Bitcoin

The tariff war fallout: Is crypto to the rescue?

Published

3 days agoon

By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

The Trump administration introduced new tariffs and expanded existing ones, which resulted in increasing trade tensions among major partners like China, the European Union, and Mexico. Global financial markets are significantly impacted by these actions, which causes increased economic uncertainty and volatility. These tariffs are aimed at a range of products, from aluminium and steel to cars and various electronic components. Unsurprisingly, some countries have responded with counter-tariffs on US exports, which could potentially trigger a big trade war.

This back-and-forth has resulted in increased trade barriers, which are slowing down economic growth—a trend that’s evident in recent macroeconomic indicators, including the Conference Board consumer sentiment index. Consequently, forecasts for US GDP growth have been adjusted downward due to the impact of these tariffs. The automotive sector, which relies heavily on imported parts, is also feeling the pinch, with Ford Motor Co. recently announcing a significant cut in expected dividends.

How trade barriers are turning Bitcoin into a global safe haven

Donald Trump’s recent actions prove that his attitude towards his tariffs is very consistent and goal-oriented, which has sparked a ‘contrarian’ positive outlook for cyclically resistant investment assets, where Bitcoin (BTC) occupies a special position. With rising tariffs and inflation worries, more people are turning to alternative, discorrelated assets, which are broadly viewed as a safeguard against both inflation and impending economic instability in general.

Historically, Bitcoin has proven to be quite resilient during tough economic times. For instance, during market upheavals—like the banking sector turmoil we saw in 2023 following the collapse of Silicon Valley Bank—Bitcoin evidently experienced price surges, hinting at a “flight to safety” trend being formed robustly and meaningfully. However, to date, such trends remain mostly perceptional and, therefore, unfortunately, hard to quantify and algorithmize.

Having said that, the fact that the US is still at the forefront of various innovative efforts in cryptocurrency and AI somewhat mitigates the broader implications of the tariff situation. Recently, Senator Cynthia Lummis (R-WY) put forth a legislative proposal suggesting that the US should acquire one million BTC, representing about 5% of the total fixed supply. This initiative is expected to spark a new wave of significant activity in the crypto market.

The combination of supportive government policies for crypto and the expectation of more tariff actions will likely create a complex but potentially very favorable market sentiment for Bitcoin. Once again, investors, swayed by these developments, are starting to see Bitcoin as a safe haven with the potential for sustained growth in a post-tariff landscape. The current market vibe, shaped by Trump’s tariff strategies and the prospect of long-term shifts, makes Bitcoin look like a low-downside-high-reward investment opportunity.

AI and robotics: Winners in the tariff war

Meanwhile, AI-aided automation and robotics are on the rise as increasing import costs from China push American manufacturers to cut labor costs. Similarly, countries like Vietnam and India are reaping the benefits as global companies relocate their manufacturing operations from China to avoid tariff-related expenses. Additionally, I see a lot of promise in sectors like AI, nuclear energy, and other manufacturing industries, which have the chance to set up operations in the United States.

Integrating AI and automation within manufacturing industries can drive greater adoption of Bitcoin as a secure and efficient method of financial transactions, incorporated into metaverse and web3 ecosystems. Furthermore, the demand for AI technologies to support automated processes will likely surge, presenting new investment opportunities in the AI sector. Most importantly, the synergy between AI-aided automation, robotics, Bitcoin, and AI investments has the potential to reshape the future of the manufacturing and technology industries, which will drive even more attention to Bitcoin.

Tariffs, trade wars, and rising risks: What investors should watch out for

Trade barriers may—at least initially—disrupt certain supply chains, increase business costs, and reduce export demand due to retaliatory tariffs. Instability in one major market or economy due to trade tensions can spill over to other countries and regions, creating a global ripple effect. This can lead to lower investment, reduced hiring, and overall slower economic expansion, potentially even triggering a recession where gold and alternative assets like Bitcoin would definitely play special risk aversion roles, making their increasingly anti-correlative Betas more and more attractive for ordinary investors to “join the club.”

It is important to keep the focus on the long term and invest in industries with high potential, such as AI, nuclear energy, healthcare, and rare earth metals. There may be some transitory, recoverable meltdown because the market is overvalued due to years of way-too-buoyant liquidity and overrated optimism. Still, if companies decide to quickly move to make production in the US and replace costly outsourcing, they have a great future due to the huge domestic market in this world’s largest economy.

To navigate the challenges of this shaky market, both private investors and institutions can use a variety of diversification strategies. One effective approach is asset class diversification, which involves spreading investments across different types of assets like stocks, bonds, real estate, commodities, and certainly alternative options like Bitcoin and other cryptocurrencies. Additionally, it’s important to consider both developed and emerging markets while using various investment strategies—like value investing, growth investing, or dividend investing—which normally yield different results in different market conditions.

Final words

Currently, the market’s reaction to Trump’s tariffs suggests that Bitcoin is becoming more discorrelated to broader macroeconomic and geopolitical factors and, hence, more appealing regarding both asset-protection and investment portfolio hedging purposes. Historically, Bitcoin demonstrated notable resistance to economic cycles and episodes of banking system instability. Now, it offers a legitimate test of its suitability as a risk aversion tool for real-world economic troubles. Its inclusion in the U.S. strategic reserve further underpins this thesis.

John Murillo

John Murillo is the chief dealing officer of B2BROKER, a global fintech solutions provider for financial institutions. John is a seasoned trading professional with more than 20 years of experience in capital markets. Throughout his professional life, John has managed broker-dealer business, performed risk management for trading desks with high volumes, and worked with institutional clients worldwide to deliver tailored liquidity solutions. He has been part of B2BROKER since its early days, ensuring the company grows and functions effectively. At B2BROKER, he is responsible for all the facets of liquidity, ensuring client setups are seamless before going live and enhancing internal risk management procedures. Treasury operations, creating strategic services, and expanding international market presence are also among his duties.

Source link

You may like

Dogecoin Follows This Blueprint, Says Crypto Analyst

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Bitcoin

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Published

1 hour agoon

April 14, 2025By

admin

Japanese technology firm Metaplanet has acquired an additional 319 bitcoin worth approximately ¥3.78 billion ($26.3 million), continuing its aggressive bitcoin accumulation strategy amid growing U.S.-China trade tensions.

The Tokyo-listed company purchased the bitcoin at an average price of ¥11.85 million ($83,147) per coin, according to a company announcement on Monday. The latest acquisition brings Metaplanet’s total bitcoin holdings to 4,525 BTC, with an aggregate cost basis of $408.1 million at an average purchase price of $90,194 per bitcoin.

The purchase comes as bitcoin experienced a slight decline over the weekend, dropping more than 2% to $83,482 during Asian trading hours. The bitcoin and crypto market has shown sensitivity to emerging geopolitical tensions, particularly surrounding potential new U.S. trade tariffs targeting Chinese electronics.

Metaplanet often referred to as “Asia’s MicroStrategy,” has outlined ambitious plans to expand its bitcoin holdings by 470% to reach 10,000 BTC by the end of 2025 and 21,000 bitcoin by the end of 2026. The company evaluates its performance through “BTC Yield,” a metric measuring bitcoin holding growth relative to shares outstanding. For Q1 2025, Metaplanet reported a BTC yield of 95.6%, with a year-to-date figure of 6.5% as of April 14.

The company’s latest move has elevated its position to become the ninth-largest public holder of bitcoin globally. Metaplanet’s bitcoin strategy has gained additional attention following the recent appointment of Eric Trump to its Strategic Advisory Board, citing his business expertise and passion for bitcoin. The timing of the purchase coincides with complex market dynamics as investors process mixed signals from Washington regarding U.S. trade policy.

Metaplanet’s bitcoin acquisition strategy is supported by various capital market activities, including bond issuances and stock acquisition rights, designed to raise funds while minimizing shareholder dilution. The company has currently executed approximately 41.7% of its “210 million plan.”

Metaplanet’s strategic pivot to bitcoin accumulation closely mirrors the playbook pioneered by Michael Saylor’s Strategy, albeit on a smaller scale. Since launching its bitcoin treasury operations, the Japanese firm has demonstrated remarkable success in implementing a similar approach of leveraging financial instruments and market opportunities to acquire bitcoin.

Like Strategy, Metaplanet has utilized a combination of convertible debt offerings and equity-linked instruments to fund its acquisitions while maintaining a healthy balance sheet. The strategy has yielded impressive results, with the company’s bitcoin holdings growing to over 4,500 BTC in just over a year.

Source link

Bitcoin

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Published

3 hours agoon

April 14, 2025By

admin

A widely followed crypto strategist believes that Bitcoin (BTC) can take the path of higher for longer this market cycle.

Pseudonymous analyst Jack tells his 268,200 followers on the social media platform X that he thinks Bitcoin will not print a new all-time high this year after US President Donald Trump instigated a global trade war and created uncertain market conditions.

The trader shares a chart suggesting that Bitcoin will create a durable bottom between $66,000 and $80,000 for the rest of the year before launching a new bull run in 2026.

“Trump path clearly is contraction for now.

But in that world of less globalization and trust, Bitcoin is a good asset to have, becoming a ball held under water.

Similar to how 2013 saw a short bear [market].”

Looking at the trader’s chart, he appears to suggest that Bitcoin will rally to as high as $297,000 by November of 2026.

Jack says that one catalyst that could send Bitcoin flying is the potential capital rotation from gold to BTC. According to the trader, gold investors will eventually come to know that Bitcoin is far better than the precious metal as a safe-haven asset.

“What if Gold is trading like it is because everyone is scrambling to redeem paper for physical, of which there is a scarcity, vs. all the paper that has been issued, essentially catching up to its true value that has been diluted with paper

Bitcoin doesn’t have this issue and will rally once people realize it is the better alternative for trade due to this very specific property.”

“Paper” gold refers to financial instruments that allow investors to gain exposure to the precious metal without having to deal with the expenses or logistics of physically possessing the commodity. Jack appears to be highlighting Bitcoin’s portability as BTC holders can easily store, access and transfer their coins as long as they have the keys to their wallet.

At time of writing, Bitcoin is trading for $84,244.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

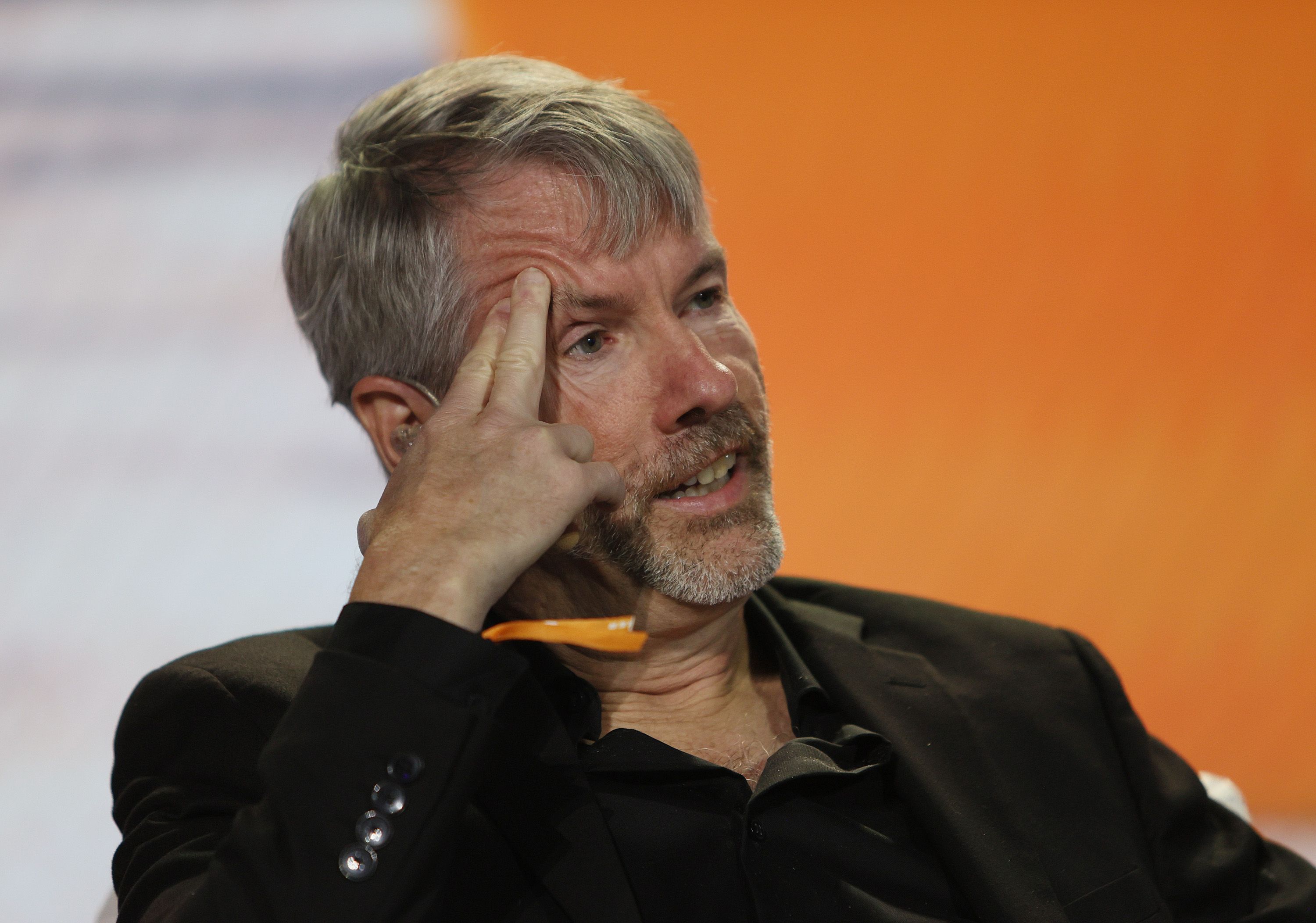

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Published

7 hours agoon

April 14, 2025By

admin

Bitcoin (BTC) proponent Michael Saylor has hinted the company he co-founded, Strategy (MSTR), may be set to announce an additional BTC purchase this week shortly after revealing it expects a net loss in the first quarter of the year over unrealized losses on its massive BTC holdings.

The company has added 80,785 BTC to its balance sheet since the beginning of the year after raising a total of $7.69 billion during the first quarter, with over half of that coming from common stock sales. Most, if not all, of those funds were used to buy bitcoin.

On Sunday, Saylor posted a BTC holdings tracker to X, a move that typically precedes a purchase announcement, commenting there are “no tariffs on orange dots.” The comment implies the company’s BTC purchases were unaffected by the reciprocal tariffs Donald Trump introduced earlier this month and the ensuing U.S.-China trade war.

The company paused its buying during the week ending April 6. Its crypto stash is currently worth roughly $44.59 billion, and was acquired for $35.63 billion.

Strategy currently holds 528,185 BTC bought at an average price of $67,458 according to Bitcointreasuries data equivalent to 2.515% of the cryptocurrency’s total supply.

Source link

Dogecoin Follows This Blueprint, Says Crypto Analyst

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x