SOL price analysis

Solana (SOL) Consolidates in Symmetrical Triangle – Analyst Reveals $160 Target On Breakout

Published

2 months agoon

By

admin

Solana (SOL) is now trading at a critical juncture following last week’s market surge. The token has climbed over 20% from its recent local lows, now testing a crucial supply level around $150.

Related Reading

This resistance zone has drawn the attention of analysts and investors, with many believing Solana is on the verge of a rally to higher price levels. Among those who are bullish on SOL is prominent analyst Carl Runefelt, who recently shared a detailed analysis, predicting that Solana could reach new highs within days if the current momentum continues.

As the broader market continues to gain strength, investors are eagerly awaiting Solana’s next move. A successful breakout above $150 could signal a confirmed uptrend, paving the way for a potential rally. However, the coming days will be pivotal for SOL as it approaches this key level, with the market closely watching whether it will reclaim higher ground or face renewed resistance.

Solana Bullish Pattern About To Break

Solana (SOL) is currently testing crucial supply levels that could pave the way for a significant rally to higher prices. After days of consolidation, the altcoin looks ready to break out and confirm a daily uptrend.

Many analysts and investors are closely watching for the next move. This potential shift comes as the entire crypto market has turned from fear to optimism, spurred by the Federal Reserve’s recent decision to cut interest rates, which has breathed new life into the market.

Analyst Carl Runefelt, one of the prominent voices in the crypto space, has shared his technical analysis on X, revealing that Solana has formed a symmetrical pattern. According to Runefelt, if SOL breaks out of this pattern, it could trigger a substantial upward move, with price targets around $160.

The symmetrical triangle, a key technical formation, typically signals a strong price movement after a prolonged period of consolidation.

Related Reading: Crypto Analyst Predicts Dogecoin Will Surge 1,000% Past ATH – Price Targets Revealed

As Solana hovers near this critical level, the market eagerly awaits confirmation of a breakout. Investors expect a move above $150, confirming the uptrend and likely leading to higher price levels in the coming weeks. For now, all eyes remain on Solana’s ability to break through this resistance and potentially rally to new heights.

SOL Technical Analysis: Price Levels To Watch

Solana (SOL) is currently trading at $150 after testing the daily 200 moving average (MA) at $154 as resistance. This key technical level has kept the price in check, and SOL is now entering a consolidation phase. Investors are optimistic, and rising demand could soon trigger a breakout from this consolidation.

To keep momentum, SOL must reclaim the 1D 200 MA and target new highs beyond $164. This price has worked as a crucial resistance; if broken, it would confirm the continuation of a daily uptrend. A successful breakout at this level could push SOL toward even higher prices, potentially setting the stage for a run to challenge its all-time highs.

Related Reading

However, failure to break above the daily 200 MA could signal a shift in sentiment. In this case, SOL could retrace to key support levels, with potential targets around $140 or even lower. This would indicate a short-term correction before another attempt at reclaiming higher price levels. Investors are closely watching SOL’s next moves to determine the coin’s near-term direction.

Featured image from Dall-E, chart from TradingView

Source link

You may like

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

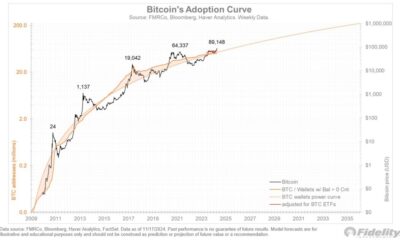

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Bonk (BONK)

3 Solana Coins To Turn Portfolio of $100K to $1M By December 2024

Published

1 month agoon

October 17, 2024By

admin

The cryptocurrency world is buzzing with high hopes as certain Solana coins show great potential for massive gains. Investors aiming for substantial returns see opportunities to grow a $100,000 investment into $1 million by December 2024.

The crypto market trades sideways as Solana’s price remains firm, hovering around $152. Bitcoin is steady above $67,000, while Ethereum trades near $2,600.

3 Solana Coins Poised to Turn $100K Into $1M

Bonk (BONK)

Bonk (BONK), a Solana-based meme coin, has attracted attention by distributing half of its tokens to Solana users. Over the past year, BONK’s price surged 11,857%, sparking predictions that it could turn a $100,000 investment into $1 million by December 2024.

Currently, the value of BONK is at $0.00002291, with a slight 3% dip, but it still shows a 40% increase over the past month, indicating potential for further growth.

Crypto analyst has highlighted a potential breakout for Bonk, predicting a surge of 180% soon. According to the chart shared by the analyst, BONK is forming a bullish pattern, indicating a strong upward trend.

Dogwifhat (WIF)

Dogwifhat (WIF), a meme coin in the Solana ecosystem, has gained attention for its impressive growth. Since its launch, WIF has skyrocketed over 1,429%, positioning itself as a potential game-changer.

This rapid surge suggests a $100,000 investment could turn into $1 million by December 2024. Despite a minor 0.16% drop, WIF’s current price is $2.58, showcasing its growing influence and popularity within the crypto community.

According to the santiment data, the percentage of stablecoin supply held by whales, with more than $5 million, has seen a notable increase. As these large holders gain more control over the supply, analysts closely monitor the potential effects on liquidity and volatility. This trend could be crucial in shaping the next phase of market growth and price behavior.

Popcat (POPCAT)

Popcat (POPCAT), a cryptocurrency on the SOL blockchain, has experienced a remarkable surge, rising by 7935% recently. This increase has positioned POPCAT as a strong contender for significant portfolio gains, with a $100,000 investment potentially reaching $1 million by December 2024.

The current price of the Cat themed-based coin is $1.34, reflecting its ongoing bullish trend. If POPCAT surpasses its current resistance levels, it may soon climb to $2. The cryptocurrency’s upward trend mirrors broader market movements, indicating a strong potential for continued growth.

With the current market trends, three Solana coins could turn a $100,000 portfolio into $1 million by the end of 2024. While the market remains volatile, the potential upside in Solana-based projects makes them attractive for investors looking to maximize returns in the next year.

Frequently Asked Questions (FAQs)

Bonk (BONK), Dogwifhat (WIF), and Popcat (POPCAT) show strong growth potential.

These coins could potentially turn $100K into $1M by 2024.

Market sentiment, broader crypto trends, and Solana ecosystem developments impact prices.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Price analysis

Solana Price Rebound Aims for 25% Surge as TVL Heads Toward $6 Billion

Published

2 months agoon

October 12, 2024By

admin

In Friday’s US trading session, the crypto market rebounded with renewed buying strength as the Bitcoin price spiked 4.34%. After a week-long consolidation, the bullish momentum uplifted most major altcoins, including SOL, to kick-start a sustainable recovery. The Solana price is up 5% today, indicating potential for further recovery as the Total Value Locked (TVL) continues to rise.

Solana Price Gears Up for 25% Rally as TVL Edges Toward $6 Billion

Following the initial market sell-off triggered by geopolitical tension in the Middle East, the Solana price plunged $136.2 in early October. The coin price managed to stabilize with short consolidation and developed a bullish reversal double-bottom pattern.

The SOL price has been up 7.8% in the last 48 hours to trade at $145, while the market cap boosted to $68.28 billion. The recent price jump also reclaimed the crucial daily EMAs (50, 100, and 200), positioning SOL price for further rally. With sustained buying, the Solana price could rise 25% to hit $180, challenging the triangle resistance for the pennant pattern.

Theoretically, the pattern shows a long pole defining the primary trend, followed by a counter-trend move led by two converging terminals. The short pullback is meant to recuperate exhausted bullish momentum and offer a strong breakout for the next big move.

Thus, a potential break-out from the overhead trend line will accelerate the bullish momentum and trigger the Solana price prediction rally to $209, followed by $275.

SOL TVL Surges to $5.7 Billion with User Activity at 3.44M

According to theBlock data, Solana’s active addresses have swiftly rebounded to 3.44 million, highlighting a surge in user activity and engagement on its network. This increase in active addresses signals growing confidence and participation in Solana’s ecosystem, which is a positive indicator of network health.

In addition, Solana’s Total Value Locked (TVL) has displayed a steady upward trend since March 2024. According to DeFiLlama data, the SOL TVL has surged by $5.7 Billion. Reflecting increased investor confidence and engagement in decentralized finance (DeFi) projects within its ecosystem.

On the contrary, if the Solana price breaks below the pennant’s lower trendline, the bearish momentum will accelerate, extending the correction trend to $100, followed by $80.

Frequently Asked Questions (FAQs)

Solana’s price is up 5% today, and this momentum is expected to continue toward a 25% surge, driven by rising Total Value Locked (TVL) in its decentralized finance (DeFi) ecosystem

Solana’s price formed a bullish double-bottom pattern after a stabilization period following an initial sell-off

If Solana’s price drops below the pennant’s lower trendline, bearish momentum could accelerate, extending the correction

Sahil Mahadik

Sahil is a dedicated full-time trader with over three years of experience in the financial markets. Armed with a strong grasp of technical analysis, he keeps a vigilant eye on the daily price movements of top assets and indices. Drawn by his fascination with financial instruments, Sahil enthusiastically embraced the emerging realm of cryptocurrency, where he continues to explore opportunities driven by his passion for trading

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Why Is Solana Price Down Today?

Published

3 months agoon

September 5, 2024By

admin

Since yesterday, the crypto market has officially entered the fear zone, hinting at the investor’s hesitation in placing trade. The result of these hesitations is the cryptos struggling in the market, especially altcoins like Solana, Ethereum, XRP, and many others. Out of these, Solana, which ruled the market thanks to heavy demand for Solana tokens, is struggling. It is because the Solana price dropped below $130 earlier in the day, concerning the holders for its further drop amid its ongoing week-long downtrend.

Solana has lost more than 8% of its value in the last week, currently at $133.28 after a minor recovery. However, with the high selling pressure, the downtrend may continue if the SOL price fails to surge above the pivot at 139.42.

Three Reasons Why Solana Price Is Struggling

Solana’s was booming at the beginning of the year, as its price surged to a high of $202.87. However, with the bulls losing their grip on the market, most of the altcoins began to struggle, especially as the market entered the fear zone yesterday, continuing even today.

Regardless, the biggest reason for Solana’s price is the Pump.fun selling nearly 50% of its accumulated assets. With this, the Solana-based meme coin deployer, Pump.fun has dumped 274,373 SOL ($42.64M) in recent Lookonchain reports.

Since its launch in January, the platform boomed in terms of popularity and token launch. It has hit the 680K $SOL($91M) mark in revenues and has accumulated more than 0.1% of Solana’s current supply. But at the same time, it sold its first share of 254,074 $SOL($40.26M) at an average price of $158.

The https://t.co/DrKlYnPPqY Fee Account sold 10,300 $SOL($1.38M) at $134.46 again 40 mins ago!https://t.co/DrKlYnPPqY has sold 264,373 $SOL($41.64M) at an average price of $157.5.https://t.co/dZDKPfB4vU pic.twitter.com/mRLYK100zl

— Lookonchain (@lookonchain) September 3, 2024

The second selling was on September 3, which dumped 10,300 $SOL($1.38M) at $134.46, resulting in an instant SOL price drop. A few have called it locking in the profits, whereas many called it offering the token at a low before the price boost.

However, this was not the end of the Solana’s struggles. Earlier DefiLlama reports revealed that Solana’s daily revenue also hit a six-month low on Monday due to the rise of the pump.fun competitors like Ethervista and SunPump. As per reports, the Solana revenue was only $190.7K on September 1, a 90% decline from March’s peak at $2.47 million.

The impact of this declining revenue and competition has also dropped the Solana price, especially with the launch of SunPump, which has already beaten Pump.fun in terms of popularity. The impact of this popularity is also its native token as analysts believe SUN Price Could Explode 300% in future.

Final Thoughts

Despite the 4% recovery in the Solana price, the token is struggling on the weekly charts, including its drop to $123K on August 4. This drop came after the Solana meme coins deployer, Pump.fun sold almost 50% of its accumulated SOL assets at an average price of $157.5. Moreover, with rising competition like Ethervista and SunPump, the altcoin’s suffering has increased.

Pooja Khardia

With years of love for reading and 5 years of content writing experience, I’m here, working on my favorite writings about cryptocurrency. I’m actively looking for trending topics and informational statistics to curate the best content pieces for crypto enthusiasts. Staying updated with trends and learning the basis and advancements of this field is the best part of the day.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

The transformative potential of Bitcoin in the job market

Ripple CLO Stuart Alderoty Challenges US SEC

Changpeng Zhao critiques meme coins, suggests projects should focus on utility

Expert Warns Of Upcoming 25% Drop, Timing And Trends Explained

Is Marathon Digital (MARA) a Better Bet Than MicroStrategy (MSTR) Stock Now?

Cardano eyes spot ETF entry as analyst foresees surge, Rollblock set to explode next

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: