Altcoins

The Sandbox Sets Sights On 1,111% Growth Amid Pressures

Published

3 months agoon

By

admin

The Sandbox (SAND) has lately attracted interest with opposing opinions on its potential price movement. Although some analysts believe there is room for large increases, short-term data point to a more wary stance.

Though long-term estimates show a different, more hopeful picture, recent studies hint to a likely price decline in the next weeks. What then is the actual SAND story, and should investors act right now or hold off?

Related Reading

Crypto price prediction website CoinCodex says, by mid-October 2024, the total value of The Sandbox should have gone down by 5.45% to $0.232674. Technical indicators are rather unfavorable. If indeed, as it’s turned out today,

The Fear & Greed Index is neutral at 51, then there is definitely no sigh of quick recovery in sight either. SAND has 63% of the green days over the last month; however, its volatility rate is 6.27%, which speaks for continuous instability.

Transient Issues

Short term, SAND does not look amazing. The technical perspective of things so far is a bit conservative, meaning that now may not be the best time to buy. While SAND has recently been able to display resilience with a decent number of green days, the overall vibe is trending down. Waiting for more favorable conditions could be a preferable plan for people trying to make rapid profits.

Some investors are hanging on despite the great volatility, thinking the market would shortly flip. Nothing new about volatility in cryptocurrencies; The Sandbox has seen such storms previously. This does not mean, though, SAND is impervious to more declines. Should the price projection be accurate, a slide to $0.232674 could attract more short-term market activity.

Long-Term Positive Outcomes

Unlike the gloomy short-term projection, some analysts—like Alan Santana—are showing a more optimistic long-term stance. Santana speculates that SAND might be in a critical accumulation phase with great upside possibility.

He claims that although recent volatility has caused fluctuations, the coin has regularly reached lower lows since July 2021, pointing an overall increasing trend. Moreover, he thinks that this would be a great opportunity for long-term investors to build SAND at the present low price.

#Altcoins ✴️ The Sandbox 1,111% Growth Potential (Accumulation Strategy)

While we are going to be looking at the log. chart for The Sandbox, when we look at the linear chart we can simply say that this pair is trading at bottom prices.https://t.co/sx1l4xkU6a

A simple… pic.twitter.com/GWEu2qSxkC

— Alan Santana (@lamatrades1111) September 14, 2024

Santana has lofty long-term SAND projection. From its present price, he projects a price goal of $22.22, which offers a whopping 8,600% return on investment. Apart from this long-term objective, one has to take short-term figure into account. Santana projects a 415% rise not too far off, then a mid-term target of 1,111%. Investors could make significant gains even before the long-term goal is met.

Related Reading

Market Change To Bullish?

The whole cryptocurrency sector fought to start a bull run in 2023. SAND, like several cryptocurrencies, fell to their lowest levels in recent months. Some observers believe the market is gradually turning bullish. If this changes, The Sandbox may benefit from a market resurgence.

The Sandbox is currently showing $0.2532 and declining some 0.27% over the past day. Long-term promise is here–even so with a few short-term hazards–because there are some unfavorable warnings at the moment that investors will have to weigh against the more hopeful view for 2025 and going forward.

Featured image from Phemex, chart from TradingView

Source link

You may like

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Altcoin Season

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Published

15 hours agoon

December 23, 2024By

admin

The creators of the crypto analytics firm Glassnode are warning that altcoins could lose all bullish momentum following last week’s market correction.

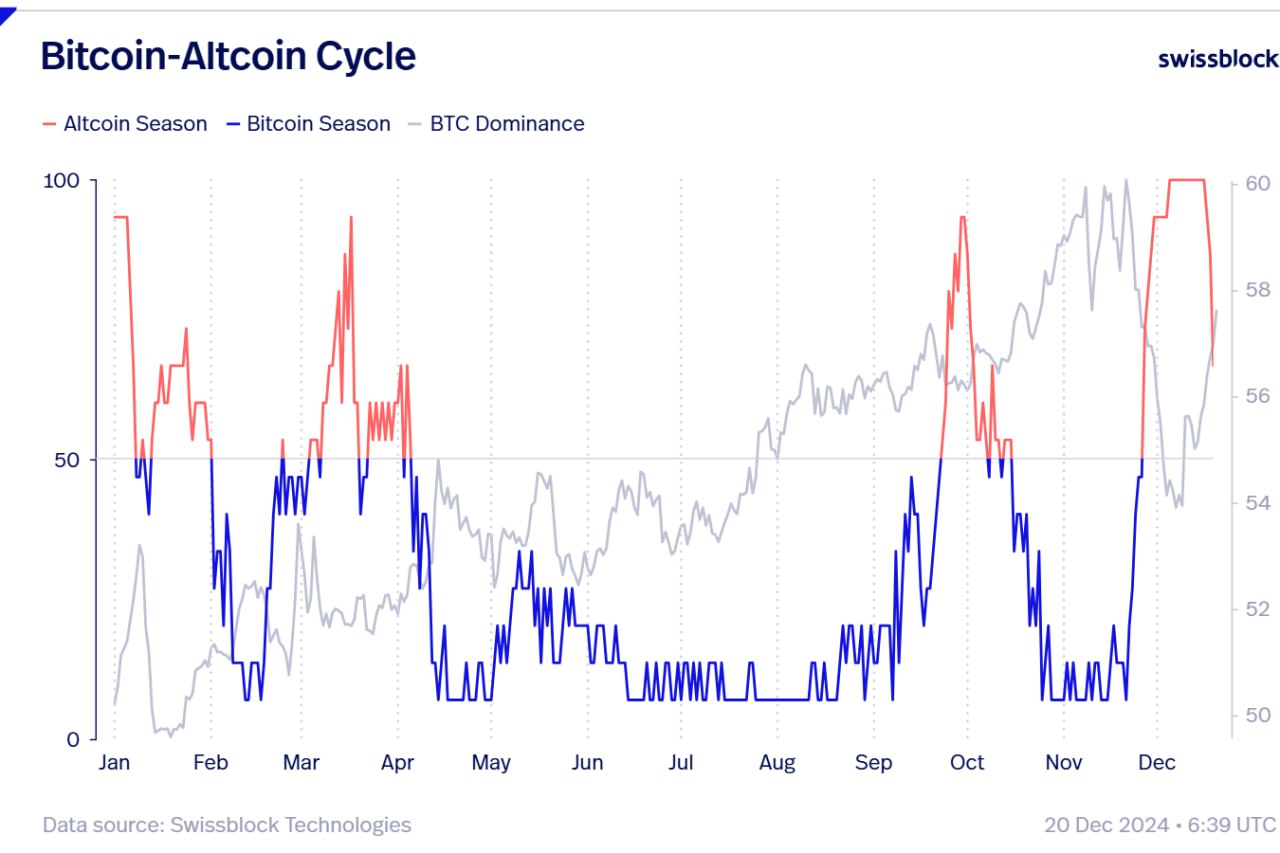

Jan Happel and Yann Allemann, who go by the handle Negentropic on the social media platform X, tell their 63,400 followers that “altcoin season,” which they say began in late November, could come to an abrupt end after alts witnessed deep pullbacks over the last seven days.

According to the Glassnode co-founders, traders and investors will likely have a risk-off approach on altcoins unless Bitcoin recovers a key psychological price point.

“Is This the End of Altcoin Season?

Bitcoin dominance is surging after dipping below $100,000, while altcoins are losing critical supports. Dominance has risen and resumed its upward trend, signaling a stronger BTC environment.

If BTC stabilizes above $100,00, we might see a pump in altcoins now in accumulation zones. Until then, Bitcoin appears poised to lead, leaving altcoins lagging behind.”

The Bitcoin Dominance (BTC.D) chart tracks how much of the total crypto market cap belongs to BTC. In the current state of the market, a surging BTC.D suggests that altcoins are losing value faster than Bitcoin.

At time of writing, BTC.D is hovering at 59%.

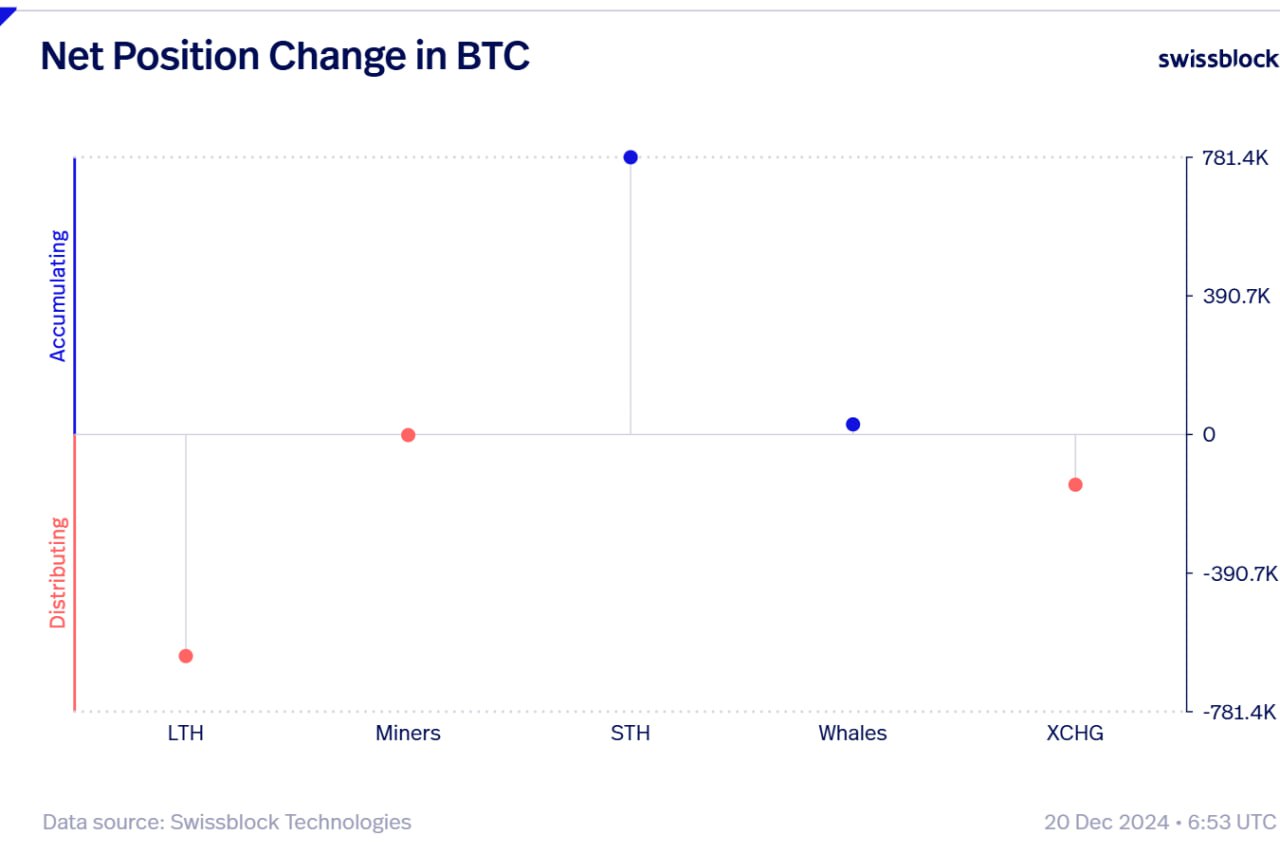

Looking at Bitcoin itself, the Glassnode executives say long-term Bitcoin holders are massively unloading their holdings as other investor cohorts pick up the slack.

“The Board Keeps Shifting.

As BTC continues flowing out of exchanges during this dip, long-term holders are exiting forcefully, while short-term holders step in without hesitation.

Whales quietly accumulate, miners remain neutral, and selling pressure has merely reshuffled the board.

New hands are absorbing the sales.”

At time of writing, Bitcoin is worth $97,246.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

Published

1 day agoon

December 22, 2024By

admin

Bitwise CIO Matt Hougan says a wave of institutional interest in altcoins is coming next year, largely due to potential regulatory clarity and more exchange-traded funds (ETFs).

In a new interview with Bloomberg, Hougan says that institutional money is in the early stages of broadening out to other crypto assets besides just Bitcoin (BTC).

Hougan forecasts that 2025 will be the year that institutional investors will begin to incorporate more diversification in their crypto-investing strategies the same way they do in other asset classes like equities or bonds.

“You’re already seeing it broaden out actually. A lot of people were worried about the Ethereum ETFs for instance, which launched this summer and had tepid inflows.

But over the last month or so, you’ve seen billions of dollars flow into those products.

Again, the things that have happened in crypto in the past keep happening. Historically, most people enter crypto through Bitcoin, and then they discover Ethereum, and then they think about Solana. There’s no reason to assume that the institutions that came into Bitcoin won’t move on to other assets in the future.

In fact, I think in 2025, you’re going to see an explosion of interest in index space strategies that give diversified exposure to crypto. Of course, [that is] something we’ve been doing at Bitwise since 2017 when we pioneered that concept. I think 2025 is when that becomes a mainstream way to allocate to this space, the same way it is to stocks and bonds and real estate and everything else.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Julien Tromeur/Sensvector

Source link

Altcoins

Analyst Says Altcoin That’s Rallied Over 21,000% Year-to-Date at a ‘Do-or-Die’ Level, Updates Outlook on Bitcoin

Published

3 days agoon

December 20, 2024By

admin

A widely followed cryptocurrency analyst and trader is saying that an altcoin in the Solana (SOL) ecosystem is at a critical juncture.

The analyst pseudonymously known as Sherpa tells his 234,700 followers on the social media platform X that the memecoin Popcat (POPCAT) is at a “do-or-die” level.

Based on Sherpa’s POPCAT chart, it appears that the Solana-based memecoin has formed a head and shoulders pattern on the daily time frame and could plunge if the support level fails to hold. A head and shoulders pattern is typically considered a bearish pattern in technical analysis.

POPCAT is trading at $0.802 at time of writing, up by 21,147% since the January 5th low of $0.00379.

Next up is Bitcoin (BTC). According to Sherpa, there are several reasons to remain bullish on Bitcoin and other crypto assets, even after a recent correction that saw the flagship digital asset briefly dip below the $100,000 price.

“Bitcoin dominance has yet to come down.

Ethereum has yet to fully send.

January is an incredibly bullish time for crypto.

[US President-elect] Trump is pro-crypto, owns some, and has his own decentralized finance (DeFi) project.

….and you’re selling??”

Bitcoin is trading at $100,624 at time of writing. Bitcoin dominance, the ratio of the market cap of Bitcoin relative to the rest of the crypto market, is currently at 54.7% down by several percentage points from the 2024 high of 58.99% recorded mid-last month.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential