Cryptocurrency Market News

Texas Strategic Bitcoin Reserve is Great News for $STARS Presale

Published

4 months agoon

By

admin

Texas is moving forward with plans to introduce a strategic Bitcoin reserve. State Rep. Giovanni Capriglione announced yesterday that he has submitted a bill that will enable the state to accept donations, fees, and taxes in the form of bitcoin, with the condition that it be held for a minimum of five years.

“Probably the biggest enemy of our investments is inflation,” said Capriglione. “A strategic bitcoin reserve, investing in bitcoin, would be a win-win for the state.”

Texas is the second US state to consider incorporating Bitcoin into its financial strategy. In November this year, legislation to form the Pennsylvania Bitcoin Strategic Reserve was introduced, with plans to allocate up to 10% of its treasury reserves to Bitcoin.

This came after the Pennsylvania House of Representatives passed what is informally called the Bitcoin Rights Bill in October, giving Pennsylvania residents the option of Bitcoin as a potential payment method while safeguarding their rights to manage their own cryptocurrency.

“By enacting this legislation, we can make the Commonwealth a friendly place for blockchain innovation and provide our citizens with the tools to engage in the digital economy safely,” according to Rep. Mike Cabell, who sponsored House Bill 2481 – or the Digital Assets Authorization Act – as it is formally known.

What Does This Mean for the Crypto Economy?

The moves to establish strategic Bitcoin reserves by both Texas and Pennsylvania are positive news for the cryptocurrency economy, albeit at state-level, not yet federal. However, Dennis Porter – CEO of NPO Satoshi Action Fund, who worked with Capriglione on the draft legislation – is optimistic.

“The state level, in our opinion, is the best place to create political momentum for bitcoin,” he said in an interview on CNBC New York. “The very best thing that we can be doing is passing this legislation at the state level, providing political momentum for federal legislation.”

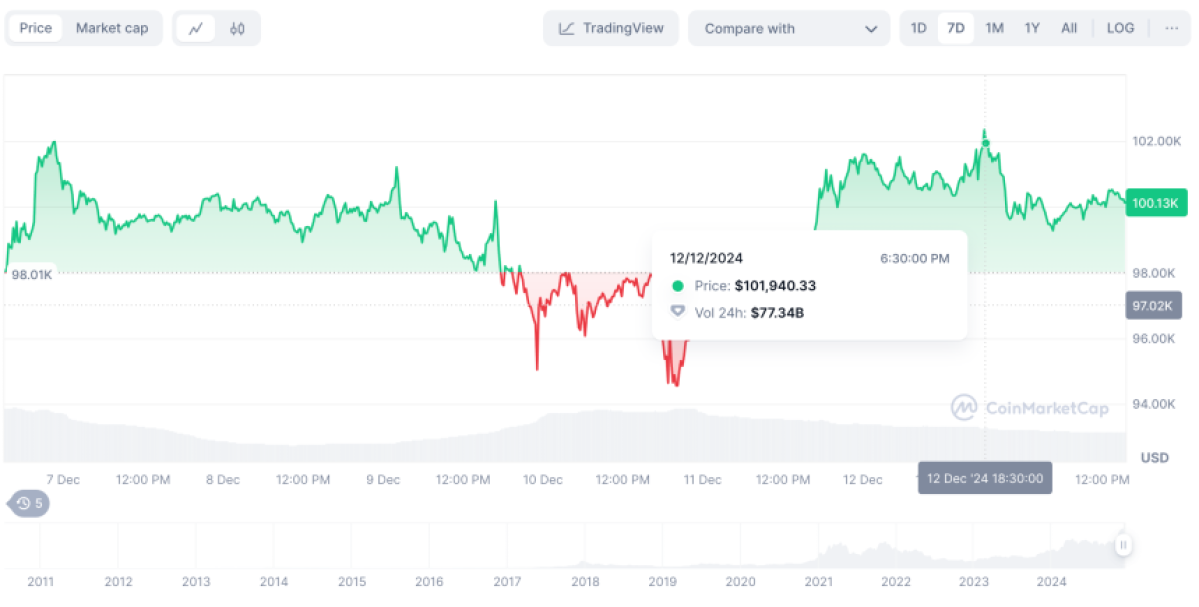

Bitcoin, which has been experiencing a post-US election boom – reaching the $100k milestone – continued to rally following yesterday’s announcement of Texas’ Strategic Bitcoin Reserve, although at the time of writing, it had dipped slightly.

“Over its short history, Bitcoin has seen both major surges and sell-offs,” asset manager BlackRock noted in a report released earlier this week. BlackRock’s iShares Bitcoin Trust ETF currently manages some $53.8bn in assets.

The Black Rock report adds that this volatility, “plus Bitcoin’s unique characteristics, raises the question of what role it should play in portfolios.” The financial giant advises that investors place a maximum of 2% of Bitcoin in their portfolio.

It’s Not Only Bitcoin That’s In The Pound Seat

Bitcoin’s rally is great news for other tokens – because when Bitcoin goes up, they tend to go up, too. And that includes the best meme coins.

Take Crypto All-Stars ($STARS), for instance. This meme coin/DeFi token is currently on presale, and with a 200% APY and excitement surrounding its upcoming MemeVault, Crypto All-Stars is proving to be a massive success so far.

$STARS has already raised over $15.3M, but with just seven days left until its official launch, time is running out if you want to buy $STARS at a presale bargain. Don’t forget to DYOR, though. Take a look at Crypto All-Stars on X to start your homework.

Source link

You may like

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

crypto analyst

Solana Needs 15% Bounce After Multi-Year Support Retest

Published

5 days agoon

April 9, 2025By

admin

Rubmar is a writer and translator who has been a crypto enthusiast for the past four years. Her goal as a writer is to create informative, complete, and easily understandable pieces accessible to those entering the crypto space. After learning about cryptocurrencies in 2019, Rubmar became curious about the world of possibilities the industry offered, quickly learning that financial freedom was at the palm of her hand with the developing technology.

From a young age, Rubmar was curious about how languages work, finding special interest in wordplay and the peculiarities of dialects. Her curiosity grew as she became an avid reader in her teenage years. She explored freedom and new words through her favorite books, which shaped her view of the world. Rubmar acquired the necessary skills for in-depth research and analytical thinking at university, where she studied Literature and Linguistics. Her studies have given her a sharp perspective on several topics and allowed her to turn every stone in her investigations.

In 2019, she first dipped her toes in the crypto industry when a friend introduced her to Bitcoin and cryptocurrencies, but it wasn’t until 2020 that she started to dive into the depth of the industry. As Rubmar began to understand the mechanics of the crypto sphere, she saw a new world yet to be explored.

At the beginning of her crypto voyage, she discovered a new system that allowed her to have control over her finances. As a young adult of the 21st century, Rubmar has faced the challenges of the traditional banking system and the restrictions of fiat money.

After the failure of her home country’s economy, the limitations of traditional finances became clear. The bureaucratic, outdated structure made her feel hopeless and powerless amid an aggressive and distorted system created by hyperinflation. However, learning about decentralization and self-custody opened a realm of opportunities. Cryptocurrencies allowed her to experience financial control for the first time and expand her financial education.

Moreover, the peculiar nature of the crypto community sparked Rubmar’s curiosity about the other layers of the industry. As a result, she found a particular interest in discovering the diverse perspectives of investors, market watchers, experts, and developers. Her attempts to better understand the crypto space made her realize the strong links of the community with other industries, enriching her perspective of the sector. As someone who spends most of her day online, Rubmar enjoys finding the points where the crypto world meets with her other passions and hobbies –or her favorite memes.

In her free time, she usually finds joy in different art forms. As a child, she enlisted in every extra-curricular activity in her hometown, including music classes, dancing, jewelry making, and the local chorus. Despite her many attempts to learn different instruments, Rubmar only knows how to play the xylophone, which she played for 7 years in her school’s marching band.

She also has a passion for learning new languages and cultures, having set the goal to learn another six languages – currently attempting to learn Italian and Korean. Scrapbooking, paper crafting, and bookbinding are her biggest interests outside of work, constantly taking classes and attending workshops to learn new techniques. The rest of her free time is spent stressing over football matches and transfer market news or feeding cats –hers or stray.

In summary, Rubmar seeks to present entertaining and educational pieces to be enjoyed by everybody, aiming to report on the latest news and offer a unique perspective while adding a meme or a pun whenever possible.

Source link

Cryptocurrency Market News

Red Alert For Solana: 21% Price Drop Raises Fears Of Further Collapse

Published

6 days agoon

April 7, 2025By

adminSolana has taken a sharp nosedive, losing nearly 22% of its value and trading around $98.09. This steep drop has sent shockwaves through the crypto community, sparking fears of an imminent larger breakdown. SOL is now flashing red across the board, with sellers firmly in control and bulls scrambling to defend critical levels.

The decline highlights increasing bearish sentiment, likely fueled by technical breakdowns, weak market confidence, and rising concerns over broader economic trends. With the $100 psychological barrier now broken, all eyes are on the next key support zones.

Is A Deeper Correction On The Horizon?

In his recent post on X, King_Ab highlighted that Solana is currently trading around $98.09, marking a sharp 21.84% drop from its previous close. He further noted that the day’s trading session has been highly volatile, with SOL reaching a high of $120.07 and dipping as low as $98.06, underscoring the intense pressure in the market.

According to King_Ab, this substantial drop in Solana reflects the broader downturn witnessed across the cryptocurrency market over the past week. The decline isn’t isolated but rather part of a wider trend of risk-off sentiment as investors react to global macroeconomic uncertainty and shifting market dynamics.

He pointed out that Solana’s market capitalization currently stands at approximately $51.15 billion, while its 24-hour trading volume hovers around $5.17 billion, indicating sustained trading activity despite the sharp correction. This combination of declining price and high volume could suggest either panic-driven sell-offs or aggressive repositioning by market participants

Critical Support Breached: Can Solana Hold The Line Below $100?

Solana’s drop below the key $100 mark signals a potential shift in momentum from bullish to bearish. This level has previously acted as a solid support zone, providing a bounce point during corrections. However, with the recent 21% decline, that line has been breached, and market sentiment is growing increasingly cautious.

For SOL to regain its bullish momentum, it needs to swiftly reclaim and sustain levels above $100 to avoid further downside pressure. If this key level remains unheld, Solana might drop to the next support zone around $79.25. A break below this level could accelerate bearish sentiments, opening the door for an extended decline toward the $58.25 support area, where the bears may gain additional control.

At this critical juncture, it’s essential to closely watch the price action for signs of stabilization or the risk of continued capitulation. As the bearish volume rises, Solana’s ability to reclaim the broken support level will likely dictate its short-term trajectory. Whether the price can recover above key levels will be a decisive factor in determining if the downtrend will persist or if a reversal is on the horizon.

Source link

APT

Analysts Eye 20% Breakout If This Level Is Reclaimed

Published

1 week agoon

April 4, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

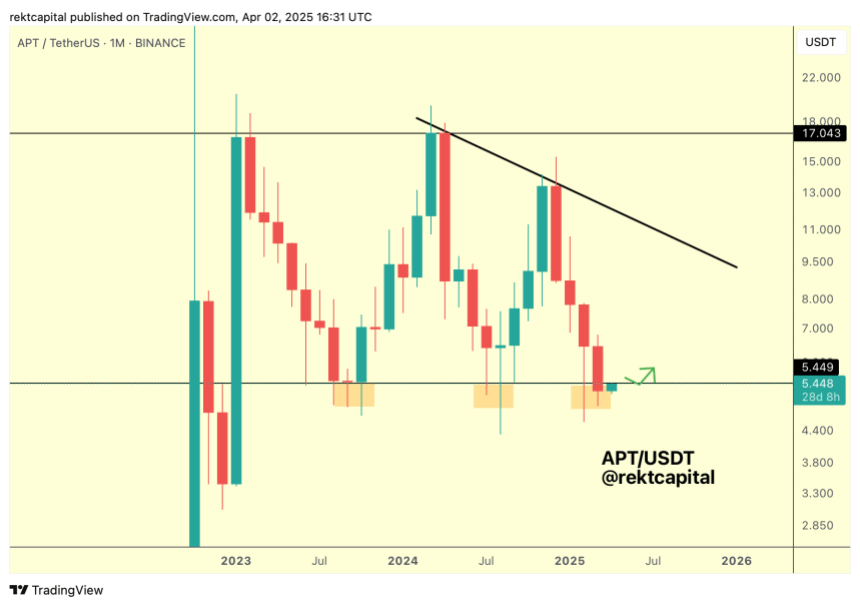

Amid the market retrace, Aptos (APT) has seen an 8% decline in the past 24 hours, falling below a key support zone for the second time this week. Despite the correction, some analysts consider that the cryptocurrency could be poised for a breakout soon.

Related Reading

Aptos Loses Macro Range Lows

During the March retraces, Aptos fell below a crucial support level for the first time since August 2024 but recovered 24% near the end of the month. However, APT followed the rest of the market and dumped 11% to close the March below key levels.

Analyst Rekt Capital noted that APT closed last month below its Macro Range Low of $5.44 for the first time. The cryptocurrency has been trading within the $5.45-$17 price range since 2023, retesting the range lows two times before.

Historically, “APT tends to develop bases here in the form of downside wicks for three-month periods,” he explained, adding that the cryptocurrency seems to be developing a third three-month base, with the difference that it has closed below this range for the first time in the monthly timeframe.

Following this performance, Aptos will need to reclaim the $5.44 level as support “to end this Monthly close as a downside deviation” and “avoid a bearish retest here.”

Previously, the analyst suggested that holding this level could reverse ATP’s price action in the coming months, as it has done with the other clusters. Additionally, he pointed out the previous consolidations included a “downside wicking below support.”

In his recent analysis, Rekt Capital considers that APT’s daily bullish divergence “is still something worth watching” as the cryptocurrency’s Relative Strength Index (RSI) continues to form Higher Lows despite the recent downside deviation, and its price “is trying to transition away from Lower Lows into a new Higher Low.”

According to the analyst, “a clear market structure is developing here, and a breakout from it would validate the Bull Div and set APT up for a reclaim of the Macro Range Low of $5.44,” which is key for a bullish rally.

APT To Reclaim $6.5 Resistance?

Analyst Sjuul from AltCryptoGems highlighted Aptos’ strength amid the market volatility, which saw Bitcoin (BTC) drop from $88,000 to $81,000 in the past 24 hours. APT dropped from the $5.40 mark to the $4.95 support.

The analyst considers that a retest of the local range lows could be necessary before the cryptocurrency aims for the next crucial level, as the current price zone has been tested many times.

Related Reading

Moreover, a reclaim of the $5.44 range could see the APT surge another 20% to the $6.5 resistance lost two months ago. Another market watcher suggested that Aptos is “showing potential for a bullish breakout as it trades within a descending channel.”

Per the chart, the cryptocurrency has been trading within a descending channel since early February, testing the channel’s lower and upper boundaries throughout March. “After testing the lower trendline, it may be finding support, and a break above the upper resistance will signal a significant rally,” the analyst concluded.

As of this writing, Aptos trades at $5.02, a 16.1% decline in the weekly timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Bitcoin price tags $86K as Trump tariff relief boosts breakout odds

Where Top VCs Think Crypto x AI Is Headed Next

India’s Leading Bitcoin And Crypto Exchange Unocoin Integrates Lightning

Solana Triggers Long Thesis After Pushing Above $125 – Start Of A Bigger Rally?

Popcat price surges as exchange reserves fall, profit leaders hold

Crypto Analyst Says Bitcoin Back in Business, Calls for BTC Uptrend if One Support Level Holds

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x