Fees

Solana recorded the highest daily active addresses ever

Published

3 months agoon

By

admin

Solana’s blockchain has surpassed previous records for daily network users.

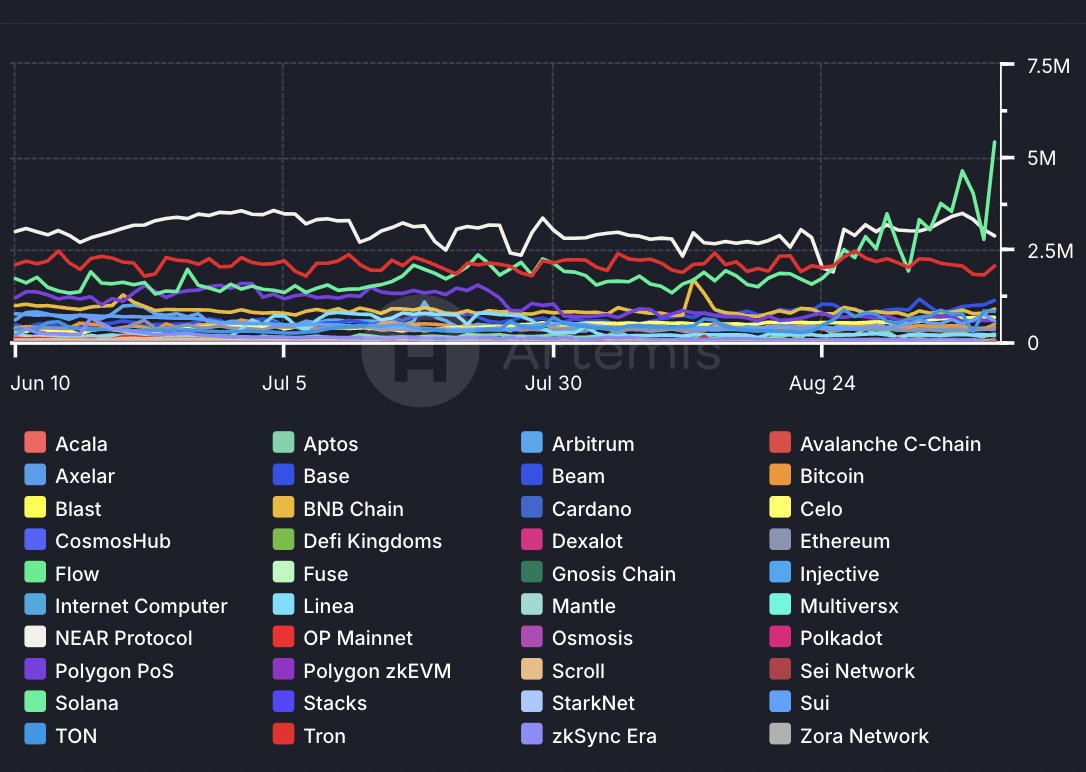

According to Artemis.XYZ data, Solana (SOL) recorded the highest number of daily active addresses in blockchain history, despite the fifth-largest cryptocurrency revisiting its lows from April and January. As of this writing, a single SOL coin was worth around $136.

Artemis noted that SOL’s 24-hour users exceeded the five million mark on Sept. 10, while the chain’s closest competitor hovered just above 2.5 million daily active wallets on the same day.

Solana’s activity surges, but memecoin sector slips

Solana’s active address milestone occurred despite decreased activity in its memecoin sector. Specifically, Pump.fun has generated fewer fees since its peak in late July.

Last week, data confirmed an 80% decline in revenue generated by the memecoin launchpad. General SOL fees and prices have also slumped since July, highlighting a correlation between SOL revenue and Pump.fun activity.

Is the Pump.fun casino crashing?

Although broader crypto prices remain in limbo, Pump.fun’s regression may signal a declining pattern for Solana memecoins. The protocol was the fastest decentralized finance platform to reach $100 million in revenue, achieving this milestone in roughly seven months. However, its peak may have passed, as many debate whether the platform was a net positive for cryptocurrency and DeFi.

At its height, Pump.fun allowed developers to launch over 500,000 tokens in a single month. Memecoins flooded SOL-based exchanges like Raydium, turning speculative investors into overnight millionaires or sometimes obliterating 99% of capital in seconds.

SOL’s chain became the memecoin hotbed, and creators like Vitalik Buterin expressed concerns about the trend. The chief worries stemmed from Pump.fun’s sustainability and the Casino-like ethos it promoted.

Nevertheless, Pump.fun remains active, continuing to produce scores of memecoins daily. A crypto.news analysis found that the oversaturation of meme tokens correlated with weak average gains. Less than 1% of memecoin traders earned over $1,000 from the speculative plays.

Source link

You may like

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

DeFi

Babylon Bitcoin staking drives BTC fees above $130

Published

4 months agoon

August 22, 2024By

admin

A Bitcoin fee bidding war erupted on Aug. 22 as Babylon debuted phase one of its native BTC staking offering.

Early on Thursday, Aug. 22, the average Bitcoin (BTC) transaction fee was under $1. Closer to noon, users had to pay around $132-$137 to transfer BTC after Babylon’s Bitcoin staking program went live.

Babylon’s BTC staking allows users to earn yield by depositing crypto directly on proof-of-stake (PoS) networks. The idea aims to expand BTC utility beyond the “digital gold” narrative, which typically incentivizes holding the asset rather than using it in more active financial strategies.

Phase one of Babylon’s staking system was a “locking-only phase,” where users quickly filled the maximum allocation within hours.

In BTC’s case, as a proof-of-work (PoW) blockchain, miners validate transactions in exchange for fees. Higher fees can encourage miners to prioritize certain transactions.

The rush to participate in Babylon’s staking platform triggered an on-chain scramble among users, driving competition for miner priority and propelling BTC fees near $140, as confirmed by CryptoQuant analyst J.A. Maartun.

Over 1,000 BTC, worth nearly $61 million, was prepared for phase two after the race to stake assets. More than 12,700 stakers and 20,610 solo delegates queued up to earn rewards by securing PoS chains with BTC.

Rising Bitcoin adoption and utility

Staking in decentralized finance (DeFi) is common among PoS chains, allowing crypto holders to generate passive income from their assets. While this practice is native to PoS networks, developers have been exploring ways to extend it to Bitcoin’s ecosystem.

The move effectively broadens BTC’s role in DeFi, at a time when institutional interest in crypto is growing. Wall Street giants like BlackRock and Fidelity were approved to launch spot BTC ETFs in January, and funds from traditional finance and crypto-native wealth managers have since accumulated over $50 billion in assets.

U.S. presidential candidates have mentioned creating a national BTC reserve and institutional ownership continued on the uptrend at press time.

Source link

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential