24/7 Cryptocurrency News

Terra Classic Rejects Major Proposal; TFL Update To Boost LUNC Rally?

Published

5 months agoon

By

admin

The Terra Classic community has overwhelmingly rejected a proposal to create an independent community website, fueling market discussions. However, despite this setback, Terra Classic’s LUNC token saw a notable rally, gaining over 5%. This surge is likely attributed to recent positive developments surrounding Terraform Labs (TFL) and its Chapter 11 bankruptcy proceedings.

Terra Classic Community Rejects Key Proposal

The Terra Classic community has recently voted on a governance proposal to establish an independent website, modeled after Bitcoin.org. This proposed independent website was intended to integrate design processes and concept workshops, fostering a more cohesive community.

However, the Terra community’s proposal received minimal support. Only 4% of the votes were in favor, while over 21% voted against it. A significant 63% of the participants chose to veto the proposal, and 12% chose the “Abstain” option.

Meanwhile, the rejection of this proposal reflects the Terra Classic community’s reluctance to pursue this direction at this time. But despite the proposal failure, the price of Terra Classic (LUNC) experienced a surprising rally. The token’s value increased by about 5%, capturing market attention and demonstrating the resilience of the Terra ecosystem.

Also Read: Is Elon Musk Joining Donald Trump In Nashville Bitcoin Conference?

TFL Bankruptcy Update Boosts Price?

The recent rally in LUNC can be attributed to updates from Terraform Labs’ Chapter 11 bankruptcy proceedings. As reported by CoinGape Media earlier, a new court order has authorized the reopening of the shuttle bridge and a substantial 150 million LUNA burn. This development has sparked renewed interest and optimism within the Terra Classic community.

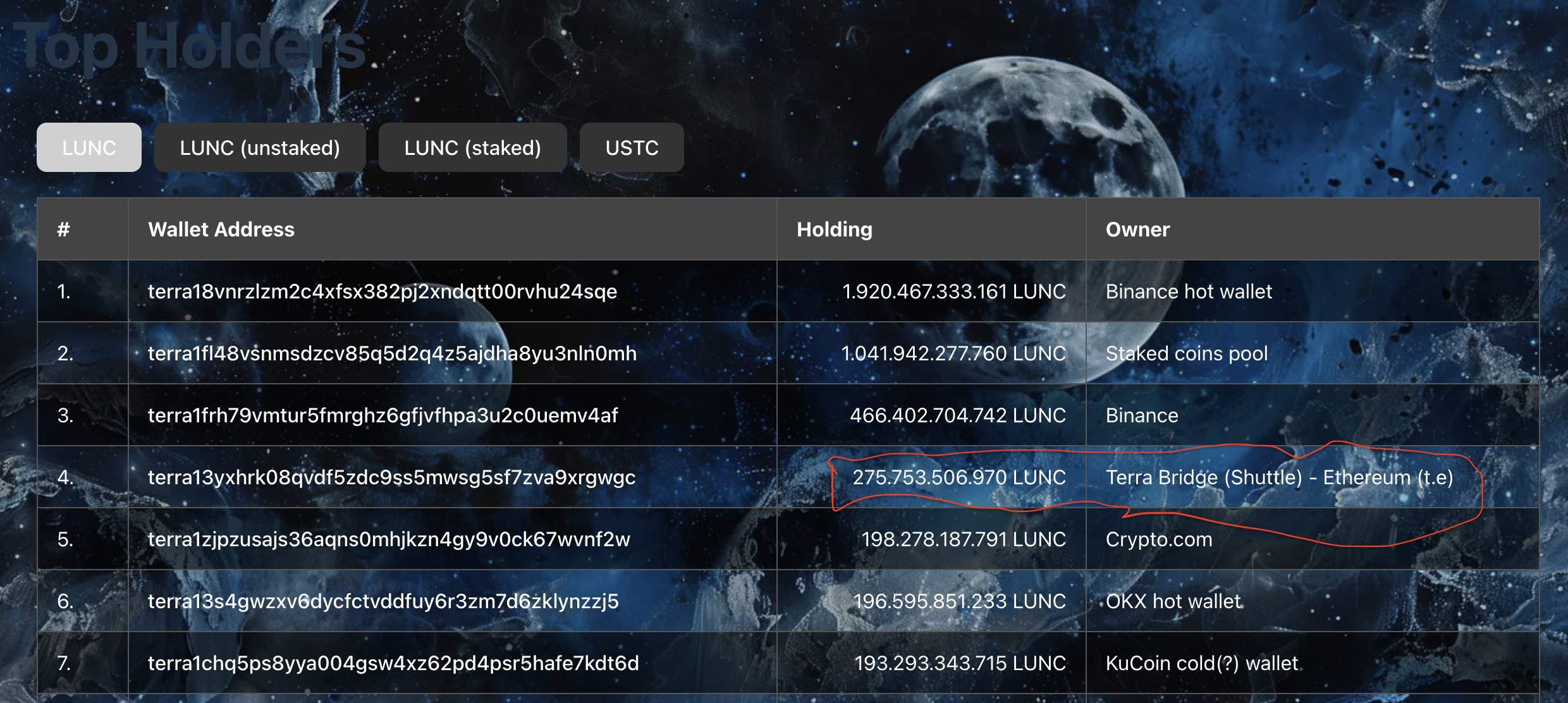

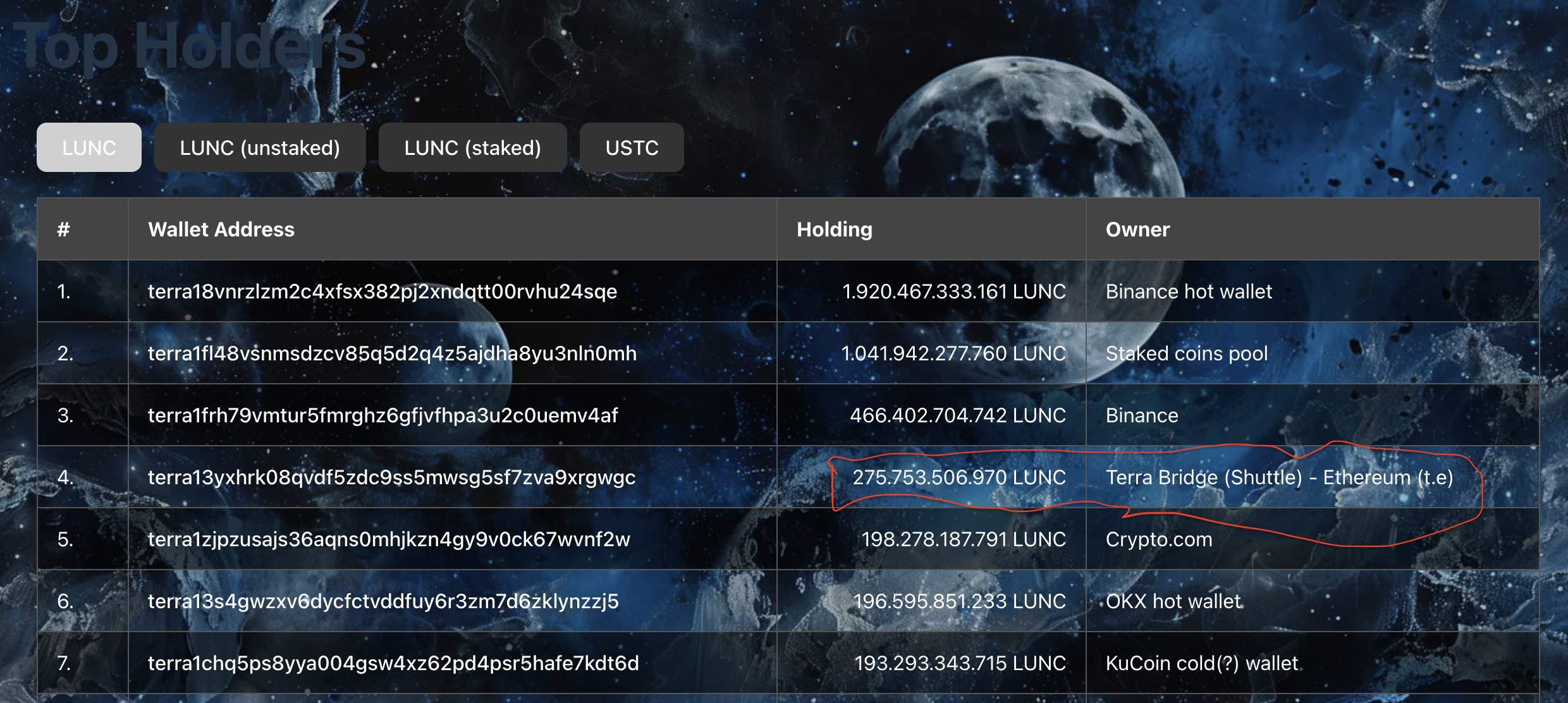

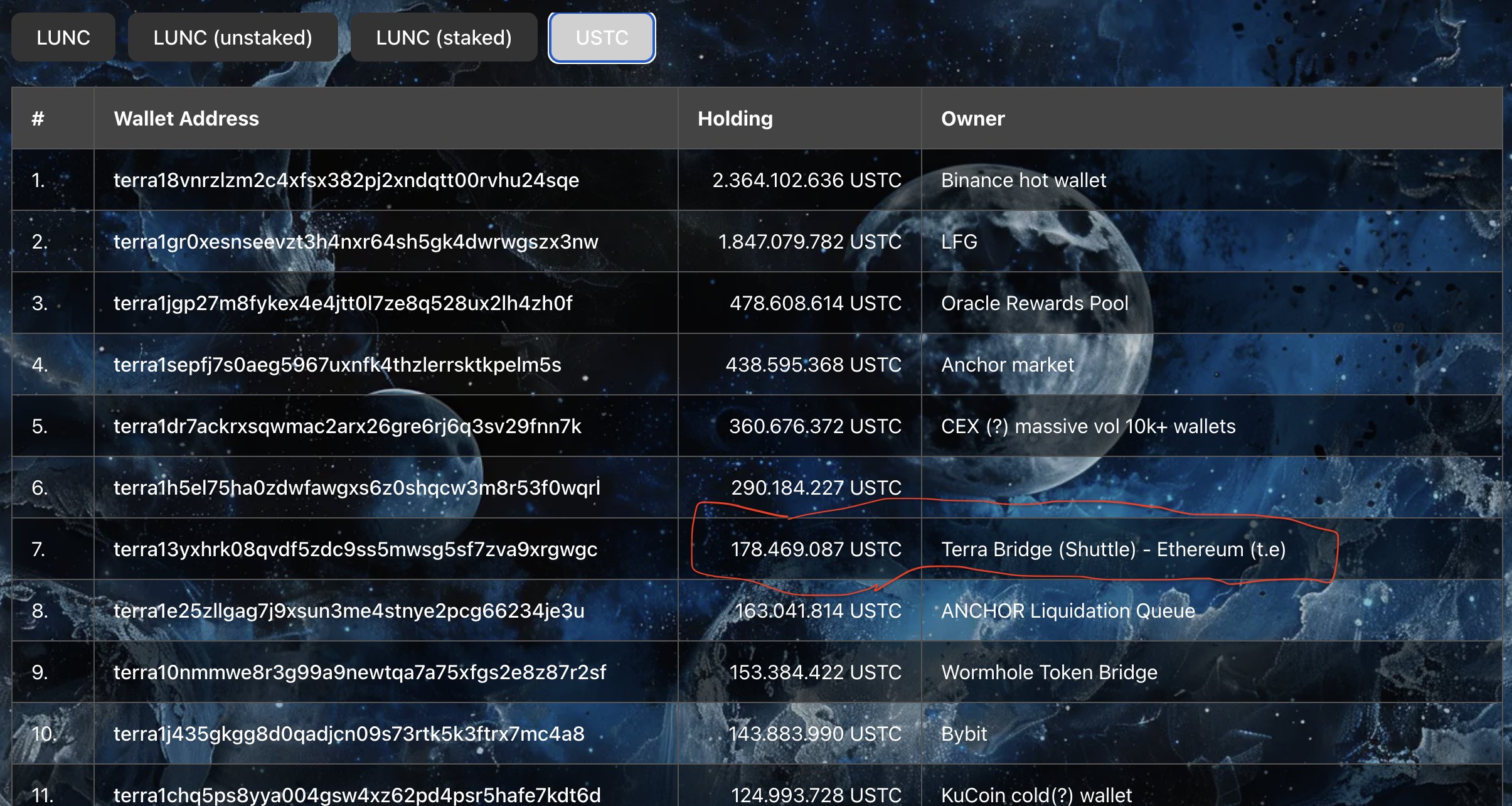

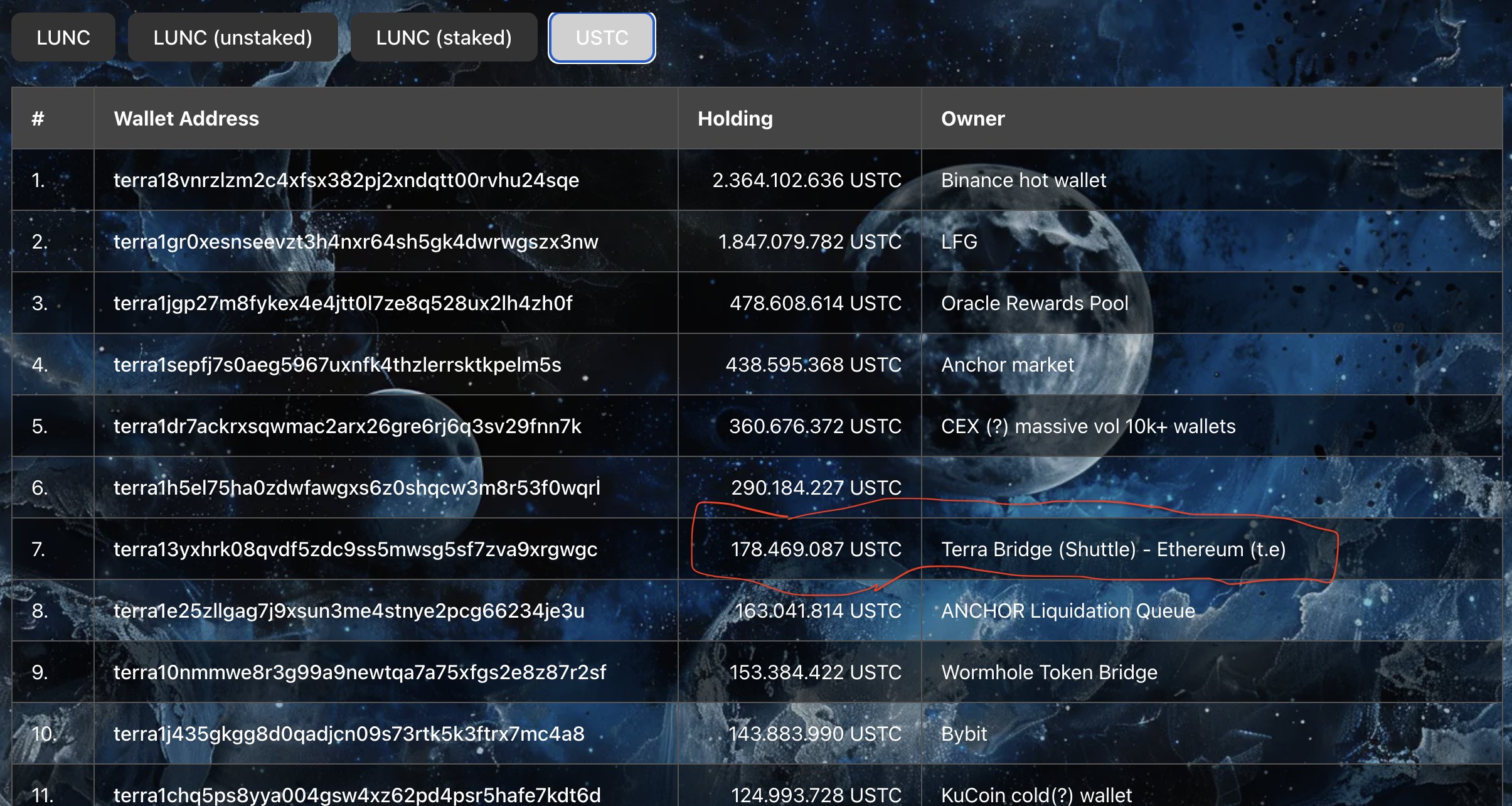

Meanwhile, the Terra community highlighted the importance of these updates. The reopening of the shuttle bridge allows for the movement of significant amounts of LUNC and USTC.

Specifically, the bridge contains 275.7 billion LUNC and 178.4 million USTC, according to data. Notably, the Terra Classic community plans to keep the bridge open for one month. If the funds are not withdrawn during this period, they will be burned, reducing the circulating supply.

This strategic move aims to bolster market confidence and support the long-term stability of the Terra ecosystem. Besides, additional wallets are also scheduled for burning, with detailed information expected by September 2024. This systematic approach to managing the token supply has been well-received by the community and investors alike.

As of writing, LUNC price was up 4.65% and exchanged hands at $0.00009108, while hitting a 24-hour high of $0.00009153. The token noted a surge of nearly 30% in the last seven days, reflecting the growing market interest.

On the other hand, USTC price was up about 4% to $0.02047. Furthermore, its one-day trading volume jumped about 60%, indicating significant trading activity.

Also Read: XRP Lawyer Targets Gary Gensler Amid SEC’s Latest Defeat

Rupam, a seasoned professional with 3 years in the financial market, has honed his skills as a meticulous research analyst and insightful journalist. He finds joy in exploring the dynamic nuances of the financial landscape. Currently working as a sub-editor at Coingape, Rupam’s expertise goes beyond conventional boundaries. His contributions encompass breaking stories, delving into AI-related developments, providing real-time crypto market updates, and presenting insightful economic news. Rupam’s journey is marked by a passion for unraveling the intricacies of finance and delivering impactful stories that resonate with a diverse audience.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

A Very Bitcoin Christmas

From DMM Bitcoin to the US Government: Largest Crypto Exploits and Hacks of 2024

Access control exploits account for nearly 80% of all crypto hacks in 2024

Will XRP Price Break All-Time Highs In 2025?

Why it’s a better investment than Solana or Ripple in 2024

Six Bitcoin (BTC) Mutual Funds to Launch in Israel Next Week: Report

24/7 Cryptocurrency News

Will XRP Price Break All-Time Highs In 2025?

Published

4 hours agoon

December 25, 2024By

admin

XRP price has recorded a slight decline today, following its massive rally over the past few months. Notably, the crypto has crossed the brief $2 mark for the first time since 2018 recently, with recent market trends indicating a further rally ahead. In addition, top experts also predicted the asset to hit a new ATH in 2025 amid the positive developments of Ripple and a pro-crypto sentiment in the US after Donald Trump’s election win.

Will XRP Price Hit ATH In 2025?

XRP price has recorded a robust rally this year hitting a multi-year high, indicating growing confidence of the investors. Besides, the recent whale activity and other positive market trends indicate that the XRP is poised to hit a new ATH as soon as next year.

Notably, the Ripple whales are on a buying spree, as evidenced by the recent activity of the large holders. Recently, prominent crypto market expert Ali Martinez said that whales have accumulated more than 60 million coins, reflecting the bullish sentiment hovering in the market.

Besides, Ripple’s recent launch of RLUSD stablecoin has also fueled market optimism. It marks a crucial milestone for the blockchain firm, with a flurry of exchanges like Bullish Exchange adding it to their platforms. In addition, it also debuted in the Singapore market with the Independent Reserve (IR) exchange listing recently.

On the other hand, the anticipation over XRP ETF also soared recently, especially with Donald Trump’s election win. A flurry of key players have already filed to launch the investment instrument in the US. Now, with US SEC Chair Gary Gensler’s resignation in January 2025, whom many deem as an anti-crypto regulator, optimism peaked toward a potential launch ahead.

In addition, Donald Trump’s focus on the crypto issued by US-based firms has also fueled speculations. Meanwhile, many in the crypto community also anticipate the ongoing Ripple Vs SEC case to conclude with pro-crypto Paul Atkin’s nomination as the US SEC Chairman by Donald Trump.

Ripple’s Native Crypto Eyes Breakout

XRP price today was down about 0.7% and exchanged hands at $0.29, after touching a 24-hour high of $2.35. Notably, this decline comes as Whale Alert showed that an XRP whale, identified by the wallet address “rBgEs..SLEcj”, has recently dumped 30.17 million coins. According to the report, the whale has dumped XRP worth $69.24 million to the leading crypto exchange Coinbase.

On the other hand, the Futures Open Interest for Ripple’s native crypto stayed near the flatline, indicating that investors are taking a pause amid the holiday season. However, top experts have shared bullish forecasts for the crypto, indicating a new XRP ATH soon.

In a recent X post, popular market analyst EGRAG Crypto said that XRP is poised to $3.775 in the near term. However, he also warned that the crypto could potentially slip to $1.37 in the short run if the bearish momentum dominates. Despite that, the market sentiment remained strong towards the crypto, given the recent developments.

On the other hand, another market expert Dark Defender recently shared an XRP price chart, which showed that the crypto could rally to about $20 in 2025. This has also fueled market sentiment, especially after the recent run of the crypto towards the north.

Besides, a recent XRP price analysis indicates a potential rally to $10 ahead. Considering all these aspects, it is highly likely that Ripple’s native crypto could soar past its previous ATH of $3.84 through 2025.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

What Happens If Paul Atkins Dismisses the XRP Lawsuit?

Published

7 hours agoon

December 25, 2024By

admin

The long-running SEC v Ripple case is in focus again as crypto-friendly Paul Atkins prepares to take over SEC Chairman responsibilities from outgoing Gary Gensler. Moreover, the January 15 deadline for the US SEC to file an opening brief in the XRP lawsuit in the 2nd Circuit Court of Appeals is approaching. Experts and lawyers have shared insights on what could happen next.

Incoming SEC Chair Paul Atkins to Dismiss Ripple Case

The crypto market, especially Bitcoin and XRP, has seen a paradigm shift after Donald Trump’s presidential election win. Moreover, pro-crypto Trump administration formation, including Paul Atkins’s nomination as SEC Chairman further sparked bullish sentiment in the crypto market.

This includes positive developments towards Ripple case dismissal or withdrawal and reduce former SEC Director Bill Hinman’s influence in the agency. Experts including pro-XRP lawyers Jeremy Hogan, Fred Rispoli, Bill Morgan cleared that there are high odds of XRP lawsuit dismissal under incoming SEC Chair Paul Atkins. This could lead to a rally in XRP price.

Moreover, an ethics investigation into SEC Corporation Finance Director Bill Hinman is now completed and issued to management. It is important to note that Ripple CLO Stuart Alderoty urged the incoming administration to “cleanse the lingering stain of Hinman from the agency.” He suggested starting with restoring trust in the SEC as Atkins works to repair the damage done under Gary Gensler.

The Digital Chamber said:

“The SEC has the opportunity to reset its historically troubled relationship with the industry This week, members of TDC’s Token Alliance Leadership Committee presented our 2025 SEC Digital Asset Policy Priorities to SEC staff.”

XRP Lawsuit Appeals Opening Brief Deadline Nears

The SEC must file its appeal opening brief in Ripple case by January 15, while the overall mood is on the lawsuit’s end. However, some believe Gensler to play his last major card in the Ripple vs SEC lawsuit as he leaves office, five days after the appeals opening brief deadline.

Notably, the SEC under Gensler has already filed an 81-page filing in Binance lawsuit opposing dismissal, what Ripple CLO called “failed arguments.” Gensler continues to affirm his claim that crypto has no inherent value.

Meanwhile, most experts including crypto executives are upbeat on appeals dismissal or withdrawal, which could lead to XRP price rally to $3 and higher. They believe the SEC under Gary Gensler went after crypto companies with their much-criticized regulation-by-enforcement approach. However, the new SEC should flip the script and work on pro-crypto Donald Trump’s agenda. The community also expects XRP ETF approval under new SEC.

Another long-running XRP lawsuit approaches an end, with the appeals court announcing the scheduled date. Ripple and CEO Brad Garlinghouse are to submit a reply in April.

Varinder Singh

Varinder has over 10 years of experience and is known as a seasoned leader for his involvement in the fintech sector. With over 5 years dedicated to blockchain, crypto, and Web3 developments, he has experienced two Bitcoin halving events making him key opinion leader in the space.

At CoinGape Media, Varinder leads the editorial decisions, spearheading the news team to cover latest updates, markets trends and developments within the crypto industry. The company was recognized as “Best Crypto Media Company 2024” for high impact and quality reporting.

Being a Master of Technology degree holder, analytics thinker, technology enthusiast, Varinder has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

BlackRock Bitcoin ETF (IBIT) Records Largest-Ever Outflow of $188M

Published

10 hours agoon

December 25, 2024By

admin

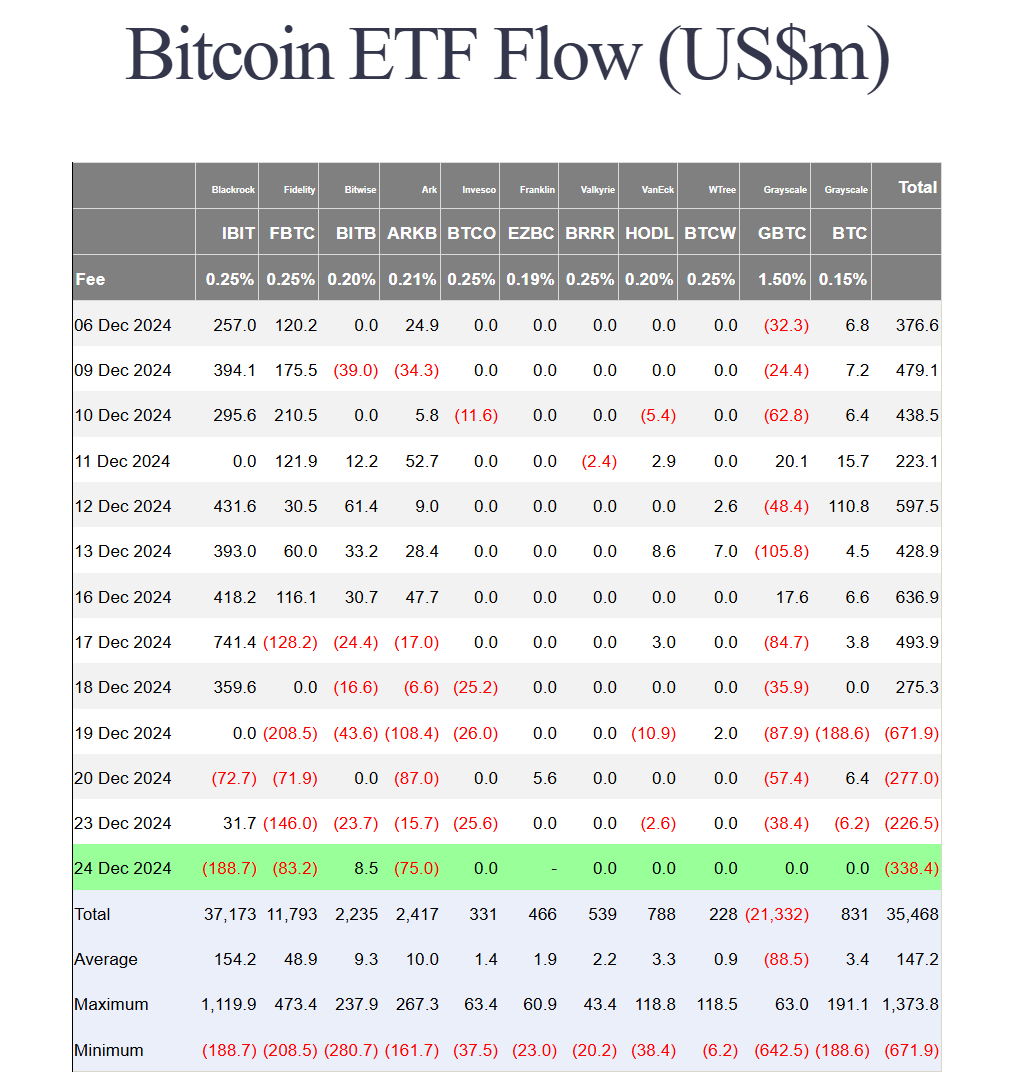

BlackRock’s iShares Bitcoin ETF (IBIT) has recorded its largest-ever $188.7 million in outflow on Tuesday, raising concerns over future implications. Also, US-based spot Bitcoin ETFs saw consecutive outflows for the fourth day as Fidelity’s FBTC and Ark Invest’s ARKB continued weak performance amid holidays. Bitcoin ETFs have now recorded over $1.5 billion in outflow in last 4 days.

BlackRock Bitcoin ETF Sees Biggest Outflow Since Launch

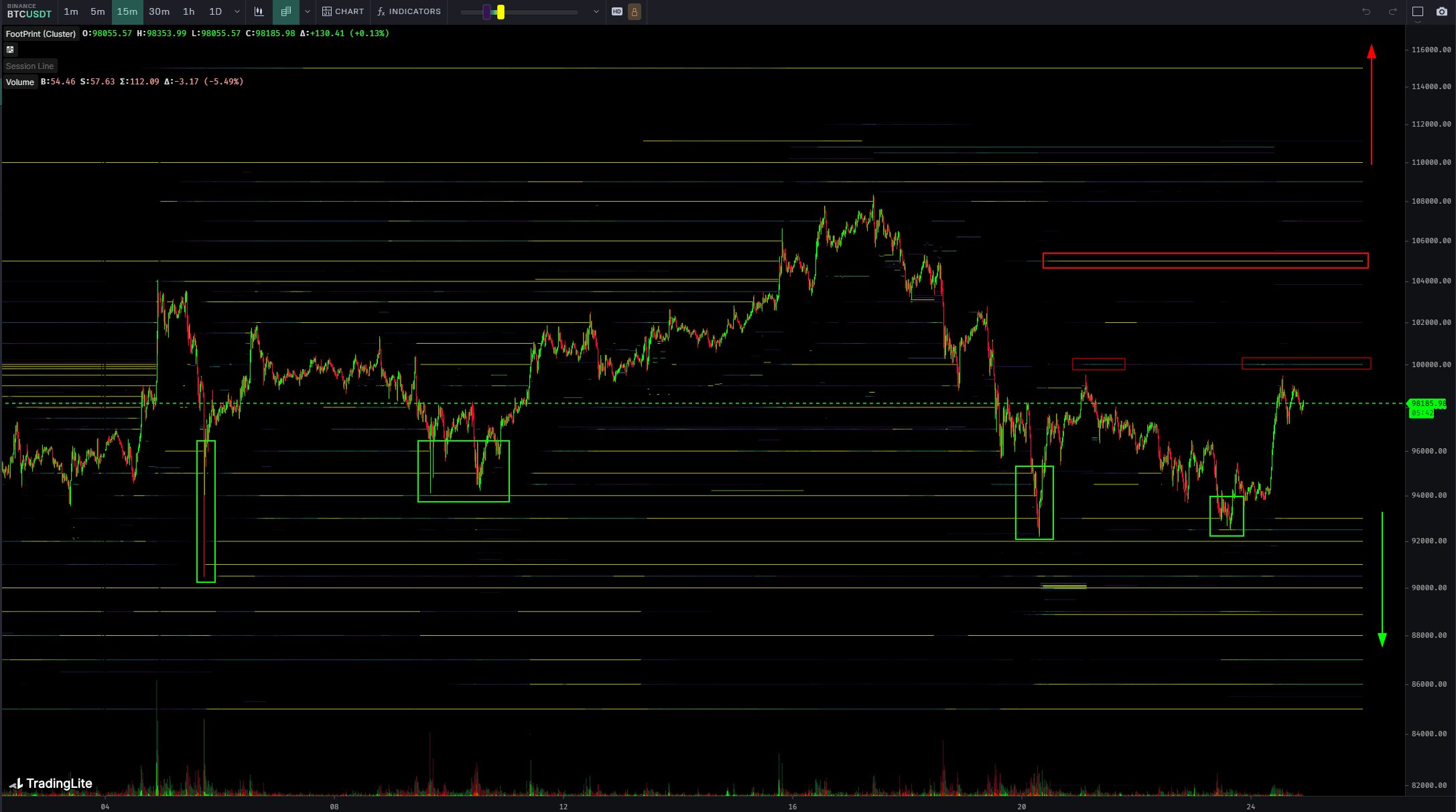

The crypto market showed signs of recovery as Bitcoin, Ethereum and other altcoins rebounded over the last 24 hours. Bitcoin price recovered from $94K to $99K today likely as traders FOMO Santa Claus rally. BTC currently holds above $98K, but a change in sentiment can trigger profit booking.

The promising factors for the change in sentiment could come from BlackRock Bitcoin ETF, which recorded its largest-ever outflow since launch on Tuesday, as per Farside Investors data on December 25. iShares Bitcoin ETF (IBIT) witnessed $188.7 million in outflow, almost double its previous largest outflow of $72.7 million last Friday.

The total outflow from US spot Bitcoin ETFs was $338.4 million, the fourth consecutive outflow. Fidelity’s FBTC saw $83.2 million and Ark 21Shares’ ARKB recorded $75 million in outflows. The flows for other crypto exchange-traded funds were negligible.

This has raised concerns among traders, raising problems for them as the year-end crypto expiry is almost here. While analysts and investors are primarily bullish, the recent prediction by experts including BitMEX co-founder Arthur Hayes about a potential crypto market crash near Donald Trump’s inauguration day sparked sell-offs.

However, crypto firms such as MicroStrategy, Metaplanet, Matador Technologies, and others buy the Bitcoin price dip. In fact, MicroStrategy’s Michael Saylor announced a special shareholder meeting to vote on a proposal for its 21/21 Bitcoin plan and boost its treasury.

What’s Next for Bitcoin Price?

BlackRock Bitcoin ETF’s largest-ever outflow and consecutive outflows from spot Bitcoin ETFs made investors to think about their next move.

Crypto analyst Skew revealed that the current passive ask liquidity is around $100K given quoting and previous LTF high, which is an important price area. Besides, ask liquidity and spot supply is around $105K. He believes flows and volatility will be a key factor here.

“Dynamic use of taker & limit bid for acquiring BTC here, likely a strategic play by some large market entity that expects higher prices into year end & early Q1.”

BTC price jumped 4% in the past 24 hours, with the price currently trading at $98,014. The 24-hour low and high are $93,744 and $99,404, respectively. Furthermore, the trading volume has decreased by 24% in the last 24 hours, indicating a decline in interest among traders.

Traders must keep an eye on volume and sentiment in the market for cues on direction in upcoming days, with BlackRock Bitcoin ETF also a major factor. Notably, 147 BTC options with $14.40 billion in notional value to expire on Deribit this Friday. The max pain price is $84,000 and put-call ratio is 0.68.

Varinder Singh

Varinder has over 10 years of experience and is known as a seasoned leader for his involvement in the fintech sector. With over 5 years dedicated to blockchain, crypto, and Web3 developments, he has experienced two Bitcoin halving events making him key opinion leader in the space.

At CoinGape Media, Varinder leads the editorial decisions, spearheading the news team to cover latest updates, markets trends and developments within the crypto industry. The company was recognized as “Best Crypto Media Company 2024” for high impact and quality reporting.

Being a Master of Technology degree holder, analytics thinker, technology enthusiast, Varinder has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

A Very Bitcoin Christmas

From DMM Bitcoin to the US Government: Largest Crypto Exploits and Hacks of 2024

Access control exploits account for nearly 80% of all crypto hacks in 2024

Will XRP Price Break All-Time Highs In 2025?

Why it’s a better investment than Solana or Ripple in 2024

Six Bitcoin (BTC) Mutual Funds to Launch in Israel Next Week: Report

What Happens If Paul Atkins Dismisses the XRP Lawsuit?

Malicious Google ad campaign redirects crypto users to fake Pudgy Penguins website

BlackRock Bitcoin ETF (IBIT) Records Largest-Ever Outflow of $188M

Solana (SOL) Gearing Up: Is a New Surge on the Horizon?

XRP, SOL, NEAR, DOGEN, and DOT poised to explode

Crypto Trader Turned $90 Into $3.25M As Token Skyrockets 5,500%

Here’s a Potential Downside Price Target for Cardano If ADA Sees New Correction, According to Benjamin Cowen

Which crypto will explode in 2025? Expert insights and predictions

XRP Price Pumps 7% On Christmas Eve, Will It Reach Yearly Highs?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: