News

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Published

2 months agoon

By

admin

Paolo Ardoino, the CEO of stablecoin issuer Tether, is squashing rumors that his firm is being probed by federal agencies.

In a post on the social media platform X, Ardoino addresses a Wall Street Journal (WSJ) report, which claims that authorities are investigating Tether for potential violations of anti-money laundering and sanctions laws.

The WSJ reports that the Manhattan U.S. Attorney’s Office is looking into whether Tether’s USDT has been used by bad actors to fund illegal activities or launder the proceeds generated by the criminal acts.

The report also claims that the Treasury Department is looking at possibly sanctioning Tether for the “widespread use” of USDT among entities sanctioned by the US.

In response, Ardoino says the WSJ is merely recycling long-played-out narratives.

“As we told the WSJ, there is no indication that Tether is under investigation. WSJ is regurgitating old noise. Full stop.”

Ardoino also highlights that Tether has been routinely cooperating with US authorities to prevent bad actors from using USDT to fund illicit activities.

“At Tether, we deal regularly and directly with law enforcement officials to help prevent rogue nations, terrorists and criminals from misusing USDT.

We would know if we are being investigated as the article falsely claimed. Based on that, we can confirm that the allegations in the article are unequivocally false.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

DTX Exchange could be the next big thing with 3x potential while Ripple & Dogecoin bleed

Can Shiba Inu Price Skyrocket 60% As Short-term SHIB Holders Capitulate?

The Year in NFTs: Bitcoin Ordinals Boom, Airdrop Craze, and Brands Come and Go

How To Buy Bitcoin During Bull Market Dips

PENGU price prediction | Is Pudgy Penguins a good investment?

Binance Peer To Delist XRP and Litecoin (LTC), But There’s A Catch

AI

OKX Launches Perpetual Futures for GRIFFAIN and ZEREBRO

Published

14 hours agoon

December 27, 2024By

admin

OKX will launch USDT-margined perpetual futures for AI projects GRIFFAIN and ZEREBRO on Dec. 27, 2024, with 50x leverage and reduced fees.

Crypto exchange OKX will launch USDT-margined perpetual futures for two new digital assets, GRIFFAIN and ZEREBRO – projects focused on artificial intelligence applications. The listings will launch today at 07:00 am UTC for GRIFFAIN and at 07:15 am UTC for ZEREBRO. Support for the launch will come via OKX’s web platform, mobile application and API.

GRIFFAIN is an AI-powered platform that enables users to transform their intentions into tasks through its smart, personalized AI agents. The platform is designed to allow users to build and deploy custom AI agents within its ecosystem with the express purpose of automation. Traders can open GRIFFAIN perpetual futures with up to 50x leverage from 0.01x, which will be settled in Tether (USDT). The contract size is 10, with a funding interval of 4 hours.

ZEREBRO is an AI platform that enables decentralized content creation, distribution, and analysis on social platforms. The perpetual futures contract has trading specifications in common with GRIFFAIN, including a leverage range of 0.01x to 50x, with settlement option in USDT. ZEREBRO enables autonomous AIs to better integrate into decentralized content ecosystems.

To reduce the impact of market volatility in the first phase of trading, OKX will limit the funding fee of both perpetual futures to 0.03% until Dec. 27, 4:00 pm UTC. After this introductory phase, the maximum funding fee will go back to the normal 1.5% max. Funding fees will be applied every four hours following this adjustment, with the first post-adjustment fee set to be used at 8:00 pm UTC the same day the platform is added.

The listing decisions are consistent with OKX’s continuous plans to add to its perpetual futures item set in response to increasing demand for AI-themed crypto assets. Traders are recommended to read the insights of the exchange towards perpetual futures trading guide and terms, particularly since the perpetual contracts follow the same price limits mapped out for any of the other digital assets traded on the platform.

According to CryptoSlate, the AI crypto space shows diversified interest, with a 4.68 percent rise in overall market cap over the last 7 days valued at $32.63 billion sector.

Source link

bear market

Crypto Bull Market Much Closer To End Than We Realize, Warns Analyst Jason Pizzino

Published

16 hours agoon

December 27, 2024By

admin

A closely followed analyst says the crypto bull market’s end is much closer than most traders realize.

In a new thread on the social media platform X, Jason Pizzino tells his 123,400 followers that investor sentiment indicates traders now are closer to the end of the bull market than the start.

“Bitcoin and crypto ‘end-stage’ emotional volatility has dramatically increased which only suggests we are much closer to the end than the beginning of the cycle.

That might seem like an obvious statement now, but wait until the market gets closer to the final top; it won’t be so obvious which is generally a signal within itself.”

In an accompanying video update, Pizzino says historically, when the market gets excited and overconfident, stagnation tends to follow.

“I think a lot of people believe this cycle should run until the end of 2025, but what if we’re seeing a lot of that excitement come back into the market?

Every time it goes up, all I see is just everyone getting super bullish and then it pauses for a bit, corrects, and then we start on the next move. So I’m just keeping an open mind.”

The trader’s chart uses Bitcoin (BTC) as an example. According to Pizzino, the top crypto asset by market cap may correct or trade sideways all the way until October 2025.

“Looking somewhere [between] Q2 out to Q3, just the beginning of Q4… Most people can’t handle six to 10 months.

They talked about a drop of one month and they all freaked out yesterday, it’s absolutely bonkers out there, which is why I think we are in those final moves, basically the end of the cycle.”

BTC is trading at $98,900 at time of writing, a marginal increase on the day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

XRP Has Most Bullish-Looking Chart in Entire Crypto Space, According to Analyst – Here’s Why

Published

1 day agoon

December 26, 2024By

admin

A widely followed cryptocurrency analyst and trader is leaning bullish on XRP.

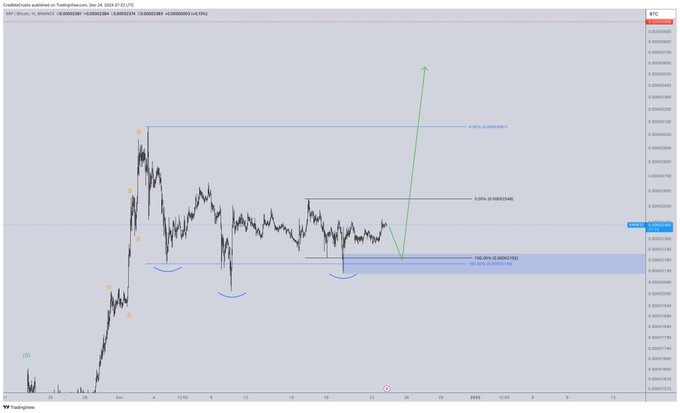

The analyst pseudonymously known as CredibleCrypto tells his 450,200 followers on the social media platform X that paired against Bitcoin (BTC), XRP “looks absolutely fantastic.”

The trader says he plans to enter a long position in the coming days.

Based on the analyst’s chart on the one-hour time frame, it appears he is suggesting that XRP could first trend downwards before skyrocketing by at least 65%.

It also appears that the analyst believes XRP has formed an inverse head-and-shoulders pattern in the same time frame. An inverse head-and-shoulders pattern is considered a bullish signal in technical analysis.

“Still the most bullish-looking chart in the entire space off the lows in my opinion. Just a powder keg building pressure…”

XRP is trading at 0.00002323 BTC ($2.28) at time of writing.

Next up is Ethereum (ETH). CredibleCrypto says that ETH is likely to trade in a range of between $3,000 and $3,800 before bottoming out at around $2,800.

Based on the pseudonymous analyst’s chart on the 12-hour time frame, he suggests Ethereum could then rally to a new all-time high above $6,000.

Ethereum is trading at $3,492 at time of writing.

Turning to the Ethereum/Bitcoin pair, the widely followed analyst says he is still targeting Ethereum to drop to around the 0.02700 BTC to 0.02800 BTC level before he can enter a long position. According to CredibleCrypto, ETH/BTC is now “grinding back down” after initially rallying.

“Would be an absolutely epic entry if we get it that will probably mark this cycles pico bottom on ETH/BTC as well.”

ETH is trading at 0.03542 BTC at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Zaleman/INelson

Source link

DTX Exchange could be the next big thing with 3x potential while Ripple & Dogecoin bleed

Can Shiba Inu Price Skyrocket 60% As Short-term SHIB Holders Capitulate?

The Year in NFTs: Bitcoin Ordinals Boom, Airdrop Craze, and Brands Come and Go

How To Buy Bitcoin During Bull Market Dips

PENGU price prediction | Is Pudgy Penguins a good investment?

Binance Peer To Delist XRP and Litecoin (LTC), But There’s A Catch

Bitcoin (BTC) Kimchi Premium Spikes as South Korea’s Political Turmoil Weighs on Won

Undervalued altcoins to keep an eye on

Is BitStamp Building Exchange on XRP Ledger?

BCH Miner helps users make $5,000 a day

Moo Deng Crypto Climbs 70% On Buterin’s Backing

Is Bitcoin Price Crash To $60K Imminent Before Donald Trump Inauguration?

OKX Launches Perpetual Futures for GRIFFAIN and ZEREBRO

FTX Co-Founder Ryan Salame Sentence Reduced By 1 Year

Crypto Bull Market Much Closer To End Than We Realize, Warns Analyst Jason Pizzino

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential