crypto assets

Top cryptocurrencies to watch this week

Published

4 months agoon

By

admin

The crypto market just wrapped a highly bullish phase, with the global crypto market cap surging by $220 billion to reach a record-high valuation of $3.8 billion as of Sunday.

This upward trend was largely driven by Bitcoin (BTC), which surpassed the $100,000 milestone. However, several altcoins also capitalized on the momentum, achieving massive gains.

Following their noteworthy performances last week, here are our top cryptocurrency picks to keep an eye on this week:

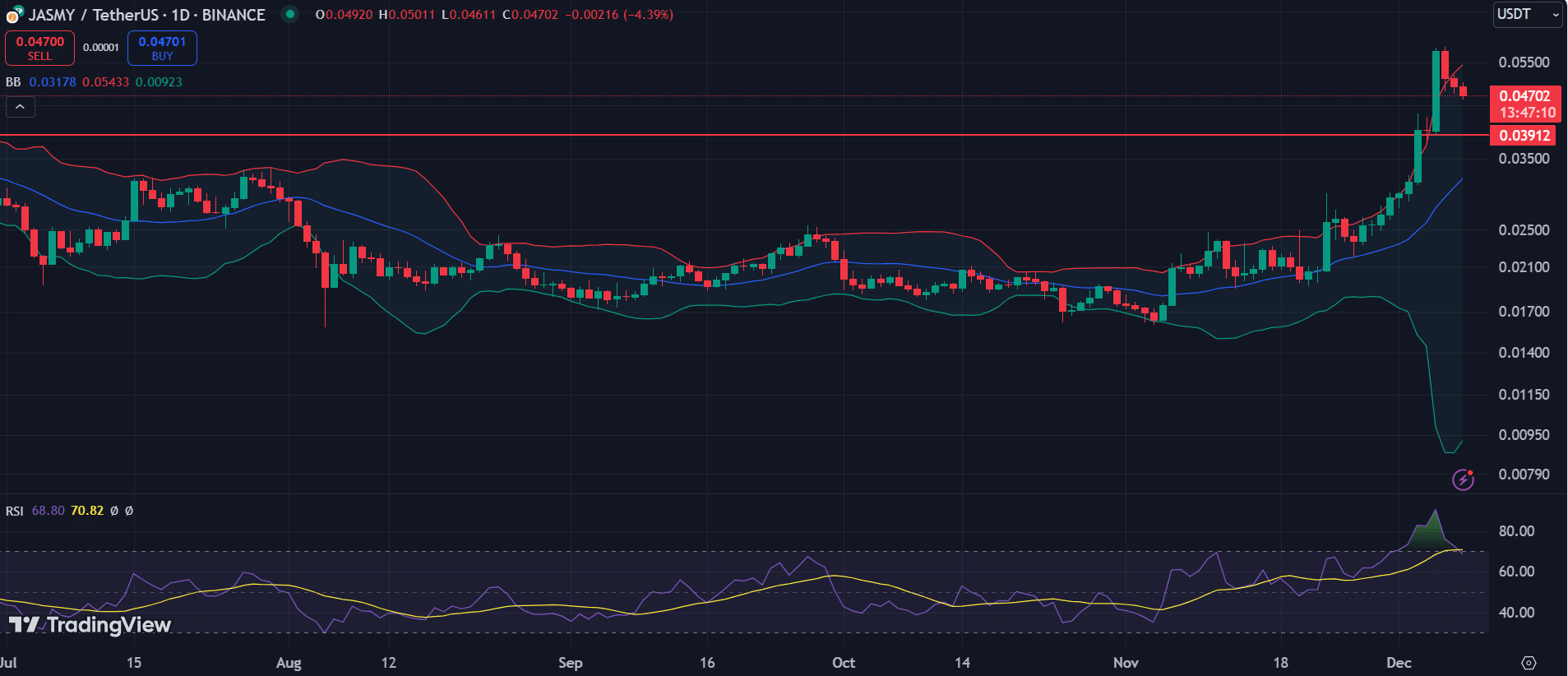

JASMY claims 2-year peak

JasmyCoin (JASMY) was a major beneficiary of last week’s uptrend. It built on a momentum that began on Nov. 27 and closed the week with an impressive 69% gain. See below.

Introduced by Jasmy Corporation for the Ethereum-based Jasmy platform, JASMY looks to combat concerns around data security. It operates on the Ethereum blockchain as an ERC-20.

The token soared by 27.49% on Dec. 3 — its largest intraday gain in nearly 10 months. Despite a slight pullback the next day, the asset engineered a more remarkable 45% rise on Dec. 5, eventually claiming a two-year peak of $0.0590.

JASMY has so far dropped to retest $0.047. Its relative strength index (RSI) has also slumped to 68.

The asset must retain $0.3912 to hedge against steeper drops. Below this, the next support rests on the 20-day MA at $0.03178.

QNT rallies 67%

Quant (QNT) also began the week on a bullish note, riding on Bitcoin’s uptrend to record a substantial weekly gain of 67%.

This marked one of its most bullish weekly performances this year.

QNT is the ERC-20 utility token of the Quant blockchain project, designed to bolster interoperability among different networks through its Overledger Network.

The token has been one of the best performers in the ongoing bull run. Quant has been on an ascending channel since early November, with the bulls leveraging the lower trendline to defend a drop below $96 on Dec.1.

As the bullish momentum wanes, QNT must hold above the Fibonacci 0.618 retracement at $126.3 to remain within the channel and sustain the uptrend. If the upsurge resumes, a push above $170.7 could trigger the start of a new explosive phase.

Overledger connects blockchains and traditional systems without requiring infrastructure changes. It supports the creation of multi-chain applications (mDApps) for seamless interaction across networks.

Targeted at sectors like finance, healthcare, and supply chain, Quant facilitates use cases such as cross-border payments, supply chain transparency, and digital identity management.

With partnerships including Oracle and Hyperledger, Quant stands out for integrating blockchain with regulated industries.

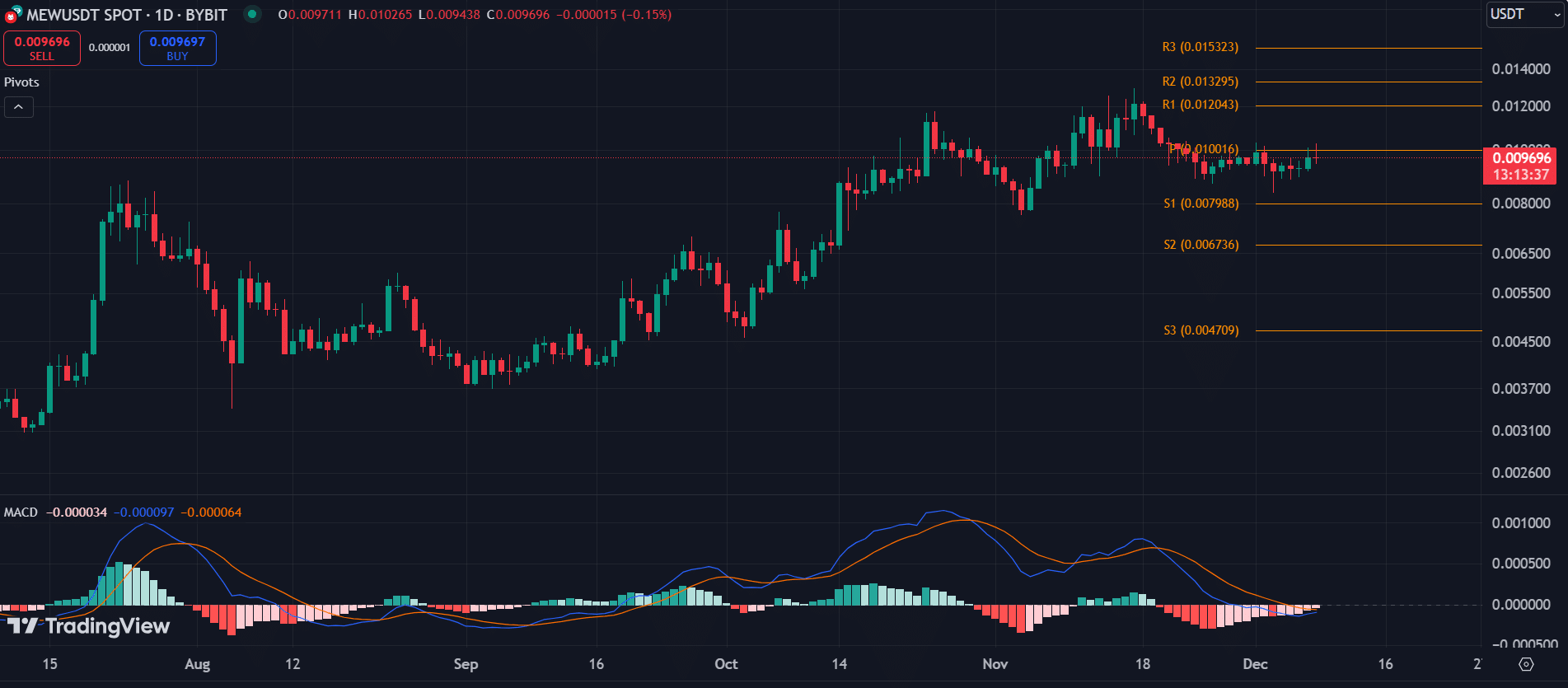

MEW consolidates below $0.01

Despite the prevalent uptrend in the market last week, cat in a dog’s world (MEW) largely consolidated. However, the meme coin managed a 2.5% weekly gain.

Launched in March, MEW is a cat-themed Solana-based meme coin, standing out in a market dominated by dog-themed tokens. It gained attention by burning 90% of its supply at launch.

In May, the project also partnered with LOCUS Animation Studios to create a 3D animated series, further enriching its narrative and boosting its fanbase. Within hours of launch, MEW reportedly achieved $150 million in transaction value and attracted significant traction across the Solana ecosystem

By Dec. 1, MEW began last week with an impressive 4.62% gain, but it all went downhill from there. The token collapsed 7.32% in two days, retesting the $0.0083 low, and then consolidating at $0.009 following a mild recovery.

Its MACD is also flashing a bearish trend, requiring an intervention to flip bullish. This week, MEW would have to recover above the Pivot level at $0.010016 to turn its momentum bullish. Above this, the first resistance would rest at $0.01204, with a further roadblock at $0.01329.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

You may like

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Altcoin

Dogecoin could rally in double digits on three conditions

Published

3 weeks agoon

March 28, 2025By

admin

Dogecoin rallied nearly 10% this week, resilient in the face of the U.S. President Donald Trump’s tariff war and macroeconomic developments. Most altcoins have suffered the negative impact of Trump’s announcements, DOGE continues to gain, back above $0.2058 for the first time in nearly two weeks.

Dogecoin rallies in double-digits, what to expect from DOGE price?

Dogecoin (DOGE) hit a near two-week peak at $0.20585 on Wednesday, March 26. In the past seven days, DOGE rallied nearly 10%, even as altcoins struggled with recovery in the ongoing macroeconomic developments in the U.S.

The largest meme coin in the crypto market could continue its climb, extending gains by nearly 11%, and testing resistance at the lower boundary of the imbalance zone between $0.24040 and $0.21465.

The upper boundary of the zone at $0.24040 is the next key resistance for DOGE, nearly 24% above the current price.

Two key momentum indicators, the RSI and MACD support a bullish thesis for Dogecoin. RSI is 52, above the neutral level. MACD flashes green histogram bars above the neutral line, meaning there is an underlying positive momentum in Dogecoin price trend.

Dogecoin on-chain analysis

On-chain analysis of the largest meme coin shows that the number of holders of DOGE is on the rise. If Dogecoin’s number of holders keep climbing or steady in the coming week, the meme coin could remain relevant among traders.

The network realized profit/loss metric shows that DOGE holders have realized profits on a small scale. Typically, large scale profit-taking increases selling pressure on the meme coin and could negatively impact price.

The metric supports a bullish thesis for DOGE in the coming week. Dogecoin’s active address count has been steady since mid-March, another sign of the meme coin’s resilience.

DOGE derivatives analysis and price forecast

The analysis of Dogecoin derivatives positions across exchanges shows that open interest is recovering from its March 12 low. Open Interest is $1.98 billion, as Dogecoin trades at $0.19. Coinglass data shows a steady climb in OI in the chart below.

The total liquidations data shows $4.29 million in long positions were liquidated on March 27. Sidelined buyers need to watch liquidations data and prices closely before adding to their derivatives position.

The long/short ratio on top exchanges, Binance and OKX exceeds 1, meaning derivatives traders are betting on an increase in DOGE price.

When technical analysis and derivatives data is combined, it is likely Dogecoin price could test resistance at $0.21465 next week, if spot prices follow the cue of derivatives traders.

What to expect from DOGE

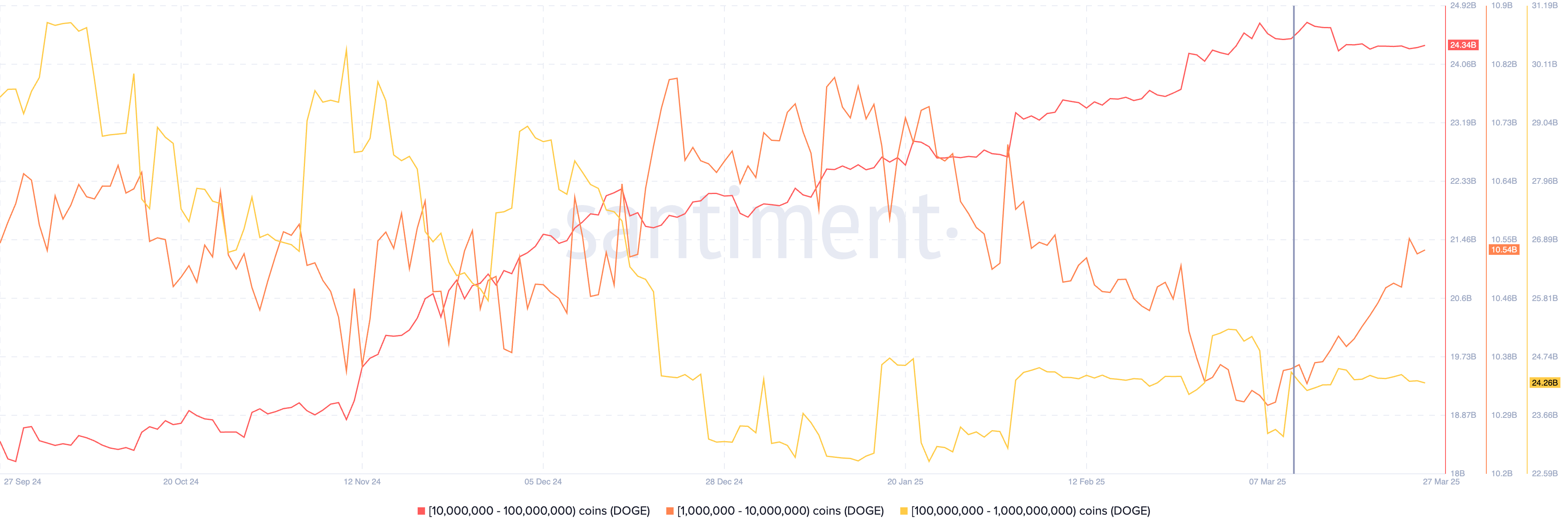

Dogecoin wallets holding between 1 million and 10 million DOGE tokens added to their portfolio consistently between March 10 and 27, while the other two categories, holding between 10 million and 100 million DOGE and 100 million and 1 billion DOGE tokens held nearly steady in the same timeframe.

The data from Santiment shows that DOGE’s traders holding between 1 million and 10 million tokens are rapidly accumulating, even as the token’s price rises. This supports demand for DOGE and a bullish thesis for the meme coin.

Dogecoin ETF and DOGE catalysts

DOGE holders are closely watching developments in Bitwise’s Dogecoin ETF filing with the SEC. The ETF filing is an effort to legitimize the meme coin as an investment category for institutional investors, as DOGE price holds steady among altcoins rapidly eroding in value.

Bitcoin flashcrashes dragged Dogecoin down with it, to a small extent, however the meme token recovered each time and consistent gains could signal an end to DOGE’s multi-month downward trend.

Other key catalysts for Dogecoin are positive updates in crypto regulation, passage of the stablecoin bill in the Congress, and demand for DOGE among whales and large wallet investors.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Altcoin

XRP hits new all-time high gears to extend bullish streak

Published

3 months agoon

January 19, 2025By

admin

XRP gained 42% in the past week, after rallying close to 1% on Friday. The altcoin hit a new all-time high, with the 24-hour trade volume leaving Ethereum (ETH) to bite the dust on Thursday. The token could extend its streak in the coming days following President-elect Donald Trump’s inauguration.

XRP could extend rally alongside Bitcoin

XRP rallied over 40% in the past week. Bitcoin (BTC), the largest cryptocurrency recovered from its flashcrash under $90,000 and made a comeback above $104,000 on Friday. The native token of the XRPLedger is rallying alongside the top crypto.

Trump’s upcoming inauguration is one of the leading catalysts, alongside optimism on crypto regulation, pro-crypto policy and a new approach by financial regulatory agencies in the U.S.

XRP could gain further, entering price discovery next week.

XRP trades at $3.26 at the time of publication.

On-chain indicators support gains

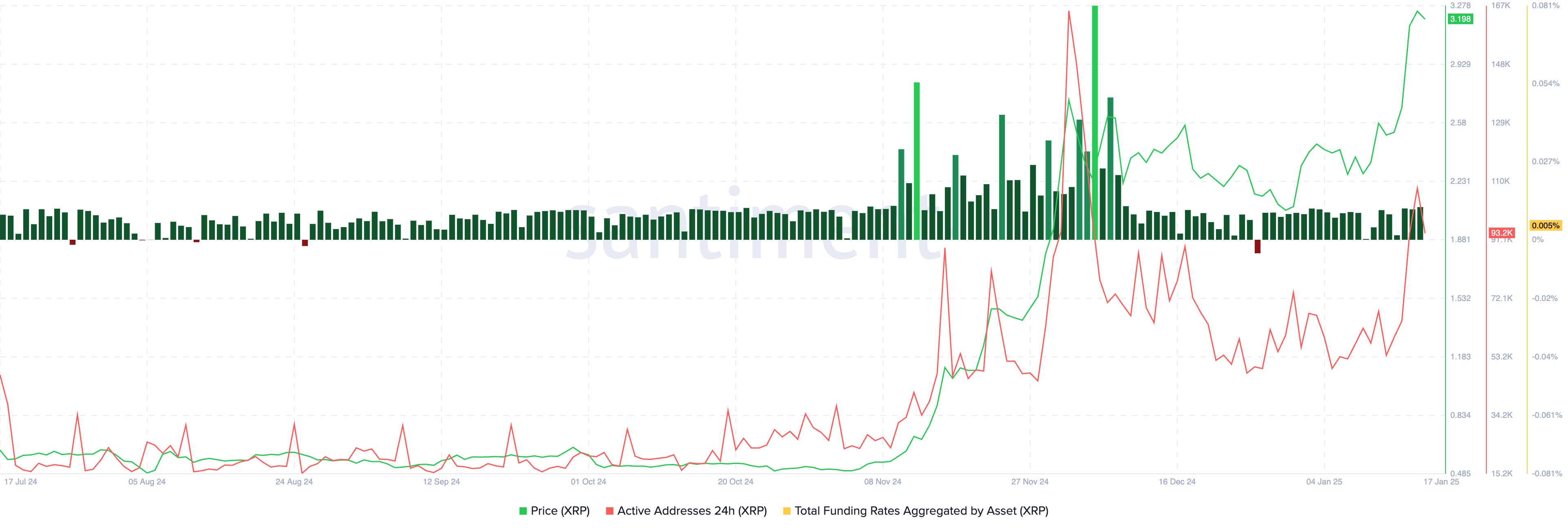

XRP’s on-chain indicators support a bullish thesis for the altcoin. The total funding rate metric is positive, greater than one throughout January 2025. The count of active addresses recorded a large spike on Thursday, Jan. 16.

The on-chain indicators on Santiment are conducive to further gains in XRP in the coming week.

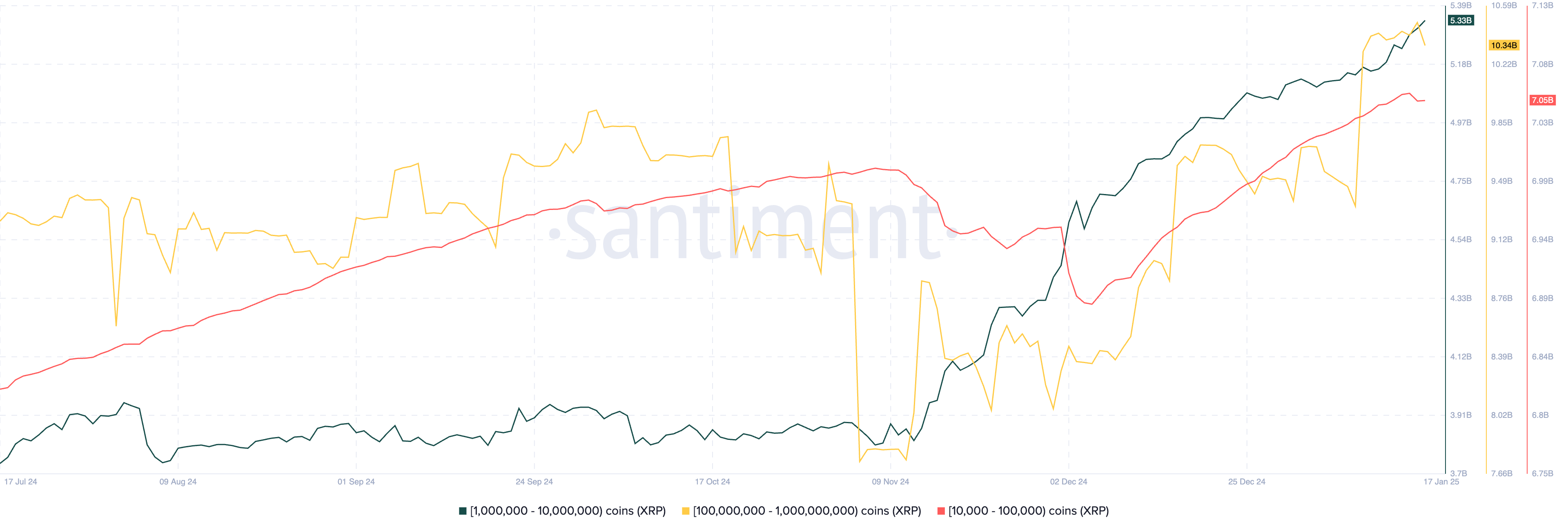

The supply distribution metric on Santiment shows an increase in XRP token supply held by wallets that own 10,000 to 100,000, 1 million to 10 million and 100 million and above XRP tokens. The three classes of holders have accumulated the altcoin, even as the price climbs. This is indicative of a likely XRP price increase in the future.

Market movers and Ripple lawsuit

Monday’s inauguration is the largest market mover in crypto. But RippleNet’s rising adoption among institutions, the developments in RLUSD stablecoin and the SEC’s lawsuit against Ripple are the three key market movers influencing the altcoin’s price.

Even as the U.S. financial regulator filed an appeal against Ripple on Jan. 15, the altcoin continued its rally undeterred. The July 2023 ruling by Judge Analisa Torres that classified secondary sales of XRP as non-securities is being challenged and the SEC is seeking to have those retail sales classified as unregistered securities sales.

Ryan Lee, chief analyst at Bitget Research, told crypto.news in an exclusive interview:

“XRP’s surge can be attributed to favorable outcomes in Ripple’s SEC lawsuit and a more crypto-friendly political climate in the US. If regulatory uncertainties are resolved, the influx of institutional investors could further solidify XRP’s position in the crypto market.”

It remains to be seen whether the Trump administration will support pro-crypto regulation and whether it influences the outcome of lawsuits against firms like Ripple Labs.

Technical analysis and XRP price forecast

XRP is hovering close to its all-time high at $3.40. At the time of writing, XRP traded at $3.2385. A 22% price rally could push XRP into price discovery, at the 141.4% Fibonacci retracement level of the climb from the $1.9054 low to the $3.4000 peak.

The technical indicators, RSI and MACD support a bullish thesis for XRP. MACD flashes consecutive green histogram bars. Traders need to keep their eyes peeled as RSI signals that the token is currently overbought or overvalued, as it reads 83.

In the event of a correction, XRP could find support at the 50% Fibonacci retracement level at $2.6977.

James Toledano, COO at Unity Wallet, told crypto.news in an exclusive interview:

“Given that XRP was stuck at around $0.50 for literally 3 years, its recent breakout momentum reflects new levels of investor optimism around regulatory clarity and the potential approval of an XRP ETF in the following months. If the XRP ETF gets approved, it will have the potential to open the floodgates of capital inflow, meaning it could reach new heights in 2025.”

Toledano warns XRP holders to be wary as altcoins take volatility to the next level in the current market cycle.

He said:

“Altcoin ETFs have genuine potential to attract capital, especially if supported by innovation-friendly policies with the new incoming U.S. administration. But, their success may be less consistent compared to Bitcoin ETFs due to the seemingly episodic nature of interest in altcoins.

Just take a look at fluctuations in Bitcoin’s price this week. The factors are multifaceted; we could say it’s Trump, seasonality, geopolitics, macroeconomics and sentiment all blended together. To play devil’s advocate, we humans are pattern seekers but sometimes there are hidden drivers and the cause and effects are not always linked.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Bitwise

Bitwise CEO predicts Trump administration to boost crypto mergers

Published

3 months agoon

January 6, 2025By

admin

Hunter Horsley links corporate power consolidation to crypto demand.

The CEO of Bitwise Asset Management, Hunter Horsley, has suggested that the economic policies of the Trump administration could have a major impact on the cryptocurrency sector.

In a recent tweet, Horsley noted that the potential deregulation of mergers and acquisitions could allow major companies like Google or Amazon to expand even further through strategic acquisitions. M&As refer to the consolidation of companies, either through the merging of businesses or the purchase of one company by another. This process often helps corporations achieve economies of scale, expand market share, or acquire critical assets.

Trump administration may unfreeze M&A.

Large corporates — mag 7, etc — may finally be able to wield their market cap. Amazon could buy Instacart. Google could buy Uber. etc etc

The big may get bigger, and the middle may shrink.

If that happens, I think it will accelerate…

— Hunter Horsley (@HHorsley) January 5, 2025

Horsley argued that this concentration of power could drive the adoption of decentralized systems, aligning with the core tenet of cryptocurrency: the skepticism toward centralized organizations. He believes that as large corporations gain more control, the demand for cryptocurrencies—designed to offer an alternative to such institutions—could grow.

Corporate behemoths like Google and Amazon are becoming increasingly interested in blockchain technology and digital assets as they look for ways to enter the crypto markets. One example of a blockchain-related service that Amazon Web Services has introduced is Amazon Managed Blockchain, which enables companies to create and oversee scalable blockchain networks. With this action, Amazon establishes itself as a major force in the expanding enterprise blockchain market.

By establishing strategic alliances with prominent blockchain initiatives and participating in campaigns to incorporate blockchain technology into its cloud infrastructure, Google has also increased its presence in the cryptocurrency sector. Blockchain-as-a-service is now available on Google Cloud, allowing companies to create and implement decentralized apps.

These initiatives demonstrate how major companies are using blockchain technology to diversify their business models while leveraging traditional M&As to expand their reach, thereby further driving the adoption of decentralized systems.

Horsley’s statement comes amid a major rebound in the cryptocurrency market, following Donald Trump’s recent re-election. Trump’s victory has been welcomed by many in the cryptocurrency industry, given his pro-business stance and policies that are seen as supportive of digital assets and blockchain technology. These policies have fueled a bullish trend in the market, with experts attributing much of the surge to a more favorable regulatory approach under Trump’s administration.

Since Trump’s election win, the cryptocurrency market has seen notable growth, with the biggest example being Bitcoin which surged from approximately $69,000 on Nov. 8, 2024, to over $100,000 in early December.

This increase has been largely driven by political shifts and the anticipation of loosened regulations, which experts believe will create a more conducive environment for digital assets.

Experts also believe this rise is driven by the political shift and the potential loosening of regulations, which may create a more favorable environment for digital assets.

Horsley is the CEO of Bitwise, an investment firm that has exclusively focused on cryptocurrency investments for the past seven years. The company offers a range of products including crypto-focused funds, ETFs, and others, designed to provide investors exposure to the crypto and Web3 markets.

According to Horsley, the influence of major market players—along with regulatory changes—could shape the future of both digital assets and traditional financial systems in 2025, making this an exciting time for both M&A activity and the cryptocurrency sector.

Source link

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Will Shiba Inu Price 3x?

Bitcoin Cash (BCH) Gains 4.2%, Leading Index Higher

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals