layer 1

Toncoin nears a dreaded pattern despite strong on-chain metrics

Published

3 months agoon

By

admin

The Toncoin token remained in a bear market and was at risk of forming the dreaded death cross pattern, despite strong on-chain metrics.

Toncoin (TON) was trading at $5.81 on Monday, Sep. 30, down by over 30% from the year-to-date high.

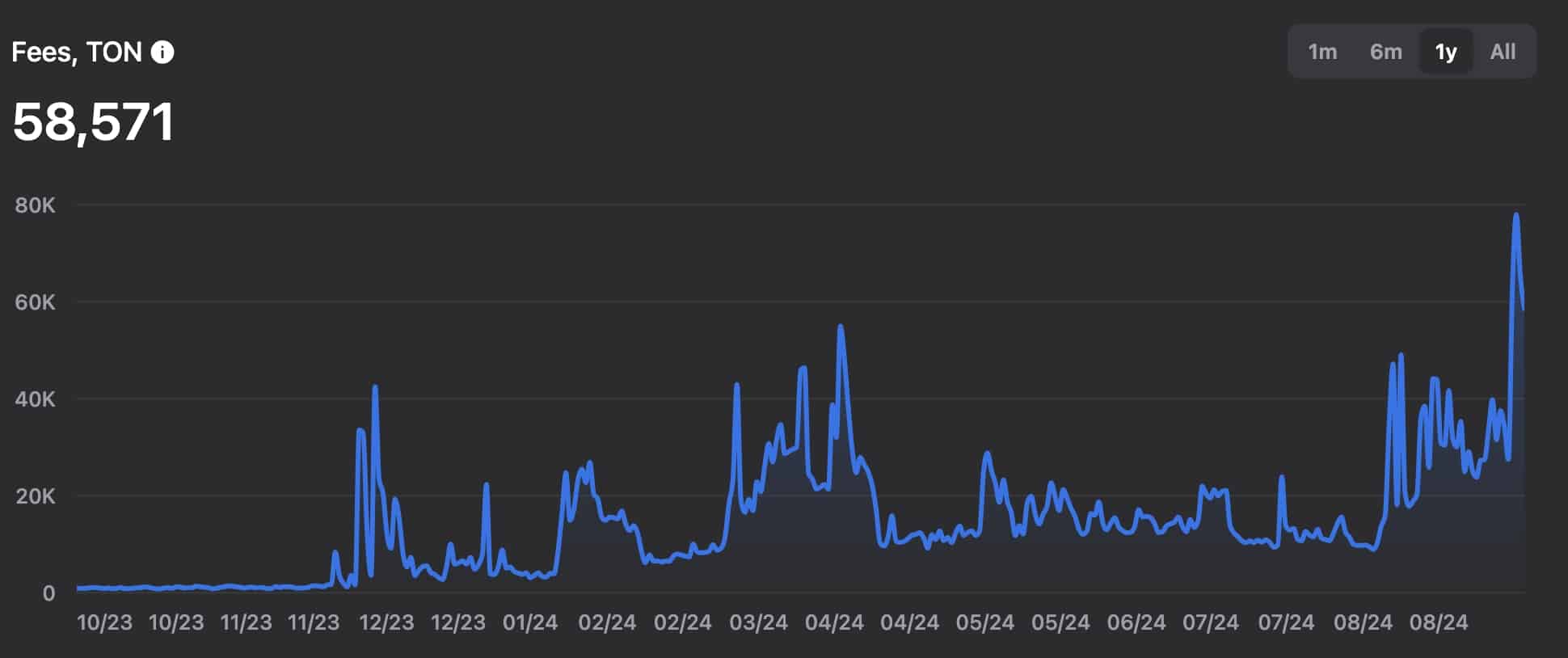

Strong on-chain metrics

Additional data showed that the number of on-chain activated wallets has risen to over 20.8 million, a significant increase from January’s low of 1.1 million.

Moreover, the number of Toncoins burned daily has continued to rise, reaching the year-to-date high of almost 39,000. These burns have coincided with a sharp decline in the number of minted Toncoins, which has dropped to 39,000 from this month’s high of over 50,000.

Role in DeFi is fading

Toncoin’s price has likely retreated due to its waning role in the decentralized finance industry, where the total value locked in the network has dropped from over $765 million in July to $427 million.

TON has moved from being a top ten player in the DeFi industry to becoming the 20th-biggest chain. Smaller chains such as Core, Mode, Mantle, and Linea have surpassed it in recent weeks.

Toncoin has also dropped because of Pavel Durov’s recent arrest in France and the performance of its tap-to-earn tokens. Hamster Kombat, which launched its airdrop last week, has dropped by almost 60% from its highest level.

Similarly, Notcoin (NOT) dropped by 71%, while Catizen (CATI) has fallen by 50% from their all-time highs. Most of all the recently launched Telegram’s tap-to-earn tokens have dropped to record lows.

Meanwhile, Toncoin’s futures open interest dropped to $260 million on Sep. 30, down from the year-to-date high of over $360 million. This figure has reached its lowest point since Sep. 12, indicating waning demand.

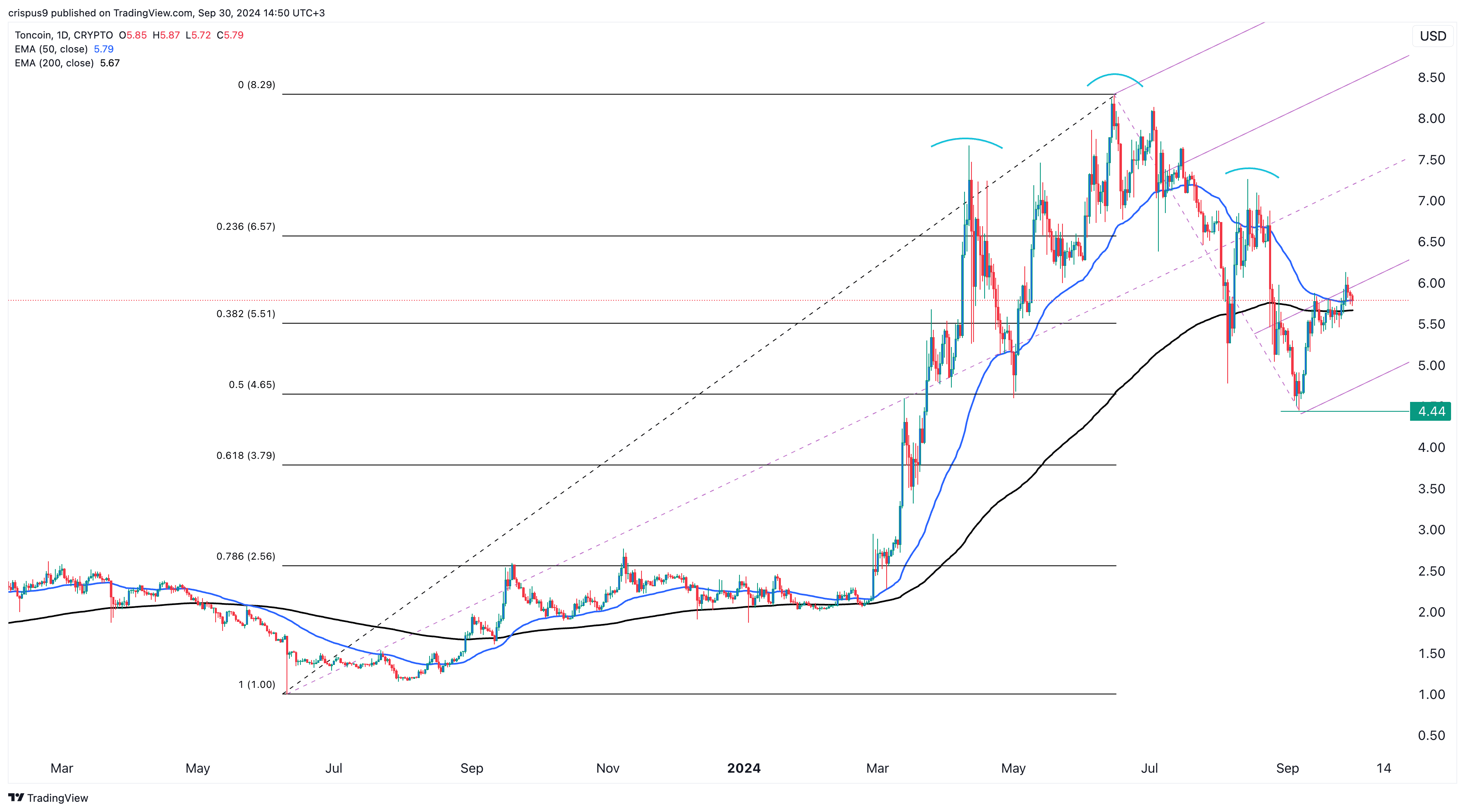

Toncoin price analysis

Toncoin’s token has dropped by over 30% from its year-to-date high, and the 50-day and 200-day Exponential Moving Averages are close to forming a death cross pattern. The last time it formed this pattern in May of last year, it resulted in a drop of over 50%.

TON has also formed a head and shoulders and a rounded top pattern. It remains below the first support level of the Andrew’s pitchfork tool and the 23.6% Fibonacci Retracement level.

Therefore, Toncoin may have a bearish breakout to the next key support at $4.45, its lowest point in September, unless it moves above the 50-day and 200-day moving averages.

Source link

You may like

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

layer 1

Cardano price forms rare pattern pointing to a Santa Claus rally

Published

7 days agoon

December 16, 2024By

admin

Cardano’s price has remained sideways this month, but a rare chart pattern indicates a potential comeback in the coming weeks.

Cardano (ADA), the popular layer-1 cryptocurrency, is trading at $1.06, down nearly 20% from its highest level this year.

The pullback followed a rally that pushed the coin to a multi-year high of $1.327 in November during the crypto bull run. This decline mirrors the performance of other cryptocurrencies, like Avalanche (AVAX) and Binance Coin (BNB), which have also retreated from their year-to-date highs.

Cardano’s drop coincided with a decline in the total value locked (TVL) within its decentralized finance ecosystem. According to DeFi Llama, Cardano protocols now hold over $597 million in total assets, down from last month’s high of nearly $700 million. The largest protocols in its ecosystem include Liqwid, Minswap, Indigo, and Splash Protocol.

Whale activity for Cardano has also slowed, and the number of active addresses over the past 24 hours is below 43,000. Meanwhile, open interest in the futures market has continued to decline.

However, several catalysts may push Cardano’s price higher in the short term. For instance, rising crypto demand—highlighted by Bitcoin’s surge past $106,000—could support ADA. Additionally, Cardano may benefit from a potential spot ADA ETF listing as early as 2025.

In the near term, the coin could also experience a boost from the “Santa Claus rally,” a phenomenon where asset prices tend to rise ahead of Christmas Day.

Cardano price has formed a rare chart pattern

The daily chart shows that the ADA price staged a strong comeback in November after Donald Trump won the election. It has since slowly formed a bullish pennant chart pattern, consisting of a long vertical line and a symmetrical triangle. This pattern is nearing its confluence point, suggesting that a bullish breakout could occur.

Cardano has also formed a golden cross pattern, where the 50-day and 200-day Exponential Moving Averages have made a bullish crossover.

As a result, Cardano is likely to see a strong bullish breakout in the coming days. If this happens, the coin could rise to $1.325, its highest point this year, representing a 23% increase from its current level. A drop below the support at $1.00, however, would invalidate the bullish outlook.

Source link

Blockchain

Alchemy Pay plans to launch its own layer-1 blockchain

Published

2 weeks agoon

December 11, 2024By

admin

Crypto payments provider Alchemy Pay has announced plans to launch its own layer-1 blockchain, which the company says will target large-scale business applications.

Alchemy Pay (ACH) notes that the layer-1 blockchain will be dubbed Alchemy Chain and built on the Solana (SOL) Virtual Machine architecture. Per an announcement on Dec. 11, the new L1 will offer a payment system allowing users to transact with fiat and crypto.

The platform will also offer a user-friendly ecosystem bridging on-chain and off-chain processes, chain abstraction, a stablecoin revenue mechanism, and yield generation. Additionally, the blockchain network will integrate a layer-2 solution, as outlined in the company’s blog post.

Alchemy Chain is set to launch with a meme launchpad and a meme Telegram bot, aiming to tap into the growing popularity of meme-based projects.

The company revealed initial plans for the L1 blockchain in late October 2024, news that saw the price of ACH jump double-digits.

Latest details on the previously disclosed objective has also seen ACH price record a significant spike, with the token up 14%. However, as well as the project related news, its price was trading higher as Bitcoin (BTC) spiked to $100k amid fresh recovery by bulls.

In recent months, several platforms have looked to launch own layer-1 and layer-2 chains.

Coinbase unveiled the mainnet of Base in August 2023, while Chiliz revealed its own blockchain in February. World, formerly Worldcoin, partnered with Alchemy Pay to launch World Chain. Recently, crypto exchange Kraken disclosed plans to debut its L1 blockchain in 2025.

Source link

layer 1

Crypto expert explains why VeChain price is set to soar

Published

3 weeks agoon

December 5, 2024By

admin

VeChain price continued its strong bull run, reaching its highest level in over two years as the altcoin index rose.

VeChain (VET) climbed to $0.080, marking a 270% increase from its lowest level this year and pushing its market cap to over $5.7 billion. Its rally aligns with other cryptocurrencies that surged during the 2021 bull run, such as EOS, NEO, and Zilliqa.

Some analysts predict further upside for the coin, highlighting its ecosystem growth and practical applications. In a statement, Michel van de Poppe noted the VeBetter platform, which has completed over 335,000 transactions, and its partnership with UFC, a popular U.S. sports organization.

Another catalyst for VeChain’s price surge is Grayscale’s recent decision to list it as an asset “under consideration.” This suggests the company might launch a fund similar to its Grayscale Bitcoin Trust. Other assets under consideration include Bittensor, Chainlink, Filecoin, and The Graph.

In an X post, crypto analyst Gremlin Mystery predicted VeChain’s price could jump to $0.175, representing a 150% upside from the current level, citing strong technical indicators.

A potential fundamental risk for the VeChain price is that the amount of assets in its DeFi ecosystem has been quite small. It has a DeFi total value locked of $877,058, making it one of the smallest layer 1 networks in the crypto industry.

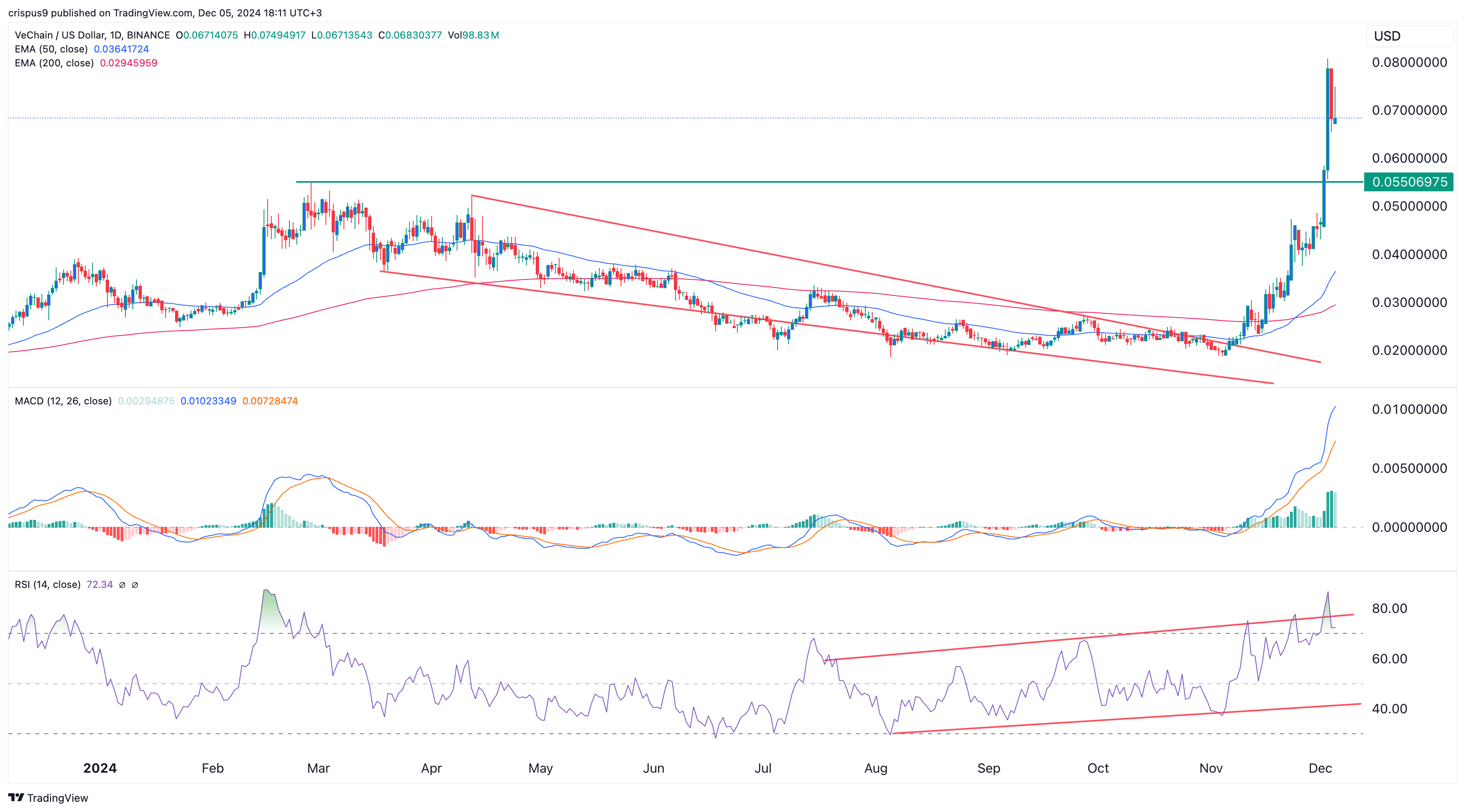

VeChain price analysis

VeChain’s price has rebounded in recent weeks, rising over 270% from its November lows. This recovery followed months of forming a falling wedge pattern, a widely recognized bullish signal.

The coin has also formed a golden cross pattern as the 200-day and 50-day moving averages crossed. Additionally, it moved above the key resistance level at $0.0550, its February 2024 high.

Therefore, the likely scenario is where the VeChain price drops and retests the support at $0.0550 and then resumes the uptrend. This pattern is known as a break and retest, and is a highly popular continuation signs.

Further gains will be confirmed if the coin climbs past $0.080, its high for the week. If successful, VeChain could move on to test the $0.10 level.

Source link

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential