SOL

Solana Struggles To Break $160 Resistance As Top Analyst Predicts A Coming Surge

Published

2 months agoon

By

admin

Solana (SOL) has been experiencing significant volatility and choppy price action since Monday, testing a crucial supply level that will determine its direction in the coming weeks. As the market continues to push higher, most analysts and investors are anticipating a potential surge for SOL, especially with the $160 resistance level appearing to weaken under recent upward pressure.

The crypto community is closely watching these developments, as breaking through this key resistance could lead to substantial gains for the altcoin.

Related Reading

Top analyst and investor Carl Runefelt recently shared a technical analysis that paints an optimistic picture for Solana’s price action in the next few hours. According to Runefelt, the weakening resistance could pave the way for a breakout, with bullish momentum carrying SOL to higher targets.

While the market remains volatile, confidence in Solana’s ability to overcome current challenges is growing. If the supply level is breached, it could mark the start of a new upward trend, making SOL a focal point for traders looking for opportunities in the current market landscape.

The next few days will be critical in shaping Solana’s trajectory, as investors will closely monitor whether the price will confirm the anticipated rally.

Solana Bullish Pattern Signals Momentum

The entire crypto market is experiencing heightened volatility, and Solana has not been immune to it, with its price fluctuating between $148 and $160 since Monday. This consolidation phase has left traders eager to see which direction the altcoin will take in the coming days.

Runefelt recently shared a technical analysis on X, highlighting that Solana is breaking out of a 1-hour Falling Wedge pattern, a bullish signal.

The immediate upside target is $159.6, a level that, if broken and sustained, could lead to a massive surge toward $185—a significant move that would position Solana near its yearly highs.

Despite this bullish setup, the market remains cautious, and there is still the risk that Solana could fail to reclaim key levels. If the price struggles to break and hold above the $159.6 resistance, the current consolidation could persist or even lead to a potential pullback, with downside targets near $148. Such a scenario would disappoint bulls looking for a rally and could dampen market sentiment temporarily.

Related Reading

A confirmed breakout and sustained momentum could signal the beginning of a new bullish phase, attracting both retail and institutional investors.

However, the risk of a failed breakout looms, keeping market participants on edge. Traders are watching closely as Solana’s next move will likely set the tone for its performance over the next few weeks. If it breaks through resistance, SOL could be well on its way to challenging yearly highs.

Technical Levels To Watch

Solana is currently trading at $154 after finding support at the 200-day moving average (MA) at $150.7, a critical level that signals long-term strength if it holds as a demand zone. This MA has historically acted as a key indicator for market trends, and holding above it would reinforce the bullish outlook for SOL.

For bulls to maintain momentum, the price must stay above the 200-day MA and push to break the crucial $160 resistance, a level that has capped Solana’s upward movement since early August. Breaking through this resistance would signal a potential surge in price, opening the door to further gains in the coming weeks.

However, if SOL fails to hold above the 200-day MA and cannot overcome the $160 resistance, it risks a corrective move. A drop below the 1D 200 MA could lead to a decline toward $140, a level that will play a pivotal role in determining the next phase of Solana’s price action.

Related Reading

Bulls and bears alike are closely watching these key levels, as the next move could set the tone for Solana’s performance in the near term.

Featured image from Dall-E, chart from TradingView

Source link

You may like

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Altcoins

Trader Predicts ‘God Candle’ Breakout for Ethereum, Says New All-Time High Loading for One Memecoin

Published

4 days agoon

December 19, 2024By

admin

A popular crypto analyst thinks that Ethereum (ETH) is on the verge of printing a massive breakout rally also known as a god candle.

Pseudonymous analyst Inmortal tells his 221,100 followers on the social media platform X that Ethereum’s two-hour chart looks similar to Bitcoin’s (BTC) price action over the last two weeks.

The analyst says that while Ethereum struggles to clear resistance at $4,000, he notes that BTC also had trouble breaching $100,000 for weeks before surging to new all-time highs.

“Same price action, but with one difference.

God candle after the breakout.

ETH.”

Based on the trader’s chart, he seems to predict that ETH will surge close to its all-time high of $4,800 after the breakout. At time of writing, ETH is worth $3,892.

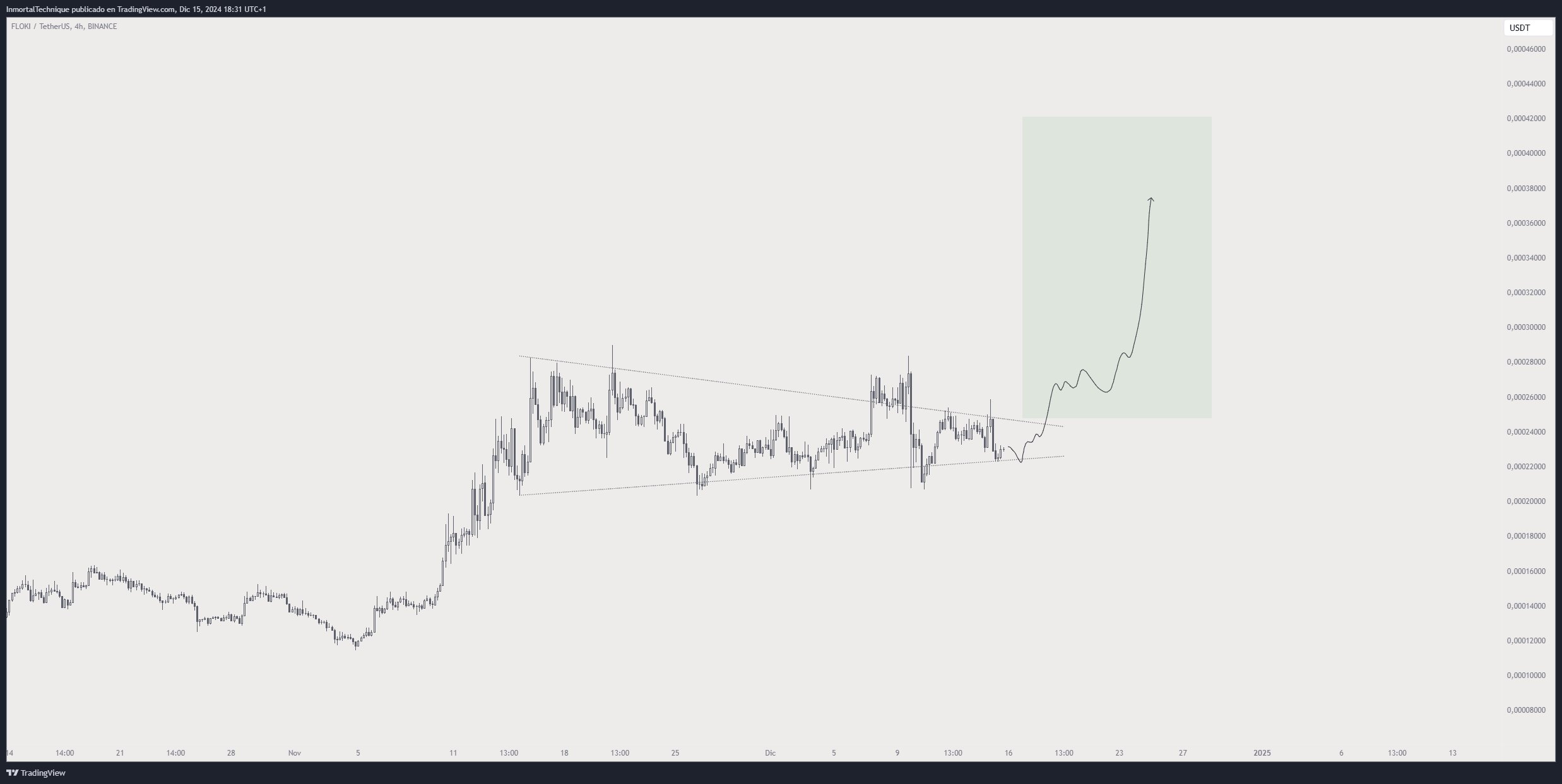

The trader also has his radar locked on the memecoin Floki (FLOKI). According to the trader, FLOKI appears to be trading in a symmetrical triangle pattern and is gearing up to shatter the structure’s diagonal resistance en route to new record highs.

“Second leg up – loading.

New ATH – loading.

Price discovery – loading.

FLOKI.”

Based on the trader’s chart, he seems to predict that FLOKI will explode to a new all-time high of $0.00038. At time of writing, FLOKI is worth $0.000219.

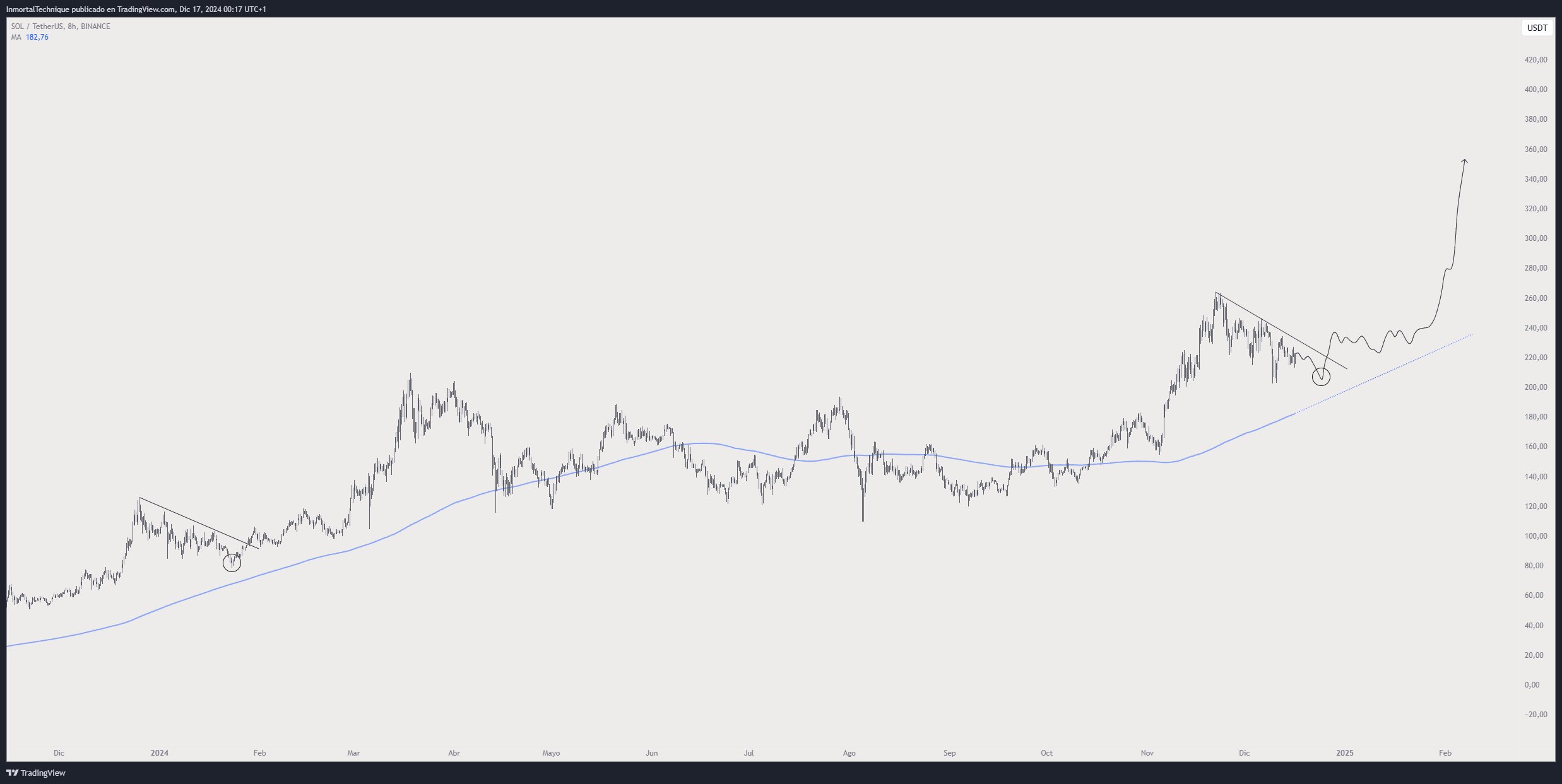

Looking at Solana (SOL), the trader sees the Ethereum rival bursting above its diagonal resistance to rally toward $300.

“Something like this.

SOL.”

At time of writing, SOL is worth $222.60.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoin Sherpa

Trader Says Altcoin That’s Up over 8x in Under Three Months to Outperform Market, Updates Outlook on Solana

Published

6 days agoon

December 17, 2024By

admin

A widely followed crypto analyst says that Ethena (ENA), a synthetic dollar protocol built on Ethereum (ETH), looks primed to continue its red-hot streak.

The pseudonymous analyst known as Altcoin Sherpa tells his 234,500 followers on the social media platform X that ENA is worth investing into when it dips in price as it will outpace most of the market.

“I think that this just continues going higher. My average is still pretty high like $0.92 or something but this one still just outperforms most of the market [in my opinion]. Buy any dips that you can.”

ENA, the 56th-ranked crypto asset by market cap, is up more than 8x in the past three months and is trading at $1.18 at time of writing. It’s also up more than 1% in the past day.

Altcoin Sherpa appears less bullish on the smart contract platform Solana (SOL) over the medium term, especially compared to other top crypto assets, noting that he believes it will be outperformed by the top two digital assets by market cap.

“I think SOL underperforms both ETH and Bitcoin in the coming months. I don’t know what happens long term and I still believe it’s the best casino on earth. But I also have to be rational with it.”

SOL is trading at $217.74 at time of writing. The 6th-ranked crypto asset by market cap is down more than 1% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

SOL

Solana (SOL) Faces Headwinds: Can Bulls Revive Momentum?

Published

1 week agoon

December 16, 2024By

admin

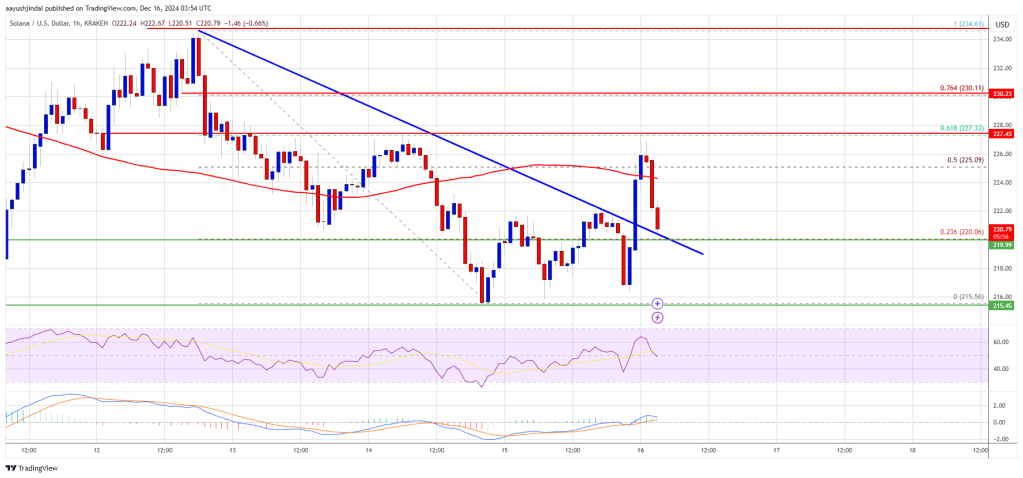

Solana remained stable above the $215 level. SOL price is now recovering losses and facing hurdles near the $228 and $332 levels.

- SOL price started a fresh increase after it tested the $215 zone against the US Dollar.

- The price is now trading below $225 and the 100-hourly simple moving average.

- There was a break above a connecting bearish trend line with resistance at $222 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if the bulls clear the $228 zone.

Solana Price Eyes Upside Break

Solana price formed a support base and started a fresh increase from the $215 level but lagged momentum like Bitcoin and Ethereum. There was a decent increase above the $218 and $220 resistance levels.

There was a break above a connecting bearish trend line with resistance at $222 on the hourly chart of the SOL/USD pair. The pair climbed above $225 and tested the 50% Fib retracement level of the downward move from the $234 swing high to the $215 low.

However, the price is now facing many hurdles near $225. Solana is now trading below $225 and the 100-hourly simple moving average. On the upside, the price is facing resistance near the $225 level.

The next major resistance is near the $228 level or the 61.8% Fib retracement level of the downward move from the $234 swing high to the $215 low. The main resistance could be $230. A successful close above the $230 resistance level could set the pace for another steady increase. The next key resistance is $235. Any more gains might send the price toward the $250 level.

Another Decline in SOL?

If SOL fails to rise above the $228 resistance, it could start another decline. Initial support on the downside is near the $220 level. The first major support is near the $215 level.

A break below the $215 level might send the price toward the $205 zone. If there is a close below the $205 support, the price could decline toward the $200 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is losing pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $220 and $215.

Major Resistance Levels – $228 and $230.

Source link

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential