24/7 Cryptocurrency News

XRP Price To Hit $5 Despite US SEC Appeal, Top Analyst Predicts

Published

3 months agoon

By

admin

The XRP price was on the investors’ radar this week, with the crypto noting a sharp decline following the latest development in the Ripple SEC case. In the latest development, the US SEC has filed a Notice of Appeal, signaling that the legal battle is far from over for now. This move has sparked speculations in the crypto market, triggering a massive selloff in the crypto’s price.

However, despite that, a renowned analyst claims that Ripple’s native crypto could hit $5, sparking market optimism. Besides, it also comes amid a slight recovery in the crypto’s price, which indicates that the crypto could witness further gains in the near future.

Top Analyst Predicts XRP Price To Hit $5

A renowned analyst remains optimistic about XRP price despite the recent decline in crypto following the US SEC’s notice of appeal in the Ripple case. EGRAG Crypto predicts that XRP could hit $5, citing two possible scenarios.

The analyst notes that if the SEC appeal leads to a similar situation as in December 2020, when XRP took a hit but still managed a 10X gain from the bottom, the cryptocurrency could reach the $5-$6 range. In addition, if Bitcoin hits a new all-time high between $80K-$100K, altcoins like XRP could follow suit with similar percentage gains.

Meanwhile, using Fibonacci levels, EGRAG Crypto estimates that if BTC hits $80K, Ripple’s native crypto could reach $2.31, and if BTC hits $100K, XRP could hit $2.88. The analyst’s predictions have sparked market optimism, especially after XRP’s slight price recovery.

The ongoing Ripple SEC case has led to market uncertainty, but analysts like EGRAG Crypto remain bullish on XRP’s long-term potential. While the appeal process unfolds, investors are cautious, but predictions like these offer a glimpse of hope for XRP’s future growth.

What’s Next In Ripple SEC Case?

According to the latest comments from pro-XRP lawyer Fred Rispoli, the Ripple SEC case is not likely to conclude before early 2026. This comment has sparked widespread speculations, while many in the crypto community have slammed the US SEC for prolonging the case.

On the other hand, another pro-XRP attorney Jeremy Hogan said that the latest US SEC appeal is a “big mistake” by the agency. This showcases his confidence in a potential win for the blockchain firm if it plans to cross-appeal.

In addition, Ripple CLO Stuart Alderoty has recently targeted the US SEC, while hinting at a potential cross-appeal in the case. Amid this, XRP price traded near the flatline today at $0.523, after crossing the brief $0.66 level earlier this week.

Meanwhile, the investors also remain optimistic about the crypto, especially after Bitwise filed for an XRP ETF, indicating growing institutional interest in the crypto. Besides, the latest bullish forecast by EGRAG Crypto has also bolstered market confidence, indicating a potential rally for the crypto in the near future.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

24/7 Cryptocurrency News

5 Tokens Ready For A 20X After Solana ETF Approval

Published

2 hours agoon

December 23, 2024By

admin

The US Securities and Exchange Commission (SEC) looks likely to approve a Solana exchange-traded fund (ETF) under Donald Trump’s administration. With this Solana ETF approval looking imminent, there are tokens that are ready to enjoy a 5x price increase once this happens.

5 Tokens That Could 20x After A Solana ETF

Bloomberg analysts recently suggested that a Solana ETF could launch at some point next year, although the exact timing remains uncertain due to some complex legal issues. Ahead of this potential launch, these are 5 tokens that could witness a significant price increase after the SEC approves a Solana ETF.

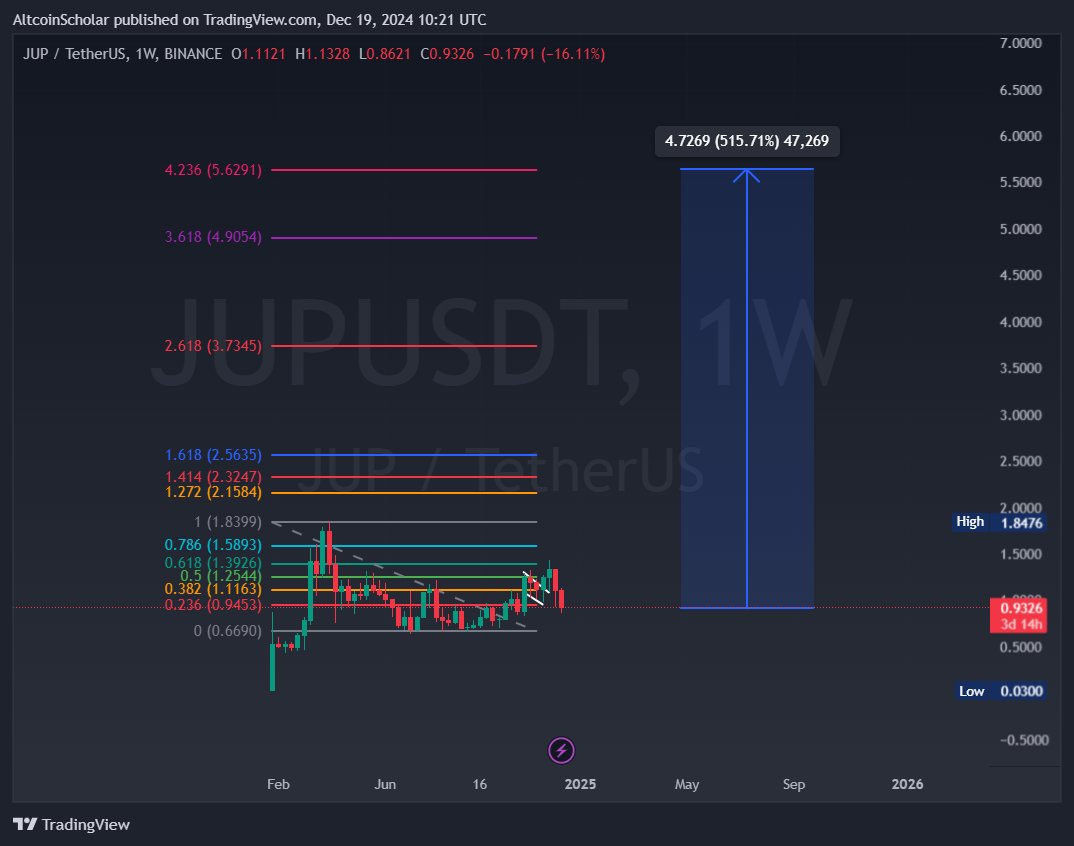

Jupiter (JUP)

Jupiter (JUP) is one of the tokens that is ready for a 20x price increase after a Solana ETF approval. The JUP price is in a good position to benefit from such bullish development, considering its status as one of the top Solana coins.

As such, the DeFi token will likely witness a parabolic surge on the back of an ETF approval. Crypto analyst Altcoin Scholar predicted that JUP could rally to $10 or higher in this bull run.

NebulaStride Token (NST)

NebulaStride Token (NST) is in a good position to witness a significant price increase after a Solana ETF approval. This ETF approval provides a bullish outlook for the crypto and NST, as a newer token, could enjoy one of the most gains.

As a newer token, NST could even record more than a 20x price increase since it has more room to run to the upside than these older coins. the token’s fundamentals also provides a bullish outlook for its as NebulaStride is revolutionizing the finance space.

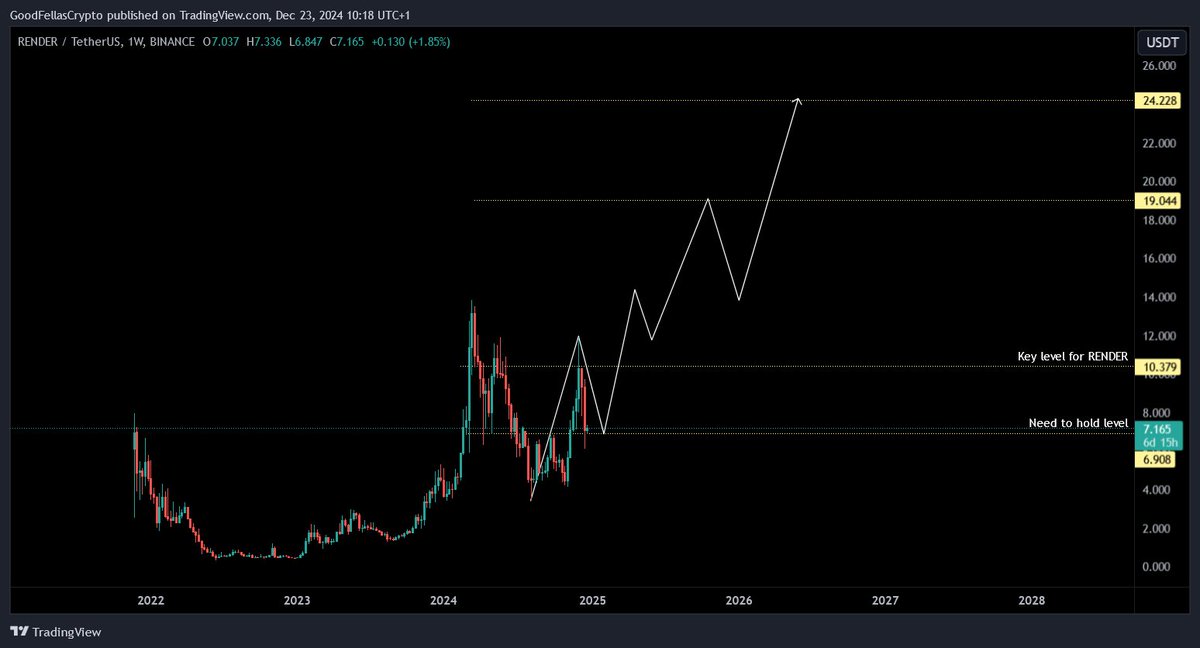

Render (RENDER)

Render (RENDER) is another top Solana coin that is ready for a 20x price increase after a SOL ETF approval. The token already boasts a bullish outlook based on its ties to the artificial intelligence (AI) narrative.

Meanwhile, from a technical analysis perspective, crypto analysts have suggested that RENDER is well primed for a parabolic surge. In an X post, crypto analyst Exotrader predicted that the AI coin couuld rally to as high as $24 as long as it holds the $6.9 support level on the weekly close.

Bonk (BONK)

Bonk (BONK) has become more than just a meme coin in the Solana ecosystem. The top meme coin has gained several use cases and even boasts an exchange-traded product (ETP).

Meanwhile, it is worth mentioning the upcoming BONK token burn with 1 trillions coins set to be burnt. With this 1 trillion token burn on the horizon, the meme coin eyes a $0.11 price target.

XRP

XRP looks like an obvious play if the SEC were to approve a Solana ETF, especially if this approval comes before the one for an XRP ETF. In a scanario where a SOL ETF gets approved an XRP ETF, XRP will likely witness a 20x price increase as traders anticipate the XRP ETF next.

Moreover, crypto analysts have already provided a bullish outlook for the XRP price. One of these analysts is Dark Defender who predicted that XRP could rally to as high as $18 in this market cycle.

Conclusion

A Solana ETF approval is undoubtedly bullish for JUP, NST, RENDER, BONK, and XRP. These coins, most especially NST, are ready to enjoy a 20x price increase once these SEC approves the SOL ETF.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

BTC Risks Falling To $20K If This Happens

Published

5 hours agoon

December 23, 2024By

admin

Bitcoin News: A recent report from The Kobeissi Letter hints at a potential BTC crash to $20,000 in the coming few weeks. The report cited Bitcoin’s relation with the global monetary supply, saying that if the crypto continues to move in tandem, it could witness a massive dip ahead. Besides, it also comes amid highly volatile trading noted in the broader crypto market, with the flagship crypto falling below the $100K mark recently.

Bitcoin News: Why BTC Can Crash To $20K?

In the latest Bitcoin news, the crypto could face a significant correction, potentially dropping to $20,000 in the coming weeks, The Kobeissi Letter said. The report highlights Bitcoin’s historical tendency to mirror global money supply trends, suggesting a steep decline might be on the horizon. The analysis revealed a close relationship between Bitcoin prices and global monetary supply, with BTC often reacting with a 10-week lag.

As global money supply peaked at $108.5 trillion in October, Bitcoin hit an all-time high of $108,000 recently. However, a subsequent $4.1 trillion drop in money supply to $104.4 trillion, its lowest since August, raises concerns about Bitcoin’s near-term trajectory.

Meanwhile, The Kobeissi Letter raised concerns over the potential crash ahead. They noted, “If the relationship still holds, this suggests that Bitcoin prices could fall as much as $20,000 over the next few weeks.” Notably, this prediction comes amid heightened market volatility, with BTC recently slipping below the psychological $100K mark. Such movements have amplified fears of a broader selloff in the crypto market, which has already faced pressure from global economic uncertainties.

What’s Next For BTC Amid Bearish Sentiment?

The latest positive Bitcoin news and strong rally this year showcased its resilience but this potential correction could pause its bullish momentum. Traders and investors are now closely monitoring macroeconomic factors, including shifts in monetary supply, which could significantly impact BTC’s performance. However, the question remains whether Bitcoin will defy this predicted trend or align with historical patterns.

If the BTC crash occurs, it would mark a critical juncture for the cryptocurrency market, testing Bitcoin’s role as a safe haven in uncertain times. For context, Robert Kiyosaki has recently hinted towards a looming economic depression, while urging investors to buy Bitcoin amid the economic turmoil.

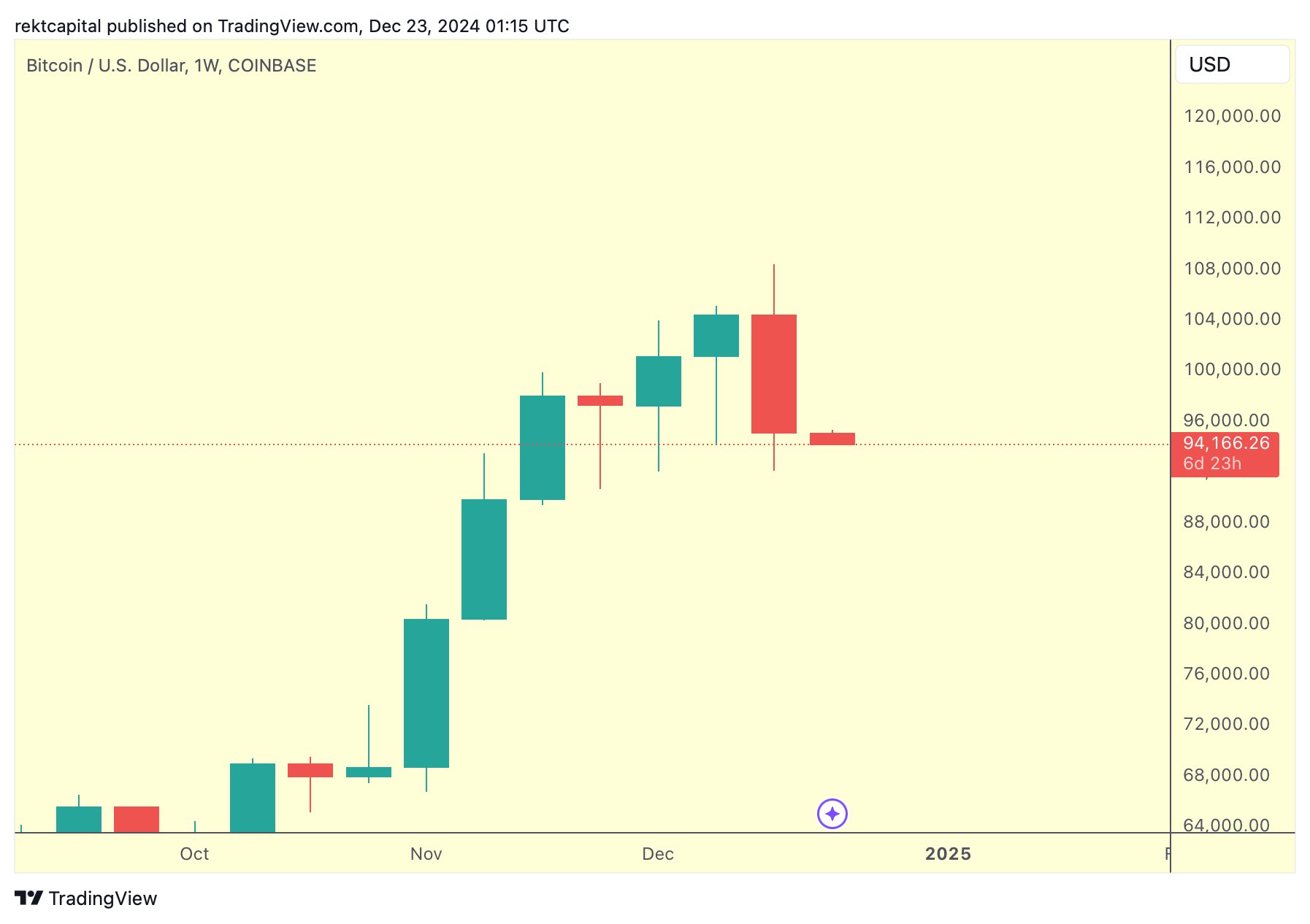

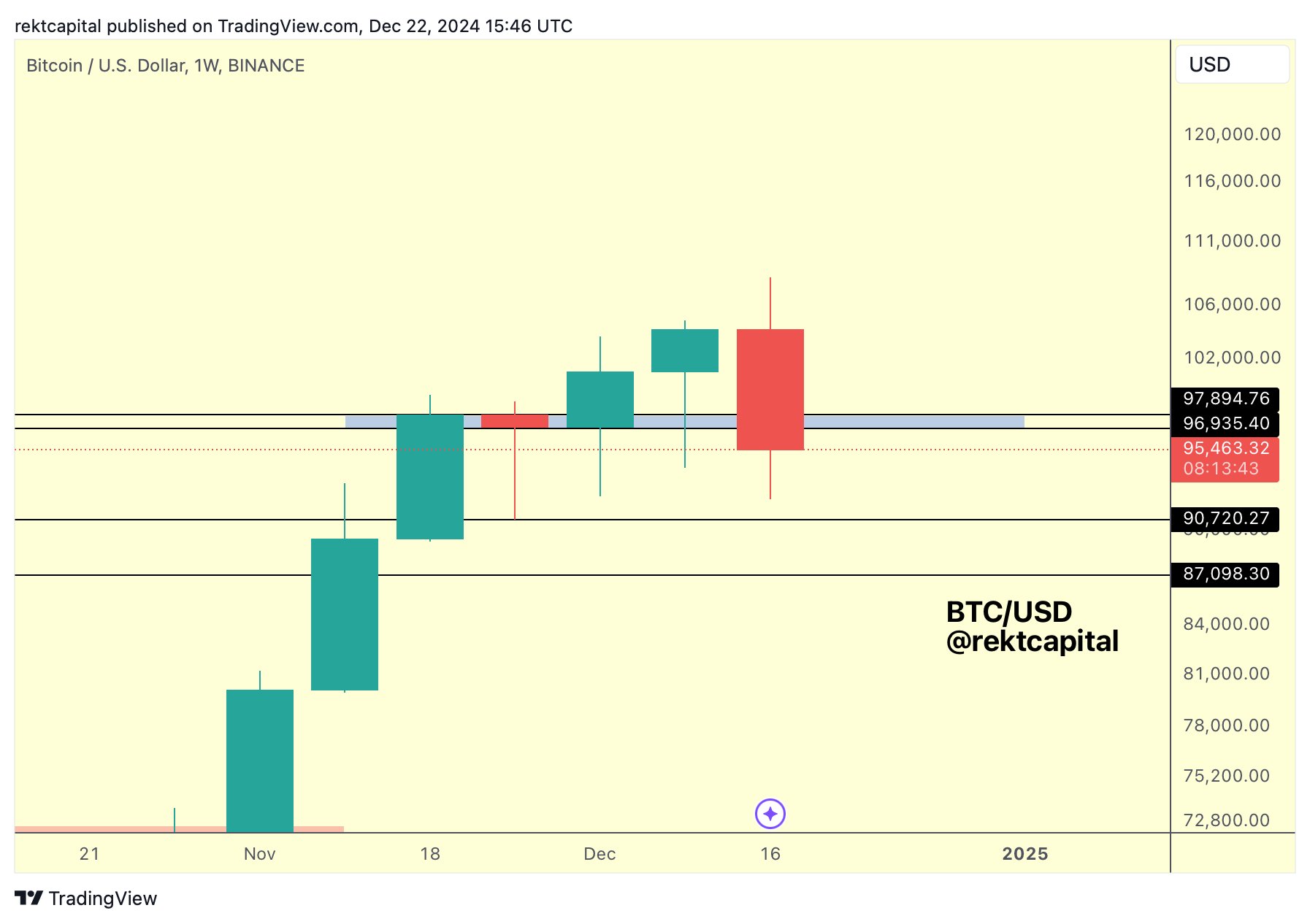

However, popular crypto market expert Rekt Capital also said that the crypto “has confirmed a Bearish Engulfing Candlestick formation”, highlighting the bearish momentum in the market.

In a separate post, the analyst said that BTC has lost its weekly support and its 5-week technical uptrend is over. Considering that, the expert warned about a potential multi-week correction for the crypto ahead.

However, despite that, the institutional interest remained strong for the crypto. For context, Matador has recently revealed its plan to buy $4.5 million in BTC this month. On the other hand, MicroStrategy also continued its buying trend, indicating strong market interest.

Meanwhile, BTC price today was down more than 1% to $94,430, while its one-day trading volume jumped nearly 34% to $54.39 billion. Notably, the crypto has touched a high of $97,217 over the last 24 hours. In addition, a recent Bitcoin price analysis highlights three potential reasons that could help in ending the bearish momentum ahead.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

Published

11 hours agoon

December 23, 2024By

admin

Rich Dad Poor Dad author Robert Kiyosaki has issued a stark warning while hinting towards an economic depression ahead. In a recent X post, the renowned author said that the global market crash has already started, as he predicted earlier, which indicates that the financial market might enter a “depression” phase. Notably, this comes as the crypto market records immense volatility, sparking concerns over what’s next for Bitcoin (BTC).

Robert Kiyosaki Hints At Economic Depression Ahead

Robert Kiyosaki, in a recent X post, has revealed a stark warning of a looming economic depression. The Rich Dad Poor Dad author warned that a global market crash has already begun, citing Europe, China, and the U.S. as regions facing significant downturns.

In his post, Kiyosaki urged caution, advising individuals to safeguard their finances and maintain their jobs. “Global crash has started. Europe, China, USA going down. Depression ahead?” he asked while emphasizing the enduring value of assets like gold, silver, and Bitcoin. He added, “For many people, crashes are the best times to get rich.”

This warning aligns with Kiyosaki’s earlier prediction of what he called the “biggest crash in history.” Earlier this month, he encouraged his followers to prepare for financial turmoil, stating, “Please be proactive and get rich… before the BOOMER’s go BUST.”

However, this recent comment from Robert Kiyosaki indicates his sustained confidence in BTC. As the crypto market faces heightened volatility, Bitcoin could emerge as a hedge against traditional market instability, he noted. Besides, it also indicates that the flagship crypto, alongside gold and silver, might continue to gain traction amid this economic turmoil.

What’s Next For BTC?

Bitcoin price today has continued its volatile trading, losing nearly 1.5% over the last 24 hours to $95,323. The crypto touched a high and low of $97,260 and $93,690 in the last 24 hours, showcasing the highly volatile scenario in the market.

In addition, the US Spot Bitcoin ETF also recorded significant outflow, with BlackRock Bitcoin ETF witnessing its largest outflux since its launch. This has weighed on the investors’ sentiment, sparking concerns over a waning institutional interest.

However, despite that, many experts remained confident on the asset’s future trajectory. For context, in a recent X post, Peter Brandt shared a new BTC price target, indicating his confidence in the digital asset.

On the other hand, institutions like Metaplanet have also continued to boost their BTC holdings. These moves indicates that the institutions, as well as many investors, are bullish towards the long-term potential of the crypto. Besides, as Robert Kiyosaki said, the recent dip also provides a buying opportunity to investors, which might further boost Bitcoin to its new ATH ahead.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: