Bitcoin

Trump holds $7 million in crypto: Arkham Intelligence

Published

4 months agoon

By

admin

Donald Trump, President-elect of the United States, revealed holds $7.2 million in many cryptocurrencies. This is another proof that he is a pro-crypto.

According to data from Arkham Intelligence, on Nov. 25, the 47th President of the United States owned digital assets in cryptocurrencies worth about $7.2 million. He held $26 million in cryptocurrency on Jun. 6, but dropped just a few days after to $17 million.

His most significant hold on crypto is meme coin Trog (TROG), with 210 billion coins equal to $1.86 million. At the time of writing, TROG prices surged 343% from $0.000002008 to $0.000008914 in the past 24 hours.

The most exciting part is that he holds TROG bigger than Ethereum (ETH), with $1.7 million, and the average price of Ethereum is $3,401. WETH (WETH) became the third largest crypto held, with 478 WETH, which is equal to $1.63 million.

Another million holds on crypto is themed-coin of his name, TRUMP with 579k or equals to $1.03 million. He mostly holds meme coins, including GUA, TUA, PUPPIES, and CZAR. Among those on the top list, Bitcoin (BTC) was not on the list as the biggest crypto that he holds.

Trump’s movement on crypto

Although he was ever known as anti-crypto back then in 2021, when he was not re-elected as U.S. President, now he is one of the most significant figures in the crypto industry.

When entering this year’s election, he eventually became pro-crypto as he attended the Bitcoin Conference 2024 in Nashville. He shares the pro-crypto program if re-elected, which includes Bitcoin Strategic Reserve and is supported by numerous Republican senators to propose the idea to Congress.

Now, he has been re-elected to the White House and chosen several names for his cabinet, some of which are identified as pro-crypto, including Robert F. Kennedy Jr and Elon Musk. Trump also chose Scott Bessent as the Secretary of Treasury, who he called as the “most pro-crypto treasury we’ve ever seen,”.

Source link

You may like

Why ‘Tiger King’ Joe Exotic Launched a Solana Meme Coin From Behind Bars

Trump pardons BitMEX, is ‘Bitcoin Jesus’ Roger Ver next?

Terraform Labs to Open Claims Portal for Investors on March 31

BitGo CEO Calls For Regulation Amid Galaxy Digital’s Settlement

Ethereum Bulls Disappointed As Recovery Attempt Fails At $2,160 Resistance

US recession 40% likely in 2025, what it means for crypto — Analyst

Bitcoin

Trump pardons BitMEX, is ‘Bitcoin Jesus’ Roger Ver next?

Published

2 hours agoon

March 30, 2025By

admin

Vitalik Buterin, Ross Ulbricht, and Tucker Carlson are among those urging President Donald Trump to pardon Roger Ver, aka Bitcoin Jesus.

Known as Bitcoin Jesus for his early advocacy of Bitcoin, Ver faces up to 109 years in prison on tax charges, including allegations of evading $48 million in taxes. Despite renouncing his U.S. citizenship in 2014 to avoid prosecution, Ver’s legal troubles resurfaced when he was arrested in Spain in 2024. But following the president’s earlier pardons of figures like Ulbricht and BitMEX co-founders, observers wonder whether Ver’s would catch a break. Is a pardon on the way, or will Ver’s legal troubles continue?

Read on for a closer look.

Crypto cronies

After Trump embraced cryptocurrency, many crypto leaders rallied to support him by donating funds to his inauguration and hobnobbing at galas.

Trump also , which industry brass celebrated.

In return, Trump signed an order to stockpile tokens and swiftly acted in favor of the industry. Under Trump-appointed SEC chair Mark Uyeda, investigations into several cryptocurrency companies, including Immutable, Crypto.com, Ripple, and Coinbase, were dismissed.

In a notable move on Thursday, March 27, Trump pardoned BitMEX co-founders Arthur Hayes, Benjamin Delo, and Samuel Reed, who had pleaded guilty to federal charges related to money laundering and regulatory violations. The trio was convicted for failing to implement anti-money laundering measures at BitMEX, which prosecutors had labeled a “money laundering platform.” Reed had also violated the Bank Secrecy Act and paid a $10 million fine. But under Trump, it seems all is forgiven.

This has sparked speculation on whether Ver, a prominent figure in the crypto world, could also receive the same courtesy.

Ver, a Silicon Valley native with a libertarian streak, was deeply involved in the early days of cryptocurrency, investing in companies like Kraken, Ripple, and Blockchain.com. In 2017, Ver hyped Bitcoin Cash (BCH) as more suitable for everyday payments.

Roger Ver was there for me when I was down and needed help. Now Roger needs our support.

No one should spend the rest of their life in prison over taxes. Let him pay the tax (if any) and be done with it. #FreeRoger pic.twitter.com/flP573hm0N

— Ross Ulbricht (@RealRossU) February 20, 2025

Ver’s past

In 2000, by the age of 20, Ver began to participate in libertarian party debates.

During these debates, he made critical statements about the agents of the Bureau of Alcohol, Tobacco, and Firearms, calling them “murderers” and referencing their involvement in the scandalous Waco Siege in which dozens of children were killed in a standoff between FBI and ATF agents and Branch Davidian cult followers. Ver didn’t know that ATF agents were present during these debates.

In the 2000s, Ver became involved in e-commerce. On top of tech enterprises, Ver was selling firecrackers on eBay. After selling unlicensed firecrackers in 2001, he was charged and spent 10 months in prison. The fact that he was locked in jail instead of being fined or notified about the necessity of obtaining a license led Ver to think that the case was politically motivated and that his criticism of ATF was the real reason behind his prosecution. Without fear of further persecution, Ver left the U.S. after his post-prison probation ended.

By 2011, Ver learned about Bitcoin and became one of its first investors. He also advocated for Bitcoin long before it went mainstream, with multi-million investments and national leaders talking about its importance for the future of their countries.

The key points of Ver’s advocacy for Bitcoin were the financial freedom of individuals and the stopping of government and banks from interfering in people’s lives.

The legal fight

Since February 2014, Ver has been a citizen of Saint Kitts and Nevis. He claims that he had to renounce his U.S. citizenship after long-lasting targeting from the U.S. government.

In April 2024, he was indicted and arrested in Spain on charges of U.S. tax evasion and mail fraud. Ver is accused of dodging $48 million in taxes after earning up to half a billion dollars through cryptocurrencies.

According to prosecutors, Ver failed to pay his “exit tax” on 131,000 BTC owned by his two companies when he left the U.S. and provided false info to the law firms filing Ver’s tax returns. Allegedly, he sold his bitcoins in 2017 without notifying the financial attorneys.

Ver clarifies that three charges of mail fraud (combined, punishable by 19 years behind bars) are based on the three letters with his tax returns he sent to the Internal Revenue Service (IRS).

Ver denies he committed crimes such as tax evasion and mail fraud. He insists he was doing his best to comply with the nascent Bitcoin taxation rules, and that his prosecution was politically motivated.

In December, he began his legal fight against the prosecution, denying all the charges. He filed a motion to dismiss charges, but the government rejected it in January.

Ver’s legal team challenged an exit tax as “an unconstitutional burden on the fundamental right to expatriate.” For people like Ver, who have substantial amounts of low-liquidity assets, the exit tax may be prohibitive. The government suggests Ver is a fugitive. He disagrees with this status as he doesn’t hide and didn’t commit crimes for which he is judged while living in the U.S.

On March 1, Ethereum’s Buterin published an X post arguing that the exit tax doesn’t exist in most other countries and called it the “tax-by-citizenship” and “extreme.”

In addition, Buterin mentioned that the IRS obtained some of the information by intimidating Ver’s lawyers. The Ethereum founder added:

“Genuine good faith mistakes should be treated by giving the actor the opportunity to pay back taxes if needed with interest and penalties, not with prosecution.”

Going to prison for the rest of your life over non-violent tax offenses is absurd. The case against Roger seems very politically motivated; like with @RealRossU, there have been plenty of people and corporations who have been accused of far worse and yet faced sentences far… https://t.co/7G3zDkn2F2

— vitalik.eth (@VitalikButerin) March 1, 2025

Will Bitcoin Jesus be pardoned?

Trump promised to pardon Ross Ulbricht if get elected. Ulbricht, the man behind the Silk Road marketplace charged for money laundering and drug trafficking, is an important figure in the history of Bitcoin as his marketplace drove Bitcoin’s adoption. After the inauguration, Trump indeed pardoned Ulbricht to much acclaim.

Soon, various crypto advocates began to urge Trump to pardon Roger Ver. On Jan. 21, 2025, following the pardon of Ross Ulbricht, an X influencer using the moniker Rothmus published a short post calling for the pardon of Ver to which Elon Musk replied: “will inquire.” This reply gave the community hope for the pardon of Bitcoin Jesus.

https://twitter.com/Rothmus/status/1881536312710402268

On March 17, Marla Maples, Trump’s ex-wife, took to X to share a touching video where people who met Ver tell their stories of his generosity.

It is not clear, though, if the POTUS paid attention to this post.

The hope for a pardon of Ver was seriously undermined on Jan. 26, when Elon Musk suddenly, via an X post, stated that Ver would not be pardoned because he gave up his U.S. citizenship.

Roger Ver gave up his US citizenship. No pardon for Ver. Membership has its privileges.

— Elon Musk (@elonmusk) January 26, 2025

The statement drew much criticism, as Musk is not an elected official and cannot decide who to pardon and who not to. He is, however, Trump’s advisor and was a major donor to his “MAGA” campaign.

More than that, the POTUS is not prohibited from pardoning non-U.S. citizens. Finally, many commented that Ver had to renounce his citizenship under pressure from ATF and a U.S. prison sentence.

I missed this tweet.

Another time I will publicly criticize Elon, hopefully for his own benefit. Because this is a terrible and wildly ignorant “hot take”.

1) You don’t need to be a citizen to get a pardon.

2) Ver was a citizen and specifically renounced his U.S. citizenship in…— Viva Frei (@thevivafrei) January 27, 2025

A few hours after Musk’s tweet, Ver took X to post a video in which he briefly explained why he was prosecuted and asked Trump for a pardon.

In the video, Ver stated that he is American and that renouncing his citizenship was one of the “hardest and saddest decisions [he] ever made.”

After Ulbricht, Hayes, Delo, and Reed received presidential pardons, others, including Angela McArdle, who currently serves as Chair of the national Libertarian Party, called for freeing Ver as well.

“Let’s pray Roger Ver is next!” she declared on Friday.

It remains to be seen whether Musk made skeptical comments over the possibility of Ver’s clemency on Trump’s behalf or if it was only his view of the situation.

At last check Saturday, Trump hasn’t commented on Ver’s situation.

Source link

24/7 Cryptocurrency News

Here’s Why Peter Schiff Predicts Bitcoin (BTC) Price Crash to $10K

Published

20 hours agoon

March 29, 2025By

admin

Peter Schiff, a BTC critic, has recently predicted that Bitcoin price could plummet to as low as $10,000. Schiff has expressed concerns over Bitcoin’s long-term viability, particularly in comparison to gold. His argument revolves around Bitcoin’s current performance, which he believes is being driven by short-term hype rather than solid fundamentals.

Schiff’s prediction is particularly alarming for those who view Bitcoin as a store of value. In the current trends, Peter Schiff notes that millions of young people are invested in Bitcoin while gold, a standard hedge, is pushing higher.

This view stems from his assertion that when gold prices rise to new record levels then the value of Bitcoin may plummet.

“By the time they get to their target of $5K for gold, they will drag Bitcoin down to $10K, meaning a drop of 95% from the highest it was valued at in 2021,” Schiff reasoned.

Bitcoin Price Recent Performance Against Gold

According to Peter Schiff, Bitcoin price has underperformed in relation to gold. Gold prices recently broke through $3,000 per ounce as global economic conditions continued to affect the global economy. Meanwhile, Bitcoin has depreciated in value, especially in terms of the precious metal, gold.

Since early 2025, the prices of Bitcoin have come down by over 30% against gold with one Bitcoin currently only equivalent to 27.4 ounces of gold as compared to 41 ounces in December of 2021.

If Bitcoin is an asset that people only buy when the stock market is going up and risk appetite is high, what is it that investors are buying? It’s not a stock as it will never have earnings or pay a dividend. It’s clearly not a risk-off asset, a store of value, or digital gold.

— Peter Schiff (@PeterSchiff) March 28, 2025

Another issue that Schiff dislikes about Bitcoin also revolves around its categorization as a “risk asset.” He says that BTC price movements are synchronized with the rest of the market, especially when investors are more willing to take risks. While gold provides investors with a safe-haven, the Bitcoin price operation is defined as having a volatility closer to that of the traditional markets among investors. Therefore, as argued by Peter Schiff, BTC price may decline as investors turn to the safe-havens, such as gold, in turbulent times.

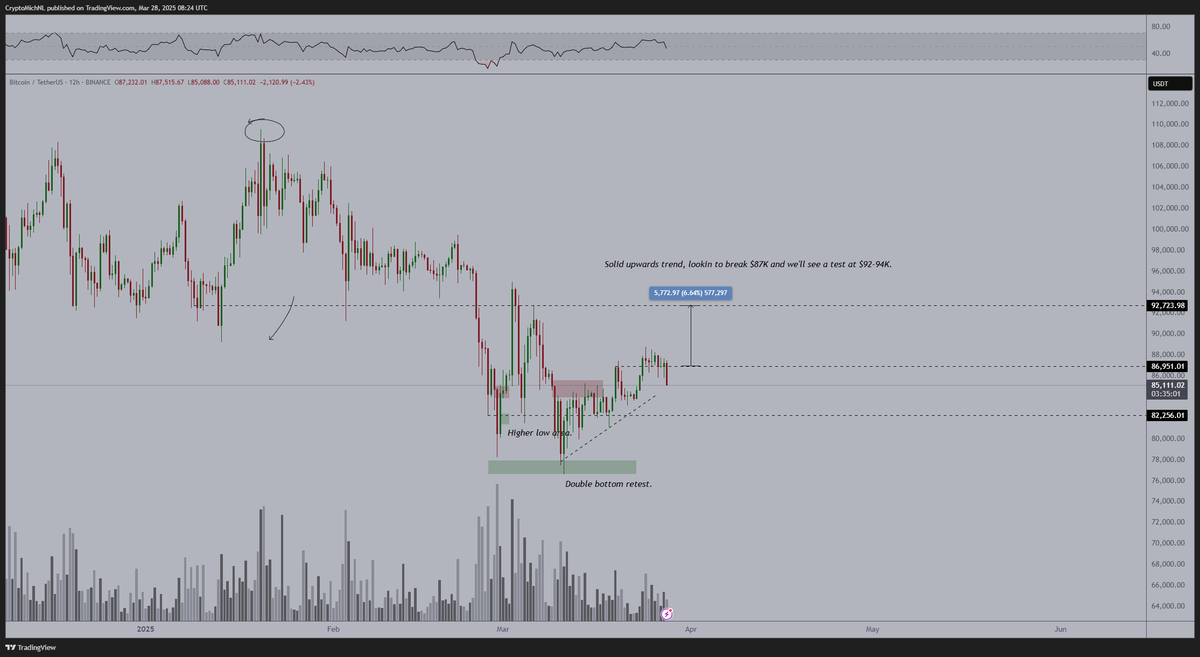

Market Analyst Weigh In On Bitcoin Trend

Several market analysts are echoing Schiff’s concerns, suggesting that Bitcoin price could face challenges in the near term. Peter Brandt, a veteran trader, has pointed out that Bitcoin might be on a path to $65,635, citing a “bear wedge” pattern that has emerged in the cryptocurrency’s price charts.

Meanwhile, crypto trader Michaël van de Poppe shared his own cautious outlook on Bitcoin’s short-term prospects. Van de Poppe noted that while Bitcoin price has been holding above the $80,000 mark, its price action is starting to show signs of weakness. He added, “It starts to look slightly less good,” and suggested that if Bitcoin falls below $84,000, a deeper correction could be imminent.

Similarly, the crypto trader TheKingfisher expressed doubts about a sustained bullish recovery, indicating that Bitcoin’s current price movement aligns with a typical market cooldown. He suggested that Bitcoin could be approaching a “seasonal reset” as part of the broader market trend.

Alternative Views on Bitcoin’s Future Trend

Not everyone shares Peter Schiff’s pessimism about Bitcoin price. Charlie Morris, founder of ByteTree, highlighted that despite recent challenges, Bitcoin may have already seen its worst. He explained that while gold ETFs are experiencing slower inflows, Bitcoin could be positioned for a potential recovery.

This view contrasts sharply with Peter Schiff’s, emphasizing that the cryptocurrency may not be as doomed as some critics suggest.

Additionally, Robert Kiyosaki, author of Rich Dad Poor Dad, has weighed in on the broader market of precious metals and cryptocurrencies. While Kiyosaki acknowledged Bitcoin’s role as a hedge against inflation, he predicted that silver would outperform both Bitcoin and gold in the near term

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Chainlink Monthly Close To Determine LINK’s Fate, $19 Next?

Published

22 hours agoon

March 29, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

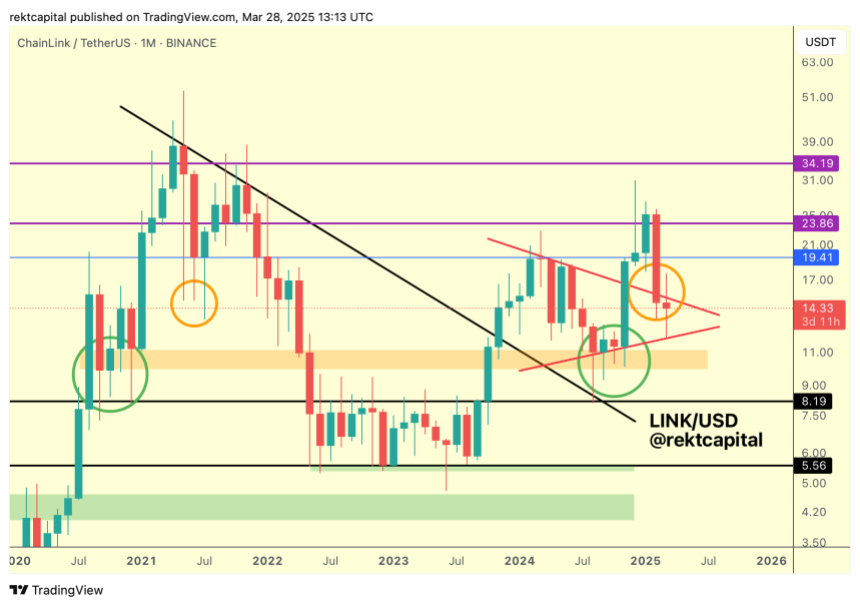

Amid today’s market correction, Chainlink (LINK) has lost its recent gains, falling back to a crucial support level. An analyst suggests a monthly close above its current range could position the cryptocurrency for a 35% surge.

Related Reading

Chainlink Retest Crucial Price Zone

Chainlink has retraced 9.1% in the past 24 hours to retest the key $14 support zone again. The cryptocurrency surged 15.7% from last Friday’s lows to hit an 18-day high of $16 on Wednesday, momentarily recovering 35% from this month’s low.

However, the recent market correction halted the momentum of most cryptocurrencies, with Bitcoin (BTC) falling back to the $83,700 mark and Ethereum (ETH) dipping to the $1,860 support zone.

Today, LINK dropped from $15 to $14.07, losing all its Wednesday gains. Previously, analyst Ali Martinez noted that the cryptocurrency has been in an ascending parallel channel since July 2023.

Chainlink has hovered between the pattern’s upper and lower boundary for the last year and a half, surging to the channel’s upper trendline every time it retested the lower zone before dropping back.

Amid its recent price performance, the cryptocurrency is retesting the channel’s lower boundary, suggesting a bounce to the upper range could come if it holds its current price levels.

Meanwhile, Rekt Capital highlighted that the token is testing its multi-month symmetrical triangle pattern, which could determine the cryptocurrency’s next move.

As the analyst explained, Chainlink consolidated inside a “Macro Triangular market structure” for most of 2024 before breaking out of the pattern during the November market rally.

During the Q4 2024 breakout, the cryptocurrency hit a two-year high of $30.9 but failed to hold this level in the following weeks. As a result, it has been in a downtrend for the past three months, with LINK’s price falling back into the Macro Triangle.

“The main goal for LINK here is to retest the top of the pattern to secure a successful post-breakout retest,” Rekt Capital detailed, adding, “It’s possible this is a volatile post-breakout retest.”

LINK Needs To Hold This Level

Rekt Capital pointed out that, historically, Chainlink has had downside deviations into this price range: “Back in mid-2021, LINK produced a downside deviation into this price area in the form of multiple Monthly downside wicks.”

Nonetheless, the cryptocurrency is downside deviating “but in the form of actual candle-bodies closes rather than downside wicks” this time.

The analyst also highlighted that, like in 2021, LINK is trading within a historical demand area, at around $13-5 and $15.5, testing this zone as support. Based on this, the cryptocurrency must successfully hold this area to “position itself for upside going forward.”

Related Reading

Moreover, the retest is key for reclaiming the top of its triangular market structure. Breaking and recovering that level would “exact a successful post-breakout retest” and enable the price to target the $19 resistance in the future.

The analyst concluded that if LINK closes the month above the triangle top, it “would position price for a successful retest, despite the downside deviation.”

As of this writing, Chainlink trades at $14.09, a 6.9% drop in the monthly timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

Why ‘Tiger King’ Joe Exotic Launched a Solana Meme Coin From Behind Bars

Trump pardons BitMEX, is ‘Bitcoin Jesus’ Roger Ver next?

Terraform Labs to Open Claims Portal for Investors on March 31

BitGo CEO Calls For Regulation Amid Galaxy Digital’s Settlement

Ethereum Bulls Disappointed As Recovery Attempt Fails At $2,160 Resistance

US recession 40% likely in 2025, what it means for crypto — Analyst

Crypto Investment Firm Galaxy Digital Settles With New York AG for $200,000,000 Over Luna Allegations

Bitcoin Covenants: CHECKTEMPLATEVERIFY (BIP 119)

This Week in Bitcoin: GameStop Reveals Reserve, But Inflation Fears Rear Their Head

Solana price prepares a wild ride as risks rise

FTX to Begin $11.4B Creditor Payouts in May After Years-Long Bankruptcy Battle

Here’s Why Crypto Market Is Bleeding Today

Support Or Resistance? Chainlink (LINK) Investor Data Suggests Key Price Zones

Sonic Labs ditch algorithmic USD stablecoin for UAE dirham alternative

Crypto Whale’s Losses on TRUMP Memecoin Balloon to $15,700,000 After Exiting Three Losing Trades in a Row

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: