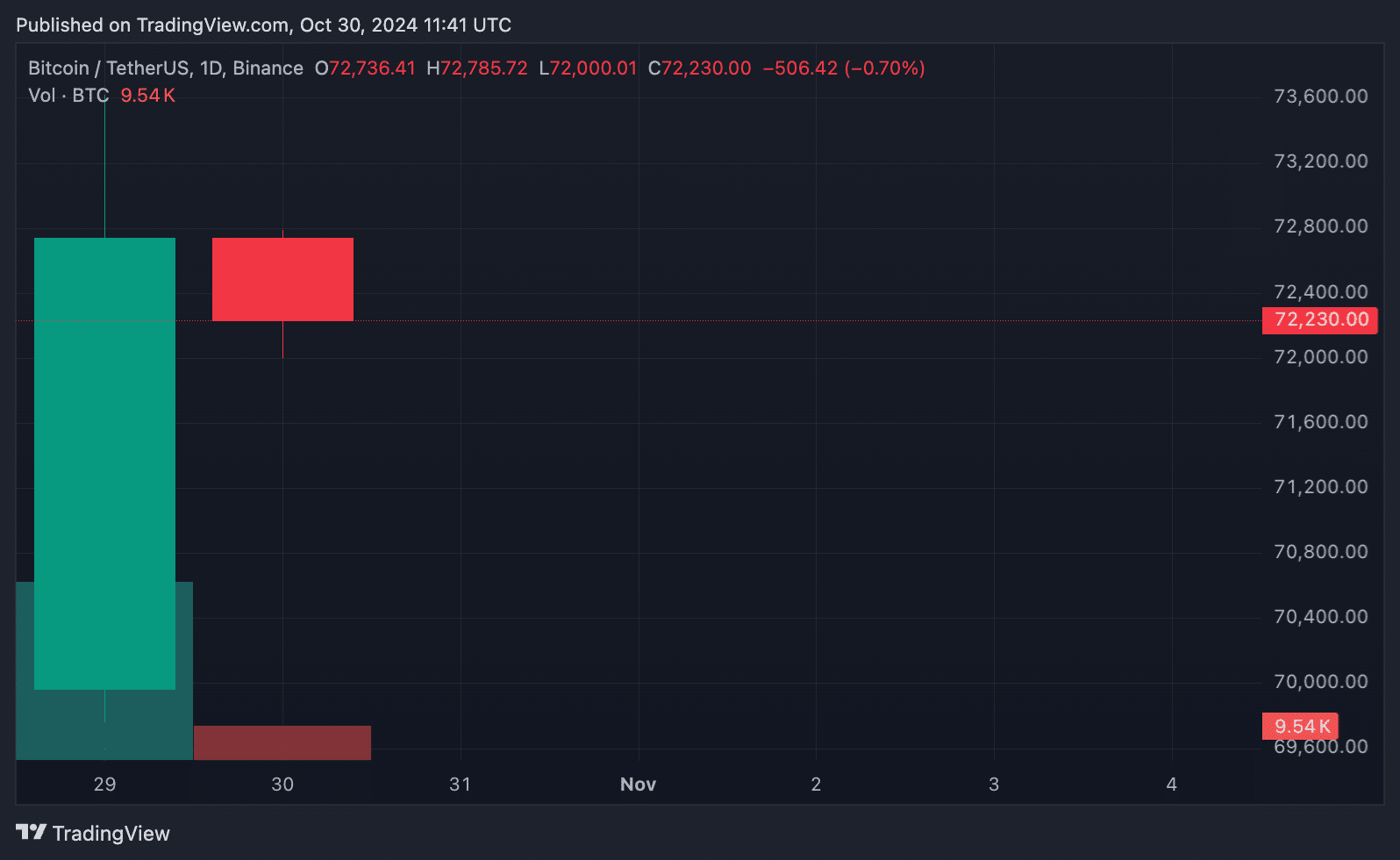

Notably, the crypto market was booming at the time of the layoff announcement, which is generally considered a good time for crypto companies. Thus, on Oct. 29, the Bitcoin (BTC) rate grew from $70,000 to just over $73,600, approaching the historical maximum of $73,777. Since the beginning of the month, the cryptocurrency’s value has grown by 12%. Analysts associate this trend with forecasts for the U.S. presidential election.

Interestingly, the growth of Bitcoin is also explained by the situation in the U.S., which the CEO of ConsenSys previously complained about, explaining the layoffs.

The growth in the price of Bitcoin is due to several factors. In particular, interest in Bitcoin ETFs from large companies such as BlackRock is increasing, which attracts significant investments. Recently, the U.S. saw an influx of $2.7 billion into Bitcoin ETFs, which helped attract new investors and raise the price.

In addition, the desire to protect against inflation significantly impacts the market. Against a weakening dollar and rising inflation, many investors are turning to limited assets such as Bitcoin to preserve their savings.

dYdX cuts staff while competitors gain momentum

Since the beginning of the year, the crypto market has been recovering from a long crypto winter, with many exchanges ramping up their growth. According to Bloomberg, Crypto.com, Binance, Coinbase, Gemini, and Kraken are hiring as cryptocurrencies like Bitcoin rise—not dYdX, though.

When announcing the staff reduction, Juliano mentioned that in its current form, the exchange is different from what it should be, without specifying what exactly he meant. However, further development will require human capital capable of reviving the platform. Therefore, announcing a 35% staff reduction against the backdrop of crypto exchanges trying to get the most out of the current rally looks illogical, to say the least, but Juliano is hardly worried about FOMO.

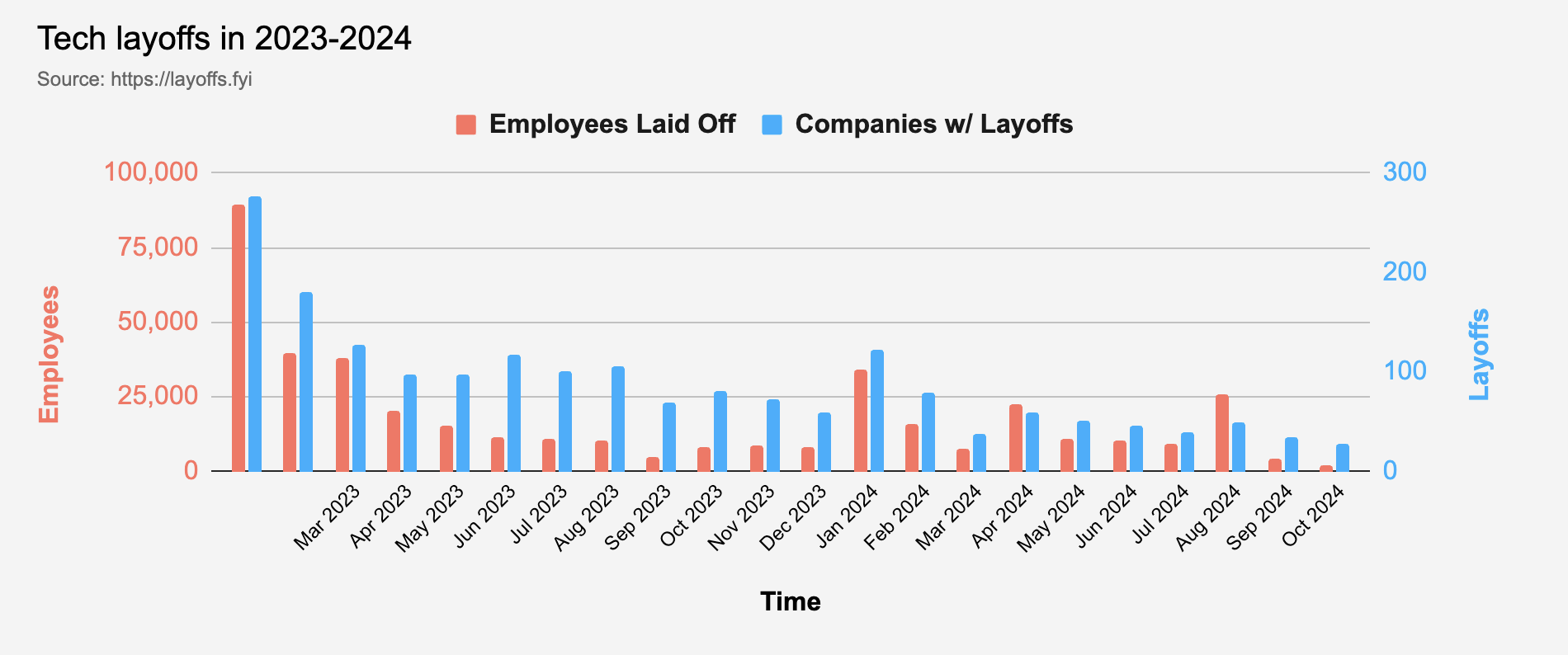

How the dynamics of layoffs in the crypto industry have changed?

According to layoffs.fyi, Q1 2023 was the peak in layoffs since 2020, when more than 167,000 employees lost their jobs. However, in 2024, the situation looks much better: the peak of layoffs occurred in Q1, with 57,000 employees who lost their jobs. There were even fewer layoffs in the second and third quarters – 43,000 and 38,000, respectively.

Thus, the story of dYdX and ConsenSys has become more of an exception to the rule than a typical trend for 2024. After massive layoffs in 2022 and 2023, the blockchain job market seems to be recovering.

Source link

24/7 Cryptocurrency News

Texas Court Dismisses Consensys Suit Against SEC on Procedural Basis

Published

3 months agoon

September 20, 2024By

admin

The United States District Court for the Northern District of Texas dismissed Consensys Software Inc.‘s case against the Securities and Exchange Commission. This was after a long legal battle to determine the status of Ethereum and other similar software products.

Texas Court Ends Consensys Suit Against SEC

The U.S. District Court in Fort Worth has thrown out the allegations made by Consensys against the Securities and Exchange Commission in a recent legal move. The court, presided over by Judge Reed O’Connor, ruled on procedural grounds. The judge determined the claims concerning Ethereum classification and the regulatory approach to MetaMask were not ripe for judicial review. This decision effectively puts an end to the current litigation initiated by Consensys in April of this year.

The dismissal focused particularly on the lack of final agency action from the SEC, which the court noted was a requisite for a substantial legal challenge. This procedural dismissal indicates that despite the issues raised, the court decided not to proceed with evaluating the merits of the case.

Legal Battle Over Ethereum and MetaMask

Initially, Consensys challenged the SEC’s classification of Ethereum and its derivatives as securities. The complaint highlighted concerns over the SEC’s focus on MetaMask, a software service provided by Consensys that facilitates crypto transactions and staking.

Despite an earlier notification in June about the SEC dropping its investigation into Ethereum, the broader implications of this regulatory scrutiny remained a contentious issue.

Subsequent to the initial lawsuit, the SEC initiated a separate enforcement action in June, accusing Consensys of operating its MetaMask swaps service without proper registration.

In addition, according to Judge O’Connor, this case lacked the necessary finality from the Securities and Exchange Commission side to be considered ready for court adjudication.

Reactions and Future Regulatory Steps

The court’s decision to dismiss on procedural grounds does not conclude the legal issues surrounding the regulation of Ethereum and other blockchain technologies.

More so, Consensys has expressed its intention to continue advocating for blockchain developers and to challenge the SEC’s actions in other jurisdictions, indicating that the struggle over crypto regulation in the U.S. is far from over. The case’s dismissal in Texas does not preclude the blockchain company from pursuing other legal avenues to address their grievances.

In addition, most recently, a US Bankruptcy judge Brendan Shannon approved Terraform Labs plan to liquidate its assets following an ongoing SEC lawsuit.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. His work includes notable contributions to Cryptopolitan and Coingape News Media, where he shares his insights on the latest developments in the cryptocurrency market. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

consenSys

Linea’s growth lead resigns over vision discrepancies

Published

3 months agoon

September 11, 2024By

admin

Linea’s growth lead Marco Monaco has stepped down from his role, citing misalignment in vision with the project’s future direction.

Marco Monaco, the growth lead for Linea, the zk-rollup developed by Consensys, has left the project, citing a misalignment in vision as the primary reason for his departure.

In an announcement made via X on Sept. 11, Monaco, who had been a key figure in driving Linea’s growth, disclosed that he is “no longer working on Linea in any capacity,” explaining that his resignation follows a period of decreased engagement over the past few months after previously resigning from Consensys.

2/ Many of you, especially Linea developers, may have noticed that my engagement has significantly decreased over the past few months. I resigned from @Consensys in mid-June and officially left the project in mid-July, after EthCC.

— Marco Monaco (@marcomonaco83) September 11, 2024

Throughout his two-year tenure, Monaco says he devoted “nearly 20 hours a day” to developing Linea’s business vision, emphasizing his efforts to “build a vibrant ecosystem” and leverage tech stack by Consensys to advance the platform. Despite his achievements, Monaco expressed a desire to shift the network’s perception from “just farming” to a focus on community engagement and organic growth.

As Linea undergoes a significant transition, Monaco noted that the review process and vision discussions led to a mutual agreement with Consensys leadership that his continued involvement was no longer aligned with the project’s future direction.

“[…] Consensys leadership and I agreed that the best path forward for Linea does not involve me personally as our visions are not aligned anymore.”

Marco Monaco

However, he did not elaborate on the specific points of disagreement with Consensys.

Monaco’s departure comes a few months after Linea faced scrutiny for pausing its entire network to block an address associated with a hacker who exploited the Velocore decentralized exchange, built on Linea, for $7 million. In June, Linea confirmed it had suspended block production to prevent the hacker from selling a large sum of stolen tokens, a move that drew criticism from the broader crypto community.

The pause, which spanned one hour, allowed Linea to assess the situation and coordinate with the Velocore team and centralized exchanges to freeze the hacker’s funds. However, the decision raised concerns about the project’s centralization, with some criticizing the ability to stop the entire network, which at the time held over $1.2 billion in locked value, according to L2Beat data.

Linea acknowledged that its reliance on centralized operations was a vulnerability, but reiterated its commitment to transitioning toward a decentralized, censorship-resistant network.

Source link

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: