Donald Trump

What Will Happen to the Meme Coin Market if Trump Wins?

Published

2 months agoon

By

admin

Many experts believe that Donald Trump will positively impact the crypto market more than Kamala Harris. However, the impact on the meme coin segment remains a matter of debate.

According to Columbia Business School professor Omid Malekan, Trump’s success in the election could negatively impact the meme coin sector.

To further ingratiate myself with Solana fans, here’s an argument of why a Trump win and/or Republican sweep (which Polymarket has at 50%) is bearish memecoins.

i) Memecoins themselves are a form of economic populism. They are a statement against the unfair ( and often grifty)…

— Omid Malekan 🧙🏽♂️ (@malekanoms) October 27, 2024

The expert noted that investor interest in meme coins has increased due to disappointment in the tokenomics of venture-backed projects. If Trump becomes president, the Republican Party may change some rules allowing token holders to benefit from dividends and fees, which could reduce interest in meme coins.

Meme coins as a response to SEC policies

Meme coins have become a kind of response to the tough policy of the U.S. Securities and Exchange Commission (SEC), so their softening in the event of a victory of the Republicans with Donald Trump at the helm will lead to a drawdown, stated the co-founder and general partner of the firm Castle Island Ventures, Nic Carter.

This is how he commented on the publication of the professor of the Columbia Business School, Omid Malekan. In it, he called on the community of the Solana project to support the Democrats, who are represented in the presidential elections by Kamala Harris.

The expert argued his opinion as follows:

- Meme coins represent economic populism and a protest against traditional crypto assets and the participation of venture investors.

- Institutionally funded projects are becoming a response to SEC Chairman Gary Gensler’s and Senator Elizabeth Warren’s “repressive policies.”

- A Republican victory could strengthen the position of significant traditional crypto assets. This will introduce economic mechanisms to token holders who are absent from meme coins.

Malekan insisted that better regulation of the crypto sphere in the U.S. will act as a “bearish” factor for meme coins. Carter supported him, saying that if the SEC’s position changes, demand for meme coins will decrease, but it will not disappear completely due to existing speculative interests.

Opinions from the crypto community

People react to these statements differently. Blogger and influencer Murad believes that the growth of meme coins is not due to political factors but economic ones, and the election results are unlikely to significantly affect this sector.

99% of Memecoin buyers couldn’t care less about Politics

There are secular socio-economic forces at play that are much bigger than a single election

The rise of Memecoins has more do to with the persistently rising Global Money Supply.

Will that stop under Trump? Nope.…

— Murad 💹🧲 (@MustStopMurad) October 27, 2024

Another popular blogger, Jordan Fish, known as Cobie, also disagrees with Malekan and Carter, emphasizing that the interest of ordinary traders in meme coins remains high since they cannot participate in large projects in the early stages.

Meme coins and the U.S. Election

The meme coin sector has become the fastest-growing sector in the crypto industry in 2024, rising by more than 1800% since the beginning of the year. Ahead of the U.S. election, meme coins associated with Donald Trump have seen a sharp increase in volume and price.

This category holds a small capitalization relative to the entire meme coin market. Coingecko estimated its size at $1.2 billion, which is 2.4% of the entire market, with only four of them having a capitalization above $100 million. However, this did not prevent them from attracting the attention of the crypto community.

Forrest Przybysz, a trader and CEO of Sistine Research, noted that meme coins’ popularity is based on attention cycles, and the more attention they receive, the higher their value will be.

“Trump is an attention magnet. Therefore he is the ideal subject for a meme token.”

Forrest Przybysz, a cryptocurrency trader and CEO of Sistine Research

Yan Liberman, co-founder at crypto research firm Delphi Digital, emphasized that meme coins act as collectibles, allowing for the monetization of public attention.

“Meme coins are similar to nonfungible tokens in terms of being a bit of collectors’ item. The idea is that you monetize public attention,”

Yan Liberman, co-founder at crypto research firm Delphi Digital

Thus, if Trump’s election promises come true, America will see a new boom in the cryptocurrency segment. However, the question of meme coins remains open — the coins are unlikely to have any practical utility and strategic importance for the development of the decentralized finance market.

One way or another, the crypto market is likely to face volatility as the U.S. presidential elections approach. But it’s not entirely clear what kind of volatility it will be.

Source link

You may like

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

Donald Trump

Michael Saylor is willing to advise Trump on the crypto policy

Published

3 days agoon

December 21, 2024By

admin

MicroStrategy Inc. co-founder and executive Chairman Michael Saylor says he is willing to advise Trump on cryptocurrency policy when the crypto advisory council is set.

During the Dec. 18 episode of the Open Interest show on Bloomberg Television, Saylor voiced his willingness to provide his advice on the digital assets policy to President-elect Donald Trump, either publicly or confidently, if he is asked to do so.

Before expressing his willingness to advise Trump on the crypto policy, Saylor admitted that he had already met “with a lot of people” in the incoming administration but declined to specify the personalities nor mentioned if he already met Trump.

Is Saylor fit for a position?

Since the 2020s, Michael Saylor has been one of the key Bitcoin advocates and investors. Saylor is one who puts money where his mouth is, as he personally spent around one billion dollars on BTC. In 2020, Saylor took to X (Twitter at the time) to announce that he personally owns 17,732 bitcoins and that he acquired these coins before MicroStrategy (MSTR) made the first massive purchase of bitcoins. YahooFinance! reports that currently MicroStrategy owns around 440,000 BTC, which is close to a 2% share of the entire BTC supply. MicroStrategy made headlines on the eve of the latest BTC price peak when the company was included in the Nasdaq 100 index.

Michael Saylor names Bitcoin an apex property of the human race and has an insatiable thirst for bitcoins. He compares Bitcoin to the territories like Manhattan or Alaska that were bought by the early colonist administration, specifying that Bitcoin is rather a kind of cyberspace. That’s why MicroStrategy aims to own bitcoins in bulk. According to Saylor, buying as much of this “space” as possible is crucial for the United States. This vision speaks to the statement posted by Donald Trump on the Truth Social platform. “We want all the remaining Bitcoin to be MADE IN THE USA!” the post reads.

Saylor singled out Trump as the most crypto-friendly Republican politician. It seems that Saylor shares the President-elect’s views on Bitcoin. Although not an outright GOP supporter, in September, Saylor made claims that he sees Republicans as a more progressive party when it comes to cryptocurrency regulation. He names regulation pressure decrease, treating crypto as a tool to boost the U.S. economy, and encouraging individuals to pursue their economic aims using digital finance as progressive characteristics of the Republican approach to the crypto industry.

What Do We Know About the Crypto Advisory Council?

Trump proposed the creation of a crypto advisory council during his now famous speech at the Nashville cryptocurrency conference in July 2024. As of December, not much information about the preparations of this council has been made public.

The participating companies’ lineup is not clear yet. However, it has been reported that such brands as Coinbase, Ripple Labs, Paradigm, and Andreessen Horowitz (a16z) are seeking interactions with the incoming administration. Allegedly, an a16z rep was involved in advising the Trump team during the presidential campaign. On December 6, Trump introduced entrepreneur and venture capitalist David O. Sacks as the “White House A.I. and Crypto Czar” via the Truth Social post.

It’s worth saying that, to say the least, before 2024, Trump wasn’t an avid crypto enthusiast. In the past, the President-elect made a series of anti-crypto remarks, calling Bitcoin “not money” and saying that the value of cryptocurrencies is based on thin air.

However, the 2024 Presidential campaign saw a drastic change in Trump’s stance on crypto. He started to take donations in digital currencies, visited a major crypto conference in Nashville where he promised to make America “a crypto capital of the world,” and made several important proposals concerning the cryptocurrency policy.

On top of tax cuts for the U.S. cryptocurrency companies, the removal of Gary Gensler from the SEC, and the creation of the strategic Bitcoin reserve, Trump announced the creation of the advisory body with the leading position granted to the richest man on Earth and his passionate supporter Elon Musk. This unofficial agency is called The Department of Government Efficiency, or simply DOGE, a reference to a legendary memecoin, a notorious soft place of a Tesla CEO. Who knows just what else to expect from Donald Trump when he goes crypto?

Source link

China

China May Be On the Verge of Ending Its Bitcoin Ban

Published

6 days agoon

December 18, 2024By

admin

Look, I think it’s only a matter of time before China pulls a complete 180 on its Bitcoin ban. Yes, they outlawed trading and mining back in 2021, but honestly, a lot has changed since then — especially this year. Bitcoin’s momentum globally has been insane.

We’ve seen US President-Elect Donald Trump calling to stockpile Bitcoin; Bitcoin ETFs get approved, Fed Chair Jerome Powell calling Bitcoin “digital gold,” Larry Fink flipping pro-Bitcoin, and even Putin saying nice things about it. With all of this happening, I wouldn’t be shocked if China has already started quietly stacking sats (buying bitcoin).

Here’s why I think that: China doesn’t like to announce what it’s doing beforehand — it’s just not how they operate. Former Binance CEO CZ talked about this recently at the Bitcoin MENA conference in Abu Dhabi, saying that while the US loves to make big public statements about upcoming policies (like Trump announcing Bitcoin plans to court voters), Asian countries prefer to move in silence.

And let’s not forget China doesn’t have elections. They don’t need to win over public opinion like Trump does. If they’re making moves with Bitcoin, they’ll do it quietly — and we’ll find out when they’re ready to make it official.

Now, with Trump’s big push for Bitcoin and crypto, I can’t see China sitting on the sidelines for too long. This is turning into a global race, and if China wants to stay competitive, they can’t afford to miss the Bitcoin train. My gut tells me they’re already planning to unban Bitcoin and crypto — and I wouldn’t be surprised if it happens as early as Q1 next year, especially if Trump takes office.

Another big hint? Hong Kong. China has a long history of using Hong Kong as a sandbox to test things before rolling them out on the mainland. And this year, we’ve seen Hong Kong make major moves — approving Bitcoin and crypto ETFs and greenlighting more crypto exchanges. Let’s be real: this isn’t a coincidence. They are planning to eliminate crypto taxes for institutions. I think China is watching carefully, and these are early steps toward a broader shift.

In my opinion, China has likely been quietly accumulating bitcoin all along. When the time is right, they’ll unban it — and not just to compete with the US, but to lead. Watch this space. I think it’s going to happen much sooner than most people expect.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Bitcoin Sell-Off Likely When This Metric Reaches 4%, Analyst Explains

Published

1 week agoon

December 14, 2024By

admin

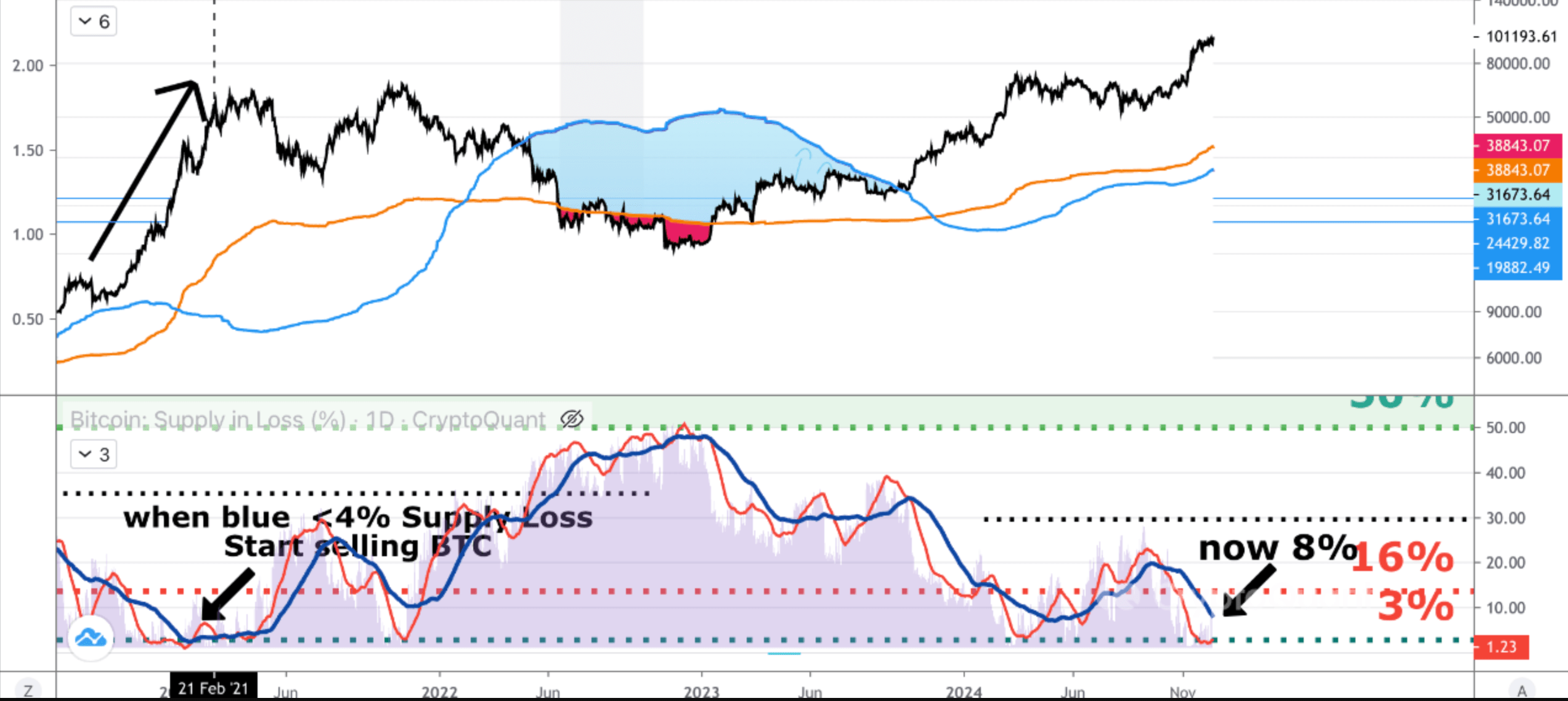

While Bitcoin (BTC) fluctuates around the critical $100,000 price level, some investors may seek the ideal opportunity to take profits and exit the market. In this context, a CryptoQuant analysis highlights a key BTC metric that can serve as a valuable tool for crafting an exit strategy.

Have Profits In Bitcoin? Keep An Eye On This Indicator

In a Quicktake blog post published today, CryptoQuant contributor Onchain Edge shared insights into timing the sale of BTC during the current bull market. The analyst emphasized the importance of the Bitcoin supply in loss metric, noting its potential to signal when to start exiting the market to preserve profits.

Related Reading

For those unfamiliar with Bitcoin, the supply in loss measures the percentage of BTC held at a loss based on its last moved price. A low percentage of supply in loss typically indicates peak market euphoria and serves as a warning to secure profits before a bear market correction begins.

According to the CryptoQuant analysis, when BTC supply in loss drops below 4%, it signals a good time for investors to consider dollar-cost averaging (DCA) out of their BTC holdings and wait for the next bear market lows. Currently, the BTC supply in loss sits at 8.14%.

DCA is an investment strategy where investors allocate a fixed amount of money to an asset at regular intervals, regardless of its price. This method helps reduce the impact of market volatility and lowers the average cost per unit over time. The analyst adds:

Why? Below 4% means a lot of people are in a profit this is the peak bullrun phase. Trust me you don’t want to be bagholding because you thought we will never see a bear market again. Be fearful when others are greedy.

Analysts Confident Of Further Upside In BTC Price

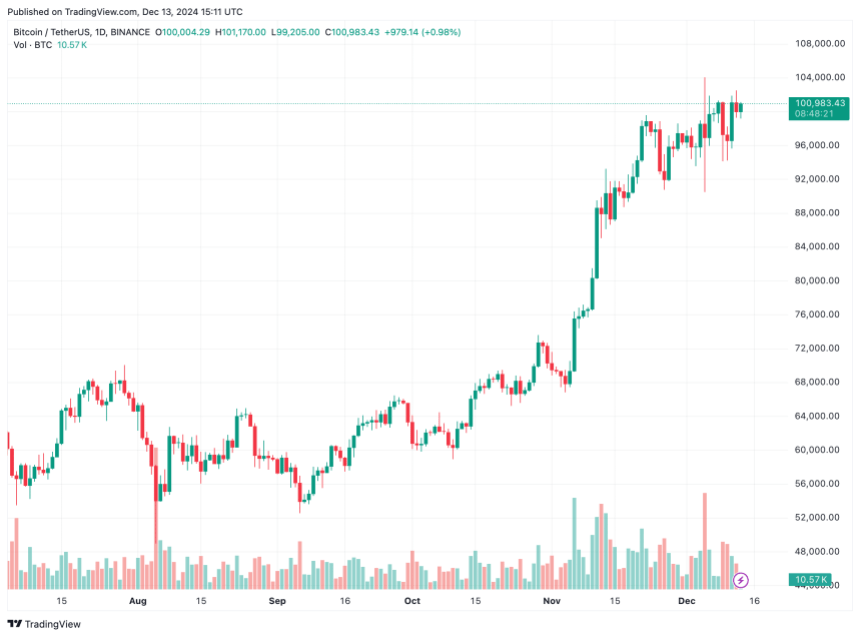

While tracking the BTC supply in loss metric can help investors safeguard their profits, recent forecasts from crypto analysts suggest there might still be room for further upside before this indicator becomes crucial.

Related Reading

According to crypto analyst Ali Martinez, BTC forms a classic cup and handle pattern on the weekly chart. The premier cryptocurrency looks poised to break out of the bullish formation, with targets as high as $275,000.

Similarly, Donald Trump’s victory has brought fresh optimism in the crypto industry. In the recently concluded Bitcoin MENA conference in Abu Dhabi, Trump’s former campaign chairman, Paul Manafort, noted that BTC investors can “expect more than $100,000” during the ongoing market cycle.

Other forecasts remain equally bullish. Tom Dunleavy, Chief Investment Officer at MV Global, projects BTC to reach $250,000, while Ethereum (ETH) might climb to $12,000 during this market cycle. BTC trades at $100,983 at press time, up a modest 0.1% in the past 24 hours.

Featured image from Unsplash, Charts from CryptoQuant and TradingView.com

Source link

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential