Binance

Top 20 Wallets Control Over 50% Of Supply, But Who’s Number 1?

Published

2 months agoon

By

admin

XRP, the native cryptocurrency of the Ripple network, has seen its price grow massively in recent months, allowing it to overtake many other large-market cap cryptocurrencies. At the time of writing, XRP is the third-largest crypto by market cap, and current buying trends suggest it might stay there for a while.

As of January 25, 2025, the altcoin has a total supply of 100 billion tokens, with approximately 57.64 billion currently in circulation. Notably, a significant portion of this circulating supply is concentrated among a small number of wallets. Specifically, the top 10 addresses hold about 20.99% of the circulating supply, while the top 50 addresses control approximately 53.3%, which raises the question about the distribution of wealth in the ecosystem and who stands to benefit the most from the price rally.

Top 20 Wallets And Their Dominance Over XRP Supply

The largest XRP holdings are primarily associated with Ripple Labs, its founders, and major cryptocurrency exchanges. In terms of numbers, data from Coincarp shows that out of the 4,840,747 addresses, the top 20 holders, the top 50 holders, and the top 100 holders hold 50.31%, 63.74%, and 71.76% of the circulating supply, respectively.

Related Reading

According to distribution data, Ripple Labs currently owns around 46 billion XRP tokens, although most are locked in escrow. These tokens are released periodically in pre-set amounts, limiting Ripple’s ability to freely access or manipulate the escrowed funds. Even with these restrictions, Ripple Labs holds a considerable amount of liquid XRP. Data from blockchain explorer Bithomp indicates that one of Ripple’s wallet addresses alone contains over 1.3 billion XRP.

Also, Ripple Labs co-founder Chris Larsen is the largest individual holder of XRP, holding over 5 billion tokens, making him one of the wealthiest individuals in the ecosystem. Major exchanges like Binance and Uphold also manage significant reserves. For instance, one of Binance’s wallets holds over 1.3 billion XRP, accounting for approximately 1.33% of the circulating supply. South Korean-based crypto exchange Upbit also holds about 4.38% of the total supply, among a few other exchanges.

Holding Distribution: Anything To Fear?

These large-scale holdings by exchanges and Ripple-related entities paint a picture of an XRP ecosystem dominated by a relatively small group of stakeholders. However, when you think about it, these large holdings are not in the hands of any private company or individual that would potentially be at risk of manipulating the price for their benefit.

Related Reading

Furthermore, the bulk held by exchanges represents aggregated assets belonging to thousands, if not millions, of individual users. As such, their concentration in exchanges does not pose any unnatural risk to the natural price dynamics for XRP.

At the time of writing, XRP is trading at $3.10, having recently reached a seven-year high of $3.38.

Featured image from Medium, chart from Tradingview.com

Source link

You may like

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

XRP Price Slides Slowly—Is a Bigger Drop Coming?

Darkweb actors claim to have over 100K of Gemini, Binance user info

Altcoins

Whales Abruptly Deposit Ethereum Altcoin to Binance and OKX, Causing Price To Plummet 50%: On-Chain Data

Published

3 days agoon

March 25, 2025By

admin

Deep-pocketed traders triggered a price crash over the weekend after depositing a huge chunk of an altcoin’s supply to digital asset exchanges.

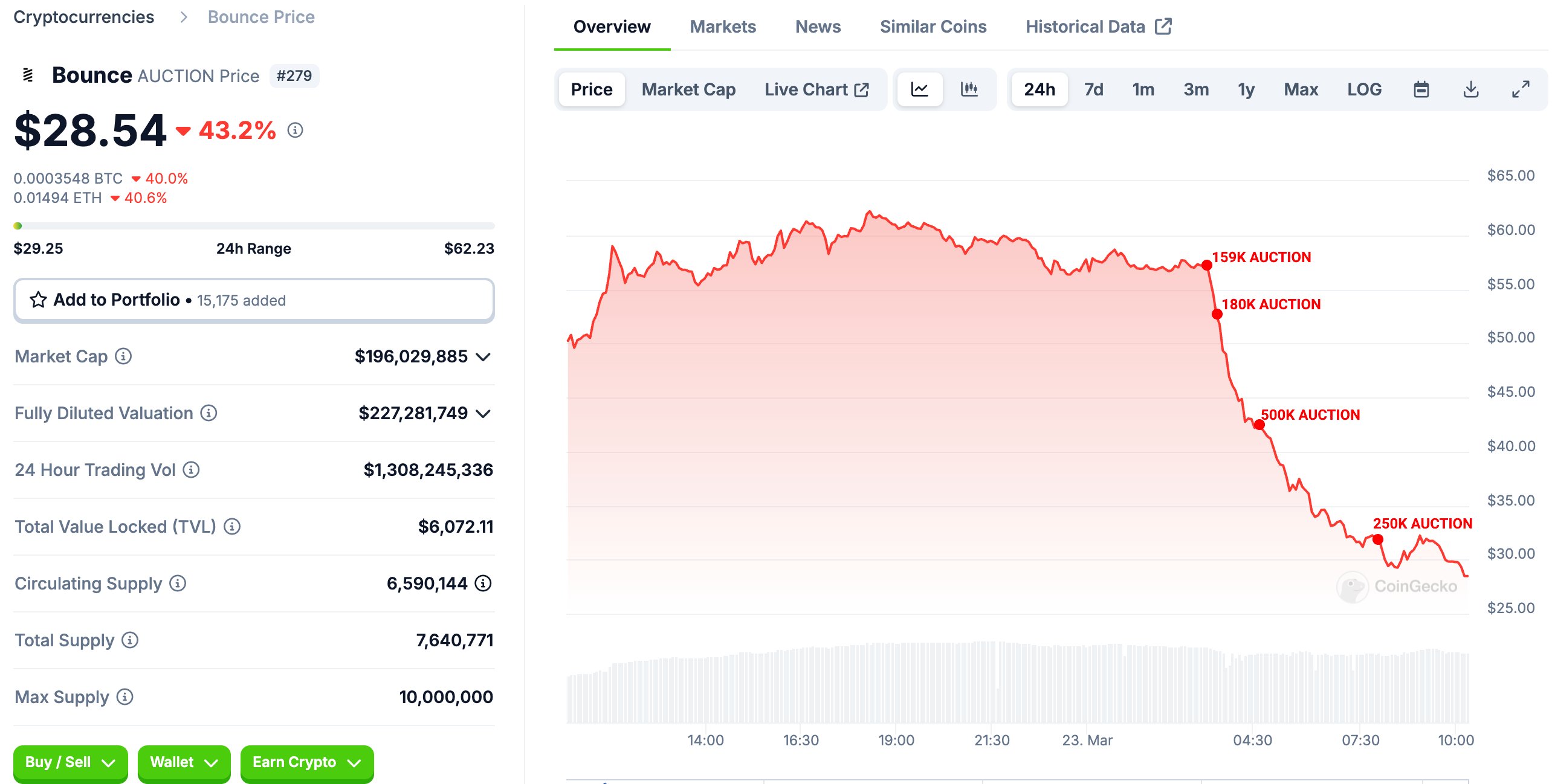

According to blockchain tracking firm Lookonchain, whales in the Bounce (AUCTION) market have been greatly influencing the altcoin’s price action for the past week, causing massive swings in both directions.

Bounce Finance is a decentralized auction platform enabling auctions for various assets, such as physical assets tokenized on the blockchain and non-fungible tokens (NFTs).

AUCTION tokens are used for governance, staking, and fees for participating in auctions or creating NFTs on the platform.

Lookonchain says that in the last several days, whales sent over 14% of the circulating supply of AUCTION to Binance, the largest crypto exchange in the world by volume, and OKX. Those deposits presumably led to coins being sold on the open market, which ultimately caused prices to plummet.

Says Lookonchain,

“AUCTION Whales deposited 1.08 million AUCTION ($48.6 million, 14.26% of the total supply) into Binance and OKX again, causing the price to plummet by 50%.

Pay attention to price changes.”

At time of writing, AUCTION has not recovered, currently trading at $20.93 with a market cap of $137 million. AUCTION is ranked as the 363rd-largest crypto asset by market cap.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Ali Martinez

Analyst Sets Dogecoin Next Target As Ascending Triangle Forms

Published

4 days agoon

March 24, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst CobraVanguard has revealed the next price target for Dogecoin as an ascending triangle forms for the foremost meme coin. A rally to this price target could pave the way for the new highs, especially with the crypto market looking to be in rebound mode.

Next Target For Dogecoin As Ascending Triangle Forms

In a TradingView post, CobraVanguard set $0.197 as the next target for the Dogecoin price with an ascending triangle forming. He noted that this ascending triangle indicates a potential price increase. The analyst added that it is anticipated that the price could rise, aligning with the projected price movement of AB=CD.

Related Reading

Meanwhile, CobraVanguard warned that it is crucial to wait for the triangle to break before taking any action. His accompanying chart showed that Dogecoin needs to break above $0.177 to confirm a break above the ascending triangle. A break above that target would then lead to a rally to the $0.197 target.

Dogecoin already looks to be in rebound mode at the moment, alongside Bitcoin, which is nearing the $90,000 mark again. The foremost meme coin is nearing the $0.177 target for a break above the ascending triangle. As crypto analyst Kevin Capital suggested, DOGE will likely rally as long as BTC is in bullish territory.

Crypto traders are also betting on a Dogecoin rally to the upside. Crypto analyst Ali Martinez revealed that 76.26% of traders with open DOGE positions on Binance futures are leaning bullish. This is particularly bullish because Binance traders have a good track record of being right most of the time. In another X post, Martinez revealed that whales bought over 120 million DOGE last week, which is also bullish for the foremost meme coin.

DOGE’s Market Structure Has Shifted

In an X post, crypto analyst Trader Tardigrade revealed that Dogecoin’s market structure has shifted. This came as he noted that Dogecoin is recovering from an ascending triangle, forming higher highs and higher lows from lower highs and lower lows.

Related Reading

Based on this, the analyst affirmed that Dogecoin had shifted the market structure from a downtrend to an uptrend on the hourly chart since it just formed the second higher high. His accompanying chart showed that DOGE is eyeing a rally to $0.177 as it continues to form higher highs.

Martinez raised the possibility of the Dogecoin price rallying to as high as $4 or even $20 in the long term. He stated that if DOGE holds above the $0.16 support at the lower boundary of an ascending channel, history suggests that it could rebound toward the mid-range at $4 or upper range at around $20.

At the time of writing, the Dogecoin price is trading at around $0.174, up over 3% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Pexels, chart from Tradingview.com

Source link

Altcoins

Binance Launchpool To Roll Out Support for New Native Token of Private Data ‘Blind Computer’ Project

Published

5 days agoon

March 23, 2025By

admin

Binance is planning on launching trading support for the new native asset of a decentralized network focused on secure data storage.

Binance Launchpool, which lets users stake coins to farm new assets, says its 65th project will be Nillion (NIL), a secure computation network that decentralizes trust for high-value and private data.

Explains the project,

“Nillion is Humanity’s First Blind Computer – a whole new category of decentralized network designed for AI and the future of the Internet. Nillion makes new applications possible by providing storage and computation on high-value, encrypted data without ever seeing it. Whether a user, an app, or an enterprise, your data stays yours – always.”

Between March 21st and 24th, Binance users can lock their BNB, the crypto exchange platform’s native asset, as well as the stablecoins First Digital USD (FDUSD) and USDC, to receive NIL airdrops.

The top global crypto exchange then plans to list the asset on March 24th. Binance will attach a seed tag to NIL, which the exchange applies to lower-liquidity projects that may exhibit higher volatility compared to other listed tokens.

Binance requires users who own assets with seed tags to pass quizzes every 90 days to ensure they’re aware of the risks before trading the tokens.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

XRP Price Slides Slowly—Is a Bigger Drop Coming?

Darkweb actors claim to have over 100K of Gemini, Binance user info

Whale Who Netted $108,000,000 Profit on TRUMP Books Loss on the Memecoin After President’s Truth Social Post

Hardware Wallets: Bitcoin’s Biggest Adoption Barrier

SEC Officially Drops Cases Against Kraken, ConsenSys, and Cumberland DRW

Dogecoin could rally in double digits on three conditions

Sei Foundation Explores Buying 23andMe to Put Genetic Data on Blockchain

Coinbase CLO Applauds US SEC Chair Nominee Paul Atkins Ahead of Senate Confirmation

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

$16.5B in Bitcoin options expire on Friday — Will BTC price soar above $90K?

$5,000,000,000,000 Asset Manager Fidelity To Launch a USD-Pegged Stablecoin: Report

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x