Donald Trump

Trump crypto venture WLFI is a ‘huge mistake,’ investor says

Published

4 months agoon

By

admin

The latest Trump family business venture — originally pitched as a DeFi platform dubbed “The Defiant Ones,” but has since been rebranded as World Liberty Financial — is fraught with controversy just days after it was unveiled.

While Trump’s eldest sons, Eric Trump and Donald Trump Jr., are “ambassadors” of World Liberty Financial, CoinDesk reports that the once “Defiant” company is also linked to individuals involved in liquidity protocol Dough Finance.

Recall how Dough Finance lost $1.8 million in Ethereum (ETH) and USD Coin (USDC) to a flash-loan attack on July 12.

Zachary Folkman and Chase Herro – the duo that built Dough Finance — are bosses at the new Trump-led firm, too. They started the companies Date Hotter Girls LLC and crypto-focused Pacer Capital, respectively.

Trump first endorsed the decentralized finance project in an Aug. 22 post on Truth Social. He posted about it again on Aug. 29 (by then it was dubbed World LibertyFi).

The X accounts of two of his family members were subsequently compromised and used to promote a fake Solana-based memecoin. One of the targets was Lara Trump, who is co-chair of the Republican National Committee.

The whole initiative sounds fishy to crypto venture capitalist and Trump supporter Nic Carter, who didn’t mince words on the matter. “This is a huge mistake,” he said per Politico. “It looks like Trump’s inner circle is just cashing in on his recent embrace of crypto in a kind of naive way, and frankly it looks like they’re burning a lot of the goodwill that’s been built with the industry so far.”

“Goodwill?” It’s worth mentioning that some of the sector’s most famous names have been found guilty of fraud.

Former Binance CEO Changpeng Zhao received a four-month sentence in prison; crypto entrepreneur Do Kwon spent more than six months in a Montenegrin prison; and FTX founder Sam Bankman-Fried was sentenced to 25 years in prison.

Trump is also no stranger to having his business ventures marred by illegalities (see Donald J. Trump Foundation and Trump University). He is also the first former U.S. president to be convicted of felony crimes.

Trump, crypto and trust

Trump, who once said he was “not a fan” of Bitcoin (BTC), has been weaving pro-crypto policies into his stump speeches in the lead-up to the 2024 presidential election.

In May, he became the first major political candidate to accept crypto donations. Crypto celebrants then received a flurry of promises should Trump be re-elected: a government-backed crypto reserve and the firing Gary Gensler, the oft-critiqued current Securities and Exchange Commission chair.

I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity….

— Donald J. Trump (@realDonaldTrump) July 12, 2019

His one-eighty won him the support and financial backing of such deep pockets as Cameron and Tyler Winklevoss — founders of the Gemini exchange — who gave $1 million in Bitcoin each to the former president.

But since then, fraudsters have targeted his so-called “MAGA” base with fake crypto websites and misleading donation centers. In June, a London-based cybersecurity company called Netcraft began monitoring several attacks surrounding the Trump campaign, discovering fraudulent donation schemes and phishing attempts.

The latest scrutiny surrounding World LibertyFi and its World Liberty Coin is no different.

For weeks, the Trump brothers teased a financial venture that would challenge traditional banking. And when it debuted, scammers had plenty of new fodder to work with.

Carter, who remains a Trump supporter (because “Trump himself is only tangentially involved”) warns that the World Liberty project “genuinely damages” the Republican nominee’s electoral prospects. Polls indicate that the presidential race against Democratic Vice President Kamala Harris is extremely tight.

“It’ll be the juiciest DeFi target ever and it’s forked from a protocol that itself was hacked. [It’s] also an obvious target for the SEC,” he wrote on Sept. 3. “At best it’s an unnecessary distraction, at worst it’s a huge embarrassment and source of (additional) legal trouble,”

is there something that we, as crypto twitter, can collectively do to stop the launch of world liberty coin? i think it genuinely damages trump’s electoral prospects, especially if it gets hacked (it’ll be the juiciest DeFi target ever and it’s forked from a protocol that itself…

— nic carter (@nic__carter) September 4, 2024

Source link

You may like

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Donald Trump

Michael Saylor is willing to advise Trump on the crypto policy

Published

3 days agoon

December 21, 2024By

admin

MicroStrategy Inc. co-founder and executive Chairman Michael Saylor says he is willing to advise Trump on cryptocurrency policy when the crypto advisory council is set.

During the Dec. 18 episode of the Open Interest show on Bloomberg Television, Saylor voiced his willingness to provide his advice on the digital assets policy to President-elect Donald Trump, either publicly or confidently, if he is asked to do so.

Before expressing his willingness to advise Trump on the crypto policy, Saylor admitted that he had already met “with a lot of people” in the incoming administration but declined to specify the personalities nor mentioned if he already met Trump.

Is Saylor fit for a position?

Since the 2020s, Michael Saylor has been one of the key Bitcoin advocates and investors. Saylor is one who puts money where his mouth is, as he personally spent around one billion dollars on BTC. In 2020, Saylor took to X (Twitter at the time) to announce that he personally owns 17,732 bitcoins and that he acquired these coins before MicroStrategy (MSTR) made the first massive purchase of bitcoins. YahooFinance! reports that currently MicroStrategy owns around 440,000 BTC, which is close to a 2% share of the entire BTC supply. MicroStrategy made headlines on the eve of the latest BTC price peak when the company was included in the Nasdaq 100 index.

Michael Saylor names Bitcoin an apex property of the human race and has an insatiable thirst for bitcoins. He compares Bitcoin to the territories like Manhattan or Alaska that were bought by the early colonist administration, specifying that Bitcoin is rather a kind of cyberspace. That’s why MicroStrategy aims to own bitcoins in bulk. According to Saylor, buying as much of this “space” as possible is crucial for the United States. This vision speaks to the statement posted by Donald Trump on the Truth Social platform. “We want all the remaining Bitcoin to be MADE IN THE USA!” the post reads.

Saylor singled out Trump as the most crypto-friendly Republican politician. It seems that Saylor shares the President-elect’s views on Bitcoin. Although not an outright GOP supporter, in September, Saylor made claims that he sees Republicans as a more progressive party when it comes to cryptocurrency regulation. He names regulation pressure decrease, treating crypto as a tool to boost the U.S. economy, and encouraging individuals to pursue their economic aims using digital finance as progressive characteristics of the Republican approach to the crypto industry.

What Do We Know About the Crypto Advisory Council?

Trump proposed the creation of a crypto advisory council during his now famous speech at the Nashville cryptocurrency conference in July 2024. As of December, not much information about the preparations of this council has been made public.

The participating companies’ lineup is not clear yet. However, it has been reported that such brands as Coinbase, Ripple Labs, Paradigm, and Andreessen Horowitz (a16z) are seeking interactions with the incoming administration. Allegedly, an a16z rep was involved in advising the Trump team during the presidential campaign. On December 6, Trump introduced entrepreneur and venture capitalist David O. Sacks as the “White House A.I. and Crypto Czar” via the Truth Social post.

It’s worth saying that, to say the least, before 2024, Trump wasn’t an avid crypto enthusiast. In the past, the President-elect made a series of anti-crypto remarks, calling Bitcoin “not money” and saying that the value of cryptocurrencies is based on thin air.

However, the 2024 Presidential campaign saw a drastic change in Trump’s stance on crypto. He started to take donations in digital currencies, visited a major crypto conference in Nashville where he promised to make America “a crypto capital of the world,” and made several important proposals concerning the cryptocurrency policy.

On top of tax cuts for the U.S. cryptocurrency companies, the removal of Gary Gensler from the SEC, and the creation of the strategic Bitcoin reserve, Trump announced the creation of the advisory body with the leading position granted to the richest man on Earth and his passionate supporter Elon Musk. This unofficial agency is called The Department of Government Efficiency, or simply DOGE, a reference to a legendary memecoin, a notorious soft place of a Tesla CEO. Who knows just what else to expect from Donald Trump when he goes crypto?

Source link

China

China May Be On the Verge of Ending Its Bitcoin Ban

Published

6 days agoon

December 18, 2024By

admin

Look, I think it’s only a matter of time before China pulls a complete 180 on its Bitcoin ban. Yes, they outlawed trading and mining back in 2021, but honestly, a lot has changed since then — especially this year. Bitcoin’s momentum globally has been insane.

We’ve seen US President-Elect Donald Trump calling to stockpile Bitcoin; Bitcoin ETFs get approved, Fed Chair Jerome Powell calling Bitcoin “digital gold,” Larry Fink flipping pro-Bitcoin, and even Putin saying nice things about it. With all of this happening, I wouldn’t be shocked if China has already started quietly stacking sats (buying bitcoin).

Here’s why I think that: China doesn’t like to announce what it’s doing beforehand — it’s just not how they operate. Former Binance CEO CZ talked about this recently at the Bitcoin MENA conference in Abu Dhabi, saying that while the US loves to make big public statements about upcoming policies (like Trump announcing Bitcoin plans to court voters), Asian countries prefer to move in silence.

And let’s not forget China doesn’t have elections. They don’t need to win over public opinion like Trump does. If they’re making moves with Bitcoin, they’ll do it quietly — and we’ll find out when they’re ready to make it official.

Now, with Trump’s big push for Bitcoin and crypto, I can’t see China sitting on the sidelines for too long. This is turning into a global race, and if China wants to stay competitive, they can’t afford to miss the Bitcoin train. My gut tells me they’re already planning to unban Bitcoin and crypto — and I wouldn’t be surprised if it happens as early as Q1 next year, especially if Trump takes office.

Another big hint? Hong Kong. China has a long history of using Hong Kong as a sandbox to test things before rolling them out on the mainland. And this year, we’ve seen Hong Kong make major moves — approving Bitcoin and crypto ETFs and greenlighting more crypto exchanges. Let’s be real: this isn’t a coincidence. They are planning to eliminate crypto taxes for institutions. I think China is watching carefully, and these are early steps toward a broader shift.

In my opinion, China has likely been quietly accumulating bitcoin all along. When the time is right, they’ll unban it — and not just to compete with the US, but to lead. Watch this space. I think it’s going to happen much sooner than most people expect.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Bitcoin Sell-Off Likely When This Metric Reaches 4%, Analyst Explains

Published

1 week agoon

December 14, 2024By

admin

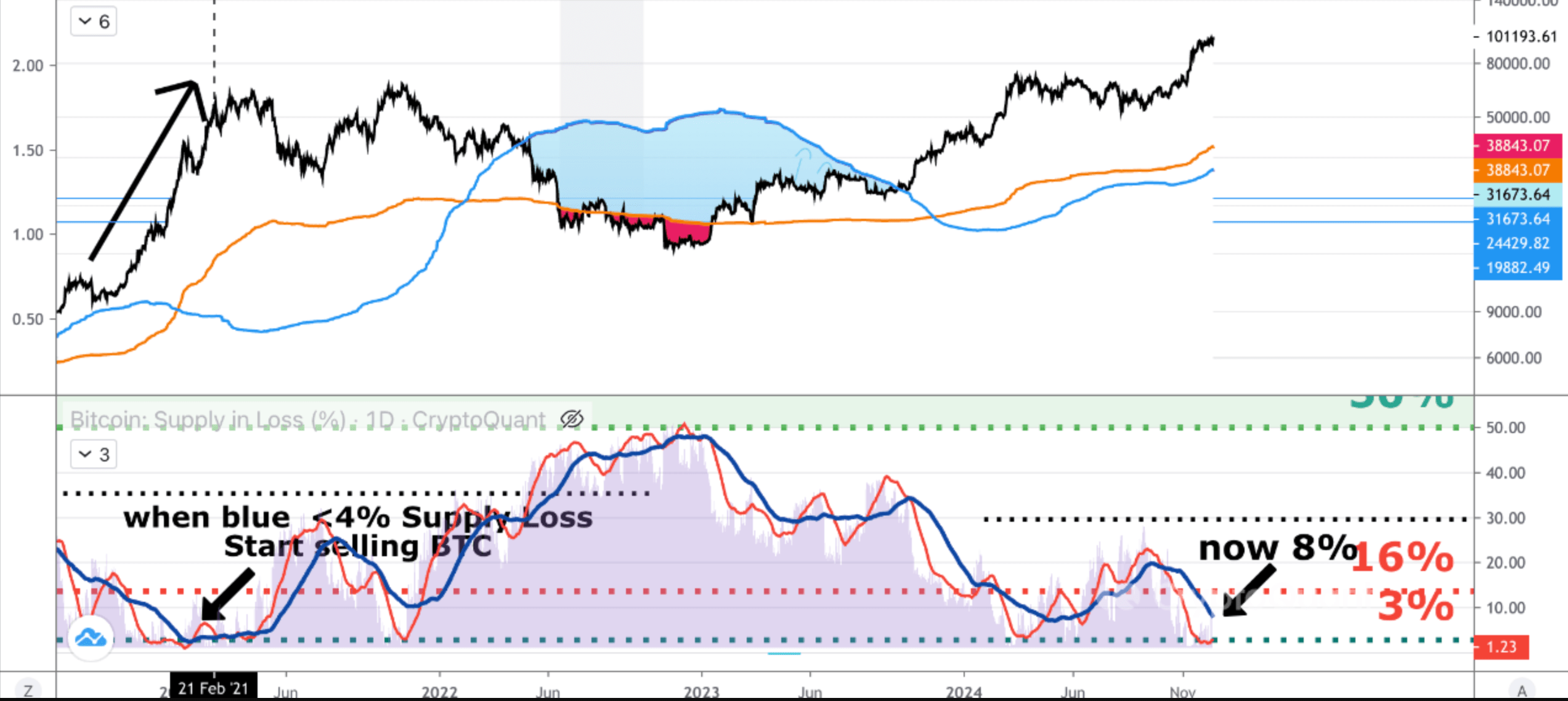

While Bitcoin (BTC) fluctuates around the critical $100,000 price level, some investors may seek the ideal opportunity to take profits and exit the market. In this context, a CryptoQuant analysis highlights a key BTC metric that can serve as a valuable tool for crafting an exit strategy.

Have Profits In Bitcoin? Keep An Eye On This Indicator

In a Quicktake blog post published today, CryptoQuant contributor Onchain Edge shared insights into timing the sale of BTC during the current bull market. The analyst emphasized the importance of the Bitcoin supply in loss metric, noting its potential to signal when to start exiting the market to preserve profits.

Related Reading

For those unfamiliar with Bitcoin, the supply in loss measures the percentage of BTC held at a loss based on its last moved price. A low percentage of supply in loss typically indicates peak market euphoria and serves as a warning to secure profits before a bear market correction begins.

According to the CryptoQuant analysis, when BTC supply in loss drops below 4%, it signals a good time for investors to consider dollar-cost averaging (DCA) out of their BTC holdings and wait for the next bear market lows. Currently, the BTC supply in loss sits at 8.14%.

DCA is an investment strategy where investors allocate a fixed amount of money to an asset at regular intervals, regardless of its price. This method helps reduce the impact of market volatility and lowers the average cost per unit over time. The analyst adds:

Why? Below 4% means a lot of people are in a profit this is the peak bullrun phase. Trust me you don’t want to be bagholding because you thought we will never see a bear market again. Be fearful when others are greedy.

Analysts Confident Of Further Upside In BTC Price

While tracking the BTC supply in loss metric can help investors safeguard their profits, recent forecasts from crypto analysts suggest there might still be room for further upside before this indicator becomes crucial.

Related Reading

According to crypto analyst Ali Martinez, BTC forms a classic cup and handle pattern on the weekly chart. The premier cryptocurrency looks poised to break out of the bullish formation, with targets as high as $275,000.

Similarly, Donald Trump’s victory has brought fresh optimism in the crypto industry. In the recently concluded Bitcoin MENA conference in Abu Dhabi, Trump’s former campaign chairman, Paul Manafort, noted that BTC investors can “expect more than $100,000” during the ongoing market cycle.

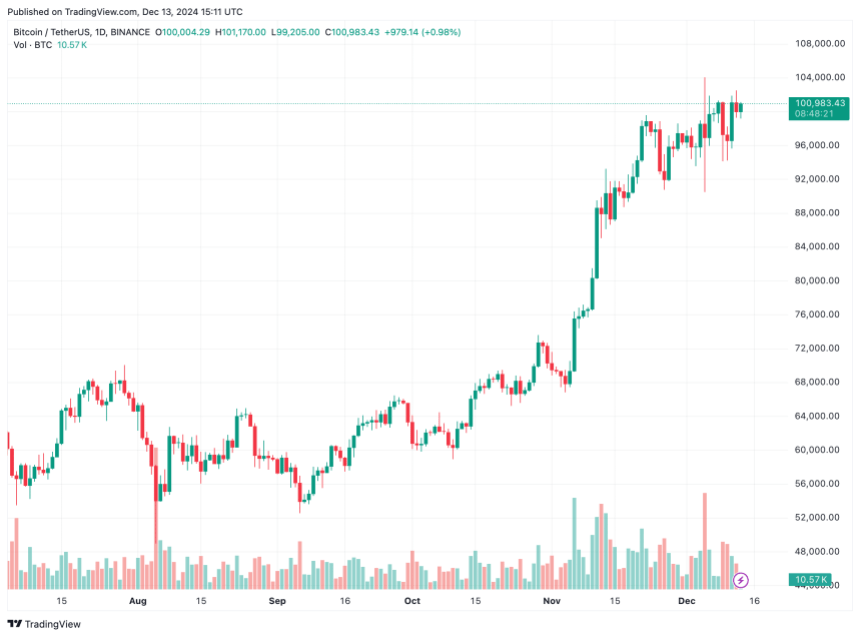

Other forecasts remain equally bullish. Tom Dunleavy, Chief Investment Officer at MV Global, projects BTC to reach $250,000, while Ethereum (ETH) might climb to $12,000 during this market cycle. BTC trades at $100,983 at press time, up a modest 0.1% in the past 24 hours.

Featured image from Unsplash, Charts from CryptoQuant and TradingView.com

Source link

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential