bull market

Top cryptocurrencies to watch this week

Published

5 months agoon

By

admin

The global cryptocurrency market capitalization surged by an impressive 16.3% last week, reaching a record high of $3.2 trillion and gaining $430 billion in valuation for the week.

Bitcoin (BTC) led the charge, achieving a new all-time high above $93,000. Here are some of last week’s other standout performers to watch:

XRP finally reclaims $1

After underperforming at the start of the market uptrend two weeks ago, Ripple’s XRP (XRP) staged an impressive solo rally last week, closing with a remarkable 100% gain and solidifying its position among the top performers.

The asset began the week trading below the critical $0.60 mark, following a dip from a $0.57 high days earlier. However, it gained momentum amid the market rally, surpassing $0.60 on Nov. 11.

Defying a slowdown in the broader market, XRP continued its upward trajectory, breaking through the $1 barrier on Nov. 16 for the first time in three years. The rally peaked at $1.26 before facing a pullback, though XRP managed to hold above $1, ending the week at $1.12.

Should the pullback persist this week, traders should monitor the upper Bollinger Band at $0.9980, as a drop below this level could signal further downward pressure.

XLM rallies 115%

Stellar (XLM), which often mirrors XRP’s price movements, delivered an equally impressive rally last week, recording a staggering 115% surge by the week’s close.

The majority of these gains were realized on Nov. 16, with XLM posting a 50.95% increase. This upward momentum was triggered by a breakout above the upper boundary of the Keltner Channel on Nov. 15, propelling XLM past the $0.13 mark.

However, the new week has seen XLM facing a sharp 12% decline, accompanied by a drop in its RSI, signaling weakening momentum.

Despite this, the RSI remains at 75, indicating it is still in oversold territory. For now, bulls remain in control as long as XLM holds above the upper Keltner Channel boundary at $0.1693.

LTC knocks at $100

Litecoin (LTC) initially trailed in the broader market uptrend but experienced a significant rally last week, breaking through the $70 range. The asset initially spiked to $80 on Nov. 11 before retreating to $71 two days later.

A subsequent recovery pushed LTC above $90 for the first time since May, reaching a seven-month high of $98 on Nov. 16. However, resistance at the critical $100 level halted further gains.

LTC ended the week with a solid 29% gain but has since declined by 8.36% in the new week. The rally was partly fueled by a surge in social media mentions, as the Litecoin community humorously explored a pivot to meme coin status.

Due to current market conditions I now identify as a memecoin.

— Litecoin (@litecoin) November 14, 2024

Currently trading at $87.58, LTC finds immediate support at the 38.2% Fibonacci retracement level around $85.64. If this level is breached, the next line of defense lies at $81.57 to prevent a drop below $80.

On the upside, Litecoin needs to clear $90.67 to regain bullish momentum.

Source link

You may like

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

24/7 Cryptocurrency News

CryptoQuant CEO Explains Why Bitcoin Bull Market is Over Now

Published

1 week agoon

April 5, 2025By

admin

CryptoQuant CEO Ki Young Ju avers that the Bitcoin bull market is over as prices hover around the $82K mark. The expert hinges his theory for Bitcoin price on key technicals, analyzing the relationship between Realized Cap, Market Cap, and selling pressure to reach his conclusions.

Expert Gives Reason Why The Bitcoin Bull Market Is Over

According to an analysis on X, Ki Young Ju reveals that Bitcoin is firmly in bear market territory to the dismay of investors. The CryptoQuant CEO surmised in his analysis that the curtain has fallen for the Bitcoin bull market giving reasons.

In his analysis, Ju bases his prediction on the interplay between Bitcoin’s Realized Cap and the asset’s market capitalization. Realized market cap measures Bitcoin’s value using the price at which each BTC held in wallets was transferred. On the other hand, the market cap measures value by multiplying the circulating BTC supply with current prices.

The CryptoQuant CEO notes that market capitalization alone is not the best way to track the Bitcoin Bull Market. According to Ju, when there is low selling pressure in the markets, small Bitcoin purchases often send the market capitalization to new highs. Ju notes that Strategy has ridden the tailwind of low selling pressure to grow the paper value of their BTC holdings.

Conversely, when sell pressure is high, sizeable purchases are unable to send Bitcoin price on a rally. Strategy’s purchase of 22,048 BTC for $1.92 billion did not trigger a rally like its previous acquisition.

Onchain data indicates that Bitcoin’s Realized Cap is rising but market capitalization continues its decline, an indicator of bearish sentiments. Ju notes that fresh capital is flooding the markets but prices are not responding, signaling the end of the bitcoin bull market.

“When even large capital can’t push prices upward, it’s a bear,” said Ju.

Bitcoin Price Flashes Bearish Signals

Despite glowing fundamentals and large acquisitions, on-chain indicators are underwhelming for the top cryptocurrency. Bitcoin price is consolidating within a bearish pennant, a signal for even lower prices. However, a small bump has triggered speculation of a potential Bitcoin price decoupling from S&P500.

Crypto Sat says a short-term drop to $80K is in play for Bitcoin with prices standing at $82,950. However, Ju has even grimmer predictions for BTC, noting that a near-term rally is unlikely for the asset. The CryptoQuant CEO notes that it will take the asset up to six months to drag itself out of the bear market.

“Sell pressure could ease anytime, but historically, real reversals take at least six months,” said Ju.

Despite the dour sentiments, US Treasury Secretary Scott Bessent has praised BTC as a store of value comparing it with gold.

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Following a sharp multi-week selloff that dragged Bitcoin from above $100,000 to below $80,000, the recent price bounce has traders debating whether the Bitcoin bull market is truly back on track or if this is merely a bear market rally before the next macro leg higher.

Bitcoin’s Local Bottom or Bull Market Pause?

Bitcoin’s latest correction was deep enough to rattle confidence, but shallow enough to maintain macro trend structure. Price seems to have set a local bottom between $76K–$77K, and several reliable metrics are beginning to solidify the local lows and point towards further upside.

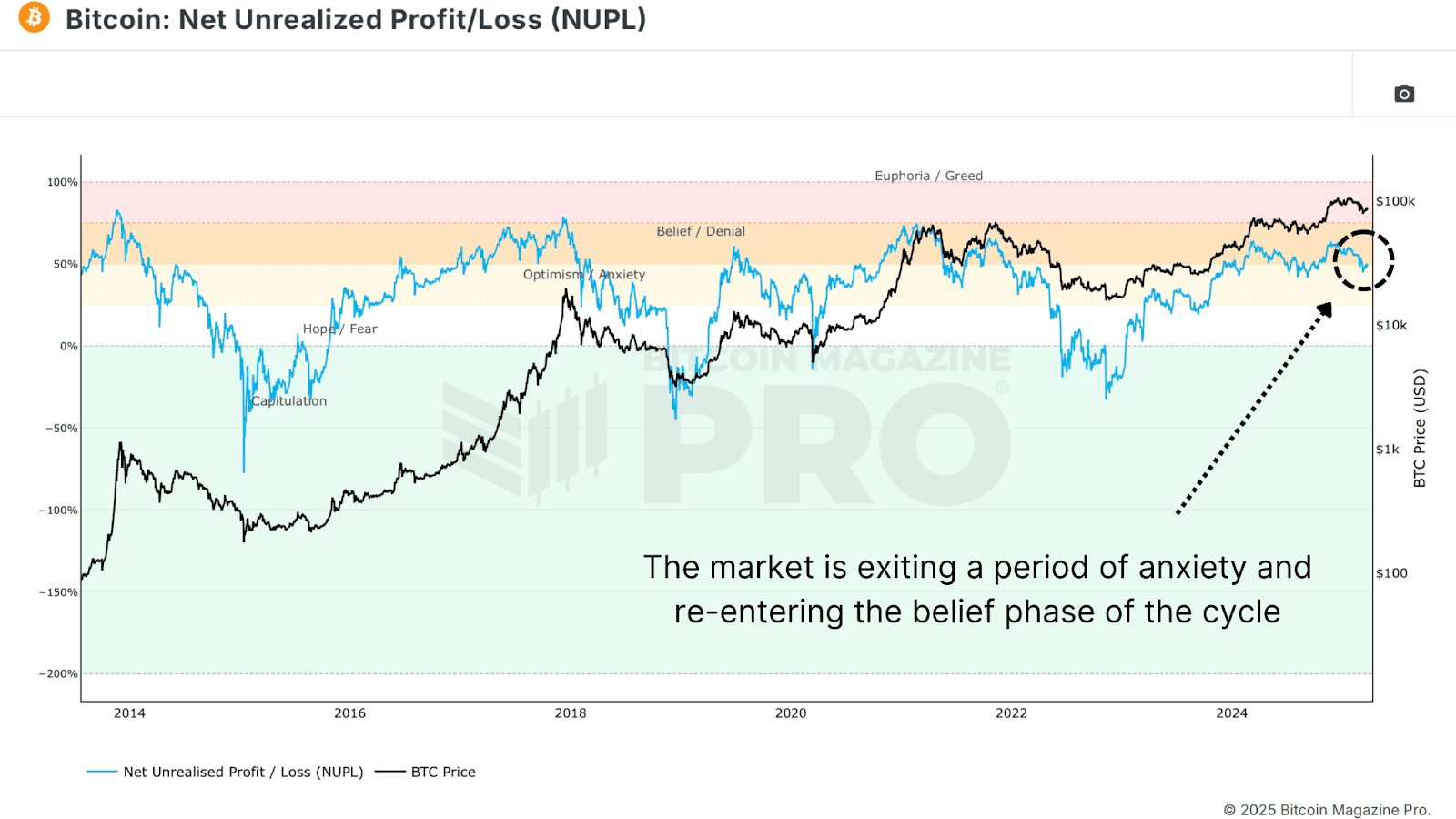

The Net Unrealized Profit and Loss (NUPL) is one of the most reliable sentiment gauges across Bitcoin cycles. As price fell, NUPL dropped into “Anxiety” territory, but following the rebound, NUPL has now reclaimed the “Belief” zone, a critical sentiment transition historically seen at macro higher lows.

The Value Days Destroyed (VDD) Multiple weighs BTC spending by both coin age and transaction size, and compares the data to a previous yearly average, giving insight into long term holder behavior. Current readings have reset to low levels, suggesting that large, aged coins are not being moved. This is a clear signal of conviction from smart money. Similar dynamics preceded major price rallies in both the 2016/17 and 2020/21 bull cycles.

Bitcoin Long-Term Holders Boost Bull Market

We’re also now seeing the Long Term Holder Supply beginning to climb. After profit-taking above $100K, long-term participants are now re-accumulating at lower levels. Historically, these phases of accumulation have set the foundation for supply squeezes and subsequent parabolic price action.

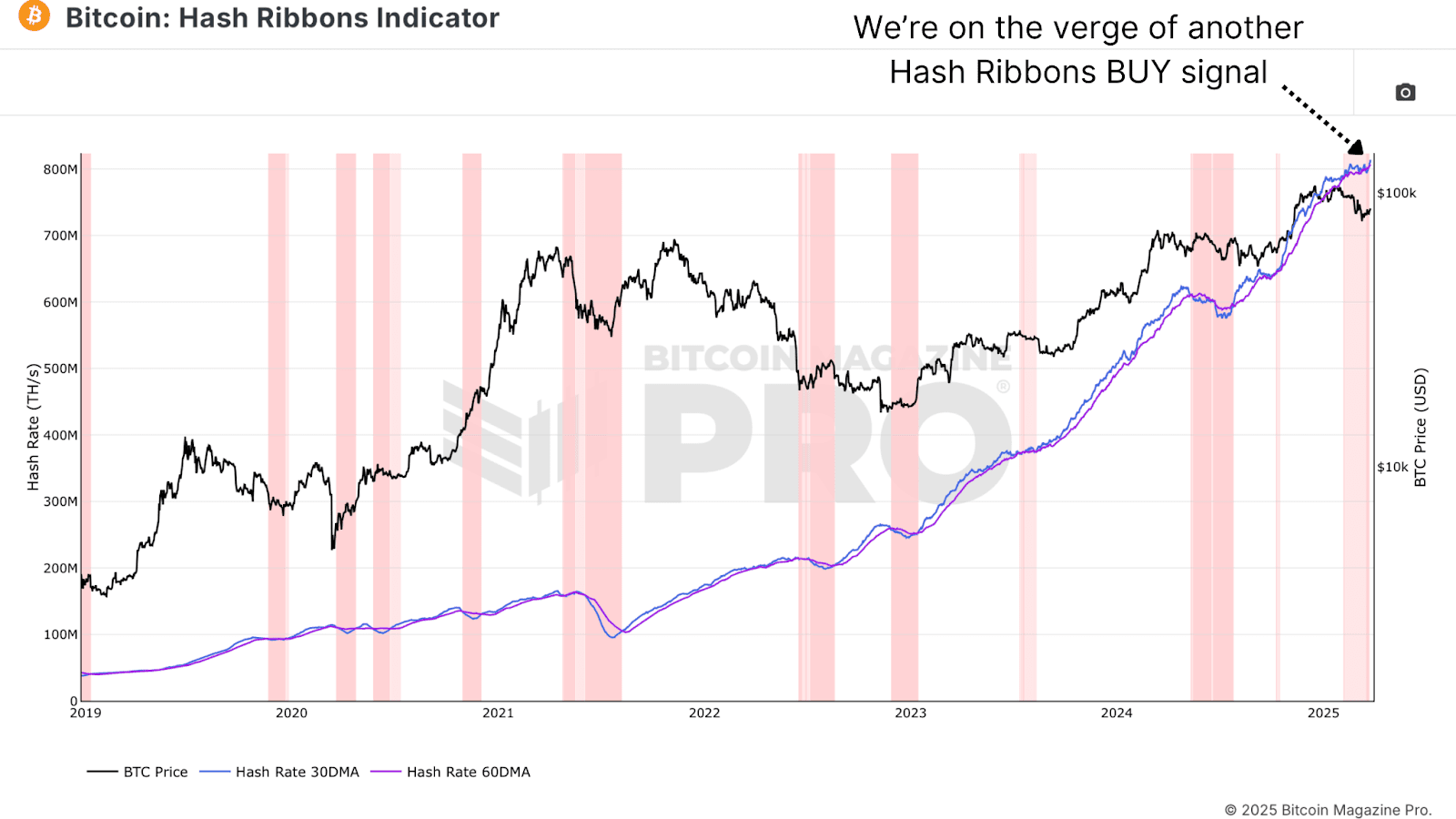

Bitcoin Hash Ribbons Signal Bull Market Cross

The Hash Ribbons Indicator has just completed a bullish crossover, where the short-term hash rate trend moves above the longer-term average. This signal has historically aligned with bottoms and trend reversals. Given that miner behavior tends to reflect profitability expectations, this cross suggests miners are now confident in higher prices ahead.

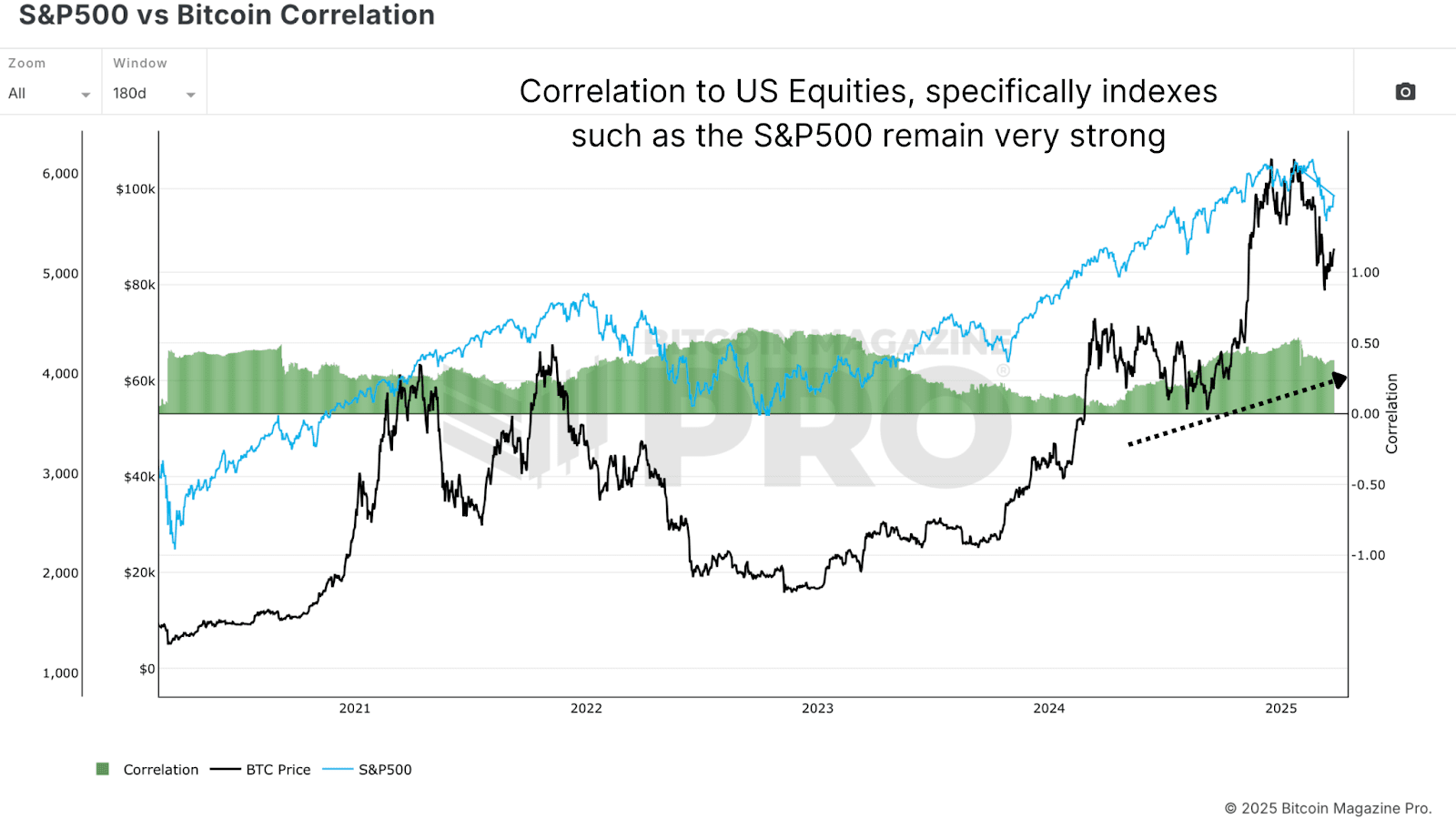

Bitcoin Bull Market Tied to Stocks

Despite bullish on-chain data, Bitcoin remains closely tied to macro liquidity trends and equity markets, particularly the S&P 500. As long as that correlation holds, BTC will be partially at the mercy of global monetary policy, risk sentiment, and liquidity flows. While rate cut expectations have helped risk assets bounce, any sharp reversal could cause renewed choppiness for Bitcoin.

Bitcoin Bull Market Outlook

From a data-driven perspective, Bitcoin looks increasingly well-positioned for a sustained continuation of its bull cycle. On-chain metrics paint a compelling picture of resilience for the Bitcoin bull market. The Net Unrealized Profit and Loss (NUPL) has shifted from “Anxiety” during the dip to the “Belief” zone after the rebound—a transition often seen at macro higher lows. Similarly, the Value Days Destroyed (VDD) Multiple has reset to levels signaling conviction among long-term holders, echoing patterns before Bitcoin’s rallies in 2016/17 and 2020/21. These metrics point to structural strength, bolstered by long-term holders aggressively accumulating supply below $80,000.

Further supporting this, the Hash Ribbons indicator’s recent bullish crossover reflects growing miner confidence in Bitcoin’s profitability, a reliable sign of trend reversals historically. This accumulation phase suggests the Bitcoin bull market may be gearing up for a supply squeeze, a dynamic that has fueled parabolic moves before. The data collectively highlights resilience, not weakness, as long-term holders seize the dip as an opportunity. Yet, this strength hinges on more than just on-chain signals—external factors will play a critical role in what comes next.

However, macro conditions still warrant caution, as the Bitcoin bull market doesn’t operate in isolation. Bull markets take time to build momentum, often needing steady accumulation and favorable conditions to ignite the next leg higher. While the local bottom between $76K–$77K seems to hold, the path forward won’t likely feature vertical candles of peak euphoria yet. Bitcoin’s tie to the S&P 500 and global liquidity trends means volatility could emerge from shifts in monetary policy or risk sentiment.

For example, while rate cut expectations have lifted risk assets, an abrupt reversal—perhaps from inflation spikes or geopolitical shocks—could test Bitcoin’s stability. Thus, even with on-chain data signaling a robust setup, the next phase of the Bitcoin bull market will likely unfold in measured steps. Traders anticipating a return to six-figure prices will need patience as the market builds its foundation.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin

Trader Predicts Crypto Rallies Amid Expectations of Fed Monetary Policy Shift – But There’s a Catch

Published

4 weeks agoon

March 18, 2025By

admin

A widely followed crypto analyst is predicting higher prices for crypto assets as he expects the Federal Reserve to end its anti-inflation monetary policies.

In a new thread, the pseudonymous crypto analyst Pentoshi tells his 861,300 followers on the social media platform X that we are close to seeing the end of quantitative tightening (QT), which are policies that reduce the Fed’s balance sheet and lowers the supply of money in circulation.

The trader cites data from the decentralized prediction platform Polymarket, which shows that 100% of users believe that the Fed will end QT by May of this year.

The cessation of QT is typically seen as bullish for risk assets like Bitcoin (BTC) and altcoins as the move signals the end of tight monetary conditions.

However, Pentoshi warns investors to be “cautiously optimistic” as both the S&P 500 and top crypto assets have seen growth over the last few years that appears unsustainable.

“I think we are getting close to [the] end of QT with Polymarket now pricing in odds as a sure thing whereas before they were much lower odds. As previously stated, it does seem Trump would end up forcing it. I don’t think QT automatically means it’s easy mode.

I think that mode is clearly gone overall in the way people think about it (2017/2021). While prices are much lower, I think it’s best to be cautiously optimistic. Many things are down significantly and there hopefully will be some decent mean reversion. Markets in general have rallied hard. And assets were likely a bit overvalued before.

SPX going 25% back to back years was going to have low growth or negative this year as it wasn’t a sustainable pace. BTC went from $16,000 to $108,000, SOL [from] $8 to $300. Cautiously optimistic. [Be] patient for any time capitulation, as often, following big trends, we eventually get longer sideways periods and less volatility as the market finds balance.”

While Pentoshi is flipping tactically bullish on stocks and crypto, he warns investors that any rally will likely be short-lived.

“I think any up currently will be a lower high. People underestimate the time aspect.”

At time of writing, Bitcoin is trading for $83,248.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: