bill

UK Parliament Introduces Bill to Recognize Bitcoin and Crypto as Personal Property

Published

3 months agoon

By

admin

The UK Parliament has introduced the Property (Digital Assets etc) Bill today to officially and legally recognize Bitcoin, cryptocurrency, and other digital assets as personal property. With this new legislation, for the first time, British law would officially protect digital holdings such as Bitcoin and other cryptocurrencies, non-fungible tokens (NFTs), and carbon credits.

JUST IN: 🇬🇧 UK Parliament introduces bill to recognize #Bitcoin as personal property. pic.twitter.com/FzMHgmIZjx

— Bitcoin Magazine (@BitcoinMagazine) September 11, 2024

“It is essential that the law keeps pace with evolving technologies and this legislation will mean that the sector can maintain its position as a global leader in cryptoassets and bring clarity to complex property cases,” said Justice Minister Heidi Alexander. “Our world-leading legal services form a vital part of our economy, helping to drive forward growth and keep Britain at the heart of the international legal industry.”

This bill aims to address a long-standing legal gap, where digital assets were previously excluded from English and Welsh property law. As a result, owners of digital assets had little recourse if their holdings were interfered with, leaving them in a legal grey area.

Under the new bill, digital assets will be classified as a third category of property, allowing owners to benefit from stronger legal protections against fraud and theft. The legislation will also assist courts in resolving complex disputes, such as those arising in divorce settlements or business agreements involving digital assets.

“The Bill will also ensure Britain maintains its pole position in the emerging global crypto race by being one of the first countries to recognise these assets in law,” stated the announcement.

The UK government further explained that with this new legislation, their legal sector will be better equipped to respond to these new technologies and attract more business and investment to the legal services industry.

“The UK has passed a new bill that will allow crypto and other digital assets to be recognised as personal property,” stated the UK Ministry of Justice X account. “That means owners of digital assets will gain legal protection against fraud and scams.”

Source link

You may like

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

bill

Texas State Rep Files For Strategic Bitcoin Reserve

Published

1 week agoon

December 12, 2024By

admin

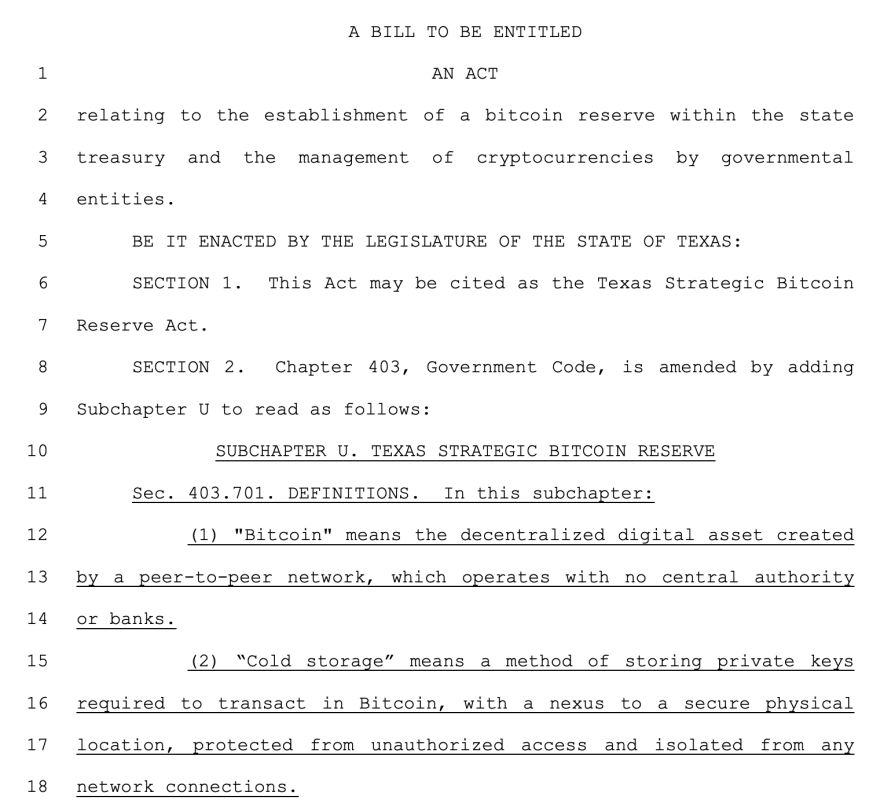

Today, Texas State Representative Giovanni Capriglione officially filed for a Strategic Bitcoin Reserve bill for the state of Texas during a 𝕏 spaces with Dennis Porter of Satoshi Action Fund, a Bitcoin advocacy organization working with politicians on pro-Bitcoin legislation.

To summarize, the bill would effectively:

- See Texas buy and hold bitcoin as a strategic reserve asset.

- Securely store the BTC in cold storage for at least five years.

- Allow Texas residents to donate bitcoin to the reserve.

- Ensure transparency via yearly reports and audits.

- Allow state agencies to accept cryptocurrencies, and convert them to bitcoin.

- Establish rules for security, donations, and management.

“This Act takes effect immediately if it receives a 12 vote of two-thirds of all the members elected to each house, as 13 provided by Section 39, Article III, Texas Constitution,” the legislation states. “If this Act 14 does not receive the vote necessary for immediate effect, this Act 15 takes effect September 1, 2025.”

This is yet another step towards America embracing Bitcoin, fueled by President-elect Donald Trump and Senator Cynthia Lummis’ lead by introducing a Strategic Bitcoin Reserve bill for the United States earlier this year. The hype around implementing a Strategic Bitcoin Reserve has caused a snowball effect of other states and countries introducing legislation to adopt one as well. Other states like Pennsylvania and countries like Russia and Brazil are among those introducing bills for a Strategic Bitcoin Reserve.

“Chairman Capriglione is the Chair of the Texas Pensions, Investments, and Financial Services Committee so this bill has legs!” commented Lee Bratcher, President of the Texas Blockchain Council. “No taxpayer funds will be spent on the bitcoin.”

Source link

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential