ADA Price

Will the 7-Month High NVT Ratio Lead to a Crash?

Published

4 months agoon

By

admin

ADA price is at a crossroads. With the Chang hard fork up ahead and a thin slice of support holding the price up, it is difficult to predict what will happen next. While on-chain metrics hint the market sentiment may be more bullish than bearish, analysis of traders’ behaviors shows they are bearish on the asset. Will ADA price survive the mixed sentiment in the market?

Onchain Metrics Reveal ADA Price Potential Rally

Data from Santiment shows that the Cardano Network Value to Transactions (NVT) ratio hit a 7-month high, but the price has dropped for the last five days. When the NVT ratio spikes while the price decreases, it generally indicates a bearish signal for the crypto asset.

However, IntoTheBlock data shows large holder netflow increased from August 25 to 28 as the price dropped, which indicates that large investors or “whales” may be accumulating the asset despite the falling price.

However, IntoTheBlock data shows large holder netflow increased from August 25 to 28 as the price dropped, which indicates that large investors or “whales” may be accumulating the asset despite the falling price.

The buying activity from large holders can signal their confidence in the asset’s long-term potential, even if the short-term price action is negative. Coupled with the spike in the NVT ratio, this positive investor sentiment may signal they are pricing Cardano at a premium, possibly due to speculative interest or future growth expectations.

This accumulation may have provided a level of price support, as the increased demand from large holders eventually stabilizes or even pushes the price up, as seen on the Cardano technical analysis.

This accumulation may have provided a level of price support, as the increased demand from large holders eventually stabilizes or even pushes the price up, as seen on the Cardano technical analysis.

ADA Technical Analysis: Temporary Support or Launch Pad?

The Cardano price tried to stay above the 50-day exponential moving average, but the selling pressure was too high. The price dropped below the 50 EMA (indicated by the green line), suggesting that a bearish momentum is dominant.

ADA price found support around $0.3550, where most of the whales seem to be building a buy wall. The candlestick analysis at this level shows small-bodied candles with wicks on both sides, indicating indecision in the market.

However, data from the Coinglass 7-day Liquidation Map shows a huge sell wall between $0.372 and $0.4. This means it will take a great effort to push the price beyond this price to the upside.

Conversely, there is a thin slice of sell buy order between $0.348 and $0.312, which, if eliminated, may result in an ADA price free fall to sub $0.3 price.

Conversely, there is a thin slice of sell buy order between $0.348 and $0.312, which, if eliminated, may result in an ADA price free fall to sub $0.3 price.

Will Cardano Price Crash 10%?

ADA price remains overall bearish unless the price breaks above the previous high at $0.4. Positive investor sentiment can sustain the price up, but eventually, the profit-driven Futures traders have more power as they don’t have an actual stake in the asset – only leverage. The successful launch of Chang hard fork will go a long way in helping Cardano price decide the next course of direction.

Frequently Asked Questions (FAQs)

The NVT ratio for Cardano has recently reached a 7-month high, suggesting that the network may be overvalued.

Data from IntoTheBlock shows that large holders have increased their netflow from August 25 to August 28, even as the price of ADA dropped.

Yes, there is a risk. If the price fails to break above $0.4 and the Chang hard fork launch is problematic, ADA could face a 10% price drop.

Related Articles

Evans Karanja

Evans Karanja is a content writer and scriptwriter with a focus on crypto, blockchain, and video gaming. He has worked with various startups in the past, helping them create engaging and high-quality content that captures the essence of their brand. Evans is also an avid crypto trader and investor, and he believes that blockchain will revolutionize many industries in the years to come. When he is not writing, you can find him playing video games or chasing waterfalls.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

24/7 Cryptocurrency News

Cardano Price Eyes Rally To $4 If ADA Maintain This Support, Top Analyst Says

Published

2 weeks agoon

December 10, 2024By

admin

The recent dip in Cardano price to near $1 has sparked discussions in the broader crypto market, especially after the recent strong rally. It appears that the dip comes amid a retreat noted in the broader crypto market, indicating that investors are taking a pause ahead of the crucial economic releases. However, despite the recent dip, a top expert predicts ADA to hit $4 in the coming days if it holds a key support level.

Top Analyst Predicts Cardano Price To Hit $4

The crypto market saw its biggest liquidation recently, with traders liquidating $1.76 billion in the last 24 hours. This has triggered immense selling pressure on the broader crypto market, with Bitcoin and the top altcoins taking the biggest hits.

There was no exception for Cardano price as well, which saw a slump of nearly 10% during writing. However, despite the recent dip, top crypto market experts appear to have remained bullish on the future trajectory of the crypto.

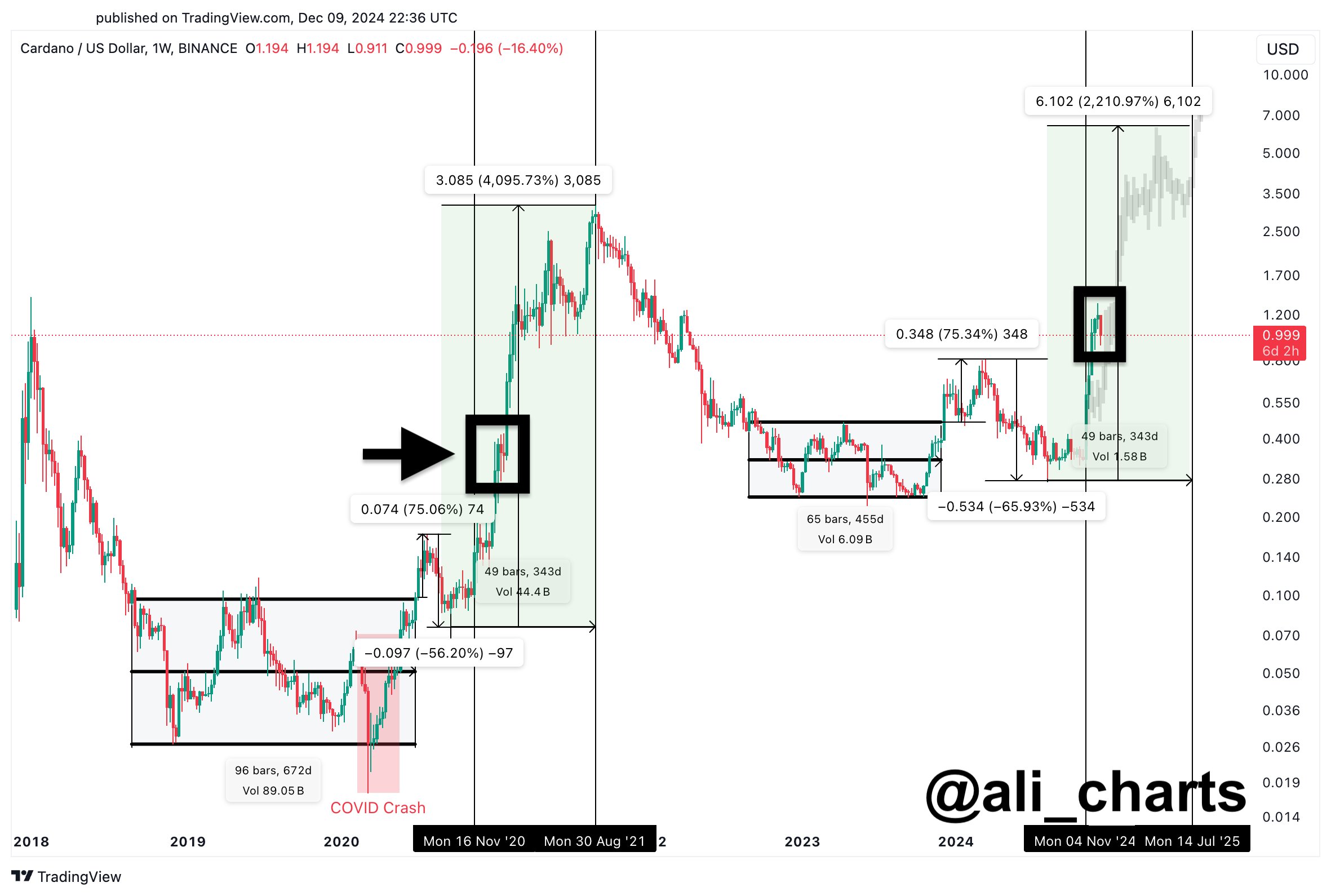

For context, Ali Martinez, a prominent figure in the crypto space, recently shared a price chart of ADA, citing its historical trends. The analyst has compared the recent price swings to its 2020 performance, saying that he would continue to accumulate ADA even if the price continue to slump.

In addition, Martinez also hinted that the crypto is poised to hit $4 or even $6, which would allow traders to book profit. In his recent X post, he stated:

“Even if it dips down to $0.76, I’m buying more and plan to book profits between $4 and $6.”

What’s Next For ADA?

ADA price today was down nearly 10% during writing and exchanged hands at $1.01. However, the crypto’s trading volume has rocketed 122% to $3.88 billion at the same time. Notably, the crypto has touched a 24-hour high of $1.15, while noting a monthly gain of 75%.

Besides, CoinGlass data showed that Cardano Futures Open Interest slumped 25% amid a broader crypto market crash, indicating a waning risk-bet appetite of the investors. However, the Relative Strength Index for ADA at 53 suggests a neutral stance for the crypto. This indicates that the crypto could witness further gains.

Additionally, Martinez has highlighted a key trend for Cardano price, saying that the crypto has slipped below the “critical $1.20 support level.” He noted that around 93,000 addresses had purchased 2.54 billion ADA at this level. Besides, he also said that the next demand zone for the crypto stands at $1 now.

In addition, the Cardano Foundation X handle was hacked recently, which has also sparked concerns in the market. The hackers have promoted a false token, saying that it would stop ADA withdrawals due to the US SEC crackdown. However, the team was quick to address the issues, which has boosted the market spirit.

On the other hand, a recent analysis hints at a potential ADA rally to $2. Also, the analysis showed that the Cardano price trajectory remains bullish as long as it holds above the $0.644 support level, indicating that the crypto could witness further rally in the coming days.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Why Is Cardano Price Poised To Hit ATH Soon?

Published

1 month agoon

November 17, 2024By

admin

Cardano price has been on the investors’ radar lately, as evidenced by the recent ADA rally. Besides, a flurry of developments around Founder Charles Hoskinson has also sparked optimism in the market over further rallies. Amid this, market experts have predicted a strong rally ahead for the crypto.

So, let’s explore the potential reasons that may help ADA price to continue its gain in the coming days.

Reasons Why Cardano Price Poised To Hit ATH Soon

A flurry of recent market developments hints at potential ATH for Cardano price soon. For context, in a recent X post, Cardano founder Charles Hoskinson lauded the ADA community, citing it as the “best community” and said that it has the best entrepreneurs as well. Besides, he also predicted the Voltaire update to make the ecosystem the “finest government ever assembled by humanity.”

This post reveals the founder’s confidence in the community, which could extend the ongoing rally in ADA price. Additionally, Charles Hoskinson visiting Elon Musk’s SpaceX office has also sparked speculations, especially given the individual’s growing influence in the US political landscape.

Besides, Hoskinson has recently said that he would support the Trump Government in shaping crypto legislation. He aims to help the US administration in crafting clear regulatory frameworks for digital assets, which have faced regulatory pressure over the past few years.

ADA Rallies As US Appeal Soars

The recent comments from Ripple CEO Brad Garlinghouse have also sparked market optimism. In a recent FOX Interview, Garlinghouse said that XRP, ADA, SOL, and other crypto issued by the US companies have noted strong rallies in recent days, surpassing other crypto. He said that the anticipation over pro-crypto policies under the Republican government has fueled the rally, while many anticipate the Trump rally to continue to benefit the crypto.

Besides, a flurry of market pundits predicts that crypto to note a strong rally ahead. For context, prominent crypto market analyst Ali Martinez said that Cardano price is poised to hit $6 in 2025, further fueling anticipation over the ADA rally to its new ATH.

Notably, ADA price has recently soared past the $0.78 mark, marking its highest level since March 2024. Besides, Cardano Futures Open Interest also rose more than 20% over the weekend, CoinGlass data showed, indicating the growing confidence of the investors.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

ADA Price

Analyst Says Cardano Price Is “Bottoming” After Hitting Two-Year Low

Published

2 months agoon

October 18, 2024By

admin

Except for the brief rally in early 2024, Cardano has been on a downtrend since its all-time high (ATH) of $3.1 in August 2021. ADA currently trades at $0.347, a level that was last seen two years ago. However, market analysts are suggesting that Cardano price could be forming a long-term bottom, hinting at a potential reversal and the start of a bull rally. However, investors should remain cautious as Bitcoin faces a tough resistance level of around $67,000 and could disrupt altcoin moves.

Why is Cardano Price Down Today?

ADA price today is down 0.2% in the last 24 hours and trades at $0.3476. This bearish outlook for Cardano is not localized and can be seen across the board. This can be attributed to capital rotation into Bitcoin as it approaches key levels and hints at a breakout form its seven-month consolidation. As a result, top altcoins tend to slide lower as investors allocate capital into BTC, a less risky bet than alternative cryptocurrencies.

Regardless, let’s take a look at Cardano price form a long-term perspective and see if it is bottoming.

Analyst Says Cardano Price Could be “Bottoming”?

Analyst Sam Mti noted that the ADA price could be bottoming out on the weekly after hitting a two-year low. However, the early Bitcoin trader said he was not interested in investing in the asset as there was no “buy signal.”

Considering that ADA is down 90% from its ATH, the chances that a bottom could be forming is higher. However, a breakout rally might occur soon.

ADA Price Analysis: What’s Next For Cardano?

Cardano price action seems to be consolidating after hitting the bottom, which is a classic sign of accumulation. In comparison, Chainlink (right) underwent an accumulation for about 1 year before finally breaking out to the upside.

Cardano underwent significant changes in 2024, including the Chang hard fork, which converted ADA into a governance token, and the successful demonstration of Hydra’s speed on the DOOM game at the Rare Evo 2024 blockchain conference.

Nevertheless, despite these huge milestones for the network, ADA price performance has been underwhelming.

Cardano price is in a Wyckoff accumulation phase, which typically precedes a bullish move. The price has been moving horizontally, oscillating between a demand zone around $0.30 and a supply zone near $0.40.

This kind of price action indicates accumulation, where smart money is quietly buying up tokens before a potential bullish breakout.

Accumulation phases can take time to complete as the asset consolidates within the range before building momentum for a breakout.

In the short term, the price is likely to continue oscillating between these two levels. If the accumulation pattern continues, we can expect a breakout above the $0.42 level, which could lead to a bullish rally targeting levels as high as $0.50 or beyond.

The relative strength index (RSI) is currently around 46, which is neutral. This indicates that the price has room to move either upward or downward in the short term. It’s neither overbought nor oversold, allowing for further consolidation or the beginning of an upward move.

If the Cardano price breaks below $0.31, it could trigger a larger bearish move, with potential targets at $0.27, $0.24, $0.22, and possibly lower. This would invalidate the current neutral-to-bullish thesis and confirm the completion of the accumulation phase.

Frequently Asked Questions (FAQs)

Cardano price action has been independent of Bitcoin’s recent performance. ADA’s decline can be attributed to a mix of market conditions and investor sentiment.

According to some analysts, including early Bitcoin trader Sam Mti, Cardano’s price may be “bottoming out” after reaching a two-year low.

Analysts are cautiously optimistic but suggest waiting for clearer buy signals. While some signs indicate the price may be bottoming out, there’s still a risk of further dips.

Related Articles

Evans Karanja

Evans Karanja is a crypto analyst and journalist with a deep focus on blockchain technology, cryptocurrency, and the video gaming industry. His extensive experience includes collaborating with various startups to deliver insightful and high-quality analyses that resonate with their target audiences. As an avid crypto trader and investor, Evans is passionate about the transformative potential of blockchain across diverse sectors. Outside of his professional pursuits, he enjoys playing video games and exploring scenic waterfalls.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: