24/7 Cryptocurrency News

US CPI In Focus As Bitcoin & Altcoins Gear Up For Further Rally

Published

4 months agoon

By

admin

The crypto market enters a crucial week, with the US CPI inflation figures in focus. In addition, the US Producer Price Index (PPI) data, another critical inflation metric considered by the US Federal Reserve to decide their rate cut plans, is also scheduled for this week. Notably, investors eagerly await this figure as Bitcoin as well as the altcoins sector is gearing up for further rally, potentially hitting new records ahead.

Crypto Market Awaits US CPI Inflation Figures

The crypto market has noted a strong rally recently, with investors anticipating the rally to continue ahead. Now, with the robust Labor market, as evidenced by last week’s Job data, traders are eagerly waiting for the upcoming US CPI inflation figures. For context, the US added 227K jobs in November, up from the market expectations of 220K. Besides, the US unemployment rate also rose to 4.2% in November, up from 4.1% in the prior month.

Notably, the economic indicators tend to influence the broader financial market, let alone the digital assets space. Having said that, inflation and other key figures play a key role in shaping the market sentiment.

Now, investors eagerly await the US Consumer Price Index data, which is scheduled for Wednesday, December 11. According to the market forecast, the inflation is expected to come in at 2.7%, as compared to 2.6% in the prior month. Simultaneously, the Core CPI, which excludes food and energy prices, is expected to cool down to 3.2% from 3.3% noted in October. A hotter-than-anticipated inflation figure usually results in a waning risk-bet appetite of the traders.

On the other hand, the US PPI data, another key metric to gauge inflationary pressure, is scheduled for Thursday, December 12. The market participants would also keep close track of these figures for clarity on the current inflationary pressures in the nation. Notably, the market is expecting the US PPI figures to remain unchanged from last month.

Will Bitcoin & Altcoins Continue To Rally?

The crypto market, along with Bitcoin and the top altcoins has noted a robust rally recently, indicating strong market confidence. Notably, BTC has recently soared past the $100K mark, touching its ATH of $103,900 last week. Notably, the rally started as optimism soared toward pro-crypto regulations in the US after Donald Trump’s election win.

Now, despite anticipation over hot US CPI inflation figures, the market anticipates the Bitcoin and altcoins rally to continue ahead. Although some analysts warned over short-term pullbacks during these bull phase, the digital assets are likely to set new records ahead.

In addition, historical data suggests that Q4 tends to be positive for the financial markets, especially cryptocurrencies. It’s worth noting that so far, the crypto market also showed a similar performance this year as well. Considering that, the economic indicators are not likely to weigh much on the investors’ sentiment ahead.

What’s Next For BTC & Other Crypto?

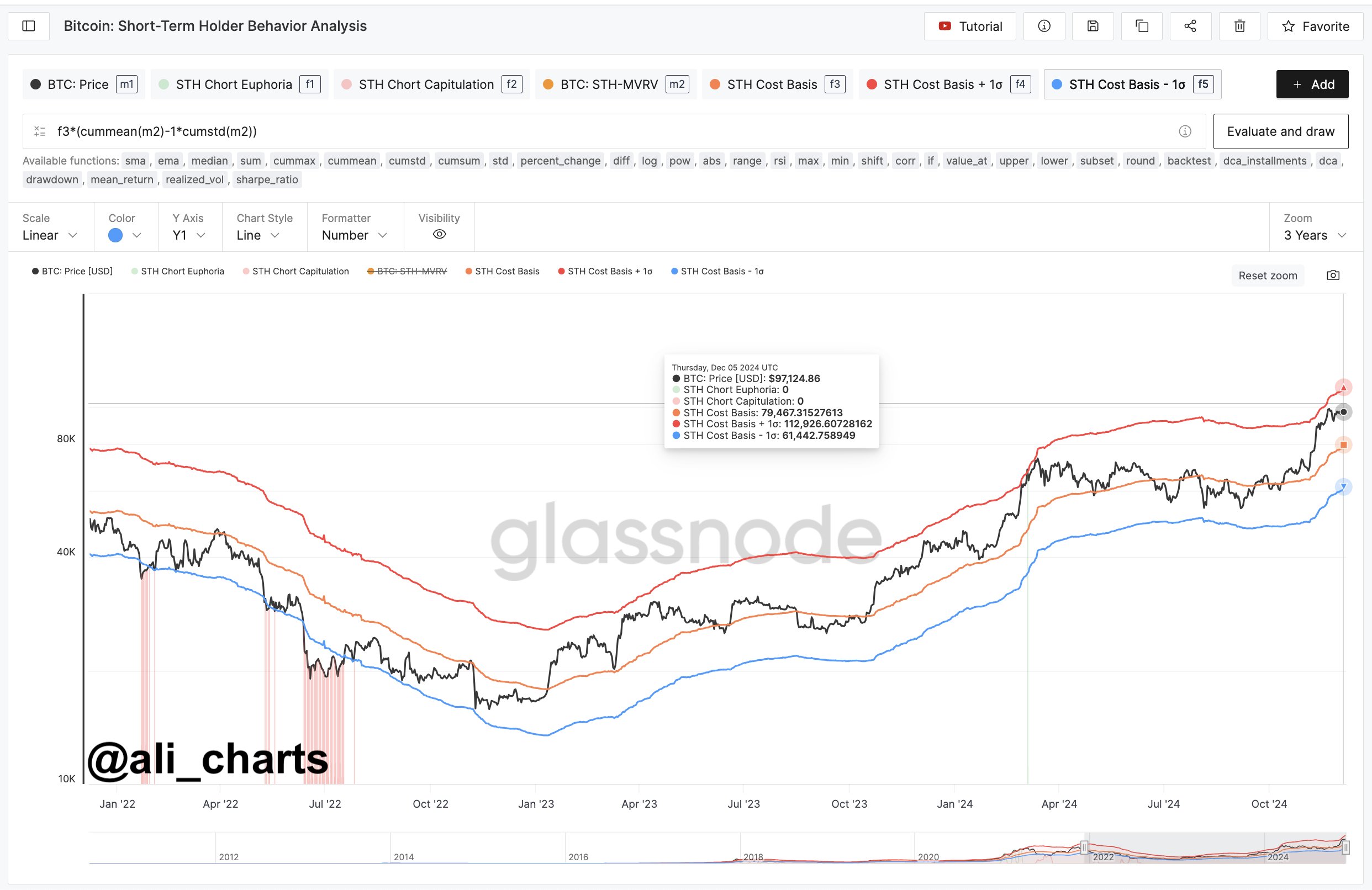

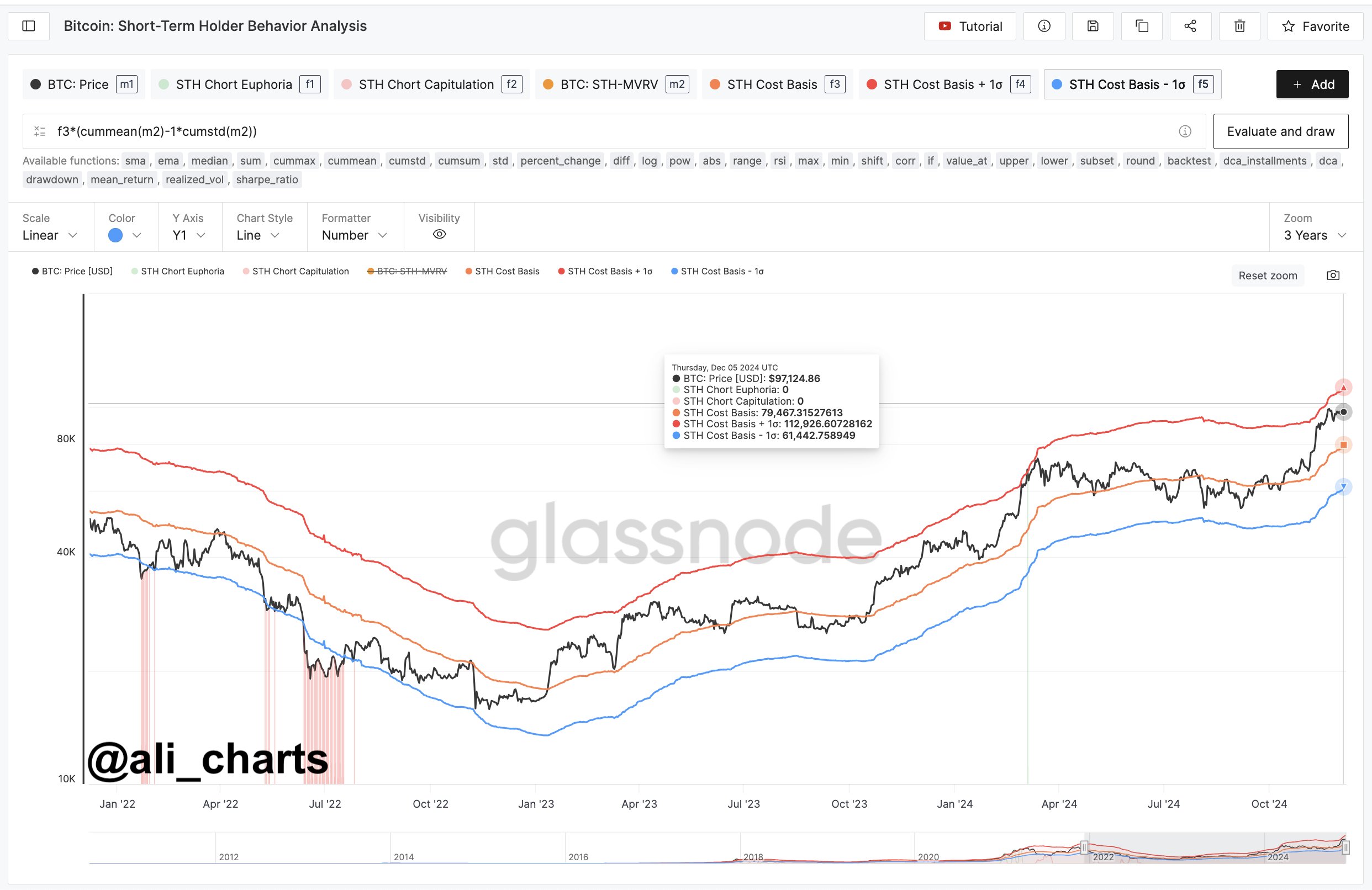

In a recent analysis, top crypto market analyst Ali Martinez said that Bitcoin is poised to reach $112,926, citing technical trends. This has sparked optimism among investors, especially as BTC whales are on a buying spree in recent days.

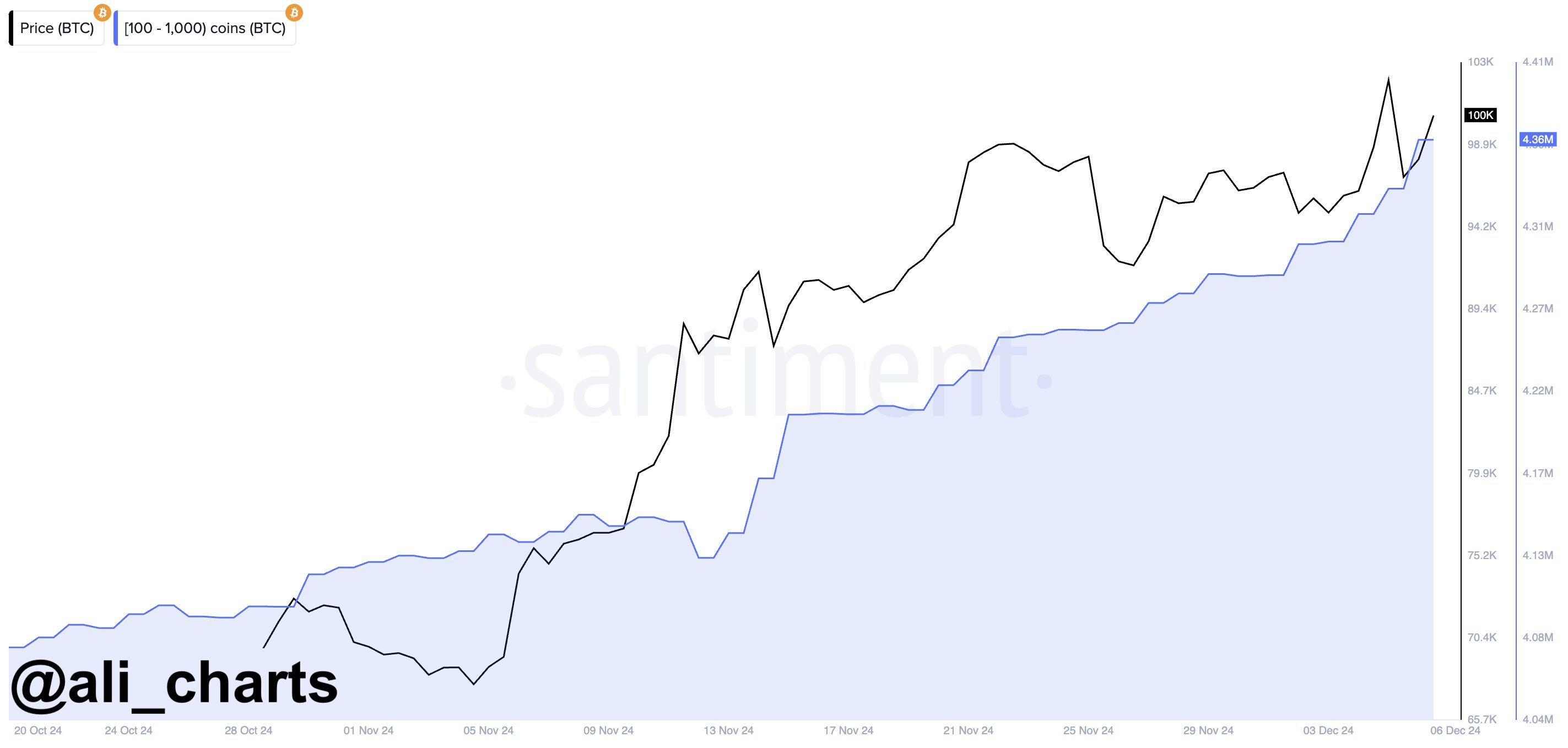

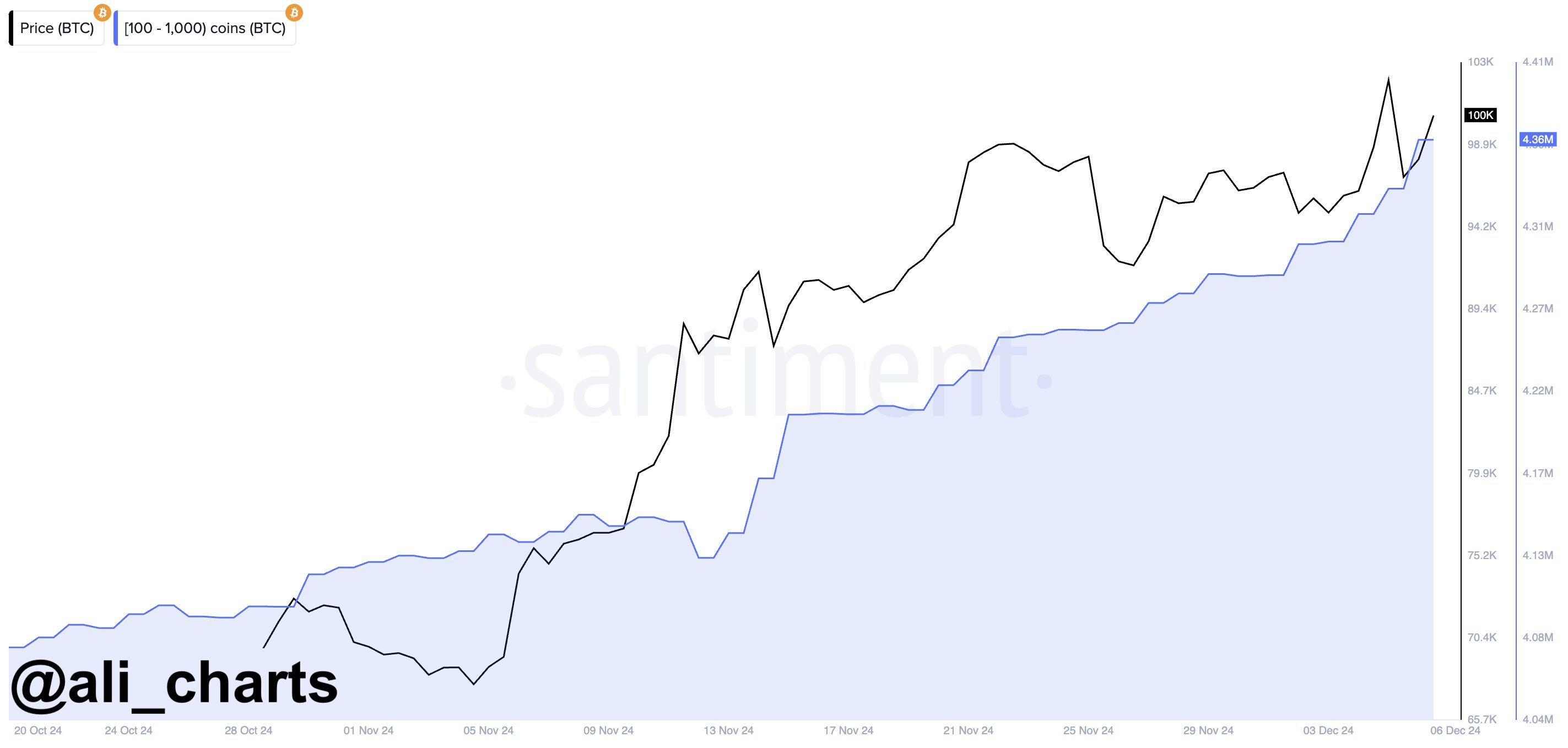

Martinez also said in another post that “Bitcoin whale accumulation is going parabolic.” He noted that recently the whales have purchased 20,000 BTC, worth around $2 billion. In addition, the soaring retail interest also hints toward a further rally ahead. Notably, Marathon Digital (MARA) has accelerated its BTC buying strategy, gaining investors’ attention.

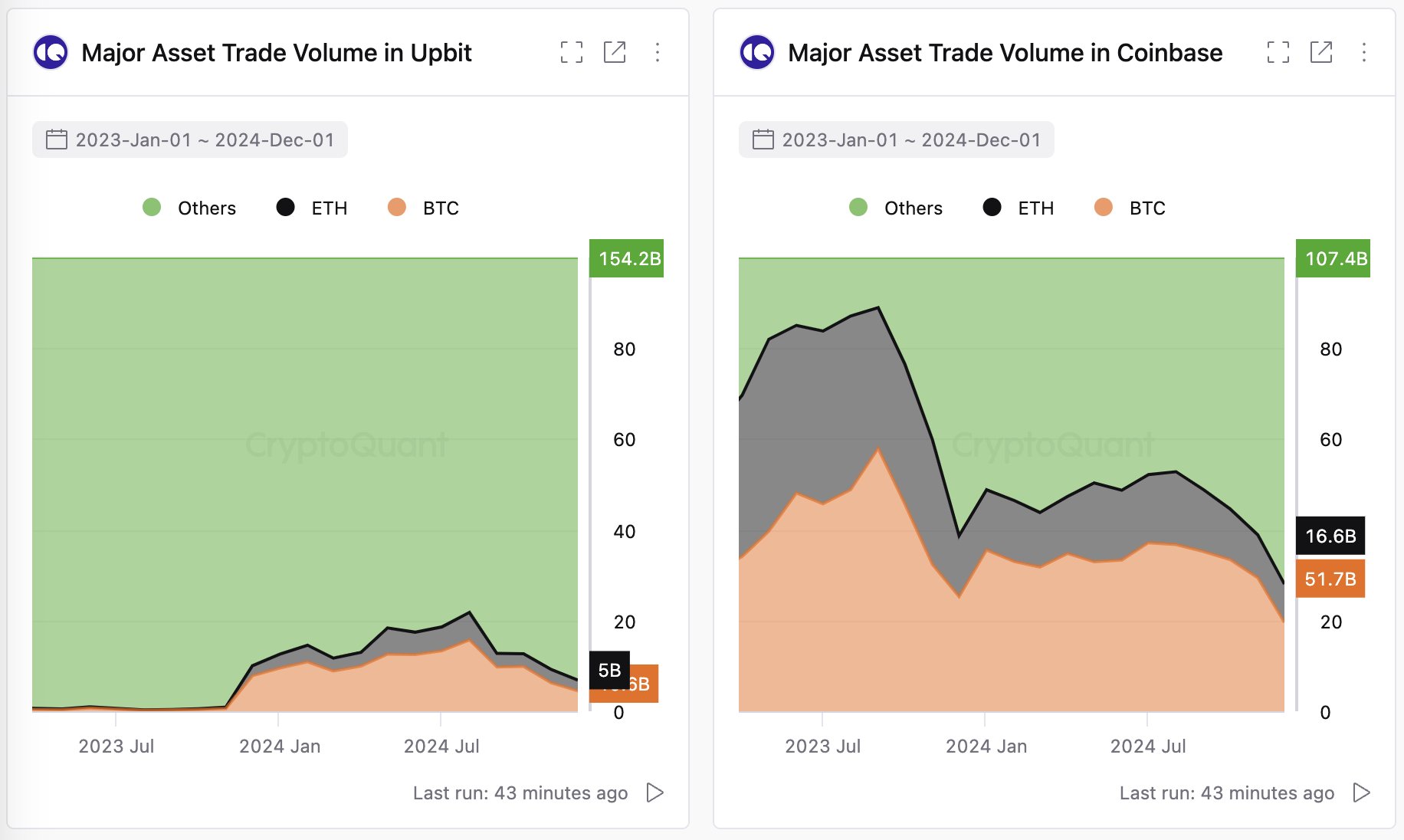

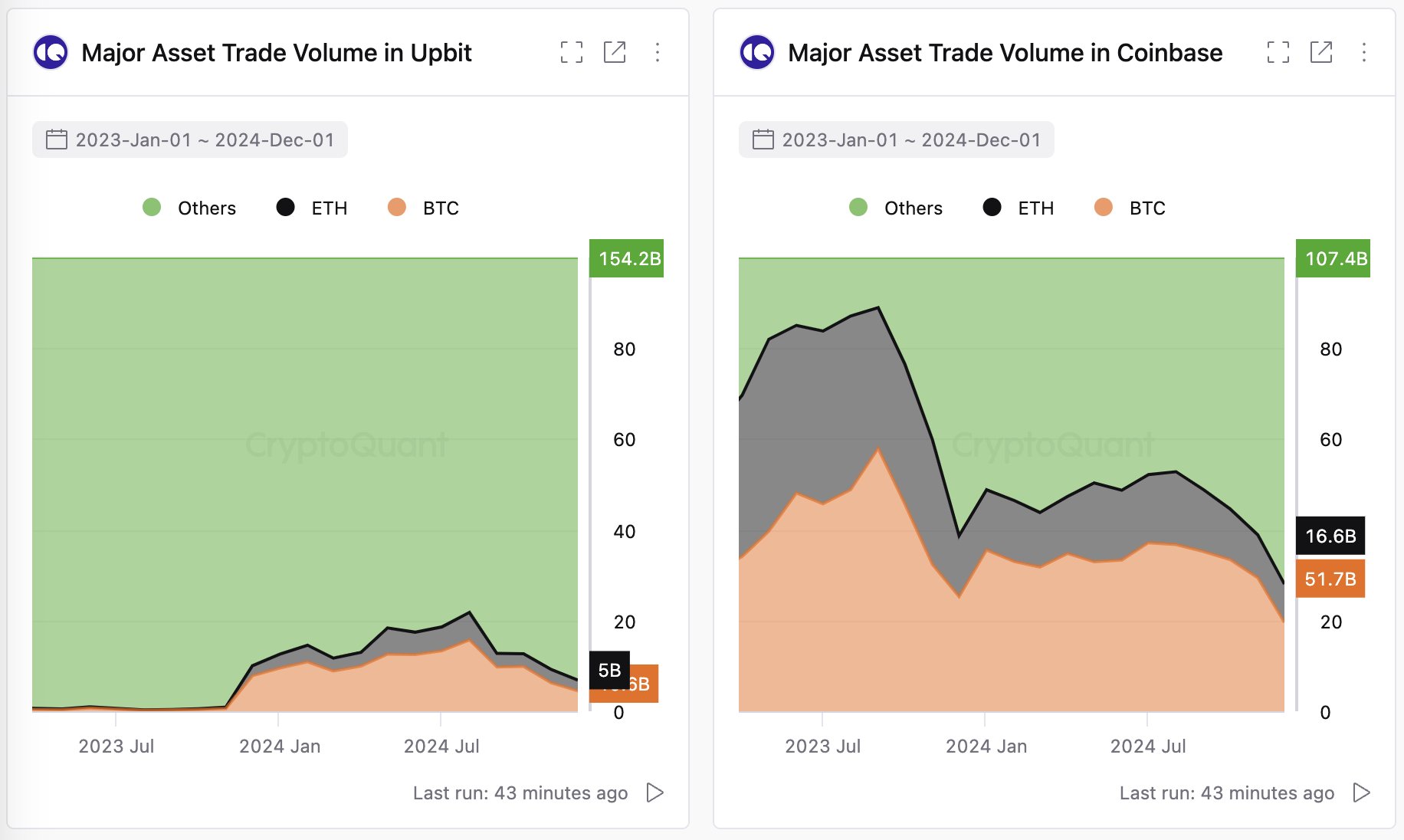

So far, the altcoins have also followed Bitcoin’s run towards the north. Talking about the altcoin season, CryptoQuant CEO and Founder Ki Young Ju showed confidence in the altcoin market, citing the crypto trading trend in South Korea. In a recent X post, he stated:

“South Korea: The world’s second-largest crypto market, where 93% of trades are altcoins and only 4% are Bitcoin. Every season is alt season.”

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Block Agrees to $40M NYDFS Penalty Over Lackluster Compliance Program

Top Bitcoin miners produced nearly $800M of BTC in Q1 2025

24/7 Cryptocurrency News

Top 4 Altcoins to Sell Before US-China Trade War Extends Beyond 125% Tariffs

Published

11 hours agoon

April 10, 2025By

admin

The altcoins are on a constant decline as investors jump to sell their tokens. The crypto market still struggles to recover from the trade war. More importantly, the fear is building as Donald Trump has increased the tariff on China to 125%. In contrast, China has implemented an 85% tariff on US imports, intensifying the US-China trade war situation. In this turmoil, the cryptos could face further uncertainty and even collapse.

Top 4 Altcoins to Sell Amid US-China Trade War

The US-China tariff trade war has become one of the most bearish factors for the crypto market. All the digital assets, including Bitcoin, are struggling with extreme whale movements and downtrends. More importantly, the recovery is vague, so consider FTX Token (FTT), Toncoin (TON), Shiba Inu, Pi Coin, and a few other altcoins to sell.

1. FTX Token (FTT)

FTT faced a massive downtrend with the collapse of the FTX exchange. More importantly, its recovery from the drop is still vague, with the prime being 98.93% away from current levels. Now, the risk is building as Binance’s ‘vote to delist’ includes this struggling altcoin. If that happens, the token may face a further downtrend.

2. Toncoin (TON)

In early 2024, TON was among the best-performing cryptos, but that changed with the regulatory issues with Telegram and Pavel Durov. As a result, it crashed and has been under consolidation ever since, making it among the top choices for altcoins to sell.

3. Shiba Inu (SHIB)

Shiba Inu is known as the second biggest and top meme coin but is under scrutiny due to the declining demand for these meme-themed cryptos. Experts believe that these cryptos may never make a complete recovery from their drops as they lack utility and trend and face high competition.

At present, the SHIB price is on the recovery trail but may crash amid the US-China trade war, making it the right time to sell along with other struggling cryptos.

4. Pi Coin (PI)

Pi Coin is often a topic of discussion, as the crypto community is split between calling it the scam coin and the profitable coin. Since its launch, it has witnessed a significant uptrend, gaining investors’ attention, but the downfalls were also persistent. With regulatory concerns and Binance’s pending listing, its credibility is low.

Bottom Line

The recent crypto market crash has been in constant turmoil for weeks, losing billions in liquidations. Many digital assets have lost all the gains they made during the Trump presidency-influenced bull run, and if the US-China trade war continues, the loss can extend. As a result, investors must consider struggling altcoins like FTT, Shiba Inu, and others to sell.

Frequently Asked Questions (FAQs)

Donald Trump has increased the tariff to 125% on China, whereas China has implemented 85% tariffs on the US.

FTT, PI, SHIB, and TON are the poor-performing altcoins that investors can consider to sell.

As Trump’s trade war extends, the uncertainty is rising in the crypto market, but it may recover with time with rising investor activity.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market.

As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

21shares

21Shares Files For Spot Dogecoin ETF With US SEC

Published

19 hours agoon

April 10, 2025By

admin

Asset manager 21Shares has filed with the US Securities and Exchange Commission (SEC) to offer a Dogecoin ETF. This development comes just as the Dogecoin price rebounds following a wave of sell-offs which saw it drop to as low as $0.14.

21Shares Files For Dogecoin ETF With US SEC

21Shares has filed the S-1 form for its Dogecoin ETF with the US SEC. The asset manager becomes the third to file for a DOGE ETF, joining Grayscale and Bitwise. The next step is for the asset manager, through an exchange, to file the 19b-4 form for this fund, which will officially kickstart the process towards a potential approval from the Commission.

Interestingly, this filing comes on the same day 21Shares launched its Dogecoin ETP on the SIX Swiss Exchange through its partnership with the House of Doge. These two will collaborate again if the SEC approves this ETF, as the asset manager revealed in the prospectus that the House of Doge, the corporate arm of the Dogecoin Foundation, will help in marketing the fund.

Meanwhile, the top crypto exchange, Coinbase, will be the Trust’s custodian. The ETF will hold Dogecoin and provide institutional investors an avenue to gain exposure to the top meme coin.

This undoubtedly provides a bullish outlook for the Dogecoin price, as this move could boost the meme coin’s adoption and further drive inflows into its ecosystem.

DOGE Forms Bullish Divergence

Amid 21Shares’ Dogecoin ETF filing, crypto analyst Kevin Capital has revealed that a daily bullish divergence on DOGE’s chart is starting to play out. He remarked that this development is obviously mostly due to the macro news, but nonetheless, the charts were already hinting at this possibility.

This macro news is Donald Trump’s decision to halt reciprocal tariffs for 90 days. Dogecoin and the broader crypto market rebounded on the back of this news.

However, it remains to be seen if this would be a bullish reversal or a bear trap. As CoinGape reported, crypto analyst Master Kebobi stated that the bottom is in for the top meme coin and predicts that the Dogecoin price would rally to the much-anticipated $1 level in the coming months.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across several topics and niches. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover, a traveler and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

What Next For Crypto Market As China, EU Announce Retaliatory Tariffs On US Goods?

Published

1 day agoon

April 9, 2025By

admin

The crypto market is currently in a state of uncertainty and risks further downside as China and the EU announce retaliatory tariffs on US goods. Some analyses suggest that the market could drop lower, led by Bitcoin, while others indicate that this might be the bottom, regardless of whether the trade war persists.

What Next For Crypto Market As China, EU Announce Tariffs

The crypto market is at risk of a further crash, with the Bitcoin price possibly dropping to new lows following China and the EU’s announcement of retaliatory tariffs on US goods. According to a CNN report, China announced 84% tariffs on US imports, which will become effective from April 10.

Meanwhile, the EU has announced plans to impose 10% and 25% tariffs on US imports, effective April 15. As CoinGape reported, the crypto market witnessed another crash yesterday following news that the US would impose 104% tariffs on China, which took effect today.

Crypto analysts such as Rekt Capital have suggested that the Bitcoin price risks dropping lower in the short term amid this tariff war. In an X post, Rekt Capital stated that BTC is experiencing downside continuation after upside wicking into the early March weekly lows.

He added that having confirmed this red level as new resistance, the Bitcoin price is now dropping into the $71,000 to $83,000 volume gap to fill this market inefficiency.

Meanwhile, crypto analyst CrediBULL Crypto suggested that BTC could still drop lower to suck the liquidity at the higher timeframe demand between $69,000 and $74,000.

Bullish Case For The Market

Market expert Anthony Pompliano has again raised the possibility of the US Federal Reserve intervening in the tariff war by announcing an emergency cut rate. Pompliano noted that the increasing 10-year yield likely pushes the Fed closer to acting in emergency fashion.

As CoinGape reported, Fed Chair Jerome Powell could announce an emergency rate cut as Trump’s tariffs persist. This would be bullish for the crypto market, as the US Central Bank’s easing monetary policies would inject more liquidity into crypto assets.

US President Donald Trump also recently stated that it is a great time to buy, which could mark the bottom for the market. Crypto analyst MikyBull Crypto noted that the president has made the same statement on two occasions, which marked the bottom.

The first was in October 2018, with the market bottoming two and a half months later, while the second was in March 2020, with the market bottoming one to two weeks later.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across several topics and niches. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover, a traveler and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Block Agrees to $40M NYDFS Penalty Over Lackluster Compliance Program

Top Bitcoin miners produced nearly $800M of BTC in Q1 2025

Tariffs, Trade Tensions May Be Positive for Bitcoin (BTC) Adoption in Medium Term: Grayscale

The U.S. Tariff War With China Is Good For Bitcoin Mining

Dogecoin Bull Div Plays Out, Analyst Maps Next Price Targets

Web3 search engine can reshape the internet’s future

Billionaire Ray Dalio Says He’s ‘Very Concerned’ About Trump Tariffs, Predicts Worldwide Economic Slowdown

Top 4 Altcoins to Sell Before US-China Trade War Extends Beyond 125% Tariffs

OpenAI Countersues Elon Musk, Accuses Billionaire of ‘Bad-Faith Tactics’

81.6% of XRP supply is in profit, but traders in Korea are turning bearish — Here is why

Stablecoins Are ‘WhatsApp Moment’ for Money Transfers, a16z Says

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trump’s Coin Is About As Revolutionary As OneCoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: