Bitcoin

Trump and the Future of Bitcoin

Published

5 months agoon

By

admin

If you weren’t there in person, it would be hard to accurately describe how long and winding the line was to see Donald Trump speak at the Bitcoin conference. The wait to even pass through security and find a seat in the auditorium was hours long and thousands of folks were scrambling to find seats at the Nakamoto Stage early in the day. As the line snaked through the expo hall, it was easy to find an even distribution of Bitcoiners and Trump supporters (some were both) all eager to hear Trump speak. There was an excitement in the atmosphere, and while I didn’t share in the excitement, it did permeate the air in Nashville. Uber drivers were quick to point out that Trump was speaking at the conference. Around the city were large images of Trump’s face next to Bitcoin symbols advertising the conference. Trump-mania surely had taken over the conference, but it also seemed to take over the city of Nashville, too.

I can’t deny that getting Donald Trump to speak at the Bitcoin Conference during an election year is a huge “get.” It is an important moment for Bitcoin and we should all appreciate this development, in some sense, as a milestone that we can all be proud of as Bitcoiners. Trump’s speech promised to lunge Bitcoin into the mainstream political conversation and thereby normalize an up and coming digital currency that most people still dismiss as “fake internet money”. It was a moment we were all supposed to remember for the rest of our lives; this was Bitcoin’s chance to be included in serious conversations held by serious people.

If Trump had shown up for his speech on time, we would have known an hour earlier that this wasn’t going to happen. Instead, we waited. Once Trump did start his speech, it didn’t take long to realize that the folks waiting for hours all day were sold a bill of goods. Trump’s speech was a rambling, at times incoherent, stump speech with a few little nods toward crypto, and… I guess… Bitcoin thrown in for good measure. The first mention of Bitcoin came about six and a half minutes into his remarks. I don’t blame Trump for speaking about crypto more than Bitcoin; most politicians do. But while he was speaking at the Bitcoin conference, I was expecting him to spend more time discussing Bitcoin than his genius uncle who used to work at MIT. Alas, sometimes you just can’t set the bar low enough.

The most concrete take away from hearing Trump speak about Bitcoin was the not-so-shocking realization that Robert Kennedy Jr. thinks more deeply about Bitcoin while he has his first cup of coffee each morning than Donald Trump has thought about Bitcoin during his entire life. All of Trump’s best moments during his speech (and there were some) were lifted, whole cloth, from RFK Jr’s keynote address the day prior. The parts of the speech he didn’t copy from RFK Jr were dismissive, arrogant, pandering and ill informed. The value in watching the speech at all is that the single issue Bitcoin voters I keep hearing about now have an easy decision to make.

No doubt, there are plenty of Bitcoiners who love Trump and loved his speech. But there are also a surprising number of folks that see all this for what it is: a politician pandering for money and votes and an insecure Bitcoin community pandering for some borrowed legitimacy. Having a leading presidential candidate discuss Bitcoin has some positive effects, but the most serious people I know in the space also recognize there are some risks and dangers involved, too. Chief among these dangers is that by cozying up to Trump, the Bitcoin community risks alienating itself from pre-coiner audiences for the foreseeable future. This seems to be a point, I think, that is hard to comprehend if you already like Bitcoin or already like Trump. Try to remember, most people don’t fit into either category.

I’ve publicly been in the Bitcoin space long enough to appreciate the massive cognitive dissonance that exists among many Bitcoiners. Some of these people are Libertarians who are fully committed to individual freedom, but are unwilling to respect a person’s gender identity. Some of these people are Conservatives who want to see the government get smaller while that same government polices what books get banned and what healthcare people are allowed to receive. Some of these people are Bitcoiners who want to see the government disintermediated from the financial system while they cheer uproariously for a politician promising to buy Bitcoin on behalf of the United States Government. If I can see the cognitive dissonance, why is it so hard for a community that prides itself on being heterodox, skeptical and don’t-trust-verify?

I consider it a personal responsibility to orange pill as many people as I can, and I have been serious about doing that. This means, I want to expose the 57% of Americans that don’t like Trump to Bitcoin as a force for good in this world; my job is hard and since Nashville, it just got harder. Let’s be real: Bitcoin is the perfect combination of “internet” and “money” that should make anyone skeptical. There is no shortage of FUD dismissing Bitcoin as pretend money or a scam or a ponzi scheme or money for criminals. Experienced Bitcoiners may not be worried about any of that, but the pre-coiners I know certainly are hyper aware of the reputation. If my job is to convince them to take a second look, that gets harder when Bitcoiners are falling over themselves to align with a known con artist, philanderer, fraud, and convicted felon.

To be sure, Bitcoin will attract its share of con artists, philanderers, frauds and felons. Bitcoin is for them, too. But we shouldn’t capitulate and rebrand Bitcoin as something Trumpian. This is simply bad marketing. The most compelling argument I’ve heard in support of seeking out Trump’s approval is that it will force other politicians to support Bitcoin and his policies would force other nations to take Bitcoin seriously. This could prove to be true, but it is just as likely that the opposite will happen. Normie pre-coiners, if they are paying attention at all, will so easily be able to hold up the “scam” Bitcoin next to the “scam” Trump and walk away from the whole thing and sleep easily. Meanwhile, Trump will have no genuine affinity toward Bitcoin after the votes are counted.

After so much effort going toward ensuring Bitcoin is non-partisan, bi-partisan and non-political, it was our community (really a handful of influential and connected Bitcoiners) that sought out an alliance with the most polarizing political figure in generations. It would be one thing if Trump found Bitcoin on his own, but that’s not the case. We committed this unforced error ourselves, or more accurately, we allowed the leaders in our leaderless movement to err on our behalf.

I can hear you screaming “Well, what’s your solution? Vote for the other guys?!” Fair question. Here’s my solution: Walk away from politicians and walk towards voters. Meet them where they are and educate them about the ways Bitcoin solves the problems they care about. That’s really it. The rest will take care of itself. Take a low time preference and it will happen from the ground up, without having to sacrifice your principles. This is the best way to promote Bitcoin adoption, protect the marginalized people Bitcoin can help, and attract policy makers who truly and deeply care about Bitcoin and eschew “crypto”. If you do get to interact with politicians, advocate for protections for self custody, de minimis tax treatment so Bitcoin can be easily spent, and consumer protections imposed on exchanges and brokerages.

For those that think Trump is now one of us, he isn’t. He will drop our community the moment it serves him, and we will be worse off for it. Zoom out. One week after Trump appeared in Nashville, he sat for a disastrous interview with the National Association of Black Journalists. This, it turns out, did not make him a Black journalist. Nor did showing up in Nashville make him a Bitcoiner. We would, all of us, be well served to remember that.

This is a guest post by Jason Maier. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

Bitcoin

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Published

15 minutes agoon

December 23, 2024By

admin

Tokyo-listed Metaplanet has purchased another 9.5 billion yen ($60.6 million) worth of Bitcoin, pushing its holdings to 1,761.98 BTC.

Metaplanet, a publicly traded Japanese company, has acquired 619.7 Bitcoin as part of its crypto treasury strategy, paying an average of 15,330,073 yen per (BTC), with a total investment of 9.5 billion yen.

According to the company’s latest financial disclosure, Metaplanet’s total Bitcoin holdings now stand at 1,761.98 BTC, with an average purchase price of 11,846,002 yen (~$75,628) per Bitcoin. The company has spent 20.872 billion yen in total on Bitcoin acquisitions, the document reads.

The latest purchase is the largest so far for the Tokyo-headquartered company and comes just days after Metaplanet issued its 5th Series of Ordinary Bonds via private placement with EVO FUND, raising 5 billion yen (approximately $32 million).

The proceeds from this issuance, as disclosed earlier, were allocated specifically for purchasing Bitcoin. These bonds, set to mature in June 2025, carry no interest and allow for early redemption under specific conditions.

Metaplanet buys dip

The company also shared updates on its BTC Yield, a metric used to measure the growth of Bitcoin holdings relative to fully diluted shares. From Oct. 1 to Dec. 23, Metaplanet’s BTC Yield surged to 309.82%, up from 41.7% in the previous quarter.

Bitcoin itself has seen strong performance this year, climbing 120% and outperforming assets like the Nasdaq 100 and S&P 500 indices. However, it has recently pulled back from its all-time high of $108,427, trading at $97,000 after the Federal Reserve indicated only two interest rate cuts in 2025.

Despite the retreat, on-chain metrics indicate that Bitcoin is still undervalued based on its Market Value to Realized Value (MVRV-Z) score, which stands at 2.84 — below the threshold of 3.7 that historically signals an asset is overvalued.

Source link

Altcoin Season

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Published

4 hours agoon

December 23, 2024By

admin

The creators of the crypto analytics firm Glassnode are warning that altcoins could lose all bullish momentum following last week’s market correction.

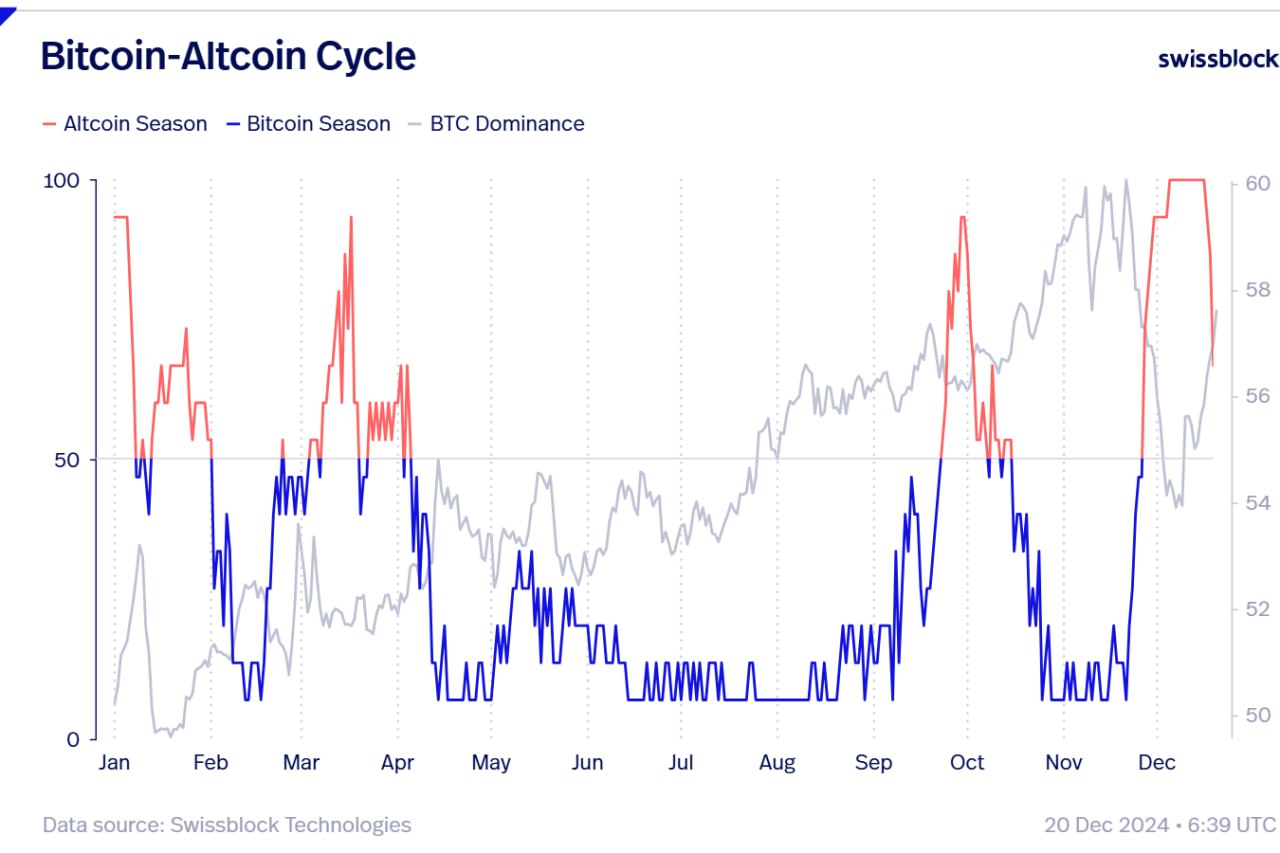

Jan Happel and Yann Allemann, who go by the handle Negentropic on the social media platform X, tell their 63,400 followers that “altcoin season,” which they say began in late November, could come to an abrupt end after alts witnessed deep pullbacks over the last seven days.

According to the Glassnode co-founders, traders and investors will likely have a risk-off approach on altcoins unless Bitcoin recovers a key psychological price point.

“Is This the End of Altcoin Season?

Bitcoin dominance is surging after dipping below $100,000, while altcoins are losing critical supports. Dominance has risen and resumed its upward trend, signaling a stronger BTC environment.

If BTC stabilizes above $100,00, we might see a pump in altcoins now in accumulation zones. Until then, Bitcoin appears poised to lead, leaving altcoins lagging behind.”

The Bitcoin Dominance (BTC.D) chart tracks how much of the total crypto market cap belongs to BTC. In the current state of the market, a surging BTC.D suggests that altcoins are losing value faster than Bitcoin.

At time of writing, BTC.D is hovering at 59%.

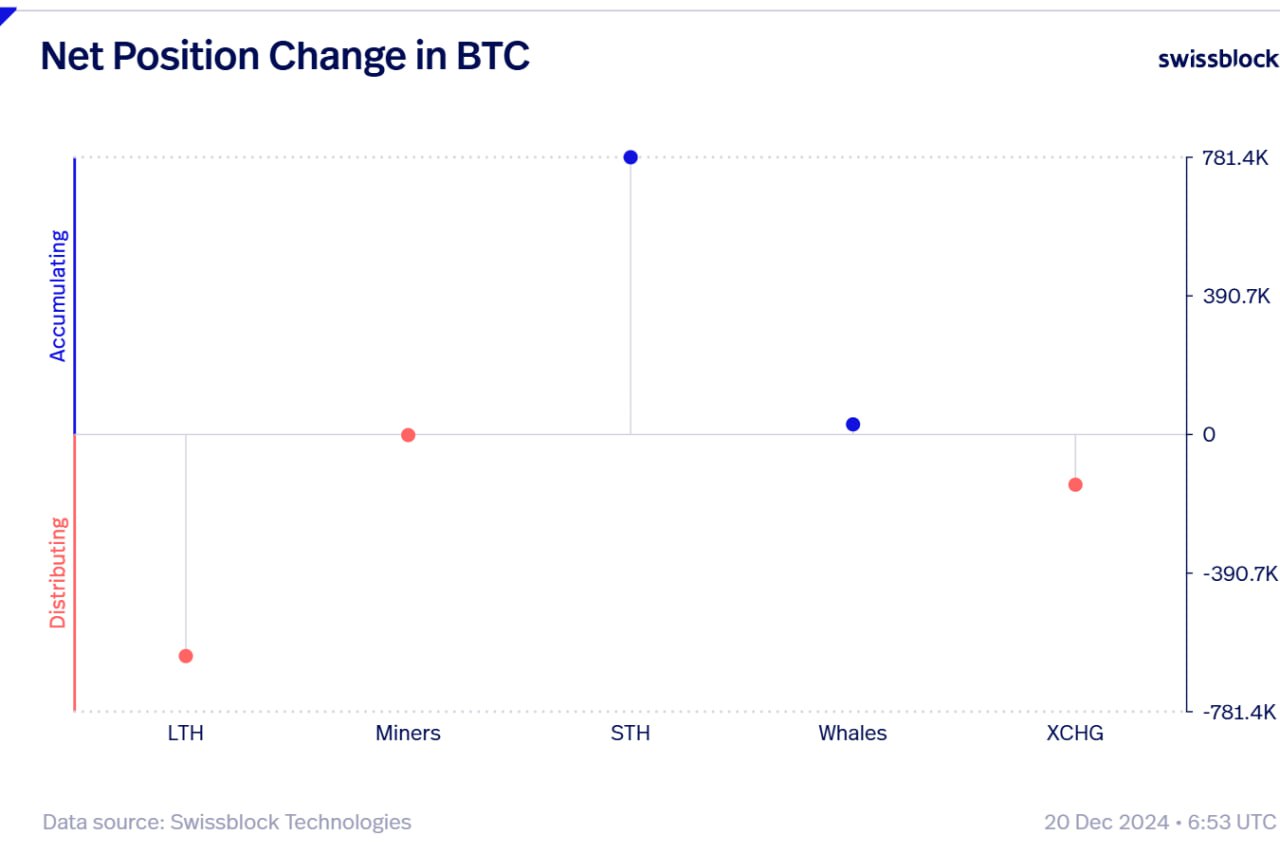

Looking at Bitcoin itself, the Glassnode executives say long-term Bitcoin holders are massively unloading their holdings as other investor cohorts pick up the slack.

“The Board Keeps Shifting.

As BTC continues flowing out of exchanges during this dip, long-term holders are exiting forcefully, while short-term holders step in without hesitation.

Whales quietly accumulate, miners remain neutral, and selling pressure has merely reshuffled the board.

New hands are absorbing the sales.”

At time of writing, Bitcoin is worth $97,246.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

Published

20 hours agoon

December 22, 2024By

admin

Bitwise CIO Matt Hougan says a wave of institutional interest in altcoins is coming next year, largely due to potential regulatory clarity and more exchange-traded funds (ETFs).

In a new interview with Bloomberg, Hougan says that institutional money is in the early stages of broadening out to other crypto assets besides just Bitcoin (BTC).

Hougan forecasts that 2025 will be the year that institutional investors will begin to incorporate more diversification in their crypto-investing strategies the same way they do in other asset classes like equities or bonds.

“You’re already seeing it broaden out actually. A lot of people were worried about the Ethereum ETFs for instance, which launched this summer and had tepid inflows.

But over the last month or so, you’ve seen billions of dollars flow into those products.

Again, the things that have happened in crypto in the past keep happening. Historically, most people enter crypto through Bitcoin, and then they discover Ethereum, and then they think about Solana. There’s no reason to assume that the institutions that came into Bitcoin won’t move on to other assets in the future.

In fact, I think in 2025, you’re going to see an explosion of interest in index space strategies that give diversified exposure to crypto. Of course, [that is] something we’ve been doing at Bitwise since 2017 when we pioneered that concept. I think 2025 is when that becomes a mainstream way to allocate to this space, the same way it is to stocks and bonds and real estate and everything else.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Julien Tromeur/Sensvector

Source link

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential