SOL

Solana Breaks Above Daily Downtrend – Analyst Expects New ATH Soon

Published

3 months agoon

By

admin

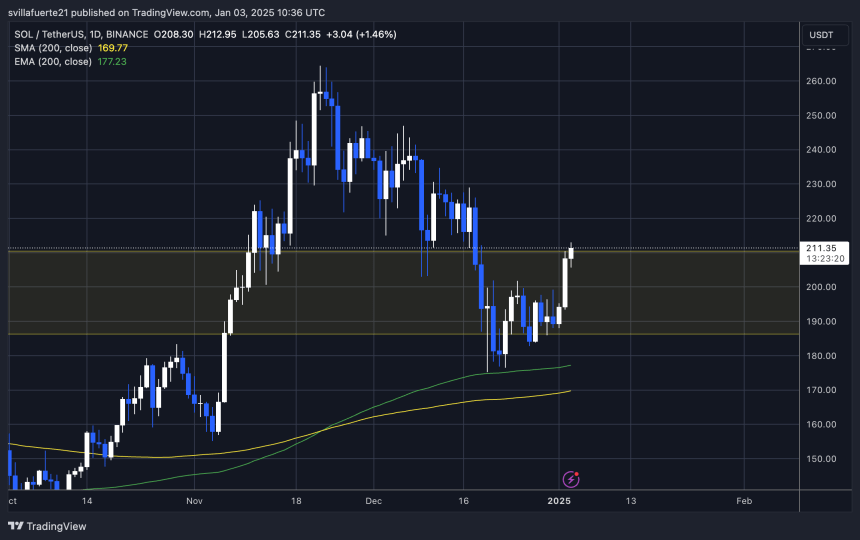

Solana has kicked off the year with an impressive 12% surge, reaching the pivotal $210 level and reigniting investor optimism. This rally comes as market sentiment shifts positively, fueling a broader resurgence in altcoins. With Solana now gaining significant traction, many are asking whether this marks the beginning of a massive rally for the high-performance blockchain.

Related Reading

Top analyst Jelle recently shared a technical analysis on X, highlighting a critical development in Solana’s price action. According to Jelle, SOL has successfully broken a daily downtrend that originated after it reached its all-time high. This breakout is viewed as a bullish signal, suggesting that Solana may be gearing up for a more extended upward move in the coming weeks.

The $210 mark is crucial for Solana, as flipping it into support could pave the way for a sustained rally. With altcoins showing strength across the board, investors will be closely watching Solana’s ability to capitalize on this momentum. As the new year unfolds, the question remains: can Solana leverage this bullish start to achieve new highs and solidify its position as a leading force in the crypto market?

Price Action Suggests An Upcoming Move

As the crypto market rebounds from local lows, Solana is riding the wave with impressive momentum. The altcoin giant has continued to rise after holding a critical demand level above the $180 mark. This has sparked optimism among investors, who increasingly view Solana as a resilient and promising asset in the current market environment.

Top analyst Jelle recently shared a detailed technical analysis on X, highlighting several bullish developments for Solana. According to Jelle, SOL has not only broken out of its prolonged downtrend but has also reclaimed crucial monthly and weekly support levels. Additionally, Solana is now trading back above its 50-day exponential moving average (EMA), signaling a renewed bullish structure and growing strength in its price action.

These technical signals suggest Solana is preparing for a significant move, potentially driving the price to new all-time highs. However, such a breakout will require strong market participation and favorable sentiment in the coming weeks to sustain the rally.

Related Reading

For now, Solana’s performance is a testament to its resilience, positioning it as a top contender for those seeking growth opportunities in the altcoin market.

Solana Testing Technical Levels

The Solana (SOL) daily chart is showing promising signs of strength after a sharp bounce from the critical $175 level, which coincided perfectly with the 200-day EMA. This technical rebound has propelled the price to a key supply zone at $210, a significant milestone as SOL continues to push higher.

For bulls, the immediate target must be the $230 level. Reclaiming this area as support would likely trigger a fast and aggressive rally. Driving Solana into uncharted territory with new all-time highs. The confluence of technical indicators and recent bullish momentum suggests this scenario is achievable if the broader market continues to support the trend.

Related Reading

However, time is of the essence. If Solana fails to reclaim the $230 mark in the coming weeks, the momentum could weaken, leading to sideways consolidation. Such a consolidation phase might slow the pace but could also build a stronger base for the next breakout.

Featured image from Dall-E, chart from TradingView

Source link

You may like

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Altcoin

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Published

6 hours agoon

April 13, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana appears to be gearing up for a major technical breakout, with recent price action building up an interesting chart formation. A familiar bullish pattern has formed, and if validated, it could drive the price to a level not seen in recent weeks. This new development was highlighted by popular analyst Titan of Crypto on social media platform X.

Pattern Breakout Sets $143 In Sight

Like every other large market-cap cryptocurrency, Solana has experienced an extended period of price crashes since late February. In the case of Solana, this price crash has been drawing out since January, when it reached an all-time high of $293 during the euphoria surrounding the Official Trump meme coin. Since then, Solana has corrected massively, even reaching a low of $97 on April 7.

Related Reading

The price action before and after this $97 low has created an interesting formation on the 4-hour candlestick timeframe chart. As crypto analyst Titan of Crypto noted, this formation is enough to send Solana back up to $143.

At the heart of the latest bullish outlook is a clearly defined inverse head and shoulders structure, which is known for its reliability in signaling a reversal from a downtrend to a bullish breakout. The left shoulder of the pattern began forming in early April as Solana attempted to rebound from sub-$110 levels. The subsequent drop to the $96 bottom on April 7 formed the head of the structure. From there, a recovery started as buyers cautiously stepped back in, giving rise to the right shoulder.

The breakout of the neckline resistance has taken place in the past 24 hours. With this in mind, Titan of Crypto predicted that $143 becomes the next logical destination based on the measured move from the head to the neckline.

Image From X: Titan of Crypto

Momentum Strengthens With Structure Confirmation

Looking at the chart shared by the analyst, the momentum behind Solana’s price movement appears to be gaining strength. Trading volume is an important metric in evaluating the strength of a breakout, and the volume accompanying the recent breakout above the neckline seemingly confirms it.

Particularly, Solana has seen a 5.3% increase in its price during the past 24 hours, with trading volume surging by 3.76% within this timeframe to $4.21 billion.

Although it is common to see a throwback or minor consolidation just above the neckline, the projected path suggests continued upside as long as price action holds above that key breakout zone.

Related Reading

At the time of writing, Solana is trading at $129, 10% away from reaching this inverse head-and-shoulder target. A move to $143 would not only represent a meaningful recovery from April’s lows but could also improve the confidence in Solana’s price trajectory moving into Q2. The next outlook is what happens after it reaches this target of $143, which will depend on the general market sentiment.

Featured image from The Information, chart from TradingView

Source link

SOL

Solana Triggers Long Thesis After Pushing Above $125 – Start Of A Bigger Rally?

Published

14 hours agoon

April 13, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana is trading above the $125 mark after bulls stepped in with force, reclaiming critical technical levels and bringing some relief to a market that had been dominated by selling pressure. After weeks of steep declines and heightened volatility, Solana is finally showing signs of strength as buyers return and confidence starts to rebuild.

Related Reading

The bounce came at a crucial moment, as SOL was on the verge of breaking into lower demand zones following a sharp 47% drop since early March. The shift in momentum has caught the attention of market participants, especially as broader market sentiment begins to stabilize.

Top analyst Big Cheds shared a technical analysis on X, suggesting that Solana has “triggered a long thesis overnight” after reclaiming several key levels on the chart. His comments are fueling speculation that this move could mark the beginning of a broader recovery phase for SOL—provided bulls can hold current levels and build momentum from here.

As traders monitor upcoming resistance and key indicators, the next few days will be crucial in determining whether Solana’s rally has legs—or if it’s just another short-lived bounce in a volatile macro environment.

Solana Surges 40% As Long Thesis Takes Shape

Solana has gained over 40% since last Monday, sparking renewed bullish sentiment and opening a debate among analysts and traders: is this the start of a sustained move higher, or will SOL consolidate around current prices? After weeks of persistent selling pressure, Solana has finally seen a wave of buying interest, bouncing strongly from a $95 low. This bounce marks one of the most aggressive reversals among major altcoins during the recent market correction.

The surge came shortly after US President Donald Trump announced a 90-day pause on reciprocal tariffs for all countries except China, which now faces a 145% tariff. The announcement sparked relief rallies across risk assets, with Solana among the top beneficiaries.

Big Ched’s analysis reveals that Solana triggered a long thesis after successfully reclaiming the $125 resistance level. This move is seen as a breakout confirmation, suggesting that a bullish structure may now be forming.

However, global tensions and trade war fears continue to inject uncertainty into financial markets. For Solana, holding above the $120–$125 support zone will be key in determining whether the recent bounce has staying power—or if further consolidation is in store.

Related Reading

Price Holds Above Key Moving Averages: Crucial Resistance Awaits

Solana (SOL) is trading at $131 after finally breaking above the 4-hour 200 Moving Average (MA) and Exponential Moving Average (EMA), which sat around $125 and $128, respectively. This move signals a potential short-term trend shift in favor of the bulls, who are now holding some advantage after reclaiming these critical technical levels. The breakout came on strong volume, reinforcing the bullish momentum that emerged from last week’s bounce off the $95 low.

However, for the rally to continue and higher highs to form, SOL must maintain its position above the $125 level and push toward the next major resistance around $146. Reclaiming this level would strengthen bullish conviction and confirm a recovery rally in the broader trend.

Related Reading

Despite the recent strength, risks remain. If Solana fails to hold above $125, the bullish setup could unravel quickly, and the price may revisit the $100 demand zone. With global market volatility still elevated due to ongoing macroeconomic tensions, traders are watching this support-resistance range closely to determine whether SOL can sustain upward momentum or return to consolidation.

Featured image from Dall-E, chart from TradingView

Source link

SOL

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

Published

3 days agoon

April 10, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana has staged an impressive comeback, rallying over 25% from its recent low of $95 earlier this week. The sharp move followed a major shift in macroeconomic sentiment after US President Donald Trump announced a 90-day pause on reciprocal tariffs for all countries except China, which was hit with a 125% tariff. The temporary relief sparked a renewed wave of optimism in financial markets, helping risk-on assets like Solana regain strength after weeks of heavy selling pressure.

Related Reading

Top analyst Bluntz weighed in on the rally, sharing on X that the recent bounce could be more than just a short-term reaction. He noted that Solana’s latest downtrend lasted nearly three months—a duration he believes could mirror the length of the current recovery phase. If his analysis plays out, SOL may be entering a sustained period of upward momentum.

Despite broader market uncertainty and continued global tensions, Solana’s sharp rebound is offering bulls some relief and potentially setting the stage for a longer-term rally. Traders are now closely watching key resistance levels and overall market sentiment to determine whether this bounce will evolve into a lasting trend shift.

Solana Eyes Recovery After Deep Correction

Solana has finally seen a burst of buying activity after enduring nearly three months of relentless selling pressure. Since reaching its all-time high in January, SOL has lost more than 60% of its value, with bulls losing momentum the moment prices slipped below the $180 level. The correction was deep, sharp, and reflective of broader weakness in crypto and traditional markets as macroeconomic tensions escalated.

President Trump’s continued push for tariffs has added significant stress to global markets, dampening risk appetite and weighing heavily on altcoins like Solana. The environment has been far from friendly for speculative assets, but the recent bounce suggests that sentiment may be shifting.

Bluntz’s insights on X note that Solana’s previous downward leg lasted nearly three months—a timeline he believes the current recovery could mirror. According to his analysis, this bounce could impact prices by as much as 75% in the near term, with a potential target around the $200 level. While it’s too early to confirm a full trend reversal, this optimistic outlook offers some hope to investors holding through the drawdown.

For now, Solana must reclaim key resistance levels and sustain momentum above $120 to validate a broader recovery phase. The next few weeks will be critical as volatility continues to dominate and global tensions remain.

Related Reading

Bulls Must Hold $110 And Reclaim $130 to Confirm Recovery

Solana is currently trading at $114 after briefly dropping below the critical $100 support level earlier this week. The recent bounce has given bulls a fighting chance, but price action remains fragile. For Solana to confirm a recovery rally, bulls need to reclaim the 4-hour 200-day Moving Average (MA) and Exponential Moving Average (EMA), both of which sit around the $130 level.

Holding above the $110 support zone is key. If SOL manages to maintain strength at current levels and successfully pushes above $130, it could open the door for a massive upside move. A breakout above the 4-hour MAs would likely trigger fresh momentum and renewed buying pressure, potentially sending Solana back into the $150–$180 range.

Related Reading

However, the bullish outlook hinges entirely on reclaiming these technical levels. Failing to do so could lead to renewed consolidation in the $100–$115 range or even spark another sell-off. If Solana falls back below $110 and retests the $100 mark, it could invite further downside and shake investor confidence again. The coming days will be pivotal as bulls try to shift momentum and stabilize the recent recovery.

Featured image from Dall-E, chart from TradingView

Source link

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Bitcoin price tags $86K as Trump tariff relief boosts breakout odds

Where Top VCs Think Crypto x AI Is Headed Next

India’s Leading Bitcoin And Crypto Exchange Unocoin Integrates Lightning

Solana Triggers Long Thesis After Pushing Above $125 – Start Of A Bigger Rally?

Popcat price surges as exchange reserves fall, profit leaders hold

Crypto Analyst Says Bitcoin Back in Business, Calls for BTC Uptrend if One Support Level Holds

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x