Opinion

The Urgent Need for Bitcoin Tax Reform to Encourage Everyday Use

Published

3 months agoon

By

admin

The debt based monetary system has become quite extreme. On one hand, the US crossed the $35 trillion national debt milestone, placing a $104k burden on every US citizen. On the other hand, the Congressional Budget Office (CBO) puts federal expenditures for 2024 at 24.2% of GDP.

This divergence between profligate spending and debt ballooning puts the economy on a narrow path. It is exceedingly unlikely that USG would opt to reduce spending, most of which goes to social programs, entitlements and the military. The latter alone is the key ingredient that backs USD as world currency.

Conversely, this entails another Fed balance sheet expansion, with three 0.25% rate cuts this year already priced in. In turn, non-currency assets like equities, gold and Bitcoin are poised for growth yet again. At the root of this dynamic is the question of information validity.

Just as the US Bureau of Labor Statistics is expected to revise down job figures by up to one million between April 2023 and March 2024, the information corruption is visible with central banking itself. If the Federal Reserve can increase M2 money supply by 27% in 2020-21, the money itself loses informational coherence.

It is this why investors then seek equities, gold and Bitcoin. These assets become vehicles of value because currency loses its ability to reliably relay value. The problem is, they are also taxed as a way to subdue the velocity of exiting the central banking system.

This is especially pertinent for Bitcoin, a unique asset that is both a store of value but could be made as a daily transaction driver. The question then poses itself, is a legalistic landscape viable in which low-value Bitcoin transactions are exempt from federal taxation?

Bitcoin’s Usage and Currency Substitution Suitability

To understand the regulatory path forward, we first need to understand how Bitcoin is typically used. After all, contrasting Bitcoin usage against fiat usage paints a clearer picture if Bitcoin can be used as a practical currency, or if it will be perceived as a threat to the current monetary system.

Notwithstanding layer 2 scaling solutions such as Lightning Network, the more BTC is used the greater is the load on the Bitcoin mainnet as miners process transaction blocks. In turn, greater network activity generates greater friction, manifesting as escalating fees for each BTC transaction.

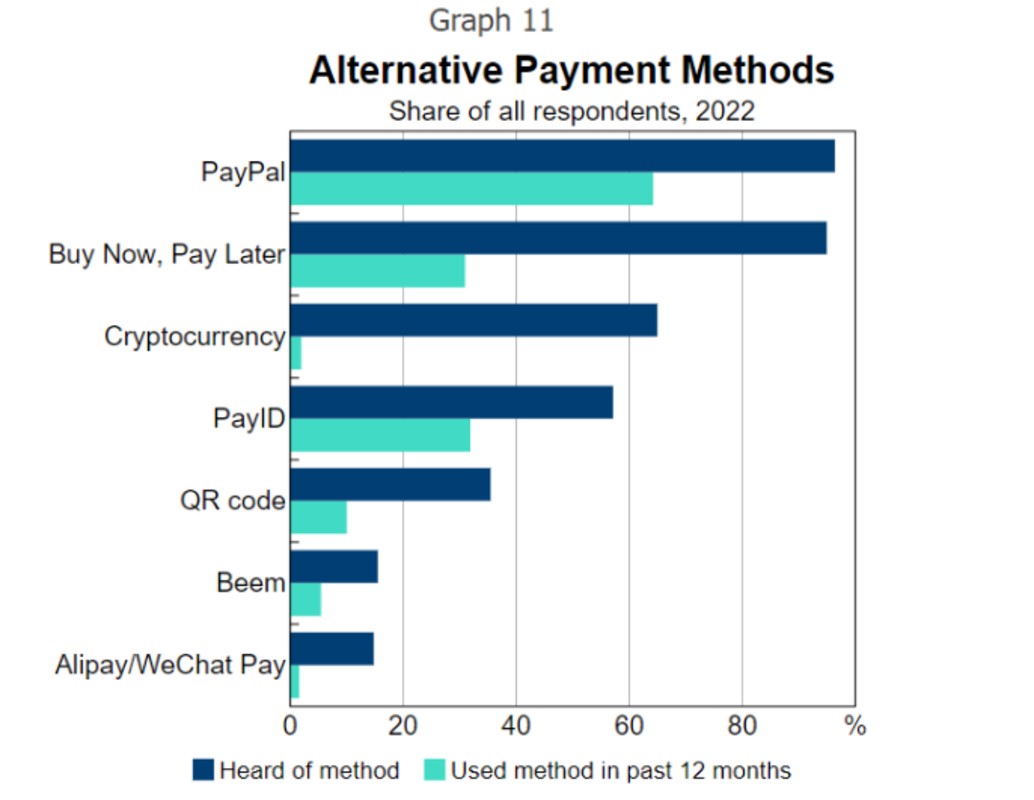

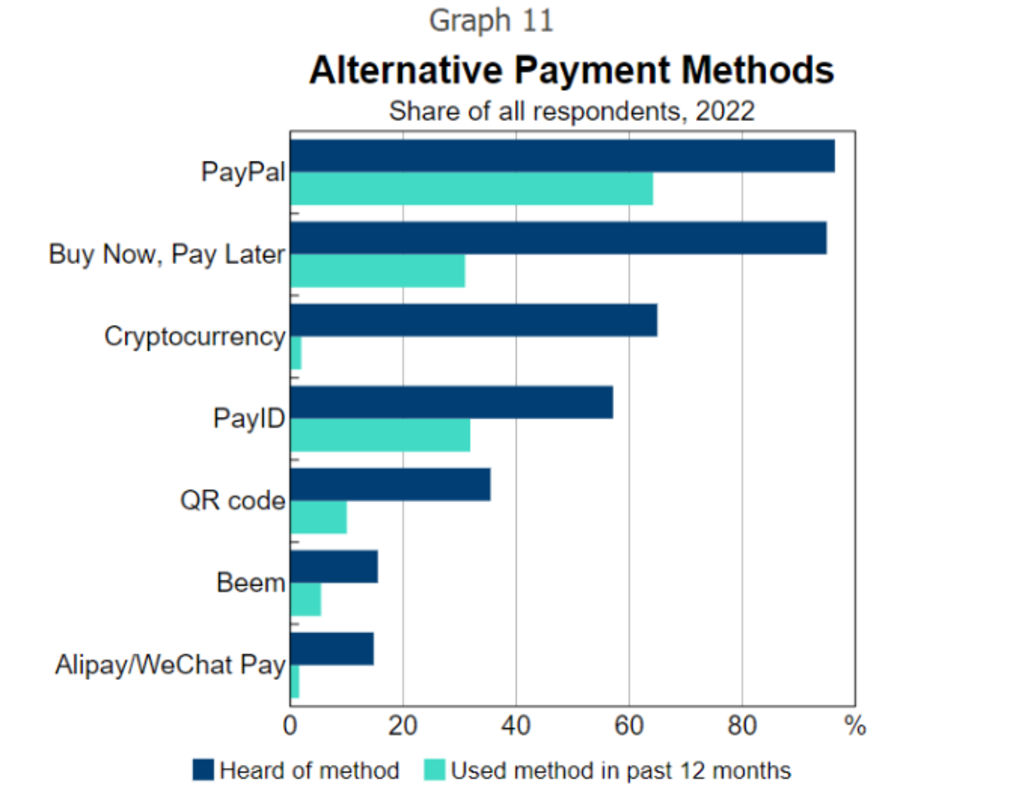

In a developed country like Australia, cryptocurrency usage for payments has been typically minimal.

Image credit: Reserve Bank of Australia

This is predictable as people need strong incentives to move away from existing payment solutions, ones that are already instantaneous and convenient.

At best, BTC transactions mostly revolve around third-parties facilitating BTC transactions using fiat currency. Case in point, Bitcoin onramp platform Strike had to ditch Prime Trust custodian as it eventually filed for bankruptcy. However, Strike still uses banks such as Lead, Cross River Bank, and Customers Bank.

In other words, Bitcoin adoption is attached to online payment systems, through commercial banks which are tied to central banks. The latter have already made money de facto digital, except it is hosted on their ledgers.

Although these institutions can tamper with the money supply, they can do so to facilitate maximum liquidity needed for a debt-based monetary system in which fiat currency is effectively a debt-tracker.

In contrast, Bitcoin’s scarcity makes it less appealing for such use. Gold already showcased this when it was abandoned. Because gold’s supply was not flexible enough to support a growing (debt-based) economy, mainstream economists viewed the gold-backed currency as outdated.

Moreover, Bitcoin is ill-suited as a daily currency driver against feeless alternatives like Nano (XNO) that boast eco-friendly green hosting or potential CBDCs. Rather, Bitcoin’s strength relies on inviolable scarcity, one that serves as a global reserve settlement layer.

While both of these factors, network friction and flexible liquidity, are making Bitcoin less suitable as a proper medium of exchange, it also makes Bitcoin less threatening to the system. But does that mean that Bitcoin’s tax treatment should be tweaked?

The Impact of Current Tax Policies on Bitcoin Usage

On exchanges and platforms like aforementioned Strike, users can freely buy Bitcoin without worrying it will be a taxable event. It only becomes so when BTC is sold for profit. Then, it is subject to capital gains tax for trading.

That’s because the Internal Revenue Service (IRS) designates Bitcoin as property. If Bitcoin is held less than a year before it is sold, holders are subject to ordinary income tax rate ranging from 10% to 37%.

Holding Bitcoin over one year makes it subject to 0% – 20% tax rate, depending on the income level spread across three brackets – 0%, 15% and 20%. In turn, Bitcoin holders have to keep a track of when they bought BTC, at which price, and when they sold it, at which price. The profit difference is taxed as capital gains.

Likewise, swapping Bitcoin for another cryptocurrency is a taxable event, subject to capital gains tax. If BTC is received as payment/earnings, or from mining/staking/airdrops, it is then treated as wages income tax, falling into the 10% – 37% ordinary income tax range.

Alongside buying BTC, holding it or donating it to a registered non-profit, users can also transfer bitcoins from exchanges to wallets without constituting taxable events. Although BTC gifts can also pass as non-taxable upon reception, they would still be subject to the same tax regime later.

In the case of selling Bitcoin at a loss, holders could write it off, limited to $3,000 per year (carriable into next year if exceeded). At the moment, it is still possible to engage in Bitcoin tax-loss harvesting, in which holders can sell BTC at a loss to claim the tax break, and then buy it back.

Unfortunately, this leeway not enjoyed by shareholders could be terminated with the proposed Lummis-Gillibrand Responsible Financial Innovation Act, under Section 1091, “Loss from wash sales of specified assets”.

But even with that tax break still open, it is clear that Bitcoin’s unique nature is not reflected in IRS treatment. The tracking alone of every BTC transaction severely discourages daily use as the mere purchase of a pint of beer would require calculating initial BTC price to see whether it was at a loss or at a gain.

Likewise, merchants would have to hassle with the same tax regime because they technically received property, not money. Combined with the previously mentioned issues of friction and flexible liquidity, this puts an additional burden on mass Bitcoin adoption by incentivizing long-term holding.

Moreover, Bitcoin’s expansion into innovative financial products is impeded as well.

The Tax Burden on Bitcoin Derivatives

Although Bitcoin has become the least volatile cryptocurrency due to its large $1.2 trillion market cap, holders would still prefer to protect themselves against price fluctuations. Derivatives, such as options and futures, make this possible.

Additionally, Bitcoin’s price volatility creates opportunities for traders willing to bet if BTC price will go up (going long) or down (going short). This speculative market important for risk hedging and price discovery is also burdened by the current tax regime.

Once an options contract is exercised, or when it expires, it is subject to capital gains tax. Most traders will create trading alerts to signal the moment BTC price crosses a certain threshold. This helps traders to respond quickly as the loss or capital gain tax is calculated based on the difference between Bitcoin’s fair market value and the strike price. So, staying consistently updated on Bitcoin’s fair market value is a challenge.

Additional difficulty would be to calculate the fair market of another cryptocurrency if it was the vehicle for Bitcoin contract settlement.

But if the contract expires without buying BTC, the capital loss would be regarded as the paid premium for the contract. On the other end of the equation, sellers of Bitcoin options premiums would have to pay capital gains tax as well.

When it comes to futures contracts, 60% of gains/losses are taxed as long-term capital gains/losses, while 40% are taxed as short term capital gains/losses. This is irrespective of futures contract length.

While derivatives markets greatly enhance liquidity and trading volume, the current Bitcoin tax regime discourages broader participation.

The Virtual Currency Tax Fairness Act and Bitcoin

The year 2024 turned into a massive pileup of good news for Bitcoin, barely bothered by the German government’s BTC selloffs. The most recognizable cryptocurrency received an institutional blessing when the Securities and Commissions Exchange (SEC) approved 11 exchange-traded funds (ETFs), having climbed to $48.13 billion AuM as of August 20th.

Not only did Bitcoin ETFs exceed all expectations, but their success served as an endorsement ramp for two presidential candidates, Robert F. Kennedy Jr. and former President Donald Trump. Both endorsed the idea of a strategic Bitcoin reserve at the Nashville Bitcoin 2024 conference at the end of July.

Just at that time, senators Ted Budd (R-NC), Krysten Sinema (I-AZ), Cynthia Lummis ( R-WY) and Kirsten Gilibrand (D-NY) re-introduced bill S.4808, the Virtual Currency Tax Fairness Act.

As the bill’s title implies, cryptocurrencies would receive the same tax treatment that is currently reserved for foreign currencies.

Meaning, under the value of $200, cryptocurrency transactions would only be subject to regular sales tax. Although this is still behind El Salvador’s approach of having Bitcoin as legal tender, the bill would immediately lift the barrier for small item purchases in merchant locations.

Previously, one of the co-sponsors, Sen. Cynthia Lummis, noted she is “absolutely certain that Bitcoin will be among them…and perhaps dominant among them”, referring to a future world order based on a basket of global reserve currencies.

As of the latest campaign development, presidential candidate Kamala Harris is in favor of President Biden’s 44.6% capital gains tax, in addition to raising the corporate tax rate from 21% to 28%.

The Broader Implications for Bitcoin Adoption

Although to a lesser extent, recession is still on the table moving into 2025. If materialized, this will be another BTC price test, if its risk-off status will be light or heavy. But on the long-term horizon, the structure of mass democracy doesn’t allow for austerity.

And if austerity is not on the horizon, the ballooning of the Fed’s balance sheet is, inevitably eroding USD confidence. It is anyone’s guess if factions vying for power will allow Bitcoin to become a potential exit vehicle on that road.

Making BTC transactions under $200 subject to sales tax, instead of capital gains tax, would go a long way in further ingraining Bitcoin into the financial system. Considering that Blackrock’s IBIT has become the largest Bitcoin ETF, at $17.24B AuM, it is fair to say that Bitcoin’s “threat” perception has been muted, if not abandoned.

Conclusion

Currently priced at above $60k per BTC, it is becoming increasingly clear that only a tiny micro minority will ever own more than 1 BTC. Accordingly, such a small population pool is unlikely to shake the proverbial central banking boat.

What is more likely to form is a parallel, hybrid system in which Bitcoin is both a commodity and a premium currency that is tracked. This is evidenced by the fact that even senators not explicitly anti-crypto want expansive cryptocurrency surveillance.

And Bitcoin’s transparent ledger is ideally suited for it. This is a positive development as privacy-oriented cryptocurrencies like Monero (XMR) have already been ousted from the largest exchange onramps.

Without those headwinds when sailing on a fiat ocean, Bitcoin is free to foster greater financial inclusivity and innovation despite the onramp/offramp barriers, including taxing an appreciating asset. The Virtual Currency Tax Fairness Act is paving the road, but it is likely to receive more tweaks. Specifically, it is yet not clear how transactions amounting to $200 are aggregated.

This is a guest post by Shane Neagle. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Blockchain

Most Layer 2 solutions are still struggling with scalability

Published

3 hours agoon

December 23, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Since pivoting to a layer 2-centric approach, the Ethereum (ETH) ecosystem has relied heavily on L2 solutions to scale. However, these solutions are struggling to compete effectively, especially under pressure from alternatives like Solana (SOL). During the recent meme coin craze, Solana attracted much of the activity due to its advantages: low fees, high transaction speed, and user-friendliness.

To understand the challenges, it’s essential to examine why L2 solutions have not demonstrated the scalability and cost advantages that were widely anticipated.

Why meme projects favor Solana over Ethereum L2s

Meme projects have significantly contributed to the recent surge in market activity. These projects favor Solana for several reasons beyond user-friendliness:

- Low fees: Solana’s low transaction costs make it ideal for fee-sensitive applications like memecoins.

- High speed: Solana’s multithreaded architecture enables high throughput, ensuring seamless user experiences.

- Better developer experience: Solana’s tools and ecosystem are optimized for ease of use, attracting developers and projects.

Why is scalability important?

Scalability is fundamentally measured by the number of transactions a blockchain can process. A highly scalable blockchain can handle more TXs while offering lower fees, making it crucial for widespread adoption and maintaining a seamless user experience.

This is especially important for grassroots projects like meme coins, many of which are short-lived and highly fee-sensitive. Without scalability, these projects cannot thrive, and users will migrate to platforms that offer better efficiency and cost-effectiveness.

Why Ethereum L2s aren’t up to the challenge

Architectural limitations of Ethereum. Ethereum has long faced scalability issues, and L2 rollups are its primary solution to these problems. L2s operate as independent blockchains that process transactions off-chain while posting transaction results and proofs back to Ethereum’s mainnet. They inherit Ethereum’s security, making them a promising scaling approach.

However, Ethereum’s original design poses inherent challenges. Ethereum’s founder, Vitalik Buterin, has admitted that “Ethereum was never designed for scalability.” One of the key limitations is the lack of multithreading in the Ethereum Virtual Machine. The EVM, which processes transactions, is strictly single-threaded, meaning it can handle only one transaction at a time. In contrast, Solana’s multithreaded architecture allows it to process multiple transactions simultaneously, significantly increasing throughput.

L2s inheriting Ethereum’s limitations. Virtually all L2 solutions inherit Ethereum’s single-threaded EVM design, which results in low efficiency. For instance, Arbitrum: With a targeted gas limit of 7 million per second and each coin transfer costing 21,000 gas, Arbitrum can handle about 333 simple transactions per second. More complex smart contract calls consume even more gas, significantly reducing capacity. Optimism: With a gas limit of 5 million per block and a block time of 2 seconds, Optimism can handle only about 119 simple transfers per second. Gas-intensive operations further reduce this capacity.

Unstable fees. Another major issue with Ethereum and its L2 solutions is unstable fees during periods of high network activity. For applications relying on low and stable fees, this is a critical drawback. Projects like meme coins are especially fee-sensitive, making Ethereum-based L2s less attractive.

Lack of interoperability between L2s. The scalability argument for having multiple L2s only holds if contracts on different L2s can interact freely. However, rollups are essentially independent blockchains, and accessing data from one rollup to another is as challenging as cross-chain communication. This lack of interoperability significantly limits the potential of L2 scalability.

What can L2s do to further scale?

Embed features to enhance interoperability. Ethereum L1 needs to do more to support interoperability among L2s. For example, the recent ERC-7786: Cross-Chain Messaging Gateway is a step in the right direction. While it doesn’t fully resolve the interoperability issue, it simplifies communication between L2s and L1, laying the groundwork for further improvements.

Architectural updates: Diverge from the existing L1 design. To compete with multithreaded blockchains like Solana, L2s must break free from Ethereum’s single-threaded EVM design and adopt parallel execution. This may require a complete overhaul of the EVM, but the potential scalability gains make it a worthwhile endeavor.

Future milestones

Ethereum’s L2 solutions face significant challenges in delivering the scalability and cost-effectiveness that applications like meme coins demand. To stay competitive, the ecosystem must address fundamental architectural limitations, enhance interoperability, and embrace innovations in blockchain design. Only by doing so can Ethereum L2s achieve the scalability needed to support widespread adoption and fend off competition from emerging blockchains like Solana.

Laurent Zhang

Laurent Zhang is the president and founder of Arcology Network, a revolutionizing Ethereum layer-2 solution with the first-ever EVM-equivalent, multithreaded rollup—offering unparalleled performance and efficiency for developers building the next generation of decentralized applications. With an executive leadership and innovation background, Laurent holds a degree from Oxford Brookes University. Laurent’s professional journey includes over a decade of experience in science, research, engineering, and leadership roles. After graduating in 2005, he joined MKS Instruments as an Algorithm Engineer. From 2010 to 2012, he worked as a research engineer at the Alberta Machine Intelligence Institute, followed by a position as a research scientist at Baker Hughes from 2012 to 2014. He then served as vice president of engineering at Quikflo Health between 2016 and 2018. Since 2017, Laurent has been the president of Arcology Network, being a visionary of a future where blockchain technology reaches its full potential, offering unmatched scalability, efficiency, and innovation.

Source link

Recently, BlackRock released an educational video explaining Bitcoin, which I thought was great—it’s amazing to see Bitcoin being discussed on such a massive platform. But, of course, Bitcoin X (Twitter) had a meltdown over one specific line in the video: “There is no guarantee that Bitcoin’s 21 million supply cap will not be changed.”

HealthRnager from Natural News claimed, “Bitcoin has become far too centralized, and now the wrong people largely control its algorithms. They are TELLING you in advance what they plan to do.”

Now, let me be clear: this is total nonsense. The controversy is overhyped, and the idea that BlackRock would—or even could—change bitcoin’s supply is laughable. The statement in their video is technically true, but it’s just a legal disclaimer. It doesn’t mean BlackRock is plotting to inflate bitcoin’s supply. And even if they were, they don’t have the power to pull it off.

Bitcoin’s 21 million cap is fundamental—it’s not up for debate. The entire Bitcoin ecosystem—miners, developers, and nodes—operates on this core principle. Without it, Bitcoin wouldn’t be Bitcoin. And while BlackRock is a financial giant and holds over 500,000 Bitcoin for its ETF, its influence over Bitcoin is practically nonexistent.

Bitcoin is a proof-of-work (PoW) system, not a proof-of-stake (PoS) system. It doesn’t matter how much bitcoin BlackRock owns; economic nodes hold the real power.

Let’s play devil’s advocate for a second. Say BlackRock tries to propose a protocol change to increase bitcoin’s supply. What happens? The vast network of nodes would simply reject it. Bitcoin’s history proves this. Remember Roger Ver and the Bitcoin Cash fork? He had significant influence and holdings, yet his version of bitcoin became irrelevant because the majority of economic actors didn’t follow him.

If Bitcoin could be controlled by a single entity like BlackRock, it would’ve failed a long time ago. The U.S. government, with its endless money printer, could easily acquire 10% of the supply if that’s all it took to control Bitcoin. But that’s not how Bitcoin works. Its decentralized nature ensures no single entity—no matter how powerful—can dictate its terms.

So, stop worrying about BlackRock “changing” Bitcoin. Their influence has hard limits. Even if they tried to push developers to change the protocol, nodes would reject it. Bitcoin’s decentralization is its greatest strength, and no one—not BlackRock, not Michael Saylor—can change that.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Opinion

It’s Time to Admit It – There Are Only 2.1 Quadrillion Bitcoins

Published

2 days agoon

December 21, 2024By

admin

If the above statement offends you, you might not have read the Bitcoin source code.

https://x.com/pete_rizzo_/

Of course, I’m sure you’ve heard that there are 21 million bitcoin – and this is true, the Bitcoin protocol allows for only “21 million bitcoin” to be created, yet these larger denominations can be subdivided into 100 million sub-units each.

Call them whatever you want, there are only 2.1 quadrillion monetary units in the protocol.

This dollars and cents differential has long been the subject of debate – in the time of Satoshi, Bitcoin’s creator, the dual conventions, Bitcoin having both a bulk denomination, and a smaller unit, was not much of a concern. There were questions about whether the software would work at all, and bitcoin were so worthless, selling them in bulk was the only rational option.

Rehashing this debate is BIP 21Q, a proposal to the Bitcoin users authored by John Carvalho, founder of Synonym, creator of the Pubky social media platform, and a tenured contributor whose work dates back to the days of the influential Bitcoin-assets collective.

In short, the BIP proposes that network actors – the various wallets and exchanges – change how Bitcoin denominations are displayed, with the smallest unit of the protocol renamed “bitcoins,” as opposed to “satoshis,” as they have been commonly called.

Here are the specifics of the BIP:

Redefinition of the Unit:

- Internally, the smallest indivisible unit remains unchanged.

- Historically, 1 BTC = 100,000,000 base units. Under this proposal, “1 bitcoin” equals that smallest unit.

- What was previously referred to as “1 BTC” now corresponds to 100 million bitcoins under the new definition.

Terminology:

- The informal terms “satoshi” or “sat” are deprecated.

- All references, interfaces, and documentation SHOULD refer to the base integer unit simply as “bitcoin.”

Display and Formatting:

- Applications SHOULD present values as whole integers without decimals.

- Example:

- Old display: 0.00010000 BTC

- New display: 10000 BTC (or ₿10000)

Unsurprisingly, the debate around the BIP has been hostile. For one, it’s not a technical BIP, though this is not a requirement of the BIP process. Suffice to say, it’s perhaps the most general BIP that has been proposed under the BIP process to date, as it mainly deals with market conventions and user onboarding logic, not any changes to the software rules.

However, I have to say, I find the proposal compelling. Nik Hoffman, our News Editor, does not, preferring to stick to the market affirmative.

Yet, I think the proposal raises relevant questions: why should new users be forced to compute their Bitcoin balances using only decimals? Surely this has the adverse side effect of making commerce difficult – it’s simply antithetical to how people think and act today.

Also, in terms of savings, at an $100,000 BTC price, it isn’t exactly compelling to think you could be spending a whole year earning 1 BTC, though that may be.

Indeed, there have been various debates for all kinds of units – mBTC, uBTC – that play around with the dollars and cents convention, but Carvalho here is wisely skipping to the end, preferring just to rip the band-aid off. $1 would buy 1,000 bitcoins under his proposal.

What’s to like here, and I argued this during a Lugano debate on the topic in 2023, is that it keeps both the larger BTC denomination and the smaller unit, now bitcoins. They are both important, and serve different functions.

My argument then was that having a larger denomination like BTC (100 million bitcoins) is important. If there was no “BTC unit,” the press and financial media would be faced to reckon that “1 bitcoin” is still worth less than 1 cent.

How much mainstream coverage and interest do we think there would be? I’d bet not very much.

In this way, BIP 21Q is a best-of-both-worlds approach.

The financial world, press, and media can continue championing the meteoric rise in value of “BTC,” while everyday users can get rid of decimals and complex calculations, trading the only real Bitcoin unit guaranteed to exist in perpetuity.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential