Best Altcoins 2025

Top Crypto Analyst Unveils Plan To ‘Make Millions’ By March 2025

Published

2 months agoon

By

admin

Crypto analyst Miles Deutscher, boasting 550,000 followers on X, has released a new video titled “My Plan To Make Millions In Crypto By March 2025! [Fool Proof Strategy].” In this analysis, Deutscher outlines his strategic approach to navigating the current crypto bull run.

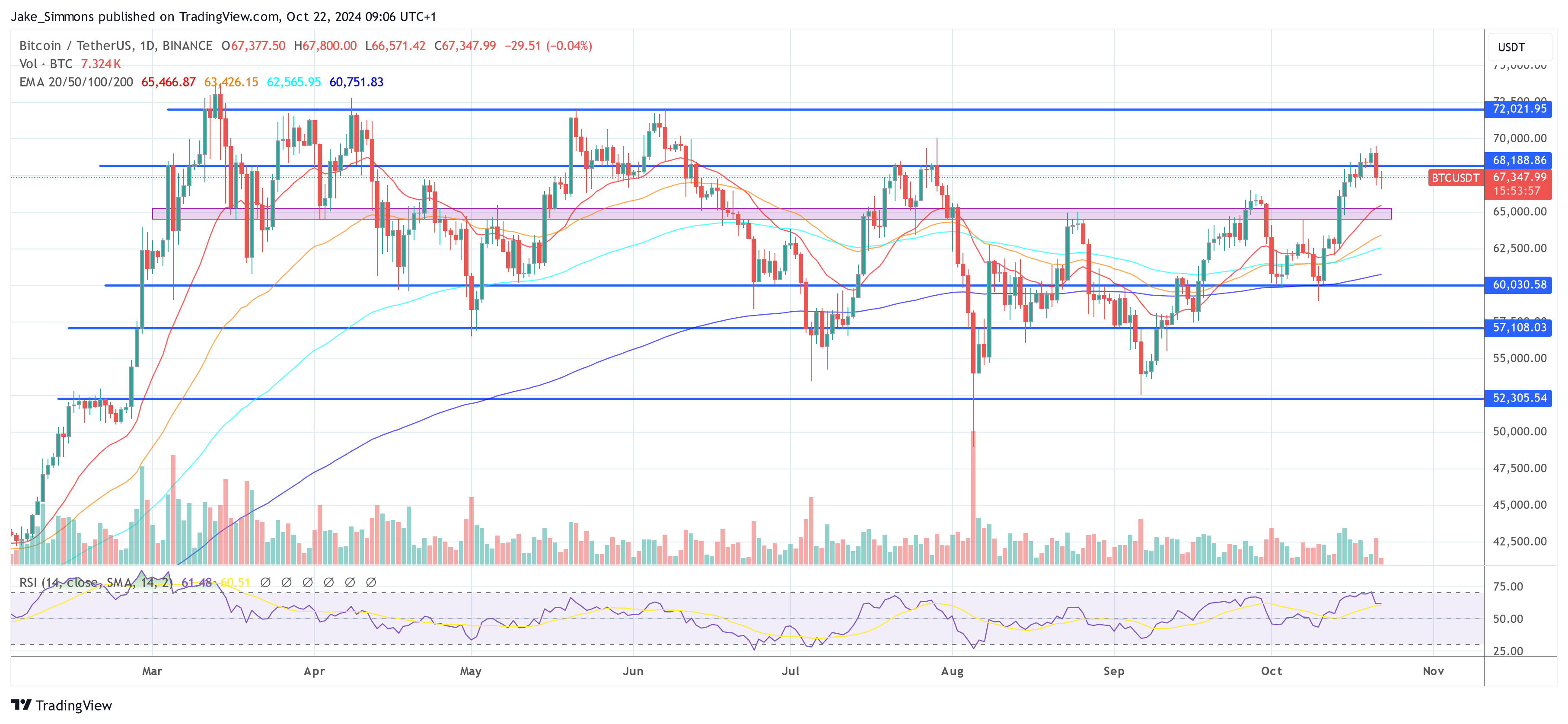

The Start Of The Bitcoin Bull Run

First, Deutscher highlights the bullish outlook for Bitcoin, particularly on the monthly chart. “We have been consolidating above the high that we made in 2021 in February for a matter of eight months now,” he notes. “On the higher time frames, Bitcoin looks really, really good. It honestly looks primed for expansion for another leg potentially to take us to that $100,000 zone.”

He attributes this bullish consolidation to significant inflows into Bitcoin ETFs, signaling increased interest from traditional finance investors. “Over $2 billion worth of inflows into the Bitcoin ETFs last week,” Deutscher reports. “We also saw, to end the week, another additional $273 million flowing into the Bitcoin ETF. The landscape is very strong here for Bitcoin from a TradFi perspective.”

Despite this momentum, Bitcoin is lagging behind gold, which has surged 30% above its yearly high to $2,700 per ounce. “Bitcoin is still sitting 10% below its yearly high,” Deutscher points out. “If Bitcoin were to catch up to the current price performance of gold this year, that would indicate a Bitcoin price of $96,400, which would be absolutely insane.”

Related Reading

Deutscher also discusses the potential impact of macroeconomic factors and political events on Bitcoin’s trajectory. He observes a correlation between Bitcoin’s price performance and the election odds of former President Donald Trump. “It is quite interesting that Bitcoin is behaving very similarly to the Trump election odds based on Polymarket,” he remarks. While he acknowledges this could be coincidental, he suggests that “the market is anticipating a Trump win to be bullish for Bitcoin.”

He also references the transition from quantitative tightening to quantitative easing and its potential effect on the crypto market. Citing a tweet, he poses the question: “What do you think happens when you leave a seven, actually eight-month trading range off a low historical volatility into an election with a transition from quantitative tightening to quantitative easing and at the end phase of an 18.6-year real estate cycle?” His answer: “Explosion.”

Strategy How To “Make Millions”

Turning his focus to altcoins, Deutscher provides a strategy for capitalizing on emerging market trends to potentially “make millions by March 2025.” He emphasizes the importance of strategic accumulation during market dips and highlights the significance of current uptrends. “Alts are now uptrending. We have started to break above the range. Bitcoin is uptrending. We are starting to break above key levels and make higher highs,” he explains.

Deutscher advises against attempting to time market rotations between Bitcoin and altcoins. “You can play the game of timing the Bitcoin dominance rotation,” he acknowledges, but cautions that it requires precise timing. Instead, he recommends positioning for the “end game” by holding altcoins that are poised to outperform Bitcoin in the latter stages of its move. “Although that means I’m going to have to hold throughout periods of altcoin underperformance […] by the end of the cycle, I’m going to make more money playing that game,” he asserts.

He stresses the importance of focusing on strong narratives and being selective with investments. Quoting Warren Buffett, he notes, “Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing.” Deutscher elaborates: “I think you should be selective. You don’t want to be over-diversified to the point where you hold six AI coins, six RWA coins, eight meme coins, five Layer-1s, three Layer-2s. This is a market where you’re better off to have maybe two plays from each narrative and just go higher conviction into those coins.”

Key Narratives and Top Altcoin Picks

Deutscher identifies several hot crypto narratives and specific altcoins that he believes have the potential to yield significant profits. In the memecoin sector, Deutscher highlights the emergence of AI-driven meme coins, where AI agents create and promote tokens. His leading play in this space is GOAT. “This narrative either goes to billions and really takes off and GOAT could be a one-billion-plus coin, or it goes to zero,” he admits, acknowledging the high risk involved.

Besides AI memecoins, Deutscher recommends looking at the memecoin list by Murad Mahmudov. “I do think SPX6900 is a decent play. I also like GIGA, but probably not as much as SPX. I also like MOG. I like pretty much all of these but I think, you just gotta pick two or three that you resonate with the most.”

Related Reading

Beyond meme coins, Deutscher is heavily investing in AI projects. He has taken positions in tokens like Bittensor and Near Protocol. “I’m meeting two to three AI founders a day. I’m really digging deep into AI research because it’s one of the verticals that I’m most interested in right now,” he shares.

Deutscher also revealed his investments in projects that tokenize real-world assets, such as Mantra (OM), Ondo Finance (ONDO), and Pendle. While he has started taking profits from these investments due to significant gains, he is reallocating into projects like Clearpool (CPOOL), which he believes can “push up into that top-five echelon of RWA protocols.” He hints at another RWA project he’s bullish on but hasn’t publicly disclosed yet.

Deutscher emphasizes the importance of accumulating crypto positions during market dips, especially in sectors poised for growth. He notes that the current market phase rewards dip buyers. “We’re in this new paradigm where we are getting higher lows. The market is actually rewarding those that buy these dips and take advantage of the dips,” he observes.

He underscores the need for adaptability and disciplined risk management to maximize profits and potentially make millions. “You need to be evolving in the market in order to be profitable, and you need to be condensing positions that maybe aren’t so great or sexy or attractive for this next run into positions that are attractive,” he advises.

Deutscher also cautions against fixating on arbitrary price targets or portfolio milestones. “Price targets are stupid,” he asserts. “The number one way that people wreck themselves last cycle was attaching themselves to arbitrary numbers like, ‘Oh, when I hit a million dollars, then I’ll cash out,’ or ‘Oh, when Bitcoin hits 100K, then I’ll cash out.’”

Instead, he recommends implementing an incremental profit-taking system. “For each coin that you buy, have a plan to shift out set percentages at certain multiples,” he suggests. “This approach allows investors to secure gains progressively and adjust to market conditions without the need to predict exact peaks.”

At press time, Bitcoin traded at $67,347.

Featured image from Shutterstock, chart from TradingView.com

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

Best Altcoins

Crypto Guru Reveals His Top 10 AI Altcoins For 2025

Published

3 weeks agoon

November 29, 2024By

admin

Miles Deutscher, a prominent crypto analyst with over 575,000 followers on X (formerly Twitter), has unveiled his top ten artificial intelligence (AI) altcoins poised for significant growth by 2025. Emphasizing the burgeoning potential of the AI sector within the cryptocurrency landscape, Deutscher suggests that this could be “the biggest opportunity of the bull run.”

Why AI Offers A Lot Of Potential

Deutscher highlights the rapid expansion of the global AI market, noting that it grew by approximately $50 billion between 2023 and 2024. Projections estimate a compound annual growth rate (CAGR) of 28.46%, potentially surpassing $826 billion by 2030. Despite AI’s significant presence in public discourse—accounting for nearly one-third of attention in the crypto space—it currently ranks as the 34th largest crypto sector by market capitalization, trailing behind sectors like liquid staking, memecoins, and decentralized finance (DeFi). “Yet, AI is still only the 34th ranked crypto sector by market cap, behind liquid staking, dog memes, DeFi, and more. I could easily see AI as a top 5-10 sector in a year’s time,” Deutscher stated.

He argues that this disparity presents a massive opportunity for investors. “Many mid-low cap AI tokens are still sitting at ridiculously low valuations. All it takes is a strong rotation into AI for many of these to quickly reprice 5-10x higher,” he explained. Deutscher outlines his fundamental thesis for why AI crypto is set for substantial growth. Firstly, he notes that everyone is becoming aware of how impactful AI will be on society. “Either people are scared, excited, or intrigued by the latest developments. This already cements AI in general in the minds of the masses,” he said.

Related Reading

Secondly, he points out that AI is constantly innovating, with new products regularly entering the market. “Every time a new AI product is released, this puts even more focus on the sector. And crypto is an attention economy. More eyeballs equals more speculation,” Deutscher observed. Thirdly, he believes that crypto offers a lower barrier to gain exposure to the growth of AI. “Crypto is easier to access, able to be fractionalized, and generally ‘cheaper’ than investing in, let’s say, AI equities. For retail, this is a massive benefit,” he asserted.

Finally, he highlights the recent rise of AI agents, which has made people aware of the power of AI integrated with crypto. “We’re moving into a future where AI agents will trade autonomously on-chain for you, manage your portfolio and risk, DeFi, and more. It’s going to completely change the landscape of crypto,” Deutscher predicted. He also notes that this trend is occurring in traditional tech sectors, with corporations like Adobe and Expedia integrating AI agents into their operations.

Focusing on the AI and crypto landscape, Deutscher mentions that he is investing across various verticals, with a particular emphasis on AI agents and AI infrastructure. He is concentrating on “pick-and-shovel infrastructure protocols” rather than individual AI agents or broader DePIN plays. He discloses that he holds positions in all the projects he mentions, some as a strategic advisor and investor.

Top 10 AI Altcoins

Deutscher’s top ten AI altcoins, ordered from the largest to the smallest market capitalization, are as follows.

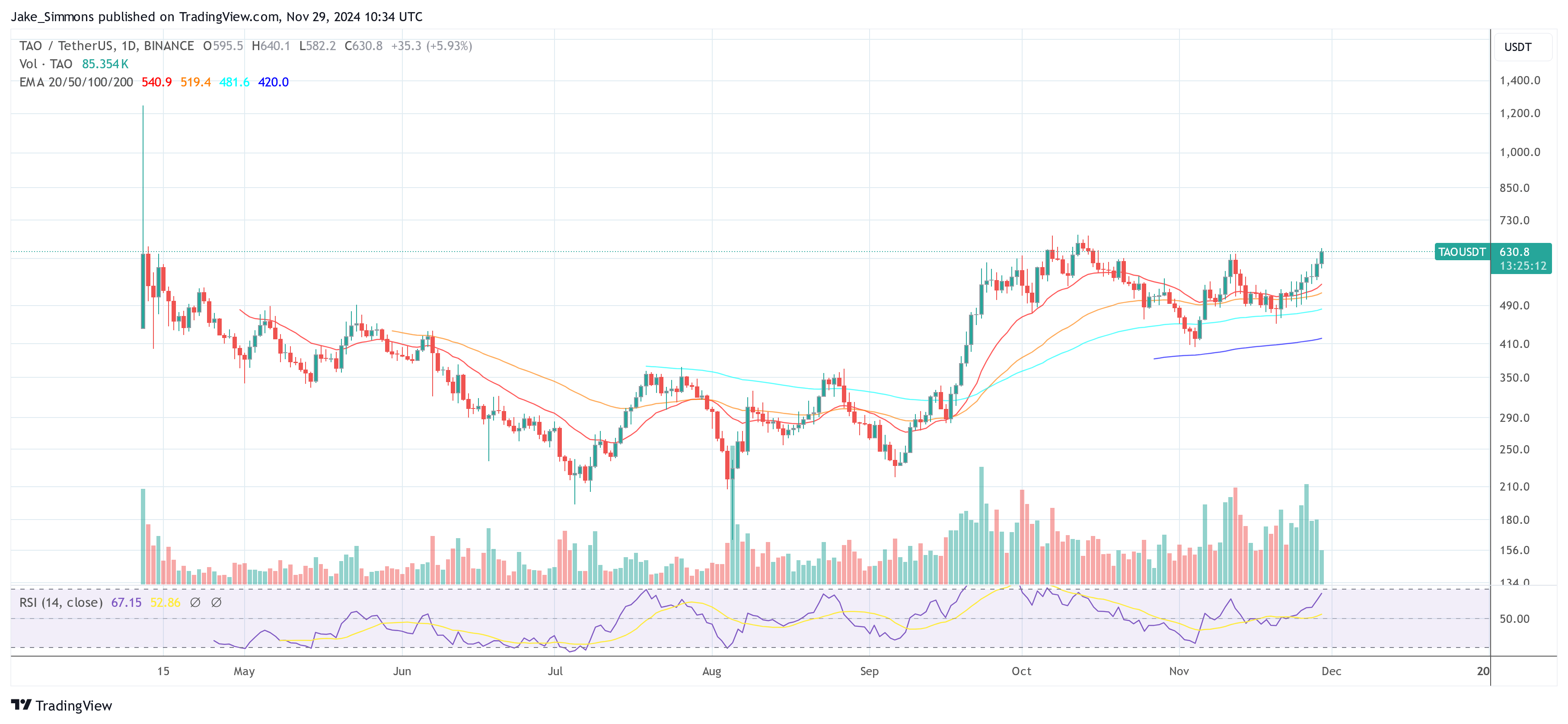

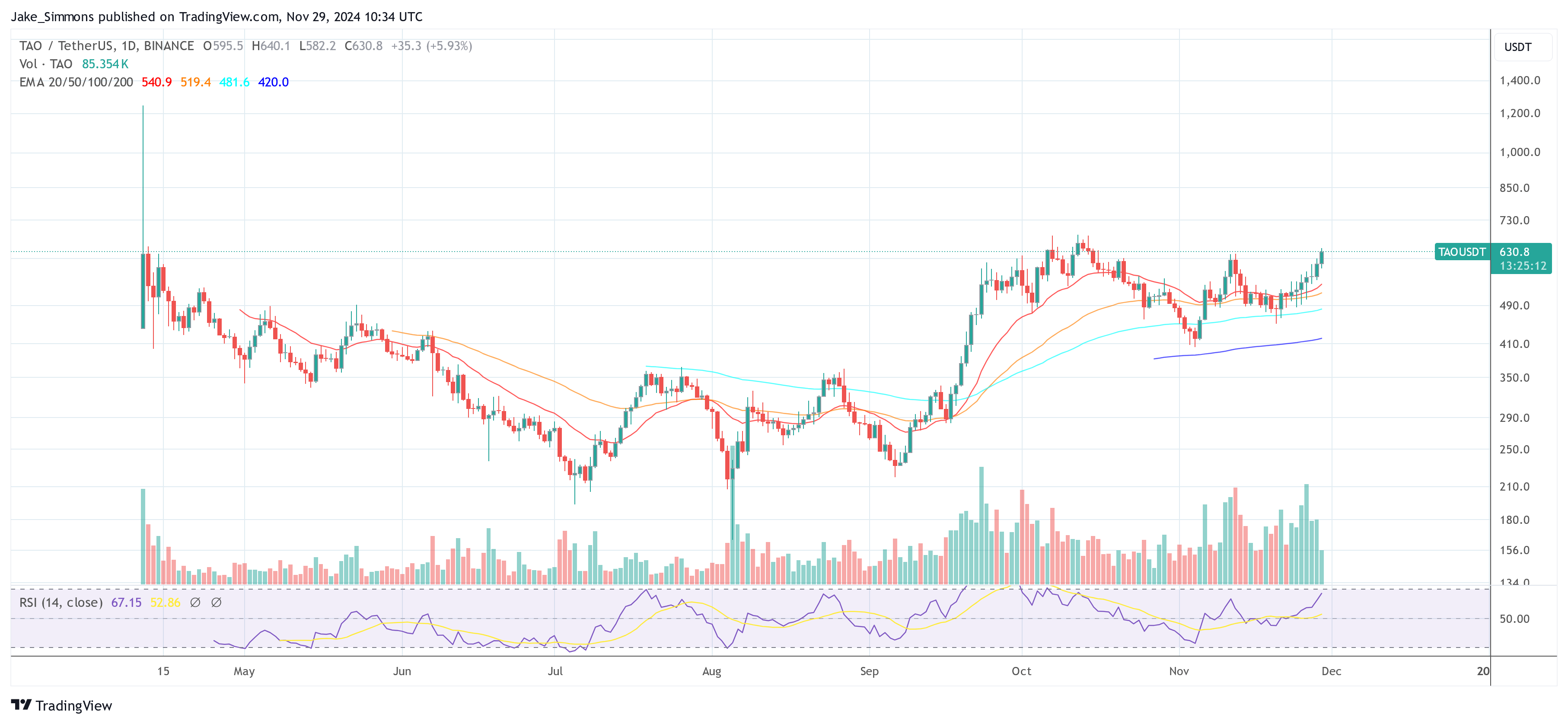

First on the list is Bittensor (TAO), which he describes as the AI market leader. Bittensor focuses on decentralizing AI research and has already seen significant adoption in scientific communities. “With the recent rollout of EVM compatibility, the network has taken a huge step forward, opening the door for developers to build DeFi ecosystems and unlock new use cases,” Deutscher noted.

Second is NEAR Protocol (NEAR), which he identifies as the leading Layer 1 (L1) blockchain intersecting with AI. “For those bullish on both verticals, NEAR serves as a solid proxy. Fun fact: Since its mainnet launch in October 2020, it has maintained 100% uptime,” he remarked.

Third is Grass (GRASS), a standout launch this cycle due to its data pipeline that seamlessly connects the real world with AI and crypto. “Recent developments in AI make data one of the most valuable commodities in the world. Grass uses crypto incentives to create a data pipeline that most AI companies otherwise cannot tap into,” he explained. He added that the demand for the Grass network is undeniable and that the protocol’s future looks incredibly promising.

Related Reading

Fourth is Spectral (SPEC), one of the leading AI agent infrastructure plays, allowing anyone to deploy and engage with AI agents. “With Syntax V2, you’ll be able to interact with sentient agents with personalities, which trade on Hyperliquid in accordance with the community’s input. It’s an interesting mix of fun, collaboration, and speculation,” Deutscher commented.

Fifth is Mode Network (MODE), which, although known as a Layer 2 (L2) solution, has been building AI technology for over a year. “They are leading the future of DeFi by facilitating the deployment of AI-driven agents, which will autonomously farm yield and optimize your portfolio on your behalf,” he said.

Sixth on the list is NeuralAI (NEURAL), connecting AI and gaming—two of crypto’s biggest adoption drivers. “They just announced SentiOS, which supplies autonomous AI to create, populate, and bring virtual worlds and economies to life,” Deutscher mentioned.

Seventh is PinLinkAi, where Deutscher is a strategic advisor and investor. PinLink is the first real-world asset-tokenized DePIN platform, empowering the fractional ownership of yield-bearing assets, physical or digital. “They have also recently partnered with Akash, Pendle, FetchAI, OpenSea, Alephium, ParallelAI, and more. Their business development is on another level,” he praised.

Eighth is Zero1 Labs (DEAI), another project where he serves as a strategic advisor and investor. Zero1 Labs enables innovators to build decentralized AI applications with fully homomorphic encryption, ensuring secure data governance and complete privacy. “Think of it as a pick-and-shovel AI infrastructure play. With a market cap of around $76 million, this is one of my ‘higher upside’ AI bets,” Deutscher revealed. He noted the debut of Seraphnet, the first of many projects planned through their incubator.

Ninth is Empyreal, also a project where he is an advisor and investor. As a believer in AI agents, Deutscher highlights that Empyreal provides AI infrastructure to turn social media messages into on-chain actions like trades and swaps through their Simulacrum platform. “It’s super cool,” he added.

Tenth is enqAI (ENQAI), another project where Deutscher is involved as an advisor and investor. EnqAI is a decentralized large language model network solving the bias and censorship issues common to centralized AI. “Despite its $20 million market cap, enqAI already has 20,000 monthly active users across 50-plus countries and has already handled over one million API requests with minimal downtime or lags,” he highlighted.

As a bonus, Deutscher mentions Guru Network (GURU), where he is also an advisor and investor. With its Layer 3 mainnet now live, Guru powers AI processors and chatbots with a decentralized exchange, stablecoin support, bridges, and base chain integration. “I’ve been working with Guru to launch a Telegram and Discord mini-app, delivering a full turnkey solution for DeFi on Telegram. It’s going to be very cool!” he exclaimed.

Deutscher emphasizes the importance of risk management. He reveals that his personal portfolio balance is approximately 70% large caps and 30% small to mid caps. “I recommend that you do your own research, and if you do decide to take a position in any of these protocols, make sure to manage position sizing and risk in line with your goals and overall strategy,” he advised.

At press time, TAO traded at $630.80.

Featured image created with DALL.E, chart from TradingView.com

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential