HodlX

What Is the Best Way To Secure My Bitcoin

Published

2 months agoon

By

admin

HodlX Guest Post Submit Your Post

The question still comes up – is crypto too complex for the ‘average user’ to understand?

The answer seems straightforward. Bitcoin quickly became a cultural phenomenon – appearing in rap songs and movies – and then was adopted by national governments and major corporations.

It is safe to say that the people get it.

Up to now, users have happily taken advantage of custodial exchanges to hold their digital assets when they don’t have the right hardware devices or living situation for self-custody.

Many others successfully store digital assets on a secure mobile phone with no problems.

It is clear that people are figuring out how to not only buy and sell digital assets but how to store them as well.

The question, then, is perhaps less about whether or not crypto is too complex and more about whether or not our technical education worldwide suffices for the modern age.

Is crypto too complex for most

The older generation is skeptical of new technology and would rather stick to banks with deposit insurance or crypto ETFs (exchange-traded funds).

That is the world they have always known, and it has served them well. They see no reason to change their ways now. But ETFs are not the world of tomorrow.

Young people understand digital assets. They are digital natives. The concept of digital assets is not foreign to them.

The industry could always use more education, especially free technical information for the unbanked.

But across the planet, individuals from all walks of life have successfully adopted Bitcoin and digital assets.

The industry must continue creating free educational content for dissemination on social media like it has done this far so well.

Storing Bitcoin doesn’t have to be complex

There are quite complex ways to store Bitcoin. Some large exchanges use a Faraday cage with an electromagnetic shield so as to not leak RF (radio frequency).

On the other hand, some people use very little security. They hold their digital assets on their smartphone or even laptop.

At the end of the day, it’s about striking a good balance. You’ve got to ask yourself, “What works for you?”

Everyone has different risk models when storing Bitcoin

Different individuals and/or entities will have different risk models and appetites when it comes to storing Bitcoin and other digital assets.

For many individuals, increased technical complexity could make things less secure rather than more secure.

Therefore, individuals will have to find a sweet spot where they are satisfied with security and ease of access to their digital assets.

If one were to employ a system too complex, they run the risk of losing coins due to their own mistakes. One should not chase security and add complexity beyond their skill set.

The main question to ask is whether their setup is secure or not.

Each individual must assess for themselves the risks they face from external factors versus their technical skill sets – as well as the skillsets of those who will inherit their stash.

The lion’s share of digital asset holders do not have the technical expertise to employ highly complex storage strategies.

If the industry confuses people with overly-complicated security setups, they will be driven to custodial exchanges, which defeat the entire purpose of Bitcoin.

On the other hand, if people attempt storage setups that are too complex for them – then they risk losing their coins.

How to back up a non-custodial wallet

Perhaps the most important aspect of holding Bitcoin in a non-custodial wallet – hot or cold – is to consider how wallets are backed up and how those backups are stored.

A wall or floor safe is enough security for many people – as long as others don’t know you hold Bitcoin.

If people know where you live and that you also own Bitcoin, then you have higher risk and must account for that.

Simply writing 24 English words on a piece of paper is one way to back up your hardware wallet, but there are extra steps you can take to ensure your own protection.

Be sure to laminate the paper seed so it is protected from moisture. You can also put it in a tamper evident sealed envelope to ensure nobody has access to the seed phrase.

A bigger risk than having your seed phrase stolen is misplacing it or losing it to moisture or another natural disaster.

Some common threats to consider include fire, flood and termites that eat through paper backups, etc.

Most attacks on cold storage devices involve access to devices. Even then, most such attacks don’t work.

The biggest risk users face is not properly backing up a hardware wallet or making the instructions too difficult.

Can I use a cell phone to store Bitcoin

If you can’t obtain a hardware wallet, the next best option would be a mobile smartphone device, which likely has a secure element in the form of a security chip used to store particularly sensitive information accessible only by an authorized program.

This security chip creates isolation in a mobile OS (operating system)

A clean installation of a cell phone OS – which is able to keep up with manufacturer updates – is generally more secure than a laptop, and probably the most secure device you own.

Plus, cell phones include secure authentication methods including biometrics, pins and more.

From there, you can install a BIP39-compatible hardware wallet using a backed up mnemonic phrase.

BIP39 is an open-source protocol to standardize the means of creating and backing up a digital asset wallet with a mnemonic phrase.

Opt for a mobile wallet that has smart features around privacy and fee management.

If you have no mobile device, it might be more secure to use a custodial exchange – because desktops are just not that secure, truth be told.

What does the future of Bitcoin security look like

In the future, the digital asset industry may settle on a standard wherein a social sharing mechanism is employed in order to achieve secure storage.

Such a procedure entails a mnemonic phrase sharded into multiple shards that achieve quorum–three of fifteen or a hierarchical system where some shares are worth more than others.

We share these pieces with our families and become each other’s guardians by storing shards of each other’s mnemonic phrases securely.

This social mechanism would rely on a network of friends and family. The mnemonic phrases can be chiseled in the steel.

Kadan Stadelmann is a blockchain developer and operations security expert as well as Komodo Platform’s chief technology officer. His experience includes working in operations security in the government sector. Kadan started his journey into blockchain technology in 2011 and joined the Komodo team in 2016.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Trump holds $7 million in crypto: Arkham Intelligence

John Deaton Calls Out Gary Gensler For Ties With Sam Bankman-Fried

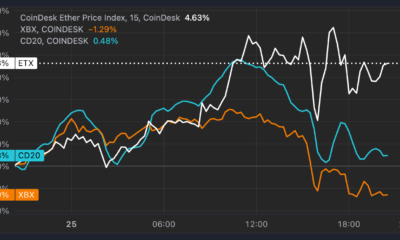

Ethereum’s ETH Outperforms as Bitcoin (BTC) Price Recoils Off $100K Sell Wall

Safegcd’s Implementation Formally Verified

US detaining Bitcoin mining equipment at border: report

Robinhood Lists Dogwifhat, WIF Price To $5?

HodlX

Crypto Exchanges at Crossroads – Adapting to Market Changes

Published

3 months agoon

September 6, 2024By

admin

HodlX Guest Post Submit Your Post

Despite years of development, the cryptocurrency market remains the Wild West of finance – an unpredictable arena where fortunes can be made or lost in the blink of an eye.

And seeing as a great portion of the activities with digital assets take place on crypto exchanges, they are often at the center of this turbulent landscape.

While crypto exchanges have played a crucial role in the market’s growth, there is much uncertainty about their future.

As the market matures and attracts more and more players from the traditional side of finance, these platforms are going to face an existential crisis.

This market is rich in scandals around scams and hacker attacks, and communication failures and a lack of robust crisis management by exchanges isn’t helping the situation.

Without significant changes in audience engagement, the future of crypto exchanges will remain uncertain.

The impact of scandals on the market

Recurring scandals that plague this industry are a major challenge for crypto exchanges since they damage not just individual exchanges but the entire market.

Take the collapse of FTX, for example – one of the most painful cases in recent market memory – precipitated by allegations of financial mismanagement and fraud.

Having once been one of the largest crypto exchanges around, FTX’s downfall in 2022 sent shockwaves throughout the industry.

Investors lost billions, highlighting the risks of an unregulated market.

Not long after, in the summer of 2023, the US SEC filed a lawsuit against Binance, accusing the exchange of facilitating illegal trading practices and artificially inflating its trading volumes.

Changpeng Zhao has also been personally implicated in misleading investors and regulators about Binance’s operations and compliance measures.

These allegations have damaged Binance’s reputation, weakening another pillar of the crypto exchange landscape.

Beyond these, we’ve also seen several cases like BitMEX and KuCoin where exchanges faced accusations of failing to maintain AML compliance standards.

And these are just a handful of examples. Each scandal sets the crypto industry back, eroding trust and stability in an already volatile market.

The road ahead – stricter regulation, professionalism and transparency

Looking to the future, it is clear that the crypto exchange landscape must evolve if it is to endure. In the coming years, this market will likely see larger, more established players enter.

These giants will bring with them a level of experience and presence that is sorely lacking in the current crypto exchange market.

Also, many traditional companies have long-established reputations, which in itself lends them a certain amount of trust from people.

As the crypto market welcomes such well-established entities, the presence of anonymous companies with no physical offices is likely to become increasingly untenable.

Users dealing with large sums of money need to know who they are entrusting with their assets. Otherwise, if something goes wrong, they won’t even know who to reach out to.

Because of this, the era of ‘distributed teams’ with no clear point of contact will give way to a new business model that involves more accountability.

Openness and clarity will be the two key principles critical in this transformation.

Communication patterns that need to be addressed

A good number of trust issues with crypto exchanges could be addressed by fixing the fundamental problems with communication that these companies often have.

When people think of financial exchanges, they generally imagine large regulated entities that convey a sense of reliability and trustworthiness – NYSE, NASDAQ, LSE and the like.

In TradFi, the list of major regulated stock exchanges worldwide is pretty short and their names are commonly known.

In contrast, the crypto market counts hundreds of exchanges, and regulation-wise, they operate in a much murkier space.

The lack of transparency and complex jargon alienate users and undermine trust. The term, ‘neobank with crypto,’ for instance, could serve as a simpler, more understandable concept for an average person.

It gives off a fairly clear implication that users would interact with a straightforward app that allows them to manage their digital assets – much like they would with a normal bank account.

Many crypto exchanges blur the lines in explaining what it is that they do, which leads to confusion and suspicion.

There is much talk about crypto ‘going mainstream,’ but without transparent communication, crypto exchanges will struggle to gain the confidence of mainstream users.

The absence of proper crisis management

Another critical issue is the seeming lack of anti-crisis measures among crypto exchanges. In the world of finance, crises are inevitable.

Whether due to market fluctuations, regulatory changes or internal mismanagement, financial institutions must be prepared to respond swiftly to minimize damage to their funds and reputation.

Unfortunately, many crypto exchanges seem to operate under the assumption that nothing will go wrong. This lack of preparedness becomes glaringly obvious when a crisis does occur.

Without robust crisis management, these exchanges flounder, unable to control the narrative. The result is often a scandal that could have been avoided with better planning.

Final thoughts

Crypto exchanges stand at a crossroads. The path they choose will determine whether they can secure a stable future or fade into obscurity.

The key to survival lies in adopting a more professional approach, where transparency and clear communications are prioritized.

Making the services of crypto platforms clearer and more accessible to the general public won’t only help protect individual exchanges but will also stabilize the broader crypto market.

Valentina Drofa is an international entrepreneur and business leader with over 15 years of working in the financial market. She is a financial market consultant with a PhD in Economics and author of a few books on financial literacy. In 2011, she co-founded the consulting firm for finance and fintech brands Drofa Comms.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Trump holds $7 million in crypto: Arkham Intelligence

John Deaton Calls Out Gary Gensler For Ties With Sam Bankman-Fried

Ethereum’s ETH Outperforms as Bitcoin (BTC) Price Recoils Off $100K Sell Wall

Safegcd’s Implementation Formally Verified

US detaining Bitcoin mining equipment at border: report

Robinhood Lists Dogwifhat, WIF Price To $5?

MicroStrategy Adds 55,500 More BTC To Its Portfolio For $5.4 Billion

Newmarket Capital Launches Battery Finance, Bitcoin-Collateralized Loan Strategy

Can the XRP price realistically jump to $10 in 2024?

Shiba Inu Price Eyes 76% Rally As 6.8m SHIB Tokens Burned

VanEck Doubles Down on Big Bitcoin Price Target, Says Key Indicators Continue To ‘Signal Green’

Multichain AI token poised to dethrone SOL, TON: 5,000% gains expected

Will Pi Network Price Reach $100 in This Bull Market?

Axie Infinity developer cuts 21% workforce: report

Chill Guy Meme Coin Pumps Another 50% as Creator Fights Back

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential