crypto hack

WazirX implements ‘socialized loss strategy’ following $235m hack

Published

5 months agoon

By

admin

Indian crypto exchange WazirX has unveiled a plan to mitigate the effects of a recent hack that resulted in the loss of approximately $235 million.

The breach, which affected 45% of user funds, has led the exchange to introduce what it’s calling a “socialized loss strategy” to ensure what it calls a more equitable resolution for its users and maintain platform stability.

WazirX’s July 27 blog post states that the firm plans to implement a 55/45 approach, where users can access 55% of their assets immediately, while the remaining 45% will be locked in Tether (USDT)-equivalent tokens.

The exchange says its strategy aims to distribute losses fairly among all users, preventing disproportionate impacts on any single group.

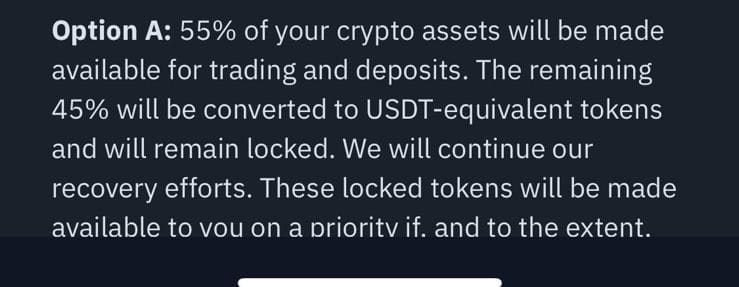

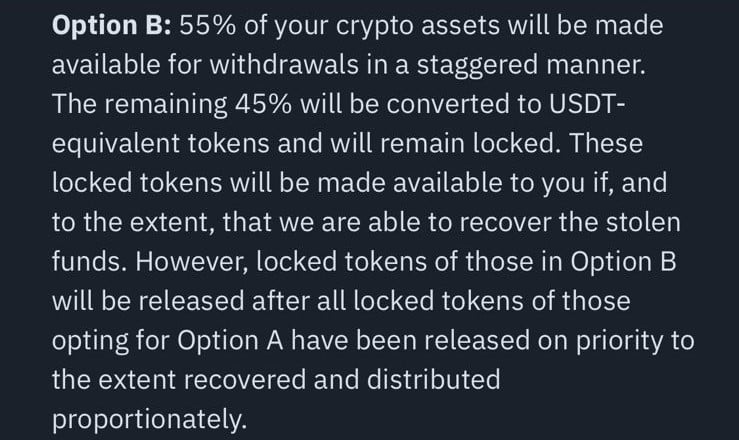

According to correspondence that WazirX sent to affected users — a copy of which was shared with crypto.news — the exchange presented a poll with two options to recover stolen funds. “Option A” lets users access 55% of their funds “for trading and deposits,” without withdrawal rights, but gives them priority in potential recovery proceeds. “Option B” lets users withdraw 55% of their assets “in a staggered manner,” albeit with lower priority in the recovery queue. In both cases, WazirX states that the remaining 45% of user assets will remain locked on the exchange as “USDT-equivalent tokens,” which would only be returned to users if the firm succeeds in recovering the stolen funds.

In their post, the exchange requested that affected users vote for their preferred option by Aug. 3, 2024.

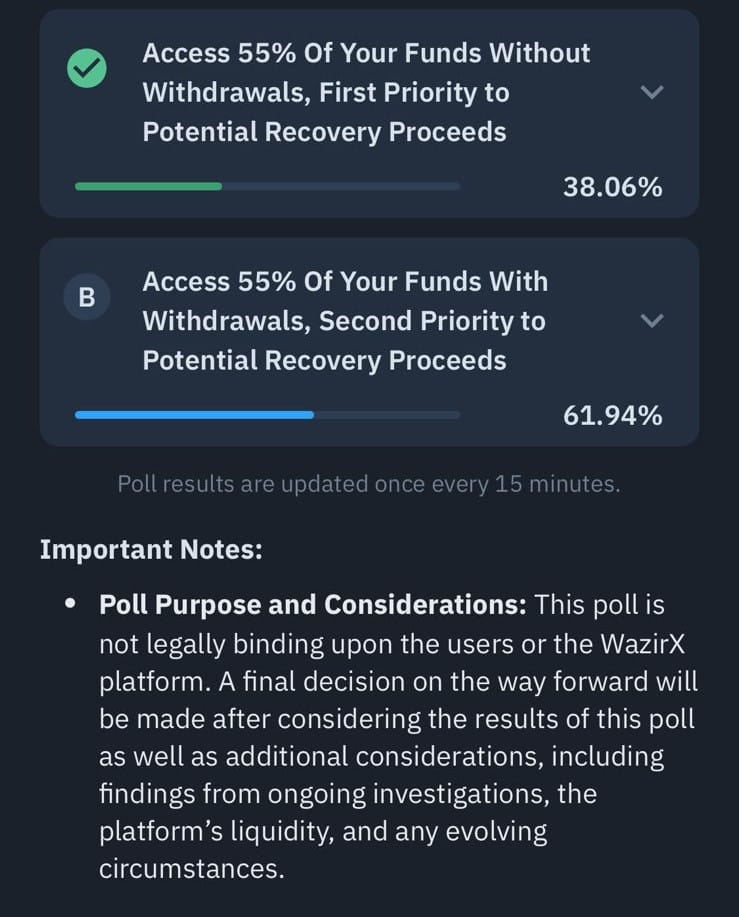

According to poll results shared with the crypto.news team, at the time of writing, approximately 62% of the impacted users have selected Option B, which lets them make withdrawals. The other 38% have decided against this, choosing instead to forego immediate withdrawals in favor of securing first priority for any potential recovery proceeds.

Background on the massive hack

The breach at WazirX led to a substantial loss of around $235 million, ranking it as the second most significant hack of a centralized exchange recently. This incident was only outdone by the DMM exploit on May 31, where the losses amounted to $308 million.

Nischal Shetty, the exchange’s co-founder, took to X today to assure users of the exchange’s potential for recovery and growth following the significant hack.

Notably, Shetty outlined two historical responses to such crises: lengthy legal proceedings or adopting a socialized loss model coupled with rebuilding efforts. He advocated for the latter, emphasizing quicker recovery through operational growth and profit distribution.

Nothing is impossible if WazirX can survive this. It will grow and if it makes profits those can be used for recovery.

But, it’s only possible if all our customers support us at this time.

Historically there have been two options that exchanges which faced such situation…

— Nischal (Shardeum) 🔼 (@NischalShetty) July 27, 2024

Shetty also stressed the importance of community support, adding, “Only together, we can do this,” as he rallied for a unified approach to overcoming the platform’s challenges.

Community criticism

Meanwhile, there has been significant discontent among crypto users regarding WazirX and its co-founder, particularly concerning the socialized loss strategy. Many have labeled the approach a scam and have questioned why the burden of the exchange’s challenges should fall on the users.

Additionally, some affected users have voiced their preference not to have the 45% of their affected assets that will remain locked converted to a stablecoin like USDT, but rather to keep them in the original cryptocurrencies.

In response, Shetty acknowledged these concerns, arguing that maintaining a stable value in USDT is crucial for planning recovery strategies effectively.

Shetty noted that the cost of cryptocurrencies fluctuates constantly, with lower values in bear markets and higher in bull markets, making it challenging to determine a consistent recovery amount with volatile assets.

I hear you but this is not feasible or sustainable as cost fluctuates every minute.

In a bear market the price will be low and in bull price will be high.

In order to be able to device plans for recovery, a stable value helps as that’s the final amount that need to be solved… https://t.co/PqsElUjOBB

— Nischal (Shardeum) 🔼 (@NischalShetty) July 27, 2024

In 2023, crypto industry participants lost over $1 billion in various hacks.

Source link

You may like

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

24/7 Cryptocurrency News

Federal Appeals Court Revives AT&T $24M Crypto Hack Lawsuit

Published

3 months agoon

October 1, 2024By

admin

A panel from the Ninth Circuit Court of Appeals has reinstated a key claim in the lawsuit brought by cryptocurrency investor Michael Terpin against AT&T. Terpin claims that AT&T permitted hackers to take over his phone, which resulted in the loss of $24 million in cryptocurrency.

This decision reinstates a part of the lawsuit which was earlier thrown out by the court and allows Terpin to proceed with his claims under the Federal Communications Act (FCA).

Court Revives AT&T $24M Crypto Hack Lawsuit

According to a Bloomberg report, the claims against AT&T have been narrowed. However, the appellate panel overturned the dismissal of the most fraud and negligence claims and only restored Michael Terpin’s Section 222 of the FCA claim, which regulates telecommunications carriers to protect customer proprietary network information.

The court stated that Terpin had presented a triable issue of fact that but for AT&T’s failure to protect Terpin’s account during the SIM swap, he would not have been exposed to hackers who subsequently stole his cryptocurrency.

The panel in its decision observed that through the fraudulent SIM swap, the hackers were able to acquire Terpin’s phone number, which provided them with access to his personal information. This access allowed hacker to change passwords and steal $24 million of cryptocurrency from Terpin’s wallets.

Details of the 2018 SIM Swap Attack

The alleged hack happened in January 2018, and according to the lawsuit filed by Terpin, a group of hackers led by Ellis Pinsky, who was 15-years old at the time, paid an AT&T staff to transfer Terpin’s phone number to a SIM card owned by the hackers. Even though new measures were taken in the year 2017, after the previous breach, which included a 6-digit passcode, the hackers found their way around the protection.

Having gained access to Michael Terpin’s phone number, the hackers changed his account passwords via his phone and sent himself $24 million in cryptocurrencies. Pinsky, however, returned his portion of the stolen money, but another hacker, Nicholas Truglia, was told by a Los Angeles court to pay Terpin $75.8 million in damages.

Concurrently, AT&T in July faced a situation where it was breached by hackers who reportedly stole customers’ information such as call records and text messages. As per the reports, AT&T then agreed to pay $400,000 in Bitcoin to the hackers to get the data deleted. While AT&T has not officially admitted or denied this payment, information from blockchain sources like Chainalysis indicates transfer of funds in relation with the mentioned ransoms.

What Next After Reinstatement?

Reinstating Terpin’s claim under the FCA allows his lawsuit to move forward to trial where he is sueing for $24 million in damages, plus prejudgment interest, and attorney’s fees. Terpin’s lawyer Pierce O’Donnell said that the appeal court ruling was good for consumers and opened up the possibility of other courts following suit to enable consumers to sue telecoms firms for SIM swap fraud.

While AT&T has apologized to the cryptocurrency investor for the theft of his assets, the telecommunications giant noted that the majority of the accusations leveled against it were thrown out of court. The company still has confidence to defend the remaining allegations related to FCA.

As the number of cryptocurrency-related hacking incidents continues to increase, it has caught the eye of blockchain experts like ZachXBT who recently exposed another big scam in the UK. In his investigation, ZachXBT discovered that more than 250 users were defrauded using fake Bybit demo accounts and lost $650,000.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Onyx Faces Security Breach With Hackers Draining $3M, Here’s All

Published

3 months agoon

September 26, 2024By

admin

Decentralized protocol, Onyx is facing a major breach as bad actors drained $3.2 million sparking user fears. This adds to the recent cases of hacking activities in the crypto market as global authorities ramp up scrutiny. Some commentators say the infamous trend will dampen sentiment amid rising institutional investment.

Onyx Hack Losses Hit $3M

OnyxDAO is reportedly facing a security breach that has led to losses hitting $3.2 million. Blockchain security and data firm PeckShield flagged the recent activity around the company. On-chain data shows the malicious wallet holds large amounts of VUSD with funds being moved across platforms. The attacker currently holds about 521 ETH worth approximately $1.36M.

It seems today’s victim @OnyxDAO (w/ >$3.8m loss) falls prey to a known precision issue in forked CompoundV2 code base. The drained funds include 4.1m VUSD, 7.35m XCN, 5k DAI, 0.23 WBTC, 50k USDT.

The bug is exploited to leverage a nearly empty market to manipulate the exchange… https://t.co/Apddu5aMbD pic.twitter.com/EKKRarFu5X

— PeckShield Inc. (@peckshield) September 26, 2024

The Onyx incident has been attributed to a precision issue involving the CompoundV2 code base with the bug exploited to manipulate exchange rates leading to loss of funds. Assets drained include VUSD, DAI, XCN, USDT, and WBTC. This event has sparked debates on the security of decentralized protocols and assets within the ecosystem. Previously, crypto users have faced huge losses due to the activities of hackers.

While phishing attacks and bridge hacks are popular targets, other platforms also face security incidents to varying degrees. Recently, Ethena Labs suspended its website activities after it faced a security breach on its domain registrar. The platform also urged users not to interact with sites purporting to be Ethena to avoid losses.

Regulators Ramp Up Efforts

Hacks similar to the Onyx incident have drawn the attention of regulators to the crypto market. While these attempts are to protect user funds from bad actors, regulatory methods can stifle innovation in the sector. This is seen in the United States regulatory sphere with the Securities and Exchange Commission (SEC) filing several lawsuits against crypto exchanges and firms.

US Congressman Ritchie Torres accused the SEC of misusing its SAB 121 regulation to target crypto firms. However, the community lauds recent efforts made in the US ecosystem as the election approaches.

David Pokima

David is a finance news contributor with 4 years of experience in Blockchain Technology and Cryptocurrencies. He is interested in learning about emerging technologies and has an eye for breaking news. Staying updated with trends, David reported in several niches including regulation, partnerships, crypto assets, stocks, NFTs, etc. Away from the financial markets, David goes cycling and horse riding.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

WazirX To Open Withdrawals On August 26

Published

4 months agoon

August 23, 2024By

admin

WazirX, one of India’s largest crypto exchanges, has provided a crucial update on the status of user withdrawals. It also outlined the next steps in tackling the hack fiasco. The July 18 attack, which saw hackers make off with $230 million worth of ERC-20 tokens, had forced the platform to suspend withdrawals and trading. However, the exchange will resume withdrawals next week, according to a latest release.

WazirX Offers Update On INR Withdrawals

In a move that will likely bring some relief to its users, the exchange has provided an update on the status of INR withdrawals, which have been frozen since the cyberattack. The platform has announced that starting from August 26, 2024, it will begin to lift the suspension on INR withdrawals in a phased manner.

This decision comes after a careful assessment of user feedback and the current situation. WazirX has assured its users that the INR reserves, managed by Zanmai Labs Pvt Ltd, the entity responsible for INR-related activities on the platform, remain secure.

However, the Indian crypto exchange has clarified that not all INR balances are currently available for withdrawal. Approximately 34% of these balances have been frozen by law enforcement agencies (LEAs) due to ongoing investigations into third-party entities.

These frozen funds are not linked to any wrongdoing by Zanmai Labs, which the exchange emphasizes is not a target of these investigations. To manage the withdrawal process effectively, the Indian exchange has outlined a phased approach:

- From August 26 to September 8, 2024: Users will be able to withdraw up to half of the available 66% of their INR balances.

- From September 9 to September 22, 2024: Users will be able to to withdraw the full 66% of their INR balances.

In addition to this phased withdrawal plan, WazirX has announced a reduction in withdrawal fees by 60%. This brings the fee down from INR 25 to INR 10. This fee reduction is intended to ease the withdrawal process for users as they regain access to their funds.

Kritika Mehta

Kritika boasts over 2 years of experience in the financial news sector. Currently working as a crypto journalist at Coingape, she has consistently shown a knack for blockchain technology and cryptocurrencies. Kritika combines insightful analysis with a deep understanding of market trends. With a keen interest in technical analysis, she brings a nuanced perspective to her reporting, exploring the intersection of finance, technology, and emerging trends in the crypto space.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: