Altcoin

Will Bitcoin, altcoins sustain momentum after Powell speech?

Published

4 months agoon

By

admin

Bitcoin and altcoins staged a strong comeback after Jerome Powell, the Federal Reserve chairman, hinted that interest rates would start falling in September.

Bitcoin (BTC) jumped to $64,000 on Aug. 24 while Ethereum (ETH) pushed to $2,765. The total market cap of all coins rose by almost 5% to over $2.26.

The same trend happened in the stock market, where key indices like the Dow Jones, S&P 500, and the Nasdaq 100 approached their all-time highs. Still, there is a risk that gains in the stock and crypto market will be short-lived.

Buy the rumor, sell the news

The market was already factoring in rate cuts for September after the recent weaker-than-expected U.S. jobs numbers. The probability in the Fed Rate Monitor tool has been above 80% in the past three weeks.

Therefore, Powell’s statement was just a clue as to what to expect at the next meeting, scheduled for Sept. 18. As such, with a rate cut fully priced in, there is a risk that stocks and crypto will retreat as investors sell the news.

This trend has happened several times. For example, Bitcoin dropped by almost 10% after halving, while Ether has fallen by double digits since the Securities and Exchange Commission approved ETFs.

Stocks typically drop sharply after the Fed starts cutting rates. Geiger Capital, a conservative-leaning commentator on X.com, recalled 2001 and 2002 as examples.

🔸First Rate Cut – Jan 3, 2001

– S&P 500 fell ~39% next 448 days

– Unemployment rose another 2.1%🔸First Rate Cut – Sep 18, 2007

– S&P 500 fell ~54% next 372 days

– Unemployment rose another 5.3%🔸First Rate Cut – Sep 18, 2024

– ?

– ? pic.twitter.com/ByaP9mtGq4— Geiger Capital (@Geiger_Capital) August 23, 2024

On the positive side, stocks have done well when the Fed starts cuts, as we saw in 2020 during the early stages of the Covid-19 pandemic.

Another positive is that these cuts are coming at a time when American companies are reporting strong earnings growth.

Money markets are seeing inflows

Another reason why cryptocurrencies may retreat after the Fed starts cutting is that low-risk money market funds are still seeing inflows.

Data shows that these funds had over $90 billion in net inflows in the first half of August even as expectations of rate cuts rose. These funds now hold over $6.2 trillion in assets.

The theory has been that risky assets like crypto and stocks will see more inflows as money market investors capitulate.

This rotation will likely happen, but it will take time since interest rate cuts will likely be gradual.

Bitcoin is still forming lower highs

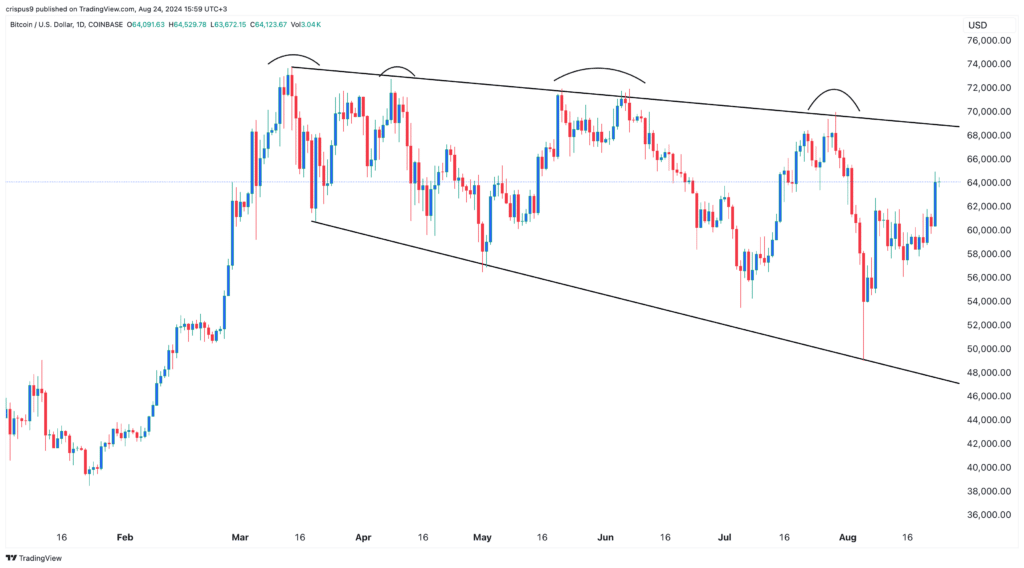

Bitcoin rebounded to $64,000 after falling to $49,000 earlier this month. However, this price action is still not yet a complete breakout because it has remained in this range in the past few months.

Notably, Bitcoin has been forming a series of lower highs since March. The first high was at $73,800 followed by $72,000 and $70,000. As such, a complete bullish breakout will be confirmed if the coin clears the first high at $73,800. Before that happens, there is a risk that Bitcoin will resume the bearish trend.

On the positive side, the series of lower highs and lower lows has resulted in a falling broadening wedge pattern, a popular bullish sign.

Source link

You may like

Will Dogecoin Price Hit $20 On Its Next Leg Up?

Dogecoin Primed for a Price Rebound As Crypto Whales Accumulate DOGE, According to Analyst

XYZVerse tops the list with promising returns

Engineer Predicts Biggest Bull Run Coming Soon for Bitcoin; Here’s All

HSBC analysts reveal which one will reach $10 by January 1, 2025

Crypto and AI Hardware That Turned Heads in 2024

Altcoin

Why meme coins are fading amidst Bitcoin institutional adoption and gains this cycle

Published

3 days agoon

December 26, 2024By

admin

Meme coins ranked among the most popular crypto narratives of 2024, creating a divide between crypto tokens. Bitcoin stands out among top crypto tokens with 125% year-to-date gains, and the meme coin category, or the “other tokens”, hit a key milestone, crossing a market capitalization of $100 billion.

Dogecoin (DOGE), Shiba Inu (SHIB) and Pepe (PEPE), the top three meme coins, have erased between 11% and 13% of their value in the past week. Bitcoin consolidates close to $95,000, nearly 12% below its all-time high of $108,353.

Bitcoin vs meme coins, most popular narrative of 2024

Meme coins captured the attention of most crypto traders and emerged as a popular narrative this year. A CoinGecko report updated on Monday notes that the meme coin narrative captured a combined 30.67% of global investor interest.

The report highlights that almost a third of crypto narrative interest this year was focused on speculative gains from meme coins. Traders placed a lower emphasis on fundamentals and turned their attention and capital towards dog and cat-related meme coins, pop culture references and internet personality-themed meme tokens.

Meme coins have enjoyed a 6% year-on-year increase in interest from crypto market participants. While Bitcoin garnered institutional attention and capital allocation following the approval of Spot BTC ETFs in the US, four meme coin-based trends ranked among the top 20 narratives in crypto.

Solana (SOL), Base, Artificial intelligence and cat-themed meme coins garnered between 14% and 8% of interest among crypto narratives.

With meme coins cementing their place as a trending token category and trending this cycle, catalysts like institutional allocation and ETF approval could pave the way for further gains for holders.

Base, Solana, XRP memes dominate over blue-chip memes in speculative gains

In the first week of December, XRP-based meme coins yielded gains for holders amidst rising relevance and demand for the XRP Ledger and its native token XRP. Similarly, Solana and Base-based meme coins have secured a rank in the top 20 cryptocurrency narratives of the year, dominating the popularity of blue-chip meme coins.

Dogecoin, SHIB and PEPE are typically considered blue-chip memes, with a market capitalization between $7 and $46 billion, as seen on CoinGecko. The top 3 tokens in the meme coin category observed a spike in active addresses and activity from traders within the first two weeks of December.

In the last seven days, the top 3 tokens have erased double-digit value, according to CoinGecko data. Several other meme tokens have accumulated double-digit losses, barring Pudgy Penguins (PENGU).

Institutional meme coin holdings tripled this year

The wave of meme coin adoption drove institutions to tripe their holdings in the category. From February to March 2024, institutional investors’ spot holdings of memecoins climbed from $62.5 million to $204.8 million.

This marks a 226% surge, a significant spike in interest in the memecoin market, according to Bybit’s report on institutional investment in meme coins.

In the Bybit report, Eugene Cheung, Head of Institutions of Bybit, is quoted as saying:

“Our report ‘Beyond the Hype’ shows that institutional and retail investors are actively leveraging the opportunities presented by the memecoin market. The strategic agility of institutions and the dynamic management by retail investors reflect a sophisticated engagement with these assets. We invite everyone to delve into the full report to understand these important dynamics better.”

Dogecoin ETF likely in 2025?

Rising institutional adoption has raised questions about the likelihood of approval from the U.S. financial regulator, the Securities and Exchange Commission, for meme coin ETFs. Nate Geraci, President of ETFStore expressed shock that an issuer has yet to file for a Dogecoin ETF, both in and outside of the U.S.

Geraci believes the only possible downside of such a filing would be that it would mark a futile attempt and end up as a marketing expense for an issuer. The President of the ETFStore commented on the “DOGE” ticker since it is the ticker for the largest meme coin and would likely hold the highest relevance and demand among issuers in the future,

Shocked an ETF issuer hasn’t filed for Dogecoin ETF yet…

What’s the downside?

Worst case, it’s a marketing expense.

Wonder which issuer is sitting on the “DOGE” ticker.

— Nate Geraci (@NateGeraci) December 23, 2024

As the SEC greenlights the Bitcoin-Ethereum hybrid ETF, DOGE traders have hopes for a Dogecoin ETF approval in 2025.

Bitcoin and meme coin divide runs deep

Ruslan Lienkha, Chief of markets at YouHodler told Crypto.news in an exclusive interview:

“Dogecoin’s recent performance appears primarily speculative, driven by its association with Elon Musk, rather than any underlying fundamentals, as it still lacks substantial real-world use cases. However, a potential utility could develop in the future.”

Lienkha comments on what divides Dogecoin and similar meme coins from Bitcoin. While Bitcoin has gained acceptance as “digital gold” and hedge against the devaluation of a fiat currency, Dogecoin and the like are considered speculative tokens.

The Bitcoin and meme coin divide runs deep and could influence the approval of a meme coin ETF, further investment from institutional investors and retail participation in the category in the second leg of the bull market.

Typically, a drawdown in Bitcoin ushers a steeper and market-wide correction, wiping recent gains from meme coins and hitting the market capitalization of the category negatively. The correlation with Bitcoin could continue to drag down meme coins, and in every instance, the largest crypto crashes or reacts to a market-moving event during this cycle.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Altcoin

Christmas gift as MOVE, BGB, ZEC lead altcoin gainers

Published

3 days agoon

December 25, 2024By

admin

Cryptocurrencies, including Movement, Bitget Token and Zcash, celebrated massive gains as Santa’s gifts showed in significant price rallies on Dec. 25.

With Bitcoin (BTC) reclaiming some footing after trading to near $92,000 on Dec. 23, the gains to above $98k also cascaded to some altcoins.

Buoyed by various factors and catalysts, some alts recorded more than 30% spikes.

Among the top coins, Movement (MOVE), Bitget Token (BGB) and Zcash (ZEC) surged by more than 31%, 18% and 9% respectively.

The altcoins led the 100 largest cryptocurrencies by market cap. Gains for most altcoins saw the overall market cap hold above $3.5 trillion — despite a 2% dip in 24 hours.

Crypto’s daily trading volume stood at $156 billion, BTC dominance at 54.5% and the crypto greed & fear index at 62. This latter metric points to overall sentiment remaining bullish amid a potential return to greater risk appetite.

Bitcoin bull and mastermind of the MicroStrategy plan Michael Saylor shared his optimism.

Earlier, analysts at QCP Capital summed up the market outlook. According to them, the next few weeks could see altcoins rally amid capital rotation.

“BTC remains range-bound below 100k, and history shows we might see the typical quarter-end volatility selloff post-expiry. But if BTC breaks through 100k, volatility could hold firm and spark fresh momentum. Meanwhile, altcoins could steal the spotlight. With #BTC dominance at 58%, a drop below this level might confirm a rotation into alts — similar to what we saw last month with ETHBTC bouncing off 0.032 support.”

QCP

MOVE, ZEC, and BGB tokens, as well as other highlight performers on the day, included Fartcoin, Solana protocol Raydium, and Virtuals Protocol.

On the other end, top losers in the past 24 hours included Hyperliquid, Stellar and Celestia.

Source link

Altcoin

Goldman Sachs Considering Bitcoin is Exactly How Best Wallet Is Slated to Reach $4.4bn of the Non-Custodial Market

Published

3 weeks agoon

December 11, 2024By

admin

Sentiment from the head of a Wall Street giant signals good news for the cryptocurrency economy. Goldman Sachs CEO David Solomon has said that the investment banking major would evaluate trading cryptocurrencies should US regulations permit the bank to do so.

“At the moment, as a regulated banking institution, we’re not allowed to own a cryptocurrency like Bitcoin as a principal,” he said at a Reuters Next conference, held on Tuesday, 10 December.

“We give our clients advice around a variety of these technologies and these issues, and will continue to do that. But for the moment our ability to act in these markets is extremely limited from a regulatory perspective.”

Interestingly, Goldman Sachs disclosed in its recent US Securities and Exchange Commission (SEC) 13F filing that the company holds more than $700M in eight Bitcoin ETFs, as of September 20, 2024.

So, it would appear that at long last, corporate attitudes to crypto are finally changing. Even US President-elect Donald Trump has positioned himself as a champion of cryptocurrency. The launch of a strategic national crypto stockpile was among the promises made by Trump in the run-up to the 2024 election. Removing Gary Gensler – the nemesis of crypto companies due to his aggressive approach to crypto regulation – from his position as SEC Chairman was another.

A Green Light for Ripple’s Stablecoin Means Meme Coins Pump

The big news for the cryptocurrency economy keeps on rolling, as Ripple CEO Brad Garlinghouse recently announced that its $RLUSD stablecoin has been approved by the New York Department of Financial Services to go live. Pegged to the US dollar at a 1:1 ratio, $RLUSD will be supported by a combination of US dollar reserves, short-term US Treasury securities, and other liquid assets, mirroring Tether’s approach to backing. $RLUSD is set to be launched on the XRP ledger in Ethereum.

In all, the latest developments are great news for the economy, cryptocurrency holders, and the likes of Best Wallet. Powered by Best Wallet’s $BEST token – currently in presale with an impressive $3.34M already raised – Best Wallet plans to capture 40% of the crypto wallet market share by end-2026.

Best Wallet is mobile-first, fully non-custodial app supports thousands of cryptocurrencies, including the best meme coins, across 50 major blockchains. But it’s that non-custodial aspect that sets Best Wallet apart.

Most crypto wallets are controlled by centralized companies or exchanges, whereas Best Wallet gives users full control over their wallet. And that’s in addition to reduced transaction fees, early access to presales, and airdrops. It’s also the first crypto wallet to use Fireblocks’ MPC-CMP wallet technology, which adds high security, zero counterparty risk, and multi-blockchain support.

All things considered, we believe $BEST is worthwhile looking into. Investors have just under two days to secure $BEST at its current price of $0.23075 before the next price increase. Bear in mind, though, this article does not constitute financial advice, and it’s always important to DYOR.

Source link

Will Dogecoin Price Hit $20 On Its Next Leg Up?

Dogecoin Primed for a Price Rebound As Crypto Whales Accumulate DOGE, According to Analyst

XYZVerse tops the list with promising returns

Engineer Predicts Biggest Bull Run Coming Soon for Bitcoin; Here’s All

HSBC analysts reveal which one will reach $10 by January 1, 2025

Crypto and AI Hardware That Turned Heads in 2024

Bitcoin Clean Energy Usage Soar, Tesla To Accept BTC Payments?

Lightchain AI among the most talked-about token of the next bull run

DeFi Education Fund Sues US IRS Over Controversial Tax Rules

Bitcoin (BTC) Institutional Adoption Accelerates as ETF Filings Show Investor Appetite

BONK reclaims top Solana meme coin spot, dethrones PENGU

US and EU Banks Accelerate Stablecoin Plans Amid Regulatory Progress

A 20%-30% Correction Is ‘The Most Bullish Thing’ That Could Happen To Bitcoin – Analyst

Blockchain groups challenge new broker reporting rule

Who Is Elisa Rossi and What’s Her Role?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Altcoins5 months ago

Altcoins5 months agoEthereum Crash A Buying Opportunity? This Whale Thinks So