24/7 Cryptocurrency News

Will BTC Crash to $90K Again?

Published

3 months agoon

By

admin

Bitcoin price today trades at $100,236.0 on 12 PM after hitting a daily high of $102,528.0 today after a -0.67% move on December 13.

Bitcoin Price Today: New BTC ATH or $90K Revisit?

Regardless of this drop, Bitcoin price today is up -0.67% and trades at $100,236.0. After dropping 2% from the December 12 swing high of $102,636 BTC currently sits above a key support level, a breakdown of which could trigger another crash, but a bounce here could kickstart the bull run.

What will it be? A crash or a rally? Let’s explore.

Regardless of this drop, Bitcoin price today is up -0.67% and trades at $100,236.0.

*bitcoin price updated as of 12 PM.

Value of BTC trades at $100,236.0, bringing the year-to-date gain from 56% on October 20 to roughly 132% as of December 13. The YTD performance has slumped due to the recent BTC crash. Although many altcoins have shot up over triple digits, Bitcoin is catching up. Ethereum price’s YTD performance is lackluster, stands around 70%, and is well below BTC.

Although Bitcoin is the largest cryptocurrency by market capitalization, Bitcoin’s popularity is due to its first-mover advantage and its being a secure, decentralized network. In addition, many narratives, like digital gold, inflation hedges, and uncorrelated assets, have kept BTC at the forefront of the crypto market since its inception in 2009.

Bitcoin To End 2024 on Bullish Note

Industry veterans’ speculation of a bull run post-US elections was right, and Bitcoin is likely to end 2024 on a positive note. Historical returns show that Bitcoin has always performed massively in the fourth quarter.

With that said, Bitcoin’s market capitalization stands at $1,984.5 billion and is close to hitting the $2 trillion mark.

Bitcoin’s Market Capitalization

While Bitcoin’s market cap hovers around $1,984.5 billion, with Ethereum, the duo controls nearly 65% of the total cryptocurrency market capitalization. Despite the seven-month consolidation, Bitcoin’s $1.93 trillion market cap remains strong, anticipating it reaching $2 trillion before 2025.

BTC: A composition of 24-hour Trading Volume

Being the top crypto has its benefits; more people tend to flock toward the asset. Likewise, BTC’s 24-hour trading volume stands at $89.1 billion. Binance, one of the largest cryptocurrency exchanges, contributes a major portion of this volume. Binance’s share of BTC’s 24-hour trading volume comprises spot and perpetuals trading. While spot volume hovers around 11%, perpetual volume is 41%. Exchanges like OKX, Bitget, etc, follow Binance.

Notable Bitcoin Blockchain Upgrades

With a market cap of $1.93 trillion, it is necessary for the network to remain secure, decentralized, and scalable. This is possible by upgrading the Bitcoin network regularly.

Here are some notable upgrades the Bitcoin network has received or planned to receive since its inception in 2009.

Key Bitcoin Blockchain Upgrades Since 2009

Here are some key milestone upgrades to the Bitcoin network over the past decade.

2020-2024:

- Taproot Upgrade (2021): Improved Bitcoin’s smart contract functionality, allowing for more complex transactions and enhanced privacy.Muir Glacier Upgrade (2020): Delayed the “ice age” that would have slowed down the network, ensuring the continued smooth operation of Bitcoin.

2017-2019:

- Segregated Witness (SegWit) Upgrade (2017): Increased the block size limit, allowing for more transactions to be processed on the network, and improved the overall scalability of Bitcoin.

- Schnorr/Tapscript Upgrade (proposed): Aims to further improve the efficiency and scalability of Bitcoin transactions, but has not yet been activated.

- SegWit2x (canceled): A proposed upgrade that aimed to increase the block size limit, but was ultimately canceled due to lack of consensus.

2015-2016:

- Bitcoin Core 0.12.0 Upgrade (2016): Introduced several improvements, including better wallet management and enhanced security features.

- BIP66 Upgrade (2015): Standardized the way Bitcoin transactions are verified, improving the overall security and reliability of the network.

2013-2014:

- Bitcoin Core 0.9.0 Upgrade (2014): Introduced a new wallet format and improved the overall performance of the Bitcoin client.

- BIP0016 Upgrade (2013): Enabled the use of payment protocol, allowing for more efficient and secure transactions.

2010-2012:

- Pay-to-Script-Hash (P2SH) Upgrade (2012): Introduced a new type of transaction that allows for more complex payment scenarios, improving the overall flexibility of the Bitcoin network.

- Bitcoin Core 0.6.0 Upgrade (2011): Introduced several improvements, including better wallet management and enhanced security features.

2009-2010:

- Bitcoin Core 0.3.0 Upgrade (2009): One of the earliest upgrades to the Bitcoin network, introducing several key features and improvements.

Bitcoin Price Outlook For Next 30 Days

| Date | Price | Change |

|---|---|---|

| December 13, 2024 | 100998.37 | 0.16% |

| December 14, 2024 | 102758.25 | 1.91% |

| December 15, 2024 | 104782.66 | 3.92% |

| December 16, 2024 | 106864.87 | 5.98% |

| December 17, 2024 | 108594.33 | 7.7% |

| December 18, 2024 | 108687.68 | 7.79% |

| December 19, 2024 | 108639.64 | 7.74% |

| December 20, 2024 | 108903.09 | 8% |

| December 21, 2024 | 109232.09 | 8.33% |

| December 22, 2024 | 109167.27 | 8.27% |

| December 23, 2024 | 108940.17 | 8.04% |

| December 24, 2024 | 109321.25 | 8.42% |

| December 25, 2024 | 110896.54 | 9.98% |

| December 26, 2024 | 113335.70 | 12.4% |

| December 27, 2024 | 114283.15 | 13.34% |

| December 28, 2024 | 114378.05 | 13.43% |

| December 29, 2024 | 114111.23 | 13.17% |

| December 30, 2024 | 113893.80 | 12.95% |

| December 31, 2024 | 114149.69 | 13.21% |

| January 01, 2025 | 114944.55 | 14% |

| January 02, 2025 | 115458.30 | 14.51% |

| January 03, 2025 | 115560.92 | 14.61% |

| January 04, 2025 | 115299.93 | 14.35% |

| January 05, 2025 | 115004.10 | 14.06% |

| January 06, 2025 | 115054.93 | 14.11% |

| January 07, 2025 | 114168.15 | 13.23% |

| January 08, 2025 | 113281.31 | 12.35% |

| January 09, 2025 | 113495.47 | 12.56% |

| January 10, 2025 | 113583.63 | 12.65% |

| January 11, 2025 | 115176.09 | 14.23% |

Based on Coingape’s Bitcoin price prediction, investors can expect a double-digit rally that leads to a peak of $108,918 as of December 31. While there may be a brief correction, BTC’s trend remains bullish. Bitcoin Price Forecast Between 2025 and 2029

Bitcoin Price Outlook Between 2025 & 2029

| January | $100,962.21 | $114,476.62 | $107,719.42 | 73.3% |

| February | $100,926.05 | $114,575.20 | $107,750.62 | 73.3% |

| March | $100,889.88 | $114,673.77 | $107,781.83 | 73.4% |

| April | $100,853.72 | $114,772.34 | $107,813.03 | 73.4% |

| May | $100,817.56 | $114,870.91 | $107,844.24 | 73.5% |

| June | $100,781.40 | $114,969.49 | $107,875.44 | 73.5% |

| July | $100,745.23 | $115,068.06 | $107,906.65 | 73.6% |

| August | $100,709.07 | $115,166.63 | $107,937.85 | 73.6% |

| September | $100,672.91 | $115,265.20 | $107,969.06 | 73.7% |

| October | $100,636.75 | $115,363.78 | $108,000.26 | 73.7% |

| November | $100,600.58 | $115,462.35 | $108,031.47 | 73.8% |

| December | $100,564.42 | $115,560.92 | $108,062.67 | 73.8% |

| All Time | $100,763.31 | $115,018.77 | $107,891.04 | 73.5% |

| January | $103,347.14 | $117,495.84 | $112,679.45 | 81.2% |

| February | $106,129.85 | $119,430.77 | $117,296.23 | 88.7% |

| March | $108,912.57 | $121,365.69 | $121,913 | 96.1% |

| April | $111,695.28 | $123,300.61 | $126,529.78 | 103.5% |

| May | $114,478 | $125,235.54 | $131,146.56 | 110.9% |

| June | $117,260.71 | $127,170.46 | $135,763.34 | 118.4% |

| July | $120,043.43 | $129,105.38 | $140,380.11 | 125.8% |

| August | $122,826.14 | $131,040.31 | $144,996.89 | 133.2% |

| September | $125,608.86 | $132,975.23 | $149,613.67 | 140.6% |

| October | $128,391.57 | $134,910.15 | $154,230.45 | 148.1% |

| November | $131,174.29 | $136,845.08 | $158,847.22 | 155.5% |

| December | $133,957 | $138,780 | $163,464 | 162.9% |

| All Time | $118,652.07 | $128,137.92 | $138,071.72 | 122.1% |

| January | $139,801.17 | $144,684.75 | $169,276.92 | 172.3% |

| February | $145,645.33 | $150,589.50 | $175,089.83 | 181.6% |

| March | $151,489.50 | $156,494.25 | $180,902.75 | 191% |

| April | $157,333.67 | $162,399 | $186,715.67 | 200.3% |

| May | $163,177.83 | $168,303.75 | $192,528.58 | 209.7% |

| June | $169,022 | $174,208.50 | $198,341.50 | 219% |

| July | $174,866.17 | $180,113.25 | $204,154.42 | 228.4% |

| August | $180,710.33 | $186,018 | $209,967.33 | 237.7% |

| September | $186,554.50 | $191,922.75 | $215,780.25 | 247.1% |

| October | $192,398.67 | $197,827.50 | $221,593.17 | 256.4% |

| November | $198,242.83 | $203,732.25 | $227,406.08 | 265.8% |

| December | $204,087 | $209,637 | $233,219 | 275.1% |

| All Time | $171,944.08 | $177,160.88 | $201,247.96 | 223.7% |

| January | $212,511.67 | $218,298 | $243,655 | 291.9% |

| February | $220,936.33 | $226,959 | $254,091 | 308.7% |

| March | $229,361 | $235,620 | $264,527 | 325.5% |

| April | $237,785.67 | $244,281 | $274,963 | 342.3% |

| May | $246,210.33 | $252,942 | $285,399 | 359% |

| June | $254,635 | $261,603 | $295,835 | 375.8% |

| July | $263,059.67 | $270,264 | $306,271 | 392.6% |

| August | $271,484.33 | $278,925 | $316,707 | 409.4% |

| September | $279,909 | $287,586 | $327,143 | 426.2% |

| October | $288,333.67 | $296,247 | $337,579 | 443% |

| November | $296,758.33 | $304,908 | $348,015 | 459.8% |

| December | $305,183 | $313,569 | $358,451 | 476.5% |

| All Time | $258,847.33 | $265,933.50 | $301,053 | 384.2% |

| January | $317,150.58 | $326,144.33 | $372,391.92 | 499% |

| February | $329,118.17 | $338,719.67 | $386,332.83 | 521.4% |

| March | $341,085.75 | $351,295 | $400,273.75 | 543.8% |

| April | $353,053.33 | $363,870.33 | $414,214.67 | 566.2% |

| May | $365,020.92 | $376,445.67 | $428,155.58 | 588.7% |

| June | $376,988.50 | $389,021 | $442,096.50 | 611.1% |

| July | $388,956.08 | $401,596.33 | $456,037.42 | 633.5% |

| August | $400,923.67 | $414,171.67 | $469,978.33 | 655.9% |

| September | $412,891.25 | $426,747 | $483,919.25 | 678.4% |

| October | $424,858.83 | $439,322.33 | $497,860.17 | 700.8% |

| November | $436,826.42 | $451,897.67 | $511,801.08 | 723.2% |

| December | $448,794 | $464,473 | $525,742 | 745.6% |

| All Time | $382,972.29 | $395,308.67 | $449,066.96 | 622.3% |

In the next year, aka 2025, Bitcoin price is likely to stay well above the six-digit territory and shows no signs of correction below it. Coingape’s Bitcoin price prediction data reveals a peak of $104,280.26 in February 2025.

Bitcoin Price Outlook Between 2030 and 2050

2030

2031

2032

2033

2040

2050

| January | $465,154.42 | $481,462.17 | $546,469.67 | 779% |

| February | $481,514.83 | $498,451.33 | $567,197.33 | 812.3% |

| March | $497,875.25 | $515,440.50 | $587,925 | 845.6% |

| April | $514,235.67 | $532,429.67 | $608,652.67 | 879% |

| May | $530,596.08 | $549,418.83 | $629,380.33 | 912.3% |

| June | $546,956.50 | $566,408 | $650,108 | 945.7% |

| July | $563,316.92 | $583,397.17 | $670,835.67 | 979% |

| August | $579,677.33 | $600,386.33 | $691,563.33 | 1012.3% |

| September | $596,037.75 | $617,375.50 | $712,291 | 1045.7% |

| October | $612,398.17 | $634,364.67 | $733,018.67 | 1079% |

| November | $628,758.58 | $651,353.83 | $753,746.33 | 1112.4% |

| December | $645,119 | $668,343 | $774,474 | 1145.7% |

| All Time | $555,136.71 | $574,902.58 | $660,471.83 | 962.3% |

| January | $667,167.08 | $691,240.58 | $802,526.58 | 1190.8% |

| February | $689,215.17 | $714,138.17 | $830,579.17 | 1235.9% |

| March | $711,263.25 | $737,035.75 | $858,631.75 | 1281.1% |

| April | $733,311.33 | $759,933.33 | $886,684.33 | 1326.2% |

| May | $755,359.42 | $782,830.92 | $914,736.92 | 1371.3% |

| June | $777,407.50 | $805,728.50 | $942,789.50 | 1416.4% |

| July | $799,455.58 | $828,626.08 | $970,842.08 | 1461.5% |

| August | $821,503.67 | $851,523.67 | $998,894.67 | 1506.7% |

| September | $843,551.75 | $874,421.25 | $1,026,947.25 | 1551.8% |

| October | $865,599.83 | $897,318.83 | $1,054,999.83 | 1596.9% |

| November | $887,647.92 | $920,216.42 | $1,083,052.42 | 1642% |

| December | $909,696 | $943,114 | $1,111,105 | 1687.1% |

| All Time | $788,431.54 | $817,177.29 | $956,815.79 | 1439% |

| January | $946,061.92 | $979,838.83 | $1,150,786.08 | 1751% |

| February | $982,427.83 | $1,016,563.67 | $1,190,467.17 | 1814.8% |

| March | $1,018,793.75 | $1,053,288.50 | $1,230,148.25 | 1878.6% |

| April | $1,055,159.67 | $1,090,013.33 | $1,269,829.33 | 1942.4% |

| May | $1,091,525.58 | $1,126,738.17 | $1,309,510.42 | 2006.3% |

| June | $1,127,891.50 | $1,163,463 | $1,349,191.50 | 2070.1% |

| July | $1,164,257.42 | $1,200,187.83 | $1,388,872.58 | 2133.9% |

| August | $1,200,623.33 | $1,236,912.67 | $1,428,553.67 | 2197.7% |

| September | $1,236,989.25 | $1,273,637.50 | $1,468,234.75 | 2261.6% |

| October | $1,273,355.17 | $1,310,362.33 | $1,507,915.83 | 2325.4% |

| November | $1,309,721.08 | $1,347,087.17 | $1,547,596.92 | 2389.2% |

| December | $1,346,087 | $1,383,812 | $1,587,278 | 2453% |

| All Time | $1,146,074.46 | $1,181,825.42 | $1,369,032.04 | 2102% |

| January | $1,387,378.67 | $1,426,572.58 | $1,647,465.92 | 2549.9% |

| February | $1,428,670.33 | $1,469,333.17 | $1,707,653.83 | 2646.7% |

| March | $1,469,962 | $1,512,093.75 | $1,767,841.75 | 2743.5% |

| April | $1,511,253.67 | $1,554,854.33 | $1,828,029.67 | 2840.3% |

| May | $1,552,545.33 | $1,597,614.92 | $1,888,217.58 | 2937.1% |

| June | $1,593,837 | $1,640,375.50 | $1,948,405.50 | 3033.9% |

| July | $1,635,128.67 | $1,683,136.08 | $2,008,593.42 | 3130.7% |

| August | $1,676,420.33 | $1,725,896.67 | $2,068,781.33 | 3227.5% |

| September | $1,717,712 | $1,768,657.25 | $2,128,969.25 | 3324.3% |

| October | $1,759,003.67 | $1,811,417.83 | $2,189,157.17 | 3421.1% |

| November | $1,800,295.33 | $1,854,178.42 | $2,249,345.08 | 3517.9% |

| December | $1,841,587 | $1,896,939 | $2,309,533 | 3614.7% |

| All Time | $1,614,482.83 | $1,661,755.79 | $1,978,499.46 | 3082.3% |

| January | $1,912,592.58 | $1,975,978.17 | $2,362,093.25 | 3699.3% |

| February | $1,983,598.17 | $2,055,017.33 | $2,414,653.50 | 3783.8% |

| March | $2,054,603.75 | $2,134,056.50 | $2,467,213.75 | 3868.4% |

| April | $2,125,609.33 | $2,213,095.67 | $2,519,774 | 3952.9% |

| May | $2,196,614.92 | $2,292,134.83 | $2,572,334.25 | 4037.4% |

| June | $2,267,620.50 | $2,371,174 | $2,624,894.50 | 4122% |

| July | $2,338,626.08 | $2,450,213.17 | $2,677,454.75 | 4206.5% |

| August | $2,409,631.67 | $2,529,252.33 | $2,730,015 | 4291.1% |

| September | $2,480,637.25 | $2,608,291.50 | $2,782,575.25 | 4375.6% |

| October | $2,551,642.83 | $2,687,330.67 | $2,835,135.50 | 4460.1% |

| November | $2,622,648.42 | $2,766,369.83 | $2,887,695.75 | 4544.7% |

| December | $2,693,654 | $2,845,409 | $2,940,256 | 4629.2% |

| All Time | $2,303,123.29 | $2,410,693.58 | $2,651,174.63 | 4164.3% |

| January | $2,753,723.75 | $2,916,544.25 | $3,019,295.17 | 4756.4% |

| February | $2,813,793.50 | $2,987,679.50 | $3,098,334.33 | 4883.5% |

| March | $2,873,863.25 | $3,058,814.75 | $3,177,373.50 | 5010.6% |

| April | $2,933,933 | $3,129,950 | $3,256,412.67 | 5137.7% |

| May | $2,994,002.75 | $3,201,085.25 | $3,335,451.83 | 5264.9% |

| June | $3,054,072.50 | $3,272,220.50 | $3,414,491 | 5392% |

| July | $3,114,142.25 | $3,343,355.75 | $3,493,530.17 | 5519.1% |

| August | $3,174,212 | $3,414,491 | $3,572,569.33 | 5646.3% |

| September | $3,234,281.75 | $3,485,626.25 | $3,651,608.50 | 5773.4% |

| October | $3,294,351.50 | $3,556,761.50 | $3,730,647.67 | 5900.5% |

| November | $3,354,421.25 | $3,627,896.75 | $3,809,686.83 | 6027.7% |

| December | $3,414,491 | $3,699,032 | $3,888,726 | 6154.8% |

| All Time | $3,084,107.38 | $3,307,788.13 | $3,454,010.58 | 5455.6% |

Roughly five years from now, aka 2030, Bitcoin’s price will see an explosion to the upside, with an all-time high of $774,474 in the aforementioned year. In the same period, BTC could reach a low of $465,154.42. Based on CoinGape predictions, the average price of BTC in 2050 is between $2.9 million and $3.3 million.

Investors should note that these long-term predictions can change and, hence, should be taken with a grain of salt.

Bitcoin Technical Analysis: Breaching This Key Level Could Knock BTC to $90K

Since forming a local top on November 11 at $89,657, Bitcoin’s move to $100,000 and beyond has been in a rangebound movement. Using the volume profile indicator shows three key levels:

- Value Area High/Low (VAH/L) at $99,690 and $90,924, respectively.

- Point of Control (POC) at $98,000.

So far Bitcoin has bounced from the VAH at $99,690, but how far this recovery goes is the question investors need to be asking. A lack of buying pressure that leads to a breakdown of the $99,690 with high volume spike will signal the start of a bearish outlook. In such a case, Bitcoin price could revisit $90,924 after the POC at $98,000 is breached.

Hence, the chances of BTC revisiting $90K is present, but not confirmed until the $99,690 barrier is breached. With the weekend approaching this outlook seems plausible.

On the other hand, if Bitcoin bounces off the $99,690 and sets up a higher high above the current ATH of $104,698, it would signal the continuation of the uptrend. In such a case, investors can expect a higher low to propel BTC to the next target of $111,850.

Source link

You may like

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

24/7 Cryptocurrency News

Coinbase CLO Applauds US SEC Chair Nominee Paul Atkins Ahead of Senate Confirmation

Published

13 hours agoon

March 27, 2025By

admin

The nomination of Paul Atkins to become the next chairman of the U.S. Securities and Exchange Commission (SEC) has sparked strong reactions from both supporters and critics.

Among those expressing support is Paul Grewal, Chief Legal Officer of Coinbase, who recently attended a Senate Banking Committee hearing on Atkins’ confirmation. Coinbase CLO Paul Grewal has highlighted the importance of Atkins’ leadership in bringing clarity to the regulatory landscape for digital assets.

Coinbase CLO Applauds US SEC Chair Nominee Paul Atkins

At the Senate Banking Committee hearing, Paul Atkins highlighted that there should be clear rules and approaches to the digital assets which is in line with the Coinbase’s CLO. Grewal shared his appreciation of Atkins by tweeting and arguing that policy certainty is vital for the improvement and progression of the new economy in the United States. According to the Coinbase’s Chief Legal Officer Paul Grewal, greater clarity on regulation of cryptocurrencies would create new markets and a shield consumers and place the nation at the front row of technology ad finance.

Under his regime, Atkins revealed that digital assets would be prioritized since the current legal frameworks are a hindrance to development. “Unclear, overly politicized, complicated and burdensome regulations are stifling capital formation,” Atkins said during the hearing.

Mr. Atkins and Comptroller of the Currency nominee Jonathan Gould addressed debanking and committed to end this undemocratic practice for good.

As Mr. Atkins put it, it’s time for the SEC to get “back to basics.” He’ll be a breath of fresh air atop a crucial oversight and…— paulgrewal.eth (@iampaulgrewal) March 27, 2025

In addition to his focus on crypto, Mr. Atkins, alongside Comptroller of the Currency nominee Jonathan Gould, also addressed the issue of debanking during the hearing. The two nominees committed to ending this practice, which they both described as undemocratic. “It’s time for the SEC to get back to basics,” Coinbase’s CLO said.

This is in tandem with Coinbase urging regulators to be more clear on their regulations especially after having had a taste of the regulatory endeavours in the recent past.

“Getting workable rules and regulatory clarity for crypto will unlock US-based innovation,” Coinbase CLO Paul Grewal commented.

Senator Elizabeth Warren Calls Out Paul Atkins’ Nomination

Although Grewal endorsement Atkins has had support from some industry professionals, his appointment has drawn opposition most especially from the Democrats party. In questions addressed to Atkins, Senator Elizabeth Warren cited his interactions with Wall Street and digital asset firms, saying that being in the firm could lead to conflicts of interest due to his previous stints with the executives to fund their firms.

During the hearing Senator Warren said: “Mr. Atkins has almost dedicated his entire career to assisting such billionaires as Sam Bankman-Fried,” referring to his financial experience and contacts.

Warren’s concerns also extend to the broader financial crisis of 2008. She accused Atkins of downplaying the risks leading up to the crash. Atkins, in response, defended his past record, attributing the crisis to the subprime mortgage market, specifically the role of Fannie Mae and Freddie Mac. Nonetheless, these criticisms are unlikely to prevent his confirmation by the GOP-controlled Senate.

Atkins’ Financial Holdings and Divestment Plans

Atkins’ financial background has raised questions about potential conflicts of interest. His stake in Patomak Global Partners, a consulting firm he founded, has come under scrutiny.

According to government filings, Atkins’ stake in the firm is worth at least $25 million, while his total net worth is estimated at over $327 million.

In light of these concerns, Atkins has committed to divesting from Patomak and other holdings within 90 days of his confirmation. He also pledged to meet or exceed the same ethical standards applied to previous SEC nominees. However, Senator Warren has pressed Atkins to provide more details about who will purchase his stake and whether they will gain any undue access to his potential position as SEC chair.

US Crypto Regulatory Changes Looming

If confirmed, Atkins is expected to push for a reduction in financial regulations, a shift away from some policies introduced under the Biden administration. For instance, the SEC under Gary Gensler’s leadership focused on aggressive regulation of cryptocurrency firms, often accusing them of failing to register as exchanges.

Atkins, by contrast, has expressed a desire for a regulatory framework that fosters capital formation rather than imposing burdensome rules.

Critics of Gensler’s approach see Atkins as a favorable alternative. “It’ll be more of an emphasis on capital formation and investment choice,” said Nick Morgan, a former SEC attorney. This shift could provide a clearer path for companies in the digital asset sector, allowing them to operate with fewer regulatory hurdles.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

Published

1 day agoon

March 27, 2025By

admin

Dogecoin price has been showing major strength recently with more than 14% gains on the weekly chart and eyeing a potential breakout above $0.21, after which it can kickstart rally to $2 for another 10x gains. Furthermore, Elon Musk has once again teased DOGE, sharing a Ghibli Anime character of his from a famour scene from “The Lion King”.

Dogecoin Price Eyes A 10x Breakout Ahead

In the last 24 hours, the Dogecoin price has surged another 4%, moving to $0.205 with its market cap just touching $30 billion. Additionally, the daily trading volumes have surged more than 32%, crossing $2 billion showing a strong bullish sentiment aong traders.

Additionally, the Coinglass data shows that the DOGE futures open interest is also up 4%, moving above $2 billion, while the 24-hour liquidations have soared to $13.82 million. Popular crypto analyst CryptoELITES has cited the formation of a cup-and-handle chart pattern, wherein the DOGE price is on the move to complete the cup pattern. As a result, he expects the meme coin to register 10x gains from here onwards.

Some traders also expect the DOGE price rally to continue to $8 as the meme coin breaks past the three-month trendline.

DOGE SuperTrend Indicator

Crypto analyst Ali Martinez has highlighted a potential bullish phase for Dogecoin (DOGE) based on the SuperTrend indicator. According to Martinez, the popular meme coin could enter a significant upward trend if it manages to break through the critical resistance level of $0.21.

The SuperTrend indicator usually helps to identify trend reversals and potential breakout points. Thus, surpassing this key threshold of $0.21 Dogecoin price could signal renewed investor momentum for the meme coin.

Elon Musk Teases the DOGE Ghibli Anime

In a parody of the famous scene from Disney’s “The Lion King,” Elon Musk once again teases Dogecoin with the much popular Ghibli Anime character. Instead of a lion cub, the character is holding up a Shiba Inu dog – the mascot of the Dogecoin cryptocurrency.

Theme of the day pic.twitter.com/2ioG0StAxL

— Elon Musk (@elonmusk) March 26, 2025

The animated image is reminiscent of Studio Ghibli. The Ghibli Animes are seeing massive popularity recently, and Elon Musk jumping into the trend with DOGE, could provide further catalysts for the meme coin. Furthermore, the Dogecoin price prediction charts show a probable consolidation above $0.20 for the month of April.

- Shiba Inu Price Eyes 2x Gains As SHIB Burn Rate Shoots 60,000%

- Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

- Analyst Reveals How Much Bitcoin Is Needed for Retirement in the US

- Ethereum Price Eyes $10,000 Breakout Amid Supply Squeeze Worry

- Crypto Price Today: BTC, ETH, SOL, XRP, SHIB, DOGE, LINK, PEPE, ADA

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Expert Predicts XRP ETF Approval Is Only A ‘Matter Of Time’ As Approval Odds Soar

Published

2 days agoon

March 26, 2025By

admin

The possibility of an XRP exchange-traded fund (ETF) gaining approval is quickly becoming a reality, with experts predicting it is now only a matter of time before the U.S. Securities and Exchange Commission (SEC) gives the green light. Following a significant boost in market confidence, betting platforms, like Polymarket, show an 87% chance that the SEC will approve an XRP ETF by the end of 2025.

Ripple SEC Case End Sparks Optimism for XRP ETF

A positive outlook about an XRP exchange-traded fund’s approval has emerged after Ripple won its recent court battle. Ripple’s victory against the SEC dismantled a major barrier that prevented financial institutions from adopting its cryptocurrency. The court settlement has raised investor trust in the SEC’s approval process for an XRP Exchange-Traded Fund (ETF) thus many investors now expect approval.

According to Nate Geraci the president of The ETF Store an XRP ETF approval seems destined to happen. He predicted asset managers like BlackRock and Fidelity would dominate the space while asserting that the approval process stood just a matter of time away from completion. Geraci explains that XRP’s rising market cap position as the third non-stablecoin cryptocurrency provides institutional investors with an appealing opportunity.

“With Ripple’s legal troubles now behind it, the path to an XRP ETF approval seems clearer than ever,” Geraci noted.

XRP Market Sentiment and Polymarket Data

An increasing number of market participants expect XRP ETF approval as shown by Polymarket’s statistical analysis. Polymarket data shows investors believe the SEC will approve a spot XRP ETF before the year ends with an 87% probability.

This indicates widespread belief that the regulatory hurdles for the cryptocurrency are nearly cleared.

The introduction of an XRP ETF could trigger increased institutional interest much in the same way Bitcoin and Ethereum ETFs gained investor attention. An XRP ETF’s market entry would help traditional investors view digital assets more favorably because Bitcoin and Ethereum already demonstrated successful ETF integration.

Major Financial Firms Exploring XRP ETF

Major financial institutions like BlackRock and Fidelity among others will be instrumental in creating an XRP Exchange-Traded Fund Analysts predict BlackRock will shift its focus from Bitcoin and Ethereum to XRP ETFs because the cryptocurrency exhibits strong institutional appeal.

BlackRock’s head of ETFs, Jay Jacobs, had earlier stated that altcoins like XRP and Solana are not currently on their agenda. However, experts argue that the growing market demand and regulatory developments around XRP could soon change BlackRock’s stance.

Large asset managers including Fidelity play crucial roles when it comes to this particular market segment. The regulatory approval of XRP ETFs by the SEC will allow these financial institutions to launch XRP-related products. Such high-profile firms’ participation will speed up both the adoption and institutional utilization of XRP within portfolios.

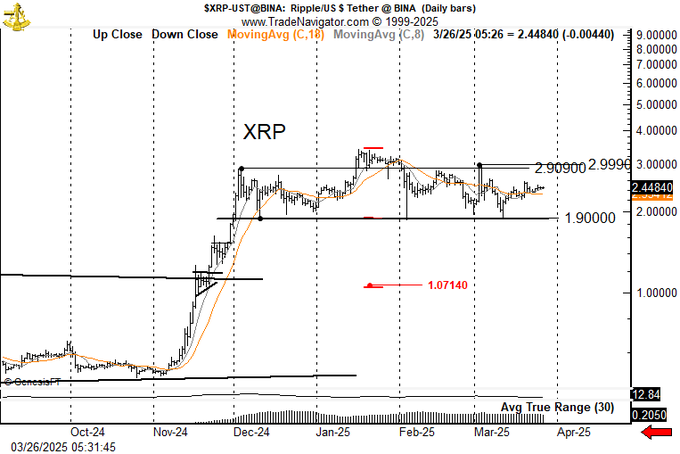

XRP Price Predictions Amid ETF Optimism

As the market anticipates the approval of an XRP ETF, different analysts have made bold price predictions for XRP. Renowned trader Peter Brandt has recently shared his technical analysis, highlighting a potential head and shoulders pattern in XRP’s price.

This pattern suggests that if XRP falls below a certain level, it could lead to significant losses, with a target price of around $1.07. However, Brandt also acknowledged that if the cryptocurrency stays above the $3 mark, shorting XRP could be risky.

On the other hand, cryptocurrency index fund manager Bitwise has offered a more optimistic price projection. Bitwise estimates that XRP could soar to as high as $29.32 by the end of the decade, assuming the cryptocurrency captures a meaningful share of the payments and tokenization sectors. In their “bull scenario,” Bitwise projects a price of $12.70 by 2030.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

XRP Price Slides Slowly—Is a Bigger Drop Coming?

Darkweb actors claim to have over 100K of Gemini, Binance user info

Whale Who Netted $108,000,000 Profit on TRUMP Books Loss on the Memecoin After President’s Truth Social Post

Hardware Wallets: Bitcoin’s Biggest Adoption Barrier

SEC Officially Drops Cases Against Kraken, ConsenSys, and Cumberland DRW

Dogecoin could rally in double digits on three conditions

Sei Foundation Explores Buying 23andMe to Put Genetic Data on Blockchain

Coinbase CLO Applauds US SEC Chair Nominee Paul Atkins Ahead of Senate Confirmation

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: