coinshares

XRP Becomes Second Favorite Altcoin of Institutions Year-to-Date With $105,000,000 in Product Inflows: CoinShares

Published

2 months agoon

By

admin

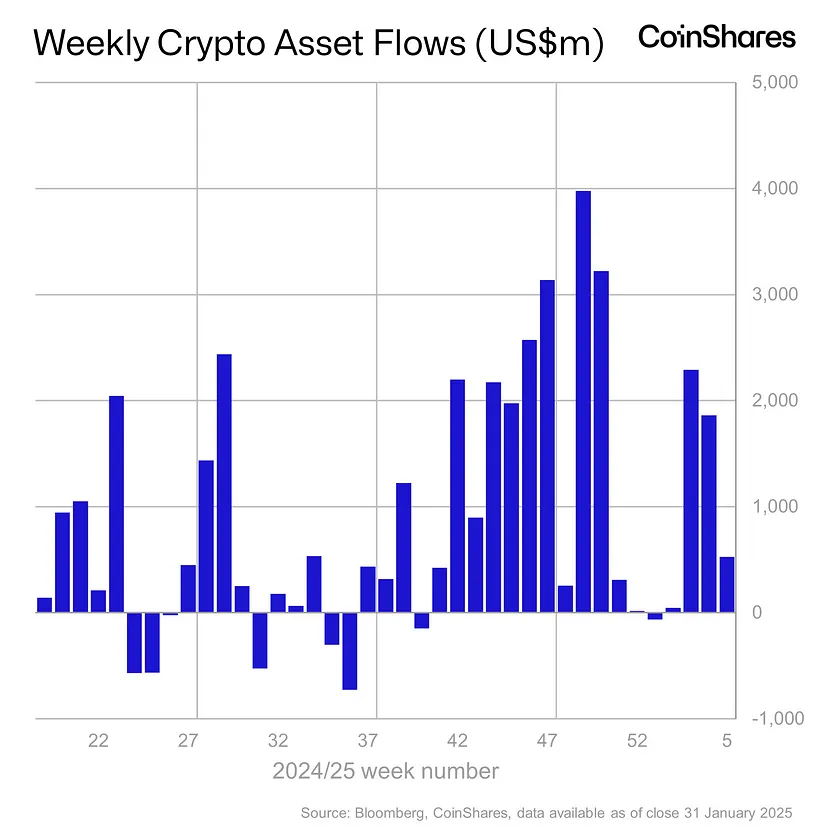

Crypto asset management giant CoinShares says institutional investors poured hundreds of millions into digital asset investment vehicles last week despite volatile market conditions.

In its latest Digital Asset Fund Flows report, CoinShares says that institutional crypto investment vehicles brought in nearly $530 million last week despite the market-wide slump triggered by Trump tariffs and DeepSeek.

“Digital asset investment products saw inflows totaling $527m last week. However, intraweek flows reflected volatile investor sentiment, heavily influenced by broader market concerns, such as the DeepSeek news, which triggered $530m in outflows on Monday.

Despite this initial sell-off, the market rebounded with over $1bn in inflows later in the week. Given the $44bn in inflows seen in 2024, US$5.3bn inflows year-to-date (YTD) and significant price gains, the current sell-off is not unexpected.”

Regionally, the US led inflows at $474 million. Europe also provided $78 million worth of inflows while Canada bled out $43 million in outflows, “perhaps due to the threat of trade tariffs imposed” by President Trump.

Bitcoin (BTC), per usual, pulled the lion’s share of inflows at $486 million. While Ethereum (ETH) products basically broke even last week with outflows of $300,000, XRP inflows of $14.7 million made it the second most popular altcoin of the year with $105 million in inflows year-to-date, second only to ETH’s $177 million.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Altcoins

‘Positive But Cautious’ Investors Pour Capital Into Ethereum, Solana, XRP and Sui: CoinShares

Published

2 weeks agoon

March 31, 2025By

admin

Crypto asset manager and research firm CoinShares says institutional investors poured millions of dollars into altcoin digital asset investment products last week.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares says crypto products enjoyed inflows last week after record-setting levels of outflows.

“Digital asset investment products saw US$226m of inflows last week suggesting a positive but cautious investor. Following the largest outflows on record, ETPs have seen 9 consecutive trading days of inflows.

Last Friday was the exception, seeing minor outflows totaling US$74m, likely in reaction to core personal consumption expenditure in the US coming in above expectations, implying the US Federal Reserve is likely to remain hawkish despite recent data alluding to weak growth.”

Bitcoin (BTC) products, as usual, led the charge with $195 million in inflows. The king crypto was followed by altcoins, which broke a month-long streak of outflows. Leading inflows were Ethereum (ETH), Solana (SOL), XRP and Sui (SUI).

“Altcoins in aggregate saw their first week of inflows totaling US$33m, following 4 consecutive weeks of outflows totaling US$1.7bn. The key beneficiaries being Ethereum, Solana, XRP and Sui, with inflows of US$14.5m, US$7.8m, US$4.8m and US$4.0m respectively.”

Regionally, the US led the world with $204 million in inflows. Switzerland and Germany also pitched in $14.7 and $9.2 million in inflows, respectively.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

President Trump’s Executive Orders Build Confidence With Institutional Crypto Investors: CoinShares

Published

3 months agoon

January 27, 2025By

admin

Crypto asset manager CoinShares says institutional investors poured billions into digital asset investment vehicles last week following Trump’s executive orders directed at the industry.

In its latest Digital Asset Fund Flows report, CoinShares says that institutional crypto investment vehicles raked in nearly $2 billion last week alone.

“Digital asset investment products saw inflows totaling US$1.9bn last week bringing year-to-date (YTD) inflows to US$4.8bn — likely as a result of recent presidential executive orders that proposed the initiation of a strategic reserve asset in Bitcoin.

Despite the relatively flat price action last week, trading volumes were high at US$25bn for the week, comprising 37% of all trading volumes on trusted crypto exchanges.”

The United States regionally led international inflows, raking in $1.7 billion of the $1.9 billion in inflows. Canada, Switzerland and Germany provided $31 million, $35 million, and $23 million, respectively.

Bitcoin (BTC), per usual, snatched up the lion’s share of inflows.

“Bitcoin saw inflows totaling US$1.6bn, bringing YTD inflows to US$4.4bn, accounting for 92% of all inflows in the digital asset sector. Following Bitcoin’s pre-inauguration new all-time highs last week, it was no surprise to see short-Bitcoin ETFs regain traction, with inflows of US$5.1 million.”

Ethereum (ETH) led altcoins with $205 million in inflows, bringing YTD ETH inflows to $177 million. With the exception of Cardano (ADA), no crypto institutional investment products suffered outflows last week.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Oliver Denker/Sensvector

Source link

24/7 Cryptocurrency News

CoinShares Files For XRP ETF With US SEC

Published

3 months agoon

January 25, 2025By

admin

CoinShares has submitted a filing to the U.S. Securities and Exchange Commission (SEC) for a spot XRP exchange-traded fund (ETF). The move is part of a surge in cryptocurrency ETF filings as financial firms seek to expand options for digital asset investments in the U.S. market.

CoinShares Seeks Approval for XRP ETF

CoinShares has submitted a registration statement on form S-1 to launch a physical XRP exchange-traded fund. This comes under the backdrop of more financial firms seeking Cryptocurrency ETFs after the approval of spot Bitcoin and Ethereum ETFs in the earlier part of last year.

Apart from CoinShares’ XRP ETF filing, several other applications for cryptocurrency ETFs were submitted on January 25. CoinShares also submitted an S-1 for a spot Litecoin ETF, indicating that there is growing interest in altcoins ETFs. At the same time, Grayscale filed a 19b-4 application to have its Solana Trust (GSOL) and Litecoin Trust turned into ETFs.

Grayscale Investments also submitted a 19b-4 application to convert its Solana Trust and Litecoin Trust into spot ETFs. Similarly, BlackRock, an asset management company, has also submitted an application for in-kind creation and redemption of its iShares Bitcoin Trust (IBIT).

Regulatory Landscape Shifts Under New SEC Leadership

The filings occur at a time when there could be shifting regulatory environment under the new administration. Prior to this, the former SEC Chair, Gary Gensler, resigned and Trump nominated Paul Atkins, a pro-crypto chair, for the position.

Market participants are hopeful that Atkins’s pro-crypto stance could lead to more ETF approvals in the market. The SEC, under acting chair Mark Uyeda, has also established a new cryptocurrency task force headed by Commissioner Hester Peirce to help develop better guidelines for the industry.

The task force is to consider the registration issues, improve the disclosure requirements and employ the enforcement tools more effectively. This change in the regulatory landscape might be beneficial for cryptocurrency ETFs, including those that are linked to XRP and other altcoins.

Will Ripple Vs SEC Case Influence XRP ETF Filings?

Despite the XRP ETF filing, Ripple Labs, the company associated with XRP, is still embroiled in a legal battle with the SEC. The lawsuit centers on whether XRP should be classified as a security, a decision that could affect the cryptocurrency’s regulatory status and its prospects for ETFs.

Ripple recently requested an April 16, deadline for its appeal and cross-appeal briefs in the case. Lawyers following the matter speculate that the new SEC leadership may opt for a resolution rather than prolonging litigation.

Pro-XRP legal expert Bill Morgan opined that the SEC could try to negotiate a settlement or even dismiss the appeal particularly under the leadership of Atkins. Such a resolution could remove all legal ambiguities for XRP and also increase the chances of approval of the ETF.

While this XRP ETF filing is ongoing, the XRP price has appreciated by 1.5% at the time of writing, trading at $3.12. Concurrent with XRP ETF approval speculation, analysts have predicted the XRP price would rally after a crucial bullish breakout toward the $10 high.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Fartcoin ‘Hot Air Rises’ — $1.50 Just A Whiff Away

What happened to the RWA token?

Crypto Strategist Sees Solana-Based Memecoin Surging Higher, Says One AI Altcoin Flashing Strong Chart

Mantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

This Week in Crypto Games: Gaming Tokens Crash Out, Eve Frontier Opens Up

Commerce Secretary Lutnick walks back tariff relief on electronics

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Crypto malware silently steals ETH, XRP, SOL from wallets

Binance Executives Met With US Government Officials To Discuss Easing of Regulatory Supervision: Report

Michael Saylor Hints At Another MicroStrategy Bitcoin Purchase, BTC Price To Rally?

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Bitcoin price tags $86K as Trump tariff relief boosts breakout odds

Where Top VCs Think Crypto x AI Is Headed Next

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: