Bitcoin

Why is Bitcoin Price Going Up? Trump’s Crypto Executive Order Could Spark $150K Rally in March

Published

1 month agoon

By

admin

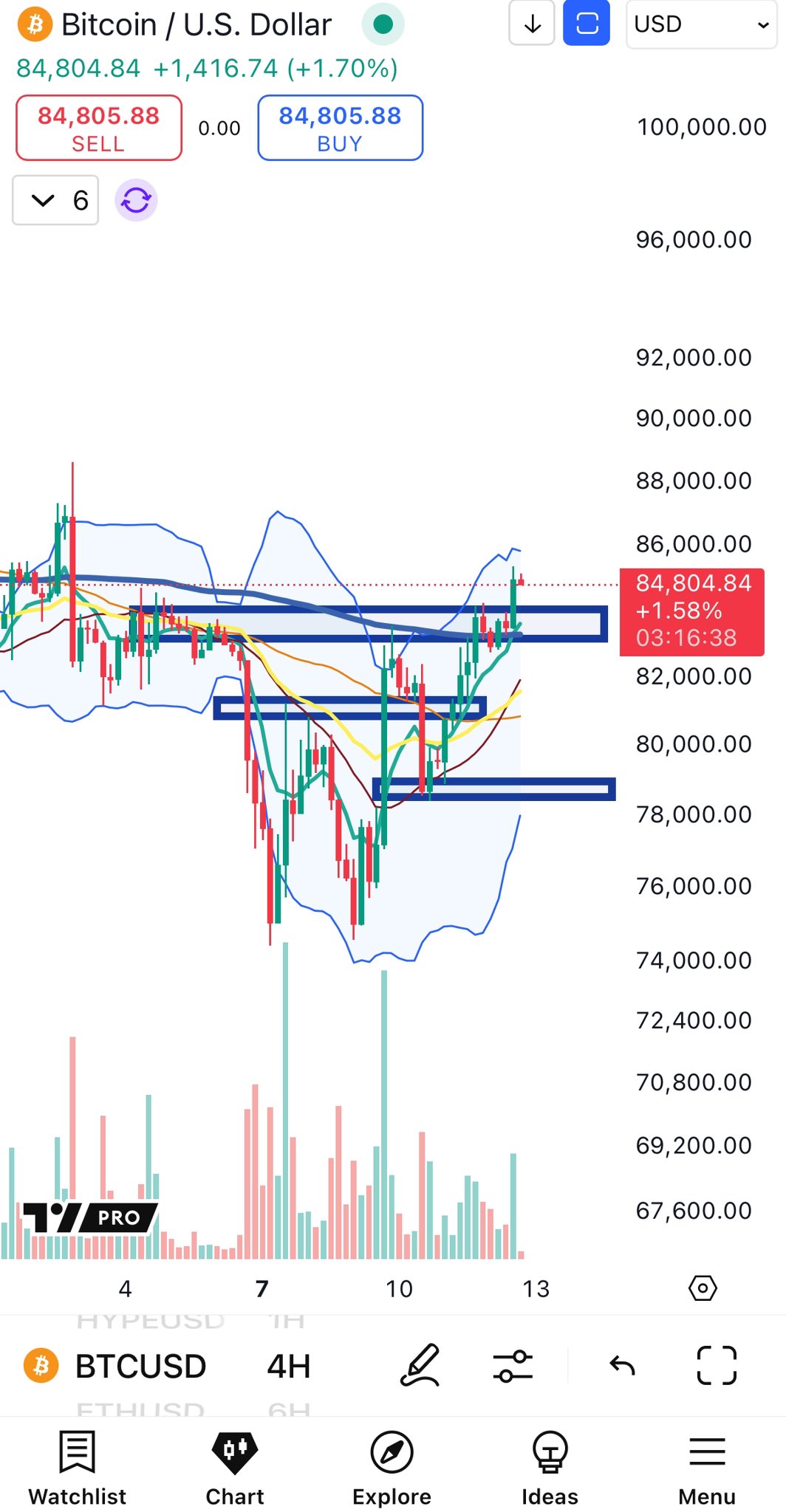

Bitcoin price has rebounded 10% in the last 48 hours, reclaiming territory above $85,000 on Sunday, March 2, after plunging to a 120-day low of around $78,200 on Friday. Key technical indicators suggest BTC could be setting up for a positive start to March 2025.

Why is Bitcoin Price Going Up Today?

Bitcoin surged 10% over the weekend, largely driven by President Trump’s executive order to advance a Crypto Strategic Reserve and investors capitalizing on last week’s overheated market liquidations. The move coincided with the imminent imposition of tariffs on Canada and Mexico on March 1, fueling further demand as traders anticipated BTC’s role as a hedge against macroeconomic uncertainties.

Bitcoin (BTC) Makes $90K rebound as Bulls Buy-in at the Bottom

After shedding over 25% of its value in February, Bitcoin found relief over the weekend as strategic buyers entered the market. The price downturn had reached its lowest point on February 28, plunging to a 120-day low of $78,200.

Trump’s decision to impose tariffs on imports from Canada and Mexico sparked a global retraction of capital from risk assets, leading to double-digit declines in major indices such as the S&P 500, Japan’s Nikkei, and Germany’s DAX in the week leading up to the March 1 tariff implementation date.

Notably, Bitcoin price bottomed out Feb 28, when prices plunged to a 120-day lows around $78,200.

Market data observed over the weekend shows that strategic investors swooped at the bottom to buy into key assets at the cusp of the March 1 tariff date. Hence, BTC price received a major boost, climbing from 120-day lows recorded on Friday, to close trading for Saturday just above $85,000.

Trump Gives Green Light for Crypto Strategic Reserve

After reclaiming the $86,000 level in early European trading, Bitcoin saw another surge as U.S. President Donald Trump issued an executive order establishing a Crypto Strategic Reserve.

According to an official announcement on the Trump-owned Truth Social platform, the reserve will initially include Bitcoin (BTC), Solana (SOL), Ripple (XRP), and Cardano (ADA), reflecting a diversified approach to U.S. digital asset holdings. This decision aligns with Trump’s broader pro-crypto stance and signals a formal recognition of digital assets within the U.S. financial system.

Within an hour of Trump’s announcement, Bitcoin surged an additional 3%, briefly surpassing $91,000 at press time on Sunday March 2.

How Will Trump’s Crypto Strategic Reserve Impact BTC Price?

Taking a cue from nations such as El Salvador and Bhutan, which have incorporated Bitcoin into their national balance sheets, many analysts expected BTC to be the exclusive asset in the U.S. reserve.

However, Trump’s decision to include SOL, XRP, and ADA mitigates concentration risk while allowing the U.S. to benefit from the unique value propositions of each project.

Long-Term Gains to Mitigate Short-Term Dip in BTC Market Dominance

By spreading capital across four crypto assets, BTC is expected to see less upside than if it were the sole asset. While this may temporarily reduce Bitcoin’s market dominance, the long-term gains from a stronger, more resilient sector could drive BTC past $150,000 in the mid-to-long term

In the short term, Bitcoin could see a brief pullback in relative market share as capital flows into newly included assets. However, the broader legitimacy conferred by a U.S.-backed reserve is likely to enhance institutional confidence, solidifying Bitcoin’s long-term growth prospects.

BTC Price Forecast: $100K Breakout ahead as SHORT traders fold on Trump’s announcement

After last-weeks bloodbath, Bitcoin price forecast charts are now leaning bullish, with technical indicators pointing toward a potential breakout past $100,000 as short traders face increasing pressure. The 12-hour chart reveals a strong 16.84% rebound in just over two days, with BTC climbing from lows of $78,200 to reclaim $90,558.

This recovery aligns with a surge in trading volume, indicating renewed investor confidence. The MACD indicator has crossed bullishly, with the blue MACD line breaking above the signal line, signaling a shift in momentum.

As Bitcoin price approaches key suppport levels near $100,000 , Short traders, who capitalized on February’s steep decline, are unlikely to put up strong resistance, considering the current active Bitcoin price catalyst has the backing of the U.S. government.

Although unlikely, a bearish scenario could emerge if BTC fails to close above $88,000, triggering a new wave of liquidations. However, the momentum favors buyers, and with shorts unwinding, BTC could quickly surge past $95,000 before testing the critical $100,000 psychological level.

Frequently Asked Questions (FAQs)

Bitcoin surged 10% after Trump’s Crypto Strategic Reserve announcement boosted demand.

Trump’s executive order established a U.S. digital asset reserve, initially holding BTC, SOL, XRP, and ADA to support the crypto sector.

If bullish momentum continues and short sellers fold, BTC could surpass $100,000, driven by institutional interest and government backing.

ibrahim

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

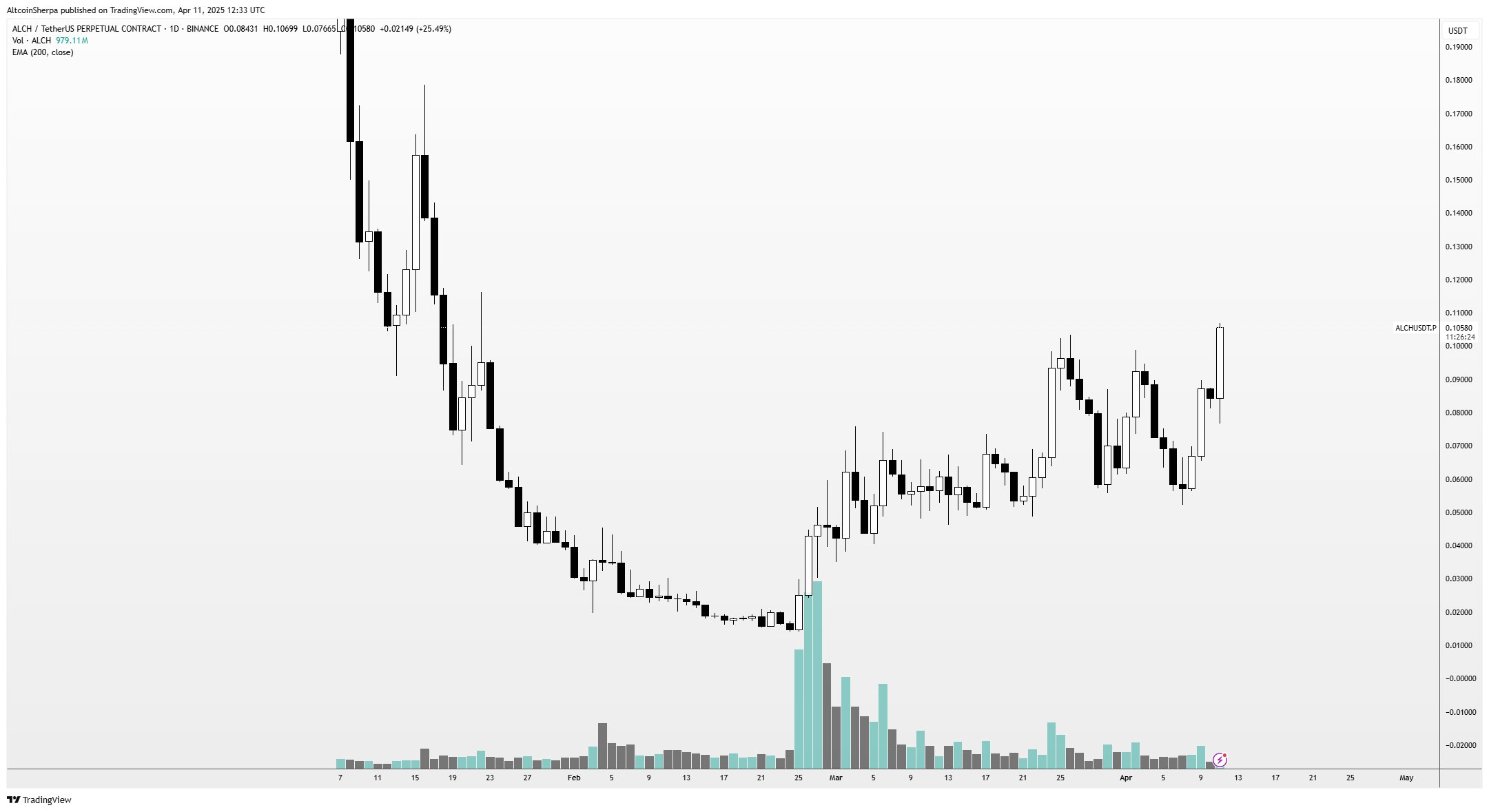

ALCH

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Published

3 hours agoon

April 14, 2025By

admin

A closely followed crypto analyst believes one meme token operating on Solana (SOL) is in the early stages of a market recovery.

Pseudonymous analyst Altcoin Sherpa tells his 243,800 followers on the social media platform X that he’s bullish on the memecoin Bonk (BONK).

The trader shares a chart suggesting that BONK will face resistance at the $0.000012 level before printing a bullish higher low setup and rallying to his target above $0.0000145.

“BONK is looking strong in the short term, and should go higher. Should be a pullback around the 200 EMA (exponential moving average) on the four-hour chart but still, I think this has pulled back enough to where any buying down here is probably reasonable.”

At time of writing, BONK is worth $0.00001376.

Turning to the low-cap altcoin Alchemist AI (ALCH), the analyst says the coin appears to be in an uptrend and that he’s waiting for potential dips to accumulate the asset.

ALCH is an artificial intelligence (AI)-based crypto project that allows users with no coding skills to generate codes by providing natural language descriptions.

Says Altcoin Sherpa,

“ALCH still seems like a really strong chart, don’t see it being mentioned much. I think it’s basically taken the place of ARC; a super volatile AI coin that moves 20% a day. Not in it but traded it a lot before; will look to buy dips.”

At time of writing, ALCH is the 431st-largest crypto asset by market cap, trading at $0.109.

Looking at Bitcoin, Altcoin Sherpa thinks that BTC will continue to consolidate within a large trading range in the short to mid-term.

“Expecting there is some sort of chop between $70,000-$90,000 over the next several weeks for BTC. Relative bottom probably in, but still some more consolidation to come.”

At time of writing, Bitcoin is trading for $85,366.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

24/7 Cryptocurrency News

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

Published

11 hours agoon

April 13, 2025By

admin

MicroStrategy is lacing up for a potential Bitcoin purchase after Michael Saylor flashed the tell-tale buy signal. The incoming purchase will be the company’s first in Q2 after pausing Bitcoin purchases at the start of April in an eyebrow-raising move.

Michael Saylor Flashes Bitcoin Buy Signal

MicroStrategy CEO Michael Saylor has dropped clues that the software company will continue its Bitcoin accumulation spree. In an X post, Saylor shared MicroStrategy’s portfolio tracker revealing the company’s Bitcoin holdings and valuations.

Michael Saylor’s previous posts sharing Microstrategy’s portfolio tracker over the weekend have resulted in purchases at the start of the week. Investors are lapping up Saylor’s portfolio tracker post and the accompanying caption as cues for a BTC purchase on Monday.

“No tariffs on Orange Dots,” said Saylor, taking a jibe at brewing tariff wars between the US and China.

MicroStrategy had previously halted its Bitcoin purchase spree at the start of April leading to a slump in MSTR price. At the time, there was significant chatter that MicroStrategy may be forced to offload its Bitcoin holdings to cover obligations following a dip in prices.

Per the portfolio tracker, MicroStrategy holds 528,185 BTC on its balance sheet valued at $44.7 billion. Michael Saylor hinting at a potential Bitcoin purchase follows a small dip in prices with BTC holding the $83K mark.

Will Bitcoin Price Rally?

Saylor’s hint at buying Bitcoin has triggered a small bump in prices as the top cryptocurrency surpassed $83K. However, an actual purchase will trigger a significant price action for BTC in line with previous accumulations.

MicroStrategy’s last Bitcoin purchase of 22,048 BTC jolted the markets in line with investors’ expectations. However, there are fears that macroeconomic events like the US-China tariff war may affect a potential BTC rally following MicroStrategy’s incoming purchase.

Bitcoin price has rebounded after a previous bloodbath, sparking fresh optimism in the markets. Crypto Joao Wedson predicts that Bitcoin is not out of the woods yet and a grim drop to $65K is still a possibility for the top cryptocurrency.

“We’re not ruling out the possibility of the price dipping below $65K, as several metrics point to that region as strong support – such as the True Market Mean Price and Alpha Price, both sitting exactly around $64,700,” said Wedson.

Crypto analyst Doctor Profit warns that a BTC price drop to these levels may force MicroStrategy to sell MSTR to avoid liquidation.

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Crypto Analyst Says Bitcoin Back in Business, Calls for BTC Uptrend if One Support Level Holds

Published

19 hours agoon

April 13, 2025By

admin

A crypto strategist who accurately called Bitcoin’s collapse below $80,000 believes that BTC’s long-term uptrend will remain intact if it stays above a key price area.

In a new strategy session, pseudonymous analyst Cheds tells his 49,800 YouTube subscribers that Bitcoin appears to have broken out of a W pattern on the four-hour chart.

A W pattern is typically seen as a bullish reversal structure, as it suggests that an asset has printed a price floor after bouncing from a key support level twice.

“We had a break of the W and then a throwback, a throwback being a bullish retest from above. This looks pretty conducive, and this type of price action tells me, ‘Okay, we might be front running $72,000.’

Giving me a little bit of a confidence was a shift in equities markets, and the idea that price was at the MA (moving average) 50, and that’s been support.”

Cheds also says that Bitcoin will likely see higher prices as long as its immediate support level between $78,500 and $81,000 holds.

“Regain $81,000 and we’re back in business… Back above $81,000, we’re back with the idea of regaining that low time frame pivot corresponding with the high time frame support at the MA50, and with the idea that the bulls are going to recapture the trend, which is the rising MA200.”

At time of writing, Bitcoin is trading at $85,301.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Bitcoin price tags $86K as Trump tariff relief boosts breakout odds

Where Top VCs Think Crypto x AI Is Headed Next

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: