bridges

UTXO Research Report: State Of The Bridges

Published

4 months agoon

By

admin

As we enter a new era of development on Bitcoin, it has become very hard for most people to understand the nuances of the L2 debate, and ever harder to follow some of the technical jargon associated with it. Sidechains, rollups, sequencer, multisig, ZKP…. In this report, we’ll try to shed some light on those concepts by outlining the UTXO thesis for Bitcoin L2s and by answering the following questions:

- Does Bitcoin even need Bridges?

- What are the differences between sidechains (BOB, Botanix, etc..) and rollups designs (Alpen, Citrea)?

- What are the strategies employed to convince Bitcoiners to bridge their BTC?

- What are the different BitVM implementations and how do they revolutionize Bitcoin Bridges?

- Can rollups compete with existing L2 designs such as Lightning?

Table of contents:

Questioning the Necessity of Bridges

The Current State of Bitcoin Bridges

Understanding the Friction Between Solving Technical Challenges and Growing a Sustainable User Base.

The Future State of Bitcoin Bridges (BitVM and others)

The Thesis for Bitcoin Rollups and Bridge Innovation

Key Takeaways:

- Delivering on the promises of Bitcoin Season 2 will require a lot more funding and research toward bridge design, blockspace dynamics, and interoperability.

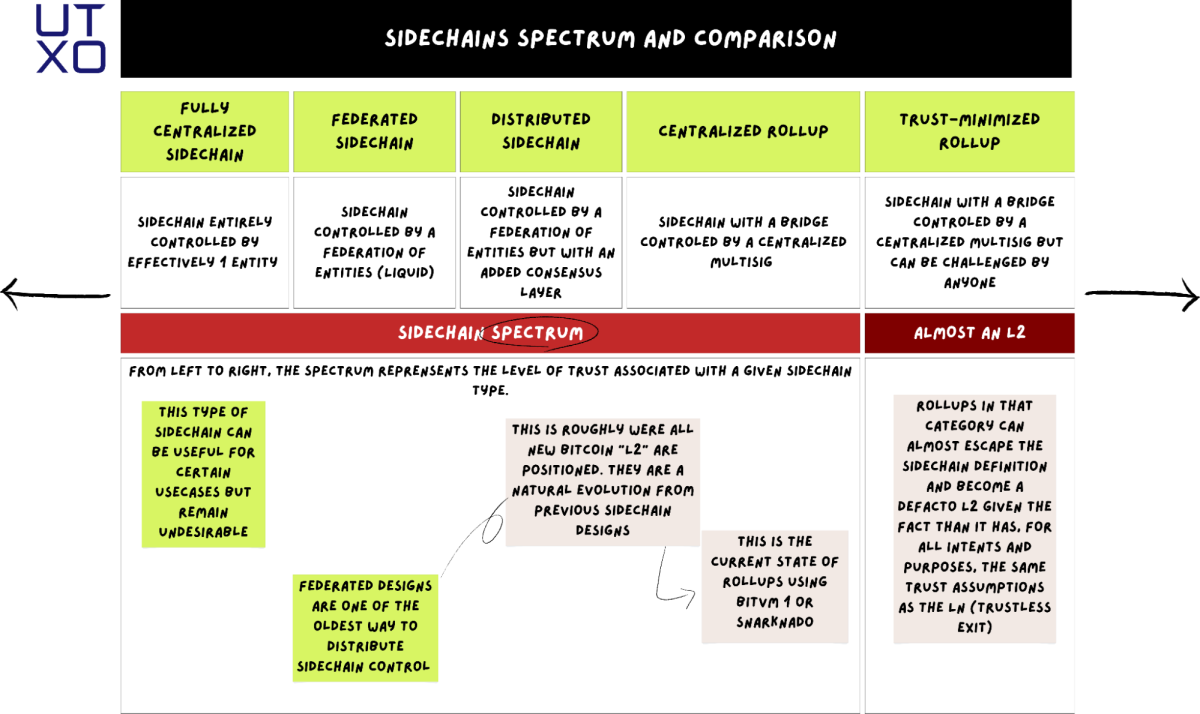

- Sidechains exist on a spectrum and the Bitcoin “L2” category is a victim of ambitious marketing despite harboring a great deal of innovative new bridge systems that provide a valuable alternative to rollups.

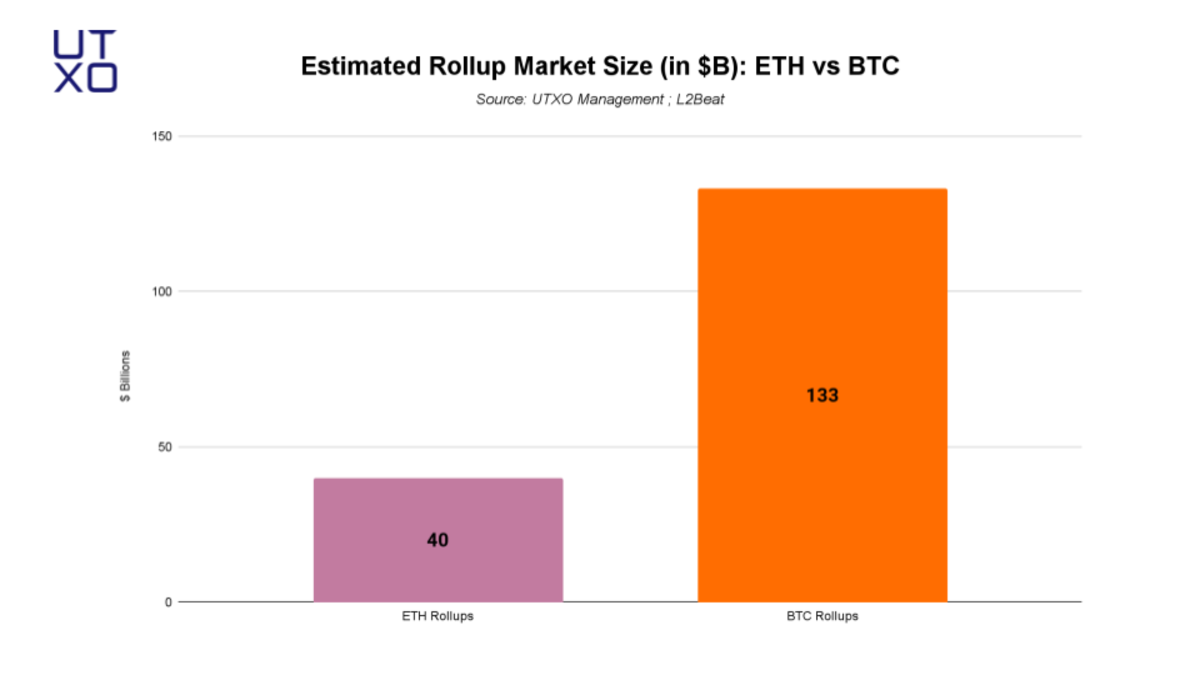

- Rollups are going to be more impactful on Bitcoin than they’ll ever be on Ethereum and have the potential to reach over $133 billion in TVL over the next five years.

- BitVM and ZKP research is at the forefront of Bitcoin innovation and will become the most important topic of this cycle.

- Investment in companies capable of solving the upcoming problems related to Bitcoin rollups is paramount, including MEV research, data availability, decentralized sequencing, attestation chains, and of course, UX.

Questioning the Necessity of Bridges

When we talk about scaling Bitcoin, the same questions inevitably arise to remind us of the scale of the challenge. Among them, the question of whether the Bitcoin base layer should scale was answered long ago during the Blocksize Wars: Bitcoin will have to scale in layers.

Layers, however, are a heterogeneous bunch and many different mechanisms exist to build them.

One of the oldest and simplest ways of bringing scale to Bitcoin is sidechains. But sidechains are not technically a true “layer” of Bitcoin since they often lack the unilateral exit component that makes them trustless for users, i.e., with the same trust assumptions as the base layer. That is why, for the many years that followed the introduction of SegWit, the Bitcoin community focused a lot of energy on building the Lightning Network (a true L2 that depends on Bitcoin security to provide users with unilateral exit options) instead of sidechains.

In order for users to join a sidechain, they first have to execute what we call a “peg-in” transaction (or “peg-out” to exit) — basically sending their BTC to an address controlled by the operators of the sidechain. The mechanism securing this system is called a bridge.

The reason why bridges are so tricky is that they often rely on a multisignature wallet holding all the sidechain’s funds, and in order to execute withdrawals, users have to trust that a majority within the multisig will cooperate to accept it. For example, a group of 20 companies would set up a bridge contract together, requiring at least 12 (could be less or more) companies to confirm a withdrawal transaction. For obvious reasons, this never was an optimized security model and created great incentives for companies (or individuals) to potentially collude and steal user funds.

A few examples of interesting sidechain design emerged during that time, such as Liquid (federation of companies) and RSK (merged-mined sidechain), but they never truly succeeded at scale.

Before we go any further, let’s add some definitions from the researchers that have spent the most amount of time thinking about this — Bitcoin Layers.

Sidechain is an L1 that exists to add more functionality to BTC, the asset. L1s are sovereign in technical architecture but typically exist as subsets of the broader Bitcoin ecosystem. It’s common for sidechains to enshrine a BTC bridge into their consensus mechanisms or involve Bitcoin miners in consensus — through merge mining or fee sharing.

Rollup is a modular blockchain that uses a parent blockchain for data availability. The blockchain stores its state root and enough transaction data to reconstruct the state of the blockchain from genesis in the parent blockchain. Rollups are L2s.

Two-way pegs are systems that facilitate the minting and burning of BTC-backed tokens on a Bitcoin layer or alternative L1. These systems are also known as bridges.

So, if bridge designs have existed for a long time and they haven’t generated a lot of traction, why do we need them now?

While Lightining dominated the L2 space for a long time, 2023 saw the introduction of a new idea that would challenge that dominance: BitVM. In a nutshell BitVM can allow Bitcoin to be more programmable, which could lead to the introduction of new L2 designs such as rollups. These new designs all rely on an old friend on sidechains: the bridge mechanism that allows users to go from the base chain to the sidechain. However, the promise of BitVM relies on the idea that we could make bridges more decentralized than with traditional sidechains by introducing a challenge mechanism that could punish dishonest actors in a federation.

Therefore, rollups on Bitcoin would not be completely trustless but trust-minimized. You would still need to rely on an honest actor (we’ll dive into the specifics later in this report) to exit the chain (rollup) but this is a trade-off that many users could get comfortable with, given the potential scaling and programmability benefits.

BitVM (and Robin Linus) essentially revived the idea of Bitcoin bridges, and brought more legitimacy to them as a way to scale Bitcoin. Bridge design is now part of every scaling discussion, and several Bitcoin companies are now fully dedicated to researching innovative ways of improving them.

Now that we’ve seen why Bridge has made a comeback as a legitimate way of scaling Bitcoin, one could still argue that rollups enabled by BitVM will suffer the same fate as previously mentioned Liquid or RSK — a very limited user base. While this could be true, the success of rollups on Ethereum indicates a very strong demand from users and a lot of appetite from investors.

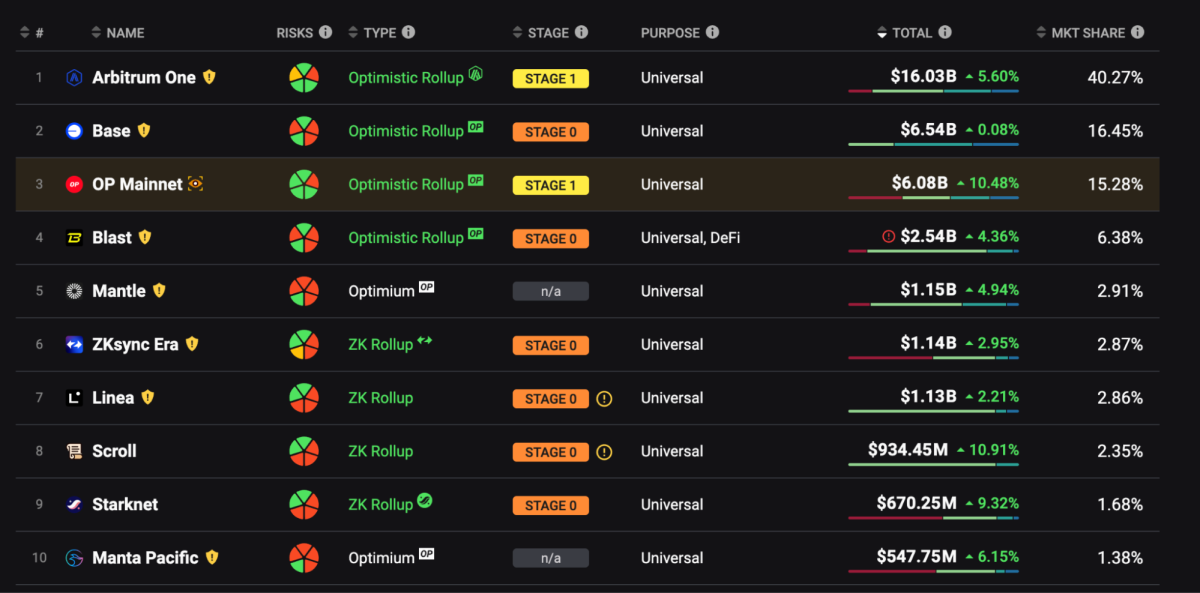

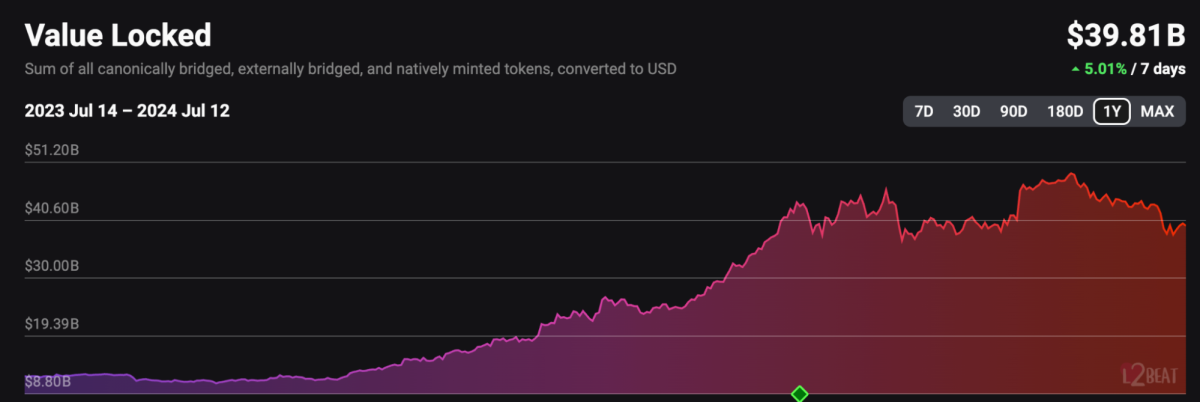

The screenshots below, taken from the leading ETH rollups analytics platform L2Beat, show that the top 10 rollups on ETH have managed to accumulate close to $40 billion in assets bridged. Arbitrum, Base (Coinbase), and Optimism together have over 71% market share. Furthermore, over the past year only, the amount of ETH locked in rollups went from $6.1 million to $13.1 million, a 114% increase.

In fact, rollups are going to be more impactful on Bitcoin than they’ll ever be on Ethereum. If we assume the same level of rollup utilization (10.4% for ETH) and take the size of both networks as of July 2024 — $383 billion for ETH vs $1.276 trillion for BTC — we could make the simple calculation that the total addressable market for Bitcoin rollups could be around $133 billion. While this number is impressive, one could even argue that Bitcoin will require even more scale than ETH as it is poised to become the settlement network for all economic applications, and therefore rollups would have the potential to become even larger still.

Seeing this potential, a ton of developer mindshare came back to Bitcoin and sparked a true renaissance for the space. Anticipating that Bitcoin users will be interested in bringing more utility (yield) to their holdings, sidechains came back in full force at the end of 2023 and the beginning of 2024. Over 70 projects launched with the promise of decentralizing their bridge design once the technology was available, while others created innovative bridge designs.

The no-bridge meta. Although not the focus of this research piece, it is important to mention that many projects in the L2 space are trying to scale Bitcoin without the need for complex bridge systems. These protocols will play an integral part in the race for scalability on Bitcoin as they provide a valuable alternative for users not willing to make certain trade-offs.

Arch: The Arch Network employs an innovative approach to state management on Bitcoin’s layer 1, utilizing ordinals through a unique “state chaining” process. State changes are committed in a single transaction, reducing fees and ensuring atomic execution. Built to add programmability without necessarily sacrificing self-custody, Arch makes it possible for Bitcoin users to develop and interact with decentralized applications without taking on additional trust assumptions. Its novel architecture consists of a two-piece execution platform: The Arch zkVM and the Arch Decentralized Verifier Network.

QED: QED solves the fundamental scaling problem of blockchains by using zk-PARTH, a novel state model which enables massively parallel transaction proving and block generation. This allows QED to scale to millions of transactions per second, while guaranteeing security via proof of math.

RGB++: RGB++ protocol is not BitVM even though it can provide native Turing-complete capability on Bitcoin layer 1. It neither relies on any new OP codes nor does it require hard forks or soft forks but rather directly provides programmability on layer 1. It also is not an EVM or a rollup, and it does not need a bridge. The RGB++ protocol attaches additional data as an extra program logic to the original Bitcoin UTXO. A single Bitcoin UTXO is linked with an off-chain data cell (or what is termed a Turing-complete UTXO). By connecting every on-chain UTXO with off-chain data and extra execution logic, the off-chain UTXO is transferred — despite being constrained by the script on the UTXO — whenever the original UTXO is transferred or spent. This allows the transfer of additional bits or assets from one UTXO to another, executing the script and effectively forging an off-chain transaction with off-chain state transfer from one state to another.

The Current State of Bitcoin Bridges

Now that we’ve established that new bridge designs can be of revolutionary value for Bitcoin as a settlement network, let’s dive into the current landscape of Bitcoin bridges, their architectures, optimizations, and different variants.

Let’s take a look at a few different L2/sidechain designs, and how teams are thinking about mitigating certain trade-offs associated with their bridging mechanism.

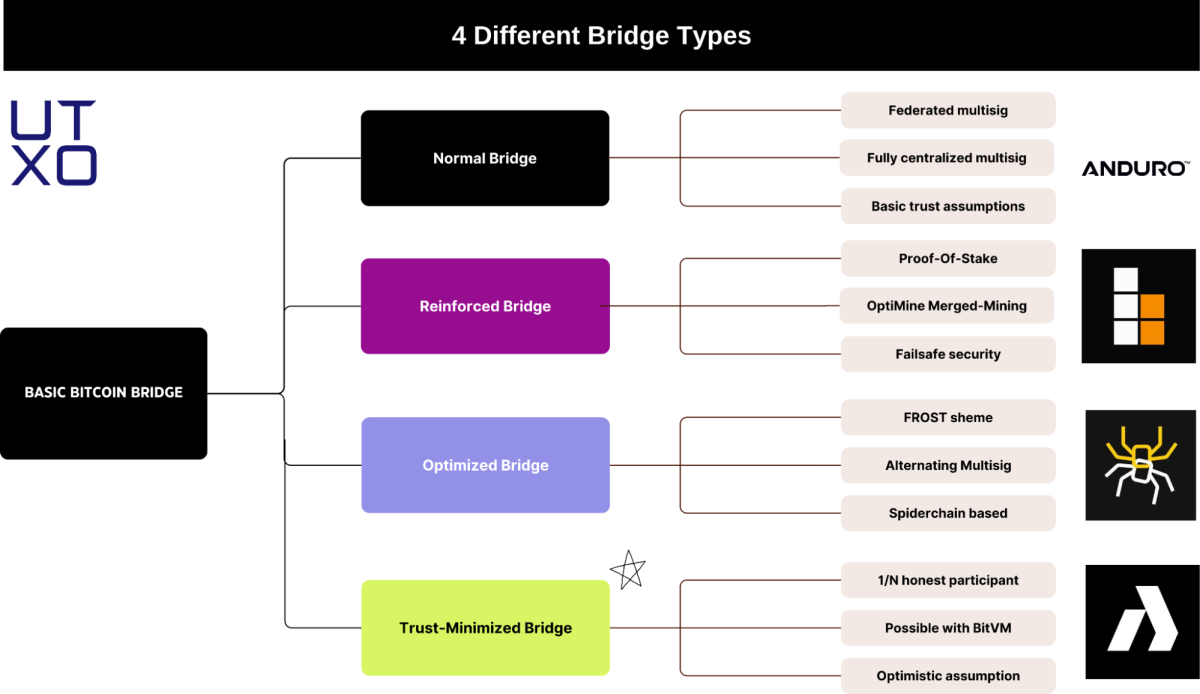

In a nutshell, we can identify four different types of bridge designs:

- Traditional Bridges: Normal bridges as described above.

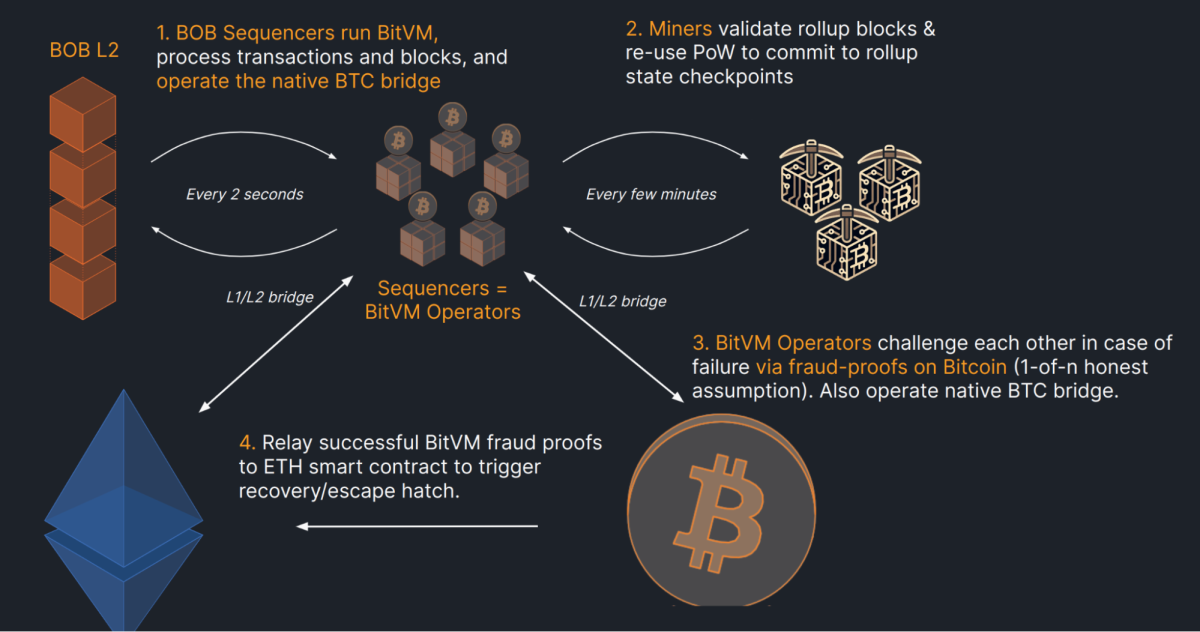

- Reinforced Bridges: Reinforced bridges are bridge designs that have an additional layer of security added in order to mitigate some aspects of the protocol that could be too centralized. In the case of BOB (Built on Bitcoin) for example, phase 2 of the roadmap is planning to remove trust in (centralized) sequencers with Bitcoin miners running full nodes of BOB and thereby verifying that the sequencer is producing valid blocks. This offsets trust in the sequencer and thereby provides Bitcoin security through mining to a rollup. This will be achieved using an alternative version of merge-mining called Optimine.

- Optimized Bridges: Optimized bridges are bridge designs that innovate by distributing trust among the participants of the multisig. A great example of an optimized bridge design is Botanix. The bridge multisig is constantly distributed among different users; it can evolve and change between blocks. In the case of Botanix, the bridge is also reinforced with a proof-of-stake (POS) system that becomes complementary to the FROST-based architecture.

- Trust-Minimized Bridges: These bridges are currently being developed by rollup teams and will feature near trustless assumptions, with the possibility of users even outside of the multisig to participate in the protocol.

Understanding the Friction Between Solving Technical Challenges and Growing a Sustainable User Base.

1. The birth of an L2: choosing the best go-to-market strategy.

For Bitcoin builders in 2024, there are only two options that can make sense in the context of the Bitcoin L2 paradigm:

- Choosing to focus on the technical challenges of bridging architecture and rollup design to build a trust-minimized layer with complex zero-knowledge proofs and BitVM optimizations. This is the Technological approach.

- Choosing to focus on the fastest go-to-market strategy by making calculated trade-offs with bridging architectures and execution environment in the hope of decentralizing those once the technology is available. To differentiate from current competitors and protect themselves from future ones, companies have to bring additional incentives in the forms of points or tokens to acquire users. This is the Community Moat approach.

With the Community Moat approach specifically, the trade-off is simple: sacrifice decentralization in the medium term in order to gain TVL and a solid user base in the short term. While this approach may be criticized by hardcore Bitcoiners, it reflects a business-first mindset that is often lacking to many projects that end up failing despite being technologically superior. Execution is EVERYTHING.

Those different approaches are the reason why having an intellectual debate on Bitcoin L2s has been so difficult recently. People tend to conflate the goals of companies attempting to solve a Technological problem with companies attempting to solve a User Acquisition problem. These companies have fundamentally different go-to-market strategies and therefore will use fundamentally different methods to convince users that they are, indeed, the best Bitcoin L2 (or the first).

2. Sidechains vs rollups: being on the spectrum. That’s really what it comes down to. There’s going to be Bitcoin sidechains, Bitcoin rollups, and everything in between. Bitcoin L2s exist on a spectrum, where the extreme is dominated either by builders going for the Technological approach or the Community Moat approach. Let’s dive into the spectrum.

As Janusz from Bitcoin Layers would say, “Not every Bitcoin layer is made equal” and most people in the space have a tendency to discard companies choosing to focus on the faster go-to-market sidechains approach while admiring the complex work done by BitVM/ZKP researchers.

(Please refer to the definitions of sidechains and rollups at the beginning of this piece if you’re struggling to understand why their approach is different.)

While we can understand that point of view from a Bitcoin Maximalist perspective, I think it is a fundamental mistake from a free market perspective. While the technology approach might be more intellectually pleasing, and the perspective of having a truly decentralized L2 exciting, actual users tend to have different priorities.

While this spectrum can be a useful tool to understand the trade-offs that companies make, ultimately, users will decide on their own how to prioritize UX, cheap fees, fast settlement, and protocol security.

When you look at the current state of the crypto market, it isn’t clear that the technology-first approach can compete with the memetic power of a protocol like Solana. How many people in the world know of Solana compared to how many people have even heard the word rollup?

At UTXO, we believe that there is value to be captured by both rollups and sidechains, especially if sidechains can deliver on their promises to decentralize over time. While this hasn’t been the case with other chains historically, we believe that once the technology is reliable and available, Bitcoin users expect trust-minimized solutions to become a standard and not just a protocol preference.

3. Do you want to make money or do you want to be right? The incentive programs of new Bitcoin layers. Let’s dive into existing projects’ go-to-market strategies and understand the opportunity size for early users and liquidity providers. The strategies described below are not exclusive to each project but we chose to focus on the ones that are the most characteristic for them.

A) Point system (BOB): The BOB point system has been by far the most successful iteration of this strategy in the Bitcoin sphere. BOB Fusion is the official points program of BOB, where users can harvest BOB Spice (points) based on their on-chain activity on the BOB mainnet.

B) Ecosystem first (Botanix): Choosing not to release a token at launch for their sidechain, Botanix’s approach is one of the smartest we’ve seen so far. Botanix is choosing an Application first approach but letting project building on top of Botanix shine. By partnering with Botanix, ecosystem projects will be supported with TVL from day one, and speculators’ only way to get exposure to Botanix launch will be to invest in its ecosystem apps. As we know, having a real and sticky user base actually using the application is the only way for L2s to survive in the long run, and Botanix is taking a radical approach to ensure this.

C) Research (Bitlayer): With one of the most technically advanced teams in the space, one of the key differentiation points for Bitlayer has been their research-first approach, a rarity outside of rollup-only projects. Since the early days of BitVM, the Bitlayer team has been active in furthering our collective understanding of the idea and has released a number of extensive research papers on the subject. Furthermore, the team is actively exploring new ways to improve current BitVM designs and will likely be considered one of the most innovative L2 teams in the space once their research comes to fruition.

The Future State of Bitcoin Bridges (BitVM and others)

When we look at bridge designs it becomes apparent that the most decentralized ones will be developed with variations of BitVM. Indeed, BitVM is not a monolithic entity that one can just refer to in order to be understood in the context of Bitcoin rollups. A few teams are working on competing (and synergistic) adaptations of the initial proposal by Robin Linus.

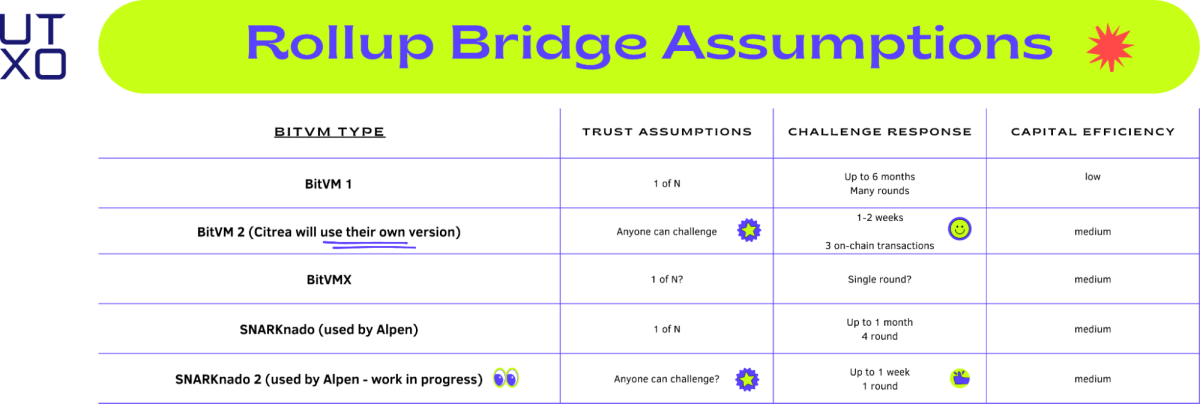

The main differences to understand in these variations of BitVM come down to a few key parameters:

- Trust assumptions: What is the level of decentralization of the bridge when it comes to the ability of users to trustlessly exit the rollup? In the case of BitVM and optimistic rollups, who can challenge the state of the rollup? Assumptions range from anyone (best) to only a majority of actors in the multisig (worst).

- Challenge response: Once a challenge has been issued to the optimistic rollup, how much time and resources (number of transactions + size of transactions at a given fee rate) are necessary for “justice to be done”? Assumptions range from months with multiple on-chain interactions (worst) to hours with a single interaction (best).

From the Snarknado whitepaper:

“BitVM, is, however, not without overhead. Like optimistic rollup, the proof needs a withdrawal period to allow challengers to come in. Notice that a fully on-chain challenge-response can require tens of roundtrips between the prover (called Paul in BitVM) and the challenger (called Vicky), and since Bitcoin has a block time of 10 minutes, it can be quite a long time. It is also a little bit unsure what would happen if many challengers want to challenge at the same time and whether it would affect the latency and the finality.”

- Capital efficiency: What are the capital requirements for operators of the rollup? How much BTC do they have to ensure that all users can withdraw funds and make transactions without any constraints? There is no good metric to objectively measure this but we can imagine a combination of “cost of capital required to lock funds for X time” + “multiple of BTC deposited by users required to be locked by operators.” Assumptions range from “high cost of capital with high BTC multiple” (worst, i.e., the incentive of operating a rollup does not make sense) to “low cost of capital with a BTC multiple of 1” (rollups can outcompete Lightning and Ark).

“an operator will initially cover user withdrawal requests out of pocket then aggregate the necessary proofs into a single submission to the network. If other operators suspect foul play, they can challenge the submission. Successful challenges result in the dishonest operator losing their initial bond and being removed from the network. If the operator’s submission is not challenged, they can then reclaim the equivalent amount they disbursed from users’ original deposits.”

Despite all this innovation at the bridge level, one cannot separate the bridge from its foundation, and in the case of rollups, the foundation has to come from a few key choices in the very design of the rollup itself. For all the security and trust-minimization of BitVM bridges, in order to make a fair comparison between sidechains and rollups, we have to compare them “dans leur ensembles” (in their whole outfits).

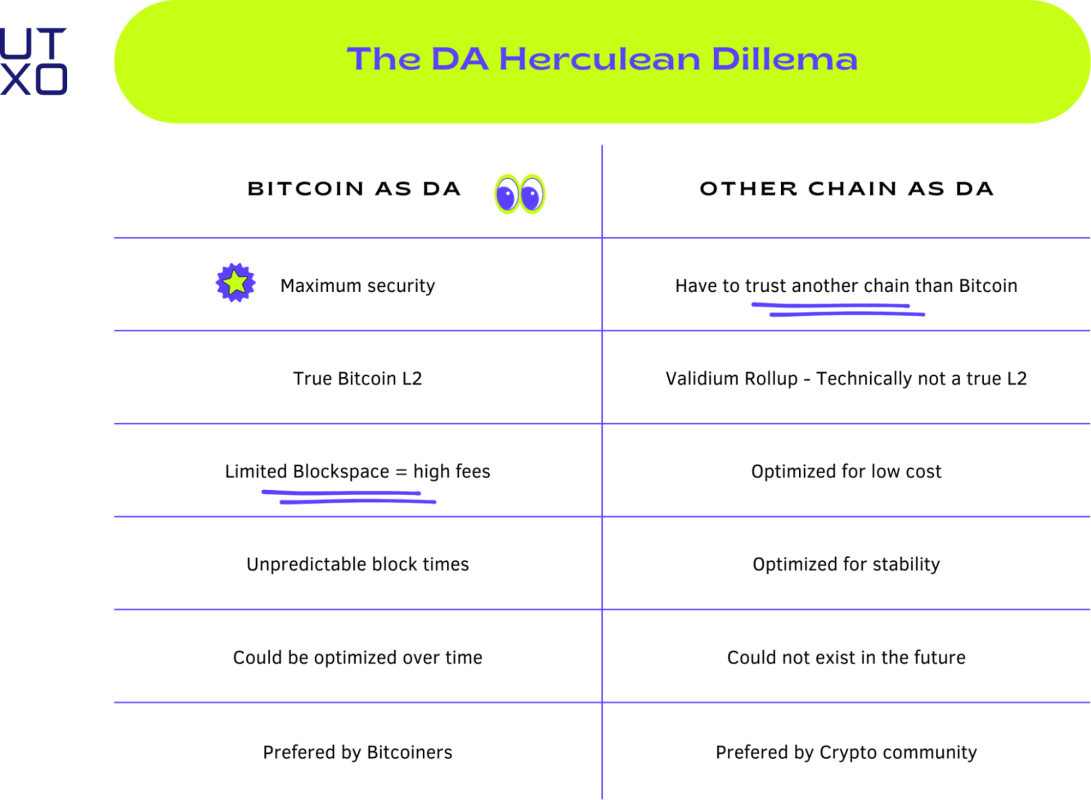

One of the herculean choices that teams will have to grapple with is the one of data availability (DA):

“The publishing of transaction data which is required to verify transactions, satisfy proving schemes, or otherwise progress the chain. Specifically, a node will verify data availability when it receives a new block that is getting added to the chain. The node will attempt to download all the transaction data for the new block to verify availability. If the node can download all the transaction data, then it successfully verified data availability, proving that the block data was actually published to the network.”

There are only two ways of ensuring data availability: post it directly to Bitcoin or post it somewhere else. In the case of Bitcoin rollups, by definition, one would expect that DA would always be posted to Bitcoin. However, this is a costly choice to make that will have negative consequences for both user transaction costs and rollup teams’ ability to generate net margins. In response to this, some teams have chosen to trade very real gains in security for cheaper transactions and additional scalability.

The DA dilemma:

Once again, trading off security for user experience may be considered sinful by Bitcoiners, but we have seen that in the case of sidechains or certain ETH rollups, some users may prefer it.

In that sense, the DA dilemma is not so much a technical challenge as it is a social one. Yes, posting DA on Bitcoin in the only way to be considered a true Bitcoin L2, but will that matter if the only rollups with users are the ones with no Bitcoin DA?

Some more definitions before going further:

Optimium: Optimium is an optimistic rollup that stores transaction data on-chain. This ensures availability and security, but increases costs and reduces scalability versus off-chain options. However, users need not trust third-party data providers.

Validium: Validium is an optimistic rollup variant that stores transaction data off-chain. This enables high scalability and low costs, but risks potential data censorship or unavailability issues without on-chain backups. Users must trust data providers are honest and resilient.

An interesting investment opportunity that arises from the situation is the development of a potential DA layer with a strong relationship to Bitcoin — the Celestia of Bitcoin. While we’re not there yet, exploring different ways of mitigating consensus failures for rollups is a big area of focus for UTXO, and has in part informed our decision to invest in CHAR by Jeremy Rubin (Bitcoin Core developer, BIP-119 author).

- CHAR is based on attestation chains where nodes commit to signing a single unconflicted sequence to organize transactions.

- By acting as a layer 2 for scale and functionality, CHAR will bring new security to BitVM with L1 bonds while incentivizing operators by distributing rewards.

- This new way of thinking about protocol security (consensus orchestration) will make the on-chain resolution of challenges on BitVM more efficient and incentive-aligned.

While LN attempts to solve the scalability in a peer-to-peer fashion, resulting in liquidity problems, rollups take transaction execution off chain — but the current architectures make it costly to use Bitcoin as a DA layer. All systems will eventually leverage centralized solutions to improve user experience, and at this point it’s difficult to tell which trade-off is worse.

Looking ahead, Citrea plans to introduce volition, a hybrid model balancing on-chain security with off-chain cost efficiency. This allows applications to choose their data storage method based on their specific needs. This is something we haven’t seen before and that would deserve more attention when it comes to the DA dilemma for Bitcoin rollups.

“So depending on your usage, if you want to deploy now a gaming application, you can use off-chain data. It is very cheap, very fast, but still gets this Bitcoin interoperability. If you want to build a Bitcoin-backed stablecoin application, you can use on-chain data so your stablecoin is fully on-chain secured, fully Bitcoin secured. A bit expensive but you still get this interoperability between the gaming application and the stablecoin application.”

Other challenges with Bitcoin as a DA layer. The best way to learn about this is to read the latest Galaxy Research report on Bitcoin as a DA layer. However, one of the specific challenges where we would like to spend more time is the issue of blockspace demand and fee rate dynamics.

- Blockspace scarcity will/could lead to centralizing forces for rollups and ultimately for pools as well. Because of the large amount of data required to settle rollup activity on Bitcoin, rollup operators may be tempted to optimize their transaction flow by using the services of pools, such as Marathon, with slipstream. These kinds of OOB (out-of-bands) agreements with miners are a centralizing force as they provide additional revenue streams to pools that are not accessible transparently on-chain. On the other hand, it is perfectly normal in a free market for competing actors to find differentiation points and does not represent a fundamental threat to Bitcoin by altering the game theory of mining (i.e., only the most cost-effective miners survive in the long term).

- Fee rate dynamics will once again change with the introduction of another blockspace buyer of last resort, but this time will be different. Constant demand for blockspace no matter the fee rate, is not something that Bitcoin has witnessed in its recent history. In the case of ordinals, degens minting jpegs have an incentive to always make transactions as long as blocks are not full, acting as a natural buyer of last resort for blockspace. However, ordinals and Runes/BRC-20 are time-preference aware (they can choose to wait, paying low fees, or pay high fees for fast inclusion in a block) while rollup operators cannot be. Their proofs will be submitted, at a fixed rate in time, no matter the fee rate. This kind of agnostic demand is most reflexive on fees precisly because it competes not just to be included in a block (4MB x size of the mempool) but for the very next block (only 4MB available). As the utility for Bitcoin as the settlement chain for all economic activity continues to grow, we can expect these types of demand to increase, further impacting fees to the upside. In that case, the economic case for rollups may become less clear as their attractiveness compared to the Lightning Network in terms of costs starts to be less competitive.

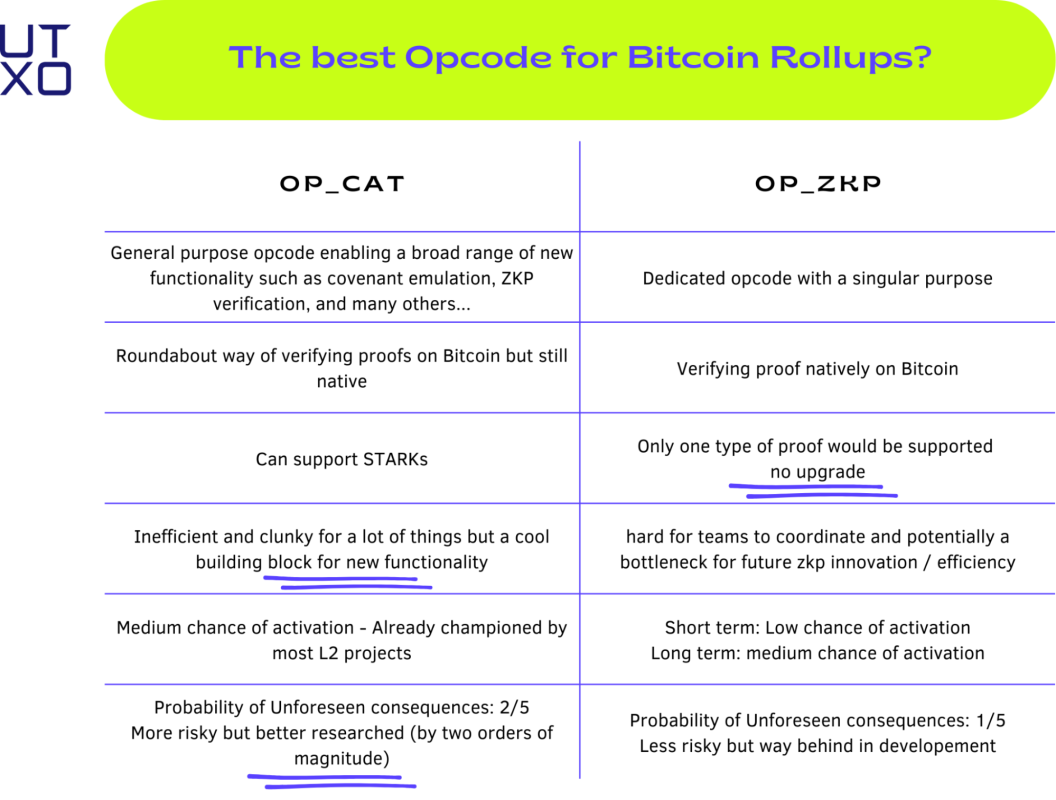

In SOTB_2, the second part of this research series, we’ll dive deeper into how the activation of different opcodes could affect the efficiency and decentralization of Bitcoin rollups. In the meantime, we can just leave readers with the following idea:

Governance discussions are always difficult ones to have, but I do believe that more of them are warranted when it comes to Bitcoin rollups. The way I see it, it is a typical chicken-and-egg problem: We want to have rollups to scale and bring new functionality to Bitcoin. The only way to have them now is by reactivating OP_CAT, but OP_CAT enables other things that are not necessary for rollups while being inefficient at verifying zero-knowledge proofs.

Should we prove the demand for optimistic rollups without a new op_code first, then activate a dedicated op_code to optimize them? Or should we activate OP_CAT first to prove the demand for rollups at the risk of them being inefficient, which could turn users away from them? We do not have the answer to this question but we can only hope that rollup teams will come up with an answer by the end of the year. In the meantime, other covenant proposals such as LNHANCE (including CTV) or TX_HASH could help Bitcoin to scale outside or rollups.

The Thesis for Bitcoin Rollups and Bridge Innovation

In this new landscape of Bitcoin L2s, the competition between sidechains and rollups will be fierce. As we’ve outlined, a common misconception within the space is that sidechains are not interesting because they are more centralized than L2s and that rollups are just a new form of sidechains.

For sidechains, the bullish case is that bringing EVM compatibility to the Bitcoin ecosystem will spark the resurgence of defi activity for Bitcoiners in search of yield opportunities. As a reminder, over $9.3 billion is currently locked in WBTC according to DeFillama. Bringing this activity back to more Bitcoin-native solutions is imperative if Bitcoin is ever to succeed as a settlement chain for economic activity. Furthermore, we believe that the innovations brought by new sidechain designs can help to mitigate some of the centralizing issues plaguing previous designs. Both Optimized and Reinforced Bridge designs have interesting value propositions that could convince enough users and institutions to participate in these ecosystems.

When talking about Bitcoin sidechains, we have to remember that their primary goal remains disintermediated economic activity, not censorship resistance for peer-to-peer cash. As such, participants in those networks will have different priorities, with economic incentives being at the top of the list.

For rollups, the innovation of BitVM can bring them very close to actual Bitcoin L2s, with trust minimization at the core of their designs. Sure, rollups on Bitcoin will have a ton of challenges to overcome, but they are being built in the true spirit of Bitcoin cypherpunks. Teams leveraging zero-knowledge-proofs represent an invaluable opportunity for Bitcoin to increase its scalability while preserving privacy and cryptographic security.

The reason why it can be hard for critics to see value in these innovations is what we’re calling the “low fee rate bias.” For years now, bitcoin fees have been artificially low because its adoption has been slowed down by speculation and usage of off-chain exchanges to settle transactions. However, this bias will rapidly disappear once fees become unbearably high for most users. This is when the panic will hit, and when the limitations on the base chain will start to become obvious. When this moment happens, we expect sidechains and rollups to become immediate successes as users rush for the exits.

In his piece titled “The bridge race is on. Godspeed my friends,” Janusz from Bitcoin Layers correctly outlines that sidechains and rollups are now in a race — a race for dominance of all of the capturable capital either sitting in Bitcoin wallets or altcoin protocols.

“Thus, I’m at least concluding that, based on our research of sidechains and L2s, Bitcoin benefits from conversations related to improved bridging mechanisms. I believe that the most successful Bitcoin L2s, long-term, will either be supported by a variation of BitVM2, proposed opcode changes, or a combination of both. A takeaway I had from Nashville is that these systems may even be complimentary.”

The rise of sidechains is only a consequence of projects trying to front-run what is shaping up to be the biggest narrative for Bitcoin in the coming years. A new narrative that will be accompanied by billions of dollars in new capital is looking to find attractive opportunities within the most secured and largest digital asset — bitcoin.

Revolutions are messy, chaotic, and by definition, they tend to surprise the people who are the least expecting it. The L2 revolution on Bitcoin follows the same path. It might be hard to make sense of everything that has been happening, however, the direction of this revolution has never been clearer. We are heading for the next step in the journey toward hyperbitcoinization.

Sources:

- https://bitcoinmagazine.com/technical/bitcoin-first-zk-rollup

- https://www.alpenlabs.io/blog/snarknado-practical-round-efficient-snark-verifier-on-bitcoin

- https://blog.bitlayer.org/BitVM_Bridge_Becomes_Practical/

- https://www.bitcoinlayers.org/layers/bob

- https://bitcointokens.wtf/

- https://l2beat.com/scaling/summary?#layer2s

- https://blog.velar.co/all-about-bitcoin-rollups

- https://zerosync.org/#intro

- https://zerosync.org/zerosync.pdf

- https://app.gobob.xyz/fusion?tab=info

- https://bitvm.org/bitvm_bridge.pdf

Source link

You may like

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential