$100k

Why $100,000 Bitcoin Is Right Around The Corner

Published

5 months agoon

By

admin

If you have been following Bitcoin news today, like I have, you can not be more bullish on Bitcoin. Seriously, what a time to be alive!

Just today:

- MicroStrategy purchased another 51,780 BTC for $4.6 billion and announced its plans to raise $1.75 billion to buy more bitcoin

- Semler Scientific bought another 215 BTC for $17.7 million

- Genius Group launched its Bitcoin treasury by purchasing 110 BTC for $10 million

- MARA Holdings announced a $700 million raise to buy more BTC

- Metaplanet issued ¥1.75B debt offering to buy more BTC

- Global healthcare group Cosmos Health adopted BTC as a treasury reserve asset

Insane, right?

The corporate Bitcoin adoption is going absolutely parabolic. The race among public companies to stack the most satoshis has kicked into hyperdrive.

Some other news:

- Donald Trump is meeting with Coinbase CEO Brian Armstrong and is expected to discuss appointments

- Donald Trump’s media $DJT in talks to purchase crypto trading platform Bakkt

- Options trading on BlackRock’s spot Bitcoin ETF could be listed as soon as tomorrow

It’s only Monday, and my head is already spinning! With this tidal wave of positive adoption, I’d be downright shocked if we don’t blast through $100,000 per Bitcoin this week.

I expect a flood of more bullish news and serious FOMO buying pressure this week. Seriously, tighten your seatbelts, folks—with this momentum, Bitcoin hitting a hundred grand is coming sooner than you imagined!

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Dogecoin Follows This Blueprint, Says Crypto Analyst

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

$1 Million

Bitcoin Price and the Psychological Leap: The Journey from $100K to $1M

Published

5 months agoon

November 16, 2024By

admin

Ah, Bitcoin. The most thrilling, gut-wrenching rollercoaster in the financial world. Every time it hits a new all-time high, there’s a chorus of celebration, the clinking of virtual glasses, and the inevitable “I told you so” from that one friend who’s been holding since 2013 (you know the one). Well, here we are again—Bitcoin has once again shattered expectations. And as I watched the price tick upwards, I had an epiphany. It wasn’t about the price tag—it was about the psychology of it all. Specifically, the strange magic of big round numbers.

Let’s take a moment and admire the humble yet powerful $100K milestone. For months, everyone’s been eyeing it like the golden prize on the horizon. Bitcoiners, with their eyes set on this threshold, have been nudging the price forward like ants moving crumbs. $60K? Almost there. $80K? Getting closer. But $100K? That’s the big one. It’s not just a number; it’s a psychological barrier. Crossing it is not just about market value; it’s about transformation.

Let’s break it down, shall we? We humans—bless our little brains—are inherently biased towards big, round numbers. They give us a sense of achievement. When your Bitcoin portfolio rises by $1,000, you’re likely to do a little victory dance. You see $1,000, and your heart skips a beat. It’s a clean number, easy to digest. You start telling people, “Oh, Bitcoin just went up $1,000 today,” and everyone nods, impressed. Nice, isn’t it?

But wait for it. Here comes the real twist. Once Bitcoin breaks through $100K, the game changes. That $1,000 rise? It’ll feel like pennies. Not because you’re suddenly richer, but because the context shifts. Suddenly, a $1,000 move is no longer a victory lap. It’s like stepping over a puddle when you’re used to climbing Everest. Sure, it’s still a move, but it’s not the same adrenaline rush.

You see, when Bitcoin hits that magical $100K milestone, we’ll stop thinking in terms of absolute prices and start thinking in terms of percentages. And this, dear reader, is where the psychological fun begins. Those small $1,000 swings will be as notable as a single raindrop in a monsoon. Bitcoin’s price will start moving in $10K chunks, or $20K, or more. You’ll see a $10,000 move and think, “Ah, just another Tuesday.” The dopamine hit from smaller moves will wear off faster than you can say “HODL.”

Here’s the real kicker: the next stop after $100K? $1 million. And once Bitcoin starts flirting with that number, we’ll all look back on those $1,000 or $10,000 moves with a chuckle. They’ll feel like mere stepping stones on the way to something far bigger. And at that point, all that will matter is the momentum—the relentless psychological pressure of “What’s next?”

Of course, let’s not forget the emotional gymnastics involved. One day, a $10K swing will make you sweat like you’re at the gym for the first time. The next day, you’ll barely blink when it surges $50K in a matter of hours—like a seasoned pro watching the tides roll in. That’s Bitcoin for you. It’s like riding a see-saw—one moment you’re up, and the next, you’re hanging on for dear life. And when Bitcoin crosses the $100K barrier, those swings will get even wilder. The price won’t rise in small, friendly hops anymore. It’ll leap, and it’ll leap fast.

So, while we celebrate today’s price movement and all the jubilant chatter about Bitcoin’s latest high, let’s take a moment to reflect. What we’re really witnessing isn’t just a price surge—it’s a mental shift. A shift from small wins to massive leaps, from numbers that are easy to wrap our heads around to ones that’ll require us to think in percentages and contemplate the next horizon. And when Bitcoin hits $1 million? Well, that’s when the real fun will start.

Hold on tight. It’s going to be a bumpy, thrilling, and, quite frankly, psychological journey.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Today, Fox Business’s Eleanor Terrett revealed that the Pennsylvania House of Representatives is introducing legislation that would effectively allow the state to hold Bitcoin on its balance sheet as a strategic reserve asset.

SCOOP: Today the Pennsylvania House of Representatives introduced legislation that would enable the state to hold Bitcoin on its balance sheet as a reserve asset in a broader movement to recognize $BTC as a store of value.

Full write-up on @FoxBusiness coming shortly.

— Eleanor Terrett (@EleanorTerrett) November 14, 2024

The overton window has finally shifted this past week and now everyone is seemingly scrambling to adopt BTC as a reserve asset. From the looks of it, it feels like a snowball rolling down a hill, gaining more momentum and growing bigger as it travels.

Here’s how this could play out:

- First, normal everyday people used bitcoin as a long-term savings vehicle

- MicroStrategy became first publicly traded company to adopt it

- El Salvador became first country to adopt it

- Corporations launched spot ETFs

- The US president elect is pledging to create a national BTC reserve

- US states are introducing legislation to adopt a BTC reserve

- Foreign nations are rumored to be buying bitcoin to front run the US

This list is only going to continue to grow. I suspect more states in the US, specifically the more conservative states, will follow Pennsylvania’s lead in the future in introducing the same or similar legislation. The benefits of adopting bitcoin have become impossible to ignore.

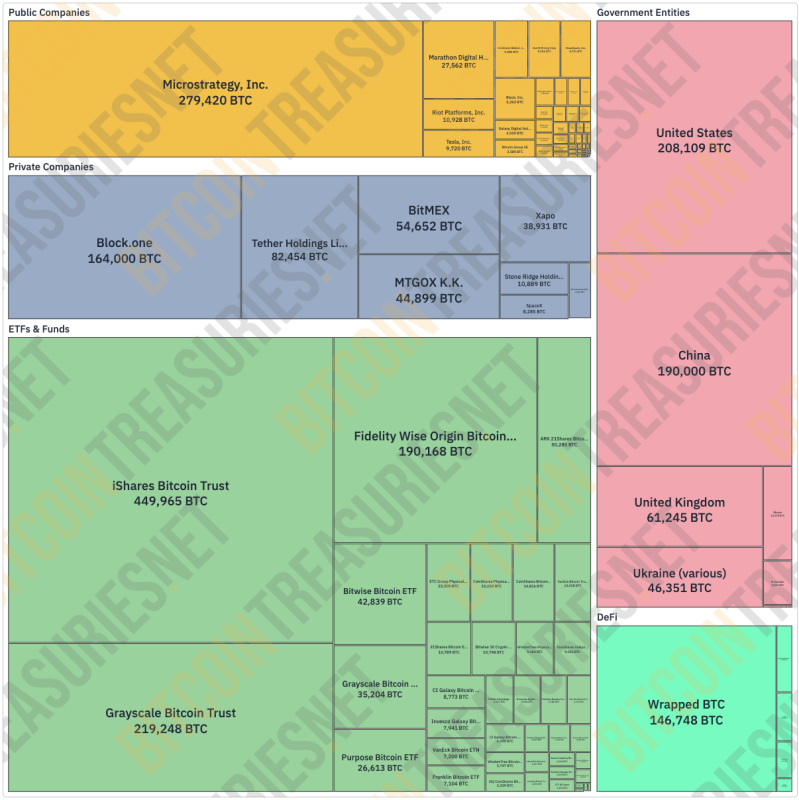

Remember, 94.20% of the total 21 million bitcoin supply has already been issued.

- It is estimated that around 3-5 million of those coins has been lost forever

- US spot Bitcoin ETF hold 1.07 million BTC

- MicroStrategy holds 279,420 BTC

- The US holds 208,109 BTC

- Various other countries are in possession of large amounts of BTC

- Tons of public and private companies are large amounts of BTC

- ? amounts of BTC owned by everyday people around the world

Many years ago I came to the conclusion that this level of bitcoin adoption was inevitable, but with all this momentum from large public institutions, I think we’re going to hit $100,000 bitcoin much sooner than I expected.

The supply of available bitcoin is shrinking each and every day, and coupled with rising demand, the price is up 130% in the last year. This is a runaway train, folks.

States, nations, and corporations are not going to stop accumulating BTC once they start buying either, so I am eagerly continuing accumulating as much bitcoin as I can before we hit that magic $100k number.

I think the floodgates will really open from there.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Dogecoin Follows This Blueprint, Says Crypto Analyst

Metaplanet Buys Additional ¥3.8 Billion Worth Of Bitcoin

Crypto Trader Unveils Massive Bitcoin Price Target Amid Extended BTC Bull Market – Here’s His Outlook

Is it possible to make $1m with crypto?

Japan’s Metaplanet Buys Another $26M in Bitcoin Amid Tariff Market Uncertainty

Has Ethereum Price Bottomed? 3 Reason Why ETH Could Crash More

Michael Saylor Teases New Bitcoin Buy After Strategy’s $7.69 Billion Q1 BTC Buying Spree

Crypto markets ‘relatively orderly’ despite Trump tariff chaos: NYDIG

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x