chainlink

Superstate integrates Chainlink for tokenized treasury fund

Published

4 months agoon

By

admin

Superstate, a blockchain-based asset management firm, has integrated Chainlink’s technology as it taps into the growing tokenization market.

The asset manager will leverage the Chainlink (LINK) Data Feeds to bring net asset value data for its tokenized treasury fund on-chain. In the announcement Superstate stated it aims to enhance the composability of its Superstate Short Duration US Government Securities Fund by utilizing Chainlink’s technology.

The integration enables the firm to access crucial off-chain data, essential for market pricing, utility, and transparency.

Rapidly growing tokenization market

Chainlink’s data will help Superstate gain further traction for its fund as the ecosystem embraces decentralized finance and real-world assets. USTB provides qualified investors with exposure to U.S. treasury assets.

“Superstate is playing a fundamental role in advancing infrastructure and servicing essential aspects of the rapidly growing tokenized asset economy,” Johann Eid, chief bBusiness officer at Chainlink Labs, said.

The tokenized treasury market has seen significant developments in recent months, including BlackRock’s launch of its USD Institutional Digital Liquidity Fund on Ethereum (ETH). BUIDL currently leads the sector with over $513 million in assets under management.

According to tokenized market tracking site rwa.xyz, Franklin On-Chain U.S. Government Money Fund by Franklin Templeton and Ondo U.S. Dollar Yield are the second and third largest tokenized U.S. Treasury assets. Franklin’s FOBXX has a market cap of over $412 million, while Ondo Finance’s USDY currently stands at $299 million.

Superstate, backed by venture capital firms such as CoinFund, Arrington Capital, and Cumberland, currently manages over $129 million in assets for its tokenized products. Its USTB ranks seventh by market cap per rwa.xyz with $75 million, trailing the Ondo Short Term U.S. Government Bond Fund, Hashnote Duration Yield Coin, and OpenEden TBILL Vault.

OUSG, USYC, and TBILL have market caps of $214 million, $181 million, and $94 million, respectively.

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

chainlink

Chainlink Price Shines With 40% Rally — Is $28.5 Possible?

Published

2 weeks agoon

December 7, 2024By

adminOpeyemi is a proficient writer and enthusiast in the exciting and unique cryptocurrency realm. While the digital asset industry was not his first choice, he has remained absolutely drawn since making a foray into the space over two years. Now, Opeyemi takes pride in creating unique pieces unraveling the complexities of blockchain technology and sharing insights on the latest trends in the world of cryptocurrencies.

Opeyemi savors his attraction to the crypto market, which explains why he spends the better parts of his day looking through different price charts. “Looking” is a rather simple way to describe analyzing and interpreting various price patterns and chart formations. However, it appears that is not Opeyemi’s favorite part – in fact, far from it.

Being able to connect what happens on a price chart to on-chain movements and blockchain activities is what keeps Opeyemi ticking. “This emphasizes the intricacies of blockchain technology and the cryptocurrency market,” he would say. Most importantly, Opeyemi thinks of any market insights as the gospel, while recognizing that he is only a messenger.

When he is not clicking away at his keyboard, Opeyemi is most definitely listening to music, playing games, reading a book, or scrolling through X. He likes to think he is not loyal to a particular genre of music, which can be true on many days. However, the fast-rising Afrobeats genre is a staple in Opeyemi’s Spotify Daily Mix.

Meanwhile, Opeyemi is a voracious reader who enjoys a wide category of books – ranging from science fiction, fantasy, and historical, to even romance. He believes that authors like George R. R. Martin and J. K.

Rowling are the greatest of all time when it comes to putting pen to paper. Opeyemi believes his reading of the Harry Potter series twice is proof of that.

Indeed, Opeyemi enjoys spending most of his time within the four walls of his home. However, he also sometimes finds solace in the company of his friends at a bar, a restaurant, or even on a stroll. In essence, Opeyemi’s ambivert (haha! been searching for an opportunity to use the word to describe myself) nature makes him a social chameleon who is able to quickly adapt to different settings.

Opeyemi recognizes the need to constantly develop oneself in order to stay afloat in a competitive and ever-evolving market like crypto. For this reason, he is always in learning mode, ready to pick up the slightest lesson from every situation. Opeyemi is efficient and likes to deliver all that is required of him in time – he believes that “whatever is worth doing at all is worth doing well.” Hence, you will always find him striving to be better.

Ultimately, Opeyemi is a good writer and an even better person who is trying to shed light on an exciting world phenomenon – cryptocurrency. He goes to bed every day with a smile of satisfaction on his face, knowing that he has done his bit of the holy assignment – spreading the crypto gospel to the rest of the world.

Source link

chainlink

Chainlink (LINK), UBS Asset Management, Swift Complete Pilot to Bridge Tokenized Funds With TradFi Payment Rails

Published

2 months agoon

November 5, 2024By

admin

The project, completed as part of the Monetary Authority of Singapore’s (MAS) Project Guardian, showcased how Swift’s infrastructure can facilitate off-chain cash settlements for tokenized funds. It also demonstrates how tokenization and blockchain can work to improve, not replace, Swift, which connects over 11,500 financial institutions in more than 200 countries.

Source link

algo

Analyst Names Two Altcoins That Can Soar About 600% This Cycle, Updates Outlook on Dogecoin

Published

2 months agoon

November 4, 2024By

admin

A closely followed crypto analyst believes that two altcoins have the potential to skyrocket by as much as 5x before this cycle is over.

Pseudonymous analyst Altcoin Sherpa tells his 228,100 followers on the social media platform X that he’s extremely bullish on the altcoin market.

According to the analyst, even average altcoins will see massive price rallies if conditions turn bullish for crypto.

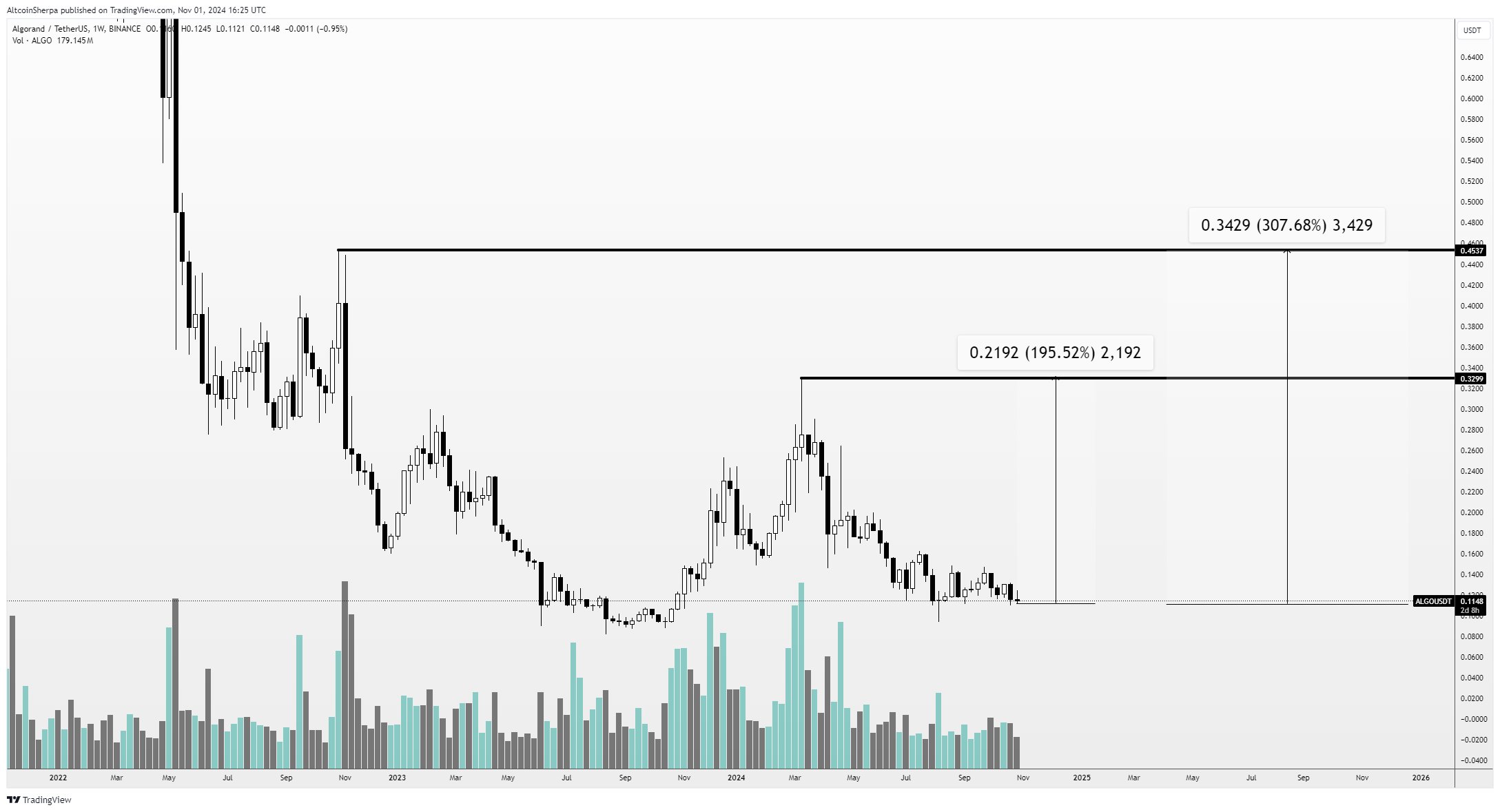

Specifically, the trader sees the decentralized oracle network Chainlink (LINK) and the layer-1 protocol Algorand (ALGO) printing gains between 400% and 600% before the current cycle comes to a close.

“Market average for sh*tcoins from here on out: probably about 3-5x for this cycle on the low end and 5-10x for prices on the high end.

Meaning: If you buy pretty much anything at this point in time, I expect it to go 3-5x.

Here are two examples with LINK [and] ALGO.”

Looking at the trader’s chart, he seems to predict that LINK will surge by over 350% to revisit all-time high levels. As for ALGO, Altcoin Sherpa shares a chart suggesting that an over 300% move will not even take the coin close to its all-time high of $3.56.

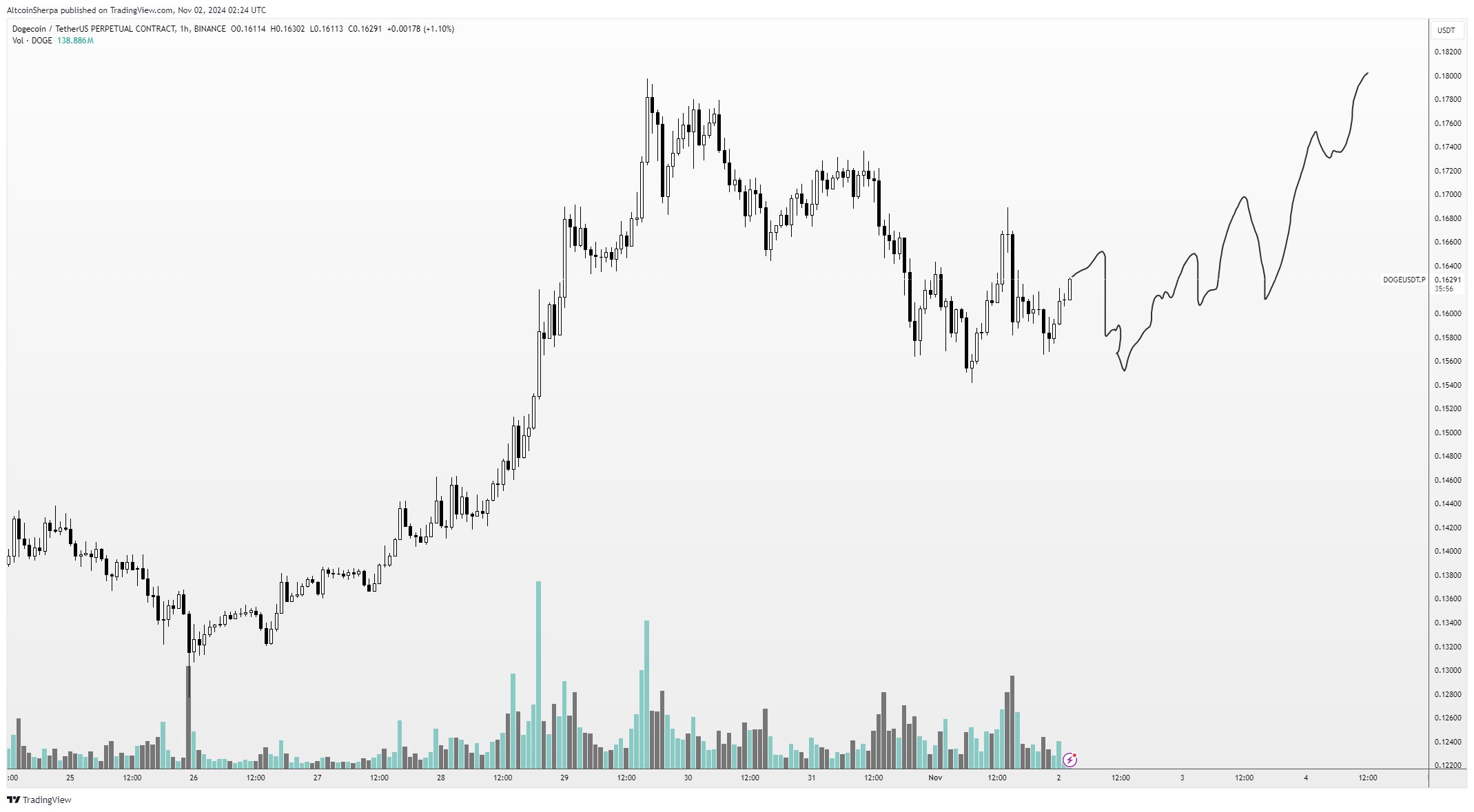

Turning to the top memecoin Dogecoin (DOGE), Altcoin Sherpa thinks the altcoin is taking a breather before sparking a new leg up.

“This is the bottom you want to see for DOGE in my opinion.

Lots of volatility and a range forming.”

At time of writing, DOGE is trading for $0.159.

Altcoin Sherpa also names other coins that he thinks will do well once the market enters full-bull territory.

“Mid-cap memes are taking a lot of mindshare and I still think stuff like BONK/PEPE/WIF probably outperforms a great percentage of utility coins. But if you’re looking for utility, I would prob go:

-New coins like EIGEN

-High float/older coins like FTM (+rebrand)

-new infra coming out like monad/berachain

-new coins that came out and down only (never pumped) aka REZ, ZK and those types

Lots of different ways to play the upcoming alt pump; be flexible and prepared.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Salamahin/HUT Design

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential