Altcoins

Whales Are Diving Into Ethereum – Could A 60% Price Spike Follow?

Published

2 months agoon

By

admin

Analysts predicted that Ethereum price could exponentially increase as whales become more interested in the crypto asset, with whale activity hitting a six-week high.

Despite the projected growth, an Ethereum insider suggested that the cryptocurrency should address several key issues to ensure that it can continue to flourish.

Related Reading

Ethereum: Projected Price Upsurge

Analyst Bаsictrаdingtv stated that prices of Ethereum could skyrocket as there is a growing interest among investors to buy the digital asset, saying that a 60% price hike is highly likely to happen.

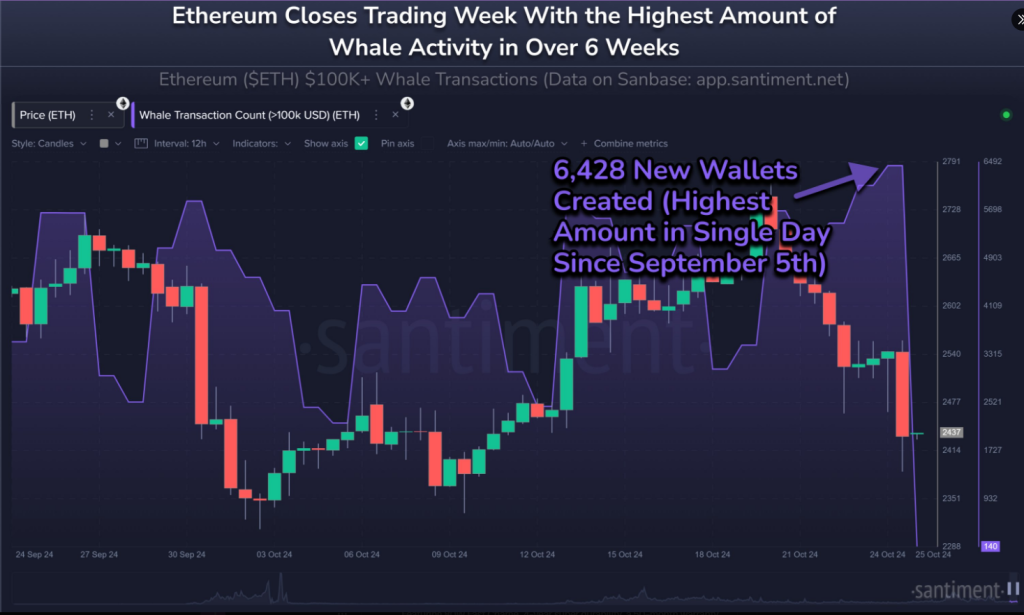

Blockchain data analysis firm Santiment identified a spike in whale activity on the Ethereum network and recommended a potential purchasing spree.

According to their recent update, whale activity reached a six-week high, with average holders accumulating Ethereum after the con’s recent price decline.

🐳 Ethereum’s whale activity spiked to a 6-week high as its price declined as low as $2.38K Friday. Historically, this is a sign of accumulation from high capital key stakeholders. Though not a guarantee this will have an immediate effect on prices bouncing, it is encouraging! pic.twitter.com/zcofdvszLF

— Santiment (@santimentfeed) October 26, 2024

Projections shown by market observers suggested that Ethereum prices could soar and hit the $4,000 mark with some analysts forecasting that it might even breach the $6,000 level.

Ethereum price growth could be fueled by its growing appeal to whales as demonstrated in the six-week high whale activity wherein more than 6,400 new wallets were made by large investors.

Bаsictrаdingtv also agreed that Ethereum prices could reach the $4,000 level. However, he hinted that the possible bullish breakout would be invalidated if the ETH price dipped to $2,000, saying that this “pricе zonе” is a key indicator that should be kept an eye on.

Recalibrating Protocol For Growth

Meanwhile, Ethereum co-founder Vitalik Buterin said in a post that there are several issues that the cryptocurrency needs to address to thrive in the ever-evolving crypto space.

Buterin explained that one of these issues is to simplify its protocol and ensure its continuous growth, saying that the coin’s protocol has become more complicated and it already undermines Ethereum’s integrity and security. He said that simplification of the protocol could help address the said issue.

He explained that Ethereum has already implemented changes in the past, citing the removal of the SELFDESTRUCT opcode as an example. The SELFDESTRUCT opcode was known to complicate interactions among users and posed potential security risks.

However, Buterin cautioned that the removal of such features must be conducted in a systematic approach so developers could see the impact of such action before implementing the changes.

Related Reading

Solving The Storage Problem

Another critical issue raised by Buterin is the storage problem being experienced by the cryptocurrency.

Buterin said that Ethereum needs at least 1.1 terrabytes of storage to house its enormous historical data.

He suggested the implementation of “cryptographic proofs of the state”, adding that this solution will allow nodes to retain only a fragment of the histories.

He added that this approach is the same as the torrent system wherein nodes only keep pieces of data that intersect from one node to another.

At the time of writing, Ethereum is being traded аt $2,470, a 2.84% price dip in the last 24 hours. On the other hand, ETH’s trаding volumе went up by more than 30% to nearly $22 billion in only a single day.

Featured image from Forbes, chart from TradingView

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

Altcoin Season

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Published

7 hours agoon

December 23, 2024By

admin

The creators of the crypto analytics firm Glassnode are warning that altcoins could lose all bullish momentum following last week’s market correction.

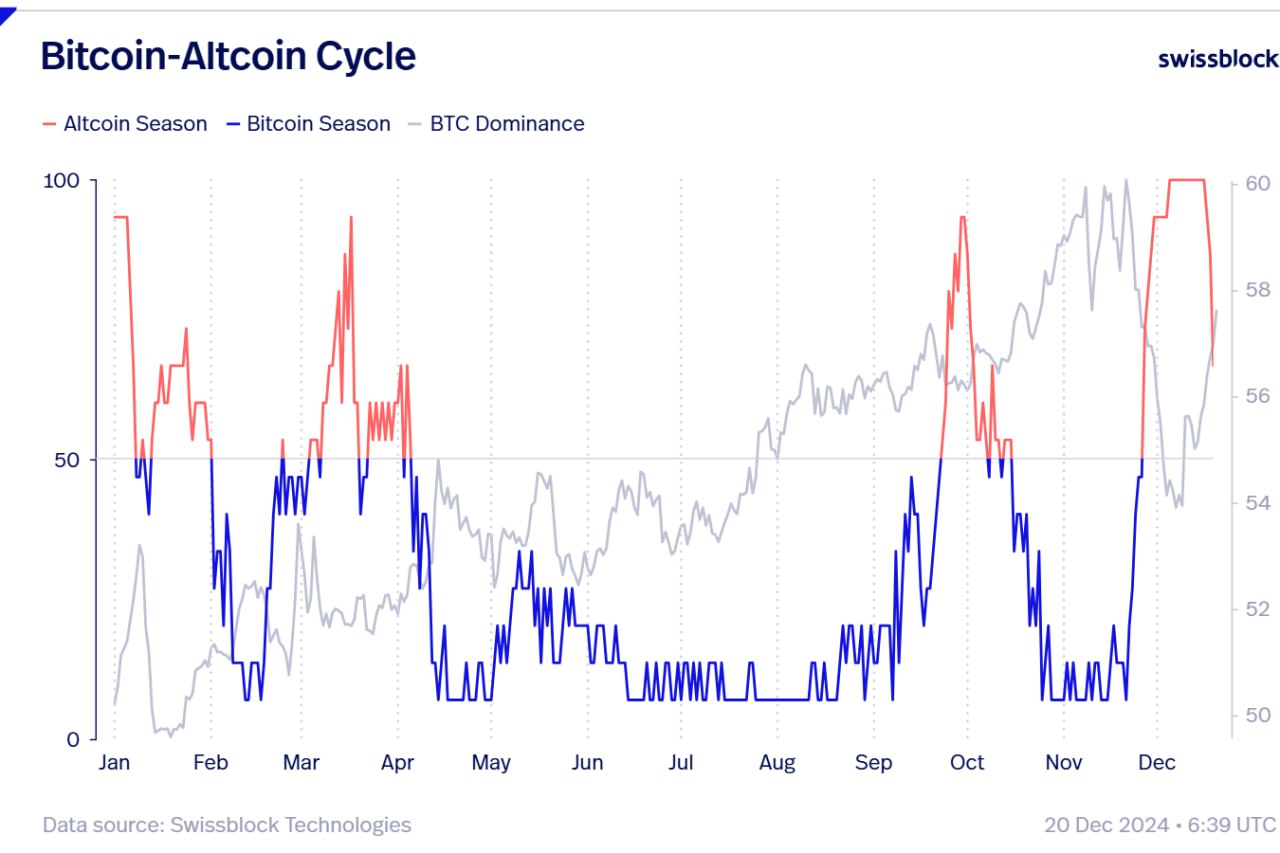

Jan Happel and Yann Allemann, who go by the handle Negentropic on the social media platform X, tell their 63,400 followers that “altcoin season,” which they say began in late November, could come to an abrupt end after alts witnessed deep pullbacks over the last seven days.

According to the Glassnode co-founders, traders and investors will likely have a risk-off approach on altcoins unless Bitcoin recovers a key psychological price point.

“Is This the End of Altcoin Season?

Bitcoin dominance is surging after dipping below $100,000, while altcoins are losing critical supports. Dominance has risen and resumed its upward trend, signaling a stronger BTC environment.

If BTC stabilizes above $100,00, we might see a pump in altcoins now in accumulation zones. Until then, Bitcoin appears poised to lead, leaving altcoins lagging behind.”

The Bitcoin Dominance (BTC.D) chart tracks how much of the total crypto market cap belongs to BTC. In the current state of the market, a surging BTC.D suggests that altcoins are losing value faster than Bitcoin.

At time of writing, BTC.D is hovering at 59%.

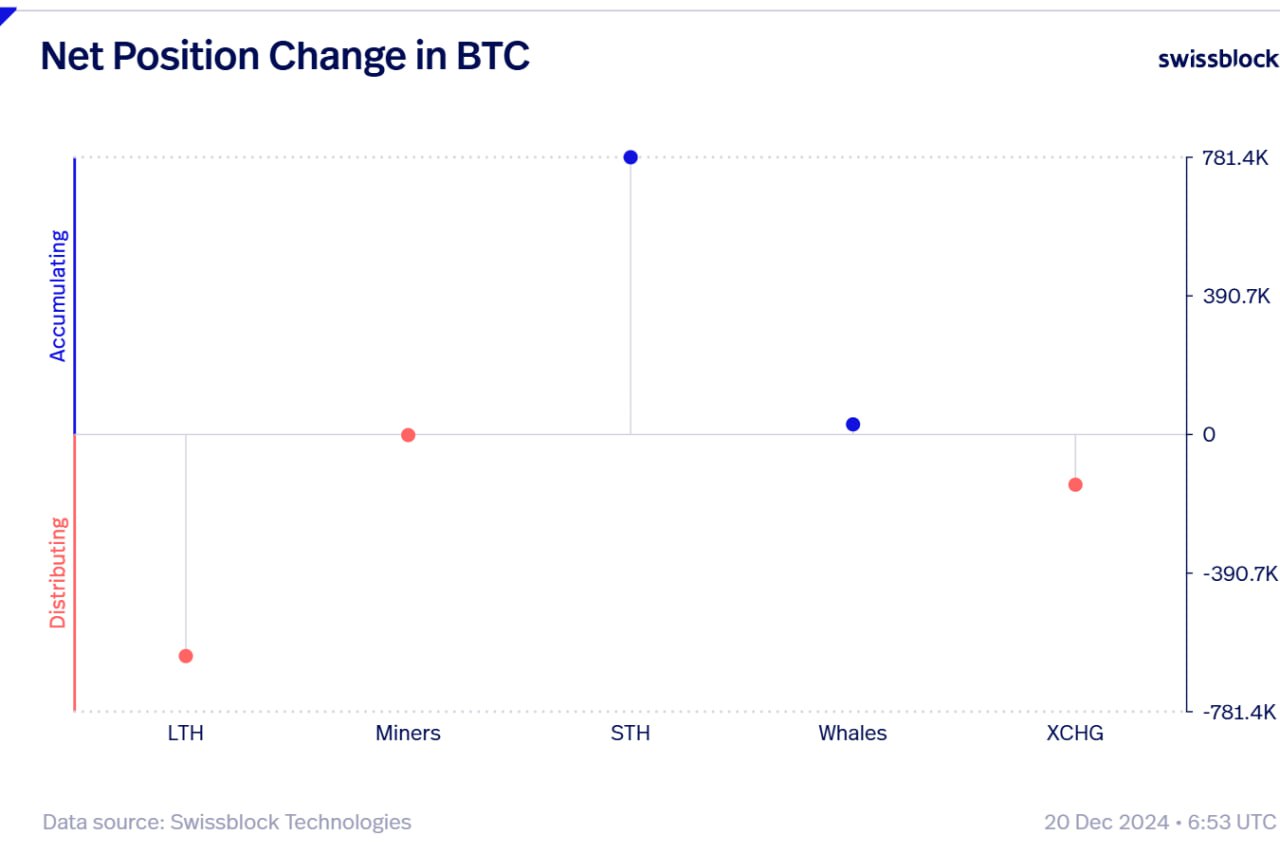

Looking at Bitcoin itself, the Glassnode executives say long-term Bitcoin holders are massively unloading their holdings as other investor cohorts pick up the slack.

“The Board Keeps Shifting.

As BTC continues flowing out of exchanges during this dip, long-term holders are exiting forcefully, while short-term holders step in without hesitation.

Whales quietly accumulate, miners remain neutral, and selling pressure has merely reshuffled the board.

New hands are absorbing the sales.”

At time of writing, Bitcoin is worth $97,246.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

Published

23 hours agoon

December 22, 2024By

admin

Bitwise CIO Matt Hougan says a wave of institutional interest in altcoins is coming next year, largely due to potential regulatory clarity and more exchange-traded funds (ETFs).

In a new interview with Bloomberg, Hougan says that institutional money is in the early stages of broadening out to other crypto assets besides just Bitcoin (BTC).

Hougan forecasts that 2025 will be the year that institutional investors will begin to incorporate more diversification in their crypto-investing strategies the same way they do in other asset classes like equities or bonds.

“You’re already seeing it broaden out actually. A lot of people were worried about the Ethereum ETFs for instance, which launched this summer and had tepid inflows.

But over the last month or so, you’ve seen billions of dollars flow into those products.

Again, the things that have happened in crypto in the past keep happening. Historically, most people enter crypto through Bitcoin, and then they discover Ethereum, and then they think about Solana. There’s no reason to assume that the institutions that came into Bitcoin won’t move on to other assets in the future.

In fact, I think in 2025, you’re going to see an explosion of interest in index space strategies that give diversified exposure to crypto. Of course, [that is] something we’ve been doing at Bitwise since 2017 when we pioneered that concept. I think 2025 is when that becomes a mainstream way to allocate to this space, the same way it is to stocks and bonds and real estate and everything else.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Julien Tromeur/Sensvector

Source link

Altcoins

Analyst Says Altcoin That’s Rallied Over 21,000% Year-to-Date at a ‘Do-or-Die’ Level, Updates Outlook on Bitcoin

Published

3 days agoon

December 20, 2024By

admin

A widely followed cryptocurrency analyst and trader is saying that an altcoin in the Solana (SOL) ecosystem is at a critical juncture.

The analyst pseudonymously known as Sherpa tells his 234,700 followers on the social media platform X that the memecoin Popcat (POPCAT) is at a “do-or-die” level.

Based on Sherpa’s POPCAT chart, it appears that the Solana-based memecoin has formed a head and shoulders pattern on the daily time frame and could plunge if the support level fails to hold. A head and shoulders pattern is typically considered a bearish pattern in technical analysis.

POPCAT is trading at $0.802 at time of writing, up by 21,147% since the January 5th low of $0.00379.

Next up is Bitcoin (BTC). According to Sherpa, there are several reasons to remain bullish on Bitcoin and other crypto assets, even after a recent correction that saw the flagship digital asset briefly dip below the $100,000 price.

“Bitcoin dominance has yet to come down.

Ethereum has yet to fully send.

January is an incredibly bullish time for crypto.

[US President-elect] Trump is pro-crypto, owns some, and has his own decentralized finance (DeFi) project.

….and you’re selling??”

Bitcoin is trading at $100,624 at time of writing. Bitcoin dominance, the ratio of the market cap of Bitcoin relative to the rest of the crypto market, is currently at 54.7% down by several percentage points from the 2024 high of 58.99% recorded mid-last month.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential