Bitcoin

Texas, Ohio, and Pennsylvania to create Bitcoin reserves

Published

17 hours agoon

By

admin

Three of the 50 states of America are expected to create local Bitcoin reserves soon. The bills differ from the proposal of the American National Bitcoin Reserve and demonstrate local specifics.

America is bullish on Bitcoin. Allegedly, each fifth American owns some BTC. While the U.S. President is pushing to create a strategic Bitcoin reserve, the states are working on local reserves. The Ohio and Texas proposals to create such reserves are about to pass; Pennsylvania is following their way, while other states are doing their considerations.

What are the specs of the local proposals compared to the federal bill?

The main distinction is that the local proposals have different end goals if compared to the federal-level proposal. The federal bill is aimed to cover the national debt and calls for purchasing one million BTC that should be stored in the U.S. Treasury.

The Texas bill is aimed at accumulating bitcoins by collecting taxes and donations in cryptocurrency. More than that, Texas has a minimum five-year embargo on selling state bitcoins. Ohio and Pennsylvania are willing to accumulate some BTC as a hedge against the eroding USD value. Bitcoins must be bought by the local treasuries. The bills don’t elaborate precisely on the terms.

The Cynthia Lummis bill

The Federal Reserve bill was introduced in July 2024 by Wyoming Sen. Cynthia Lummis. Her proposal is called Boosting Innovation, Technology and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act. The Lummis bill is expressly presented as a means to pay down the U.S. national debt.

Apart from national debt, Lummis mentions soaring inflation rates in the introduction and calls the creation of the reserve a Louisiana Purchase moment. Comparing huge-scale Bitcoin purchases with buying American lands in the past became a popular trope among Bitcoin maximalists.

According to the Lummis proposal, Bitcoin is seen as an additional store of value in the federal balance sheet. The bill suggests that the government must establish a U.S. Treasury-controlled decentralized network of Bitcoin vaults. On top of that, the government must purchase one million BTC, which is around 5% of the total supply. The amount is dictated by the fact that the U.S. is already holding 5% of all gold. Private Bitcoin holders should be given self-custody rights.

The local bills

The local bills of Texas and Ohio don’t include direct intentions to purchase a specified amount of BTC in a certain period, nor are they intended to eliminate the state debts.

The Texas bill was introduced by Texas State Representative Giovanni Capriglione on Dec. 12. The bill suggests that local residents will be able to use cryptocurrency to pay their taxes. On top of that, Texans will be able to donate cryptocurrency to the state. All the crypto is going to be exchanged for Bitcoin.

Donations, taxes, and other payments to the state agencies will be the main avenues for Texas to accumulate bitcoins. The accumulated BTC are supposed to be stored offline untouched for at least five years. Just like Lummis, Capriglione mentioned inflation as one of the biggest enemies while speaking about the need for the Bitcoin reserve. Texas has been an attractive place for Bitcoin miners due to low electricity costs and various incentives.

During the CNBC interview released on Dec. 24, Centrifuge general counsel Eli Cohen noted that the implementation may turn out to be challenging. He points out that the tax authorities may find it tricky to collect taxes in BTC and identify taxpayers. If the tax authorities demand taxpayers to provide their BTC wallets, the taxpayers may feel reluctant to obey.

🚨Today, I filed HB 703 to create the Ohio Bitcoin Reserve within the state treasury!

Provides state treasurer authority & flexibility to invest in #Bitcoin

This legislation creates the framework for Ohio’s state government to harness the power of Bitcoin to strengthen our… pic.twitter.com/hSWas2qeQd

— Derek Merrin (@DerekMerrin) December 17, 2024

On Dec. 17, the rep. Derek Merrin introduced the Ohio bill known as the Ohio Bitcoin Reserve Act. The act suggests that the Ohio treasury will set up the Bitcoin fund and will be able to invest money in Bitcoin. Bitcoin is seen as a hedge against USD devaluation. In contrast to the Lummis proposal, the bill has no mention of specific Bitcoin purchases or allocations. In 2022, Ohio had a $72.16 billion debt. It is possible that the BTC reserve could facilitate debt redemption. The bill will be worked upon further by legislators in 2025.

The Pennsylvania bill was introduced back in November. Its prime suggestion is that the state will be able to invest up to 10% of the State General Fund in Bitcoin in order to fight inflation. This means that nearly one billion dollars can be spent on bitcoins.

Will these bills pass?

The bills mentioned above were introduced. There is no guarantee that they will pass. On average, only 20% of the introduced state-level bills become laws. In Texas, Ohio, and Pennsylvania, this number is even lower. According to the New Healthcare Bill Acts, only 4.5% of the bills introduced to the 115th Congress became law. So, statistically, the odds are not that high. Practically, it depends on multiple factors, not least of all the persistence of the lobbyists. Cohen believes that Lummis is a strong Bitcoin advocate with decent experience, and her bill has a good chance.

However, the Lummis Act can fail in Congress. It receives some criticism even within the crypto community. For instance, a passionate crypto writer Nic Carter, warns that while the Bitcoin stockpile (as a store of seized bitcoins) can be beneficial, the strategic Bitcoin reserve (as a reserve of the bitcoins acquired by the government) will not bolster the dollar price (like it is supposed by the strategic Bitcoin reserve advocates) but will do the opposite.

The reason is clear: giving Bitcoin a monetary role in the country that issues dollars is signalling the move away from an inconvertible fiat standard, i.e., questioning the dollar’s value, hence risking the role of the U.S. in the global economy. We can’t state, however, that Carter’s concerns are the current mainstream. Quite the opposite.

If the strategic Bitcoin reserve is not created while the state-level reserves are successfully set, they may get a leading role in the exploration of the governmental accumulation and storage of Bitcoin and turn into international cryptocurrency hubs. If all the bills fail, new ones will follow.

Source link

You may like

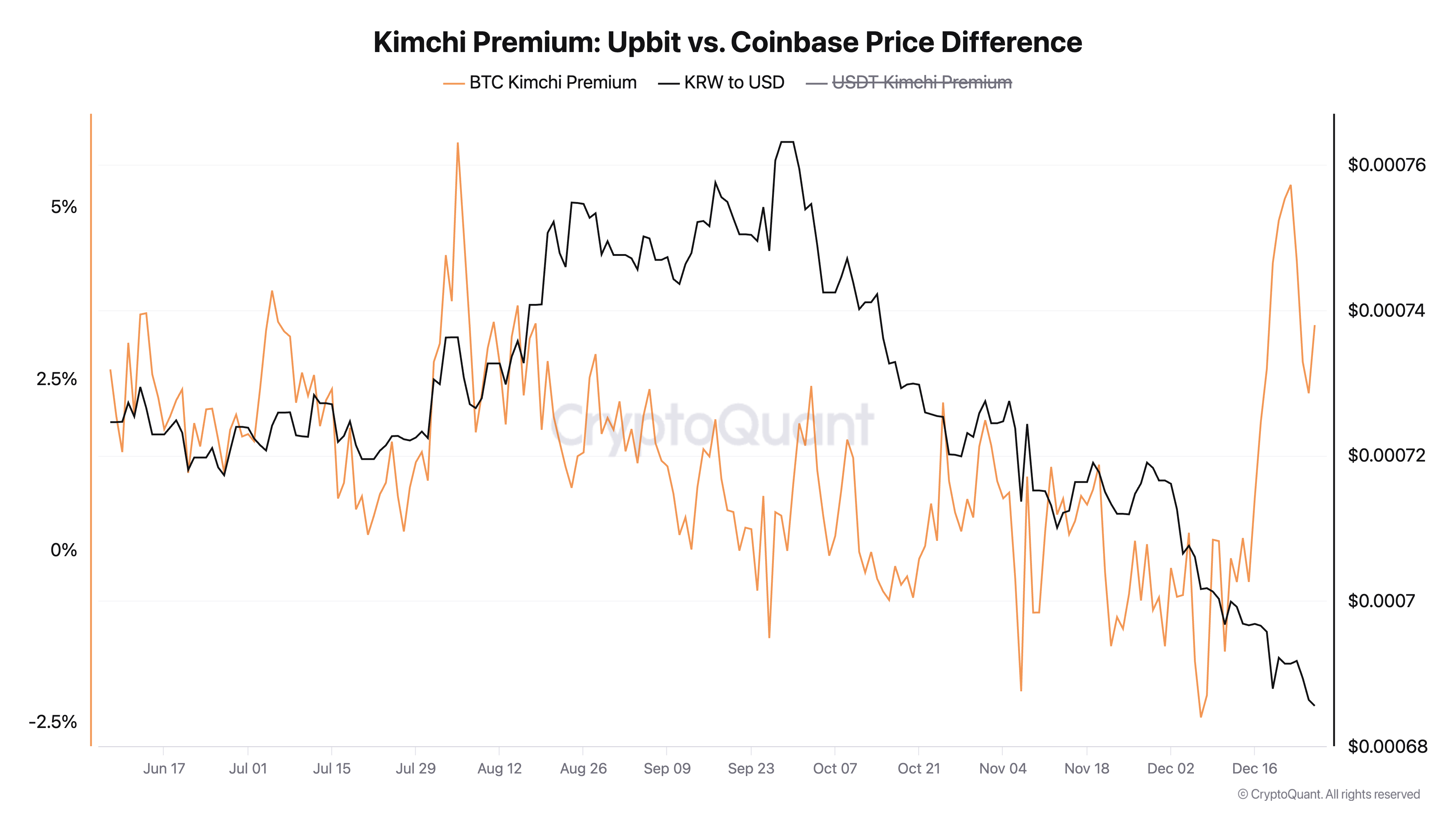

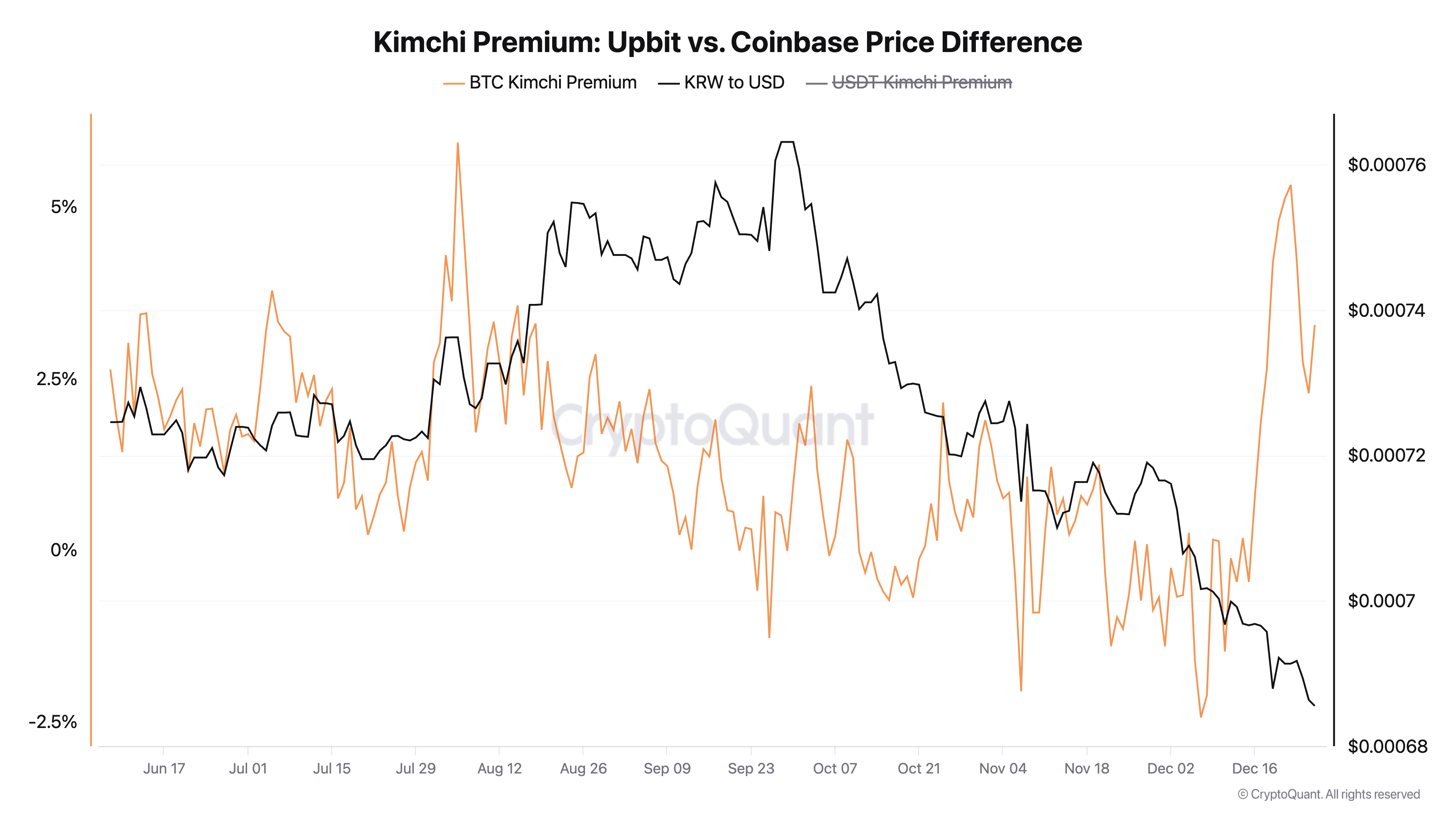

Bitcoin (BTC) Kimchi Premium Spikes as South Korea’s Political Turmoil Weighs on Won

Undervalued altcoins to keep an eye on

Is BitStamp Building Exchange on XRP Ledger?

BCH Miner helps users make $5,000 a day

Moo Deng Crypto Climbs 70% On Buterin’s Backing

Is Bitcoin Price Crash To $60K Imminent Before Donald Trump Inauguration?

Bitcoin

Bitcoin (BTC) Kimchi Premium Spikes as South Korea’s Political Turmoil Weighs on Won

Published

52 minutes agoon

December 27, 2024By

admin

South Koreans are paying a full 3% more to buy bitcoin (BTC) than their U.S. counterparts as they seek protection from the plummeting won, CryptoQuant data show.

Priced in won, the largest cryptocurrency is valued at 145,000,000 ($98,600) on the country’s largest crypto exchange, Upbit. That compares with about $96,700 on Coinbase (COIN).

The move follows a vote by the South Korean parliament to impeach Han Duck-soo, the prime minister and acting president, just weeks after impeaching President Yoon Suk Yeol. The won slumped a 15-year low against the dollar.

“This unfolding saga is fundamentally about election fraud and the erosion of trust in South Korea’s National Election Commission (NEC),” said Jeff Park, head of alpha strategies at investment manager Bitwise, in a post on X. “The use of impeachment as a political tool, combined with allegations of foreign election interference, underscores the fragility of democracy in the face of disinformation. This is not just a Korean story; it’s a warning for democracies worldwide.”

Source link

bear market

Crypto Bull Market Much Closer To End Than We Realize, Warns Analyst Jason Pizzino

Published

9 hours agoon

December 27, 2024By

admin

A closely followed analyst says the crypto bull market’s end is much closer than most traders realize.

In a new thread on the social media platform X, Jason Pizzino tells his 123,400 followers that investor sentiment indicates traders now are closer to the end of the bull market than the start.

“Bitcoin and crypto ‘end-stage’ emotional volatility has dramatically increased which only suggests we are much closer to the end than the beginning of the cycle.

That might seem like an obvious statement now, but wait until the market gets closer to the final top; it won’t be so obvious which is generally a signal within itself.”

In an accompanying video update, Pizzino says historically, when the market gets excited and overconfident, stagnation tends to follow.

“I think a lot of people believe this cycle should run until the end of 2025, but what if we’re seeing a lot of that excitement come back into the market?

Every time it goes up, all I see is just everyone getting super bullish and then it pauses for a bit, corrects, and then we start on the next move. So I’m just keeping an open mind.”

The trader’s chart uses Bitcoin (BTC) as an example. According to Pizzino, the top crypto asset by market cap may correct or trade sideways all the way until October 2025.

“Looking somewhere [between] Q2 out to Q3, just the beginning of Q4… Most people can’t handle six to 10 months.

They talked about a drop of one month and they all freaked out yesterday, it’s absolutely bonkers out there, which is why I think we are in those final moves, basically the end of the cycle.”

BTC is trading at $98,900 at time of writing, a marginal increase on the day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

24/7 Cryptocurrency News

Can Donald Trump Truly Make US The Crypto Capital?

Published

18 hours agoon

December 26, 2024By

admin

President-elect Donald Trump’s promise to ensure all remaining Bitcoin is “made in the USA” has sparked widespread debate. Announced during a meeting with crypto mining executives, the pledge reflects a shift in Trump’s stance on digital currencies. Despite this commitment, experts caution that achieving this goal may be unattainable due to various reasons discussed in this article.

Is Donald Trump Bitcoin Strategy Achievable?

Recent data indicate that 95% of Bitcoin has already been mined, leaving only a small fraction available for production. This reality makes President-elect Donald Trump’s promise to produce Bitcoin exclusively within the United States highly challenging. Bitcoin mining operates on a decentralized network, meaning no single country or entity can control the process.

Additionally, global mining operations dominate the industry, with US crypto miners contributing less than 50% of the total computing power. This disparity underscores the difficulty of centralizing Bitcoin production to a single nation. The highly competitive nature of the sector further complicates efforts to shift the balance entirely to domestic players.

More so, these challenges erupt even as Japan rejects Bitcoin for national reserves, prioritizing stability in its foreign exchange strategy. The government highlighted BTC price volatility and misalignment with traditional financial systems.

Interestingly, this cautious stance contrasts sharply with other Japanese private entities. For example, Japan’s MicroStrategy, Metaplanet, invested ¥9.5 billion to purchase 617 BTC, raising its total holdings to 1,761.98 BTC. This move boosted its Bitcoin treasury by 56% amid a price dip. The company reported a 309% yield on its BTC holdings in Q4, with CEO Simon Gerovich emphasizing Bitcoin’s role in safeguarding capital against the declining Yen.

Global Competition and Equipment Reliance Challenges

Bitcoin mining is increasingly driven by international players with deep resources, such as miners in Africa, Asia, and the Middle East. These regions often benefit from lower energy costs and fewer regulatory barriers, providing an edge over US operations. For example, countries like Ethiopia and Argentina offer access to cheap hydropower and stable revenue streams in US dollars. This boosts their competitiveness in the market.

Adding to the challenge, most Bitcoin mining equipment is manufactured by Chinese companies, particularly Bitmain. A trade war or tariff policies under Donald Trump’s administration could raise the cost of importing essential machinery, creating additional obstacles for US crypto miners.

However, despite the ambitious pledge, Donald Trump has found support from several US-based mining companies, such as CleanSpark Inc. and Riot Platforms Inc. These companies anticipate that his administration will reduce environmental regulations and increase industry support. However, some US miners are even turning to overseas partnerships to mitigate rising energy costs at home.

For instance, MARA Holdings Inc. has announced a joint venture with an Abu Dhabi sovereign wealth fund to establish one of the largest mining farms in the Middle East. While Donald Trump’s commitment to making Bitcoin “made in the USA” aligns with his broader economic goals, it faces structural and logistical barriers.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin (BTC) Kimchi Premium Spikes as South Korea’s Political Turmoil Weighs on Won

Undervalued altcoins to keep an eye on

Is BitStamp Building Exchange on XRP Ledger?

BCH Miner helps users make $5,000 a day

Moo Deng Crypto Climbs 70% On Buterin’s Backing

Is Bitcoin Price Crash To $60K Imminent Before Donald Trump Inauguration?

OKX Launches Perpetual Futures for GRIFFAIN and ZEREBRO

FTX Co-Founder Ryan Salame Sentence Reduced By 1 Year

Crypto Bull Market Much Closer To End Than We Realize, Warns Analyst Jason Pizzino

Trader who called BTC at $105k forecasts $0.0007 meme token at $1 in 2025

Top 5 Biggest Crypto Hacks of 2024

The Best Games of 2024 That You Can Snag for Under $25

3 altcoins that could skyrocket by new year’s eve

Analyst Predicts XRP Price To Reach $27, Here’s Why

Monkey Please!

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: