Bitcoin

Senator to Push the Bill in Trump’s First 100 Days

Published

5 months agoon

By

admin

The Senate hopes to push through a Bitcoin reserve bill in the first 100 days of Trump’s presidency while the Republicans consult on crypto policy.

American Senator Cynthia Lummis expressed optimism that plans to create a strategic Bitcoin (BTC) reserve will be implemented soon after Donald Trump‘s inauguration.

“I believe we can get this done with bipartisan support in the first 100 days if we have the support of the people. It is a game changer for the solvency of our nation. Let’s put America on sound financial footing and pass the Bitcoin Act!”

Senator Cynthia Lummis

Lummis’s post responded to David Bailey, BTC Inc. CEO, who has been actively advising Trump on cryptocurrency policy. Bailey had previously suggested that such a reserve could be created quickly under the new administration.

“The Bitcoin and Crypto industry’s policy wishlist is long and pressing… but the Strategic Bitcoin Reserve is the #1 most urgent and transformational policy on President Trump’s agenda. The downstream effects change everything. We must get it done in the first 100 days.”

David Bailey, BTC Inc. CEO

Bailey also floated the idea of using Bitcoin more widely in government programs. He suggested that if Robert F. Kennedy Jr. were appointed Secretary of Health and Human Services and assumed responsibility for managing the Social Security program, there would be a discussion about paying 5-10% of Social Security payments in Bitcoin, stored in a strategic reserve.

What is known about the Bitcoin reserve project?

Trump announced the creation of a Bitcoin reserve in the U.S. in July 2024 during a speech at an event supporting his election campaign. A few days before the politician’s announcement, media reports appeared that Senator Cynthia Lummis was preparing a Bitcoin reserve bill called the BITCOIN Act of 2024.

The act proposes creating a network of decentralized vaults nationwide to securely store Bitcoin reserves. The U.S. Treasury Department is supposed to have 200,000 BTC annually for five years, and the U.S. reserves would eventually amount to one million BTC. It is also assumed that Bitcoin reserves will be stored for at least 20 years.

The cryptocurrency can be purchased at the expense of other assets at the authorities’ disposal, such as gold certificates. Lummis proposes to cover the costs of purchasing cryptocurrency by revaluing it.

In addition, the proposal plans to implement a reserve verification system to verify the availability of funds and consolidate all existing BTC that are currently in the possession of the U.S. government into a new reserve.

Bitcoin reserves to make the U.S. new crypto haven

Analysts at CoinShares write that implementing the plan to create strategic reserves in BTC can generate significant institutional and government interest in Bitcoin. According to their forecasts, this will potentially accelerate its growth and raise its value to new heights.

In general, many participants in the crypto community expect that the U.S. bet on Bitcoin can significantly increase the cryptocurrency’s investment attractiveness. For example, Anthony Pompliano, the founder of Pomp Investments, is confident that the initiative will cause the market to experience FOMO.

Lummis’ proposal implies that the pace of Bitcoin purchases may outpace the cost of BTC mining. In this case, a cryptocurrency deficit will form in the market, which can also support the growth of its rate.

Trump’s rally is in full swing. Or just a rally?

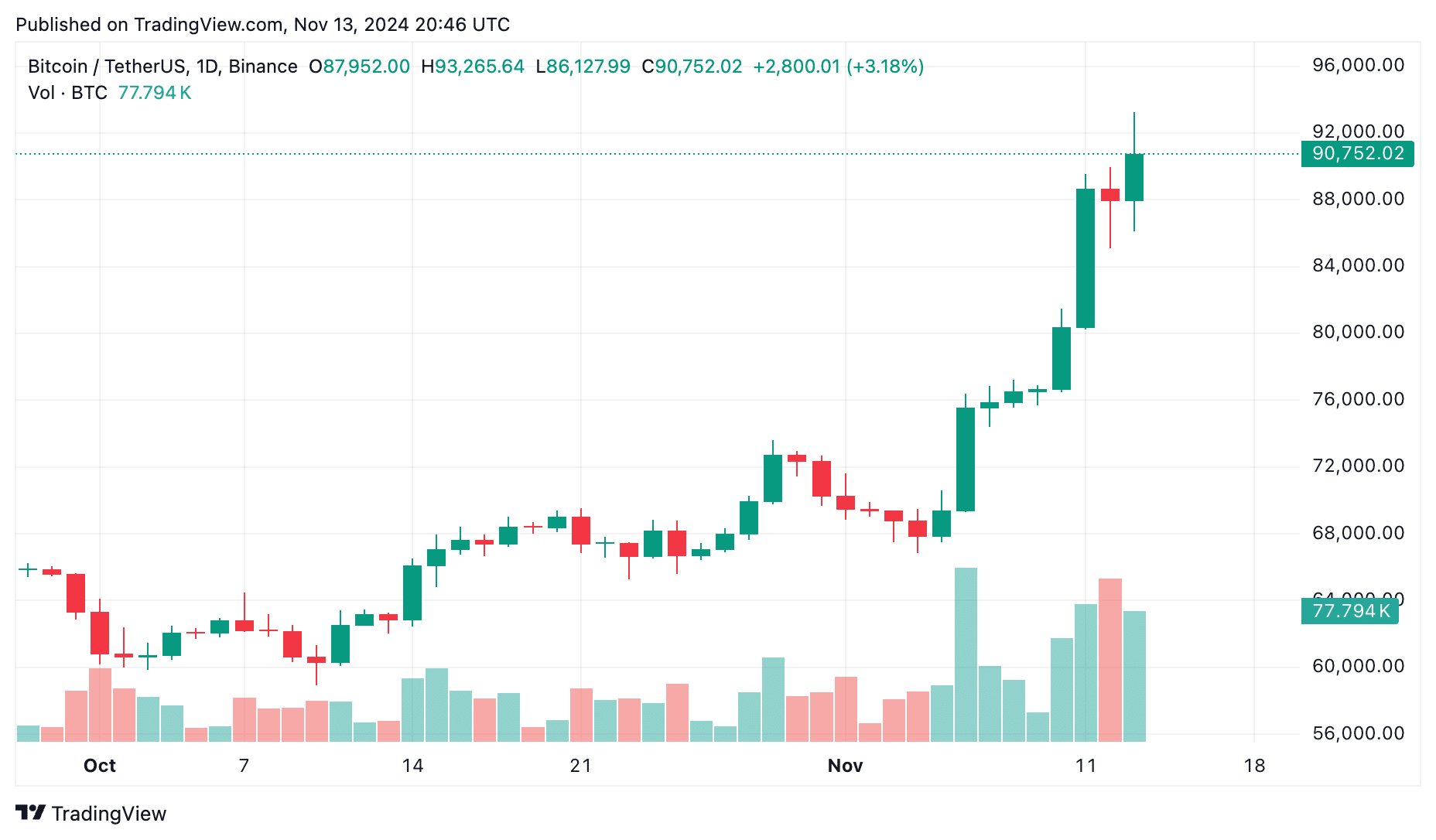

In general, Lummis’ words are confirmed based on the dynamics of Bitcoin and the entire crypto market since the U.S. elections. Over the past week, Bitcoin has repeatedly updated historical highs.

The total capitalization of the entire crypto market has grown by 25% in a week and exceeded $3 trillion. At the same time, the price of Bitcoin has increased by 23.8% in 7 days, several times updating the all-time high and reaching $93,000.

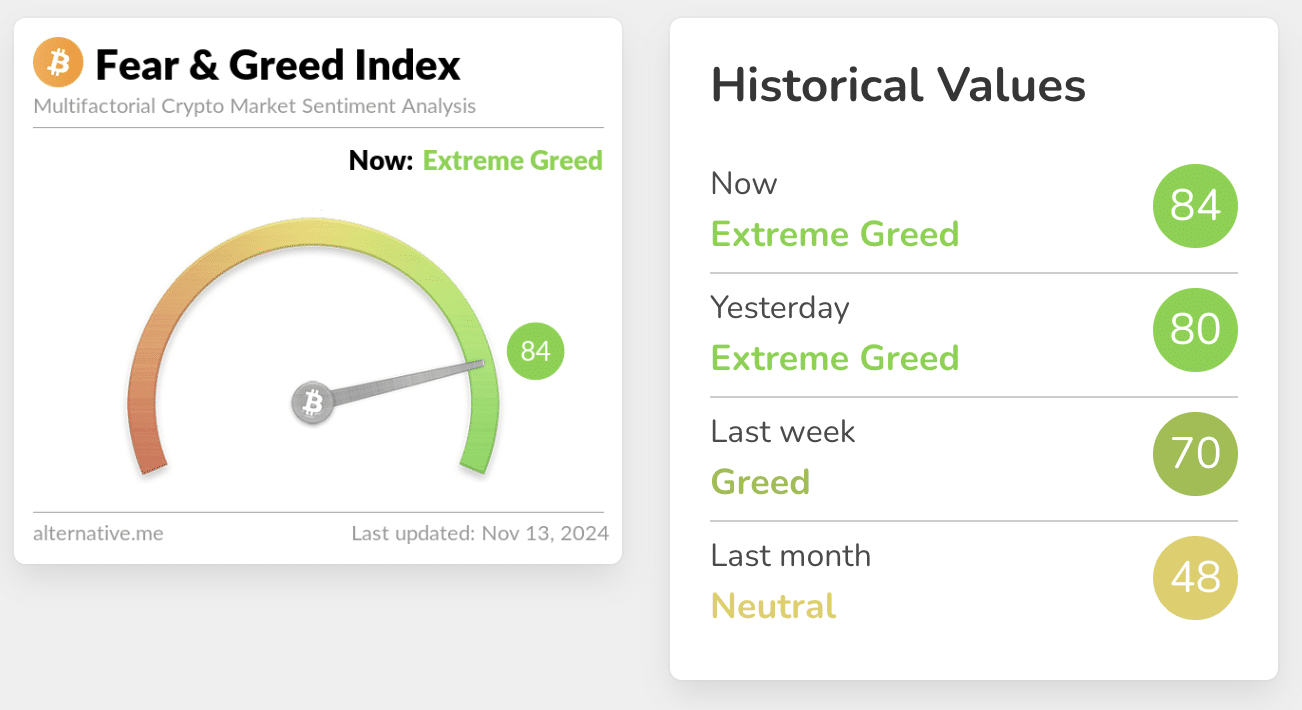

The crypto market’s index of fear and greed has grown by as much as 14 points in a week—from 70 points to 84 out of 100- indicating the market’s extreme greed.

However, some experts doubted that Trump’s victory was the only growth driver of the crypto market.

Thus, the co-founder of Onramp Bitcoin, Jesse Myers, noted that such crypto market dynamics are routine and predictable after the Bitcoin halving in April. During this time, a shortage of coins has arisen on the market, therefore the price is growing under pressure from demand. This triggers a chain reaction that should lead to another bubble.

If you’re wondering what’s happening with #Bitcoin…

Yes, the incoming Bitcoin-friendly administration has provided a recent catalyst…

But, that’s not the main story here.

The main story here is that we are 6+ months post-halving.

And that means a supply shock has… pic.twitter.com/XkwPoPxrj2

— Jesse Myers (Croesus

) (@Croesus_BTC) November 11, 2024

Myers reminded that the same situation happened after each previous Bitcoin halving, so it makes sense to expect something similar this time. The change of power in the U.S. to one potentially more friendly to cryptocurrencies only acted as a catalyst.

Source link

You may like

An Excerpt From The Satoshi Papers: The Banker Revolution

Senator Tim Scott Says Crypto Market Structure Bill To Be Passed by August of This Year

DOT recovery, Bitget burn update and BlockDAG’s $1 forecast, 10 CEX listings

Strategy Buys More Bitcoin as Tariff Exemptions Send Tech Stocks Soaring

Kraken Expands To TradFi, Set To Launch Stock & ETF Trading

U.S. Crypto Lobbyists Flooding the Zone, But Are There Too Many?

Bitcoin

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Published

10 hours agoon

April 14, 2025By

admin

Japanese technology firm Metaplanet has acquired an additional 319 bitcoin worth approximately ¥3.78 billion ($26.3 million), continuing its aggressive bitcoin accumulation strategy amid growing U.S.-China trade tensions.

The Tokyo-listed company purchased the bitcoin at an average price of ¥11.85 million ($83,147) per coin, according to a company announcement on Monday. The latest acquisition brings Metaplanet’s total bitcoin holdings to 4,525 BTC, with an aggregate cost basis of $408.1 million at an average purchase price of $90,194 per bitcoin.

The purchase comes as bitcoin experienced a slight decline over the weekend, dropping more than 2% to $83,482 during Asian trading hours. The bitcoin and crypto market has shown sensitivity to emerging geopolitical tensions, particularly surrounding potential new U.S. trade tariffs targeting Chinese electronics.

Metaplanet often referred to as “Asia’s MicroStrategy,” has outlined ambitious plans to expand its bitcoin holdings by 470% to reach 10,000 BTC by the end of 2025 and 21,000 bitcoin by the end of 2026. The company evaluates its performance through “BTC Yield,” a metric measuring bitcoin holding growth relative to shares outstanding. For Q1 2025, Metaplanet reported a BTC yield of 95.6%, with a year-to-date figure of 6.5% as of April 14.

The company’s latest move has elevated its position to become the ninth-largest public holder of bitcoin globally. Metaplanet’s bitcoin strategy has gained additional attention following the recent appointment of Eric Trump to its Strategic Advisory Board, citing his business expertise and passion for bitcoin. The timing of the purchase coincides with complex market dynamics as investors process mixed signals from Washington regarding U.S. trade policy.

Metaplanet’s bitcoin acquisition strategy is supported by various capital market activities, including bond issuances and stock acquisition rights, designed to raise funds while minimizing shareholder dilution. The company has currently executed approximately 41.7% of its “210 million plan.”

Metaplanet’s strategic pivot to bitcoin accumulation closely mirrors the playbook pioneered by Michael Saylor’s Strategy, albeit on a smaller scale. Since launching its bitcoin treasury operations, the Japanese firm has demonstrated remarkable success in implementing a similar approach of leveraging financial instruments and market opportunities to acquire bitcoin.

Like Strategy, Metaplanet has utilized a combination of convertible debt offerings and equity-linked instruments to fund its acquisitions while maintaining a healthy balance sheet. The strategy has yielded impressive results, with the company’s bitcoin holdings growing to over 4,500 BTC in just over a year.

Source link

Bitcoin

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Published

12 hours agoon

April 14, 2025By

admin

A widely followed crypto strategist believes that Bitcoin (BTC) can take the path of higher for longer this market cycle.

Pseudonymous analyst Jack tells his 268,200 followers on the social media platform X that he thinks Bitcoin will not print a new all-time high this year after US President Donald Trump instigated a global trade war and created uncertain market conditions.

The trader shares a chart suggesting that Bitcoin will create a durable bottom between $66,000 and $80,000 for the rest of the year before launching a new bull run in 2026.

“Trump path clearly is contraction for now.

But in that world of less globalization and trust, Bitcoin is a good asset to have, becoming a ball held under water.

Similar to how 2013 saw a short bear [market].”

Looking at the trader’s chart, he appears to suggest that Bitcoin will rally to as high as $297,000 by November of 2026.

Jack says that one catalyst that could send Bitcoin flying is the potential capital rotation from gold to BTC. According to the trader, gold investors will eventually come to know that Bitcoin is far better than the precious metal as a safe-haven asset.

“What if Gold is trading like it is because everyone is scrambling to redeem paper for physical, of which there is a scarcity, vs. all the paper that has been issued, essentially catching up to its true value that has been diluted with paper

Bitcoin doesn’t have this issue and will rally once people realize it is the better alternative for trade due to this very specific property.”

“Paper” gold refers to financial instruments that allow investors to gain exposure to the precious metal without having to deal with the expenses or logistics of physically possessing the commodity. Jack appears to be highlighting Bitcoin’s portability as BTC holders can easily store, access and transfer their coins as long as they have the keys to their wallet.

At time of writing, Bitcoin is trading for $84,244.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Published

16 hours agoon

April 14, 2025By

admin

Bitcoin (BTC) proponent Michael Saylor has hinted the company he co-founded, Strategy (MSTR), may be set to announce an additional BTC purchase this week shortly after revealing it expects a net loss in the first quarter of the year over unrealized losses on its massive BTC holdings.

The company has added 80,785 BTC to its balance sheet since the beginning of the year after raising a total of $7.69 billion during the first quarter, with over half of that coming from common stock sales. Most, if not all, of those funds were used to buy bitcoin.

On Sunday, Saylor posted a BTC holdings tracker to X, a move that typically precedes a purchase announcement, commenting there are “no tariffs on orange dots.” The comment implies the company’s BTC purchases were unaffected by the reciprocal tariffs Donald Trump introduced earlier this month and the ensuing U.S.-China trade war.

The company paused its buying during the week ending April 6. Its crypto stash is currently worth roughly $44.59 billion, and was acquired for $35.63 billion.

Strategy currently holds 528,185 BTC bought at an average price of $67,458 according to Bitcointreasuries data equivalent to 2.515% of the cryptocurrency’s total supply.

Source link

Ethereum Price Threatened With Sharp Drop To $1,400, Here’s Why

An Excerpt From The Satoshi Papers: The Banker Revolution

Senator Tim Scott Says Crypto Market Structure Bill To Be Passed by August of This Year

DOT recovery, Bitget burn update and BlockDAG’s $1 forecast, 10 CEX listings

Strategy Buys More Bitcoin as Tariff Exemptions Send Tech Stocks Soaring

Kraken Expands To TradFi, Set To Launch Stock & ETF Trading

U.S. Crypto Lobbyists Flooding the Zone, But Are There Too Many?

Michael Saylor’s Strategy buys $285M Bitcoin amid market uncertainty

Dogecoin Follows This Blueprint, Says Crypto Analyst

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x