Relative Strength Index

SUI Price Stability At $3.5 Signals Room For More Growth, $4 Mark Imminent?

Published

4 months agoon

By

admin

Despite market fluctuations, SUI has demonstrated remarkable stability, holding steady above the critical $3.5 support level. This steady performance reflects underlying bullish momentum, as buyers continue to defend this key zone, boosting confidence in the asset’s upward potential. With strong support intact, SUI appears well-positioned to target higher resistance levels, sparking optimism for further gains.

This analysis aims to explore SUI’s ability to stay above the $3.5 level and assess its implications for future price movements. By examining key technical indicators and resistance zones, this piece seeks to provide insights into whether SUI can sustain its bullish strength or if market pressures could trigger a shift in its trajectory.

What SUI Stability Above $3.5 Means For Bulls

SUI is showcasing renewed bullish strength as it maintains a firm position above the critical $3.5 support level. This stability highlights growing buying interest and market confidence, paving the way for a possible move toward the $4 mark. Its ability to hold above this key level and the 4-hour Simple Moving Average (SMA) reinforces the asset’s upward momentum, and positions SUI for further gains if positive sentiment persists.

An analysis of the 4-hour Relative Strength Index (RSI) analysis shows a rebound from 51%, rising toward and above the 60% level, indicating a renewed optimistic outlook. If the RSI continues to rise above 60%, it would confirm the positive trend, boosting the potential for more price growth.

Additionally, SUI shows significant upward movement on the daily chart, marked by the formation of a bullish candlestick as it moves toward the $4 mark. Trading above the crucial 100-day SMA reinforces the positive trend, indicating sustained strength. As SUI continues to climb, it bolsters market confidence, setting the stage for growth. With upside pressure brewing, the next key target to watch out for is the $4 resistance level, which could determine whether the bullish move extends.

The daily chart’s RSI has increased to 80%, signaling strong positive sentiment with sustained buying pressure. While the asset remains in an overbought territory, it shows no signs of weakening. If the momentum continues, further price gains are possible, though one should be cautious, as prolonged overbought conditions could lead to a correction if buying pressure decreases.

Potential Scenarios: Upside Targets And Risks To Watch

SUI’s current stability above the $3.5 support level indicates potential for continued upside. Should buying pressure persist, the next key target lies at $4, where bullish interest could be triggered, leading to new price highs.

However, if resistance at $4 proves challenging to break through, consolidation or a minor decline may occur, possibly causing the price to retreat toward the $3.5 support level. A break below this level could result in additional losses, with the next key support target being around $2.8, followed by other support areas below.

Source link

You may like

Top 4 Crypto to Buy Now as XRP Price Struggles above $2

US regulators FDIC and CFTC ease crypto restrictions for banks, derivatives

US Authorities Seize $201,400 Worth of USDT Held in Crypto Wallets Allegedly Intended to Support Hamas

Is Bitcoin’s Bull Market Truly Back?

Stablecoin Bills Unfairly Box Out Foreign Issuers Like Tether, Says House Majority Whip

THORChain price prediction | Is THORChain a good investment?

Altcoin

XRP Price Face Major Resistance At $2.9, Why This Analyst Believes $20 Is Still Possible

Published

2 weeks agoon

March 11, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

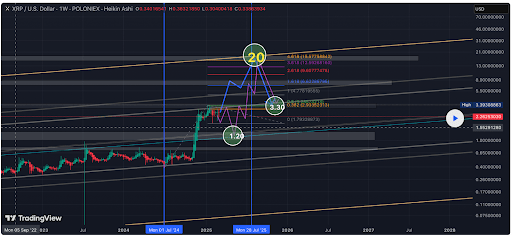

Crypto analyst ElmoX has asserted that the XRP price is still bullish despite the recent crypto market crash. His analysis revealed that XRP is set to face major resistance at $2.9, although he is confident that the crypto will eventually break this resistance and rally to as high as $20.

XRP Price Faces Resistance At $2.9 But Could Still Rally To $20

In a TradingView post, ElmoX outlined two scenarios for the XRP price as it eyes a rally to $20, although he noted that the crypto will retest the major resistance at around $2.92 either way, on its way to a new all-time high (ATH). For the first scenario, the analyst stated that XRP would break this resistance and then skyrocket to $20.

Related Reading

Meanwhile, in the second scenario, ElmoX stated that the XRP price could face another rejection, sending it below the $1.5 level before it witnesses a bullish reversal and rallies to a new ATH. The analyst revealed that he is betting on this second scenario since there is usually a swift crash before an impulsive move to the upside.

ElmoX remarked that the XRP price has barely corrected, which is also why he believes there could still be a massive crash before a rally to a new ATH. Meanwhile, the analyst didn’t provide an exact timing for the potential price correction and subsequent rally to a new ATH and the $20 price target.

Instead, he simply told market participants to be patient. He further warned that the XRP price might sit in price discovery until at least mid-July. His accompanying chart showed that XRP will first drop to as low as $1.20 before it witnesses an impulsive move to as high as $20.

The Altcoin Records A Bullish Close

In an X post, crypto analyst CasiTrades noted that although the XRP price briefly broke below the $2 trendline, the candle closed back above this trendline, reclaiming the consolidation range. She remarked that this is exactly what bulls needed to see. However, the analyst added that a confirmation is needed with XRP holding the range between $2 and $2.03 as support.

Related Reading

CasiTrades stated that a breakdown from consolidation usually leads to further downsides, but the XRP price managed to recover the level quickly, showing that buyers are stepping in. She also noted that the bullish divergence is still holding up to the 1-hour RSI even after the dip with selling pressure weakening, which suggests a shift in momentum is possible.

If the XRP price holds the support between $2 and $2.03, CasiTrades predicts that the crypto could bounce and rally toward $2.25 and $2.70. On the other hand, if XRP loses this level, she stated that the next major support sits at $1.90 which is the 0.5 Fibonacci retracement level. Meanwhile, there is also the possibility that XRP could drop to the 0.618 Fib retracement level at $1.54.

At the time of writing, the XRP price is trading at around $2.10, down over 4% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Adobe Stock, chart from Tradingview.com

Source link

Litecoin

Will Litecoin Bounce Back? $113 Becomes Key After Recent Rejection

Published

1 month agoon

February 12, 2025By

admin

My name is Godspower Owie, and I was born and brought up in Edo State, Nigeria. I grew up with my three siblings who have always been my idols and mentors, helping me to grow and understand the way of life.

My parents are literally the backbone of my story. They’ve always supported me in good and bad times and never for once left my side whenever I feel lost in this world. Honestly, having such amazing parents makes you feel safe and secure, and I won’t trade them for anything else in this world.

I was exposed to the cryptocurrency world 3 years ago and got so interested in knowing so much about it. It all started when a friend of mine invested in a crypto asset, which he yielded massive gains from his investments.

When I confronted him about cryptocurrency he explained his journey so far in the field. It was impressive getting to know about his consistency and dedication in the space despite the risks involved, and these are the major reasons why I got so interested in cryptocurrency.

Trust me, I’ve had my share of experience with the ups and downs in the market but I never for once lost the passion to grow in the field. This is because I believe growth leads to excellence and that’s my goal in the field. And today, I am an employee of Bitcoinnist and NewsBTC news outlets.

My Bosses and co-workers are the best kinds of people I have ever worked with, in and outside the crypto landscape. I intend to give my all working alongside my amazing colleagues for the growth of these companies.

Sometimes I like to picture myself as an explorer, this is because I like visiting new places, I like learning new things (useful things to be precise), I like meeting new people – people who make an impact in my life no matter how little it is.

One of the things I love and enjoy doing the most is football. It will remain my favorite outdoor activity, probably because I’m so good at it. I am also very good at singing, dancing, acting, fashion and others.

I cherish my time, work, family, and loved ones. I mean, those are probably the most important things in anyone’s life. I don’t chase illusions, I chase dreams.

I know there is still a lot about myself that I need to figure out as I strive to become successful in life. I’m certain I will get there because I know I am not a quitter, and I will give my all till the very end to see myself at the top.

I aspire to be a boss someday, having people work under me just as I’ve worked under great people. This is one of my biggest dreams professionally, and one I do not take lightly. Everyone knows the road ahead is not as easy as it looks, but with God Almighty, my family, and shared passion friends, there is no stopping me.

Source link

Relative Strength Index

XRP Price About To Make A New All-Time High Run To $5? Here’s What The Chart Says

Published

2 months agoon

February 11, 2025By

admin

The past 24 hours have seen bullish momentum return to XRP, with the cryptocurrency now reclaiming the $2.5 price level. This bullish momentum comes after a seven-day stretch of range consolidation between resistance at $2.5 and support at $2.3. Despite this consolidation of the price, technical analysis shows that XRP is still trading in a bullish setup, especially on the daily candlestick timeframe. Notably, this bullish setup shows that the XRP price is about to make a new all-time high run to $5.

Bullish RSI Divergence And Strong Support Set The Stage

Technical analysis of the XRP price, which was posted on the TradingView platform, shows that the cryptocurrency is on the verge of a maximum surge in the coming weeks. Technical indicators play a crucial role in this outlook, which is currently bullish, despite the recent price downturn.

Related Reading

One such technical indicator is the Relative Strength Index (RSI), which measures momentum in price movements. The RSI, for one, is flashing a bullish divergence on the daily timeframe. This occurs when the RSI makes higher lows while price action makes lower lows, which is a signal of reversal to the upside.

Furthermore, technical analysis shows that despite the price downturn, XRP has managed to hold above strong support at $2. The ability of XRP to hold above the support means that the recent selling pressure wasn’t an XRP price weakness as many expect, but only a consequence of a wider downturn in the entire crypto market. With the bullish structure intact and selling pressure appearing to wane, the asset remains in a strong position for a renewed rally, with a $5 target in sight.

Can XRP Break Its All-Time High And Rally To $5?

XRP’s all-time high remains at $3.40 and has yet to return to this price level since January 7, 2018. However, the altcoin has been one of the best performers this cycle, and this all-time high might not stand for long. In a recent rally, the cryptocurrency surged to $3.36, only to face sharp rejection from bearish resistance just before breaking new ground.

Related Reading

A move to $5 would not only mark a new all-time high but also solidify XRP as the best performer this cycle. The path to this milestone, however, will require the cryptocurrency to overcome key resistance zones, particularly around the $2.8 and $3 levels, where selling pressure has shot up this cycle.

At the time of writing, XRP is trading at $2.51, having increased by about 4.5% in the past 24 hours. If bullish momentum continues to build and XRP successfully clears these barriers, the projected $5 price target could be within reach.

Featured image from Adobe Stock, chart from Tradingview.com

Source link

Bitcoin Plunges Below $84K as Crypto Sell-Off Wipes Out Weekly Gains

Top 4 Crypto to Buy Now as XRP Price Struggles above $2

Ethereum Price Hits 300-Week MA For The Second Time Ever, Here’s What Happened In 2022

US regulators FDIC and CFTC ease crypto restrictions for banks, derivatives

US Authorities Seize $201,400 Worth of USDT Held in Crypto Wallets Allegedly Intended to Support Hamas

Is Bitcoin’s Bull Market Truly Back?

Stablecoin Bills Unfairly Box Out Foreign Issuers Like Tether, Says House Majority Whip

THORChain price prediction | Is THORChain a good investment?

Strategy (MSTR) Holders Might be at Risk From Michael Saylor’s Financial Wizardry

3 Altcoins to Sell Before March 31 to Prepare for Crypto Bull Market

A Big Idea Whose Time Has Finally Come

XRP price may drop another 40% as Trump tariffs spook risk traders

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x