Uncategorized

Vitalik calls out Saylor, Stocks have Worst day in Weeks, GOAT hits $870M

Published

2 months agoon

By

admin

BTC ETFs: +$192m, ETH ETFs: +$1m. SOLETH continues to hit new highs, ETH weak. Vitalik calls Saylor’s custody view ‘batshit insane’. BTC to $200k by 2025: Bernstein. BTC options point to jump to $80k post-election. Ripple misses deadline in SEC case. Denmark plans 42% tax on unrealised crypto gains. Ripple CEO debanked by Citigroup.

Source link

You may like

If you wish to show your product or service, and want to be featured on a live event, you must fill out our contact form to be officially contacted back, and if you want to advertise with us, you can add your transaction id for your payment

What you are going to find out about email in the next few minutes will absolutely change the way you email forever. You can always thank us with crypto tokens here “myecrypto.eth”

Thank you to Lumen5 for their tools in creation of this video

Read Your Daily Mail, and watch your rewards go up!

Here is my 15 year “seal of approval” from a popular LLM.

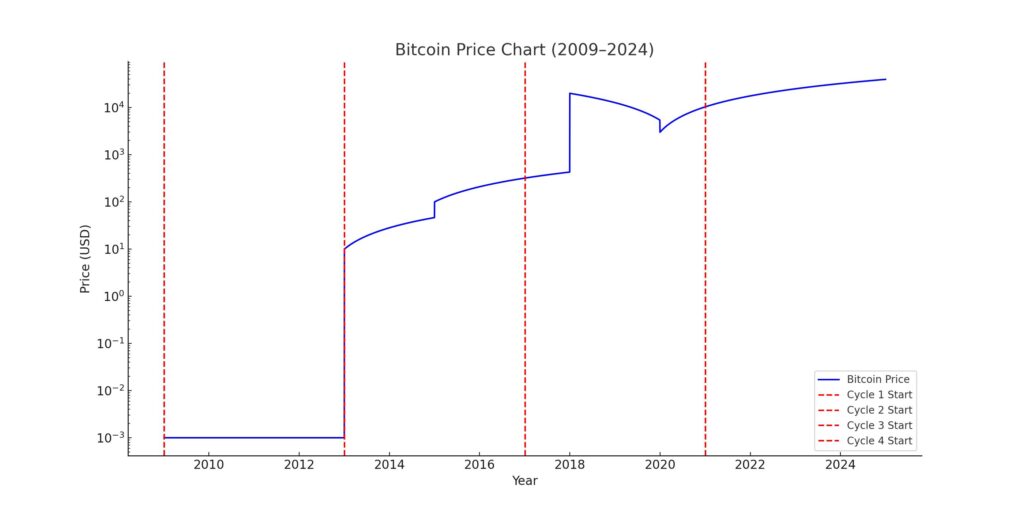

Bitcoin’s price history exhibits notable cyclical patterns, often aligned with its approximately four-year halving events. Halving’s reduce the reward for mining new blocks by half, effectively decreasing the rate at which new bitcoins are introduced into circulation. This mechanism has historically influenced Bitcoin’s supply-demand dynamics, contributing to its price cycles.

Bitcoin’s Price Evolution and 4-Year Cycles:

- 2009–2012: Genesis and Early Growth

- 2009: Bitcoin was introduced by Satoshi Nakamoto, with the genesis block mined in January. Initially, Bitcoin had negligible monetary value.

- 2010: The first recorded Bitcoin transaction established its value at $0.00099 per coin.

- 2011: Bitcoin reached parity with the U.S. dollar in February, later peaking at around $30 in June.

- 2012: The first halving event occurred in November, reducing the block reward from 50 BTC to 25 BTC.

- 2013–2016: First Major Bull and Bear Cycle

- 2013: Bitcoin’s price surged to over $1,100 in December, marking its first significant bull run.

- 2014–2015: A bear market ensued, with prices declining by approximately 84% from the peak, bottoming around $150.

- 2016: The second halving in July further reduced the block reward to 12.5 BTC.

- 2017–2020: Renewed Surge and Correction

- 2017: Bitcoin experienced a meteoric rise, reaching an all-time high near $20,000 in December.

- 2018: The market corrected sharply, with Bitcoin’s price dropping about 84% to lows around $3,200.

- 2020: The third halving in May decreased the block reward to 6.25 BTC.

- 2021–2024: Recent Trends and Projections

- 2021: Bitcoin achieved a new all-time high of approximately $68,789 in November.

- 2022: A significant downturn followed, with prices falling to around $15,495 by November.

- 2023: The market showed recovery, with Bitcoin’s price reaching $42,265 by December 31.

- 2024: The fourth halving occurred in April, reducing the block reward to 3.125 BTC.

Visualizing the 4-Year Cycles:

To illustrate these cycles, analysts often use logarithmic charts with vertical lines marking each halving event, effectively segmenting the chart into four-year intervals. These visualizations highlight the correlation between halving events and subsequent price movements. For example, a chart from TradingView delineates these cycles, showing price trends relative to each halving.

Understanding the Impact of Halving Events:

Each halving reduces the rate at which new bitcoins are generated, tightening supply. Historically, this scarcity effect, combined with sustained or increasing demand, has led to substantial price appreciation in the periods following each halving. However, these bullish phases are typically followed by corrections, leading to the observed cyclical pattern in Bitcoin’s price history.

Conclusion:

Bitcoin’s approximately four-year cycles, influenced by its halving events, have played a significant role in its price dynamics. Understanding these cycles provides valuable insights into Bitcoin’s historical performance and potential future trends.

Top 5 Biggest Crypto Hacks of 2024

The Best Games of 2024 That You Can Snag for Under $25

3 altcoins that could skyrocket by new year’s eve

Analyst Predicts XRP Price To Reach $27, Here’s Why

Monkey Please!

Texas, Ohio, and Pennsylvania to create Bitcoin reserves

Why 2025 Will See the Comeback of the ICO

Can Donald Trump Truly Make US The Crypto Capital?

Why meme coins are fading amidst Bitcoin institutional adoption and gains this cycle

Why Bitcoin Price Is Falling Today: Is $80K Next?

Here Are The Major Bitcoin Support Levels To Watch As Bulls Push For $100,000 Again

Flockerz presale enters final stage with 28 days remaining

What Happens to Ethereum Price If Bitcoin Crashes to $80,000?

XRP Has Most Bullish-Looking Chart in Entire Crypto Space, According to Analyst – Here’s Why

Coinbase CLO shares data on crypto hedge funds debanking, demands for answers

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential