News

Succinct and OP Labs team up on ZK rollups

Published

3 months agoon

By

admin

Succinct Labs and OP Labs have collaborated on a zero-knowledge proofs solution that significantly improves transaction finality and gas costs compared to optimistic rollups.

On Sept. 11, Succinct Labs announced its partnership with OP Labs, a startup contributing to the development of the Optimism (OP) protocol, to create OP Succinct.

OP Succinct by Succinct Labs and OP Labs

Paradigm-backed Succinct and OP Labs’ collaboration on OP Succinct combines the general-purpose zero-knowledge virtual machine SP1 with OP Stack to deliver a zkEVM rollup.

With this new solution, upgrading OP Stack chains to utilize zero-knowledge proofs is now cheaper and faster. According to Succinct Labs, OP Succinct is also highly customizable.

“The modular design of the OP Stack makes it easy to convert an OP Stack rollup to a ZK rollup. OP Succinct’s two-step integration requires minimal code and easily fits into existing deployments–including rollup-as-a-service setups,” Succinct Labs posted on X.

Fast finality and lower gas costs

The ZK rollup development adds to the growing layer 2 scaling solutions ecosystem, with off-chain transaction proofing offering fast finality and reduced gas costs.

OP Labs and Succinct Labs, which secured $55 million in Paradigm-led funding rounds in March 2024, are bringing this to the market with OP Succinct.

Being able to upgrade an OP Stack to use ZKPs within an hour vastly improves the fraud-proof window of seven days applicable to standard optimistic rollups. Proving costs are also at 0.5 to 1 cent, compared to higher costs of 1.34 cents on OP Mainnet and 1.11 cents on OP Sepolia.

Source link

You may like

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Bitcoin

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Published

5 hours agoon

December 23, 2024By

admin

Tokyo-listed Metaplanet has purchased another 9.5 billion yen ($60.6 million) worth of Bitcoin, pushing its holdings to 1,761.98 BTC.

Metaplanet, a publicly traded Japanese company, has acquired 619.7 Bitcoin as part of its crypto treasury strategy, paying an average of 15,330,073 yen per (BTC), with a total investment of 9.5 billion yen.

According to the company’s latest financial disclosure, Metaplanet’s total Bitcoin holdings now stand at 1,761.98 BTC, with an average purchase price of 11,846,002 yen (~$75,628) per Bitcoin. The company has spent 20.872 billion yen in total on Bitcoin acquisitions, the document reads.

The latest purchase is the largest so far for the Tokyo-headquartered company and comes just days after Metaplanet issued its 5th Series of Ordinary Bonds via private placement with EVO FUND, raising 5 billion yen (approximately $32 million).

The proceeds from this issuance, as disclosed earlier, were allocated specifically for purchasing Bitcoin. These bonds, set to mature in June 2025, carry no interest and allow for early redemption under specific conditions.

Metaplanet buys dip

The company also shared updates on its BTC Yield, a metric used to measure the growth of Bitcoin holdings relative to fully diluted shares. From Oct. 1 to Dec. 23, Metaplanet’s BTC Yield surged to 309.82%, up from 41.7% in the previous quarter.

Bitcoin itself has seen strong performance this year, climbing 120% and outperforming assets like the Nasdaq 100 and S&P 500 indices. However, it has recently pulled back from its all-time high of $108,427, trading at $97,000 after the Federal Reserve indicated only two interest rate cuts in 2025.

Despite the retreat, on-chain metrics indicate that Bitcoin is still undervalued based on its Market Value to Realized Value (MVRV-Z) score, which stands at 2.84 — below the threshold of 3.7 that historically signals an asset is overvalued.

Source link

Altcoin Season

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Published

8 hours agoon

December 23, 2024By

admin

The creators of the crypto analytics firm Glassnode are warning that altcoins could lose all bullish momentum following last week’s market correction.

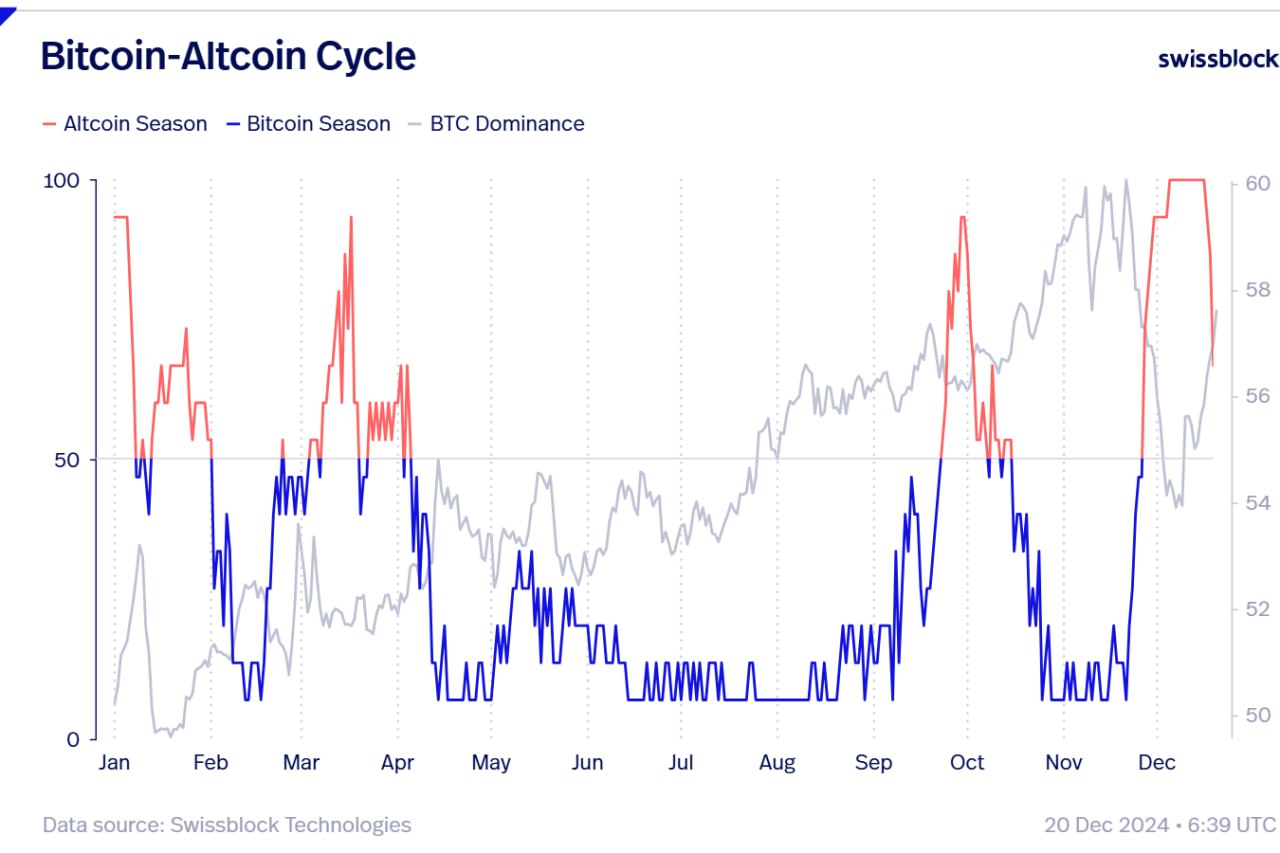

Jan Happel and Yann Allemann, who go by the handle Negentropic on the social media platform X, tell their 63,400 followers that “altcoin season,” which they say began in late November, could come to an abrupt end after alts witnessed deep pullbacks over the last seven days.

According to the Glassnode co-founders, traders and investors will likely have a risk-off approach on altcoins unless Bitcoin recovers a key psychological price point.

“Is This the End of Altcoin Season?

Bitcoin dominance is surging after dipping below $100,000, while altcoins are losing critical supports. Dominance has risen and resumed its upward trend, signaling a stronger BTC environment.

If BTC stabilizes above $100,00, we might see a pump in altcoins now in accumulation zones. Until then, Bitcoin appears poised to lead, leaving altcoins lagging behind.”

The Bitcoin Dominance (BTC.D) chart tracks how much of the total crypto market cap belongs to BTC. In the current state of the market, a surging BTC.D suggests that altcoins are losing value faster than Bitcoin.

At time of writing, BTC.D is hovering at 59%.

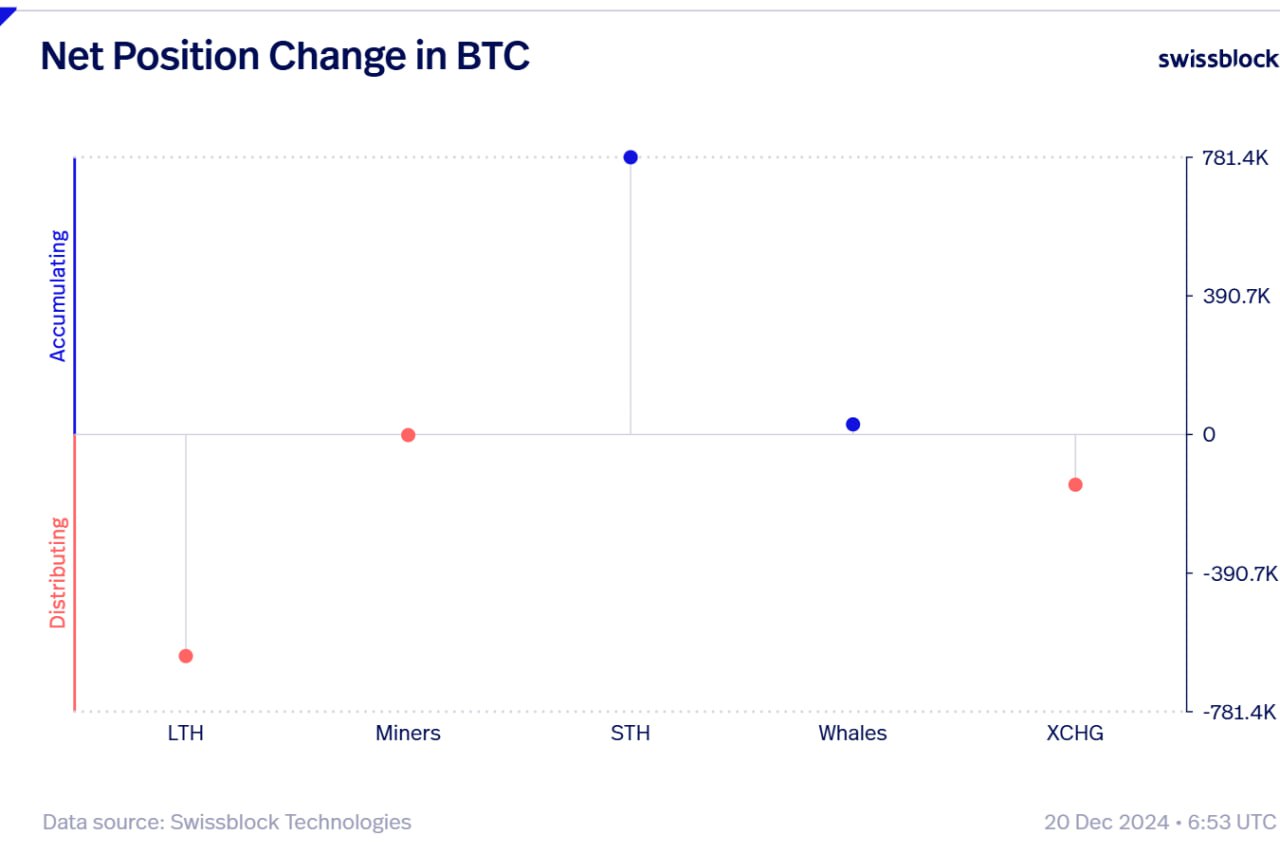

Looking at Bitcoin itself, the Glassnode executives say long-term Bitcoin holders are massively unloading their holdings as other investor cohorts pick up the slack.

“The Board Keeps Shifting.

As BTC continues flowing out of exchanges during this dip, long-term holders are exiting forcefully, while short-term holders step in without hesitation.

Whales quietly accumulate, miners remain neutral, and selling pressure has merely reshuffled the board.

New hands are absorbing the sales.”

At time of writing, Bitcoin is worth $97,246.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

News

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Published

14 hours agoon

December 22, 2024By

admin

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Cardano’s Hydra boosts ADA past $1, positioning it as a scalable dApp hub and a potential challenger to Ethereum’s dominance.

Cardano‘s Hydra is the latest scaling solution in Cardano’s ecosystem, and it has seen ADA’s price surge past $1. While ADA’s current rate represents a 65% dip from its peak, ADA holders are 90% bullish.

Compared to Ethereum’s price, ADA is much cheaper, and the developments taking place in its ecosystem could potentially threaten Ethereum’s dominance. Cardano’s Hydra, for instance, can improve Cardano’s scalability, making it a go-to ecosystem for dApp development.

Given Ethereum’s struggles to scale its network, including its move from a PoW to a PoS protocol, Cardano’s Hydra can soon help developers build speedy dApps with high rates of mass adoption.

Cardano’s Hydra on track to elevate ADA to new heights

ADA’s current price at $0.91 is on a bullish trend that has seen ADA surge over 50% in the last 60 days. After ADA’s price languished around the $0.35 zone for months, whale activity is now rising in Cardano’s ecosystem, which has seen market watchers anticipate an additional uptick to $2 in the short term.

According to reports, an influx of over 680 transactions exceeding $1 million was registered on Cardano’s ADA as confidence in ADA’s bull run grew. Cardano’s founder has also confirmed that ADA is primed for higher highs in 2025, especially with the launch of Cardano’s Hydra.

Cardano’s Hydra is set to give developers a unique scaling tool that makes transactions on Cardano cheaper, faster, and more secure. With Ethereum as Cardano’s biggest competition, Cardano Hydra might trigger a migration of developers to Cardano in the near future.

Ethereum’s price drops to below $3,400 amid scalability concerns

Ethereum‘s price has remained sluggish in responding to the bull market even though its recent uptick past $4,000. After surging to a striking distance of $5,000 in 2021, Ethereum’s price plummeted to lows of $1,000 but has recovered amid critical resistance at the $4,000 mark.

Now, Ethereum’s price has been rejected above the $4,000 mark three times, and market watchers are less optimistic that the leading DeFi ecosystem could surge further to $5,000 – $6,00 during this bull run. Some of the obstacles that have hindered a rally on Ethereum’s price include Ethereum’s bloated network, which has registered skyrocketing network fees at peak congestion.

With the advent of scalability solutions such as Cardano’s ADA, Ethereum’s price could experience further sluggish growth. What’s more, mass adoption by institutions will require a lot more liquidity to move Ethereum’s price.

Discover the future of cross-border payments with Remittix

Ethereum’s potential is fast declining this cycle and investors are looking at alternatives. However, competition from the likes of Cardano’s Hydra is concerning for ETH Holders. However, many ETH holders are switching to a new project leading a new ‘PayFi’ movement. For crypto enthusiasts who want to make swift crypto-to-fiat money payments across the globe, Remittix (RTX) is the latest solution that promises to empower businesses and crypto holders worldwide.

Remittix is fast and reliable with a simple design that allows anyone to send crypto to a recipient’s bank account without the recipient ever knowing that the payment started with crypto. The Remittix Pay API also allows businesses to accept crypto payments with a simple merchant account. Remittix is built on Ethereum, and its RTX token is now in its presale. Analysts are predicting this to become a 100x star in 2025.

To learn more about Remittix, visit the Remittix presale and join the Remittix community.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Source link

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential