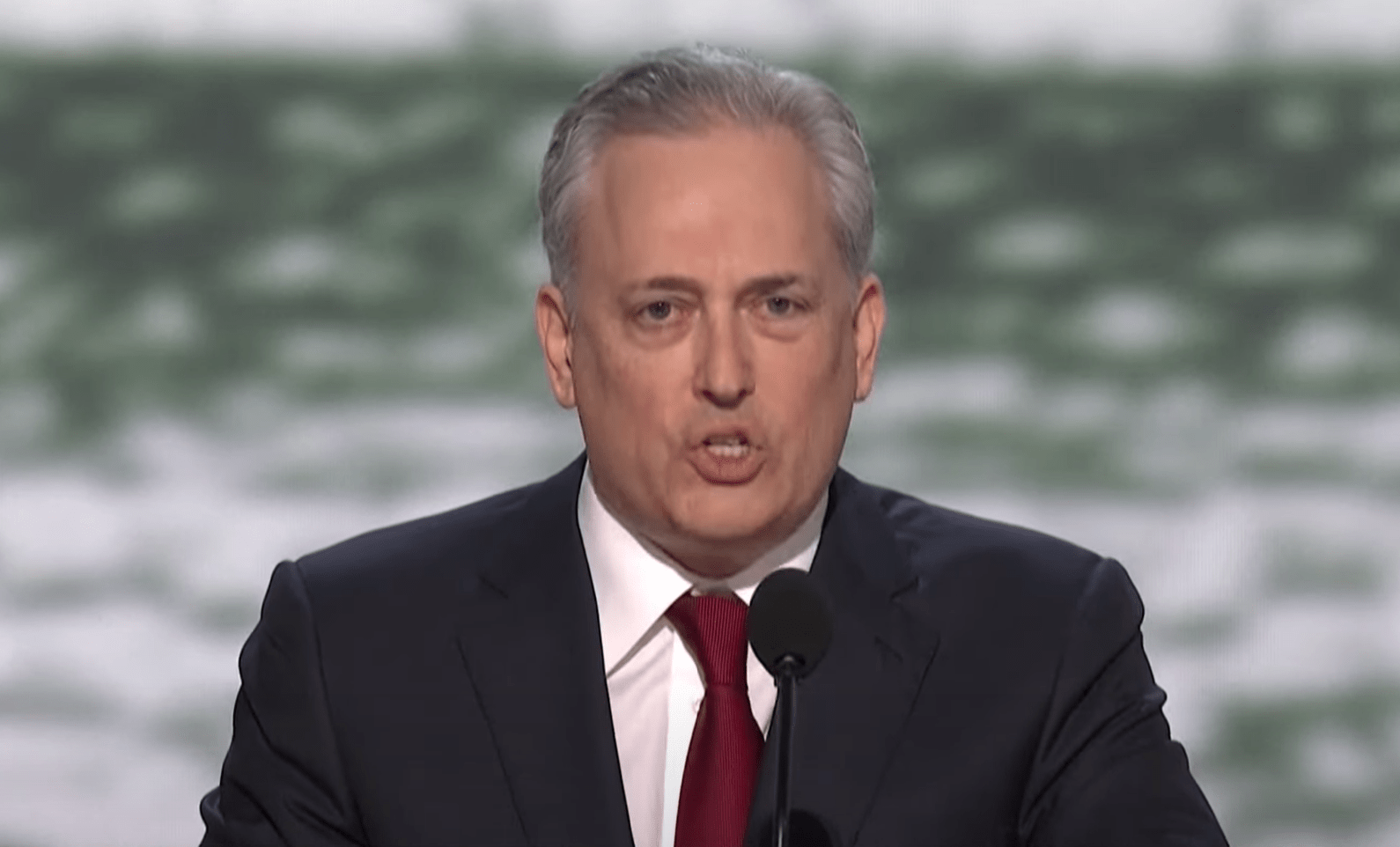

crypto czar

Trump’s Crypto Czar Sacks Is Super Bullish For Solana: Here’s Why

Published

4 months agoon

By

admin

Solana (SOL) could be one of the biggest winners from the nomination of David O. Sacks as White House Director of Artificial Intelligence and Cryptocurrency. President-elect Donald J. Trump has appointed David Sacks as “Crypto Czar” on Thursday.

Trump stated that Sacks will work to develop a legal framework to provide the crypto industry with the clarity it has been seeking, allowing the industry to flourish in the United States. Sacks brings a high-profile background to the role: he was Chief Operating Officer of PayPal during its formative years and serves as an advisor to the 0x protocol.

Related Reading

Known for his long standing support of Bitcoin as a decentralized hedge against traditional finance and a proponent of decentralized finance (DeFi) for increasing transparency in the financial system, Sacks has also invested in multiple cryptocurrency projects through his venture capital firm, Craft Ventures.

Why Sacks Is Super Bullish For Solana

Among his most notable exposures is his early investment in the Solana blockchain, achieved through the crypto-focused investment firm Multicoin Capital. In 2023, Sacks confirmed that he maintained his Solana (SOL) position despite the FTX-related market turbulence and remained “up big.”

Craft Ventures’ early involvement with Solana, via Multicoin Capital, reportedly generated substantial returns. According to Sacks’ own account on a podcast (when SOL stood at $169), this investment soared to a valuation around $1 billion.

“That fund, I mean, it’s like a 100x fund, it’s just like bonkers. And so as a result of that, we are indirect beneficiaries of this huge increase in Solana. It will end up being about, you know, a billion dollars of, I think, Solana for us in terms of returns, but the MultiCoin guys determine the trading decisions on that,” Sacks revealed during a podcast.

Sacks has discussed Solana in detail on the All-In Podcast with Chamath Palihapitiya, the founder and CEO of Social Capital. Their conversations have highlighted Solana’s capability to support rapid, cost-effective transactions at scale, often comparing its architecture and throughput favorably against that of Ethereum.

“There’s a lot of people, I’d say smart money in Silicon Valley, who are betting on a flippening where Solana could ultimately overtake Ethereum as the preferred platform,” Sacks remarked.

Related Reading

Notably, a spot Solana ETF is just around the corner in the US with 5 applications already filed with the US Securities and Exchange Commission. With the appointment of Sacks, the likelihood of a spot SOL ETF following the departure of Gary Gensler as SEC Chairman on January 20 is likely to have increased further.

Solana’s strong fundamentals and growing institutional recognition are being reflected in its price action. At press time, Solana is trading just below a new all-time high established two days ago at $264.39, having surpassed its previous record from October 2021 at $259.90.

Should SOL breach this newly formed resistance level, technical analysts point to potential upside targets. These include the 1.272 Fibonacci extension at around $328 and the 1.618 Fibonacci extension at approximately $415.

At press time, SOL traded at $234.

Featured image from YouTube, chart from TradingView.com

Source link

You may like

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Block Agrees to $40M NYDFS Penalty Over Lackluster Compliance Program

Top Bitcoin miners produced nearly $800M of BTC in Q1 2025

Bitcoin

Crypto Czar David Sacks Says US Government May Accumulate More Bitcoin To Add to Strategic BTC Reserve

Published

1 month agoon

March 10, 2025By

admin

The Trump Administration’s Crypto Czar says the US could gobble up more Bitcoin (BTC) to add to its upcoming strategic reserve.

In a new interview on the All-In Podcast, renowned venture capitalist and Crypto Czar David Sacks says that the government would be allowed to purchase more of the top crypto asset by market cap to add to its strategic reserve if certain budgetary conditions are met.

“I’m talking about Treasury and Commerce – they’re allowed to figure out strategies to accumulate more Bitcoin for the reserve if those strategies are budget neutral and don’t cost the taxpayer anything. So it’s possible that we could, I’m not saying that we will, but it authorizes them to acquire more Bitcoin if they can figure out a way to do it that doesn’t impact the federal budget or the deficit or taxpayers.”

Last week, President Donald Trump signed an executive order (EO) creating a strategic Bitcoin and crypto reserve. The EO establishes a national BTC and crypto asset stockpile by holding digital assets seized from criminal activities rather than auctioning them off as had been previous practice.

Also last week, Sacks revealed that the US Federal Government lost out on tens of billions of dollars in Bitcoin growth by previously selling some of the BTC it had in its possession. As stated by Sacks at the time,

“If the government had held the Bitcoin, it would be worth over $17 billion today. That’s how much it has cost American taxpayers not to have a long-term strategy.”

According to data from market intelligence firm Arkham, the Federal government currently holds about $16.4 billion worth of the flagship digital asset.

Bitcoin is trading for $82,524 at time of writing, a 3.2% decrease on the day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

US Government Bitcoin Stash Would Be Worth an Extra $16,634,000,000 if the DOJ Hadn’t Sold BTC: David Sacks

Published

1 month agoon

March 8, 2025By

admin

The White House’s “Crypto Czar,” David Sacks, says the US government would own an extra $16.634 billion worth of Bitcoin if the Department of Justice (DOJ) had held onto its BTC.

Sacks notes the federal government has sold approximately 195,000 Bitcoin for $366 million, far less than it could have earned for the BTC today.

“If the government had held the Bitcoin, it would be worth over $17 billion today. That’s how much it has cost American taxpayers not to have a long-term strategy.”

The US government currently owns $17.05 billion worth of BTC, per data from the blockchain analytics firm Arkham.

Sacks previously served as PayPal’s chief operating officer (COO) and is a high-profile venture capitalist who has invested in Airbnb, Palantir, Postmates, Reddit, Slack, SpaceX, Twitter, Uber and other big-name tech companies.

The U.S. Marshals Service typically sells US government-seized Bitcoin in auctions.

On Sunday, President Donald Trump confirmed that the US will set up a “crypto strategic reserve” consisting of Bitcoin, Ethereum (ETH), XRP, Solana (SOL) and Cardano (ADA).

BTC is trading at $87,104 at time of writing. The top-ranked crypto asset by market cap is down by nearly 8% in the past 24 hours but is up by more than 6.5% in the past week.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

24/7 Cryptocurrency News

Crypto Czar David Sacks Gives Take On Operation Chokepoint 2.0

Published

4 months agoon

December 8, 2024By

admin

Conversations around Operation Chokepoint 2.0 has taken a new twist after incoming Crypto Czar David Sacks said the allegations around the subject deserves probe. The latest conversation on X started with Chris Lane, the former CTO of Silvergate Bank giving account of why the institution failed.

Operation Chokepoint 2.0 Is Universal

According to Lane, its exposure to FTX Derivatives Exchange did not kill Silvergate, that regulators did. He noted that American regulators went after 5 US banks simultaneously the Sunday after Thanksgiving celebration in 2022.

With the collapse of FTX, Lane said Silvergate survived a 70% run on deposits. By his analysis, a typical bank would not have survived a 20% run, underscoring the depth of its excess reserve.

However, he noted that “regulators came in sometime in Spring 2023 and severely limited the amount of US dollar deposits we could hold for digital asset clients.” Considering its entire business hinges on this model, he said the bank had to close down.

“We effectively shut down the business and focused efforts on returning capital to shareholders Silvergate was an American business that pioneered a new business model in banking Regulators pulled a bait and switch – we were walking along and suddenly shot in the back,” Lane said in his X update.

He noted that of all the banks that actually offered services to FTX, Silvergate was solvent but was not allowed to thrive. Commenting on this blunt Operation Chokepoint 2.0 ordeal, the incoming Crypto Czar said it appears as though a lot of people suffered hurt by the crackdowns.

There are too many stories of people being hurt by Operation Choke Point 2.0. It needs to be looked at. https://t.co/IhCdyQfx0g

— David Sacks (@DavidSacks) December 7, 2024

Since he secured the nomination from Donald Trump as White House AI and Crypto Czar, this is the first definitive statement from Sacks on the issue.

Will Donald Trump Administration Change the Game?

It is worth noting that the first call to probe the crackdowns of Operation Chokepoint 2.0 came from pro-crypto lawyer John Deaton.

Since his election as President, Donald Trump has made crypto industry-approved appointments including Treasury Secretary Scott Bessent. The President-elect also named Paul Atkins as the next Chairman of the United States Securities and Exchange Commission (SEC).

These incoming government officials are pro-crypto and the industry expects they will approach the policies differently to favor emerging markets.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Block Agrees to $40M NYDFS Penalty Over Lackluster Compliance Program

Top Bitcoin miners produced nearly $800M of BTC in Q1 2025

Tariffs, Trade Tensions May Be Positive for Bitcoin (BTC) Adoption in Medium Term: Grayscale

The U.S. Tariff War With China Is Good For Bitcoin Mining

Dogecoin Bull Div Plays Out, Analyst Maps Next Price Targets

Web3 search engine can reshape the internet’s future

Billionaire Ray Dalio Says He’s ‘Very Concerned’ About Trump Tariffs, Predicts Worldwide Economic Slowdown

Top 4 Altcoins to Sell Before US-China Trade War Extends Beyond 125% Tariffs

OpenAI Countersues Elon Musk, Accuses Billionaire of ‘Bad-Faith Tactics’

81.6% of XRP supply is in profit, but traders in Korea are turning bearish — Here is why

Stablecoins Are ‘WhatsApp Moment’ for Money Transfers, a16z Says

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trump’s Coin Is About As Revolutionary As OneCoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: