layer 1

Why is Solana down by 30% from its 2024 high?

Published

4 months agoon

By

admin

Solana price has remained in a deep bear market, falling by over 30% from its highest point in 2024.

Solana (SOL), the fifth-largest cryptocurrency in the industry, was trading at $145, down from its year-to-date high of $210. Its valuation has retreated from a YTD high of $86 billion to $68 billion.

SOL is in a bear market because of its correlation with Bitcoin (BTC) and other altcoins. Bitcoin has dropped by almost 20% from the YTD high while coins like Ethereum (ETH), Avalanche (AVAX), and Cardano (ADA) are down by over 30%.

Altcoins like Solana typically make bigger moves than Bitcoin. They perform better when Bitcoin is rising and significantly underperform when it is in a downtrend. For example, BTC rose by 70% between Jan. 1 and March 24, while SOL and ETH rose by over 80% during the same period.

Solana has also retreated as it faces substantial competition from Tron (TRX), which recently launched SunPump, a meme coin generator. The DEX volume on Solana in the past seven days has fallen by almost 9% while Tron’s has risen by over 210% to $1.70 billion.

Most of Solana’s meme coins have also retreated. Dogwifhat has dropped by almost 70% from its highest level this year, while Book of Meme (BOME) has fallen by 80% from its all-time high.

Tron has also overtaken Solana in DeFi total value locked, the number of active addresses, and stablecoins. Tron has over $8.3 billion in assets, 2.47 million in addresses, and almost $60 billion in stablecoins. In comparison, Solana has $5.16 billion, 1.74 million, and $3.9 billion, respectively.

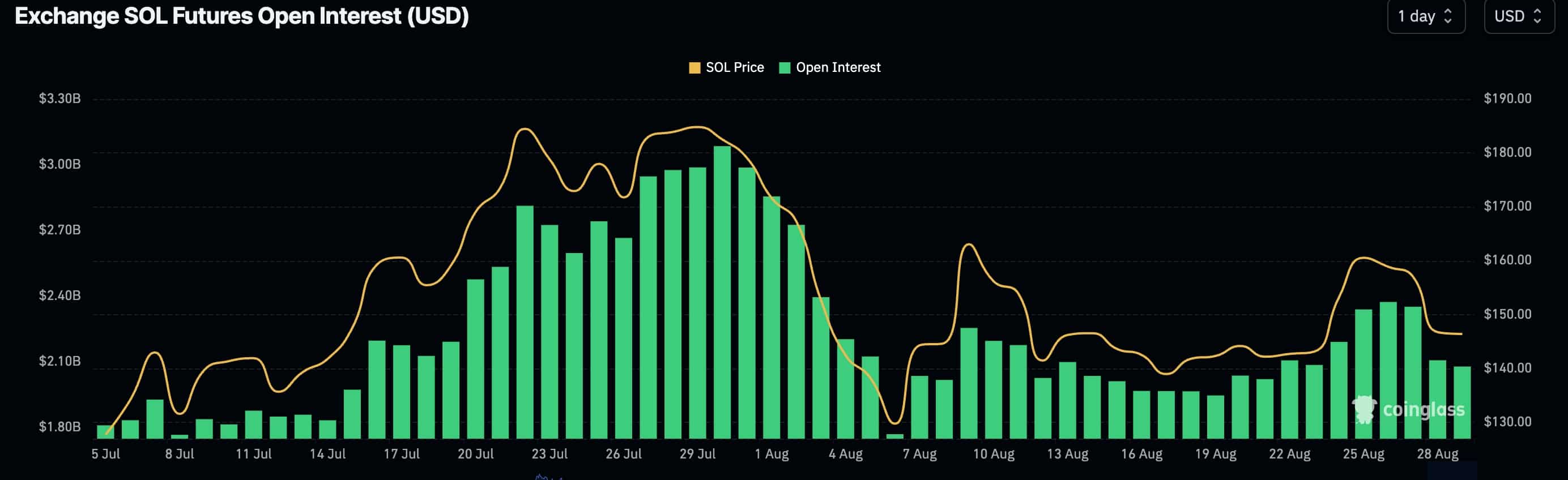

Solana’s futures open interest has fallen

Meanwhile, Solana’s open interest in the futures market has been in a downtrend. Most recently, the interest peaked at $3 billion in July and has pulled back to $2 billion, signaling waning demand.

Solana has also dropped because of the ongoing performance of spot Ethereum ETFs. The latest data shows that they have not become popular. They have had cumulative outflows of $481 million and have shed assets in five of the last six weeks.

Therefore, if the trend continues, there is a likelihood that companies like Blackrock, Fidelity, and Franklin Templeton will not apply for a spot Solana ETF. The SEC has also been reluctant to approve these funds. Earlier this month, the agency turned down Cboe Global Markets’ 19b-4 filing for a Solana fund.

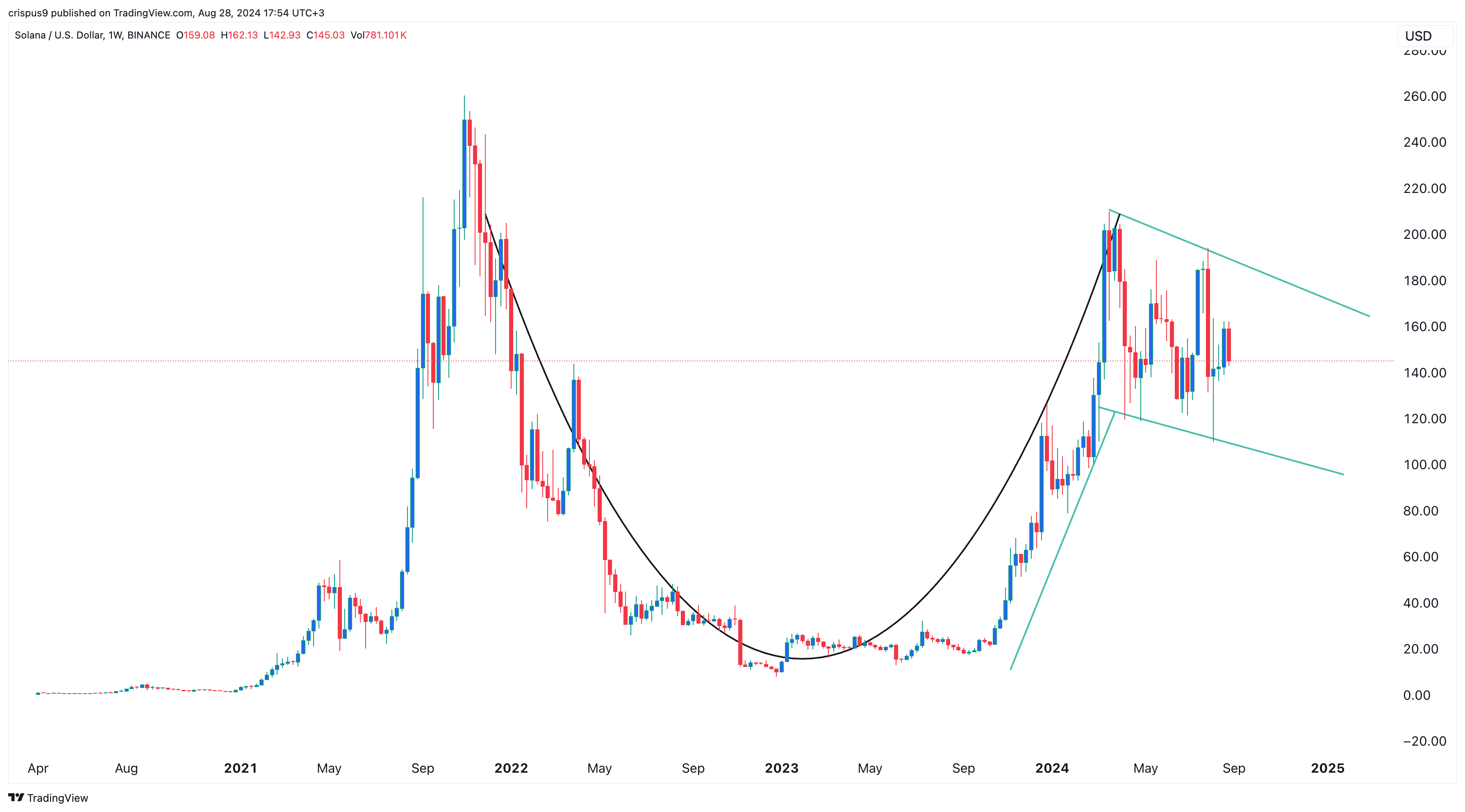

Technically, as shown above, the pullback is likely part of the formation of a bullish flag pattern. It is also part of the hand section of the cup and handle pattern on the weekly chart. If these patterns work out well, Solana will likely bounce back later this year.

Source link

You may like

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

layer 1

Cardano price forms rare pattern pointing to a Santa Claus rally

Published

6 days agoon

December 16, 2024By

admin

Cardano’s price has remained sideways this month, but a rare chart pattern indicates a potential comeback in the coming weeks.

Cardano (ADA), the popular layer-1 cryptocurrency, is trading at $1.06, down nearly 20% from its highest level this year.

The pullback followed a rally that pushed the coin to a multi-year high of $1.327 in November during the crypto bull run. This decline mirrors the performance of other cryptocurrencies, like Avalanche (AVAX) and Binance Coin (BNB), which have also retreated from their year-to-date highs.

Cardano’s drop coincided with a decline in the total value locked (TVL) within its decentralized finance ecosystem. According to DeFi Llama, Cardano protocols now hold over $597 million in total assets, down from last month’s high of nearly $700 million. The largest protocols in its ecosystem include Liqwid, Minswap, Indigo, and Splash Protocol.

Whale activity for Cardano has also slowed, and the number of active addresses over the past 24 hours is below 43,000. Meanwhile, open interest in the futures market has continued to decline.

However, several catalysts may push Cardano’s price higher in the short term. For instance, rising crypto demand—highlighted by Bitcoin’s surge past $106,000—could support ADA. Additionally, Cardano may benefit from a potential spot ADA ETF listing as early as 2025.

In the near term, the coin could also experience a boost from the “Santa Claus rally,” a phenomenon where asset prices tend to rise ahead of Christmas Day.

Cardano price has formed a rare chart pattern

The daily chart shows that the ADA price staged a strong comeback in November after Donald Trump won the election. It has since slowly formed a bullish pennant chart pattern, consisting of a long vertical line and a symmetrical triangle. This pattern is nearing its confluence point, suggesting that a bullish breakout could occur.

Cardano has also formed a golden cross pattern, where the 50-day and 200-day Exponential Moving Averages have made a bullish crossover.

As a result, Cardano is likely to see a strong bullish breakout in the coming days. If this happens, the coin could rise to $1.325, its highest point this year, representing a 23% increase from its current level. A drop below the support at $1.00, however, would invalidate the bullish outlook.

Source link

Blockchain

Alchemy Pay plans to launch its own layer-1 blockchain

Published

2 weeks agoon

December 11, 2024By

admin

Crypto payments provider Alchemy Pay has announced plans to launch its own layer-1 blockchain, which the company says will target large-scale business applications.

Alchemy Pay (ACH) notes that the layer-1 blockchain will be dubbed Alchemy Chain and built on the Solana (SOL) Virtual Machine architecture. Per an announcement on Dec. 11, the new L1 will offer a payment system allowing users to transact with fiat and crypto.

The platform will also offer a user-friendly ecosystem bridging on-chain and off-chain processes, chain abstraction, a stablecoin revenue mechanism, and yield generation. Additionally, the blockchain network will integrate a layer-2 solution, as outlined in the company’s blog post.

Alchemy Chain is set to launch with a meme launchpad and a meme Telegram bot, aiming to tap into the growing popularity of meme-based projects.

The company revealed initial plans for the L1 blockchain in late October 2024, news that saw the price of ACH jump double-digits.

Latest details on the previously disclosed objective has also seen ACH price record a significant spike, with the token up 14%. However, as well as the project related news, its price was trading higher as Bitcoin (BTC) spiked to $100k amid fresh recovery by bulls.

In recent months, several platforms have looked to launch own layer-1 and layer-2 chains.

Coinbase unveiled the mainnet of Base in August 2023, while Chiliz revealed its own blockchain in February. World, formerly Worldcoin, partnered with Alchemy Pay to launch World Chain. Recently, crypto exchange Kraken disclosed plans to debut its L1 blockchain in 2025.

Source link

layer 1

Crypto expert explains why VeChain price is set to soar

Published

2 weeks agoon

December 5, 2024By

admin

VeChain price continued its strong bull run, reaching its highest level in over two years as the altcoin index rose.

VeChain (VET) climbed to $0.080, marking a 270% increase from its lowest level this year and pushing its market cap to over $5.7 billion. Its rally aligns with other cryptocurrencies that surged during the 2021 bull run, such as EOS, NEO, and Zilliqa.

Some analysts predict further upside for the coin, highlighting its ecosystem growth and practical applications. In a statement, Michel van de Poppe noted the VeBetter platform, which has completed over 335,000 transactions, and its partnership with UFC, a popular U.S. sports organization.

Another catalyst for VeChain’s price surge is Grayscale’s recent decision to list it as an asset “under consideration.” This suggests the company might launch a fund similar to its Grayscale Bitcoin Trust. Other assets under consideration include Bittensor, Chainlink, Filecoin, and The Graph.

In an X post, crypto analyst Gremlin Mystery predicted VeChain’s price could jump to $0.175, representing a 150% upside from the current level, citing strong technical indicators.

A potential fundamental risk for the VeChain price is that the amount of assets in its DeFi ecosystem has been quite small. It has a DeFi total value locked of $877,058, making it one of the smallest layer 1 networks in the crypto industry.

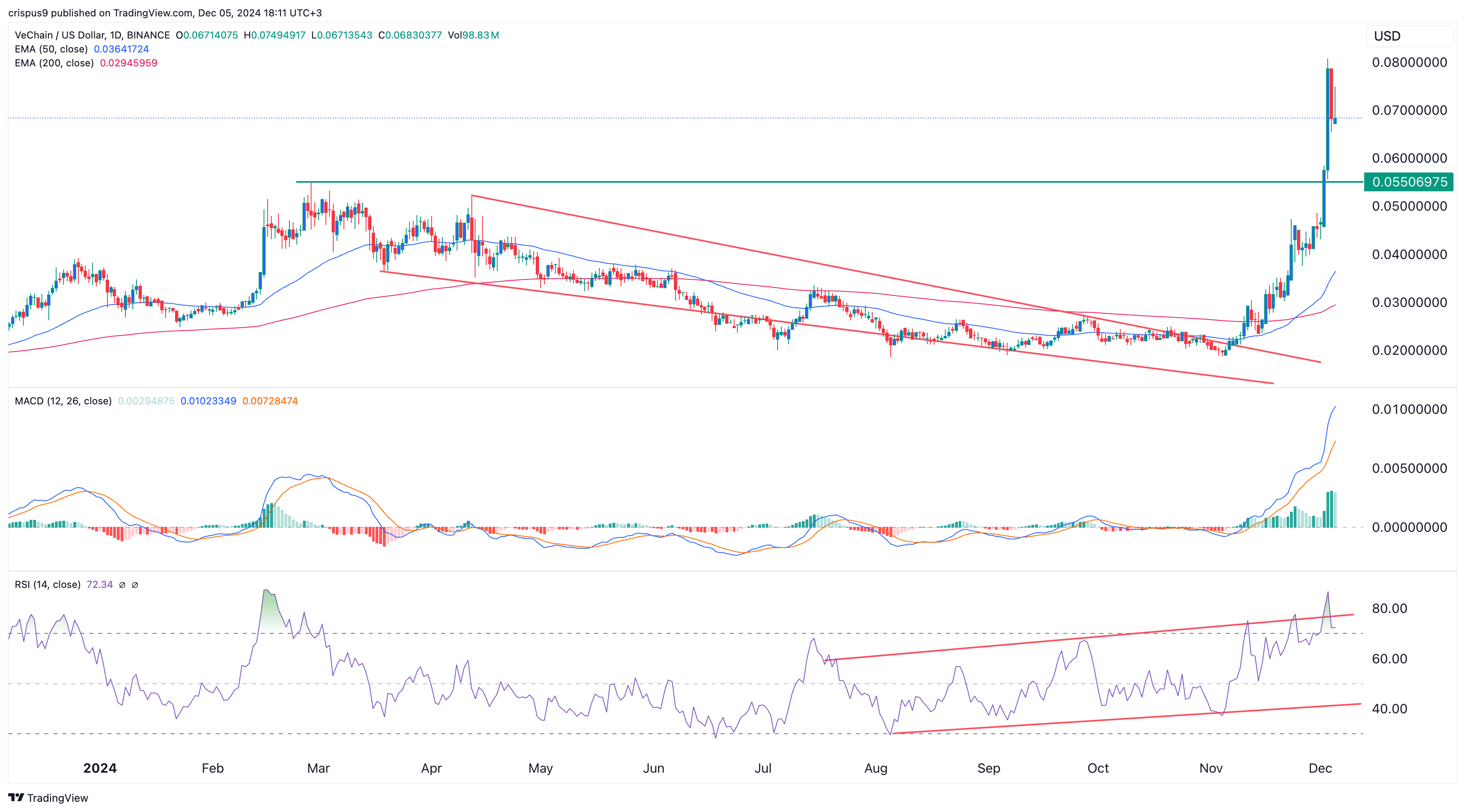

VeChain price analysis

VeChain’s price has rebounded in recent weeks, rising over 270% from its November lows. This recovery followed months of forming a falling wedge pattern, a widely recognized bullish signal.

The coin has also formed a golden cross pattern as the 200-day and 50-day moving averages crossed. Additionally, it moved above the key resistance level at $0.0550, its February 2024 high.

Therefore, the likely scenario is where the VeChain price drops and retests the support at $0.0550 and then resumes the uptrend. This pattern is known as a break and retest, and is a highly popular continuation signs.

Further gains will be confirmed if the coin climbs past $0.080, its high for the week. If successful, VeChain could move on to test the $0.10 level.

Source link

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Ripple Transfers 90M Coins, What’s Happening?

Filecoin, Monero, and Lunex dominate smart investor portfolios

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

How Low Will Ethereum Price Go By The End of December?

Analyst says buying this altcoin at $0.15 could be as profitable as buying ETH at $0.66

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential