Bitcoin Cash

Top cryptocurrencies to watch this week

Published

3 months agoon

By

admin

A rebound push last week saw the global cryptocurrency market cap recover $180 billion amid a 9% surge in valuation. As a result, the crypto market cap recovered the $2 trillion mark to end the week at $2.1 trillion.

Following their impressive contributions to this rally, here are some top cryptocurrencies to watch this week:

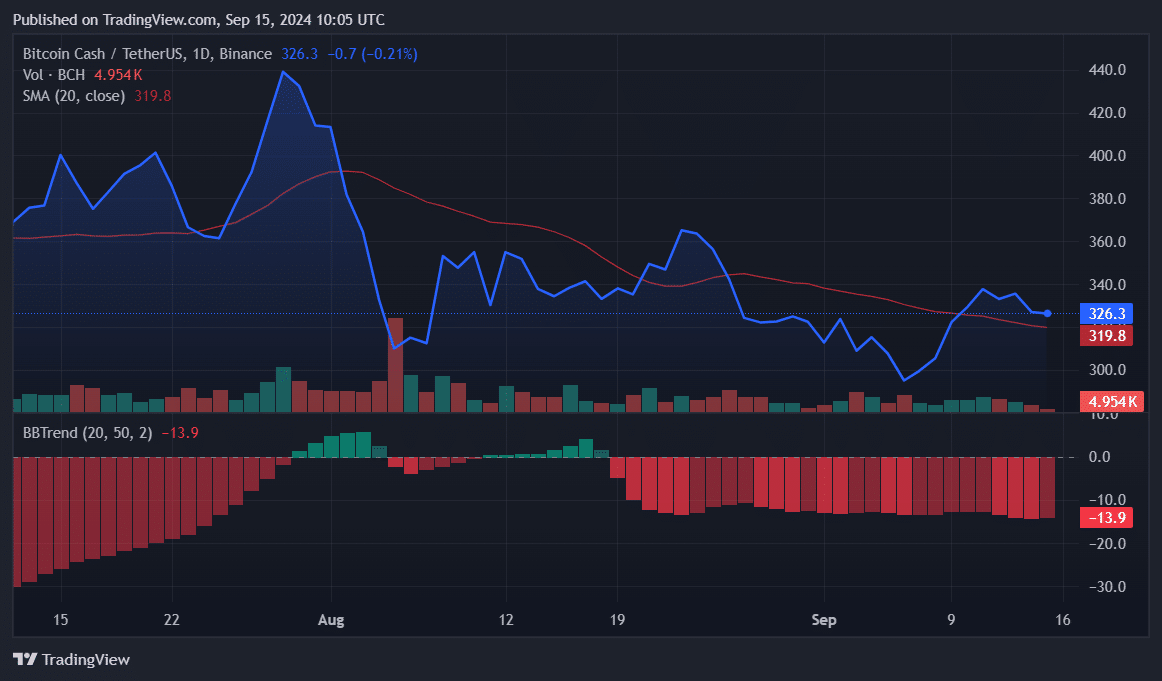

BCH crossed 20-day MA

Bitcoin Cash (BCH) surged 9.36% last week, securing its place above $300. Although it faced a minor correction, it closed the week at $327, maintaining an upward trajectory.

Despite the price rise, the BBTrend — or Bollinger Band Trend — remains bearish, signaling weakness in the uptrend.

Volume peaked on Sept. 11, but has since declined, even as the price climbed. This divergence between price and volume could indicate a lack of buying strength. Therefore, the rally may lose steam without renewed volume support.

BCH crossed above the 20-day moving average ($319) on Sept. 11, which now serves as a key support level. If the uptrend continues, BCH could target $340 or $350.

However, a dip below $319 may signal a retest of $300 or lower. Investors should watch for volume increases to sustain upward momentum.

Bitcoin Cash was developed by a group that believed Bitcoin should be used more as a peer-to-peer digital cash system, as outlined in Satoshi Nakamoto’s original whitepaper, rather than as a store of value or “digital gold,” which has been Bitcoin’s main use case.

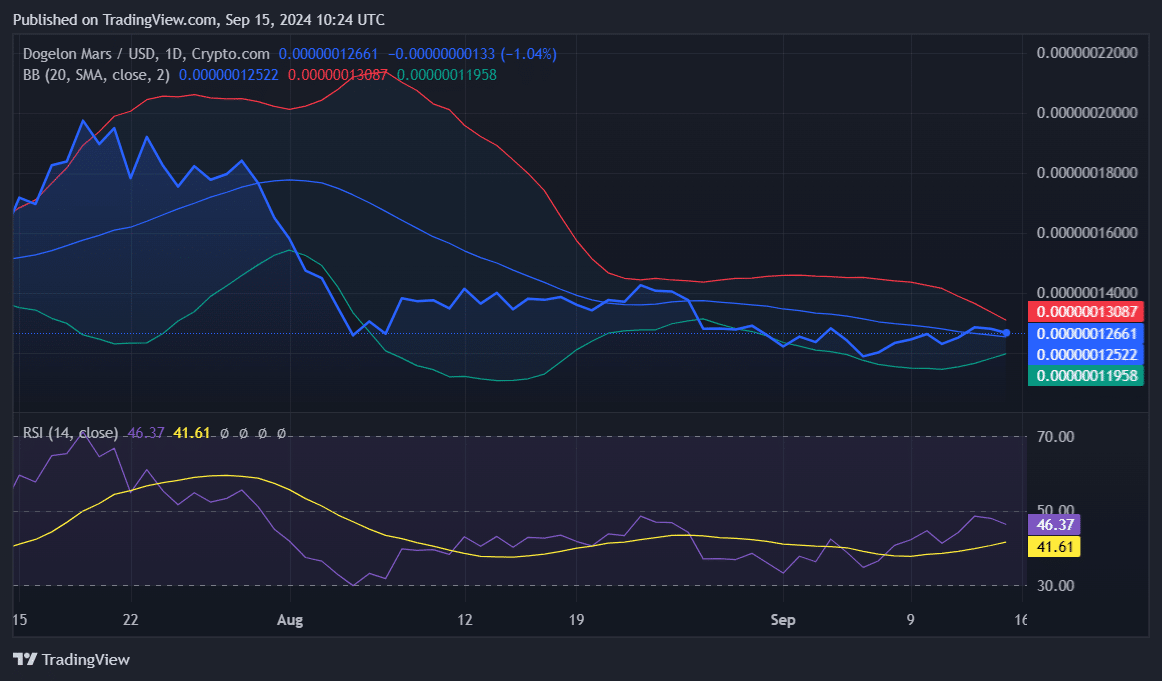

ELON performs below par

Dogelon Mars (ELON) gained 6.11% last week, performing below the broader market but managing to stay in the green.

The meme coin spent most of the week below the 20-day moving average ($0.00000012566) until the final day, closing at $0.00000012776.

Currently, ELON is positioned above the 20-day moving average (middle Bollinger Band) and the lower Bollinger Band ($0.00000011944), but below the upper Bollinger Band ($0.00000013075). This suggests it still has room to rise before hitting resistance at the upper band.

The RSI at 46.39 indicates that ELON is not overbought, signaling potential upside momentum. If the bullish trend continues, expect resistance around $0.00000013075, with support at $0.00000011944.

If it breaks above the upper Bollinger Band, ELON could push higher, but failure to hold above the 20-day MA might lead to a retest of lower levels.

ELON pays homage to both Dogecoin and Elon Musk, whose rocket company — SpaceX — is reportedly working on designs for a Martian city,

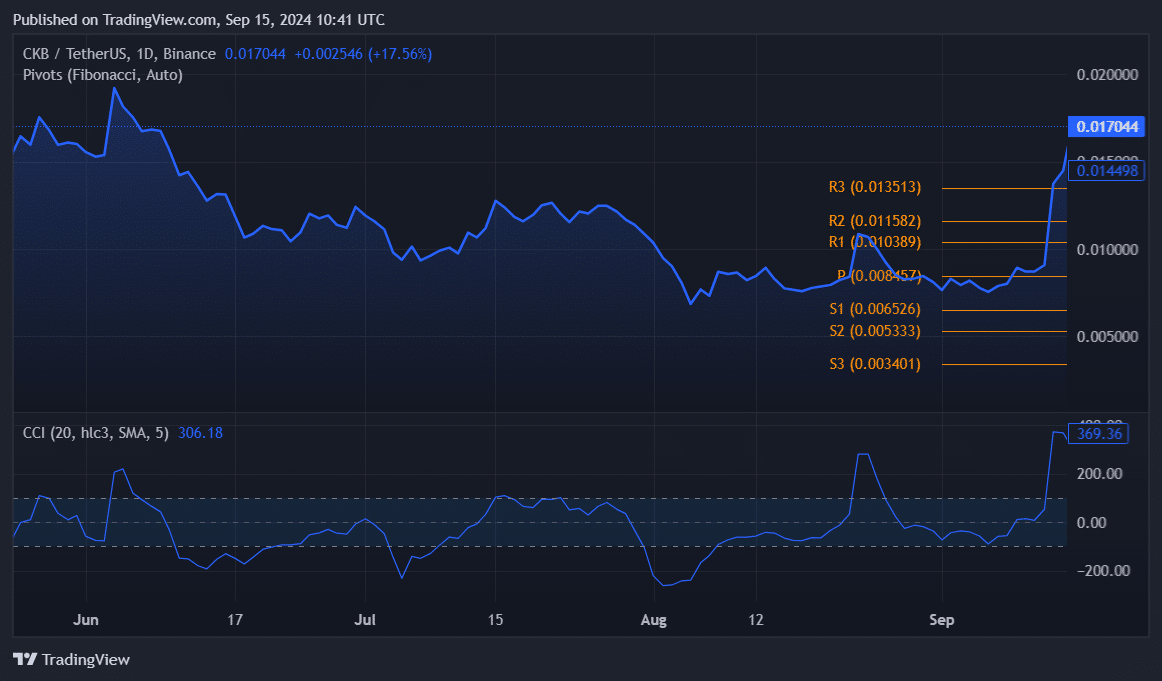

CKB tops gainers list

Nervos Network (CKB) was the top performer last week, soaring by 117% to close at $0.01449.

The dramatic rally began on Sept. 13, with a massive 51% intraday spike, the largest gain since February.

This momentum carried into the new week, with CKB peaking at $0.01762 before pulling back slightly. The Fibonacci pivot levels show immediate resistance at $0.01351, which CKB has surpassed, with support at $0.00845 (pivot) if a retracement occurs.

The Commodity Channel Index reading of 369 signals extreme overbought conditions, suggesting that while the uptrend is strong, a short-term correction could be on the horizon.

Should a correction happen, investors should look for support around $0.00845, the pivot point.

If CKB maintains its bullish momentum, a breakthrough above its three-month high could trigger further gains. However, watch for consolidation or pullback given the overextended CCI.

The Nervos Network was created by a team of blockchain developers and entrepreneurs with expertise in cryptography. The core team includes co-founders Jan Xie, Terry Tai and Kevin Wang.

The Nervos Common Knowledge Base (CKB) acts as its Layer 1 blockchain.

Source link

You may like

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

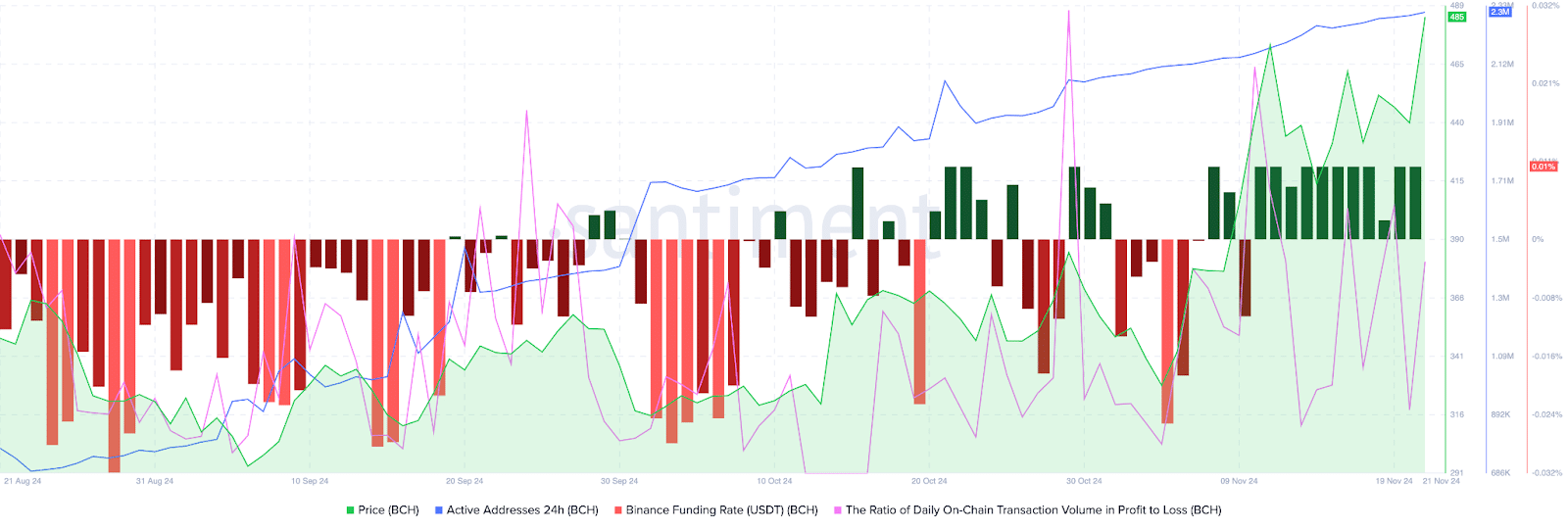

Bitcoin Cash (BCH) added nearly 35% to its value in the past month and rallied 12% on Nov. 21. Bitcoin’s (BTC) observed a rally to $98,384 early on Nov. 21, with BCH and other top cryptocurrencies tagging along for the ride.

An analysis of on-chain and technical indicators and data from the derivatives market shows that BCH could extend gains and retest its mid-April 2024 peak of $569.10.

Bitcoin hits all-time high, fork from 2017 ignites hope for traders

Bitcoin hit a record high of $98,384 on Nov. 21, a key milestone as the cryptocurrency eyes a run to the $100,000 target. BTC was forked in 2017, creating a spin-off or alternative, Bitcoin Cash.

BCH hit a peak of $1,650 in May 2021. Since April 2024, BCH has been consolidating with no clear trend formation.

BCH price rallied nearly 30% since Nov. 15, on-chain indicators show that further rally is likely in the Bitcoin spin-off token.

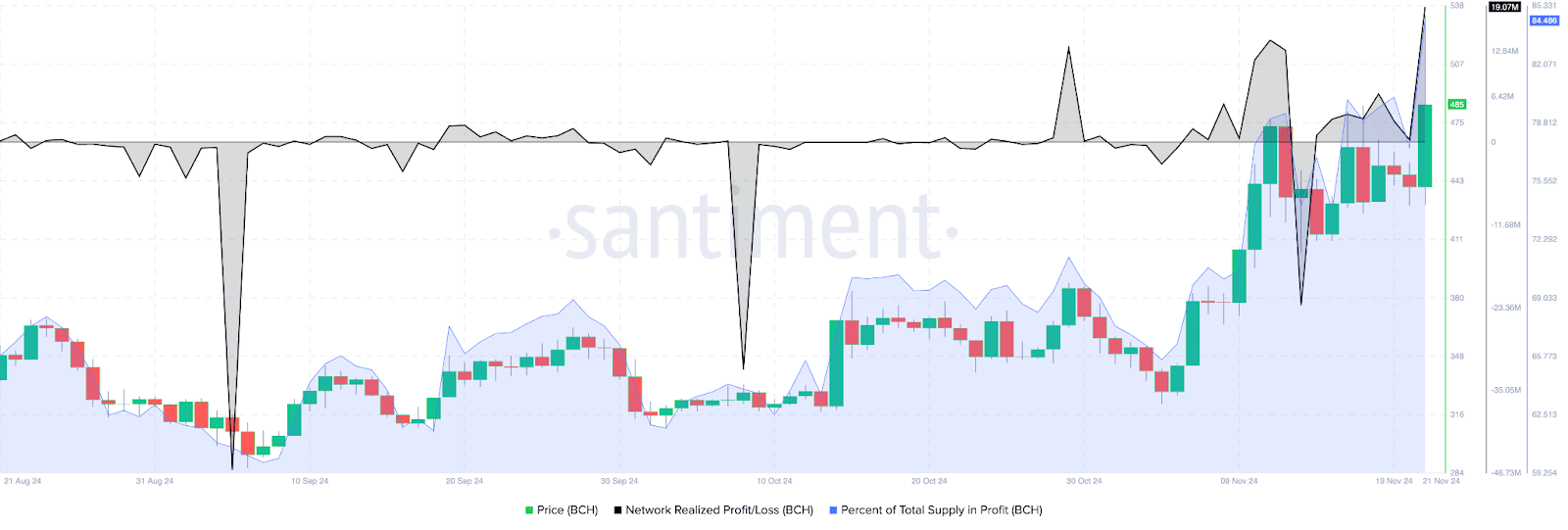

Bitcoin Cash’s active addresses have climbed consistently since August 2024. Santiment data shows an uptrend in active addresses, meaning BCH traders have sustained demand for the token, supporting a bullish thesis for the cryptocurrency.

The ratio of daily on-chain transaction volume in profit to loss exceeds 2, is 2.141 on Thursday. BCH traded on-chain noted twice as many profitable transactions on the day, as the ones where losses were incurred. This is another key metric that paints a bullish picture for the token forked from Bitcoin.

Binance funding rate is positive since Nov. 10. In the past eleven days, traders have been optimistic about gains in BCH price, according to Santiment data.

The network realized profit/loss metric identifies the net gain or loss of all traders who traded the token within a 24 hour period. NPL metric for Bitcoin Cash shows traders have been taking profits on their holdings, small positive spikes on the daily price chart represent NPL.

Investors need to keep their eyes peeled for significant movements in NPL, large positive spikes imply heavy profit-taking activities that could increase selling pressure across exchange platforms.

84.48% of Bitcoin Cash’s supply is currently profitable, as of Nov. 21. This metric helps traders consider the likelihood of high profit-taking or exits from existing BCH holders, to time an entry/ exit in spot market trades.

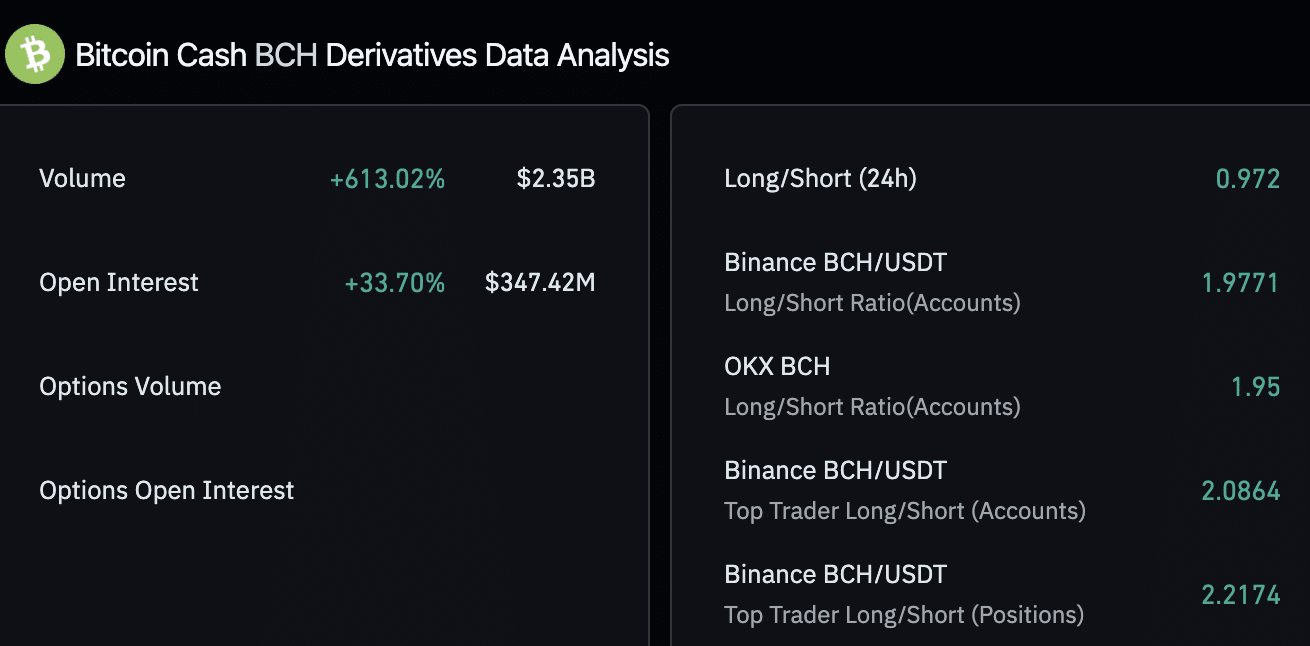

Derivatives traders are bullish on BCH

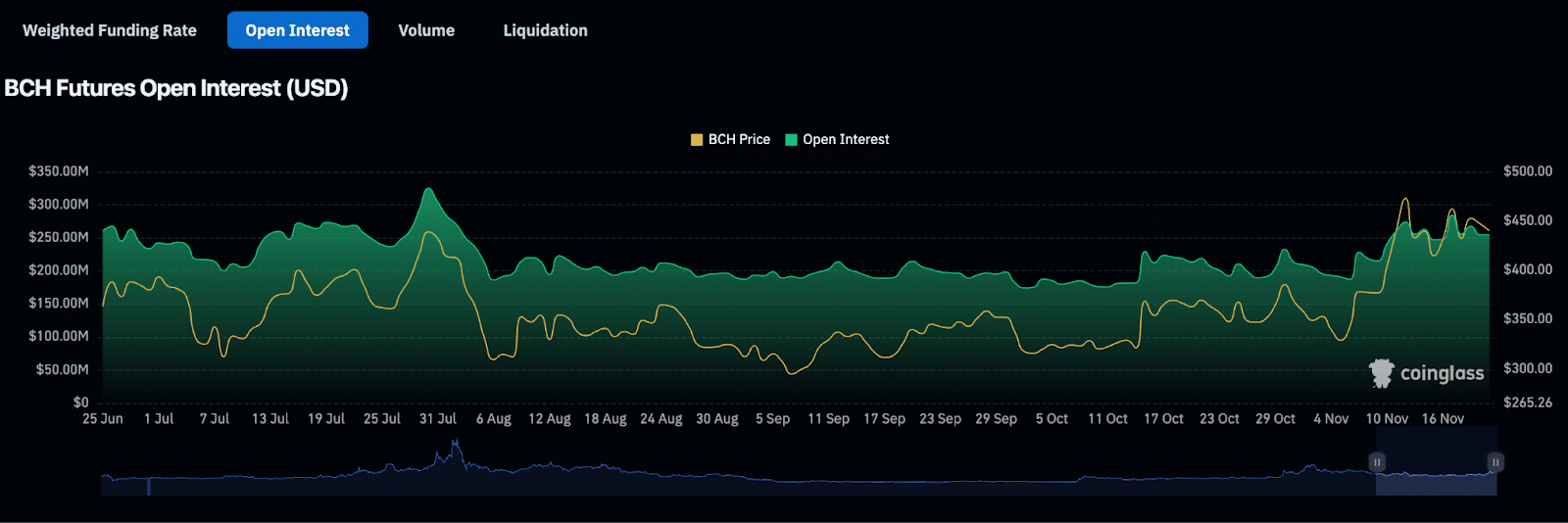

Derivatives market data from Coinglass shows a 33% increase in open interest in Bitcoin Cash. Open interest represents the total number of active contracts that haven’t been settled, representing demand for the BCH token among derivatives traders.

Derivatives trade volume climbed 613% in the same timeframe, to $2.35 billion. Across exchanges, Binance and OKX, the long/short ratio is above 1, closer to 2, meaning traders remain bullish on BCH and expect prices to rally.

BCH futures open interest chart shows a steady increase in the metric, alongside BCH price gain since November 5, 2024. Open interest climbed from $190.74 million to $254.87 million between November 5 and 21.

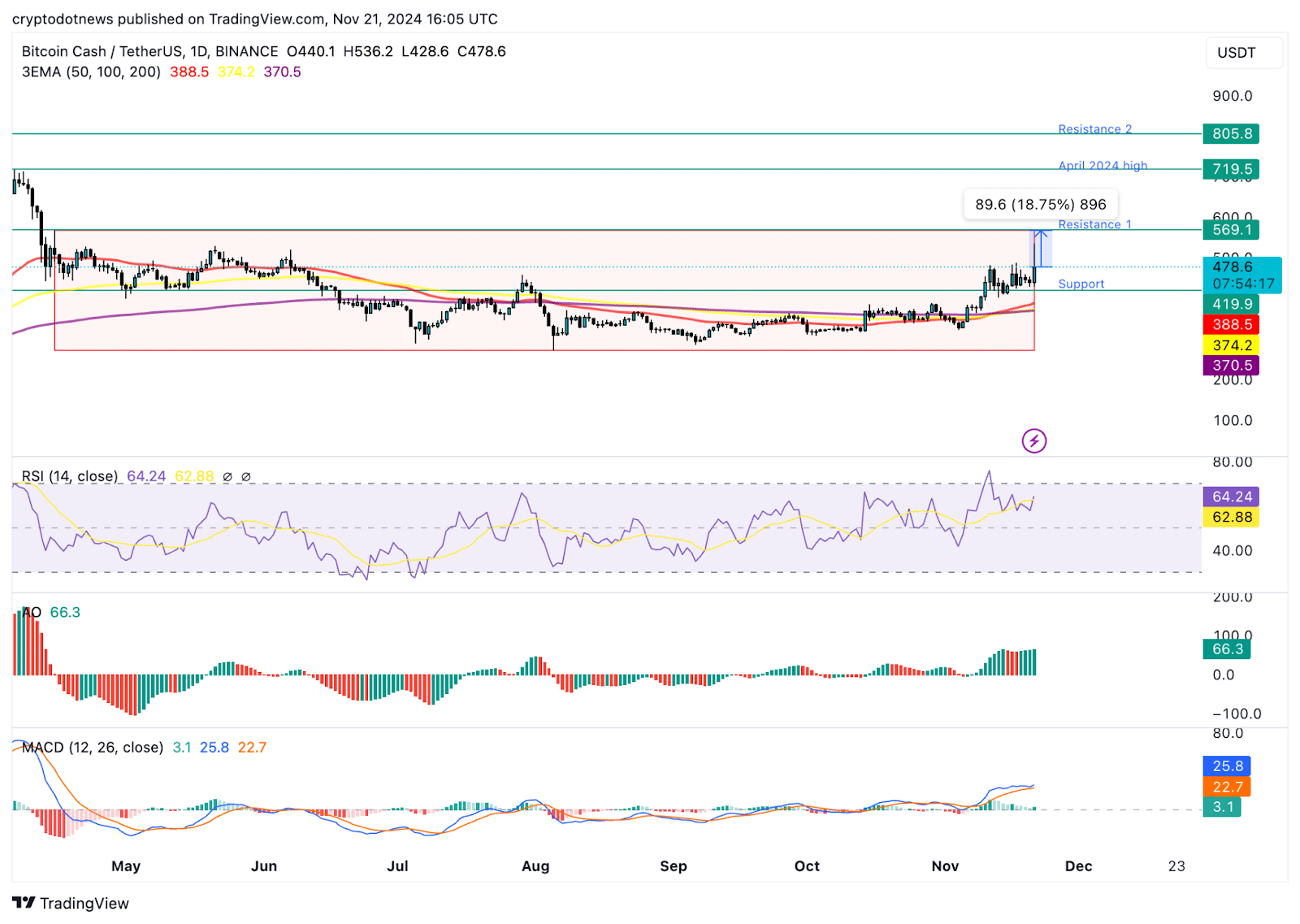

Technical indicators show BCH could gain 18%

The BCH/USDT daily price chart on Tradingview.com shows that the token remains within the consolidation. The token is stuck within a range from $272.70 to $568.20. BCH could attempt to break past the upper boundary of the range, a daily candlestick close above $568.20 could confirm the bullish breakout.

The April 2024 high of $719.50 is the next major resistance for BCH and the second key level is at $805.80, a key level from May 2021.

The relative strength index reads 64, well below the “overvalued” zone above 70. RSI supports a bullish thesis for BCH. Another key momentum indicator, moving average convergence divergence flashes green histogram bars above the neutral line. This means BCH price trend has an underlying positive momentum.

The awesome oscillator is in agreement with the findings of RSI and MACD, all three technical indicators point at likelihood of gains.

A failure to close above the upper boundary of the range could invalidate the bullish thesis. BCH could find support at the midpoint of the range at $419.90 and the 50-day exponential moving average at $388.50.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

24/7 Cryptocurrency News

Hindenburg Report Fails to Impact Indian Market, Will Crypto Recover With Asia Stocks Rally?

Published

4 months agoon

August 12, 2024By

admin

After seeing some selling pressure in the early trading hours on Monday following the Hindenburg report last weekend, the Indian market bounced back into the green zone. The report alleges a conflict of interest in the funds used by the Adani Group of companies and the SEBI chair Madhabi Puri Buch.

Hindenburg Report Fails to Impact Indian Market

Despite the early market selloff with the Nifty 50 Index falling over 300 points, it has entirely recovered over the last hour with the index trading 80 points in the green as of press time. Similarly, stocks of the Adani Group were trading 5.6% down on Monday, however, the shorts have recovered well with all the stocks trading in the green.

On the other hand, the Asian stock market is also showing strength with the former BOJ governor stating that the Japanese central bank won’t raise interest rates again this year. The focus now shifts to US CPI numbers for July to be revealed ahead this week as the market remains cautious about a US recession going ahead. Nomura Holdings Inc. said in a note:

“The skies are not fully clear yet, but there are several reasons that suggest to us that some relatively calmer seas are ahead of us”.

Similarly, the benchmarks in Australia and South Korea saw gains along with the revenue increase at Taiwan Semiconductor Manufacturing Co. boosting the Taipei Index. Similarly, the Hong Kong stocks remained mostly unchanged while the Japanese markets were closed for a holiday.

As a result, Indian investors also decided to look past the Hindenburg short-selling report.

Will the Crypto Market Recover?

The crypto market faced a major sell-off recently with the Bitcoin price crashing to $58,000 levels ahead of the much-awaited Donald Trump interview with Elon Musk.

Along with Bitcoin, altcoins have also been part of this crypto-market selloff falling more than 5-6% recently. However, all eyes are on the important macro events scheduled this week such as the US CPI data release for July, the NZ Fed taking its call on rate cuts, and much more. However, amid the recovery in Asian stocks, there’s enough probability that of short covering in the crypto market by the time the US markets open on Monday.

Bitcoin Investing Essentials, A Sneak Peek at This Week’s Big Events (8/12-8/18)

After a week of adjustment, the market has come out of the blow of the Bank of Japan’s interest rate hike. Recent dovish comments from the Bank of Japan have also given the market confidence, and…

— Greeks.live (@GreeksLive) August 12, 2024

Bhushan Akolkar

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Mt. Gox creditors report Bitcoin balances on Kraken

Published

5 months agoon

July 24, 2024By

admin

Kraken has started distributing Bitcoin received from the Mt. Gox Trustee on July 16.

Creditors of the defunct Bitcoin (BTC) exchange Mt. Gox reported seeing crypto balances on the Kraken platform, as impacted users saw relief 10 years after a historical hack. The news was confirmed on Reddit via a subreddit called “mtgoxinsolvency.”

Several users believed to be Mt. Gox claimants were seen verifying the update. Some also reported receiving Bitcoin Cash (BCH) tokens.

Per crypto.news, Kraken had promised to disburse funds to creditors within seven to 14 days. This came after Mt. Gox moved about $6 billion in crypto to several addresses. Users also noted “brute force” attacks on accounts, indicating that bad actors attempted to steal relief assets.

On July 23, Arkham also noted that the bankrupt BTC exchange sent $2.85 to four Bitstamp wallets. On-chain data showed transfers of 1598 BTC ($106.3 million), 382.4 BTC ($25.4 million), 2239 BTC ($149.1 million), and 890.9 BTC ($59.3 million), respectively. It is unknown whether Bitstamp will stick to the same two-week distribution window as Kraken.

UPDATE: MT. GOX MOVING $2.85B BTC

Mt. Gox moved a total of $2.85B BTC to new wallets this morning in order to distribute 5110 BTC ($340.1M) BTC to 4 separate Bitstamp addresses.

Bitstamp is one of the 5 exchanges that the Mt. Gox Trustee is working with to return funds to Mt.… pic.twitter.com/KsKuxMpvZS

— Arkham (@ArkhamIntel) July 23, 2024

Will Mt. Gox creditors sell their Bitcoin?

Based in Shibuya, Tokyo, Mt. Gox was hacked six times between 2011 and 2014, and hackers stole over 850,000 BTC. The incident is still one of the largest crypto hacks in history, and the haul is currently valued at more than $60 billion.

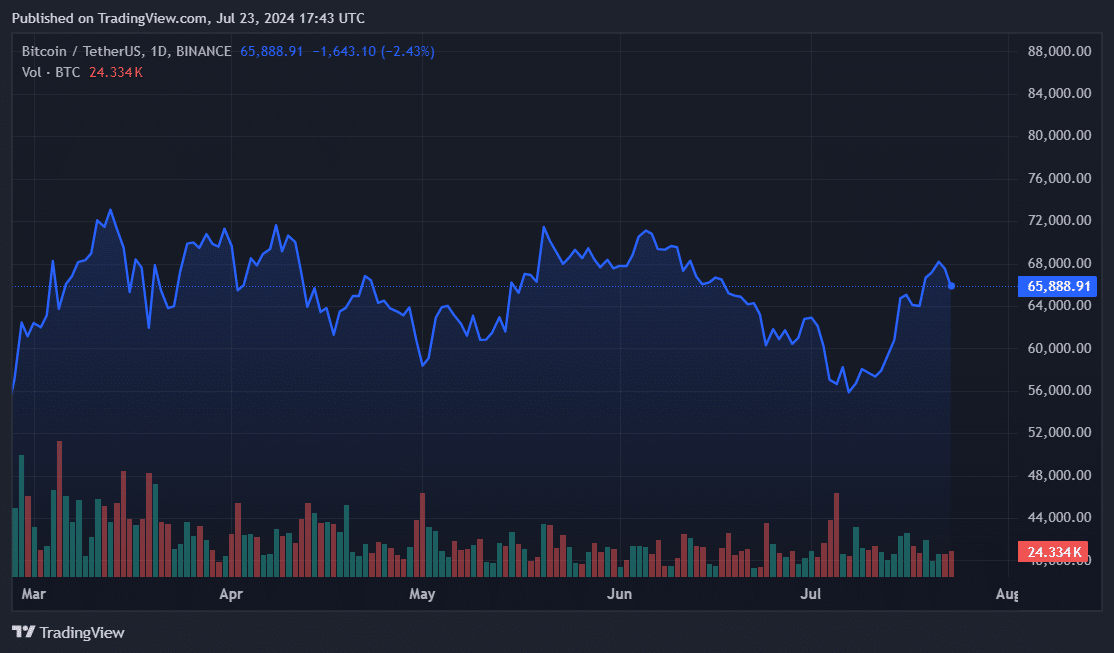

At least $9 billion is owed to creditors, and market observers hold different opinions regarding whether creditors will sell. If users decide to offload BTC tokens, BTC may experience sell pressure. As of this writing, the token traded down 2.3% and cost about $65,800 per token.

Source link

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: