Adoption

The ownership of everything: Сentralization vs. decentralization | Opinion

Published

4 months agoon

By

admin

The physical real-world asset super-system is humanity’s best defense against the rising threat of centralized ownership of all physical assets.

Source link

You may like

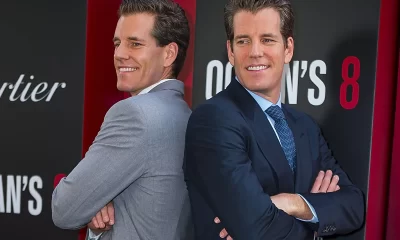

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Adoption

Survival of the healthiest: Creating a successful crypto

Published

6 hours agoon

November 24, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Darwin’s theory of evolution suggests that living organisms best adjusted to their environment are the most successful at surviving. Organisms struggle against each other in competition for resources that are necessary for existence within their environment. The same principle can be applied to cryptocurrencies. In a volatile, decentralized world characterized by competition among networks, only the healthiest, most well-structured ecosystems survive. Developers should, therefore, focus on developing a ‘healthy’ underlying network for crypto to ensure they stand the best chance of surviving the next evolutionary cycle.

What makes a crypto ‘healthy’?

The nature of cryptocurrencies is vastly different from that of living organisms, so the resources that make a crypto ecosystem ‘healthy’ differ from those that make a living organism ‘fit.’

Cryptocurrencies are decentralized virtual assets existing in the web3 space, so they rely on many individual users to interact within this ecosystem to create a healthy store of value. Like fiat currencies, without this social network made up of token holders, a cryptocurrency asset has no value. Each cryptocurrency can represent its own ‘culture’ through a transactive coin, where value is rooted in the psychology of its holders. This is mirrored by the fact that social events, user perception, and supply often impact the value of the token.

Since all cryptocurrencies derive value from community and user interactions within the web3 environment, they compete within the same web3 parameters for user attention and transactions. The parameters used to define a ‘healthy’ crypto network relate to token holder activity and include the principles of distribution, variety of holders, variety of transactions, and token flow, where there must be a sustainable number of diverse transactions.

It is not just about having user activity, but the right kind. If one individual lived in a nation-state as its sole citizen with a bank account of $100 million, the GDP per capita of that nation would be the best in the world—yet its chances of survival would be non-existent. Since there is only one holder, there would be no scope for transactions or a variety of holders, rendering it defunct and with no value.

Whilst living organisms may be competing for things like food and resources in the real world, cryptocurrency tokens are competing for transactions and user attention in the web3 world.

Since cryptocurrencies rely on blockchain, an open-source ledger storing all transactions, it is possible to map all transactions between wallets within an ecosystem and measure the parameters that determine a ‘healthy’ network. In practice, we can see which token ecosystems are developing ‘healthy’ networks and which ones are slowly becoming extinct. Over time, any patterns that align with network failure, including manipulation or crime, like any other asset class, can increase the risk relating to a token. With this data, we can rate and rank ecosystems, determining which ones are winning the competition for survival.

Bitcoin & Matic: A success story

Bitcoin (BTC) has been able to construct a healthy network. It is estimated that 106 million people around the globe own Bitcoin, making it the most widely held token. Significantly, Bitcoin now represents 58% of the total value of crypto, showing that amongst web3 users, Bitcoin is overwhelmingly the most popular store of wealth. Not only is it widely held, but it is also widely transacted. Throughout the first half of 2024, Bitcoin’s blockchain regularly had over 400,000 transactions a day. This sustainable and high transaction volume is reflected in Bitcoin’s pricing. Whilst it has experienced several devaluations, it has been sitting above $50,000 for the past nine months, and it is one of the most stable cryptocurrencies in the market, having recently surpassed 90,000 USD.

Similarly, Polygon (MATIC), has constructed a healthy network. Around 633,588 wallets hold Matic, making it a widely held token. It is also widely transacted, in varying amounts and for a variety of reasons, making it robust. Throughout 2024, Matic has regularly had over 4100 transactions a day. This sustainable and high transaction volume is reflected in Matic’s 24-hour trading volume, which sits at 7.76m USD.

Dogecoin: A rapid unraveling

Although Dogecoin (DOGE) has rallied hard in recent years, it has failed to establish a ‘healthy’ network. At certain times, it has experienced a large amount of user activity, which has driven up prices momentarily. This includes early 2021, when Dogecoin’s price increased dramatically by 23,000%. However, the number of transactions that drove this price increase was not sustainable. The user activity here was driven by short-term hype, and the transactions taking place were not diverse. The majority of users were interacting with the network purely to ‘pump and dump‘ rather than for any long-term, sustainable utility. This was fuelled primarily by Elon Musk simply tweeting about the token, creating an anomalous spike in price. This rally demonstrated the token’s immense volatility and lack of an entrenched perception by users that Dogecoin has value rooted in something greater than a singular point of interest. Whilst it is still held by around 4 million people, and it still has relatively high levels of transactions, in October 2024, around 250,000 daily transactions. However, a significant 82% of the total circulating Dogecoin is held by a shockingly small amount of wallets, only 535, demonstrating a lack of variety of transactions.

Dogecoin is experiencing another surge thanks to the recent US election result and Elon Musk’s appointment to Trump’s Department of Government Efficiency. Yet, while it has moments of high price, these have not been driven by sustained and meaningful growth. Where Dogecoin has been unable to create a sustainable number of transactions from a diverse array of wallets, Bitcoin and Matic have been able to do so. The evidence is in Bitcoin and Matic’s comparatively stable growth and Dogecoin’s volatility. While DOGE is still holding on, this is driven by hype; like the dinosaurs that came before us, it will likely become extinct.

Focus on the network, not the price

The success of cryptocurrencies and sustainable price increases rests on the health of the web3 network underpinning the token. Rather than focusing on driving the price up for the sake of price, a cryptocurrency developer should, therefore, focus on developing a ‘healthy’ underlying network by harboring sustainable and diverse transactions. This will lay the groundwork for tokens to attract users, beat off competing networks, and ultimately lead tokens to grow in price.

Simon Peters

Simon Peters is the CEO and co-founder of Xerberus, a cryptocurrency risk rating protocol offering industry-leading analysis through its Wallet Graph™️ technology. Xerberus is designed to map and monitor the systemic health of a crypto asset in real-time through its investor wallet network.

Source link

Adoption

AI startup Genius Group picks Bitcoin as main treasury asset

Published

2 weeks agoon

November 12, 2024By

admin

Bitcoin as an institutional reserve asset gained more traction as a Singapore-based AI company took a page from MicroStrategy’s book.

Per a press statement, publicly-traded artificial intelligence firm Genius Group will onboard Bitcoin (BTC) as its main treasury holding and immediately purchase $120 million worth of the world’s leading cryptocurrency.

Genius Group also said it would hold 90% of its current and future treasury value in Bitcoin, adding to its initial 1,380 token buy plan disclosed on Nov. 12. The startup’s GNS shares surged 50% during pre-market trading, according to Yahoo Finance. GNS prices shook off gains by publishing time, but the shares still traded higher than their previous close.

At least three institutional players have now adopted the BTC accumulation strategy pioneered by Michael Saylor’s software behemoth MicroStrategy. Firms like Tokyo’s Metaplanet, medical tech provider Semler Scientific, and now Genius announced BTC purchasing plans inspired by Saylor’s company.

All three companies hold over 1,000 BTC. The trio were leagues away from MicroStrategy’s 279,420 Bitcoin trove valued at over $24 billion due to recent highs.

We believe that with our Bitcoin-first strategy, we will be among the first NYSE American listed companies to fully embrace Microstrategy’s Bitcoin strategy for the benefit of our shareholders.

Thomas Power, Genius Group director

Stocking most of its treasury with BTC was also revealed shortly after Genius reshuffled its top decision-makers. Genius added multiple crypto-savvy board members as the firm paid more attention to web3 and blockchain technology.

Source link

Adoption

Crypto wins the vote in the 2024 US elections

Published

3 weeks agoon

November 3, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

The 2024 US election campaigns have been a masterclass in how to compel a large group of people to elect their country’s leaders. In a short time, we’ve seen sentiments shift after each candidate began their campaign trails and made promises to voters surrounding issues such as immigration, cost of living, and reproductive rights.

From spreading memes about migrants eating cats and dogs and the humorous “coconut tree” remark to the decisive role of lobbying regulators, the similarities between pushing political messaging and crypto narratives are difficult to ignore.

Crypto is no stranger to compelling messages. One of the most memorable phrases in crypto history, “The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks,” contained in Bitcoin’s (BTC) genesis block, is a reminder of the powerful messaging that has helped propel the industry forward. For crypto to win the “people’s vote” again, the industry can learn from several foundational communication principles we observed in this year’s elections.

Tapping into the psyche of the masses with memes

The use of memes in political messaging this election cycle has helped candidates engage the voter base and shift their perceptions.

In July, singer Charli XCX took to her almost 3.7 million followers on X to endorse Kamala Harris with a three-word X-post, “kamala IS brat.” Brat was an album launched by Charli XCX, with notable colors of neon lime green and black. The Harris campaign quickly adopted the theme into their campaign color scheme, resulting in the “Kamala is brat” meme exploding across the web and TikTok, introducing a new cultural reference that positively shaped discourse. This is particularly significant for young and new voters who are increasingly getting their news through social media, according to Pew Research.

Originating from evolutionary biology, memetics, the study of memes explores how ideas, behaviors, and cultural phenomena spread. The light-heartedness of the medium allows people to digest complex or unsettling political realities in a more approachable way, impacting voter attitudes at an emotional level.

Crypto has seen its successful application through memecoins like Dogecoin (DOGE), Shiba Inu (SHIB), and Dogwifhat (WIF), which leverage meme culture to build communities and hype. Similar to political memes spreading ideology, memecoins spread economic narratives through humor and social media engagement.

The overall industry needs to see a return to memes that captivate users broadly. Popular memes like ‘diamond hands,’ ‘WAGMI’ (we’re all gonna make it), and HODL (hold on for dear life) have in the past spread beliefs about crypto like wildfire. The industry needs to craft new memes and leverage new moments to maintain its relevance and resonate with broad audiences again.

The use of emotional and purpose-driven messaging

Political campaigns also provide examples of how emotionally resonant, purpose-driven language connects with supporters.

Donald J. Trump’s campaign used many bold statements of purpose that studies show resonate with themes of strength and patriotism. Among the most popular is the campaign’s “Make America Great Again” (MAGA) message. His appeal is connected to the psychological readiness in the US culture for an antihero figure, who represents someone bold and unconstrained by typical political decorum and the willingness to challenge the status quo. This was symbolized in Trump’s call to “fight, fight, fight!” that spread following the assassination attempt in July.

The web3 parallel is the need to evoke purpose when speaking to end-users by bypassing complex jargon in favor of emotionally engaging language. Mert Mumtaz, CEO of Helius Labs, a key crypto opinion leader, uses direct and emotionally engaging messaging to resonate with crypto enthusiasts. His commentary, which centers around key trends and recent events, enhances his credibility as a key spokesperson for Solana (SOL) and blockchain tech broadly.

Similarly to how political campaigns use soundbites that reflect the core values of the voter, web3 projects and founders need to rely more on using memorable statements that create an emotional connection, creating greater buy-in from a wider audience.

Lobbying to engage policymakers more seriously

Lobbying played a notable role in this year’s elections. The health of US citizens became an issue that rose in prominence when health lobbyist Calley Means reconnected Republican and independent presidential candidates Donald Trump and Robert F. Kennedy Jr. This played a part in RFK dropping out of the race to support Trump’s campaign, catalyzing the MAHA (Make America Healthy Again) movement and may make a difference in the final election outcome.

The US crypto industry itself has experienced regulatory hostility towards companies after the FTX collapse. Since then, there has been a growing realization that the use of money in politics is simply the way the system operates. Lobbying is needed for the industry’s priorities to be heard in the halls of Congress.

The last two years saw a major uptick in advocacy efforts for better US crypto policy. As of mid-October, crypto-focused super PACs (political action committees) had spent over $134 million to persuade voters to elect Congress members who support crypto. Just this week, the CEO of Coinbase, Brian Armstrong, announced the company was committing an additional $25 million to support the Fairshake PAC leading up to the 2026 midterms to elect pro-crypto candidates.

A continuation of this strategy by US companies could lead to significant shifts in US policy and could see better reception of crypto by users locally, with a ripple effect globally.

The 2024 US elections were littered with examples of masterful communication tactics that can be adopted by crypto projects. As the focus of the industry begins shifting from infrastructure development to the growth of consumer applications across various verticals, these strategies will be increasingly important in persuading users about why they should choose the products offered instead of the many other alternatives available to them.

Debra Nita

Debra Nita is the associate director and head of growth at YAP Global, a crypto-native PR firm. With over a decade of strategic communications and product marketing experience, Debra helps leading crypto and web3 projects gain publicity and build their reputation through top-tier media coverage, leadership, and narrative development. Her expertise includes layer-1 blockchains, rollups, decentralized finance, zero knowledge and cryptography, and stablecoins. Debra has also been a speaker and hackathon judge at leading crypto conferences, including ETHDenver, Mainnet in NYC, ETHToronto, and ETH Kuala Lumpur.

Source link

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential