DEX

what’s the difference and which is better?

Published

3 months agoon

By

admin

Both Dogecoin and Shiba Inu have emerged as major players in the meme coin world. Their light-hearted branding has proven popular in the market, catapulting them to success.

While they may seem similar on the surface, these two coins have important differences that set them apart and provide distinct use cases and investment factors to consider.

Overview of Dogecoin and Shiba Inu

Launched in 2013, Dogecoin was the first ever so-called meme coin, a digital asset launched explicitly as a joke. The currency was created by software engineers Billy Marcus and Jackson Palmer partly as a way to poke fun at Bitcoin and its growing popularity. What the developers were not to know, of course, is that their own currency would go on to be worth tens of billions of dollars.

What began as a meme featuring the Shiba Inu dog breed quickly grew into a hugely popular cryptocurrency bolstered by a dedicated community as well as press and notoriety from public figures like Elon Musk.

DOGE managed to identify a real-world use case and became a popular way for cryptocurrency users to issue tips and carry out small transactions that would be cost-prohibitive with currencies like Bitcoin due to the higher fees involved, especially in years gone by.

In 2020, the Shiba Inu cryptocurrency emerged as a potential “Dogecoin killer.” Built on the Ethereum blockchain as an ERC-20 token, Shiba Inu aimed to capitalize on the meme coin trend while offering more utility than Dogecoin. Due to being issued on Ethereum, Shiba Inu can integrate with decentralized finance and offers access to DeFi services not supported by Dogecoin.

Let’s explore these differences more in the below section.

What’s the difference between Dogecoin and Shiba Inu?

One of the biggest differences between Dogecoin and Shiba Inu is the technology behind them. Dogecoin operates on its own blockchain and uses a Proof-of-Work (PoW) system, similar to Bitcoin. The Dogecoin blockchain is capable of fast and low-cost transactions, ideal for tipping and microtransactions, but limited in terms of interoperability with other blockchains or crypto services.

(SHIB) Shiba Inu, on the other hand, is not as robust in terms of rapid transactions at a low cost but arguably offers more utility.

As an ERC-20 token, SHIB can interact with essentially any Ethereum-based applications and smart contracts in the world. However, this also means that Shiba Inu is subject to Ethereum’s sometimes high gas fees and slow transaction times, depending on network congestion.

Finally, a major difference lies in their supply strategies.

Dogecoin has an inflationary supply model, where 5 billion new DOGE coins (DOGE) are introduced each year. Many crypto users found themselves exasperated at the popular “Doge to $1” campaign that became popular in 2021 among novice entrants to the space, as the price point would have required DOGE to reach a market cap of around $130 billion.

Meanwhile, Shiba Inu has a fixed supply, with an enormous initial number of 1 quadrillion tokens. The supply is often touted as a reason that individual SHIB coins are described as ‘cheap’ or affordable. Again, however, this belies a lack of understanding of tokenomics, as what investors should be considering is the market cap rather than the price of a single coin when measuring value.

About half of the SHIB supply was burned or removed from circulation, but the remaining supply still impacts its value potential.

Of course, to do a true Shiba Inu vs. Dogecoin comparison, we must consider the price history of these two coins.

Dogecoin vs Shiba Inu: market performance and volatility

Both coins have experienced dramatic price swings, often driven by social media and public figures. Let’s weigh up Shiba Inu vs Dogecoin comparison.

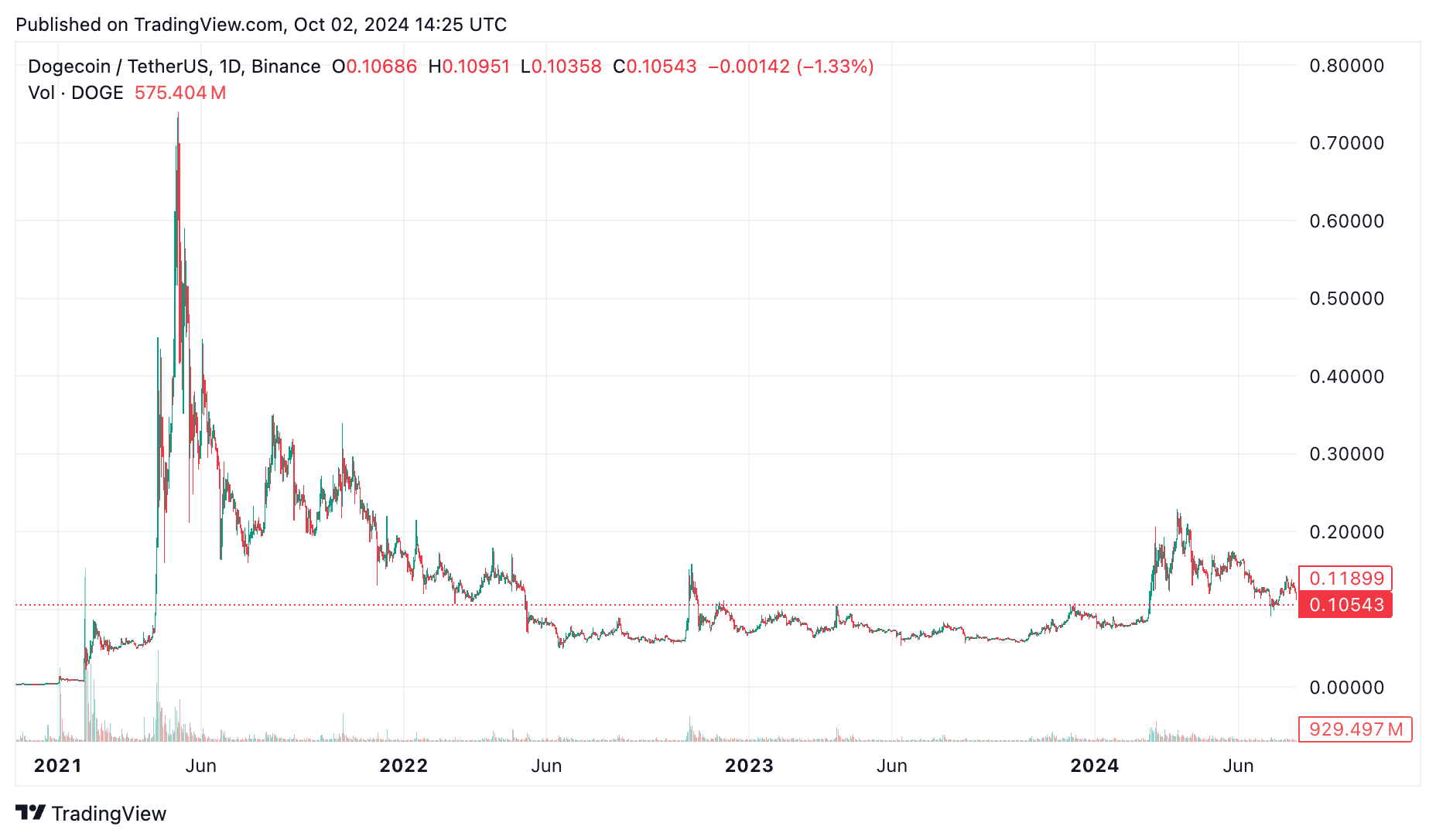

Dogecoin, thanks to endorsements from individuals like Elon Musk, saw its price peak in 2021 at $0.7376.

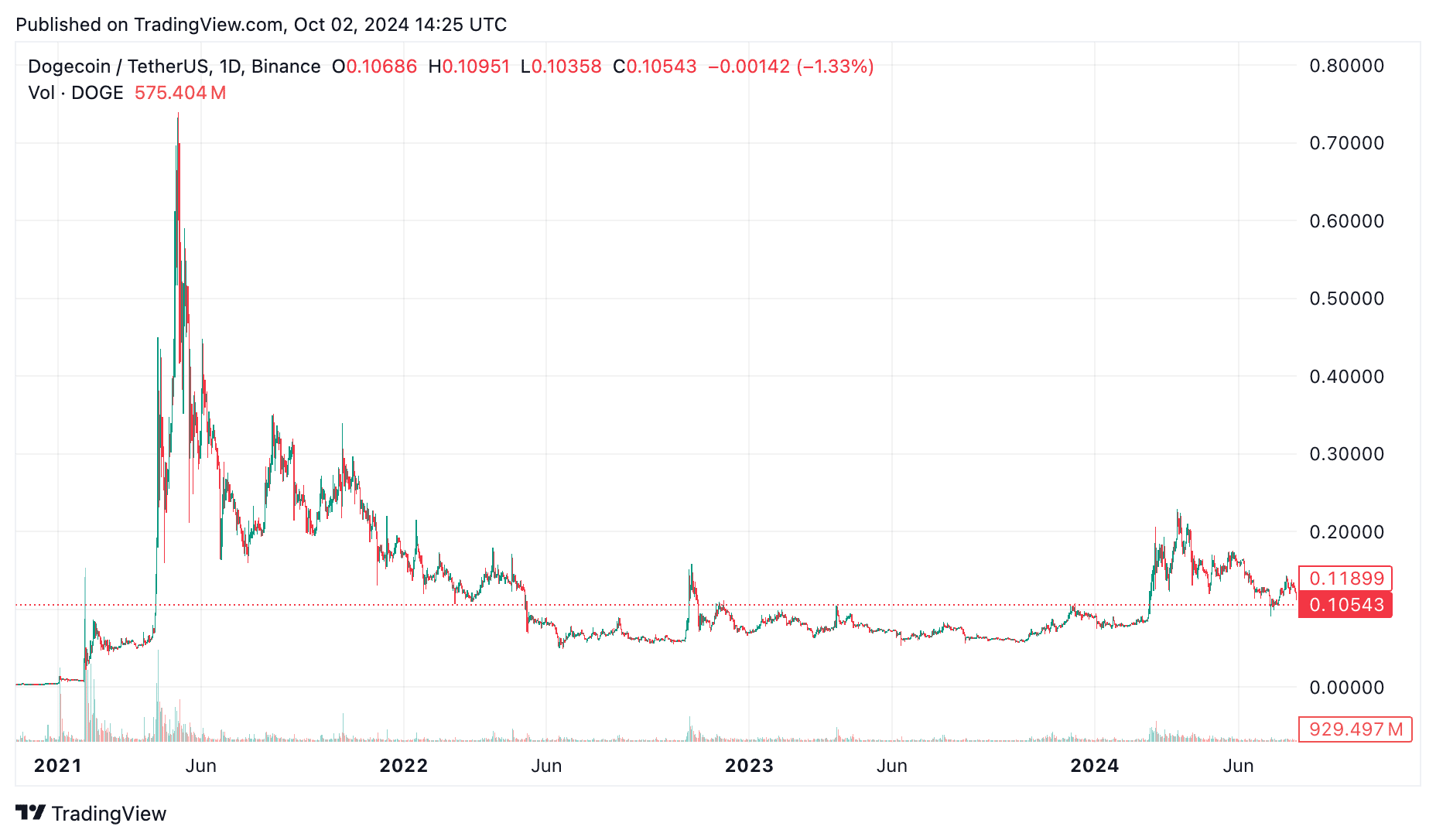

Shiba Inu peaked later in the same year at $0.00008845, fueled by the hype of its growing community.

In terms of market capitalization, Dogecoin consistently ranks higher and now stands at $15.6 billion compared to $9.6 billion for Shiba Inu. The coins are currently ranked at #8 and #13 in the overall market cap rankings respectively.

This reflects Dogecoin’s broader adoption as a simple and accessible cryptocurrency, while Shiba Inu’s complex DeFi potential offers more speculative value. However, SHIB is catching up, with a 118% growth in price over the last 12 months compared to a 69% growth this past year for DOGE.

Shiba Inu vs Dogecoin price prediction

Let’s take a look at the potential price forecast for Doge vs. Shiba.

Shiba Inu price prediction

Shiba Inu’s future largely depends on the success of projects like Shibarium, a layer-2 solution designed to reduce Ethereum’s high gas fees and increase scalability. If Shibarium succeeds, it could drive further adoption and increase SHIB’s value. However, its vast token supply may continue to weigh down the price.

As mentioned earlier, it’s interesting to note that Shiba Inu has had a strong year, but it’s quite a ways off its yearly high seen in May, with many pockets of resistance to break through before it approaches that price range.

Dogecoin price prediction

For Dogecoin, price predictions are often influenced by media hype, particularly driven by high-profile endorsements. Without significant technological advancements or new real-world use cases, its price may fluctuate based on speculative trading.

For a meme coin that was never intended to be taken seriously, it has certainly shocked the world with its strong community and price action. However, it’s difficult to accurately predict any sort of price action for this currency due to the somewhat whimsical nature of its upwards and downwards price momentum in the past and inflationary supply tokenomics.

Unlike Shiba Inu, Dogecoin is not particularly linked to success in the DeFi sector, and its success or failure is really anyone’s guess.

Which is better: Dogecoin or Shiba Inu?

So, Dogecoin vs. Shiba Inu: which is better?

When it comes to deciding which is better: Doge vs Shiba, the answer largely depends on your goals as an investor. The difference between Dogecoin and Shiba Inu is largely the transaction speed vs. functionality of the transaction, but in the end, both of these assets are meme coins.

Dogecoin offers a simple, fast, and low-cost cryptocurrency with an active community, making it a good choice for those looking for everyday utility or a fun investment.

It’s important to note that Dogecoin is by no means the only fast and low-cost cryptocurrency, nor is it the fastest or cheapest of the many options now available on the market, most of which have more features and integrations than Dogecoin. With no real utility in the modern crypto space beyond the potential for speculative gains, this is a particularly high-risk investment, even for a cryptocurrency.

Meanwhile, Shiba Inu provides more opportunities within the DeFi space due to its integration with Ethereum, offering higher potential rewards but also greater risk due to its volatility and dependence on Ethereum’s infrastructure.

Again, Shiba Inu is far from the most feature-laden or well-built DeFi currency on the market, and it has no edge or advantage over other ERC-20 tokens, and would be considered to have a disadvantage in the eyes of many investors.

At the end of the day, what these coins offer is simply a dedicated community that gets together to have fun and share memes rather than a serious investment opportunity. However, that’s not to say that seasoned investors cannot learn technical analysis to attempt to trade the charts for these meme coins.

Source link

You may like

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

DeFi

Solana beats Ethereum in a key metric 3 months in a row

Published

3 hours agoon

December 23, 2024By

admin

Solana’s continued doing well in December, as meme coins helped it gain market share against Ethereum and other blockchains.

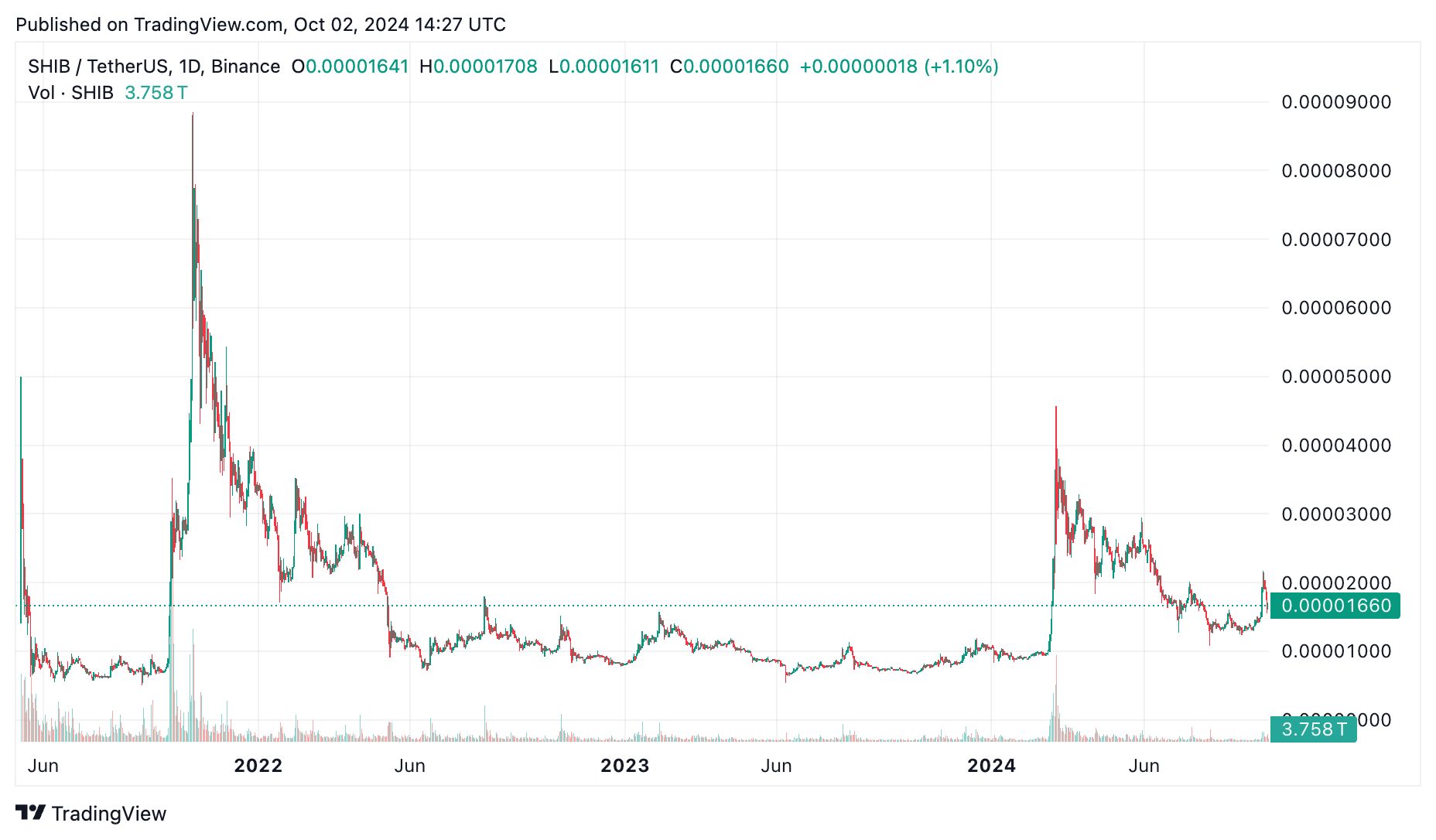

According to DeFi Llama, Solana’s (SOL) protocols in the decentralized exchange industry were the most active in December.

Its volume rose to over $97 billion, much higher than the $22.6 billion it handled in the same period last year.

Notably, it was the third consecutive month that Solana outperformed Ethereum (ETH), which has dominated the industry for years. Ethereum’s protocols had a volume of over $74 billion, while Base and Arbitrum handled $42 billion and $37 billion.

Solana also performed great in November, where its DEX networks had a volume of $129 billion, higher than Ethereum’s $70.6 billion. A month earlier, Solana handled volume of $52 billion, while Ethereum processed $41 billion.

Most of Solana’s DEX volume was because of Raydium (RAY), a network that handled coins worth $65 billion in the last 30 days. Orca handled $24 billion, while Lifinity, Pump, and Phoenix had volumes worth over $5.93 billion.

Solana’s DEX volume has jumped because of the meme coin industry, which has continued doing well this year. Solana has attracted thousands of meme coins this year, helped by the creation of Pump, the biggest token generator. All Solana meme coins have a market cap of over $14.1 billion, led by Bonk, Dogwifhat, Popcat, and Peanut the Squirrel.

This growth has been highly profitable for Solana and its native apps. All Solana native dApps generated a record $365 million in revenue in November, a record high. Similarly, according to TokenTerminal, Solana’s blockchain generated a record $725 million in fees in 2024, making it the third-most profitable chain after Ethereum and Tron.

Developers and users love Solana because of its substantially lower fees and higher throughput.

Base, the layer-2 network launched by Coinbase, has also been a big breakout star in 2024 as its total fees rose to over $82 million. It has become the biggest layer 2 network in the blockchain industry, with its DEX networks handling over $181 billion in assets, while its total value locked soared to $2 billion.

Source link

DeFi

Uniswap price rises as crypto experts see it hitting $50

Published

2 weeks agoon

December 12, 2024By

admin

Uniswap’s price has rallied, crossing a crucial resistance level, with many crypto experts predicting further gains ahead.

Uniswap (UNI) token surged to $19.44, its highest level since December 2021, as crypto momentum continued to strengthen.

This rally coincides with robust inflows across decentralized exchange (DEX) networks. Data indicates that DEX platforms handled over $372 billion worth of tokens in November, marking the largest monthly increase on record.

Uniswap alone processed $30.86 billion in volume over the last seven days, solidifying its position as the industry leader. Its volume significantly exceeded that of competitors like Raydium and PancakeSwap combined. Over its lifetime, Uniswap has facilitated over 465 million trades worth more than $2.36 trillion.

Uniswap’s price is also gaining momentum as traders anticipate the launch of UniChain, the platform’s independent Layer-2 chain. UniChain aims to enable seamless cross-chain trading on a single platform. Currently in the testnet phase, UniChain is set to launch early next year.

At the same time, there are rising odds that the Trump administration will abandon the case brought against Uniswap by the Securities and Exchange Commission. The SEC alleged that the company provided securities on its platform without registration.

Uniswap price analysis

The weekly chart reveals that UNI has formed a slanted triple-bottom pattern, a bullish reversal indicator. The price has broken above the pattern’s neckline at $17.13, suggesting that bulls are firmly in control.

UNI is also approaching the 38.2% Fibonacci Retracement level at $19.23. Furthermore, it has moved above the 50-week moving average, while the MACD indicator and Relative Strength Index are both trending upwards.

The path of least resistance for UNI appears bullish, with a long-term target of $50, representing approximately a 180% increase from the current level. This aligns with predictions from analysts like Crypto Tigers predict.

For this to happen, Uniswap price will need to rise above the 50% retracement point at $24 and its all-time high of $45.

Source link

cryptocurrency

Uniswap launches permissionless bridging across nine networks

Published

2 months agoon

October 23, 2024By

admin

Decentralized exchange Uniswap has launched in-app, permissionless cross-chain bridging for its users, with service available across nine blockchain networks.

On Oct. 23, the Uniswap (UNI) team announced that its permissionless cross-chain bridge was now live, bringing the DEX protocol closer to enabling cross-chain swaps. The cross-chain intents protocol, Across Protocol, powers this in-app Uniswap bridging feature, according to the announcement.

Only native assets

With the launch, Uniswap users can now undertake cross-chain transactions across nine networks. These include Ethereum (ETH), Arbitrum (ARB) Polygon (POL) and ZKSync (ZK). Other networks with initial support are Base, Zora, Blast, OP Mainnet and World Chain.

The feature only supports native assets, such as ETH on the Ethereum network or ARB on the Arbitrum network. Bridging will also be available for stablecoins. In terms of functionality, users will perform cross-chain transactions directly via their Uniswap interface and Uniswap Wallet.

According to data from Dune, multi-chain access currently has a cumulative count of over six million Uniswap users. However, cross-chain bridge swaps remain low. The Uniswap Labs team aims to significantly increase this number.

Uniswap recently unveiled UniChain, a new layer-2 chain targeting DeFi and cross-chain liquidity. Announced on Oct. 10, UniChain aims to help the crypto market address DeFi’s challenges. Key to this vision are decentralization, near-instant transactions, and multi-chain swapping.

Source link

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential